Dukascopy Review 2026

What is Dukascopy?

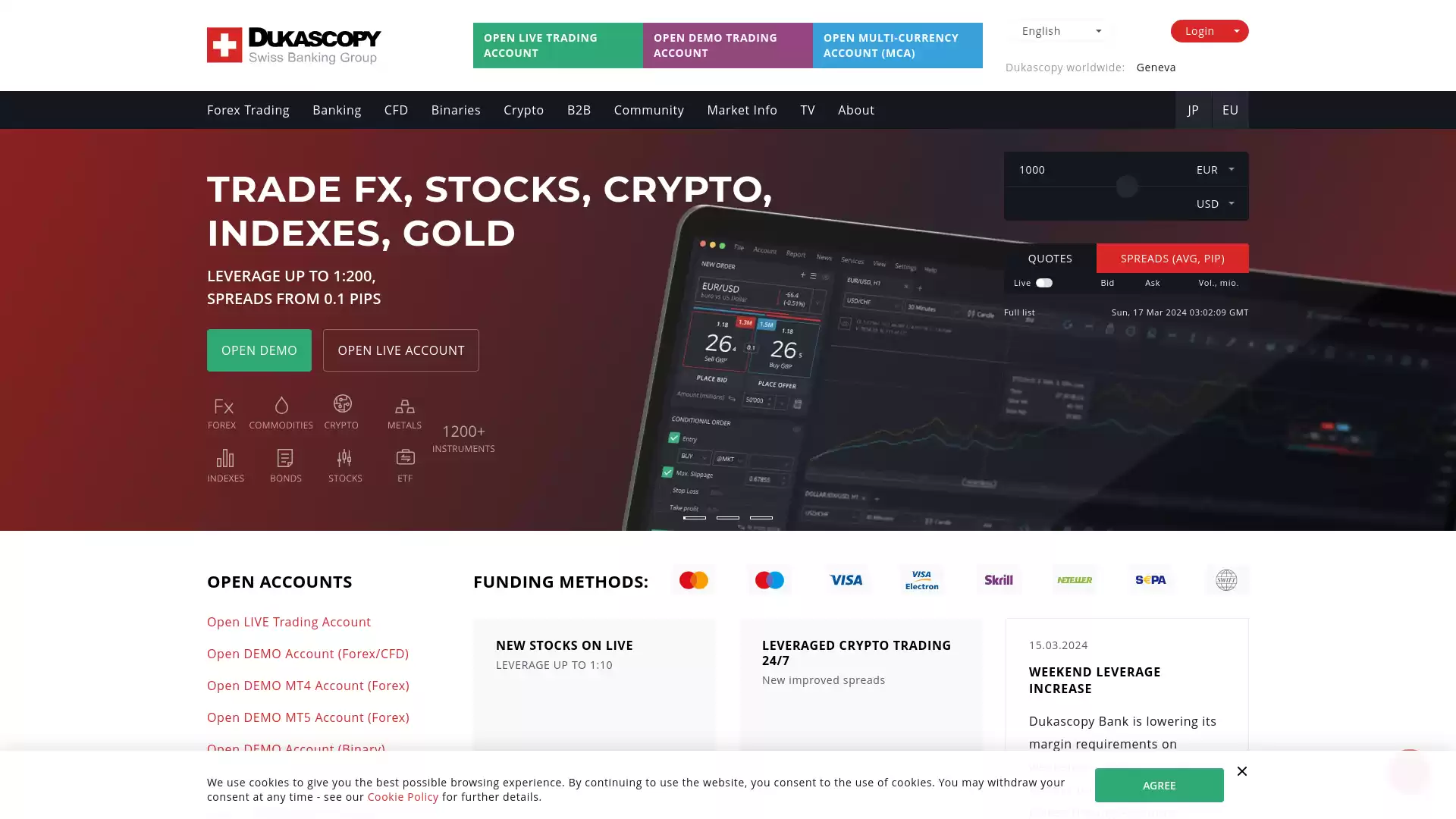

Dukascopy is a Swiss online bank that offers a range of financial services, including online and mobile trading, banking, and media. It was founded in 1998 by a group of physicists who wanted to develop complex financial systems using novel mathematical and econophysical techniques. Some of the main features of Dukascopy are:. It provides access to the SWFX - Swiss FX Marketplace, an ECN platform that connects traders with over 20 major banks and offers low spreads, fast execution, and transparent pricing. The SWFX supports trading in forex, precious metals, CFDs, and binary options. It offers a proprietary trading platform called JForex, which allows traders to trade on various markets with advanced tools for risk management and control. JForex also supports social trading through the Dukascopy Community, where traders can share ideas, strategies, and signals with other members. It provides online banking services such as currency exchange, e-banking, credit cards, and payment solutions through its subsidiaries Dukascopy Europe IBS AS (based in Riga), Dukascopy Japan (based in Tokyo), and SIA Dukascopy Payments (based in Riga). These subsidiaries are licensed by the relevant authorities in their respective countries. It produces free financial information and educational content through its website Dukascopy TV, which features live TV channels, webinars, tutorials, news, analysis, and interviews with experts. Dukascopy TV also hosts an online community where traders can interact with each other and the bank’s staff. Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a bank and a securities dealer. It is also a member of the Swiss Bankers Association since 2012. Dukascopy has offices in Geneva, Riga, Kyiv, Moscow, Kuala Lumpur, Hong Kong, Shanghai, Dubai, and Tokyo. It employs over 300 staff members who are passionate about finance and innovation. Dukascopy is one of the leading online brokers in the world that offers a comprehensive range of financial services to its clients. Whether you are interested in forex trading or other markets such as stocks or commodities or you want to enjoy the benefits of online banking or media content or you want to join a vibrant community of traders who share your interests or goals or you want to learn from experts who have years of experience in the industry or you want to be part of a bank that is committed to excellence and innovation or you want any combination of these reasons then Dukascopy is the right choice for you. : https://en.wikipedia.org/wiki/Dukascopy_Bank. : https://www.dukascopy.com/swiss/english/about/company/. : https://www.dukascopy.com/europe/english/about/company/. : https://comparebrokers.co/dukascopy-review/. : https://www.finma.ch/de/~/media/finma/dokumente/dokumentencenter/myfinma/6finmapublic/20161123-publikation-partielle-und-volle-offenlegung-2015.pdf?la=de : https://www.dukascopy.tv/en/.

What is the Review Rating of Dukascopy?

- 55brokers: 55brokers rated Dukascopy with a score of 92. This rating was last checked at 2024-01-06 06:51:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Dukascopy with a score of 67. This rating was last checked at 2024-01-06 17:28:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Dukascopy with a score of 66. This rating was last checked at 2024-01-06 14:13:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Dukascopy with a score of 74. This rating was last checked at 2024-03-12 10:00:04. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Dukascopy?

