Blueberry Markets Review 2026

What is Blueberry Markets?

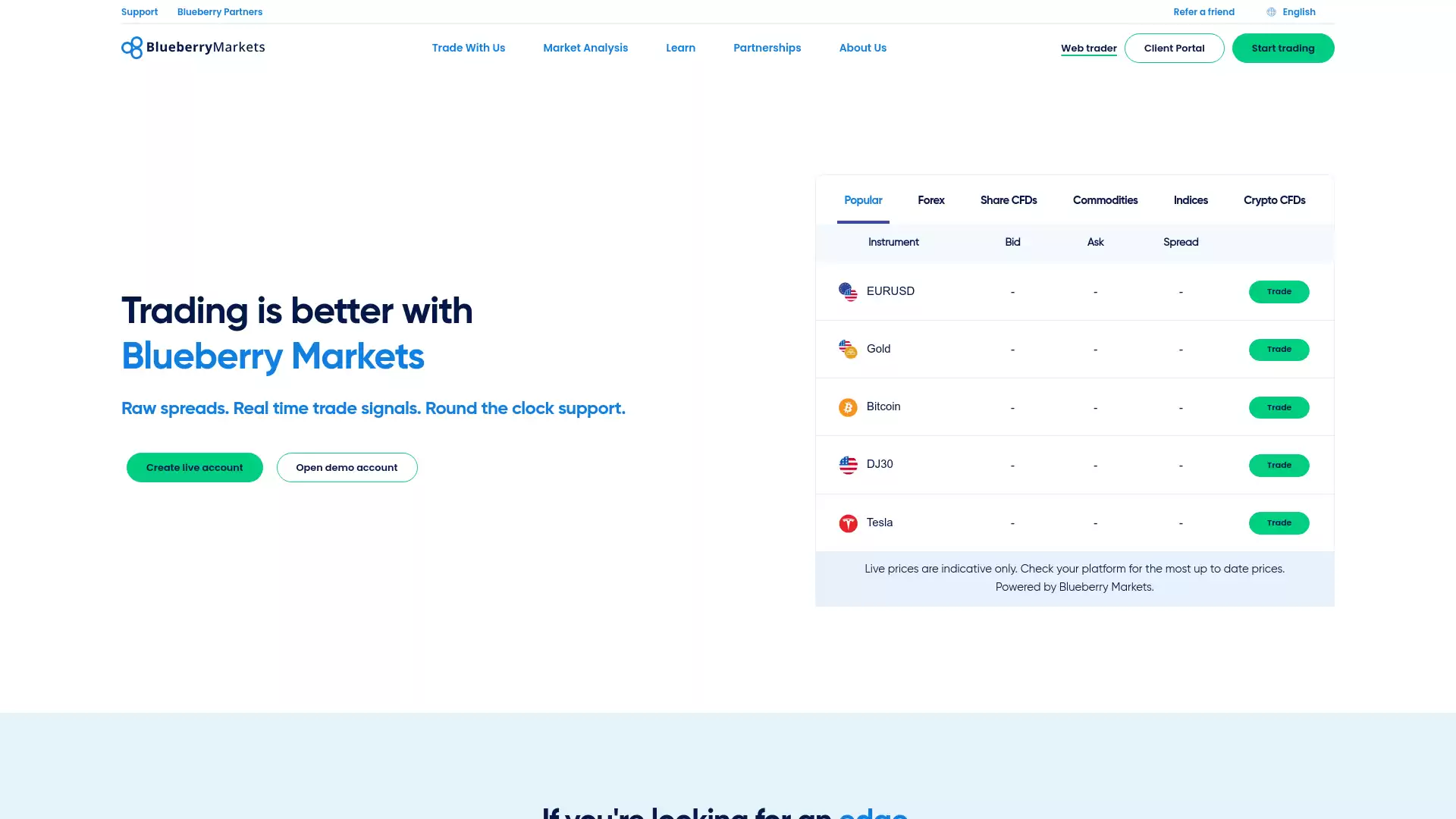

Blueberry Markets is a global forex trading platform. It offers a variety of services and features designed to cater to both novice and experienced traders. Key Features:. Low Commission Brokers with No Desk Dealing: Blueberry Markets operates with low commission rates and no desk dealing, providing a more transparent and fair trading environment. Live or Online Charts with Indicators: Traders have access to live or online charts complete with indicators, aiding in the analysis and prediction of forex market trends. Foreign Exchange Market Trading Methods: Blueberry Markets supports various trading methods, allowing traders to choose the strategy that best suits their trading style. Hours, Sessions, & Plans: Blueberry Markets provides information on forex market hours, sessions, and plans, helping traders make informed decisions. Major and Minor Pairs Currency: Traders can trade in both major and minor currency pairs, offering a wide range of trading options. Tight Forex Spreads: Blueberry Markets offers tight forex spreads, which can lead to lower trading costs. Bullish and Bearish Divergence: The platform provides information on bullish and bearish divergence, assisting traders in understanding market movements. Real-Time Trade Signals: Blueberry Markets provides real-time trade signals, helping traders make timely trading decisions. Round the Clock Support: Traders can rely on round-the-clock support for any queries or issues. 300+ Instruments: Traders can choose from over 300 instruments for trading. Security of Funds: Blueberry Markets ensures the security of funds, keeping client funds segregated in a trust account. $100 Minimum Deposit: The platform has a low minimum deposit requirement of $100, making it accessible to a wide range of traders. In conclusion, Blueberry Markets is a comprehensive forex trading platform that offers a wide range of features and services. Its focus on low commissions, transparency, and robust support make it a strong choice for individuals interested in forex trading.

What is the Review Rating of Blueberry Markets?

- 55brokers: 55brokers rated Blueberry Markets with a score of 70. This rating was last checked at 2024-01-06 11:35:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Blueberry Markets with a score of 48. This rating was last checked at 2024-01-05 20:40:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Blueberry Markets with a score of 92. This rating was last checked at 2024-01-05 23:09:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Blueberry Markets with a score of 62. This rating was last checked at 2024-03-12 12:43:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Blueberry Markets?

