ALB Review 2026

What is ALB?

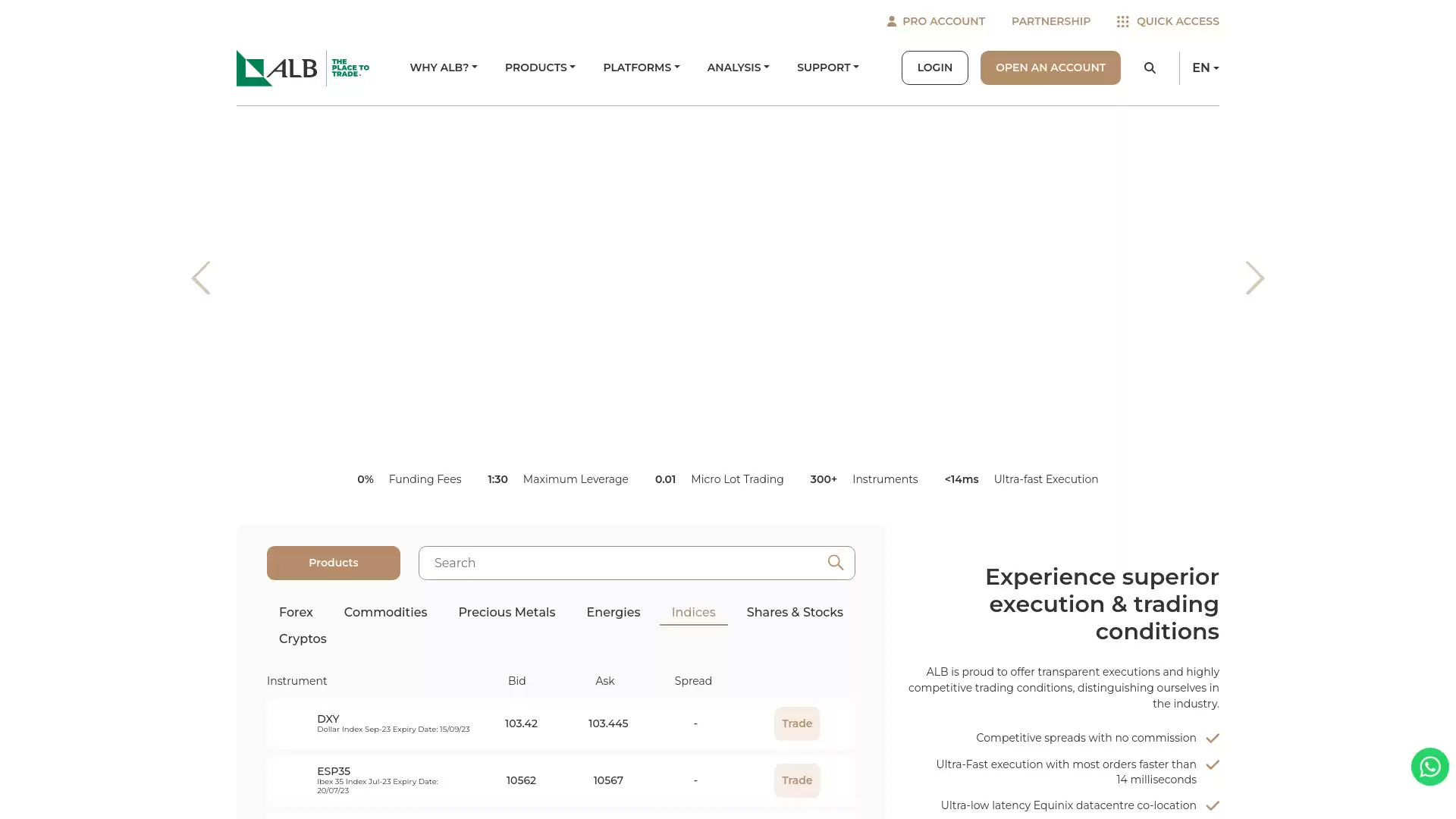

ALB is a well-regarded brokerage firm that specializes in online trading for Forex and Contract for Difference (CFD) markets. Founded in Malta in February 2017, ALB has quickly established a reputation for excellence in the financial sector. ALB offers its clients a wide range of trading options. Traders can conduct operations on major Forex exchanges, stock indices, commodities, stocks, and various cryptocurrencies. The firm’s product offerings are extensive, spanning over 100 Forex pairs, including major, minor, exotic, and Nordic. In addition to Forex, ALB allows trading on many commodities such as copper, corn, wheat, soy, sugar, cotton, coffee, cocoa, Brent oil, WTI oil, gold, silver, and Gold Gram. Clients can also trade CFDs on major US stock indices (S&P 500, Dow Jones, and Nasdaq 100), European listings (DAX, FTSE Mib, CAC 40, IBEX 35, EuroStoxx 50), the Nikkei 225, and the S&P/ASX 200. The range of instruments offered also includes cryptocurrencies like Bitcoin and Bitcoin Cash, Ethereum, Ripple, and Litecoin. ALB’s leverage options vary depending on the client’s classification. Retail clients can utilize a maximum leverage of 1:30 for Forex, 1:10 for commodities, between 1:10 and 1:20 for indices, 1:5 for stocks, and up to 1:2 for cryptocurrencies. For professional clients, the leverage effect reaches 1:100 for Forex, 1:50 for commodities and stock indices, 1:10 for stocks, and up to 1:5 for virtual currencies. ALB has been recognized with several awards, including Best New Forex Company (2017), Best Forex Company in Europe (2017 and 2019), and Best Trade Execution House in Europe (2017). These accolades reflect the firm’s commitment to providing top-tier services to its clients. In terms of costs, ALB clients benefit from a contained bid/ask spread that includes all costs. The differential can vary significantly depending on the type of account and the trading instrument. For example, the spread on the EUR/USD exchange rate can reach up to 0.7 pips. A small commission is charged for trading on stocks, commodities, stock indices, and cryptocurrencies. In conclusion, ALB is a comprehensive online trading platform that offers a wide range of financial products and services. Its commitment to customer service, competitive spreads, and diverse product offerings make it a strong choice for both retail and professional traders in the Forex and CFD markets.

