CripMarkets Review 2026

What is CripMarkets?

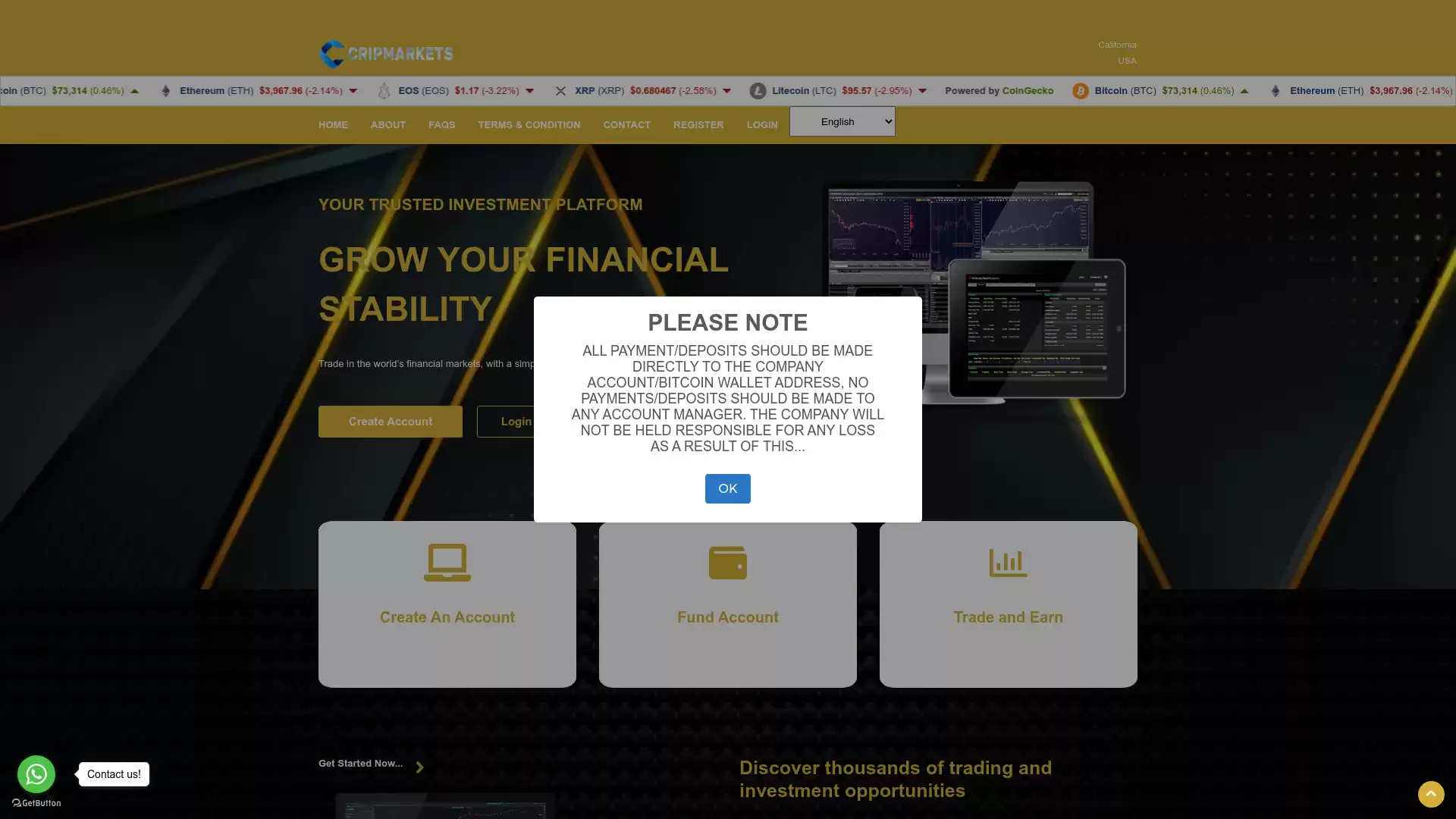

CripMarkets is a platform in the Forex & CFD markets. It is known for its promise to deliver a powerful, user-friendly, and fair trading platform. On this platform, clients can trade the most popular assets – currencies, commodities, and indices. CripMarkets clients benefit from intensive training, dedicated service, and 24/7 professional support. However, it’s important to note that there are mixed reviews about CripMarkets. Some sources suggest that it might be a fraudulent trading scheme. Therefore, it’s crucial for potential users to do thorough research and consider multiple sources before deciding to trade with CripMarkets.

