CF Merchants Review 2026

What is CF Merchants?

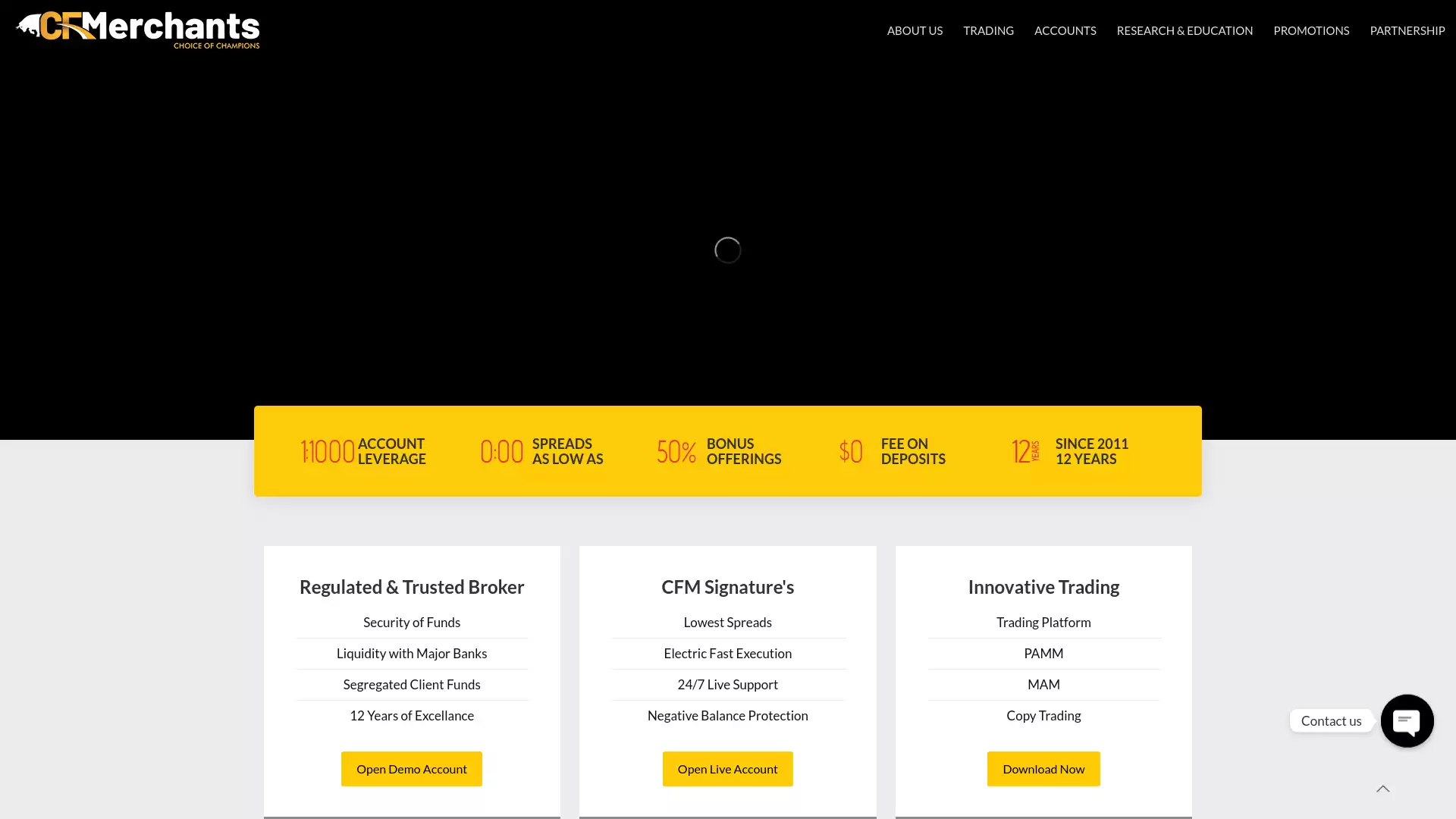

CF Merchants is a global online trading broker that offers a range of trading instruments, including forex, commodities, CFDs, indices and cryptocurrencies. CF Merchants was established in 2011 and is regulated by the Financial Marketers Authority (FMA) in New Zealand. CF Merchants claims to provide the best trading conditions, such as low spreads, fast execution, negative balance protection and innovative trading platforms. CF Merchants also offers various account types, such as ECN, Prime and Pro accounts, with different features and benefits. CF Merchants has a global presence and serves clients from over 100 countries. Some of the advantages of trading with CF Merchants are:. You can access a wide range of markets with one single platform. You can enjoy the lowest possible spreads starting from 0 pips on ECN accounts. You can benefit from 30 milliseconds instant trade execution with zero latency and zero slippage. You can use the PAMM or MAM copy trading services to manage unlimited accounts from one master account. You can get a 50% deposit bonus to maximize your profits with more equity. You can get withdrawable deposit bonus to increase your margins. You can trade with confidence with free access to educational blogs, daily market analysis and support from personal account managers. Some of the disadvantages of trading with CF Merchants are:. You may need to meet certain requirements to qualify for some account types or bonuses. You may face some restrictions on withdrawals or deposits depending on your country or currency. You may encounter some technical issues or glitches with the trading platform or the customer service. If you are interested in learning more about CF Merchants, you can visit their official website. or read some reviews from other traders. However, before you decide to trade with CF Merchants or any other broker, you should always do your own research and due diligence. Trading involves risks and you should only trade with money that you can afford to lose.

What is the Review Rating of CF Merchants?

- 55brokers: 55brokers rated CF Merchants with a score of 20. This rating was last checked at 2024-01-06 03:29:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated CF Merchants with a score of 74. This rating was last checked at 2024-01-05 20:51:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated CF Merchants with a score of 20. This rating was last checked at 2024-03-13 16:49:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of CF Merchants?