Blueberry Markets, an Australian-based CFD and forex broker, offers several advantages that make it a compelling choice for traders. Here are some of the key benefits:. Wide Range of Financial Instruments: Blueberry Markets provides access to over 300 instruments, including CFDs on forex, indices, commodities, and shares. This wide range allows traders to diversify their portfolio and take advantage of different market conditions. MetaTrader Integration: The broker offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are renowned for their robust features, including advanced charting tools, numerous technical indicators, and automated trading capabilities. Copy Trading: Blueberry Markets provides access to DupliTrade, a platform that allows traders to copy the trades of experienced traders. This can be particularly beneficial for novice traders or those looking to diversify their trading strategies. Competitive Pricing: The broker offers tight spreads and standard commissions, making it a cost-effective choice for active traders. Fast Execution Speed: Blueberry Markets is known for its fast order execution, which can help reduce slippage and improve trading outcomes. Regulation: Blueberry Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA), providing traders with an added layer of security. Customer Support: The broker offers 24/7 customer support, ensuring that traders can get assistance whenever they need it. Educational Materials: Blueberry Markets provides educational materials to help traders improve their trading skills and knowledge. Low Minimum Deposit: With a low minimum deposit of $100, Blueberry Markets makes forex and CFD trading accessible to a wide range of traders. Please note that trading involves risk, and it’s important to understand these risks before starting to trade. Always consider your financial situation and risk tolerance before trading.

What are the Cons of Blueberry Markets?

Blueberry Markets, an Australian-based CFD and forex broker, offers a range of services to its clients. However, there are several disadvantages associated with this platform that potential users should be aware of:. Limited Trading Options: Blueberry Markets does not allow trading in certain asset classes such as cryptocurrency, commodity, futures, indices, and stocks. Geographical Restrictions: The platform does not accept traders from the United States. Lack of Research Tools: Blueberry Markets does not provide comprehensive research tools, which can limit the ability of traders to analyze market trends and make informed decisions. Limited Educational Material: The platform lacks robust educational material, which can be a disadvantage for novice traders who are looking to learn more about forex trading. Withdrawal Fees: Blueberry Markets charges a withdrawal fee for transactions outside Australia. No Negative Balance Protection: The platform does not offer negative balance protection. This means that traders can potentially lose more money than they have deposited into their accounts. Complex Website Design: Some users may find the design of the official website to be complex and difficult to navigate. No Proprietary Trading App: While Blueberry Markets integrates with MetaTrader 4 and MetaTrader 5, it does not have its own proprietary trading app. Limited Bonuses: The platform offers limited bonuses for new traders. Narrow Selection of CFDs: In some asset classes, the selection of Contracts for Difference (CFDs) is narrow. These factors should be carefully considered by anyone thinking about using Blueberry Markets for forex trading.

What are the Blueberry Markets Current Promos?

Blueberry Markets, a global forex trading platform, offers a variety of promotions to its users. One of the key promotions is the 20% Trade Credit Bonus offer. This promotion allows traders to receive a 20% trade credit on their initial account deposit. This means that if a trader deposits $1,000 into their live trading account, they will receive an additional $200 credit value to trade with. This offer provides traders with more opportunity to trade and potentially increase their profits. Another promotion offered by Blueberry Markets is the chance to win an Apple Watch Ultra and $500 in cash after placing a single trade. In addition, if a trader deposits just $100 into their account, they receive lifetime access to the Daily Price Action trading group. This group provides traders with valuable insights and strategies to help them navigate the forex market. Blueberry Markets also offers low-cost trading with a commission-free account, access to raw spreads on Direct account, and dedicated account manager and online support 24/7. These features, combined with the promotional offers, make Blueberry Markets an attractive platform for both new and experienced forex traders. It’s important to note that all promotions are subject to terms and conditions, and traders should review these carefully before participating.

What are the Blueberry Markets Highlights?

Blueberry Markets is a well-capitalized and regulated platform that offers the ability to trade on a number of markets with extremely tight spreads. The platform is customizable with thousands of online tools to plug in, offering features such as one-click trading, quick order execution, and up to four pending order types and trailing stops. It also provides in-depth charts and trading history, and allows users to build their own algorithms or import Expert Advisors (EAs). The minimum deposit for trading on Blueberry Markets is $100, and there are no funding fees. The security of funds is ensured by keeping client funds segregated in a trust account. In terms of market trends, the blueberry market is forecasted to grow by USD 2,463.41 million from 2022 to 2027, with the growth momentum expected to accelerate at a CAGR of 6.5% during the forecast period. This growth is driven by the rising penetration of online retailing and e-commerce. However, stringent food safety regulations may present challenges for food manufacturers in terms of compliance and production costs. Non-compliance with these regulations can lead to the withdrawal of products from the market and manufacturers may be compelled to pay huge fines. In the context of the actual blueberry fruit market, blueberries have become popular in Europe as a healthy and easy-to-snack fruit. The growing demand is being met by an enormous increase in supply. Recently, Germany overtook the United Kingdom in import volume, with Germany’s blueberry imports increasing from 32,000 tonnes in 2017 to 67,000 tonnes in 2021. This indicates a significant growth in the blueberry market, which could potentially impact the financial markets and trading platforms like Blueberry Markets.

Is Blueberry Markets Legit and Trustworthy?

