CharterPrime Review 2026

What is CharterPrime?

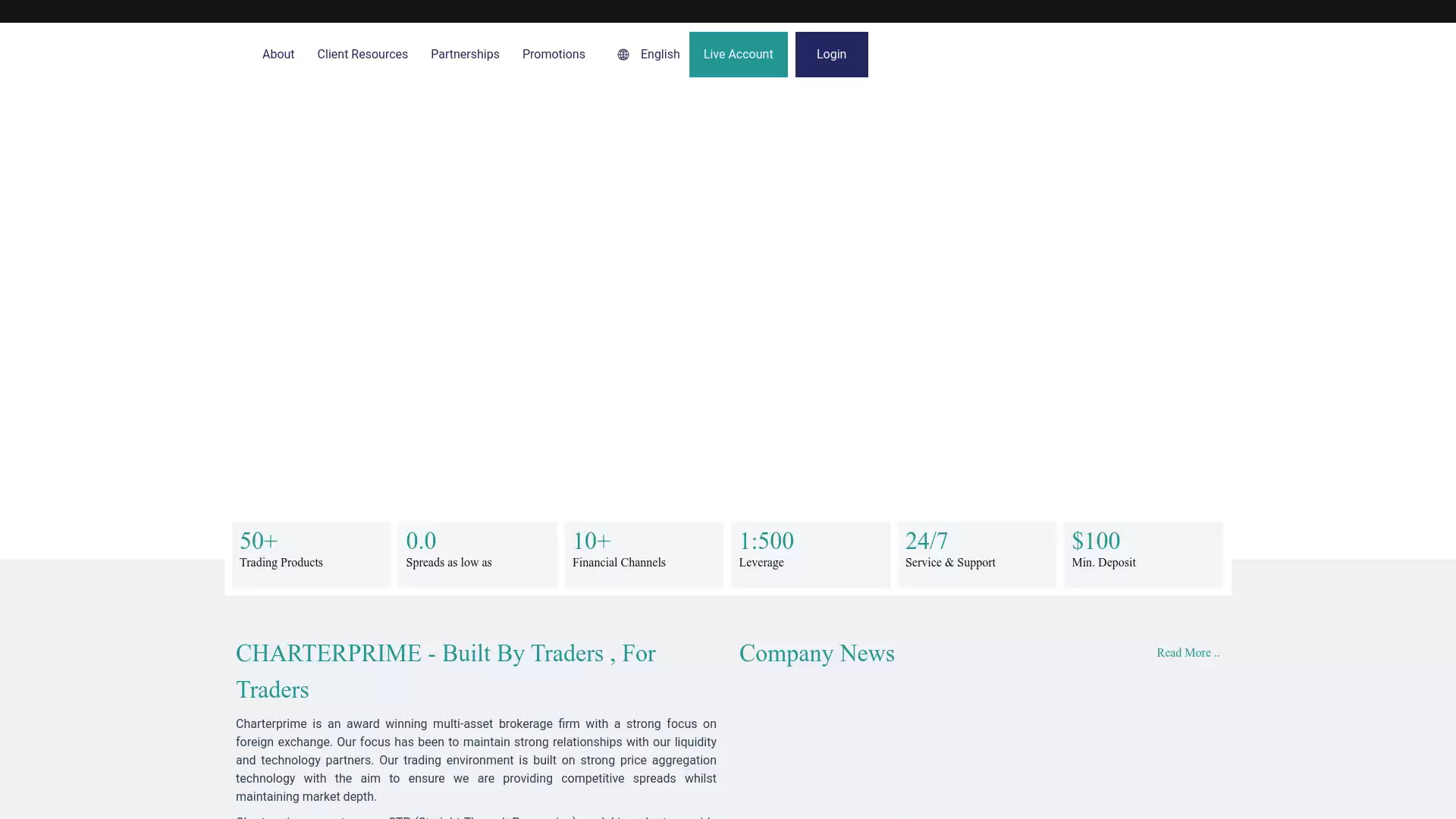

Charterprime is an award-winning multi-asset brokerage firm with a strong focus on foreign exchange. Established in 2012. , it is headquartered in Sydney, Australia. The firm’s trading environment is built on strong price aggregation technology with the aim to ensure competitive spreads while maintaining market depth. Charterprime operates on a Straight-Through-Processing (STP) model to provide transparent and ethical pricing to its clients. This model enables Charterprime to avoid any conflicts of interest with its clients and ultimately provide the best trading experience. Charterprime offers over 50 forex, commodities, and indices on the MetaTrader 4 (MT4) platform. Traders can access three account types with variable spreads and leverage up to 1:500. The firm also provides secure, reliable, and competitive services and solutions in the areas of foreign exchange and index futures trading. Over the years, Charterprime has won several awards for its excellent service. These awards have improved its clients’ trust and received wide recognition from the industry. Some of the awards include “Best Broker in Philippines” in 2020, “Most Influential Forex Broker in Asia” in 2019, and “Best Innovative Finance Service Provider” in 2018. Charterprime is authorised and regulated by the Australian Securities and Investment Commission (ASIC), and holder of an Australian Financial Services License (AFSL number 421210). The firm fully segregates client funds from operational funds with National Australia Bank (ASX:NAB). In conclusion, Charterprime is a secure and trustworthy provider of financial services in the Forex, commodities, and index futures markets. It is widely known for its top-level services and innovative solutions offered to every customer.

What is the Review Rating of CharterPrime?

- Brokersview: Brokersview rated CharterPrime with a score of 20. This rating was last checked at 2024-01-06 04:16:03.

- Trustpilot: Trustpilot rated CharterPrime with a score of 74. This rating was last checked at 2024-01-05 23:25:03.

- Wikifx: Wikifx rated CharterPrime with a score of 20. This rating was last checked at 2024-03-13 20:12:03.

What are the Pros of CharterPrime?