Dukascopy, a Swiss online bank and brokerage, offers several advantages that make it a compelling choice for both new and experienced traders. Here are some of the key benefits:. Numerous Platforms and Features: Dukascopy provides a wide range of trading platforms and features. This includes MetaTrader 4, a proprietary platform, and a web-based platform. These platforms cater to different trading styles and strategies, offering flexibility and customization options to traders. Demo and Islamic Accounts: Dukascopy offers both demo and Islamic accounts. The demo account allows new traders to practice trading without risking real money. The Islamic account is designed for traders who wish to trade according to Islamic law, which prohibits earning interest on loans. Good Customer Support: Dukascopy is known for its responsive and helpful customer support. This can be particularly beneficial for new traders who may need assistance navigating the platform or understanding certain features. Regulation and Security: Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA), a Tier 1 authority. This ensures that the broker adheres to strict regulatory standards, providing traders with a secure and transparent trading environment. Client deposits are insured up to CHF100,000 by esisuisse. Attractive Trading Conditions: Dukascopy offers attractive trading conditions, including low spreads - from 0.1 pips on EUR/USD. This can help traders maximize their profits. Wide Range of Tradable Assets: Dukascopy offers a wide range of tradable assets, including forex, cryptocurrencies, commodities, and several more. This allows traders to diversify their portfolio and take advantage of different market conditions. Banking Services: Dukascopy also provides banking services, allowing traders to transfer money between accounts for free. Traders can also open a virtual or a plastic Dukascopy card that can be used for ATM withdrawals and online & offline payments. These features make Dukascopy a reliable and versatile platform for forex trading. However, as with any financial decision, it’s important to do your own research and consider your individual needs and circumstances before choosing a broker.

What are the Cons of Dukascopy?

Dukascopy, a Swiss online bank and brokerage, is known for its innovative approach to trading. However, like any financial institution, it has its drawbacks. Here are some of the cons associated with Dukascopy:. Inability to Close Chat: One of the main drawbacks of Dukascopy is the inability to close the chat. This can be inconvenient for traders who prefer a more streamlined interface. Overwhelming Website: Some users find Dukascopy’s website somewhat overwhelming. The vast amount of information and features can be confusing, especially for novice traders. Leverage Limitations: Dukascopy offers leverage up to 1:200. While this might be sufficient for some traders, others might find it limiting, especially those who prefer high-risk, high-reward trading strategies. Account Deposit Limit: Each account is given a deposit limit based on the information provided at the account opening. This could potentially restrict the trading capacity of some users. Higher Trading Commissions for Islamic Account Traders: Traders with Islamic accounts are subject to higher trading commissions. This could be a significant disadvantage for traders who adhere to Sharia law. No Trading on Weekends: It’s impossible to open new positions on weekends. This could be a disadvantage for traders who wish to capitalize on market events that occur over the weekend. Trading Costs: Trading costs consist of spreads and commissions, which vary depending on net deposit, equity, and trading volume. The EUR/USD carries a minimum mark up of 0.1 pips. MT4 trading accounts include a $1 commission per standard lot. These costs can add up, particularly for high-volume traders. While Dukascopy has many advantages, these cons are important considerations for anyone thinking about opening an account with this broker. As always, potential traders should conduct thorough research and consider their individual trading needs before choosing a broker.

What are the Dukascopy Current Promos?

Dukascopy Bank SA offers several enticing promotional programs for forex traders. These programs are designed to enhance the trading experience and provide additional benefits to clients. Let’s delve into the details:. 1. Experience Sharing Program: Live clients of Dukascopy can participate in this program. Share your experience about Dukascopy’s services and receive a reward. How it works: Experience Sharer receives 50% (for the life-time of the account) of the trading volume commissions paid to Dukascopy by the New Client. In addition, the New Client receives 10% cashback for the life-time of the account. . 2. Equity Bonus: Available for self-trading accounts. Clients can apply for a bonus within 30 days since their last credit on their account. Bonus subscription entails conditions on traded volume which must be reached within 1 year after the bonus is credited. Receive a 10% bonus of the account equity. . 3. Volume Trading Commission Discount Program: Self-trading clients can benefit from a 20% discount on volume trading commissions. Clients can apply for the discount within 30 days since their last credit on their account. Subscription to the discount program requires reaching specific traded volume conditions within 1 year after subscription. . 4. Anniversary Bonus: Celebrating its 10-year anniversary, Dukascopy offers an exceptional opportunity. Clients can apply for a bonus within 30 days since their last credit on their account. Bonus subscription entails conditions on traded volume which must be reached within 1 year after the bonus is credited. Receive a 100% bonus of the account equity. . 5. Refer Your Friend: Share your Dukascopy trading experience with friends. Invite friends to benefit from Dukascopy’s outstanding trading conditions. If your referred friend becomes a live trader with Dukascopy Bank: Enjoy a 100% discount on your future trading commission. The commission discount will be credited daily from the moment your referred friend performs the first trade. . These promotional programs add value to your forex trading journey with Dukascopy. Remember to review the specific terms and conditions for each program to make the most of these benefits!.

What are the Dukascopy Highlights?

Dukascopy, a fully regulated Swiss bank. , is known for its significant contributions to the world of finance and forex. Here are some highlights:. Dukascopy TV: An international video hub founded in 2008, Dukascopy TV provides high-quality content about cryptocurrencies, blockchain, and highlights current hot topics from the world’s largest financial markets. It has amassed a substantial following with 42.7K subscribers and 9.1K videos. Crypto-friendly Bank: In 2023, Dukascopy held its fourth crypto event in Geneva, centered around the topic of "What it means to be a crypto-friendly bank in 2023". The event was free to encourage new members of the club to join the conversation. Financial Analysis and Forecasts: Dukascopy provides regular analysis and forecasts on various financial markets. This includes insights into stocks, gold prices, and the performance of various currencies. FinTech Meetups: Dukascopy hosts regular FinTech meetups at their Geneva Studio. These events bring together industry experts in a friendly and collaborative atmosphere. Investment Opportunities: Dukascopy provides information on potential investment opportunities. For example, they have content on how much one might have gained if they invested $1000 in certain stocks in 2023. These highlights demonstrate Dukascopy’s commitment to providing valuable financial insights and fostering a community interested in finance and technology.

Is Dukascopy Regulated and who are the Regulators?