Blueberry Markets is a well-established online broker that offers its financial services to clients worldwide. It is an expert in trading forex pairs but also has proficiency in other financial instruments such as commodities, indices, energies, metals, and CFDs. The company was founded in 2017 and is headquartered in Australia. It is regulated by one tier-1 regulator (highest trust) and one tier-3 regulator. Blueberry Markets has a trust score of 88% out of 100. Blueberry Markets offers more than 300 tradable instruments under multiple asset classes. The low spreads offered by Blueberry Markets start from just 0 pips. The competitive commission fees charged by the company ensure its clients take home the maximum percentage of their earnings. Customer reviews highlight the quality of Blueberry Markets’ customer service. Users have praised the company for its proactive and efficient service. One user mentioned that the company’s customer service team was able to expedite the reactivation process of their disabled account. However, it’s important to note that there have been some negative reviews as well. One user claimed that the affiliate development manager was scamming people. They alleged that after getting clients, the company refused to pay incentives to their affiliate. In conclusion, while Blueberry Markets has received largely positive reviews and appears to be a legitimate and trustworthy broker, potential users should always conduct their own thorough research before deciding to use their services. It’s also recommended to consider the negative reviews and understand the risks involved in forex trading.

Is Blueberry Markets Regulated and who are the Regulators?

Blueberry Markets is indeed a regulated entity. It operates under the oversight of two financial regulators: the Australian Securities and Investments Commission (ASIC). and the Securities Commission of the Bahamas (SCB). The ASIC is a well-respected regulatory body that ensures the integrity of Australia’s financial markets. It sets standards that brokers must follow, including registration and licensing requirements, minimum capital requirements, regular audits, and more. The SCB, on the other hand, is the regulatory authority in the Bahamas. Like the ASIC, it sets standards for brokers operating within its jurisdiction. However, it’s important to note that Blueberry Markets is not regulated by other major financial regulatory authorities such as the FCA or CySEC. This might be a concern for some traders who prioritize regulation and security. In the context of forex trading, regulation is crucial. It helps protect traders from fraudulent activities and ensures that brokers operate in a fair and transparent manner. For instance, the ASIC and the SCB require brokers to adhere to strict financial standards, undergo regular audits, and maintain transparent dealings with their clients. In conclusion, while Blueberry Markets is regulated by the ASIC and the SCB, potential traders should conduct their own due diligence and consider the lack of regulation by other major financial authorities before deciding to trade with them.

Did Blueberry Markets win any Awards?

Blueberry Markets, a global Forex broker headquartered in Sydney, Australia, has indeed been recognized for its exceptional services in the financial sector. The company was a finalist for the Best Online Customer Service Award in both 2020 and 2021. This award, established by the Finder website, is a testament to Blueberry Markets’ commitment to providing excellent customer service. The company’s high ratings on various social media outlets such as TrustPilot, Google Review, and Forex Peace Army further underscore this commitment. In addition to its customer service accolades, Blueberry Markets was also a finalist for the Best Bootstrapped Startup for the Australasian Startup Awards in 2018. This recognition highlights the company’s successful growth and development since its inception. Blueberry Markets offers a range of financial instruments, including 38 forex pairs, and supports all levels of traders with personalized account types. It operates 24/7 with one-to-one customer support and dedicated account managers for all demo and live account holders. In conclusion, Blueberry Markets’ recognition in these prestigious awards demonstrates its commitment to providing top-notch services in the Forex trading industry. The company’s focus on customer service and its success as a startup make it a noteworthy player in the financial sector.

How do I get in Contact with Blueberry Markets?

Blueberry Markets, a trusted worldwide online trading platform for forex trading, CFD trading, commodities trading, and more. , offers several methods for potential clients and existing customers to get in touch. Phone: Blueberry Markets can be reached by phone at (02) 8039 7480. This is a quick and direct method to speak with a representative from the company. Email: For those who prefer written communication or have detailed queries, Blueberry Markets provides an email address: global@blueberrymarkets.com. This allows for comprehensive communication at any time. Physical Address: Blueberry Markets has offices at 15 Blue St, Sydney, New South Wales 2060. and Unit 1 397 Pacific Highway, Crows Nest, New South Wales 2065. Additionally, they have an office at Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent and the Grenadines. Live Chat: For immediate assistance, Blueberry Markets offers a live chat feature on their website. This feature allows for real-time communication with a representative. Help Center: Blueberry Markets also has a comprehensive Help Center on their website. The Help Center includes FAQs and guides on a wide variety of topics, including account opening, client portal, withdrawals, and more. Remember, it’s important to have all necessary information ready when reaching out to ensure a smooth and efficient communication process. Whether you’re a potential client interested in their forex trading services or an existing customer needing assistance, Blueberry Markets has made it easy and convenient to get in touch.

Where are the Headquarters from Blueberry Markets based?

Blueberry Markets, a trusted worldwide online trading platform for forex trading, CFD trading, commodities trading, and more. , has its headquarters in two locations:. Sydney, Australia: The primary headquarters is located at 15 Blue St, Sydney, New South Wales 2060. This location serves as the main hub for the company’s operations. Saint Vincent and the Grenadines: The company also has an office at Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent and the Grenadines. This location helps the company maintain a global presence and cater to its international clientele. These strategic locations allow Blueberry Markets to provide its services to a global audience and maintain its reputation as a reliable platform for forex and other forms of trading.

What kind of Customer Support is offered by Blueberry Markets?

Blueberry Markets, a renowned player in the forex market, offers a comprehensive customer support system. The support system is designed to cater to the needs of its diverse clientele, ensuring a seamless trading experience. Contact Details Blueberry Markets can be reached 24/7 through various methods. They provide a live help option on their website, where customers can instantly connect with a support representative. For more traditional methods of communication, they offer support via email at global@blueberrymarkets.com and phone at +61 2 7908 3946 or +61 2 8039 7480. Help Center & FAQs In addition to direct contact, Blueberry Markets maintains a comprehensive Help Center. This self-service portal provides guides on a wide variety of topics, including account opening, client portal usage, deposit methods, withdrawal procedures, and more. The Help Center is designed to empower customers with the knowledge they need to navigate the platform effectively. Top-Rated Customer Support Blueberry Markets prides itself on its top-rated customer support. The support team is available 24/7, ensuring prompt assistance to customers around the globe. This commitment to customer service enhances the trading experience, making Blueberry Markets a preferred choice for many forex traders. In conclusion, Blueberry Markets’ customer support system is robust and well-rounded, designed to provide prompt and effective assistance to its customers. This commitment to customer service, coupled with their advanced trading platform, makes them a strong contender in the forex market.

