Charles Schwab Review 2026

What is Charles Schwab?

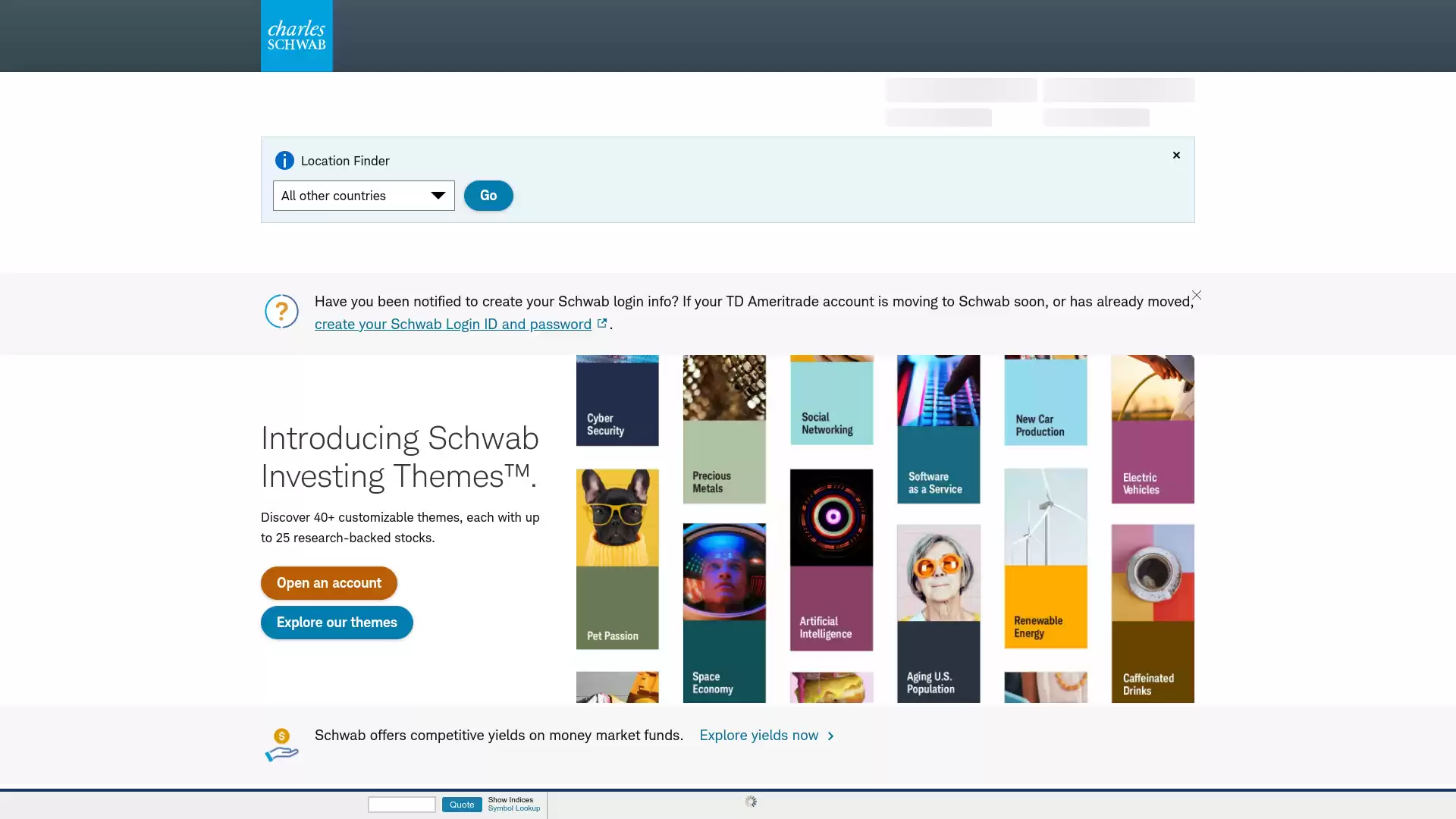

Charles Schwab is a leading online broker that offers a wide range of investment services. It provides various options for investing and retirement planning, such as self-directed, active, and full-service wealth management. The platform and mobile app offer real-time quotes, charts, and technical analysis tools. In the context of forex, Charles Schwab provides information about the foreign exchange market and currency trading. Forex trading with Charles Schwab is done through futures contracts, providing access to a wide range of currency pairs. The platform teaches about margin in forex trading, its benefits and risks, and why margin is one of the prime reasons traders are drawn to the forex market. Schwab also offers a product called Schwab Intelligent Portfolios. It builds, monitors, and automatically rebalances a portfolio based on your goals. For those who prefer a more hands-on approach, Schwab provides a full range of tools, resources, and expertise to invest the way you want. Schwab has received numerous awards for its services. It was ranked #1 in Investor Satisfaction with Full-Service Wealth Management Firms by J.D. Power in 2023. It was also the only broker to rank in the top three for all 11 years in the Investor’s Business Daily: Best Online Brokers 2023. In addition to these services, Schwab also offers a global trading account where you can trade stocks directly online in 12 of the top-traded foreign markets in their local currencies. For those interested in learning more about forex trading, Schwab provides educational resources on its platform. It also offers a virtual trading environment called paperMoney, built into all thinkorswim platforms, that allows you to test and refine strategies in a live market simulation. In conclusion, Charles Schwab is a comprehensive financial services provider that caters to a wide range of investment needs, including forex trading.

What is the Review Rating of Charles Schwab?

- 55brokers: 55brokers rated Charles Schwab with a score of 85. This rating was last checked at 2024-01-06 02:41:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Charles Schwab with a score of 30. This rating was last checked at 2024-01-05 21:04:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Charles Schwab with a score of 15. This rating was last checked at 2024-03-12 15:20:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Charles Schwab?