Dukascopy Bank, a Swiss online bank known for its services in online and mobile trading, banking, and financial services, is indeed regulated. The primary regulatory body overseeing Dukascopy Bank is the Swiss Financial Market Supervisory Authority (FINMA). FINMA regulates Dukascopy Bank both as a bank and a securities dealer. Dukascopy Bank has three subsidiaries, each of which is regulated by different authorities. Dukascopy Europe IBS AS: This is a licensed brokerage company based in Riga. Dukascopy Japan: This is a Type-1 licensed broker located in Tokyo. SIA Dukascopy Payments: This is a European licensed payment and e-money company incorporated in Riga. It’s also worth noting that Dukascopy Bank became a member of the Swiss Bankers Association in 2012. This further strengthens its credibility and regulatory oversight. In the context of forex trading, these regulations ensure that Dukascopy Bank adheres to the stringent standards set by these regulatory bodies, providing traders with a secure and transparent trading environment. This is particularly important in the volatile forex market, where regulatory oversight is crucial for protecting traders and maintaining market integrity. Please note that while Dukascopy Bank is regulated by Swiss FINMA, Dukascopy Europe is regulated by the Latvia regulator. There’s fund protection up to 20,000 euro for Dukascopy Europe, and client’s fund protection up to 100,000 CHF for Dukascopy Bank. They have also recently added negative balance protection. In conclusion, Dukascopy Bank and its subsidiaries are regulated by several authorities, ensuring a high level of security and trust for its clients. This makes it a reliable choice for forex traders looking for a regulated and secure platform for their trading activities.

Did Dukascopy win any Awards?

Yes, Dukascopy has won several awards in the forex industry. Here are some of the awards that Dukascopy has won:. Best ECN Broker for Beginners by BrokerTested.Com in 2020. Best Bank Broker by Traders Union Awards in 2020. Best FXResearch by Join The Best! in 2023. Most User-Friendly Trading Experience by JForex4 at Rimini IT Forum in 2023. Best For Cryptocurrency Trading in UAE by CryptoNewsZ.com in 2021. . Dukascopy Bank SA is a Swiss online bank that provides trading services, particularly in the foreign exchange market. The company offers a range of trading platforms, including JForex, MetaTrader 4, and MetaTrader 5, as well as automated trading and wealth management services. Dukascopy is known for its ECN model, which allows clients to trade directly with other market participants, rather than through a dealing desk. The company also offers a range of educational resources, including webinars, video tutorials, and a trading community forum. I hope this information helps. Let me know if you have any other questions.

How do I get in Contact with Dukascopy?

Dukascopy is a leading online Forex trading broker. Here are the details on how to get in touch with them:. Dukascopy Bank SA. Address: Route de Pre-Bois 20, 1215 Le Grand-Saconnex. Phone: 022 799 48 88. Operating Hours: Monday to Sunday, 22:00 - 23:00. Dukascopy Europe IBS AS. Address: Lacplesa iela 20a-1, Riga, LV-1011, Latvia. Main Phone: +371 67 399 000. Live Trading Support (24h): +371 67 399 039. For security reasons, all phone lines are recorded. They also offer a 24/7 client support chat. Please note that communication by email for any type of request to Dukascopy Europe can only be done through specific mailboxes. For any questions, requests, and instructions related to your live account, you can send them a message. For any other general questions, you can send them a message. In case of urgent instructions, it is highly recommended to contact their live client support desk or your Account Manager by phone during business hours to verify the proper reception of your instructions and to limit the risk of late execution or non-execution. Please be aware of the risks associated with communication by emails which include failure in delivery. Additionally, emails sent to addresses other than the ones mentioned may not be read at all or read with delay. It is important to verify the reception of your instructions by contacting their live client support desk or your Account Manager promptly. Dukascopy Europe shall not be held liable for any loss or expense, resulting directly or indirectly from late execution or non-execution of instructions sent to any other email addresses. Depending on their nature, instructions may be executable only during business hours.

Where are the Headquarters from Dukascopy based?

Dukascopy Bank is a renowned entity in the world of forex trading, known for its advanced technological solutions and a wide range of services. The bank’s headquarters are located in the cosmopolitan city of Geneva, Switzerland at the address Route de Pre-Bois 20, 1215 Le Grand-Saconnex. As a Swiss online bank, Dukascopy provides online and mobile trading, banking, and financial services. It offers attractive spreads and ECN Online FX Trading, making it a preferred choice for many forex traders. Despite being headquartered in Switzerland, Dukascopy has a global presence with offices in various cities around the world including Riga, Kyiv, Moscow, Kuala Lumpur, Hong Kong, Shanghai, Dubai, and Tokyo. This international footprint allows Dukascopy to cater to a diverse clientele and understand the unique needs of forex traders from different regions. In conclusion, Dukascopy Bank, with its headquarters in Geneva, Switzerland, is a significant player in the forex trading industry. Its commitment to providing advanced trading solutions and a wide range of services has made it a popular choice among forex traders worldwide.

What kind of Customer Support is offered by Dukascopy?

Dukascopy, a leading online Forex trading broker, offers a comprehensive customer support system to cater to the needs of its diverse clientele. 24/7 Customer Support Dukascopy provides round-the-clock customer support, ensuring that clients can get assistance whenever they need it. This is particularly important in the Forex market, which operates 24 hours a day. Multiple Contact Channels Clients can reach out to Dukascopy through various channels. They offer phone support with dedicated lines for live trading and client support. In addition, they provide an email address for clients to send their queries. Live Chat For immediate assistance, Dukascopy offers a live chat feature. This allows clients to get real-time responses to their queries, making it a convenient option for those who need quick answers. Call-Back Request If a client prefers to speak with a customer support representative but is unable to call, they can request a call-back from Dukascopy. Security Measures Dukascopy takes client security seriously. All phone lines are recorded to ensure the quality of service and enhance client security. Global Presence With its headquarters in Geneva, Switzerland. , and a branch in Riga, Latvia. , Dukascopy has a global presence, making it accessible to clients worldwide. In conclusion, Dukascopy’s customer support system is designed to provide efficient and effective assistance to its clients, ensuring a smooth trading experience in the Forex market. Their commitment to client satisfaction is evident in their comprehensive and responsive customer support services.

Which Educational and Learning Materials are offered by Dukascopy?

Dukascopy, a Swiss-regulated banking group, offers a wide range of educational and learning materials for traders. These resources are designed to help traders navigate the world of forex trading and other financial markets. Trading Platforms: Dukascopy provides access to MetaTrader 4, a popular platform for forex trading. They also offer JForex, a proprietary platform that is well-suited to automated trading. These platforms are equipped with powerful trading tools and market insights, providing traders with a comprehensive environment for trading. Forex Trading: With over 60 currency pairs available, Dukascopy offers a broad spectrum for forex trading. The broker also offers high leverage up to 1:100, providing traders with the potential for significant profits. Traders have access to excellent software, including MT4 and JForex, for efficient and effective forex trading. CFD Trading: Dukascopy offers highly leveraged Contracts for Difference (CFDs) with rates up to 1:200. A wide selection of asset classes are available, including currencies, equities, commodities, ETFs, and cryptos. This provides traders with a diverse range of options for their trading strategies. Crypto Trading: Traders can take positions on popular cryptocurrencies against the US Dollar. Dukascopy offers leverage up to 1:5 for crypto trading, allowing traders to potentially amplify their profits. Market Research: Dukascopy provides comprehensive market research, including technical and fundamental analysis, trading ideas, and even its own TV channel. These resources can provide traders with valuable insights into market trends and potential trading opportunities. In conclusion, Dukascopy offers a robust suite of educational and learning materials that can equip traders with the knowledge and tools they need to navigate the forex market and other financial markets effectively.