What is the Review Rating of ALB?

- 55brokers: 55brokers rated ALB with a score of 75. This rating was last checked at 2024-01-06 03:02:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated ALB with a score of 74. This rating was last checked at 2024-01-05 21:05:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated ALB with a score of 70. This rating was last checked at 2024-03-13 12:59:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of ALB?

ALB, a brokerage based in Malta, offers several advantages in the context of forex trading. 1. Regulatory Compliance: ALB is regulated by Malta’s MFSA (Malta Financial Services Authority) and is registered with several other European authorities, including Italy’s CONSOB, the UK’s FCA, and Germany’s BaFIN. This robust regulatory status ensures that ALB operates under strict guidelines, providing a secure trading environment for its clients. 2. Competitive Trading Conditions: ALB offers ultra-tight spreads and ECN execution. It also provides competitive spreads with no commission, and most orders are executed faster than 14 milliseconds. These features contribute to an efficient and cost-effective trading experience. 3. No Minimum Deposits: ALB does not require a minimum deposit. , making it accessible for traders with varying investment capacities. 4. Comprehensive Trading Platform: ALB offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are renowned for their comprehensive charting packages, fast execution speeds, and convenient programming environments. 5. Negative Balance Protection: ALB provides negative balance protection. This means that clients cannot lose more than they have initially deposited, providing an additional layer of financial security. 6. Customer Support: ALB’s customer support is available through multiple channels, including email, phone, and live chat. This ensures that clients can receive timely assistance when needed. 7. Investment Services: ALB provides investment services under the Investment Services Act. It caters to retail clients, professional clients, and eligible counterparties, offering a wide range of products. In conclusion, ALB’s regulatory compliance, competitive trading conditions, comprehensive trading platform, and customer support make it a reliable choice for forex trading. However, potential investors should conduct their own due diligence before making a decision.

What are the Cons of ALB?

ALB, a Maltese brokerage company, offers trading in forex and various CFDs on both MetaQuotes’ platforms. While it has several advantages, there are also some potential drawbacks to consider:. 1. Unclear Safety Status Despite being regulated by the Malta Financial Services Authority (MFSA), the safety of ALB as a broker is unclear. This uncertainty could potentially deter prospective traders. 2. No Actual Crypto Purchases ALB does not allow actual crypto purchases. This limitation means that cryptocurrencies can only be traded through a financial derivative, which might not appeal to all traders. 3. Limited Leverage The leverage offered by ALB is up to 1:30. While this is in line with regulations, it might be considered low by some traders, especially those who prefer high-risk, high-reward strategies. 4. Variable Spreads ALB offers variable spreads. While this can sometimes work in the trader’s favor, it can also lead to higher costs when the market is volatile. 5. New Player in the Market ALB is a relatively new player in the online FX/CFD court. Despite its achievements, its lack of long-term market presence might raise concerns among some traders. In conclusion, while ALB has several attractive features, these potential drawbacks should be carefully considered by anyone thinking about using their services for forex trading.

Is ALB Regulated and who are the Regulators?

The search results did not provide specific information about the regulation of ALB in the context of forex trading. However, it is important to note that forex market regulators set guidelines for forex brokers to abide by. These guidelines protect investors and maintain order in the trading arena. The regulator is saddled with the responsibility of conducting periodic audits, reviews, and inspection of the financial, legal, and customer-related activities of the forex market players. Forex market regulation refers to the rules and laws that firms operating in the forex industry must follow. But regulation is more than just having rules in place, it’s also about the ongoing oversight and enforcement of these rules. The purpose of regulation is to protect you from undisclosed financial risk and fraud. The supervisory bodies regulate forex by setting standards that all brokers under their jurisdiction must comply with. These standards include being registered and licensed with the regulatory body, undergoing regular audits, communicating certain changes of service to their clients, and more. Licensed forex brokers are subject to recurrent audits, reviews and evaluations to ensure that they meet the industry standards. This helps ensure that currency trading is ethical and fair for all involved. Every country has its regulatory authority that lays down the framework of rules that are to be complied with when operating in the forex trading market. Each forex regulatory body operates within its own jurisdiction and regulation and enforcement vary significantly from country to country. For more specific information about ALB’s regulation and its regulators, it would be best to directly contact the company or check their official website. They should provide detailed information about their regulatory status and the authorities that oversee their operations. It’s always important to verify the regulatory status of any forex broker to ensure the safety of your investment.