Which Educational and Learning Materials are offered by Blueberry Markets?

Blueberry Markets, an Australian-based CFD and forex broker, offers a comprehensive range of educational resources designed to enhance trading skills. These resources are structured into a Trading Program divided into Beginner, Intermediate, and Advanced levels. The Beginner level introduces basic concepts in the financial markets. The Intermediate level delves deeper into the dynamics of the Forex market, including the reasons for its popularity, such as its stability, liquidity, and the opportunities it presents for leveraging trades. The Advanced level offers insights into sophisticated and dynamic market changes, risk management strategies, and hidden opportunities. One of the key educational materials provided is a guide to common Forex trading mistakes. This guide helps traders understand the importance of a well-researched trading plan, the advantages of a stop-loss order, and the need for adequate research. It emphasizes the importance of resisting temptation, having a solid risk management strategy, and averaging out any critical position when possible. Furthermore, Blueberry Markets provides practical advice on creating a trading plan. It encourages traders to consider questions such as: When should I enter a trade? What is my trading motive? What type of currency pairs am I going to focus on? When should I exit the trade? When to set a stop-loss trade? What is my risk capacity? How much money can I risk on individual trades? What is my total budget for trading?. Additionally, Blueberry Markets offers free courses for forex traders on the advanced level to better understand forex trading algorithms, strategies, and patterns. These courses are designed with practical implications and real-time monitoring of funds. Finally, Blueberry Markets also provides access to DupliTrade, a low-latency VPS, and other educational materials. DupliTrade allows traders to copy the trades of professional investors. In conclusion, Blueberry Markets offers a wide range of educational resources that cater to traders at all levels, providing them with the knowledge and skills necessary to navigate the dynamic world of Forex trading.

Can anyone join Blueberry Markets?

Joining Blueberry Markets, a global forex trading platform, is a process that is open to many, but it does come with certain requirements. General Requirements. Applicants must be 18 years or older at the time of application. They must have a valid mobile number and email address. A valid passport or government-issued photo ID is required. Applicants must provide a legal residential address. In some cases, additional documents may be required by Compliance. Blueberry Markets also accepts non-individual account applications such as Introducing Broker/Affiliate, Joint Account, Company Account, and Trust Account. It’s important to note that the trading experience with Blueberry Markets includes access to a number of markets on extremely tight spreads. The platform is well capitalized and regulated in multiple markets, and client funds are kept segregated in a trust account. In conclusion, while anyone meeting the requirements can apply to join Blueberry Markets, the process is designed to ensure a secure and efficient trading environment for all users.

Who should sign up with Blueberry Markets?

Blueberry Markets is a premier and legitimate forex trading platform that offers powerful trading tools, tight spreads, and live support. It is a suitable choice for a wide range of individuals and entities, each with their unique needs and goals in the forex market. Individual Traders Individuals who are 18 years or older, have a valid mobile number, email address, passport or government-issued photo ID, and a legal residential address are eligible to apply for an account. Blueberry Markets offers a variety of trading instruments including major and minor currency pairs, commodities, indices, and crypto CFDs. With a minimum deposit of $100, individuals can start trading on a platform that provides real-time trade signals, round-the-clock support, and raw spreads. Experienced Traders Experienced traders looking for an edge in the forex market can benefit from Blueberry Markets’ offerings. The platform provides live foreign exchange charts with indicators, updated market hours, trading sessions, and trading plans and methods. This wealth of resources can help experienced traders make informed decisions and optimize their trading strategies. Partners Blueberry Markets also offers partnership opportunities. Individuals or entities can become an introducing broker, affiliate, or fund manager. These partners can benefit from high commissions and the best rebates, boosting their earning potential. Non-Individual Entities Non-individual entities such as companies and trusts can also apply for an account. This makes Blueberry Markets a viable option for businesses looking to diversify their investment portfolio or hedge against market volatility. In conclusion, Blueberry Markets caters to a wide audience, from individual traders to experienced professionals, and from partners to non-individual entities. Its comprehensive offerings and user-friendly platform make it a go-to choice for anyone looking to venture into or expand their presence in the forex market. Please note that additional documents may be required by Compliance during the application process.

Who should NOT sign up with Blueberry Markets?

Blueberry Markets is a global Forex broker that offers a wide range of financial instruments and has a strong emphasis on customer service. However, it may not be the right choice for everyone. Here are some types of traders who might want to consider other options:. 1. Traders Seeking the Lowest Spreads While Blueberry Markets offers competitive spreads, some traders have reported that the spreads are not as low as advertised. Traders who prioritize the lowest possible spreads might want to explore other brokers. 2. Traders Who Prefer a Different Trading Platform Blueberry Markets offers the MetaTrader 4 and MetaTrader 5 trading platforms. Traders who prefer a different trading platform may not find Blueberry Markets suitable for their needs. 3. Traders Concerned About Affiliate Programs There have been reports of issues with the affiliate program at Blueberry Markets. Traders who plan to participate in such programs might want to investigate these claims further before signing up. 4. Traders Outside of Australia Blueberry Markets is regulated by the Australian Financial Services Licence (AFSL). Traders outside of Australia who prefer a broker regulated by their own country’s financial authority may wish to look elsewhere. 5. Traders with a Low Risk Tolerance Forex trading involves significant risk. While Blueberry Markets provides educational resources and customer support, it may not be suitable for individuals with a low risk tolerance or those new to Forex trading. Remember, it’s important to thoroughly research any Forex broker before opening an account. Consider your individual trading needs and risk tolerance, and consult with a financial advisor if necessary.

Does Blueberry Markets offer Discounts, Coupons, or Promo Codes?