Can anyone join Dukascopy?

Dukascopy is a Swiss-based online broker that offers a range of trading services, including forex, CFDs, binary options, cryptocurrencies, and more. Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and the European Securities and Markets Authority (ESMA), and is part of the Dukascopy Group, which also operates in other countries such as Cyprus, Russia, and the United States. Anyone who meets the eligibility criteria can join Dukascopy as a client. The eligibility criteria vary depending on the type of account and the country of residence of the client. Here are some general requirements that apply to most accounts:. The client must be at least 18 years old or have a legal guardian who can act on their behalf. The client must have a valid passport or ID card that contains their place of birth. The client must have a bank account or a payment method that can be used to fund their account. The client must agree to comply with the terms and conditions of Dukascopy, including its risk management policies, trading rules, fees, and taxes. . Some specific requirements may apply to certain types of accounts or regions. For example:. For forex trading accounts, the minimum equity requirement is 20 EUR. The minimum margin requirement is 1% for standard accounts and 2% for ECN accounts. The maximum leverage is 1:30 for standard accounts and 1:200 for ECN accounts. For CFD trading accounts, there is no minimum equity requirement or margin requirement. The maximum leverage is 1:30 for all accounts. For binary options trading accounts, there is no minimum equity requirement or margin requirement. The maximum leverage is 1:1000 for all accounts. For cryptocurrency trading accounts, there is no minimum equity requirement or margin requirement. The maximum leverage is 1:3 for all accounts. . If you are interested in joining Dukascopy as a client, you can open an account online by visiting their website here. You can also contact their customer support team via phone, email, or live chat if you have any questions or need assistance. Dukascopy offers various benefits to its clients, such as low spreads, fast execution, free education resources, loyalty programs, bonuses, and more. You can find out more about these benefits on their website here.

Who should sign up with Dukascopy?

Dukascopy, operated by a Swiss-regulated banking group, is an online broker that offers a wide selection of markets, making it an attractive choice for various types of traders. Here are some key points to consider:. Active Day Traders Dukascopy appeals to active day traders, offering fee rebates and the JForex platform for automated trading. The minimum deposit is $100, and traders can choose from a variety of trading platforms, including MT4 and AlgoTrader. Forex Traders With over 60 currency pairs available, Dukascopy provides a broad range for forex traders. The broker offers high leverage up to 1:100, which is a good amount from a reputable and regulated broker. Traders have access to excellent software, including MT4 and JForex. Stock Traders Dukascopy offers stock trading on the world’s largest indices and companies. Users have access to markets in North America, Europe, and the Pacific region with competitive pricing. CFD Traders Dukascopy offers highly leveraged CFDs with rates up to 1:200. A wide selection of asset classes are available, including currencies, equities, commodities, ETFs, and cryptos. Spreads are also tight, starting from 0.1 pips. Crypto Traders Dukascopy allows traders to take positions on popular cryptos against the US Dollar. Traders can go long or short with decent leverage up to 1:5. Clients of Dukascopy are also protected to the tune of CHF 100’000 in the event of broker insolvency. Large-Scale Traders and Professionals Dukascopy Europe IBS AS, a 100% owned subsidiary of Swiss Forex bank Dukascopy Europe IBS AS, offers access to the Swiss Foreign Exchange Marketplace. This makes it a suitable choice for active traders, hedge funds, banks, and professionals. In conclusion, Dukascopy is a versatile platform that caters to a wide range of traders, from forex and stock traders to CFD and crypto traders. Its diverse offerings, competitive pricing, and robust trading platforms make it a strong choice for both novice and experienced traders.

Who should NOT sign up with Dukascopy?

Dukascopy is a Swiss online bank and brokerage that offers a variety of trading services, including forex, CFDs, cryptocurrencies, and stocks. However, not everyone is suitable for signing up with Dukascopy. Here are some reasons why you should NOT sign up with Dukascopy:. Leverage up to 1:200. Dukascopy allows traders to use high leverage ratios, which can magnify both profits and losses. This can be risky for inexperienced or conservative traders who may not have enough capital to withstand market fluctuations. Higher trading commissions for Islamic account traders. Dukascopy offers Islamic accounts that comply with Sharia law and do not charge or pay interest on trades. However, these accounts have higher trading commissions than standard accounts, which can reduce the net returns of traders. Each account is given a deposit limit based on the information provided at the account opening. Dukascopy does not allow traders to increase their deposit limits once they open an account. This can limit the trading opportunities and potential profits of traders who want to grow their capital. Impossible to open new positions on weekends. Dukascopy does not offer weekend trading for forex and CFDs. This means that traders cannot take advantage of the price movements that occur outside of the regular market hours. . Dukascopy is a reputable and regulated broker that offers innovative products and services to its clients. However, it also has some disadvantages that may not suit everyone’s preferences and goals. Therefore, before signing up with Dukascopy, you should carefully weigh the pros and cons and consider your own trading style and risk appetite.

Does Dukascopy offer Discounts, Coupons, or Promo Codes?

Dukascopy, a renowned forex trading platform, does offer various discounts, coupons, and promo codes. Promo Codes and Discounts Dukascopy has been known to offer promotional codes that provide significant discounts. For instance, there was a Black Friday coupon code that offered up to 65% off. Additionally, Dukascopy had a promo code in December 2023 that provided a 15% discount. Referral Program Dukascopy also has a referral program. When a new user signs up using a referral code, both the referrer and the new user receive 5 DUC+, which is equivalent to 17€. Investment Opportunities Dukascopy offers an opportunity to diversify investments with Duk+ deposits, which can earn up to 15% annually. This is a unique offering that not only provides a return on investment but also allows for portfolio diversification. Additional Savings Apart from these, Dukascopy occasionally offers other deals and discounts. It’s recommended to check their website or sign up for their newsletter to stay updated on the latest offers. In conclusion, Dukascopy does provide various opportunities for savings through discounts, coupons, and promo codes. These offers, combined with their diverse investment options, make Dukascopy an attractive platform for forex trading.

Which Account Types are offered by Dukascopy?