Charles Schwab, a well-known and respected name in the financial industry, offers a wide range of investment services, including forex trading. Here are some of the advantages of using Charles Schwab for forex trading:. Reputation and Trustworthiness: Charles Schwab has a long-standing reputation for being a reputable and trustworthy financial institution. They have been in business for over four decades and have built a strong track record of delivering reliable services to their clients. Comprehensive Research and Analysis Tools: Charles Schwab offers a wide range of comprehensive research tools, including real-time market data, charts, technical indicators, and expert analysis. These tools can help traders make informed decisions and enhance their trading strategies. Educational Resources: Charles Schwab provides a wealth of educational resources to help traders improve their forex trading knowledge and skills. They offer online courses, webinars, articles, and videos that cover a wide range of topics, from basic concepts to advanced trading strategies. These resources can be invaluable for both novice and experienced forex traders. Diverse Range of Forex Products: Charles Schwab offers a diverse range of forex products, allowing traders to access various currency pairs and trade different contract sizes. This diversity can provide traders with ample opportunities to profit in different market conditions and align their trading strategies with their risk tolerance. Competitive Pricing: Charles Schwab offers competitive pricing for forex trading. They charge a commission per trade, which can be as low as $0.65 per contract. This transparent pricing structure can be beneficial for traders, as it helps them manage their trading costs effectively. Please note that while Charles Schwab offers many advantages for forex trading, it’s important to consider all aspects of a trading platform before making a decision. It’s always a good idea to do thorough research and consider your individual trading needs and goals.

What are the Cons of Charles Schwab?

Charles Schwab, a well-known and respected name in the financial industry, offers a range of investment services, including forex trading. However, like any financial institution, it has its drawbacks. Here are some of the cons of using Charles Schwab for forex trading:. Limited Forex Trading Platforms: Charles Schwab’s forex trading platform, StreetSmart Edge, is not as feature-rich or intuitive as some of the dedicated forex trading platforms offered by other brokers. While it still provides essential trading functionalities, advanced traders may find it lacking in terms of customization options and advanced order types. Higher Margin Requirements: Charles Schwab has higher margin requirements compared to some other forex brokers. This means that traders need to have more capital in their trading accounts to hold positions overnight or take advantage of leverage. Higher margin requirements can limit the trading opportunities for traders with smaller account sizes. Limited Currency Pairs: Charles Schwab offers a limited number of currency pairs for trading compared to some other forex brokers. This could potentially limit the trading opportunities for forex traders. No Swap-Free Account Option: Charles Schwab does not provide a swap-free account option. This could be a disadvantage for traders who do not want to pay or earn interest for holding positions overnight. No Demo Account: Charles Schwab does not provide a demo account. This could be a disadvantage for novice traders who want to practice trading in a risk-free environment before trading with real money. Risk of Losing More Than Initial Deposit: When trading forex with Charles Schwab, there is a risk of losing more than your initial deposit. This is because Charles Schwab does not provide negative balance protection. High Account Minimums for Schwab Intelligent Portfolios: Charles Schwab has high account minimums for its Schwab Intelligent Portfolios. This could be a disadvantage for traders with smaller account sizes. Limited Number and Regions for International Stocks: Charles Schwab offers a limited number and regions for international stocks. This could limit the investment opportunities for traders interested in international stocks. Futures Fees Higher Than Industry Average: Charles Schwab’s futures fees are higher than the industry average. This could increase the trading costs for traders who trade futures. No Third-Party Payments: Charles Schwab does not accept payments from third parties. This could be a disadvantage for traders who want to fund their trading accounts using third-party payments. These are some of the cons of using Charles Schwab for forex trading. It’s important for traders to consider these factors when choosing a forex broker.

Is Charles Schwab Regulated and who are the Regulators?

Charles Schwab is indeed a regulated entity. It operates under the oversight of several regulatory bodies both within the United States and abroad. In the United States, Charles Schwab is regulated by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Commodity Futures Trading Commission (CFTC). These organizations are responsible for ensuring that Charles Schwab adheres to the rules and regulations governing financial institutions in the United States. Internationally, Charles Schwab is regulated by the Hong Kong Securities and Futures Commission (SFC) and the Monetary Authority of Singapore (MAS). These regulatory bodies oversee Charles Schwab’s operations in their respective jurisdictions. In addition to these primary regulators, Charles Schwab is also regulated by the Federal Reserve and the Texas Department of Savings and Mortgage Lending. Furthermore, Charles Schwab’s subsidiaries are subject to the rules of other regulators. Charles Schwab is required to comply with a number of regulatory disclosures. For instance, it must conduct company-run stress tests annually and publicly disclose certain results in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act. It is also required to make public disclosures regarding its regulatory capital and risk-weighted assets in accordance with the final rules adopted by the U.S. banking agencies to implement the Basel III regulatory capital framework. Moreover, Charles Schwab is required to make public disclosures regarding its Liquidity Coverage Ratio and Net Stable Funding Ratio on a quarterly and semi-annual basis respectively. These disclosures contain certain qualitative and quantitative information as mandated by the Board of Governors of the Federal Reserve System. In the context of forex, while Charles Schwab is not a forex-specific broker, it does offer forex trading services. As such, its forex operations are also subject to the regulations of the aforementioned regulatory bodies. In conclusion, Charles Schwab operates under stringent regulatory oversight, holding licenses from key U.S. authorities such as FINRA and the SEC, as well as international authorities like the SFC and MAS. This ensures that Charles Schwab adheres to high standards of operation, providing assurance to its clients about the safety and security of their investments.