CF Merchants is a Forex broker that offers several advantages to its clients. Here are some of the key benefits:. Experience: CF Merchants has been providing brokerage services for over a decade. This long-standing presence in the market speaks to their reliability and expertise. Diverse Trading Instruments: Traders can trade currency pairs, cryptocurrencies, and CFDs (Contract for Differences) on different assets. This variety allows traders to diversify their portfolio and explore different markets. Low Minimum Deposit: The minimum deposit to start trading with CF Merchants is $50. , making it accessible for traders with different budget levels. High Leverage: CF Merchants offers high leverage up to 1:1000. , which can potentially amplify profits. However, it’s important to note that high leverage can also amplify losses. Competitive Spreads: CF Merchants offers competitive spreads, starting from 0 pips on ECN accounts. Lower spreads can reduce trading costs and potentially increase profitability. Scalping and Hedging: CF Merchants allows scalping and hedging. , which are advanced trading strategies that can help traders manage risk and take advantage of market volatility. Award-Winning Broker: CF Merchants has been internationally recognized as an industry leader, receiving The Best ECN Broker award at the Forex Expo Dubai 2020. Global Presence: CF Merchants serves traders from more than 120 countries. , demonstrating its global reach and acceptance. Please note that while these advantages make CF Merchants an attractive choice for many traders, it’s important to thoroughly research and consider your individual trading needs and risk tolerance before choosing a Forex broker. Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital.

What are the Cons of CF Merchants?

CF Merchants is a Forex broker that offers trading services for currency pairs, cryptocurrencies, and CFDs. However, there are several cons associated with CF Merchants that potential traders should be aware of:. High-Risk Broker: CF Merchants is considered a high-risk broker. This means that there is a significant risk of losing your investment when trading with this broker. It’s crucial for traders to understand the risks involved in Forex trading and ensure they are comfortable with the level of risk associated with a particular broker. Limited Trading Instruments: The range of CFD trading instruments offered by CF Merchants is smaller than that of popular Forex brokers. This could limit trading opportunities for traders who are interested in a diverse range of trading instruments. Inferior Account Conditions: The conditions on standard accounts at CF Merchants are also inferior to those of its competitors. This could impact the profitability of trades and the overall trading experience. Unregulated: CF Merchants is said to be the trading name of Commodity and Forex Merchants Limited, a company registered in Saint Vincent and the Grenadines, and this company is not regulated by any regulatory authority to operate legally. Trading with an unregulated broker carries a high level of risk as there is no regulatory oversight to ensure fair and transparent trading practices. Customer Care Issues: There have been reports of issues with CF Merchants’ customer care. Good customer service is essential in Forex trading for resolving issues and providing assistance, and any shortcomings in this area can significantly impact the trading experience. Low Overall Score: CF Merchants has a low overall score of 1.81 out of 10. , and a very low score of 1.89/10 from WikiFX. These low scores indicate that many traders may not be satisfied with the broker. While CF Merchants does have some advantages, such as allowing scalping and hedging, and offering spreads from 0 pips on ECN accounts. , the cons listed above are significant. Traders should carefully consider these factors when deciding whether to trade with CF Merchants. It’s always recommended to do thorough research and consider multiple brokers before making a decision.

What are the CF Merchants Current Promos?

CF Merchants, a trusted global partner in the Forex market, is currently offering a range of promotions to both new and existing clients. One of the key promotions is the 50% Deposit Bonus. This bonus is applicable on all deposits and is designed to maximize profits by increasing equity and margins. The bonus amount is added to the account as a credit and can be used for trading for six calendar months from the time of deposit. To claim the bonus, clients need to open a live account at CF Merchants and deposit a minimum amount of $500. The bonus is available to all account types. The bonus amount can be withdrawn only after completing 30% Standard lots of the bonus amount taken. If the client does not complete 30% Standard lots within six months, the company will withdraw all the bonus amount. Another exciting feature offered by CF Merchants is the CFM Copy Trading. This feature allows clients to manage unlimited accounts from one Master Account. Trades can be copied in milliseconds and adjusted with equity, balance, or lot size. This feature is designed to attract more clients and maximize your portfolio. Please note that the bonus promotion will be applied only once and cannot exceed $25,000 to one client in all of his trading accounts. The bonus is not transferable to any other client’s account. The bonus will be valid for six calendar months from the time that the bonus has been credited to the account. For more information about these promotions and how to claim them, clients can contact CF Merchants directly.

What are the CF Merchants Highlights?

CF Merchants is a Forex broker that offers trading services for currency pairs, cryptocurrencies, and CFDs (Contract for Differences) on various assets. Here are some key highlights:. Established in 2011, CF Merchants has been providing quality service and fair pricing, attracting thousands of clients globally. It is a regulated and trusted broker that ensures the security of funds. It provides liquidity with major banks and maintains segregated client funds. CF Merchants offers a range of trading platforms, including PAMM, MAM, and Copy Trading. It provides 24/7 live support and offers negative balance protection. CF Merchants has a minimum deposit requirement of $50. The broker allows scalping and hedging, and offers spreads from 0 pips on ECN accounts. It has been internationally recognized as an industry leader, receiving The Best ECN Broker award at the Forex Expo Dubai 2020. In terms of trading opportunities, CF Merchants offers a variety of instruments:. Forex: It provides a platform for trading currency pairs. Commodities: Traders can invest in various commodities. Indices: It offers opportunities to trade on major global indices. Cryptocurrencies: CF Merchants provides a platform for trading popular cryptocurrencies. CF Merchants also provides up-to-date Forex news, education news, and company news. This helps traders stay informed about the latest market trends and make informed trading decisions. Please note that trading involves risk and it’s important to understand the risks involved before starting to trade.

Is CF Merchants Legit and Trustworthy?

CF Merchants is a forex broker that is registered in St. Vincent and the Grenadine. According to a review by 55brokers.com, CF Merchants is not a safe broker to trade with because it is not regulated. The same review states that St. Vincent and the Grenadines is notorious for its practically absent requirements and regulations. Another review by scamwatcher.org also warns against trading with CF Merchants, stating that it is an unregulated broker and that unregulated brokers are not reliable and abuse regulations. A review by forexing.com states that CF Merchants is a safe forex broker with a minimum deposit of $200 USD. However, this review does not provide any information on whether CF Merchants is regulated or not. Based on the reviews, it is difficult to determine whether CF Merchants is legit and trustworthy. While one review states that it is a safe forex broker, two other reviews warn against trading with it. It is important to note that CF Merchants is not regulated, which is a red flag for many traders. Traders should exercise caution when dealing with unregulated brokers, as they may not be reliable and may abuse regulations. In summary, CF Merchants is a forex broker that is registered in St. Vincent and the Grenadine. While one review states that it is a safe forex broker, two other reviews warn against trading with it. Traders should exercise caution when dealing with unregulated brokers, as they may not be reliable and may abuse regulations. .