CharterPrime is a well-established STP/ECN forex and CFD broker that offers a range of advantages for traders. Here are some of the key benefits:. Wide Range of Trading Instruments: CharterPrime provides access to over 50 forex, commodities, and indices on the MetaTrader 4 (MT4) platform. This includes a decent selection of currency pairs, metals, and energies. High Leverage: Traders can access up to 1:500 leverage, which can enhance trading opportunities. Regulated Broker: CharterPrime is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. This regulation ensures the safety of traders’ funds. MetaTrader 4 Integration: CharterPrime offers reliable MT4 integration, which is a popular and robust trading platform. Accessible Account Types: With just a $100 minimum deposit, CharterPrime offers accessible account types, including ECN and swap-free options. Award-Winning Brokerage: CharterPrime has been recognized as the Best STP/ECN Broker and Best Liquidity Provider in 2017, and the Most Transparent Forex Broker in 2016 and 2017. However, it’s important to note that while CharterPrime offers a range of benefits, it may not be suitable for all traders. For instance, the broker does not offer stock trading, and the minimum withdrawal is $100 with a $40 fee for each withdrawal. Additionally, CharterPrime’s primary regulator is located offshore in St Vincent and the Grenadines, with only Australian clients benefitting from ASIC oversight.

What are the Cons of CharterPrime?

CharterPrime, an STP/ECN forex and CFD broker established in 2012, has several drawbacks that potential investors should consider:. Limited Product Range: CharterPrime offers a very small range of 50+ products. This limited selection may not meet the needs of seasoned traders who are looking for a diverse portfolio. High Withdrawal Minimum and Fees: The minimum withdrawal is $100, and there is a $40 fee for each withdrawal. These costs are quite steep compared to other brokers. Offshore Regulation: CharterPrime’s primary regulator is located offshore in St Vincent and the Grenadines. Only Australian clients benefit from ASIC oversight. This could raise concerns about the security of funds and the reliability of the broker. Lack of Additional Tools: CharterPrime does not offer any additional tools or market analysis resources. This could limit traders’ ability to make informed decisions. No Copy Trading Solutions: Unlike most top brokerages, CharterPrime doesn’t offer any copy trading solutions for beginners or strategy providers. Negative User Reviews: Some users have reported issues with order slippage, discrepancies in charts compared to other companies, and high commissions for withdrawing money. There are also allegations of CharterPrime being a scam. These factors should be carefully considered by anyone thinking about trading with CharterPrime. While it may suit some traders, others might find these drawbacks significant enough to look for alternatives.

What are the CharterPrime Current Promos?

CharterPrime is a well-established brokerage firm that offers a variety of trading products and services. They have a strong focus on foreign exchange and operate on a Straight-Through-Processing (STP) model, which ensures transparent and ethical pricing for their clients. CharterPrime provides a trading environment built on robust price aggregation technology, aiming to offer competitive spreads while maintaining market depth. They offer over 50 trading products, with spreads as low as 0.0. The firm also provides 24/7 service and support, and the minimum deposit to start trading is $100. In terms of account types, CharterPrime offers three options with variable spreads and leverage up to 1:500. These include an ECN account, which is suitable for traders looking for a no-frills broker with a stable platform and high leverage. The minimum deposit to access these prices is $100. Unfortunately, our experts were not able to find any current promotions or bonuses offered by CharterPrime. This is fairly standard among regulated broker-dealers. Over the years, CharterPrime has won several awards for its excellent service, which has improved client trust and received wide recognition from the industry. Some of these awards include “Best STP/ECN Broker” and “Best Liquidity Provider” in multiple years. Please note that all information is subject to change and it’s always a good idea to check the official CharterPrime website or contact their customer service for the most accurate and up-to-date information.

What are the CharterPrime Highlights?

Charterprime is an award-winning multi-asset brokerage firm with a strong focus on foreign exchange. Here are some of the key highlights:. Trading Products: Charterprime offers over 50 trading products. Their services and solutions are secure, reliable, and competitive, especially in the areas of foreign exchange and index futures trading. Technology and Partnerships: Charterprime maintains strong relationships with its liquidity and technology partners. Their trading environment is built on robust price aggregation technology, ensuring competitive spreads while maintaining market depth. STP Model: Charterprime operates on a Straight-Through-Processing (STP) model. This model provides transparent and ethical pricing to clients, avoiding any conflicts of interest. Service & Support: Charterprime provides 24/7 service and support. The minimum deposit for trading is $100. Awards: Over the years, Charterprime has won several awards for its excellent service. These include “Best Broker in Philippines” (2020), “Most Influential Forex Broker in Asia” (2019), “Best Innovative Finance Service Provider” (2018), and “Best Investment Education Platform Provider” (2018). Fraud Prevention: Charterprime has taken steps to fight fraud and unauthorized use of its brand name. They have issued clarifications regarding unauthorized parties claiming to have business relationships with Charterprime. Please note that while Charterprime offers a wide range of services, it’s important to understand the risks associated with forex trading. Always do your own research and consider seeking advice from a financial advisor before making any investment decisions.

Is CharterPrime Legit and Trustworthy?

CharterPrime is a forex and CFD broker that has been in operation since 2012. It is headquartered in Sydney, Australia, and offers over 50 forex, commodities, and indices on the MetaTrader 4 (MT4) platform. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and is registered offshore in Saint Vincent and the Grenadines. This regulatory oversight provides a level of trust and security for its clients. However, it’s worth noting that only Australian clients benefit from ASIC oversight. CharterPrime offers three account types with variable spreads and leverage up to 1:500. The minimum deposit required to open an account is $100. They offer a range of free payment methods, including bank wire, credit cards, and e-wallets. In terms of trading, CharterPrime offers 45 currency pairs, which is a decent range but not the largest in the market. The spreads are most competitive in the ECN account, averaging around 0.5 pips. However, it’s worth noting that CharterPrime does not offer stock trading, only Index CFDs. They also have a small selection of metals and energies tradable via CFDs. Customer reviews of CharterPrime are generally positive, with users praising the quick response/support from online chat and the execution of trades. However, some users have expressed disappointment with the $100 minimum withdrawal and the $40 fee for each withdrawal. Overall, CharterPrime has a trust score of 90 out of 100. , indicating that it is generally considered trustworthy. However, as with any broker, it’s important for potential clients to do their own research and consider their individual trading needs before opening an account.