Dukascopy, a subsidiary of Dukascopy Bank SA in Switzerland, offers a variety of account types to cater to the diverse needs of both private individuals and institutional clients. Forex/CFD ECN Accounts. : These accounts are optimized for professional trading activity. They can be opened in different currencies including USD, CHF, EUR, GBP, AUD, CAD, CNH, CZK, DKK, HKD, HUF, ILS, JPY, NOK, PLN, RON, SEK, SGD. The minimum size of an initial deposit is 100 USD. Depending on account size and monthly traded volume, different Trading Fees and Overnight Policy are applied. All types of trading (including news trading, scalping etc) are accepted. The deposits of the clients of Dukascopy Europe are protected by EU regulation in the amount up to EUR 20’000.- for each client. Forex MT4 Account. : This account type allows for market execution type trading with no minimum deposit. It allows for hedging and the use of expert advisors. The maximum number of orders is 1’000. JForex Automated Account. : This account type is best suited to traders who are interested in manual, automated, and/or the development and testing of trading strategies based on the JAVA programming language. Gold Accounts. : Clients are able to open self-trader and current accounts in non-deliverable gold (XAU London). These accounts act as an alternative to purchasing physical gold. Private Banking and Multi-Currency Accounts. : These account types are also offered by Dukascopy, providing a comprehensive suite of financial services to their clients. Please note that the specific features and conditions of these accounts may vary and it’s always a good idea to check the latest information on the Dukascopy website or contact their customer service for detailed and personalized advice.

How to Open a Dukascopy LIVE Account?

Opening a Dukascopy Live account involves a series of steps. Here’s a detailed guide:. Step 1: Registration Start by filling in the electronic registration form. This form will ask for your personal details and financial information. Make sure to provide accurate and complete information. Step 2: Documentation After completing the electronic registration form, print out the Dukascopy account opening documentation. This documentation contains important information about your account and the terms and conditions of Dukascopy Bank SA. Step 3: Review and Sign Read the Dukascopy account opening documentation carefully. Once you understand all the terms and conditions, sign the documentation. Remember to include the place and date of signature. Step 4: Verification For an individual account, you need to send the original certified copy of a valid ID card or passport. This ID should contain a clearly visible signature and photo. You also need to send a copy of a utility bill not older than three months for verification of the address. If possible, include a business card. Step 5: Corporate Account If you’re opening a corporate account, you need to send additional documents. These include an extract from the companies register, the certificate of incorporation, the memorandum and articles of association, and a corporate power of attorney for all persons authorised to operate the account. Step 6: Final Check Double-check all the documentation before sending. Make sure you’ve included all the necessary documents and that all the information is correct. Step 7: Account Activation Once Dukascopy Bank SA receives and verifies your documents, your Live account will be activated. You can then start trading Forex/CFD or Binaries. Remember, opening a Dukascopy Live account is a serious commitment. Make sure you understand all the terms and conditions before you sign the documentation. Happy trading!.

How to Open a Dukascopy DEMO account?

Opening a Dukascopy DEMO account is a straightforward process that allows you to practice Forex trading in a risk-free environment. Here’s a step-by-step guide:. Step 1: Visit the Dukascopy Website Go to the Dukascopy website. Look for the option to open a DEMO account. This option is usually available in the Forex Trading section of the website. Step 2: Fill in Your Personal Data You will be asked to provide your personal data, including your first name, last name, e-mail, and phone number. Make sure to enter accurate information as this will be used to set up your account. Step 3: Choose Your Demo Account Settings Select the type of demo account you want. Dukascopy offers several options, including JForex, MT4, and MT5. You can also choose the default demo account settings. Step 4: Agree to Terms and Conditions By proceeding further, you express your desire to be contacted in regards to Dukascopy’s services and offers. Make sure to read and understand the terms and conditions before clicking on ‘Open Demo’. Step 5: Start Practicing Forex Trading Once your demo account is set up, you can start practicing Forex trading. The demo account provides ECN liquidity from numerous banks, a transparent pricing environment, and attractive spreads (EUR/USD from 0.1 pips). It also offers equal trading rights for all traders and deposit protection up to CHF 100’000. or EUR 20’000. Remember, the purpose of a demo account is to practice and learn. Make the most of it by trying out different trading strategies and familiarizing yourself with the trading platform. Happy trading!.

How Are You Protected as a Client at Dukascopy?

As a client at Dukascopy, you are protected in several ways:. Regulation and Insurance: Dukascopy Bank is regulated by Swiss FINMA. and Dukascopy Europe is regulated by the Bank of Latvia. Each client is protected up to CHF 100,000 against the insolvency risk of Dukascopy Bank. For Dukascopy Europe, clients are entitled to a compensation of 90% (but not exceeding EUR 20,000) for irreversibly lost financial instruments and losses caused by a non-executed investment service. Custody of Client Assets: Assets of Dukascopy Europe IBS AS clients are kept in a custodial account of Dukascopy Europe IBS AS in Dukascopy Europe IBS AS, Geneva, Switzerland. In the event of Dukascopy Europe being declared bankrupt, deposits of up to 100,000 Swiss francs are regarded as preferential deposits and will be paid out immediately to Dukascopy Europe IBS AS. No Additional Payments for Negative Balance: Dukascopy Europe IBS AS offers you an exemption from additional payments obligation in case of a negative balance on your trading account. As a result, you will not lose more than the funds invested in the trading account. Careful Management of Counterparty/Credit Risks: Dukascopy Europe IBS AS deposits money resources of customers distinct from its own money resources. Dukascopy Europe IBS AS uses customer money resources exclusively to ensure the customer’s transactions in financial instruments pursuant to a written contract signed by the customer and Dukascopy Europe IBS AS. Please note that investment protection rules shall not apply to cases where clients have suffered losses due to changes in the price of financial instruments or if financial instruments have become illiquid. Further information is available on the Bank of Latvia website.

Which Funding methods or Deposit Options are available at Dukascopy?