Is CF Merchants Regulated and who are the Regulators?

CF Merchants is a trading platform that operates in the forex market. However, it’s important to note that CF Merchants is not regulated by any major regulatory authority. The company is known as Commodity and Forex Merchants Limited and is registered in Saint Vincent and the Grenadines. Despite its registration, the absence of regulation by a recognized financial authority raises concerns about the security of funds and the overall reliability of the platform. Regulation in the forex market is crucial as it ensures the broker operates within the guidelines set by the regulatory body. This provides a level of protection for traders and investors. Regulated brokers are required to maintain adequate capital, keep client funds in segregated accounts, and adhere to fair trading practices. Unfortunately, in the case of CF Merchants, the lack of regulation means it might be challenging to withdraw funds if the company decides to ignore requests or suspend accounts. Therefore, traders and investors are advised to exercise caution when dealing with non-regulated brokers. In conclusion, while CF Merchants offers forex trading services, the lack of regulation by a recognized financial authority is a significant concern. Traders and investors should consider this factor when deciding to engage with this platform. It’s always recommended to choose a broker that is regulated by a reputable financial authority to ensure the safety of your investment.

Did CF Merchants win any Awards?

CF Merchants, a well-known forex broker, has indeed been recognized for its excellence in the industry. However, I’m unable to provide specific details about the awards they’ve won based on the information available. CF Merchants has been operating since 2011 and has established a reputation for providing low spreads, fast execution, and excellent customer support. They offer a range of trading platforms and instruments, and they have implemented measures to ensure the security of funds. It’s also worth noting that CF Merchants offers a variety of innovative trading features, such as PAMM, MAM, and copy trading. These features can be beneficial for both novice and experienced traders, allowing them to maximize their trading potential. In conclusion, while I can’t provide specific details about the awards CF Merchants has won, it’s clear that they are a respected and trusted broker in the forex industry. For the most accurate and up-to-date information, I recommend checking CF Merchants’ official website or reaching out to them directly.

How do I get in Contact with CF Merchants?

CF Merchants is a leading forex broker that has been providing excellent online trading services to clients worldwide since 2011. They offer a wide range of trading instruments, including Forex, CFDs, commodities, indices, and cryptocurrencies. To get in contact with CF Merchants, you can reach out to them through the following methods:. Email: You can send an email to info@cfmerchants.com or support@cfmerchants.com for general inquiries or support-related questions. Phone: You can also reach them by phone at +971 56 942 0323 for direct communication. . CF Merchants is headquartered at Suite 305, Griffith Corporate Center, P. O. Box 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines. Before reaching out, it’s recommended to have a clear understanding of your query or concern. This will help the CF Merchants support team provide you with the most accurate and helpful response. Remember, trading in the forex market involves risk. It’s important to fully understand the risks involved and seek independent advice if necessary before you start trading.

Where are the Headquarters from CF Merchants based?

CF Merchants is a global forex broker that offers trading services in various instruments, such as currency pairs, commodities, indices, and cryptocurrencies. The company was founded in 2011 and has been providing online trading solutions to clients from different countries and regions. The headquarters of CF Merchants are located in Kingstown, Saint Vincent and the Grenadines, a small island nation in the Caribbean Sea. The company is registered and regulated by the International Financial Services Commission (IFSC) of Saint Vincent and the Grenadines under the license number 24535/2018. The company also has offices in other locations, such as London, Dubai, Singapore, and New York. CF Merchants claims to be a trusted global partner for its clients, offering low spreads, fast execution, negative balance protection, segregated client funds, and innovative trading platforms. The company also provides various bonus offerings for its clients, such as a 50% deposit bonus on their first deposit. Additionally, the company offers copy trading services through its PAMM (Professional Account Manager) and MAM (Multi-Account Manager) systems. CF Merchants is one of the many forex brokers that operate in the online trading industry. However, before choosing any broker to trade with, it is important to do your own research and due diligence. You should consider factors such as regulation, reputation, fees, customer service, platform features, and trading conditions. You should also be aware of the risks involved in forex trading and only trade with money that you can afford to lose. I hope this answer has been helpful for you. If you have any further questions about CF Merchants or forex trading in general, please feel free to ask me. I am always happy to assist you with your queries.

What kind of Customer Support is offered by CF Merchants?

CF Merchants, a trusted global partner in the forex industry, offers a comprehensive customer support system. Their support team can be reached via email at support@cfmerchants.com. or info@cfmerchants.com. They provide a wide range of services to their clients, including 24/7 live support. , ensuring that their clients can get assistance whenever they need it. This is particularly important in the fast-paced world of forex trading, where timely support can make a significant difference. In addition to their live support, CF Merchants also offers a variety of educational resources and daily market analysis. This can be incredibly beneficial for traders, as it allows them to stay informed about the latest market trends and make more informed trading decisions. Furthermore, CF Merchants has a team of highly professional staff members who have vast experience in the forex industry. Their competence and individual approach are some of the factors that have made CF Merchants a market leader in more than 100 countries. Overall, CF Merchants’ customer support system is designed to provide their clients with the best possible trading outcomes. Whether you’re a new trader just starting out or an experienced trader looking for a reliable forex broker, CF Merchants has the resources and support to help you succeed.

Which Educational and Learning Materials are offered by CF Merchants?

CF Merchants, a recognized industry leader in the Forex trading sector, offers a variety of educational and learning materials to assist both novice and experienced traders. CFM Academy is a key resource provided by CF Merchants. It covers basic concepts of Forex trading, providing a foundation for those new to the field. However, it’s worth noting that the depth of information might not be as extensive as some other Forex brokers. In addition to the CFM Academy, CF Merchants also offers an E-Book and a Forex Glossary. These resources can be particularly useful for traders looking to expand their knowledge and understanding of Forex trading terminology. Moreover, CF Merchants provides News updates, including Forex News and Education News. Staying updated with the latest news can be crucial for traders, as it allows them to make informed decisions based on current market trends. Another interesting feature offered by CF Merchants is the CFM Copy Trading. This allows traders to manage multiple accounts from one Master Account, copy trades in milliseconds, and adjust with Equity, Balance, or Lot Size. This feature can be particularly beneficial for traders looking to maximize their portfolio. In conclusion, while CF Merchants provides several educational and learning materials, the depth of these resources might not be as comprehensive as some other Forex brokers. However, the variety of resources, including the CFM Academy, E-Book, Forex Glossary, News updates, and CFM Copy Trading, can still provide valuable insights for both novice and experienced Forex traders.