What is the Review Rating of CripMarkets?

What are the Pros of CripMarkets?

CripMarkets, a Forex trading platform, has several advantages that make it appealing to traders. Here are some of the key benefits:. User-Friendly Interface: CripMarkets offers a user-friendly interface that is easy to navigate. This makes it suitable for both first-time traders and experienced ones. Variety of Tools and Features: The platform provides a wide variety of charts, tools, and deluxe features. These tools can help traders make informed decisions based on comprehensive market analysis. 24/7 Customer Support: CripMarkets provides round-the-clock customer support. Traders can reach out to their support team via chat at any time, ensuring that help is always available when needed. However, it’s important to note that there are also concerns about the legitimacy of CripMarkets. It’s always recommended to do thorough research and consider multiple sources before choosing a Forex broker.

What are the Cons of CripMarkets?

CripMarkets, a platform in the forex trading space, has been flagged with several concerns that potential investors should be aware of:. Regulatory Status: CripMarkets lacks a valid regulatory status. This is a significant red flag as it means the platform operates without the oversight of financial authorities, increasing the risk for investors. Suspicious Business Scope: The scope of business operations for CripMarkets is considered suspicious. This lack of transparency can make it difficult for investors to understand the company’s operations and assess potential risks. High Potential Risk: Due to the aforementioned issues, CripMarkets has been flagged as having a high potential risk. This means that investors could potentially lose their capital when investing through this platform. Fraudulent Trading Scheme: There have been allegations of CripMarkets being a fraudulent trading scheme. Such schemes often involve manipulative tactics to deceive investors, leading to significant financial losses. Low Score on Review Platforms: CripMarkets has received a low score on forex review platforms. This suggests that users have had negative experiences with the platform, further indicating potential risks. In conclusion, while forex trading can be a lucrative investment opportunity, it’s crucial to conduct thorough research and choose platforms that are transparent, regulated, and have a positive reputation in the market. CripMarkets, with its current concerns, does not seem to meet these criteria. It’s always recommended to invest with caution and consider these factors before deciding to trade with any forex platform.

Is CripMarkets Regulated and who are the Regulators?

Unfortunately, there is no information available about the regulation of CripMarkets or its regulators. It’s important to note that the regulation of financial markets and institutions is a complex process involving multiple regulatory bodies. These bodies are established by governments or other organizations to oversee the functioning and fairness of financial markets and the firms that engage in financial activity. The goal of regulation is to prevent and investigate fraud, keep markets efficient and transparent, and ensure customers and clients are treated fairly and honestly. In the context of forex, it’s crucial to understand that the forex market is decentralized and operates in financial centers across the globe. This means that forex trading is regulated by a patchwork of international and national bodies. These include central banks, financial regulatory authorities, and international organizations. Regulating crypto assets, which could potentially include entities like CripMarkets, is a challenging task for several reasons. The crypto world is evolving rapidly, and regulators are struggling to acquire the talent and learn the skills to keep pace given stretched resources and many other priorities. Monitoring crypto markets is difficult because data are patchy, and regulators find it tricky to keep tabs on thousands of actors who may not be subject to typical disclosure or reporting requirements. In conclusion, it’s essential to conduct thorough research and exercise caution when dealing with financial institutions, especially those operating in relatively new and rapidly evolving markets like crypto assets. Always ensure that any institution you deal with is regulated by a reputable regulatory body. This helps protect your investments and ensures that the institution operates under a set of rules designed to protect its clients. If you’re unable to find information about a company’s regulatory status, it’s best to proceed with caution.