Is CharterPrime Regulated and who are the Regulators?

CharterPrime is indeed a regulated entity. It is overseen by two main regulatory bodies:. Australian Securities and Investments Commission (ASIC). : CharterPrime is regulated by ASIC, which is one of the most respected financial regulators worldwide. This regulation applies to Australian clients. St. Vincent and the Grenadines Financial Services Authority (SVGFSA). : CharterPrime is registered as an International Business Company of SVGFSA. This regulation is applicable to clients outside of Australia. It’s important to note that while CharterPrime is regulated, the level of oversight and protection offered to clients can vary depending on their location. For instance, only Australian clients benefit from ASIC oversight. Therefore, clients should take care when investing with CharterPrime, especially if they are located outside of Australia. CharterPrime has been operating in the financial market since 2012. , serving traders in Oceania and the South East Asian region. It offers a range of trading facilities, including forex, commodities, and indices. However, it’s worth noting that CharterPrime does not offer any copy trading solutions for beginners or strategy providers. In conclusion, while CharterPrime is a regulated broker, potential clients should carefully consider the regulatory protections available to them based on their location before deciding to invest with CharterPrime.

Did CharterPrime win any Awards?

CharterPrime, a multi-asset brokerage firm with a strong focus on foreign exchange, has indeed been recognized with several awards over the years. These accolades have not only bolstered the trust of their clients but also garnered widespread recognition within the industry. Here are some of the awards that CharterPrime has won:. Best Broker in Philippines (2020): This award recognizes CharterPrime’s outstanding brokerage services in the Philippines. Most Influential Forex Broker in Asia (2019): This award acknowledges CharterPrime’s significant influence in the Asian forex market. Best Innovative Finance Service Provider (2018): This award highlights CharterPrime’s innovative approach to providing financial services. Best Investment Education Platform Provider (2018): This award underscores CharterPrime’s commitment to providing excellent educational resources for investment. Best STP/ECN Broker (2018, 2017): These awards recognize CharterPrime’s excellence in providing Straight-Through Processing (STP) and Electronic Communication Network (ECN) brokerage services. Most Transparent Forex Broker (2018, 2017, 2016, 2015): These awards acknowledge CharterPrime’s transparency in its forex brokerage services. Best Liquidity Provider (2018, 2017, 2016, 2015): These awards highlight CharterPrime’s excellence in providing liquidity in the forex market. These awards reflect CharterPrime’s commitment to providing excellent service and maintaining strong relationships with their liquidity and technology partners. Their trading environment is built on robust price aggregation technology, ensuring competitive spreads while maintaining market depth. CharterPrime operates on a Straight-Through-Processing (STP) model to provide transparent and ethical pricing to their clients. Please note that while CharterPrime has won these awards, it’s always important for investors to do their own research and consider multiple factors when choosing a forex broker. Factors such as trading conditions, regulatory protections, customer service, and platform features should all be taken into account.

How do I get in Contact with CharterPrime?

CharterPrime is a well-regarded multi-asset brokerage firm with a strong focus on foreign exchange. They are known for maintaining robust relationships with their liquidity and technology partners. To get in contact with CharterPrime, you have several options:. Email: You can reach out to CharterPrime via email at enquiry@charterprime.com. Their commitment is to respond to all client emails within 24 hours from Monday to Friday. Phone: CharterPrime’s support team can be contacted via phone at +85281756090. Another phone number available is 400 660 3688. Please note that CharterPrime is authorized and regulated by the Australian Securities and Investment Commission (ASIC), and holds an Australian Financial Services License (AFSL number 421210). This ensures a secure and regulated environment for your forex trading needs. CharterPrime offers a range of trading products including Foreign Exchange, Commodities, Precious Metals, and Index CFDs. They provide direct access to global financial markets, globally competitive liquidity, institutionally competitive spreads, and rapid order execution. This makes them a suitable choice for individuals interested in forex trading. Remember, it’s always important to do your own research and consider your personal financial situation before engaging in forex trading. Happy trading!.

Where are the Headquarters from CharterPrime based?

CharterPrime, a renowned multi-asset brokerage firm, has its headquarters in two distinct locations across the globe. The first location is in Kingstown, St. George, Saint Vincent and the Grenadines. This Caribbean island nation is known for its vibrant financial services sector, making it an ideal location for a company like CharterPrime, which specializes in foreign exchange, commodities, and index futures trading. The second headquarters of CharterPrime is situated in Sydney, New South Wales, Australia. Sydney, being one of the major financial hubs in the Asia-Pacific region, provides a strategic advantage to CharterPrime. The city’s robust financial infrastructure and proximity to key Asian markets align well with CharterPrime’s focus on international financial services and forex brokerage. In the context of forex, having headquarters in these two different time zones allows CharterPrime to provide round-the-clock services to its global clientele. This is particularly important in the forex market, which operates 24 hours a day, five days a week. CharterPrime’s strategic locations, therefore, enable it to stay connected with the ever-changing global forex markets and provide timely services to its clients. In conclusion, CharterPrime’s dual headquarters in Kingstown and Sydney reflect the company’s commitment to providing top-notch forex services to its global clientele. These locations not only provide strategic advantages in terms of market access and round-the-clock operations but also underscore CharterPrime’s status as a truly global forex brokerage firm.

What kind of Customer Support is offered by CharterPrime?