Can anyone join CF Merchants?

CF Merchants, a trusted global partner in the forex trading industry, offers opportunities for interested traders to contribute to international financial markets. Here’s a detailed look at the process and requirements for joining CF Merchants:. Account Opening Process The account opening process at CF Merchants is simple and fast. It involves a few key steps. Registration: The first step is to register on the CF Merchants platform. Application: Choose your account type and submit your application. Funding: Fund your account using a range of funding options. Trading: Start enjoying the benefits of trading with CF Merchants, such as low spreads and fast execution. Eligibility While the specific eligibility criteria are not explicitly stated in the search results, it’s common in the forex industry for traders to be of legal age and to comply with certain financial and regulatory requirements. It’s also important to note that CF Merchants is a regulated entity, which adds to its credibility. Trading Instruments CF Merchants offers a wide range of trading instruments, including Forex, CFDs, commodities, indices, and cryptocurrencies. This diversity allows traders to choose instruments that best suit their trading strategies and risk tolerance. Support and Security CF Merchants provides 24/7 live support and ensures the security of funds. They also offer educational resources and daily market analysis to help traders make informed decisions. Unique Features CF Merchants stands out for its low spreads, fast execution, and negative balance protection. They also offer a 50% deposit bonus to maximize your profits with more equity. In conclusion, CF Merchants provides a comprehensive platform for forex trading. However, potential traders should conduct their own due diligence and consider their financial situation and trading experience before opening an account. It’s also recommended to consult with a financial advisor or conduct further research to understand the risks associated with forex trading.

Who should sign up with CF Merchants?

CF Merchants is a forex broker that offers a range of trading tools, such as forex, commodities, CFDs, indices and cryptocurrencies. It is regulated by the Financial Marketers Authority (FMA) in New Zealand and has been operating since 2011. If you are interested in trading with CF Merchants, you should consider the following factors:. Account types: CF Merchants offers three types of accounts: ECN, Prime and Pro. Each account has different features and benefits, such as leverage, spreads, commissions, minimum deposit and execution speed. You can choose the account that suits your trading style and preferences. Trading platform: CF Merchants provides its own proprietary trading platform called MetaTrader 4 (MT4), which is one of the most popular and widely used platforms in the forex industry. MT4 has a user-friendly interface, advanced charting tools, technical indicators, automated trading systems and market news. You can also access other platforms through MT4, such as cTrader and NinjaTrader. Liquidity providers: CF Merchants works with top liquidity providers from around the world, such as Swiss Quote Bank, Barclays, Citi Banks and more. This ensures that you have access to competitive prices and fast execution for your trades. Customer support: CF Merchants has a dedicated customer support team that is available 24/7 via phone, email and live chat. You can also find helpful information on their website, such as FAQs, tutorials, webinars and market analysis. Bonus offerings: CF Merchants offers various bonus programs for its clients to enhance their trading experience and profits. For example, you can get a 50% deposit bonus when you open a new account with at least $250 deposit. You can also participate in their PAMM program or MAM copy trading service to manage unlimited accounts from one master account. . In conclusion, CF Merchants is a reputable forex broker that provides a wide range of trading instruments and services for its clients. It has been in the industry for over 10 years and has established itself as a global leader in forex trading. If you are looking for a reliable partner to trade with in the forex market, you should sign up with CF Merchants today.

Who should NOT sign up with CF Merchants?

CF Merchants is a forex broker that offers a variety of trading services. However, there are certain types of traders who might want to consider other options. Here are some categories of people who might want to think twice before signing up with CF Merchants:. Regulation-Conscious Traders: CF Merchants is an offshore, unregulated broker. This significantly lowers its credibility. Traders who prioritize working with regulated brokers might want to avoid CF Merchants. Traders Seeking Advanced Trading Platforms: CF Merchants offers MetaTrader 4 as its trading platform. While this is a widely used platform, it may not meet the needs of traders looking for more advanced or diverse trading platforms. Traders Who Prioritize Customer Reviews: Some customer reviews of CF Merchants have been less than stellar. Traders who heavily weigh customer reviews in their decision-making process might be deterred by these reviews. High-Volume Traders: The minimum deposit requirement for a Standard account with CF Merchants is just 1 USD. This low entry barrier might not appeal to high-volume traders who prefer brokers with higher minimum deposits, which often come with additional services and benefits. Traders Looking for Promotions: As of the latest information, CF Merchants does not offer deposit bonuses. Traders who are attracted to brokers that offer promotions and bonuses might be disappointed. In conclusion, while CF Merchants might be a suitable choice for some traders, those who fall into the above categories might want to consider other options. As always, it’s important for each trader to conduct thorough research and consider their individual needs when choosing a forex broker.

Does CF Merchants offer Discounts, Coupons, or Promo Codes?

CF Merchants, a renowned name in the Forex trading industry, does offer promotional incentives to its clients. One such incentive is the 50% Deposit Credit Bonus. This bonus is available to all new and existing clients who open a live account at CF Merchants and deposit a minimum amount of $500. The bonus amount is added to the account as a credit and can be used for trading for six calendar months from the time of deposit. While this is a significant incentive, it’s important to note that promotions and offers can change over time. Therefore, it’s always a good idea to check CF Merchants’ official website or contact their customer service for the most current information. Please note that while I strive to provide accurate and up-to-date information, it’s always recommended to do your own research and consult with a financial advisor before making any investment decisions. Trading Forex involves risk and it’s possible to lose your invested capital. Always trade with money that you are prepared to lose. Happy trading!.

Which Account Types are offered by CF Merchants?