Dukascopy is a Swiss-based online broker that offers forex and CFD trading services to clients worldwide. Dukascopy has a variety of funding methods and deposit options to suit different preferences and needs. Here are some of the main ones:. Wire Transfer: This is a fast and secure way to transfer funds from your bank account to your Dukascopy account. You can use this method for both deposits and withdrawals. To use this method, you need to provide your bank details, such as IBAN, BIC/SWIFT code, and account number. The processing time may vary depending on your bank and the amount of funds involved. Payment Cards: This is a convenient way to fund your Dukascopy account using your credit or debit card. You can use Visa, Mastercard, Maestro, or American Express cards for this purpose. To use this method, you need to enter your card details and the amount you want to deposit. The processing time may depend on the card issuer and the network fees involved. Skrill 3 / Neteller 3: These are popular online payment services that allow you to fund your Dukascopy account using various payment methods, such as bank transfer, credit card, or e-wallets. You can use Skrill 3 or Neteller 3 for both deposits and withdrawals. To use these services, you need to create an account with them and link it with your Dukascopy account. The processing time may vary depending on the payment method chosen. Crypto: This is an innovative way to fund your Dukascopy account using cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, or Ripple. You can use crypto for both deposits and withdrawals. To use this method, you need to have a crypto wallet address that is compatible with Dukascopy’s platform. The processing time may depend on the network congestion and the transaction fees involved. . Dukascopy also offers other funding facilities for its clients who have specific needs or preferences. These include:. Bank Guarantees: This is a service that allows you to deposit funds in Swiss francs (CHF) or US dollars (USD) using bank guarantees issued by reputable banks in Switzerland or the US. You can use this service for both deposits and withdrawals. To use this service, you need to provide your bank details and the amount you want to deposit or withdraw in CHF or USD. Crypto P2P: This is a service that allows you to lend or borrow cryptocurrencies from other traders on the Dukascopy platform using peer-to-peer (P2P) lending technology. You can use this service for both deposits and withdrawals in cryptocurrencies only. To use this service, you need to create an account with Dukascopy’s partner exchange platform (such as Paxful) and verify your identity. Crypto Lending: This is a service that allows you to borrow cryptocurrencies from other traders on the Dukascopy platform using peer-to-peer (P2P) lending technology. You can use this service for both deposits and withdrawals in cryptocurrencies only. To use this service, you need to create an account with Dukascopy’s partner exchange platform (such as Paxful) and verify your identity. . Dukascopy’s funding methods and deposit options are designed to provide its clients with flexibility, convenience, security, and transparency when trading forex and CFDs online.

What is the Minimum Deposit Amount at Dukascopy?

Dukascopy, a renowned player in the forex market, has a variable minimum deposit requirement depending on the client profile. For Dukascopy Europe, the minimum deposit size is $100. However, it’s important to note that for Dukascopy’s other clients, the minimum deposit is $1000. Deposits can be made through several options including card deposits and wire transfers. Card deposits may not necessarily be deposited instantly on the account and it may take a while until the deposited amount appears on the account. If human intervention is required, feedback is typically provided within 48 hours, excluding weekend time. For wire transfers, clients can click on ‘Get instructions’ and follow the instructions to send funds. Dukascopy also offers the option of internal transfers, allowing clients to transfer funds to another Forex & CFD or Binary Option account opened in their name. It’s crucial for potential investors to understand these details to ensure smooth transactions. As always, it’s recommended to visit the official Dukascopy website or contact their customer service for the most accurate and up-to-date information.

Which Withdrawal methods are available at Dukascopy?

Dukascopy, a well-established broker in the Forex and CFD trading industry, offers several methods for withdrawing funds from your account. Wire Transfer: This is a common method for withdrawing funds. To request a withdrawal by wire transfer, you need to click on ‘Withdrawal’ in your account settings. Internal Transfer: Dukascopy allows you to transfer funds to another Forex & CFD or Binary Option account opened in your name, where applicable. This can be a convenient option if you have multiple trading accounts with Dukascopy. DC Payments: You can also send funds to your DC Payments account, where applicable. This could be a suitable option if you frequently use DC Payments for your financial transactions. It’s important to note that the available withdrawal methods may differ depending on the country in which Dukascopy operates. Additionally, currency conversion fees may apply if your withdrawal method’s base currency is not the same as your Dukascopy account’s base currency. Before you withdraw funds from your Dukascopy account, ensure that you have completed the verification process for your live account. This is a necessary step for safety reasons and because Dukascopy is legally required to verify the identity of its customers. There is no set time limit for withdrawing money from your Dukascopy account. Once your account has been validated, you can withdraw your positive balances at any time. Withdrawal requests submitted after the cutoff time or on a non-business day will be processed on the nearest following business day. Please remember that when you request a withdrawal from your Dukascopy account, the funds will be returned to the same method of payment that was used to initially fund the account, unless you select an alternative withdrawal method. If you used multiple methods of payment, Dukascopy will transfer the funds to these methods based on the order in which they were used. Lastly, be aware that there may be costs associated with withdrawing funds from Dukascopy. It’s always a good idea to check the current fees and charges before initiating a withdrawal. Please note that the information provided here is based on general information and may be incomplete or outdated. Always check the latest information on the Dukascopy website or contact their customer service for the most accurate and up-to-date details.

Which Fees are charged by Dukascopy?

Dukascopy, a renowned forex trading platform, charges various fees for its services. Here is a detailed breakdown:. Volume Commission for Margin Trading in CFD Instruments: The volume commission is charged for each opening or closing trade. The rate is expressed in USD per 1 million USD traded and is converted to the client’s account’s basic currency. The volume commission rate depends on net deposit and equity. For clients trading by themselves (Self Traders), the volume commission rate is as follows: Net Deposit less than 5,000 USD: 35 USD for currencies, 52.5 USD for precious metals Net Deposit greater than or equal to 5,000 USD: 33 USD for currencies, 49.5 USD for precious metals Net Deposit greater than or equal to 10,000 USD: 30 USD for currencies, 45 USD for precious metals Net Deposit greater than or equal to 25,000 USD: 25 USD for currencies, 37.5 USD for precious metals Net Deposit greater than or equal to 50,000 USD: 18 USD for currencies, 27 USD for precious metals Net Deposit greater than or equal to 250,000 USD: 16 USD for currencies, 24 USD for precious metals Net Deposit greater than or equal to 500,000 USD: 15 USD for currencies, 22.5 USD for precious metals Net Deposit greater than or equal to 1,000,000 USD: 14 USD for currencies, 21 USD for precious metals Net Deposit greater than or equal to 2,000,000 USD: 10 USD for currencies, 15 USD for precious metals Net Deposit greater than or equal to 3,000,000 USD: 5 USD for currencies, 7.5 USD for precious metals . Trading Commissions for Single Stock CFD, ETF CFD: Market volume commission is 0.10% of trade value for most markets, with a minimum commission ranging from 8.00 EUR to 80.00 NOK depending on the market. Some markets, like Hong Kong and Japan, have different rates. Additional Fees: In addition to the standard fees, a fee of $0.5 per 1 MT4 lot ($5 per $1 million) is charged for trading on the MetaTrader 4 platform. Please note that this information is subject to change and it is always a good idea to check the latest fee schedule on the Dukascopy website.

What can I trade with Dukascopy?