CharterPrime is an award-winning multi-asset brokerage firm with a strong focus on foreign exchange. They offer a variety of customer support options to ensure their clients have the best trading experience. Customer Support Channels CharterPrime’s customer support team can be contacted through various channels. Live Chat: For immediate assistance, clients can use the live chat option available on their website. Email: Clients can send their queries to CharterPrime’s support team via email at enquiry@charterprime.com. Telephone: Clients can also reach out to CharterPrime’s customer support team by calling +852 8175 6090. 24/7 Service & Support CharterPrime offers 24/7 service and support. This means that clients can reach out to CharterPrime’s customer support team at any time of the day, any day of the week. Quick Response Time CharterPrime is known for its quick response time. This is particularly beneficial for clients who need immediate assistance with their trading activities. Transparent and Ethical Pricing CharterPrime operates on a Straight-Through-Processing (STP) model. This enables them to provide transparent and ethical pricing to their clients, avoiding any conflicts of interest. Minimum Deposit CharterPrime has a minimum deposit requirement of $100. This makes it accessible for traders with different investment capacities. Awards and Recognition Over the years, CharterPrime has won several awards for its excellent service. These recognitions have improved their clients’ trust and received wide recognition from the industry. In conclusion, CharterPrime offers a comprehensive customer support system that caters to the needs of their clients. Their commitment to providing excellent service, combined with their transparent and ethical pricing model, makes them a reliable choice for forex traders.

Which Educational and Learning Materials are offered by CharterPrime?

CharterPrime, a global financial and Forex broker established in 2012, offers a variety of trading conditions and creates a trusted trading environment. However, it appears that the broker’s educational materials and training content are somewhat lacking. CharterPrime is an STP/ECN forex and CFD broker that provides access to over 50 forex, commodities, and indices on the MetaTrader 4 (MT4) platform. Traders can choose from three account types with variable spreads and leverage up to 1:500. While CharterPrime offers a stable platform and high leverage, it seems to be more suited to beginners or intermediate traders rather than seasoned traders. This is due to the relatively small range of products, with no stocks or additional tools on offer. Despite these limitations, CharterPrime has received several industry awards recognizing its excellent service and provided conditions. These awards reflect the broker’s commitment to maintaining strong relationships with its liquidity and technology partners. However, when it comes to educational materials, CharterPrime seems to fall short. The broker provides more supporting materials rather than comprehensive Forex education. Therefore, beginners may need to seek additional education courses, videos, and webinars elsewhere. In conclusion, while CharterPrime offers a range of trading options and has received recognition for its services, its educational offerings appear to be limited. This may be a point of consideration for those who are new to Forex trading and are seeking comprehensive educational resources.

Can anyone join CharterPrime?

CharterPrime is an award-winning multi-asset brokerage firm with a strong focus on foreign exchange. It operates on a Straight-Through-Processing (STP) model to provide transparent and ethical pricing to its clients. This model enables CharterPrime to avoid any conflicts of interest with its clients and ultimately provide the best trading experience. The firm offers direct access to global financial markets, globally competitive liquidity, institutionally competitive spreads, and rapid order execution. It provides its clients with secure, reliable, competitive services and solutions in the areas of foreign exchange and index futures trading. CharterPrime is authorised and regulated by the Australian Securities and Investment Commission (ASIC), and holder of an Australian Financial Services License (AFSL number 421210). This regulatory environment ensures that CharterPrime operates within the guidelines set by the ASIC, providing an additional layer of security for its clients. The minimum deposit to start trading with CharterPrime is $100. Traders are given a choice of leverage from 1:10 through 1:25, 1:50 and a maximum of 1:100. However, it’s important to note that trading with leverage carries significant risk and may not be suitable for all investors. In conclusion, while CharterPrime provides a robust and competitive trading environment, potential clients should carefully consider their financial situation, level of experience, and risk appetite before deciding to trade with CharterPrime.

Who should sign up with CharterPrime?

CharterPrime is a financial services provider that caters to a wide range of traders in the Forex, commodities, and index futures markets. Here are some categories of individuals who might find CharterPrime suitable for their trading needs:. 1. Beginners and Intermediate Traders: CharterPrime is particularly suited for beginners or intermediate traders. The platform is user-friendly and offers a stable trading environment, which can be beneficial for those who are new to trading or are still honing their skills. 2. Traders Seeking High Leverage: CharterPrime provides access to a leverage of up to 1:500. This is significantly higher than what most regulatory bodies deem acceptable for retail traders. Traders seeking high leverage might find CharterPrime an attractive option. 3. Traders Interested in Forex and CFDs: CharterPrime offers over 50 trading products, including Forex, commodities, and indices. Traders interested in these markets might find CharterPrime’s offerings appealing. 4. Traders Looking for STP/ECN Broker: As an STP/ECN broker, CharterPrime offers direct access to the interbank market, which can result in faster execution speeds and more competitive pricing. 5. Traders Valuing Fund Security: CharterPrime is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. This regulatory oversight can provide traders with an added layer of security for their funds. However, it’s important to note that CharterPrime might not be the best fit for everyone. For instance, seasoned traders might not appreciate the relatively small range of products, with no stocks or additional tools on offer. Additionally, the minimum withdrawal is $100, plus there is a $40 fee for each withdrawal, which might be considered steep compared to other brokers. In conclusion, while CharterPrime has a lot to offer to a certain category of traders, it’s crucial for potential users to thoroughly research and consider their individual trading needs and goals before signing up with any broker. It’s always recommended to start with a demo account to get a feel for the platform and its offerings.

Who should NOT sign up with CharterPrime?