CF Merchants, a trusted global partner in the Forex market, offers three distinct types of accounts to cater to the diverse needs of traders. These accounts are designed to accommodate different trading strategies, investment goals, and financial backgrounds. ECN Account: This account type requires a minimum deposit of $5000. It offers variable spreads starting from 0 and a commission of $7. The leverage is set at 1000 and the minimum lot size is 0.01 with a maximum lot size of 10. This account type supports scalping and hedging, and it also offers a swap-free option. Prime Account: The Prime account requires a minimum deposit of $500. It offers variable spreads starting from 1 pip and no commission. The leverage is set at 500 and the minimum lot size is 0.01 with a maximum lot size of 10. This account type also supports scalping and hedging, and it offers a swap-free option. Pro Account: The Pro account requires a minimum deposit of $50. It offers variable spreads starting from 1.6 pips and no commission. The leverage is set at 500 and the minimum lot size is 0.01 with a maximum lot size of 10. This account type also supports scalping and hedging, and it offers a swap-free option. Each of these account types offers a margin call at 75% and a stop out level at 30%. They also provide the flexibility of managing unlimited accounts from one master account. Traders can copy trades in milliseconds and adjust with equity, balance, or lot size. This feature helps attract more clients to maximize your portfolio. CF Merchants is committed to providing its clients with the best trading conditions, tailored to different types of traders, depending on their trading strategies, investment goals, and financial background. With these diverse account options, CF Merchants aims to meet the needs of all types of traders.

How to Open a CF Merchants LIVE Account?

Opening a CF Merchants LIVE account involves a few straightforward steps. Here’s a detailed guide:. Step 1: Register Begin by registering on the CF Merchants website. This process is simple and takes just a few minutes. Step 2: Choose Your Account Type and Submit Application Next, choose the type of account that best suits your trading needs. CF Merchants offers a variety of account types, each with its own unique features and benefits. After selecting your account type, submit your application. Step 3: Verification After submitting your application, you’ll need to pass the verification process. This is a standard procedure to ensure the security of your account and comply with financial regulations. Step 4: Fund Your Account Once your account is verified, you can fund it using a range of funding options. CF Merchants offers a variety of funding methods to make this process as convenient as possible. Step 5: Start Trading With your account funded, you’re ready to start trading. CF Merchants provides a robust trading platform, allowing you to trade a wide range of markets including Forex, CFDs, commodities, indices, and cryptocurrencies. Remember, trading involves risk and it’s important to trade responsibly. Good luck!.

How to Open a CF Merchants DEMO account?

Opening a CF Merchants DEMO account is a straightforward process that involves a few key steps. Here’s a detailed guide:. Step 1: Register an Account The first step is to register an account on the CF Merchants website. This involves providing some basic information such as your name, email address, and contact details. Step 2: Verification Process After registering, you’ll need to pass the verification process. This typically involves submitting proof of identity and proof of residence. The exact documents required may vary, but they usually include a government-issued ID and a utility bill or bank statement showing your current address. Step 3: Make a Deposit Once your account has been verified, you’ll need to make a deposit. For a DEMO account, this is typically a nominal amount, or even zero. However, if you wish to qualify for certain bonuses, you may need to deposit a minimum amount. Step 4: Request the DEMO Account The final step is to request the DEMO account. This usually involves contacting CF Merchants’ customer support, either through email or live chat, and asking them to set up a DEMO account for you. Remember, a DEMO account is a great way to familiarize yourself with the platform and practice trading strategies without risking real money. It’s an invaluable tool for both new and experienced traders alike. Please note that the exact process may vary slightly depending on your region and any updates to CF Merchants’ procedures. Always refer to the official CF Merchants website. for the most accurate and up-to-date information. Happy trading!.

How Are You Protected as a Client at CF Merchants?

As a client at CF Merchants, you are protected in several ways:. 1. Security of Funds CF Merchants ensures the security of client funds. This is a crucial aspect of client protection as it guarantees that your money is safe and secure. 2. Segregated Client Funds CF Merchants keeps client funds segregated. This means that client funds are kept separate from the company’s own funds, providing an additional layer of security. 3. Negative Balance Protection CF Merchants offers negative balance protection. This feature protects you from losing more money than you have deposited into your account. 4. Regulated Broker CF Merchants has been regulated and trusted for over 12 years. This means that they are subject to strict regulatory standards, providing further assurance to clients. 5. Liquidity with Major Banks CF Merchants provides liquidity with major banks. This ensures that you can always buy or sell your assets whenever you want. 6. Innovative Trading Platforms CF Merchants offers innovative trading platforms. These platforms provide a variety of trading instruments and excellent trading conditions. 7. PAMM and MAM Accounts For trading with minimal risks, CF Merchants uses PAMM and MAM accounts. These accounts allow money managers to manage multiple accounts from a single interface. 8. Copy Trading CF Merch.

Which Funding methods or Deposit Options are available at CF Merchants?

CF Merchants, a forex broker, offers a variety of funding methods and deposit options for its clients. Here are the details:. Deposit Methods CF Merchants provides several deposit methods. These include:. Bank transfer: This is a traditional method of transferring money directly from your bank account to your CF Merchants account. Credit card: You can use your credit card to deposit funds into your CF Merchants account. Skrill: Skrill is a digital wallet that allows you to send and receive money online. It’s a convenient way to deposit funds into your CF Merchants account. Neteller: Similar to Skrill, Neteller is another digital wallet that you can use to deposit funds. UnionPay: UnionPay is a payment method popular in China. If you have a UnionPay card, you can use it to deposit funds. Perfect Money: Perfect Money is another digital payment system that you can use to deposit funds into your CF Merchants account. Account Types CF Merchants offers three types of trading accounts. ECN Account: This account type offers raw spreads and charges a commission of $7 per lot. Prime Account: This account type offers spreads starting at 1.0 pips and does not charge a commission. Pro Account: This account type offers spreads starting at 1.6 pips and does not charge a commission. The minimum deposit amount specifies the account type, with the Pro account from $50, the Prime account from $500, the ECN account from $5,000. Bonus CF Merchants also offers a 50% deposit credit bonus to all new and existing clients who open a live account and deposit a minimum amount of $500. The bonus can be used for trading for six calendar months from the time of deposit. Please note that while CF Merchants offers a variety of deposit options, it’s important to consider the potential risks associated with forex trading. Always ensure that you understand these risks before you start trading.