Dukascopy Europe, a member of the Swiss Banking Group, offers a wide range of brokerage services on international capital markets. Forex Trading Forex trading is a key offering of Dukascopy Europe. Clients can trade spot Forex, with a EUR/USD spread from 0.1 and leverage up to 1:30. The transparent pricing environment ensures all clients have access to the same liquidity at equal prices through a single datafeed. Equities and ETFs Clients have access to equities and ETFs. Orders can be placed through an electronic trading platform or by phone. Fixed Income Instruments Fixed income instruments, such as bonds, are also available for trading. CFDs CFDs on bonds, commodities, indexes, stocks, ETFs and cryptocurrencies can be traded through the same platforms. Benefits The benefits of using Dukascopy Europe’s brokerage services include direct market access to exchange-traded instruments via an electronic trading platform, tailored customer support, including analytics, market data, and news. Protection Client protection is a priority, with deposit protection up to CHF 20’000. Trading Platforms Dukascopy Europe provides a variety of trading platforms, including JForex and MT4. These platforms offer a wide range of trading orders, hedging and scalping options, and automated trading with JForex API and FIX API. Automated Trading For active traders, hedge funds, banks, and professionals, Dukascopy Europe offers automated trading with JForex API and FIX API. In conclusion, Dukascopy Europe provides a comprehensive trading environment for a variety of financial instruments, making it a strong choice for traders looking for diversity in their investment portfolio.

Which Trading Platforms are offered by Dukascopy?

Dukascopy, a renowned forex broker, offers a variety of trading platforms to cater to the diverse needs of its clients. Here are the key platforms:. JForex 3: This is Dukascopy’s proprietary platform. It is compatible with both Windows and Mac Desktop, and Android/ iOS devices. JForex 3 is excellent for technical trading and automated strategies. It provides direct access to the SWFX Swiss Marketplace. The platform offers a wide range of trading orders, including Market, Limit, Stop, Take Profit, Stop Loss, Stop Limit, Trailing Stop, Place Bid/Offer, OCO, IFD, etc. It also allows hedging and scalping. MetaTrader 4 (MT4): MT4 is a well-known trading platform, appreciated by many traders around the world. Dukascopy offers fully automated and reliable transmission of orders through the MT4 environment to your trading account. The volume commission rate is determined dynamically and depends on Net Deposit, Equity, and Traded Volume according to Dukascopy’s Fee Schedule. In addition to the standard fees, $1 per 1 MT4 lot ($10 per $1 million) is charged for trading on the MT4 platform. Web Binary Trader system: This system is offered for those interested in binary options trading. Each platform has its unique features and advantages. For instance, JForex 3 offers an immersive and best-in-class trading experience. , while MT4 is appreciated for its familiarity and fully automated order transmission. The Web Binary Trader system caters specifically to binary options trading. Therefore, traders can choose the platform that best suits their trading style and needs.

Which Trading Instruments are offered by Dukascopy?

Dukascopy, a renowned player in the financial market, offers a wide range of trading instruments to cater to the diverse needs of traders. Here’s a detailed look at the offerings:. Forex: Dukascopy provides access to the Swiss Foreign Exchange Marketplace, which is known for its large pool of ECN spot forex liquidity. This marketplace is ideal for banks, hedge funds, other institutions, and professional traders. Metals: Traders can also trade in various metals. This allows for diversification of the trading portfolio and provides opportunities to benefit from the price movements in the metal market. CFDs: Dukascopy offers Contracts for Difference (CFDs) on various underlying assets such as bonds, commodities, indexes, stocks, and ETFs. CFDs allow traders to speculate on the price movements of these assets without owning them. Cryptocurrencies: With the growing popularity of digital currencies, Dukascopy has included cryptocurrencies in its trading instruments. It currently offers six of the most popular cryptocurrencies - Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Stellar (XLM), Bitcoin Cash (BCH), Tether (USDT) and Dukascoin (DUK+). Other Instruments: In addition to the above, Dukascopy provides access to the world’s main stock markets. Other markets are available on demand. It’s worth noting that Dukascopy provides different types of trading platforms, including Metatrader 4, and its proprietary JForex 3 platform. These platforms are equipped with various tools for risk management and control over order execution. In conclusion, Dukascopy offers a comprehensive suite of trading instruments, making it a preferred choice for many traders globally.

Which Trading Servers are offered by Dukascopy?

Dukascopy, a member of the Swiss Banking Group, offers a range of trading servers for its clients. These servers provide access to the Swiss Forex Marketplace (SWFX), which is known for its large liquidity pool available for banks, hedge funds, other institutions, and professional traders. Dukascopy’s Trading Servers. Forex Trading Server: This server provides an environment for trading Forex, Metals, CFDs on bonds, commodities, indexes, stocks, ETFs, and cryptocurrencies. It offers equal trading rights to all clients, ensuring that everyone has equal possibilities to provide and consume liquidity within the trading environment. Automated Trading Server: Dukascopy offers automated trading with JForex API and FIX API. This server allows for hedging, scalping, and the use of robots. It also provides tools for risk management and control over order execution. Historical Data Server: Dukascopy provides a tool for downloading historical prices and volumes for various financial instruments and periods, ranging from ticks to months. The servers are located in key locations around the world to ensure fast connection and low latency. The locations include Amsterdam, Frankfurt, London, and New York. The latency for these servers is as follows. Amsterdam: 18.68 ms. Frankfurt: 12.44 ms. London: 22.44 ms. New York: 92.45 ms. In conclusion, Dukascopy offers a range of trading servers that cater to different trading needs, from Forex trading to automated trading and historical data analysis. These servers are strategically located to ensure fast connection and low latency, providing an optimal trading environment for its clients.

Can I trade Crypto with Dukascopy? Which crypto currencies are supported by Dukascopy?

Dukascopy Bank provides leveraged CFD trading on price movements of cryptocurrencies, its derivatives, or value estimations. This allows speculative operations without the need for a digital wallet. There is no need to own cryptocurrency coins, which reduces cybersecurity risks. Due to the leverage provided on trading accounts, clients can hold cryptocurrency CFD positions larger than the amount of traditional currency initially owned. The features of crypto trading with Dukascopy include:. Trade Long & Short: It is easy to speculate in both sides and earn on any price movement. Use Leverage: You can deposit less than your contract size on Crypto. Trade Safely: No need to store Crypto in a digital wallet, so cybersecurity is higher. Meet the Regulations: Unlike Dukascopy, many providers of Crypto are still not regulated. Hedge Risks: If you hold actual digital currency you may open a short position on it and lock the price. Use Deposit Protection: Each client is protected up to CHF 100’000 against the insolvency risk of Dukascopy Bank. As for the supported cryptocurrencies, Dukascopy currently offers CFDs on the following cryptocurrencies. Bitcoin (BTC). Ether (ETH). Litecoin (LTC). Bitcoin Cash (BCH). Stellar (XLM). Dashcoin (DSH). EOS (EOS). TRON (TRX). Cardano (ADA). Uniswap (UNI). Chainlink (LNK). Polygon (MAT). Aave (AVE). Maker (MKR). Compound (CMP). Enjin (ENJ). Yearn Finance (YFI). Basic Attention Token (BAT). Please note that the underlying asset — cryptocurrencies — can be extremely volatile. It’s important to understand the risks associated with trading cryptocurrencies. Always do your own research and consider your financial decisions carefully.