CharterPrime is a forex and CFD broker that offers a range of services. However, it may not be suitable for everyone. Here are some types of traders who might want to consider other options:. Experienced Traders Seeking Variety: CharterPrime offers a relatively small range of products, with no stocks or additional tools on offer. Traders looking for a wide variety of trading options might find CharterPrime’s offerings limiting. Traders Prioritizing Regulatory Oversight: CharterPrime’s primary regulator is located offshore in St Vincent and the Grenadines, with only Australian clients benefitting from ASIC oversight. Traders who prioritize regulatory oversight might prefer a broker regulated by more recognized authorities. Traders Looking for Low Withdrawal Fees: CharterPrime has a minimum withdrawal of $100, plus there is a $40 fee for each withdrawal. Traders who prioritize low fees might find these costs prohibitive. Beginners Needing Educational Resources: CharterPrime lacks educational resources and market analysis compared to other brokers. Beginners who need comprehensive educational materials might find CharterPrime lacking in this area. UK Traders Wanting FCA Oversight and GBP Accounts: The absence of FCA oversight and GBP accounts for UK traders is a major drawback. Traders Looking for Copy Trading Solutions: Unlike most top brokerages, CharterPrime doesn’t offer any copy trading solutions for beginners or strategy providers. In conclusion, while CharterPrime might be a good fit for some traders, others might find it lacking in certain areas. As always, it’s important for traders to do their own research and choose a broker that best fits their individual needs.

Does CharterPrime offer Discounts, Coupons, or Promo Codes?

CharterPrime, a global financial and Forex broker established in 2012, is known for its personalized trading conditions and trusted trading environment. However, it does not appear to offer any discounts, coupons, or promo codes. This is fairly standard among regulated broker-dealers. CharterPrime is headquartered in Sydney, Australia, and offers over 50 forex, commodities, and indices on the MetaTrader 4 (MT4) platform. Traders can access three account types with variable spreads and leverage up to 1:500. The broker is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. While CharterPrime does not offer any bonuses or promotions, it does provide a range of free payment methods, including bank wire, credit cards, and e-wallets. It also supports USD, AUD, and EUR as account base currencies. Despite the lack of discounts or promo codes, CharterPrime offers accessible account types with just a $100 minimum deposit, including ECN and swap-free options. However, it’s worth noting that the minimum withdrawal is $100, and there is a $40 fee for each withdrawal. This could be considered steep compared to other brokers. Additionally, CharterPrime’s primary regulator is located offshore in St Vincent and the Grenadines, with only Australian clients benefiting from ASIC oversight. In conclusion, while CharterPrime offers a stable platform, high leverage, and an ECN account, it does not currently offer any discounts, coupons, or promo codes. Potential traders should consider this information when deciding whether to open an account with CharterPrime.

Which Account Types are offered by CharterPrime?

CharterPrime, an online broker based in Australia and New Zealand, offers a range of personalized trading solutions to cater to the diverse needs of traders worldwide. The broker provides a unique and dynamic trading environment, continuously striving to enhance its substantial position amidst other competitive market offerings. CharterPrime offers three distinct account types. Variable Account: This account type is designed to cater to the needs of a variety of traders. It offers flexible trading conditions, making it a suitable choice for both novice and experienced traders. ECN Account: The ECN account is designed for more experienced traders who prefer direct access to the markets. This account type offers more competitive spreads and is ideal for high-volume traders. Islamic Account: Unlike most brokers that offer the Islamic account as an option, CharterPrime provides it as a standalone account type. This account is specifically designed to meet the needs of Muslim traders, adhering to the principles of Islamic finance. Each of these accounts is tailored to meet the trading needs and objectives of a variety of traders, regardless of their level of skills, knowledge, and experience. The minimum initial deposit for all three accounts is $100. , a reasonable amount for most regular traders to get started. In addition to these live trading accounts, CharterPrime also offers a risk-free demo account. This allows traders to practice their trading strategies and get familiar with the trading platform before trading with real money. Overall, CharterPrime’s comprehensive and competitive trading conditions, spread across these dynamic account types, make it a preferred choice for many traders in the forex market.

How to Open a CharterPrime DEMO account?

Opening a CharterPrime DEMO account involves a series of steps. Here is a detailed guide:. Step 1: Navigate to the CharterPrime Website Start by navigating to the CharterPrime website. Look for the banner that says ‘Register’ and click on it. Step 2: Registration Traders will need to register with CharterPrime before they can access the demo account. This means a full registration is required. Traders will be redirected to an online application form that they need to fill out. Step 3: Fill Out the Application Form Traders will need to choose their username and password, in addition to providing their email address, last name, second name (if applicable), first name, date of birth, nationality, contact number, and language. Step 4: Provide Personal Address Next, the trader needs to provide their personal address. Step 5: Fill Out Career Background and Trading Experience The trader will then need to fill out the sections for Career Background and Trading Experience. Step 6: Upload Identification and Proof of Residence Traders will need to upload their identification and proof of residence before submitting the application. Step 7: Account Verification Once the information and documents have been checked and approved, the trader will be notified and can then log in to the CharterPrime Client Portal. Remember, the CharterPrime demo account is a great way for beginners to practice forex trading in a 100% risk-free environment. However, the demo account expires after 30 days.

How Are You Protected as a Client at CharterPrime?

As a client at CharterPrime, you are protected in several ways:. Segregation of Funds: CharterPrime ensures the separation of company and client funds. This means that your funds are kept in segregated accounts and will never be used for day-to-day business operations such as utilities, rent, or employee salaries. Regulation: CharterPrime is regulated by the ASIC (Australian Securities and Investments Commission) and is registered offshore in Saint Vincent and the Grenadines. This regulatory oversight is a reassuring sign that the brand is legitimate and trustworthy. Negative Account Protection: CharterPrime provides negative account protection for retail traders. This means that you cannot lose more money than you have deposited into your account. STP/ECN Broker: CharterPrime operates on a STP (Straight-Through-Processing) model. This model provides transparent and ethical pricing to clients, enabling CharterPrime to avoid any conflicts of interest with its clients. Security Measures: CharterPrime regularly conducts internal and external audits to ensure it meets all the necessary security standards. Awards and Recognition: Over the years, CharterPrime has won several awards for its excellent service. These recognitions have improved clients’ trust and received wide recognition from the industry. Remember, while these protections are in place, trading in forex and other financial instruments always carries a level of risk. It’s important to understand these risks and consider them in your trading decisions.

Which Funding methods or Deposit Options are available at CharterPrime?