What is the Minimum Deposit Amount at CF Merchants?

CF Merchants is a forex broker that offers three types of trading accounts: ECN, Prime and Pro. The minimum deposit amount to open an account with CF Merchants depends on the type of account you choose. Here is a summary of the minimum deposit amounts for each account type:. ECN Account: This account type has variable spreads starting from 0 pips and no commission. The minimum deposit amount for this account is $5000. Prime Account: This account type has variable spreads starting from 1 pip and no commission. The minimum deposit amount for this account is $500. Pro Account: This account type has variable spreads starting from 1.6 pips and no commission. The minimum deposit amount for this account is $50. . The minimum deposit amount is the lowest amount of money you need to fund your trading account with CF Merchants. It does not include any fees or charges that may apply when you make a deposit or withdraw money from your account. You can choose the payment method that suits you best, such as bank transfer, credit card, Skrill, Neteller, UnionPay or Perfect Money. If you are interested in trading forex with CF Merchants, you can visit their website. or contact their customer support. for more information. You can also read some reviews about CF Merchants from other traders. to learn more about their trading conditions, features and promotions. I hope this answer was helpful and informative for you. If you have any other questions about forex trading or anything else, feel free to ask me. I am always happy to chat with you.

Which Withdrawal methods are available at CF Merchants?

CF Merchants, a well-regarded forex broker, offers a variety of withdrawal methods to cater to the diverse needs of its clients. These methods are designed to provide a seamless and efficient experience for users, ensuring quick and secure transactions. The available withdrawal methods at CF Merchants are as follows. Bank Transfer: This traditional method allows users to directly transfer funds from their CF Merchants account to their bank account. Credit Card: Users can withdraw funds to the credit card associated with their CF Merchants account. Skrill: This digital wallet service provides a fast and secure way for users to withdraw their funds. Neteller: Another popular digital wallet service, Neteller offers a convenient method for users to access their funds. UnionPay: Particularly popular in China, UnionPay is a global payment network that allows users to withdraw funds directly to their UnionPay cards. Perfect Money: This is an internet-based, instant payment system that allows users to securely withdraw their funds. It’s worth noting that CF Merchants has chosen not to withhold fees for these transactions, further enhancing the convenience for its clients. Please note that while these methods are generally reliable, the processing time for withdrawals can vary depending on the method chosen and the policies of the respective financial institutions. It’s always a good idea to check with CF Merchants or your financial institution for the most accurate and up-to-date information. Remember, investing in forex markets involves risk, and it’s important to understand these risks and the functionality of your chosen withdrawal method before proceeding.

Which Fees are charged by CF Merchants?

CF Merchants is a forex broker that offers trading services for currency pairs, commodities, indices, and cryptocurrencies. It has been operating since 2011 and has a global presence in more than 120 countries. However, like any other broker, CF Merchants also charges various fees for its services. Here are some of the fees that you should be aware of before opening an account with CF Merchants:. Trading fees: These are the commissions and spreads that you pay for each trade you make on the broker’s platform. CF Merchants offers three types of accounts: Pro, Prime, and ECN. Each account has different trading conditions and fees. For example: The Pro account has fixed spreads from 1.6 pips and no commissions. The Prime account has variable spreads from 0 pips and no commissions. The ECN account has variable spreads from 0 pips and commissions of $2 per lot round turn. Deposit/withdrawal fees: These are the fees that you pay for transferring funds to or from your trading account. CF Merchants accepts various payment methods, such as bank wire, credit/debit cards, Skrill, Neteller, WebMoney, Perfect Money, QIWI Wallet, etc. However, some of these methods may incur additional fees from the payment provider or your bank. For example: For all deposits/withdrawals through bank wire, there is a limit on the minimum transfer amount without charges. For withdrawals of less than $100, $20 per transaction will be charged as a processing fee. Any third-party payments (deposits/withdrawals) are not accepted. Inactivity fees: These are the fees that you pay if you do not trade for a certain period of time on your account. CF Merchants does not specify how long the inactivity period is or how much the fee is. However, it is advisable to avoid inactivity fees by maintaining a regular trading activity on your account. . CF Merchants also charges other fees that may apply depending on your situation. For example:. If you fail to meet the margin requirements or exceed the stop out level on your account, you may face a margin call or a stop out order from the broker. If you use leverage beyond 1:1000 on your account, you may face higher risk exposure and potential losses. If you use negative balance protection (NBP) on your account, you may still lose some funds if your NBP margin falls below zero due to market fluctuations or other reasons. . To sum up, CF Merchants charges various fees for its services that may affect your trading performance and profitability. Therefore, it is important to understand these fees before opening an account with CF Merchants and compare them with other brokers in terms of pricing and quality. I hope this answer was helpful and informative for you. If you have any further questions about forex trading or brokers in general, please feel free to ask me again. I am always happy to assist you with your queries. Sources:.

What can I trade with CF Merchants?

CF Merchants is a forex broker that offers a variety of trading instruments, including: Forex: You can trade over 50 currency pairs with low spreads and fast execution. You can also benefit from the 50% deposit bonus, negative balance protection, and PAMM and MAM copy trading features. CFDs: You can trade on stock indices, metals, commodities, and energies with leverage up to 1:500. You can also access the CFM Signature platform, which provides innovative trading tools and strategies. Cryptocurrencies: You can trade on Bitcoin, Ethereum, Litecoin, Ripple, and more with competitive fees and high liquidity. You can also use the CFM Copy Trading feature to copy trades from successful traders. CF Merchants is an offshore broker registered in the Saint Vincent and the Grenadines, which means it is not regulated by any reputable authority. This poses a high potential risk for traders who want to use this broker. Therefore, you should be careful when choosing this broker and do your own research before opening an account. CF Merchants claims to have been in business since 2011 and to have a global network of clients. However, there is not much information available about the company’s history, reputation, or customer service. The broker also does not provide any contact details or physical address on its website. This makes it difficult to verify the broker’s legitimacy or trustworthiness. If you are looking for a reliable forex broker that offers a wide range of trading instruments, low spreads, fast execution, and various features and tools for traders of all levels, you may want to consider other options that are regulated by reputable authorities such as ASIC or FCA. These brokers have more transparency and security measures in place to protect their clients’ funds and interests.