Based on the search results, there is no specific information available about discounts, coupons, or promo codes offered by Blueberry Markets. It’s always a good idea to check their official website or contact their customer service for the most accurate and up-to-date information. Please note that promotions and discounts can vary and may be subject to terms and conditions. It’s important to read the details of any promotion carefully to ensure you understand what is being offered. In the context of forex trading, such promotions, if available, could potentially provide benefits like reduced trading costs or other incentives. However, traders should always consider the overall trading conditions and not just the promotional offers when choosing a forex broker.

Which Account Types are offered by Blueberry Markets?

Blueberry Markets, a renowned player in the forex market, offers two primary types of accounts. Standard Account: This account type is ideal for traders who prefer traditional spread pricing. The costs are already built into the spread, which means all the profit made is kept by the trader. The features of this account include. Spreads from 1.0 pips. No commission. Minimum deposit of $100. Maximum leverage of 1:500. Minimum trade size of 0.01. Over 300+ tradable instruments. Trading platforms include MT4, MT5, and Web Trader. Direct Account: This account type is ideal for traders who prefer raw spreads and fixed commissions. Direct account holders enjoy lower spreads with a commission of $7 USD per standard lot per round turn. The features of this account include. Spreads from 0.0 pips. Commission of $7. Minimum deposit of $100. Maximum leverage of 1:500. Minimum trade size of 0.01. Over 300+ tradable instruments. Trading platforms include MT4, MT5, and Web Trader. It’s worth noting that both account types offer the same features, except for the differences in spreads and commissions. Traders can choose the account type that best suits their trading style and strategies. Please note that the information provided is based on the latest available data and may be subject to change.

How to Open a Blueberry Markets LIVE Account?

Opening a live trading account with Blueberry Markets, a renowned forex trading platform, involves a few key steps. This process is designed to ensure secure and efficient account setup for all traders. Step 1: Start the Process Initiate the account opening process by clicking on the “start trading” button located at the top right-hand side of the Blueberry Markets webpage. Step 2: Complete the Application Fill out the secure application form provided. This form collects necessary information about the trader, including personal details and trading experience. It’s important to provide accurate information to ensure a smooth account setup process. Step 3: Confirm Your Identity Identity verification is a crucial step in the account opening process. Traders can verify their identity online or upload required ID documents. This step is in place to ensure the security of the trader’s account and comply with regulatory requirements. Account Types Blueberry Markets offers two types of accounts: the Blueberry Standard Account and the Blueberry Direct Account. Both accounts require a minimum deposit of $100 and offer a maximum leverage of 1:500. The Standard Account has spreads from 1.0 pips and no commission, while the Direct Account offers raw spreads from 0.0 pips with a $7 commission per trade. Traders can choose the account type that best suits their trading strategy and preferences. Once these steps are completed, traders can start exploring the forex market with Blueberry Markets. Remember, forex trading involves risk, and it’s important to make informed trading decisions.

How to Open a Blueberry Markets DEMO account?

Opening a Blueberry Markets DEMO account is a straightforward process that allows traders to practice trading in forex, indices, commodities, cryptocurrencies, and share CFDs. Step 1: Navigate to the Blueberry Markets website. Step 2: Look for the option to open a free demo trading account. Step 3: Click on the option to open a demo account. This will provide access to $100,000 in virtual funds. Step 4: Practice trading strategies. The demo account allows traders to build and test their newest strategies before diving into the real market. This can help minimize losses or sudden surprises. Step 5: Experiment with leverage. The demo account allows traders to power up their trading and accurately assess the risk levels by examining different types of leverage. Step 6: Learn to use MetaTrader. The demo account provides access to the world’s most popular trading platforms - MetaTrader 4 and MetaTrader 5. Once comfortable with the demo account, traders can upgrade to a live account to start trading in the real market. It’s important to note that the demo account is designed to simulate actual market conditions but involves zero risks. This makes it an excellent tool for both novice and experienced traders to gain confidence and a deeper understanding of the markets.

How Are You Protected as a Client at Blueberry Markets?

Blueberry Markets takes the security of its clients’ accounts, funds, and data very seriously. Here are some of the measures they have in place to protect their clients:. 1. Scam and Phishing Email Protection Blueberry Markets provides guidelines to help clients identify scam and phishing emails and phone calls. They will never ask for your Client Portal password, request you to withdraw your funds, ask for your credit card number, expiration date, CVV, or OTP, or ask you to deposit to a crypto wallet other than your account’s private depositing address. 2. Secure Communication Channels Blueberry Markets uses secure communication channels which can be identified by emails that end exactly with @blueberrymarkets.com, live chat widget embedded on Blueberry Markets’ official websites, Blueberry Markets official iMessage account, Telegram (for trade signals and tips) – @blueberrymarketsofficial, Telegram (for client enquiries) – @BlueberrySupport_bot, Blueberry Market’s Official WhatsApp account, and Blueberry Markets official social media accounts. 3. Account Security Blueberry Markets ensures that the security of your account, funds, and data is taken very seriously. They also provide OTP (One-time Password) for security to be sent to your registered phone number. 4. Fund Security Blueberry Markets is well capitalized and regulated in multiple markets and keeps client funds segregated in a trust account. They also ensure that the amount you deposit is always available for withdrawal, and processed within 24 hours. 5. Trading Security Blueberry Markets offers trading around the clock on a number of markets on extremely tight spreads. They provide live foreign exchange charts with indicators for major and minor currency pairs. In conclusion, Blueberry Markets has implemented a comprehensive set of security measures to ensure that clients can trade with peace of mind, knowing that their accounts and funds are secure.

Which Funding methods or Deposit Options are available at Blueberry Markets?