CharterPrime, a well-established STP/ECN forex and CFD broker, offers a variety of funding methods and deposit options for its clients. Wire Transfer: This traditional method of transferring funds is available at CharterPrime. It’s a reliable option, but it may take a few business days for the funds to appear in your trading account. Bitcoin: In response to the growing popularity of cryptocurrencies, CharterPrime accepts Bitcoin as a deposit option. This allows traders to fund their accounts using this digital currency. Tether: Another cryptocurrency option available for deposits is Tether. This stablecoin is pegged to the US dollar, providing a degree of stability in the often volatile crypto market. Union Pay: CharterPrime also accepts Union Pay, a popular payment method especially among traders in Asia. Skrill: Known for its quick and secure transactions, Skrill is another e-wallet option available for traders at CharterPrime. Neteller: Similar to Skrill, Neteller is a widely used e-wallet that offers fast and secure transactions. It’s another deposit option provided by CharterPrime. Local Gateway: CharterPrime also offers a Local Gateway deposit option. This could refer to specific payment methods available in certain countries or regions. It’s important to note that while these deposit options provide flexibility for traders, they may come with different processing times and potential fees. Therefore, traders are advised to consider these factors when choosing a deposit method. Additionally, the minimum deposit at CharterPrime is $100. , which allows access to a range of trading instruments including forex, commodities, and indices.

What is the Minimum Deposit Amount at CharterPrime?

CharterPrime is a globally recognized financial and foreign exchange broker that offers its clients the opportunity to trade in a variety of markets. The minimum deposit required to open a CharterPrime account is $100 USD. CharterPrime provides three different types of live trading accounts: Variable, ECN, and Swap-Free. Each of these accounts has a minimum deposit requirement of $100 USD. CharterPrime is regulated across several jurisdictions and is registered as an International Business Company of St. Vincent and the Grenadines Financial Services Authority (SVGFSA). It is also authorized by the Australian Securities and Investments Commission (ASIC). This ensures that CharterPrime operates under strict regulatory oversight, providing a secure trading environment for its clients. In terms of security, CharterPrime ensures that client funds are kept in segregated accounts and will never be used for day-to-day business operations such as utilities, rent, or employee salaries. This provides an additional layer of protection for client funds. CharterPrime operates on an STP (Straight-Through-Processing) model and gives traders access to 50+ trading products, 10+ Financial Channels, and 24/7 service and support. This makes it a versatile platform suitable for traders of all experience levels. In conclusion, CharterPrime is a reliable and regulated broker that offers a low minimum deposit requirement, making it accessible for traders with different investment capacities. Its commitment to client fund security, variety of trading accounts, and wide range of trading products make it a competitive choice in the forex trading industry.

Which Withdrawal methods are available at CharterPrime?

CharterPrime, a well-established broker as of 2023, offers a number of withdrawal methods for its clients. These methods are usually processed within 1 to 10 days. However, the available withdrawal methods can differ depending on the country in which CharterPrime operates. Before initiating a withdrawal, it is essential to complete the verification process for your live CharterPrime account. This is a necessary step for safety and legal reasons, as the CharterPrime trading platform is required to verify the identity of its customers. Once the verification process is completed, CharterPrime customers can withdraw their positive balances at any time of the day. Withdrawal requests are typically processed on the nearest following business day if they were submitted after the cutoff time or on a non-business day. On a typical business day, the last time to make a withdrawal is at 11:00 am Eastern European Time, which corresponds to 1:00 pm London Standard Time for CharterPrime account holders. When a withdrawal is requested from a CharterPrime account, the funds are returned to the same method of payment that was used to initially fund the account, unless an alternative withdrawal method is selected. If multiple methods of payment were used, CharterPrime will transfer the funds to these methods based on the order in which the various methods of payment were used to pay for buy and sell orders. It’s important to note that currency conversion fees may apply if the base currency of your withdrawal method is not the same as your CharterPrime account base currency. CharterPrime supports several withdrawal methods depending on your region. These include Bitcoin, Tether, Wire Transfer, Union Pay, Skrill, Neteller, and Local Gateway. Lastly, be aware of the costs associated with each withdrawal request. CharterPrime may charge fees to process each withdrawal. CharterPrime is committed to ensuring the safety of your money as they are regulated by the most authoritative authorities in the industry, including the Financial Conduct Authority (FCA).

Which Fees are charged by CharterPrime?

CharterPrime, a multi-asset brokerage firm, charges various fees for its services. Here’s a detailed breakdown:. Commissions and Fees: CharterPrime’s commissions and fees are not standard across all trading platforms. They may differ from other brokerage companies. Trading with CharterPrime can involve fees from $8 USD. Deposit Fees: There may be small fees when making deposits to CharterPrime. These fees will vary depending on your 3rd party deposit method, the currencies involved with your CharterPrime deposit, the amount you are depositing to CharterPrime, and your country of residence. Account Fees: CharterPrime does not charge account fees for standard CharterPrime trading accounts. Inactivity Fee: CharterPrime does not charge an inactivity fee for dormant non-trading accounts. Withdrawal Fees: CharterPrime does not charge withdrawal fees from verified CharterPrime accounts. Spreads: CharterPrime imposes a variety of spreads and fees, depending on the type of financial instrument traded on CharterPrime. Spreads can be as low as 0.0 pips. Other Fees: CharterPrime may also charge other fees such as management fees, clearance fees for profits, transaction fees for cryptocurrency, leverage fees, and LIBOR fees. Please note that all these fees are subject to change and it’s always a good idea to check the latest on the CharterPrime website or contact their customer service for the most accurate information.

What can I trade with CharterPrime?