Which Trading Platforms are offered by CF Merchants?

CF Merchants, a trusted global partner in the forex industry, offers a variety of trading platforms to cater to the diverse needs of traders worldwide. Trading Platforms CF Merchants provides access to the world’s most popular trading platforms. These platforms are designed to facilitate efficient and effective trading in forex, commodities, CFDs, indices, and cryptocurrencies. MetaTrader 4 (MT4): Known for its user-friendly interface, advanced charting capabilities, and automated trading features. MetaTrader 5 (MT5): An upgraded version of MT4, offering additional features such as more timeframes, technical indicators, and order types. cTrader: A platform known for its transparent pricing, speedy trade execution, and innovative back-testing facilities. Account Types CF Merchants offers three types of trading accounts, each designed to meet the specific needs of different types of traders. ECN Account: This account type offers direct access to some of the world’s deepest liquidity pools. It’s ideal for traders who prefer trading at market prices and do not wish to worry about broker interference or re-quotes. Prime Account: This account type is designed for experienced traders and offers lower spreads and commissions than the ECN account. Pro Account: This account type is suitable for professional traders who trade large volumes. It offers the lowest costs per trade and is designed to handle high-frequency trading. Additional Features CF Merchants also offers a range of additional features to enhance the trading experience:. PAMM/MAM: These features allow money managers to manage multiple accounts from a single interface. Copy Trading: This feature allows less experienced traders to copy the trades of successful traders. Negative Balance Protection: This feature protects traders from losing more money than they have deposited into their trading account. In conclusion, CF Merchants provides a comprehensive suite of trading platforms and account types, catering to traders of all experience levels. Its commitment to transparency, competitive pricing, and customer support makes it a preferred choice among forex traders globally.

Which Trading Instruments are offered by CF Merchants?

CF Merchants, a trusted global partner in the financial markets, offers a wide range of trading instruments. These include:. Forex: CF Merchants provides trading services for more than 50 currency pairs. This allows traders to take advantage of the volatility and liquidity offered by the global forex market. Commodities: Traders can also engage in the trading of various commodities. This includes popular commodities like gold and silver. , providing opportunities for traders to diversify their portfolios. CFDs: Contract for Difference (CFDs) are also available for trading at CF Merchants. CFDs allow traders to speculate on the rising or falling prices of fast-moving global financial markets. Indices: CF Merchants offers trading on indices. , which are often used as barometers for a given market or industry sector. Trading indices allows traders to take a broader view of the market. Cryptocurrencies: In response to the growing popularity of digital currencies, CF Merchants has included cryptocurrencies in its list of trading instruments. This allows traders to participate in one of the most volatile and potentially profitable markets. These trading instruments are offered with excellent trading conditions. CF Merchants is known for its low spreads, starting from 00:00, and stable spreads during highly volatile news. This, combined with instant trade execution, makes CF Merchants a preferred choice for many traders. Please note that trading involves risk and it’s important to understand the risks involved before engaging in the trading of any financial instrument.

Which Trading Servers are offered by CF Merchants?

CF Merchants, a trusted global partner in the forex industry, offers a variety of trading servers and platforms to cater to the diverse needs of traders worldwide. CFM Copy Trading is one of the key offerings by CF Merchants. This platform allows traders to manage unlimited accounts from one master account. It provides the ability to copy trades in milliseconds, adjust with equity, balance or lot size, and attract more clients to maximize your portfolio. This feature is particularly beneficial for traders who wish to leverage the strategies of successful traders and apply them to their own trading activities. In addition to the CFM Copy Trading platform, CF Merchants also offers PAMM and MAM accounts. These accounts are designed for traders who wish to trade with minimal risks. They provide traders with the opportunity to pool their funds together and have a professional trader or money manager to trade on their behalf. This can be a great way for novice traders to learn from experienced traders and for experienced traders to increase their trading volume. Moreover, CF Merchants prides itself on its transparent pricing and fast trade execution. With zero latency and zero slippage, and 30 milliseconds instant trade execution with innovative trading platforms, CF Merchants aims to provide a superior trading experience. Furthermore, CF Merchants offers a wide range of markets including Forex, CFD’s, Commodities, Indices, and Cryptos. This allows traders to diversify their trading portfolio and take advantage of different market conditions. Lastly, CF Merchants is known for offering the lowest spreads in the industry. With stable spreads even during highly volatile news events, CF Merchants provides traders with a competitive edge in the market. In conclusion, CF Merchants offers a comprehensive suite of trading servers and platforms, designed to cater to the diverse needs of traders. Whether you are a novice trader looking to learn from experienced traders, or an experienced trader looking to increase your trading volume, CF Merchants has the tools and platforms to help you succeed in the forex market.

Can I trade Crypto with CF Merchants? Which crypto currencies are supported by CF Merchants?

CF Merchants is a Forex broker that offers trading services for a variety of assets, including currency pairs, commodities, indices, and notably, cryptocurrencies. The company has been providing its services since 2011 and has attracted thousands of clients globally from more than 120 countries. CF Merchants offers the opportunity for traders to contract for Difference (CFD) on Bitcoin. A CFD is a derivative instrument that allows customers to speculate on the rising or falling cost of Bitcoin. However, the specific cryptocurrencies supported by CF Merchants are not explicitly mentioned in the available resources. The company is known for its quality service, fair pricing, and has been internationally recognized as an industry leader. For instance, it received The Best ECN Broker award at the Forex Expo Dubai 2020 ceremony. Here are some key features of CF Merchants:. Account currency: USD. Minimum deposit: $50. Leverage: Pro and Prime: 1:1 - 1:500; ECN: 1:1 - 1:1000. Spread: From 0 pips for ECN; 1 pips for Prime; and 1.6 pips for Pro. Instruments: Forex, commodities, indices, and cryptocurrencies. Margin Call / Stop Out: 75%/30%. Advantages of trading with CF Merchants include more than 10 years of providing brokerage services, a minimum deposit of $50, leverage up to 1:1000, allowance for scalping and hedging, and spreads from 0 pips on ECN accounts. Please note that while CF Merchants does offer cryptocurrency trading, it’s always important to do your own research and consider the risks involved in trading these volatile markets. As with any investment, only trade with money you can afford to lose.