Blueberry Markets offers a variety of deposit methods to cater to the diverse needs of its clients. Here are the details:. VISA & MasterCard: Deposits are usually quick, but in some cases, it may take up to 2 hours. Clients can deposit up to 50,000.00 USD at a time. Card deposits and withdrawals are free of charge to clients. However, currency conversion fees may apply if your card’s currency differs from your trading account’s. Skrill: Blueberry Markets charges no fees for Skrill; however, Skrill themselves may charge 1-3% on withdrawals. Clients can deposit up to 150,000.00 USD per transaction. Due to regulation, Skrill payments must be consistent with the client’s native currency. Bank Transfers: International bank wires usually attract a fee of approximately USD $25+. Blueberry Markets may reimburse clients for incoming payments. Bitcoin and Tether: Blueberry Markets also accepts deposits in Bitcoin and Tether. Other Methods: Other deposit methods include Poli Pay, BPay, Fasa Pay, and DragonPay. Please note that all deposits must be made from an account that bears the same name as that of the trading account. Also, it’s recommended to keep the number of cards used to deposit at a minimum, as this can complicate withdrawals.

What is the Minimum Deposit Amount at Blueberry Markets?

Blueberry Markets, a renowned player in the forex trading industry, offers a straightforward and accessible entry point for traders. The minimum deposit required to open a live trading account with Blueberry Markets is only USD $100. This amount is equivalent in other currencies, making it convenient for international traders. This low minimum deposit allows traders of all levels, from beginners to experienced, to participate in the forex market. It’s worth noting that Blueberry Markets offers two types of Standard Live Trading accounts – the Standard Account and the Direct Account. Both these accounts can be opened with the same minimum deposit of USD $100. Deposits at Blueberry Markets are handled with utmost care, ensuring a smooth and quick process with full transparency. However, it’s important to note that all deposits need to be made from a payment account that has the same name as the name on the trading account. In conclusion, Blueberry Markets provides an affordable and secure platform for forex trading. The low minimum deposit requirement of USD $100 caters to a wide range of traders, making forex trading more accessible to everyone.

Which Withdrawal methods are available at Blueberry Markets?

Blueberry Markets, a well-known forex trading platform, offers a variety of withdrawal methods to cater to the diverse needs of its global clientele. Bank Wire: This method is available globally, except in mainland China. The minimum withdrawal amount is $50, and the maximum is $250,000. The processing time is usually 3 to 7 business days, and it may incur around a $25 intermediary fee. China Union Pay: This method is available only in mainland China. The minimum and maximum withdrawal amounts are $50 and $15,000 respectively. The processing time and fees depend on the receiving bank. Credit Card: This method is available globally. The minimum withdrawal amount is $50, and the maximum depends on the amount deposited. The processing time is 1 to 7 business days, and there is no withdrawal fee. Cryptocurrency: This method is available globally. The minimum withdrawal amount is $50, and the maximum is $5,000. The processing time depends on the receiving exchange, and a 1% fee is imposed by the payment provider. Dragonpay: This method is available only in the Philippines. The minimum and maximum withdrawal amounts are $50 and $15,000 respectively. The processing time and fees depend on the receiving bank. FASA: This method is available only in Indonesia. The minimum and maximum withdrawal amounts are $50 and $1,500 respectively. The processing time is 1 to 7 business days, and there is no withdrawal fee. Neteller: This method is available globally, except in Europe. The minimum and maximum withdrawal amounts are $50 and $10,000 respectively. The processing time and fees depend on the receiving bank. Paytrust: This method is available in Indonesia, Malaysia, and Vietnam. The minimum and maximum withdrawal amounts are $50 and $15,000 respectively. The processing time and fees depend on the receiving bank. Perfect Money: This method is available globally. The minimum and maximum withdrawal amounts are $50 and $25,000 respectively. The processing time and fees depend on the receiving bank. Skrill: This method is available globally, except in Europe. The minimum and maximum withdrawal amounts are $50 and $10,000 respectively. The processing time is 1 to 7 business days, and Skrill may impose a 1 to 3% fee. SticPay: This method is available globally. The minimum and maximum withdrawal amounts are $50 and $5,000 respectively. The processing time is 1 to 7 business days, and SticPay may impose a 1 to 3% fee. THB QR Payment: This method is available only in Thailand. The minimum and maximum withdrawal amounts are $50 and $15,000 respectively. The processing time and fees depend on the receiving bank. It’s important to note that card deposits are always withdrawn first. Withdrawal of card deposits is processed to the exact same card used to fund an account. If the card used to fund is lost, stolen, or expired, you may need to provide Blueberry Markets with a certification of closure or loss and then process through other methods. Withdrawals via bank wire are processed only to bank accounts issued in the same country as your registered country. If your account has open trades upon submission of the withdrawal request, the free margin must at least be equal to or greater than 150% after the amount has been deducted.

Which Fees are charged by Blueberry Markets?

Blueberry Markets, a renowned forex trading platform, charges various types of fees. Here are the details:. Trading Fees Trading with Blueberry Markets involves fees from $3.50 USD. The exact fee can vary depending on the account type selected by the trader. Spreads Blueberry Markets offers spreads from 0.01 pips to 0.5 pips. The spread can differ based on the account type and the currency pair being traded. Commission Blueberry Markets provides commission-free trading depending on the account type chosen by the trader. Withdrawal Fees Blueberry Markets has different withdrawal methods, each with its own set of fees. For instance, Bank Wire withdrawals may incur around a $25 intermediary fee. Credit Card withdrawals are free, but the receiving bank may impose a fee. Cryptocurrency withdrawals have a 1% fee imposed by the payment provider. Other methods like Skrill and SticPay may impose a 1 to 3% fee. Minimum Deposit The minimum deposit amount required to open a Blueberry Markets live trading account is $100 USD. Please note that these details are subject to change and it’s always a good idea to check the latest information on the Blueberry Markets website.

What can I trade with Blueberry Markets?