CharterPrime, an STP/ECN forex and CFD broker established in 2012, offers a range of trading options. Here’s a detailed look at what you can trade with CharterPrime:. Forex Trading CharterPrime offers trading in over 45 currency pairs. The spreads are most competitive in the ECN account, averaging around 0.5 pips. A minimum deposit of $100 is required to access these prices. Commodities Trading CharterPrime provides the opportunity to trade in a small selection of metals and energies via CFDs. The leverage offered for these trades can go up to 1:500. Indices Trading While CharterPrime does not offer stock trading, it does provide Index CFDs. The range of 15 indices is higher than some competitors and includes interesting opportunities like the China H-Shares and Dutch 25 Indexes. Account Types CharterPrime offers three types of accounts with variable spreads and leverage up to 1:500. These include ECN and swap-free options. The minimum deposit for these accounts is $100. Regulation CharterPrime is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. However, only Australian clients benefit from ASIC oversight. Payment Options CharterPrime supports a range of free payment methods, including bank wire, credit cards, and e-wallets. The supported account base currencies are USD, AUD, and EUR. Please note that while CharterPrime offers a wide range of trading options, it’s important to consider the broker’s fees, regulatory status, and the range of products before making a decision. Always remember that trading involves risk and it’s possible to lose your invested capital.

Which Trading Platforms are offered by CharterPrime?

CharterPrime, an STP/ECN forex and CFD broker established in 2012. , offers two of the leading retail trading platforms – MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MetaTrader 4 (MT4) is the world’s most widely used trading platform and was created specifically with forex traders in mind. It provides a feature-rich environment for trading with a stable platform and high leverage. MetaTrader 5 (MT5), on the other hand, was designed for all types of trading including non-forex CFDs. It expands the offerings of MT4, catering to the needs of the most demanding traders and allowing the trading of CFDs. CharterPrime operates on a Straight-Through-Processing (STP) model to provide transparent and ethical pricing to its clients. This enables the firm to avoid any conflicts of interest with its clients and ultimately provide the best trading experience. The firm offers 50+ forex, commodities, and indices. Traders can access 3 account types with variable spreads and leverage up to 1:500. The minimum deposit is $100. In terms of forex trading, CharterPrime offers 45 currency pairs. Spreads are the most competitive in the ECN account, averaging around 0.5 pips. It’s worth noting that you would only need to deposit $100 to access these prices. However, it’s important to note that CharterPrime only offers Index CFDs, with no stocks available. That said, the range of 15 indices is higher than some competitors and includes interesting opportunities like the China H-Shares and Dutch 25 Indexes. In conclusion, CharterPrime provides a robust and versatile trading environment with its offerings of the MT4 and MT5 platforms. Whether you’re a beginner or an experienced trader, CharterPrime’s platform offerings are designed to meet a wide range of trading needs.

Which Trading Instruments are offered by CharterPrime?

CharterPrime, an STP/ECN forex and CFD broker established in 2012, offers a range of trading instruments. Forex Trading: CharterPrime provides access to 45 currency pairs. The spreads are most competitive in the ECN account, averaging around 0.5 pips. Commodities: CharterPrime offers a small selection of metals and energies tradable via CFDs. The leverage for these commodities can go up to 1:500. Indices: CharterPrime offers Index CFDs. The range of 15 indices is higher than some competitors and includes interesting opportunities like the China H-Shares and Dutch 25 Indexes. It’s important to note that CharterPrime does not offer stock trading. The firm is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. The minimum deposit is $100. CharterPrime operates on a STP (Straight-Through-Processing) model in order to provide transparent and ethical pricing to its clients. This enables the firm to avoid any conflicts of interest with its clients and ultimately provide the best trading experience. Over the years, CharterPrime has won several awards for its excellent service. These recognitions have improved its clients’ trust and received wide recognition from the industry.

Which Trading Servers are offered by CharterPrime?

CharterPrime, a renowned Australian Foreign Exchange Broker, offers a variety of trading servers to its clients. These servers are hosted in Equinix data centers, which are considered essential for any serious trading business. The servers are located in LD4 (London) and NY4 (New York). Cross connectivity to price-makers and liquidity providers is a key feature of these servers, ensuring optimal and timely execution. At the heart of this technology is an ultra-low latency order routing and pricing engine. This engine allows CharterPrime to connect to a wide range of liquidity providers. The technology supports complex order routing and aggregation, as well as multi-band liquidity streams for superior execution on high trading volumes. It also supports a wide variety of frontend interfaces, including MT4, FIX, and custom APIs. CharterPrime’s technology offering enables clients to compose, customize, and distribute their own liquidity via several platforms, including PrimeXM, FlexTrade, MetaTrader 4, MetaTrader 5, and cTrader. CharterPrime has a strong partnership with PrimeXM, a leading technology provider to the finance industry. CharterPrime offers liquidity through PrimeXM’s proprietary order management system, XCore. CharterPrime uses Xcore to connect to liquidity providers and ensure the best bid/offer aggregation. CharterPrime also hosts multiple trading servers with PrimeXM, benefiting from enterprise-level hardware, high security levels, and a fully redundant network. This partnership with PrimeXM ensures that CharterPrime benefits from ultra-low latency connectivity and is therefore able to provide the most reliable trading environment for its clients. In conclusion, CharterPrime offers a robust and comprehensive suite of trading servers and platforms, ensuring optimal performance and reliability for its clients in the fast-paced world of forex trading.

Can I trade Crypto with CharterPrime? Which crypto currencies are supported by CharterPrime?

CharterPrime, an award-winning global financial and foreign exchange broker. , is known for its strong focus on forex. It operates on an STP (Straight-Through-Processing) model and offers traders access to a variety of trading products. However, it’s important to note that CharterPrime does not support cryptocurrency trading. CharterPrime’s offerings are more focused on forex, commodities, and indices. They offer over 50+ forex pairs, which is a decent range but not the largest in the market. The spreads are most competitive in the ECN account, averaging around 0.5 pips. It’s worth noting that you would only need to deposit $100 to access these prices. In terms of commodities, CharterPrime offers a small selection of metals and energies tradable via CFDs with leverage up to 1:500. The MetaTrader 4 (MT4) platform provided by CharterPrime is an excellent, feature-rich environment for trading these CFDs. However, when it comes to cryptocurrencies, CharterPrime does not currently support any form of cryptocurrency trading. This includes both direct trading of cryptocurrencies and trading of cryptocurrency-based CFDs. In conclusion, while CharterPrime is a competitive choice for forex and some commodities trading, it does not currently support cryptocurrency trading. As always, traders should carefully consider their trading needs and objectives when choosing a broker.