What is the Leverage on my CF Merchants Trading Account?

Verkennen. Leverage in trading is a powerful financial tool that allows traders to increase their market exposure beyond the initial investment (deposit). This is achieved by using borrowed capital from the broker. CF Merchants, a Forex broker, provides its customers with a leverage of up to 1:1000. This is significantly higher than what is considered appropriate by many regulators. For instance, the maximum leverage for major currencies is up to 1:30 in Europe and Australia, and 1:50 in the United States and Canada. Let’s break down what this means. If your broker gives you a leverage factor (multiplier) of 1:1000, it means that each dollar you have gives you the buying power of $1000. So, if you have $1000 in your trading account, you can trade with $1,000,000. However, leverage is a double-edged sword. While it can significantly amplify your profits, it can also magnify your losses. Therefore, it’s crucial to understand the risks involved and employ risk management strategies when trading with high leverage. The amount of money needed to open and maintain a leveraged position is known as the margin. For example, if you want to open a trading position worth $100,000 and your leverage is 1:50, you would need a margin of $2000. It’s important to note that brokers offer leverage at a cost based on the amount of borrowed funds you’re using, and they charge you for each day that you maintain a leveraged position open. Therefore, understanding the cost of trading with leverage is essential. In conclusion, while leverage can provide traders with the opportunity to make significant profits, it also comes with high risks. Traders should have a thorough understanding of how leverage works and the associated costs before deciding to trade with high leverage. It’s always recommended to use leverage responsibly and within one’s risk tolerance levels.

What kind of Spreads are offered by CF Merchants?

CF Merchants, a leading trusted broker in the forex industry, offers a wide range of trading options with a focus on providing full-range services. Spreads Offered by CF Merchants. CF Merchants is known for offering the lowest possible spreads in the whole industry. These spreads start from 00:00 and remain stable even during highly volatile news. This unique offering sets CF Merchants apart from its competitors, making it a true industry champion. Trading Instruments. Traders at CF Merchants have free access to an extraordinary variety of trading instruments. This includes Forex, CFD’s, Commodities, Indices, and Cryptos. This wide range of markets allows traders to diversify their portfolios and take advantage of different market conditions. Trading Platform. CF Merchants provides its traders with access to the world’s most prevalent trading platform. This platform offers restricted spreads and quick execution as standard on all account types. Support and Services. CF Merchants is committed to providing excellent customer support. Traders can avail support from personal account managers, access educational blogs, and receive daily market analysis. This comprehensive support system ensures that traders are well-equipped to make informed trading decisions. Conclusion. In conclusion, CF Merchants offers competitive spreads and a wide range of trading options, making it a preferred choice for many traders globally. Its commitment to providing excellent customer support and a robust trading platform further enhances its appeal in the forex trading market.

Does CF Merchants offer MAM Accounts or PAMM Accounts?

CF Merchants, a globally trusted forex broker, does offer both MAM (Multi Account Manager) and PAMM (Percentage Allocation Management Module) accounts. MAM Accounts. MAM accounts allow fund managers to manage multiple trading accounts from a single master account. All the client accounts connected to the main account are managed proportionally to their account balance. This means that the trades made by the fund manager are distributed among the clients’ accounts according to the proportion of their individual account balance. The profit and loss are also distributed proportionally. PAMM Accounts. PAMM accounts, on the other hand, aggregate the total contributions of various clients into one account. This allows fund managers to execute trades on behalf of the investors, with the profits and losses being distributed proportionally to the investors’ share in the total fund. Key Features of MAM and PAMM Accounts at CF Merchants. CF Merchants provides a platform for MAM and PAMM accounts that is innovative and user-friendly. Trades can be copied in milliseconds, and adjustments can be made based on equity, balance, or lot size. This allows clients to maximize their portfolio by attracting more clients. Benefits of MAM and PAMM Accounts. MAM and PAMM accounts offer several benefits to both fund managers and investors. They allow for the diversification of trading strategies and provide the opportunity for investors to benefit from the expertise of experienced fund managers. Moreover, these accounts are fully automated, reducing the risk of fraud. Risks of MAM and PAMM Accounts. While MAM and PAMM accounts offer numerous benefits, they also come with risks. Any wrong decision by the fund manager may risk the investors’ money. Additionally, in PAMM accounts, the role of managers in trading may not be completely transparent, making traders dependent on the skills of the managers. In conclusion, CF Merchants does offer both MAM and PAMM accounts, providing a platform for innovative trading and the opportunity for clients to maximize their portfolio. However, as with all investment opportunities, these accounts come with their own set of risks and should be considered carefully.

Does CF Merchants allow Expert Advisors?

Yes, CF Merchants does allow the use of Expert Advisors (EAs). Expert Advisors are trading bots and applications written in the MQL4 programming language. They are used for algorithmic trading, which means they can execute trades automatically based on predefined strategies. This feature can be particularly useful for traders who want to automate their trading strategies, or for those who lack the time to monitor the markets continuously. CF Merchants is a Forex broker that has been providing its services since 2011. It offers trading in currency pairs, commodities, indices, and cryptocurrencies. The broker has been internationally recognized as an industry leader, having received The Best ECN Broker award at the Forex Expo Dubai 2020 ceremony. The broker offers a range of account types, including a Standard Account, Prime Account, VIP Account, and Corporate Account. The minimum deposit to open a Standard Account is just $1, while for the other accounts, where the spreads are much better, you will have to invest considerably more. CF Merchants also offers a swap-free or Islamic Account, designed especially to attract Muslim traders, who under the Sharia Law, are forbidden to take or receive interest. With swap-free accounts, you do not pay interest on positions left open over night. In terms of trading platforms, CF Merchants offers the MetaTrader4 platform. This platform is popular among traders due to its user-friendly interface and the ability to use and customize indicators. Please note that while CF Merchants does allow the use of Expert Advisors, it’s important for traders to understand the risks associated with automated trading. It’s recommended to thoroughly test any Expert Advisor in a demo environment before using it in a live trading account. In conclusion, CF Merchants is a versatile broker that caters to a wide range of traders, from novices to experienced ones. Its support for Expert Advisors provides an additional layer of flexibility, allowing traders to automate their strategies and potentially enhance their trading efficiency.