What is the Leverage on my Dukascopy Trading Account?

The concept of leverage is a fundamental aspect of trading with Dukascopy. It allows traders to execute trades larger than their deposit, amplifying the effect of price movements. Here’s a detailed explanation:. Maximum Authorized Leverage: By default, the initial leverage for regular trading hours is set to 1:100, which allows to increase exposure up to a 100 times the amount of the equity. This value can be set up to 1:200 upon request, although some restrictions may apply. Use of Leverage: The use of leverage is the relative use of the total authorized free trading line and is a function of the Equity and the used margin. It is displayed at the bottom of the platform main window, as a percentage of the total margin and rounded down to the nearest integer. As exposure increases, the free margin shrinks and the use of leverage increases. Margin Maintenance: The margin is defined by the equity and by the leverage authorized to the portfolio. Necessary margin to take and maintain an exposure is computed, and updates the free trading line. The margin necessary for bid/offers orders is computed and reserved as soon as order creation. Margin Call Level: The margin call territory is defined by the use of leverage when this latter is equal or above 100% and below 200%. When the use of leverage reaches 100%, the account enters the margin call territory and increasing the exposure is no longer allowed as the Free Margin is equal to zero. Margin Cut Level: If the use of leverage reaches or exceeds 200%, Dukascopy Europe has the right (but not the obligation) to fully reduce the client’s exposure by closing existing positions and cancelling pending orders. It’s important to note that the use of leverage magnifies both losses and profits. Equity can easily and quickly vanish in situations where the market prices exhibit strong volatility, potentially creating an adverse environment for the highly leveraged participant.

What kind of Spreads are offered by Dukascopy?

Dukascopy, a renowned financial institution, offers a variety of spreads that cater to different trading sessions and market conditions. Average Spreads. The average spreads offered by Dukascopy are variable and competitive. For instance, the average spread for the EUR/USD pair is approximately 0.2 pips. However, it’s important to note that traders also need to pay a commission of $7 per lot round trip. Despite this, the overall cost of trading with Dukascopy is around 0.9 pips per lot for this pair, which is considered low and competitive. Spread Distribution. Dukascopy provides a detailed view of spread distributions for different trading sessions. This includes the Asian, European, and North American sessions. The spread data can be viewed for different time periods such as daily, monthly, or quarterly. This allows traders to understand the market dynamics and make informed decisions. Forex and CFD Instruments. Dukascopy offers spreads for a wide range of Forex instruments and commodity, index, and stock CFDs. The spreads web widget provided by Dukascopy shows differences between bid and ask prices for these instruments. This data includes average spreads for different sessions as well as overall minimum and maximum values. In conclusion, Dukascopy offers a comprehensive range of spreads that cater to various trading needs. The detailed spread data provided by Dukascopy aids traders in making informed trading decisions.

Does Dukascopy offer MAM Accounts or PAMM Accounts?

Dukascopy, a renowned player in the forex market, offers a unique feature known as the Percent Allocation Management Module (PAMM). This technical solution is provided to Dukascopy Bank clients and allows them to have their accounts managed by a trader appointed by them on the basis of a limited trading power of attorney. The PAMM system is essentially a form of pooled money forex trading. This system allows investors to participate in the forex market without doing the trading themselves but by having a trader appointed by them trade on their behalf. Dukascopy also offers a unique opportunity to earn attractive returns by acting as a liquidity provider on its SWFX marketplace in a fully automated mode. This is part of their Wealth Management services, where all you need to do is open an account with at least a 1000 USD investment, and grant the management mandate to Dukascopy Bank. However, it’s important to note that while Dukascopy does offer PAMM accounts, there is no explicit mention of MAM (Multi-Account Manager) accounts in the information available. MAM accounts are similar to PAMM accounts but offer additional features such as the ability to manage multiple trading accounts using a single interface. Therefore, potential investors interested in MAM accounts may need to contact Dukascopy directly for more information. In conclusion, Dukascopy does offer PAMM accounts as part of its services, providing a way for investors to benefit from the forex market without needing to trade themselves. However, for MAM accounts, further direct communication with Dukascopy may be required.

Does Dukascopy allow Expert Advisors?

Yes, Dukascopy does allow the use of Expert Advisors (EAs). Dukascopy is a well-established broker since 1998, with headquarters in Switzerland, Latvia, Japan, United Arab Emirates, European area, and France. It offers trading spots, including forex, metals, binary options, CFDs on bonds, commodities, indices, stocks, ETFs, and cryptocurrencies through the same platforms. Dukascopy provides its proprietary platform called JForex, which can be accessed by desktop and mobile. In the desktop experience, traders can get several features including hundreds of indicators, advanced charting, historical testing, real-time news, and embedded customer support. Not only JForex, trading in Dukascopy also offers access to MetaTrader 4 platform that is appreciated by many traders around the world. It has main features such as expert advisors and customizable templates. Through its cutting-edge JForex platform technology, Dukascopy offers automated trading capabilities through Expert Advisors (EA) or algorithmic trading strategies (API). Furthermore, clients can benefit from their excellent customer service team, which can be contacted via phone, email, or live chat 24/5 during market hours. Dukascopy also supports expert advisors. These are automated trading bots that use instructions programmed by the investor to identify assets, and then open and close contracts. Using the JForex API, clients can also create and implement their own algorithmic trading bots onto the platform. In conclusion, Dukascopy does support the use of Expert Advisors, providing traders with a robust and flexible platform for automated trading in the forex market.

Does Dukascopy offer Copytrading?

Dukascopy, a member of the Swiss Banking Group. , is a renowned platform in the world of forex trading. It offers a wide range of trading options, including spot Forex, Metals, CFDs on bonds, commodities, indexes, stocks, ETFs, and cryptocurrencies. However, based on the available information, it does not explicitly mention the availability of Copytrading services. Copytrading, a popular feature in forex trading, allows traders to copy the trades of experienced traders, thereby benefiting from their knowledge and strategy. While Dukascopy does offer automated trading with JForex API and FIX API. , these features are not the same as Copytrading. Automated trading allows traders to execute trades automatically based on pre-set rules, while Copytrading involves replicating the trades of other successful traders. In conclusion, while Dukascopy provides a robust platform for forex trading with a variety of features, it does not explicitly offer Copytrading services. Traders interested in Copytrading may need to explore other platforms that explicitly offer this feature. It’s always recommended for traders to thoroughly research and consider their options before choosing a trading platform. Please note that this information is based on the latest available data and may be subject to change.