What is the Leverage on my CharterPrime Trading Account?

CharterPrime, a global financial and foreign exchange brokerage group established in 2012, is headquartered in Sydney, Australia. The company adopts the Straight Through Processing (STP) system as its business model. It is authorized and regulated by the Australian Securities and Investment Commission (ASIC), with regulatory license number 421210. The financial instruments that can be traded online with CharterPrime include forex, precious metals, indices CFDs, and spot commodities. CharterPrime offers three account types: the Variable account, the ECN account, and the Swap-free account. The minimum initial deposit for all three accounts is $100. , which is a reasonable amount for most regular traders to get started. As an Australia and New Zealand broker, CharterPrime, in compliance with its obligations to local regulation, allows high leverage. The maximum trading leverage available by this broker is up to 1:500 for forex instruments and major currency pairs available for retail traders. This high leverage can significantly increase the potential for profits, but it also carries a high level of risk, including the possibility of losing more than your initial investment. The average spread of the EURUSD for the Floating Spread Account is 2.0, while for the ECN accounts, it is 0.5. The average spread of Gold Price in US dollar for Floating Spread Accounts is 3.8, and for ECN accounts, it is 1.5. These competitive spreads can contribute to a trader’s potential profitability. CharterPrime uses the MT4 trading platform, which has powerful trading functions and analytical capabilities. This platform can provide customers with the most real-time quotation, the most competitive low spreads, and the best liquidity. In conclusion, CharterPrime offers high leverage of up to 1:500 on forex instruments, making it a potentially attractive option for traders looking to maximize their trading capital. However, it’s important to remember that while high leverage can magnify profits, it can also amplify losses. Therefore, it’s crucial for traders to have a solid understanding of leverage and risk management before trading with high leverage.

What kind of Spreads are offered by CharterPrime?

CharterPrime, an award-winning multi-asset brokerage firm with a strong focus on foreign exchange, offers a variety of spreads depending on the account type. CharterPrime’s Account Types and Spreads:. Variable Account: This account type offers variable spreads. ECN Account: The ECN account offers spreads as low as 0.0 pips. The average spread for the EURUSD is 0.5, the average spread for the EURGBP is 0.8, and the average spread for the AUDUSD is 0.7. Swap Free Account: CharterPrime also offers a Swap Free account with its own spread structure. The average spread of the EURUSD for the Floating Spread Account is 2.0, the average spread of the EURGBP is 1.9, and the average spread of the AUDUSD is 2.2. CharterPrime operates on a STP (Straight-Through-Processing) model in order to provide transparent and ethical pricing to clients. This enables CharterPrime to avoid any conflicts of interest with clients and ultimately provide the best trading experience. It’s important to note that trading with CharterPrime will involve fees from $8 USD, spreads from 0.0 pips, and commission-free trading depending on the account traders select. The minimum deposit for all account types is $100. Please note that the information provided is based on the latest available data and may vary.

Does CharterPrime offer MAM Accounts or PAMM Accounts?

Unfortunately, the information available does not specify whether CharterPrime offers MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts. It’s recommended to directly contact CharterPrime for the most accurate and up-to-date information. For context, MAM and PAMM accounts are types of managed accounts that allow fund managers to manage multiple accounts from a single account without having to create an investment fund. The performance (profits and losses) of a MAM or PAMM account manager is distributed among the managed accounts. In a MAM account, the manager can allocate trades on a fixed basis, which means that they can define the number of lots traded by each individual account. This fixed allocation can also be done using a LAMM (Lot Allocation Management Module) account. The manager can also change the amount of leverage applied to the sub-accounts if their clients want to take on a greater level of risk. A PAMM account, on the other hand, features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a PAMM account, an investor can also allocate a percentage of their account to one or more managers. The manager’s PAMM account is a large “main account”, whose capital is equal to the sum of the sub-accounts. The manager’s trades are automatically replicated in the sub-accounts according to a percentage basis. These types of accounts are beneficial for both investors and fund managers. Investors can take advantage of the expertise of professional traders without having to actively manage their investments on their own. Meanwhile, qualified traders who manage MAM or PAMM accounts can expand their audience reach.

Does CharterPrime allow Expert Advisors?

CharterPrime, an STP/ECN forex and CFD broker established in 2012, is headquartered in Sydney, Australia. The firm offers more than 50 forex, commodities, and indices on the MetaTrader 4 (MT4) platform. Traders can access three account types with variable spreads and leverage up to 1:500. One of the key features of CharterPrime is its integration with the MT4 platform. MT4 is known for its advanced charting capabilities, automated trading systems known as Expert Advisors (EAs), and extensive back-testing environment. While CharterPrime’s integration with MT4 is not explicitly stated to include support for EAs, the use of EAs is a standard feature of MT4. However, traders should note that while EAs can automate trading and implement complex strategies without human intervention, they also come with risks. EAs depend on the historical data and may not account for future market changes or unforeseen events. Therefore, traders should use EAs with caution and not rely solely on them for their trading activities. CharterPrime is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. It offers a range of free payment methods, including bank wire, credit cards, and e-wallets. The minimum deposit is $100. Despite these advantages, CharterPrime has some limitations. The minimum withdrawal is $100, and there is a $40 fee for each withdrawal. Also, CharterPrime’s primary regulator is located offshore in St Vincent and the Grenadines, with only Australian clients benefitting from ASIC oversight. Unlike most top brokerages, CharterPrime doesn’t offer any copy trading solutions for beginners or strategy providers. In conclusion, while CharterPrime offers a range of features and integrates with the MT4 platform, which typically supports EAs, traders should verify the specifics directly with the broker and use EAs responsibly. It’s also important to consider the broker’s regulatory status and fee structure when making a decision.