Blueberry Markets is a global forex trading platform that offers a wide range of trading options. Forex Trading Blueberry Markets provides a platform for trading major and minor currency pairs. Some of the currency pairs available for trading include EURUSD, AUDUSD, GBPUSD, USDCAD, and USDJPY. Commodities Trading In addition to forex, commodities are also available for trading. This includes Gold, Silver, US Crude Oil, and Brent Crude Oil. Indices Trading Blueberry Markets also allows trading on various indices. Some of the indices available for trading include DJ30, UK100, GER30, and JP225. Crypto CFDs Trading For those interested in cryptocurrencies, Blueberry Markets offers Crypto CFDs trading. Some of the cryptocurrencies available for trading include Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple. Share CFDs Trading Share CFDs are another trading option available on Blueberry Markets. Some of the shares available for trading include Netflix, Tesla, Pfizer, Amazon, and Walmart. Blueberry Markets also provides advanced analytics, three levels of training, and a free VPS server. It also offers a MetaTrader 4 platform that provides fast execution speeds, flexible trading conditions, and a user-friendly forex trading experience. The platform is customizable with thousands of online tools to plug-in. Please note that trading involves risk and it’s important to understand the risks involved before starting to trade.

Which Trading Platforms are offered by Blueberry Markets?

Blueberry Markets, a prominent player in the global forex trading platform, offers its clients several trading platforms. The primary platforms provided by Blueberry Markets are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are popular among traders for their comprehensive features, including excellent charting, several add-ons, trading automation, and much more. They are available for all devices, including desktop and mobile, allowing traders to engage in forex trading on-the-go. In addition to MT4 and MT5, Blueberry Markets also offers a Web Trader for those who prefer trading on their browser. This platform provides the flexibility to trade from anywhere without the need to download any software. These platforms support trading in a wide range of instruments, including major and minor currency pairs, commodities, indices, and crypto CFDs. They offer tight spreads and real-time trade signals, enhancing the trading experience. Furthermore, Blueberry Markets provides round-the-clock support and a variety of deposit and withdrawal options, ensuring a seamless trading experience. The platform also offers live foreign exchange charts with indicators and updated market hours and trading sessions. In conclusion, Blueberry Markets provides a robust and versatile trading environment with its offering of MetaTrader 4, MetaTrader 5, and Web Trader platforms, catering to the diverse needs of forex traders.

Which Trading Instruments are offered by Blueberry Markets?

Blueberry Markets, a renowned online broker, offers a wide range of trading instruments. These include:. Forex: This is the primary financial instrument traded on Blueberry Markets. The platform provides a variety of currency pairs for trading. Some of these include AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/SGD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, EUR/AUD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/NZD, EUR/USD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/NZD, GBP/USD, NZD/CAD, NZD/CHF, NZD/JPY, NZD/USD, USD/CAD, USD/CHF, USD/JPY, and USD/SGD. Indices: Traders can speculate on price movements in stock indices. Metals: Trading in metals like gold and silver is also available. Commodities: Blueberry Markets offers the opportunity to trade in commodities. Cryptocurrency CFDs: The platform supports the trade of cryptocurrencies through Contracts for Difference (CFDs). Share CFDs: Traders can also trade in single stock shares through CFDs. These instruments provide traders with a lot of variety and the opportunity to diversify their portfolio. The minimum order size for forex trading is 0.01 lot. It’s important to note that trading involves risk and it’s crucial to understand the instruments before investing.

Which Trading Servers are offered by Blueberry Markets?

Blueberry Markets, a renowned player in the Forex trading industry, offers its clients a robust and efficient trading experience through its high-performance servers. The company provides a Forex Virtual Private Server (VPS) that executes trades with speed and accuracy. This external server allows for better trading connectivity and keeps MetaTrader running 24 hours a day. It eliminates downtimes caused by electrical or computer issues. One of the key features of Blueberry Markets’ VPS is its low latency trading. The system is hosted in a data center close to Blueberry Markets’ main trading servers. This proximity allows orders to be filled before the rest, with trades executed in 1-3 ms or less. In terms of trading platforms, Blueberry Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are comparable with many leading brokers. They also provide a mobile platform counterpart for trading on-the-go. , as well as a Web Trader for those who prefer trading on their browser. In conclusion, Blueberry Markets provides a comprehensive suite of trading servers and platforms, designed to cater to the diverse needs of Forex traders. Its commitment to high performance, low latency, and versatile trading options makes it a preferred choice for many in the Forex trading community.

Can I trade Crypto with Blueberry Markets? Which crypto currencies are supported by Blueberry Markets?

Yes, Blueberry Markets offers the opportunity to trade popular cryptocurrency CFDs. This includes a range of cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Dash, Ripple, and more. These can be traded against the US Dollar on their leading CFD platform. Cryptocurrency CFDs, or Contract for Differences, allow you to speculate on the price movement of cryptocurrencies without taking ownership of the actual underlying assets. This means you can potentially profit from both rising and falling prices in the cryptocurrency market. Blueberry Markets provides a fixed 2:1 leverage on your trades. , which can help amplify your profits. However, it’s important to note that leverage can also amplify losses, so it’s crucial to manage risk effectively. One of the advantages of trading cryptocurrency CFDs with Blueberry Markets is that you don’t need a digital wallet. This can simplify the trading process and avoid the complexities of holding a digital wallet. Furthermore, Blueberry Markets uses the MetaTrader platform, which offers accurate insights, fast executions, and automated trading strategies. This platform is full of advanced features, yet simple enough for beginners, potentially unlocking unlimited trading possibilities. In terms of costs, Blueberry Markets is committed to keeping costs as transparent and competitive as possible. You can check out live spreads on cryptocurrency CFDs on their platform. In conclusion, Blueberry Markets offers a comprehensive platform for trading a variety of popular cryptocurrencies as CFDs. With competitive spreads, 2:1 leverage, and the convenience of not requiring a digital wallet, it presents an attractive option for those interested in cryptocurrency trading.

What is the Leverage on my Blueberry Markets Trading Account?

Leverage on a Blueberry Markets Trading Account is a key feature that allows traders to hold large positions in the Forex market with fewer capital. Leverage in Forex Trading. Leverage in Forex trading refers to borrowing money from a Forex broker to open a position in the market. With leverage, traders can put only a fraction of the full value of a position with their broker lending them the rest of the amount needed. The leveraged money is then used by the trader to hold a larger position in the market. How Leverage Works. Leverage works by allowing traders to use any size of account balance. It depends on the leverage ratio and margin of the Forex broker. The leverage ratio is the amount of a trader’s fund in relation to the broker’s credit size. It shows how much a trade can be magnified with the margin by the broker. The margin required by a broker depends on the rules and trade size of the exchange house. Leverage at Blueberry Markets. Blueberry Markets offers scalable leverage from 1:1 to 1:500, for all account types. For Forex exotics, the leverage is up to 1:100 and 1:200 for Indices. Oil and Metals remain with a maximum of 1:500 leverage. By default, Blueberry Markets sets the leverage to 1:100. However, despite the restrictions on the amount of leverage that have recently been introduced in the EU, Blueberry Markets, an Australian brokerage company, still offers high leverage ratios up to 1:500 for Forex instruments. Benefits of Leverage Trading. Leverage trading multiplies returns whenever a trade is successful, as profits are always calculated on the full position. With leverage, traders can speculate market movements and benefit from both rising and falling markets. So when the market is bearish, traders can go short to profit from the dip. In conclusion, leverage is a powerful tool in Forex trading that can magnify returns but also losses. Therefore, it’s important for Forex traders to learn how to manage leverage and mitigate risks to minimise losses.

What kind of Spreads are offered by Blueberry Markets?

Blueberry Markets offers a variety of spreads that cater to different trading needs. The spreads are competitive and are designed to provide traders with the best possible trading conditions. Forex Spreads. Blueberry Markets offers competitive spreads on all major forex currency pairs. The spread is the difference between the buy (ask) and the sell (bid) price quoted for an underlying instrument. Here are some examples of the spreads for various currency pairs:. AUDCAD: 1.6. AUDCHF: 5.2. AUDJPY: 0.6. AUDNZD: 2.4. AUDUSD: 0.1. CADCHF: 7.6. CADJPY: 1.4. CHFJPY: 9.8. EURAUD: 2.1. EURCAD: 1.6. EURCHF: 1.9. EURGBP: 0.7. EURJPY: 1.9. EURUSD: 0.2. GBPAUD: 3.1. GBPCAD: 1.9. GBPCHF: 6. GBPJPY: 2.3. GBPUSD: 0.2. Account Types and Commissions. Blueberry Markets offers two types of accounts: Standard Accounts and Direct Accounts. The spreads on Standard Accounts range from 1 pip, whereas on Direct Accounts, they can be as low as 0.0. Direct Accounts also incur a commission of USD $7 per standard lot per round turn. Share CFD Spreads. In addition to forex spreads, Blueberry Markets also offers spreads for Share CFDs. Traders can trade Share CFDs on Blueberry Markets with low commissions and fixed 5:1 leverage. Please note that the spreads mentioned are indicative and may vary. Traders are advised to check the platform for the most up-to-date prices.

Does Blueberry Markets offer MAM Accounts or PAMM Accounts?

Blueberry Markets, a global forex trading platform, does offer both MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts. MAM Accounts MAM accounts are designed for account managers and allow them to manage multiple trading accounts from a single interface. Blueberry Markets provides access to MAM software, which offers straightforward integration with MT4 and MT5 trading platforms. This software also supports trading with expert advisors and provides flexible trade allocation parameters. However, it’s important to note that internal transfers between sub-MAM and individual accounts are disabled at Blueberry Markets. This is to prevent the sub-MAM account from having insufficient margin while being traded by the MAM manager. PAMM Accounts Similar to MAM, PAMM accounts at Blueberry Markets allow fund managers to manage multiple sub-accounts with one unified account. The PAMM software provided by Blueberry Markets helps fund managers stay ahead by offering potential for further capital allocation, bespoke performance and commission fees, and dedicated account management. In conclusion, Blueberry Markets does offer MAM and PAMM accounts, but only to clients who have been referred to Blueberry Markets by a fund manager. They do not recommend particular products or services to clients.

Does Blueberry Markets allow Expert Advisors?

Blueberry Markets does indeed allow the use of Expert Advisors (EAs). EAs are programmed algorithms that run on trading platforms like MT4 and help automate trading activities based on preset parameters. They are used to monitor key markets, find opportunities according to set parameters, and open or close positions automatically. Traders can either build their own EAs by creating automation algorithms in MetaQuotes Language 4 (MQL4), or they can also import EAs into MT4 from other sources. The biggest benefit of Expert Advisors is that they allow traders to keep opening or closing trades automatically without having to constantly monitor the markets. EAs combine these yes/no rules into a complex mathematical model and execute trading strategies. They use algorithms and triggers to make trading decisions almost instantly. To set up Expert Advisors, traders need to set up the MT4 trading account, which includes registering with a forex broker. At the same time, traders should install the MT4 trading platform to ensure EAs can function properly. There are two main ways to acquire EAs – Traders can create their own custom Expert Advisors on MT4 through MetaEditor or they can also download EAs from other sources. Codebase is a free source library where traders can get access to free Expert Advisors, scripts, and indicators. Forex Expert Advisors (EAs) enable the automation of forex trading. EAs have become increasingly popular among traders due to some benefits they provide, like customizable strategies, 24/7 trading, risk management features and more. They can also be customized to suit a trader’s specific needs and preferences and can operate 24 hours a day–allowing traders to take advantage of market opportunities at any time. EAs operate on a forex trading platform and execute automatic trades based on specific rules and parameters set by the trader. Once the trader has defined the rules, the EA can analyze the market data and identify potential trading opportunities. It then executes trades automatically, eliminating the need for manual intervention. In conclusion, Blueberry Markets not only allows the use of Expert Advisors but also provides a conducive environment for their effective utilization.