FIBO Group Review 2026

What is FIBO Group?

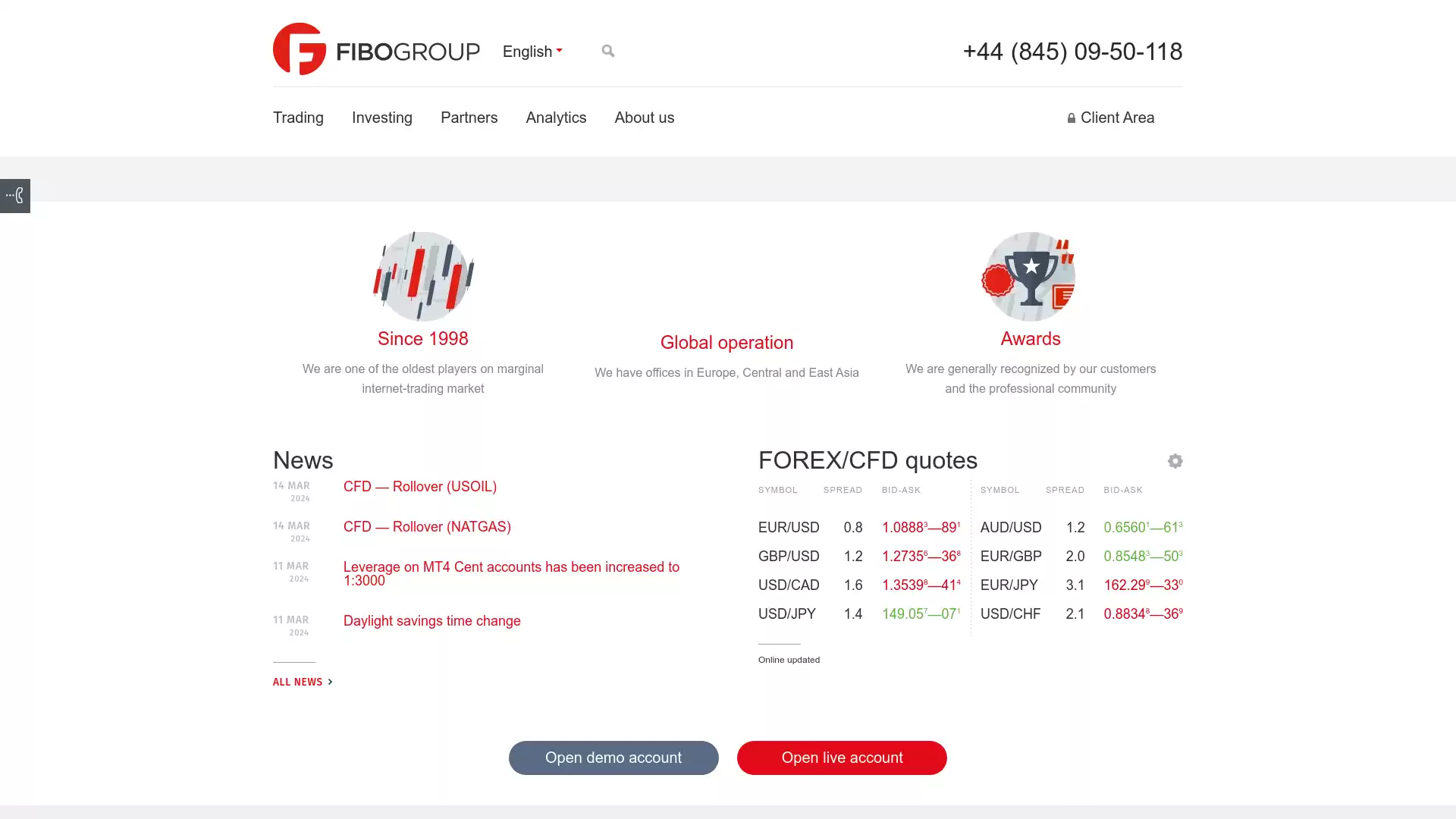

The FIBO Group. is a leading online broker that offers forex and CFD trading. It has been in operation since 1998, making it one of the oldest players in the marginal internet-trading market. FIBO Group provides its clients with the most transparent trading conditions. It offers more than 60 currency pairs for trading. , with low spreads and up to 200x financial leverage. The group operates globally, with offices in Europe, Central, and East Asia. It is generally recognized by its customers and the professional community. FIBO Group also provides a range of trading platforms, including MetaTrader 4. This platform is highly popular among CFD and FOREX traders worldwide, thanks to its user-friendly and useful software. In addition to forex trading, FIBO Group offers trading in a variety of other financial instruments. These include CFDs on gold and silver, world’s major indices, energy carriers, and agricultural commodities. The group also provides regular updates on forex/CFD quotes. , as well as analytics and news related to the forex market. This makes it a comprehensive resource for traders looking to stay informed about market trends and make smart investment decisions. In conclusion, the FIBO Group is a well-established and reputable online broker that offers a wide range of trading options, transparent conditions, and valuable resources for forex and CFD traders.

What is the Review Rating of FIBO Group?

- 55brokers: 55brokers rated FIBO Group with a score of 79. This rating was last checked at 2024-01-06 03:54:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated FIBO Group with a score of 63. This rating was last checked at 2024-01-06 19:19:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated FIBO Group with a score of 84. This rating was last checked at 2024-01-05 22:06:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated FIBO Group with a score of 72. This rating was last checked at 2024-03-12 19:31:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of FIBO Group?

FIBO Group, an international financial holding company, has been operating since 1998 and is considered one of the first brokers to operate in the Forex market. Here are some of the key advantages of trading with FIBO Group:. Wide Range of Trading Platforms: FIBO Group offers a wide range of trading platforms, including terminal versions for mobile devices. This flexibility allows traders to choose the platform that best suits their trading style and needs. 24/7 Technical Support: FIBO Group provides round-the-clock technical support. This ensures that traders can get the help they need, whenever they need it. Large Selection of Currency Pairs: FIBO Group offers a large selection of currency pairs (over 60). This gives traders the opportunity to diversify their portfolio and take advantage of different market conditions. Reputation and Awards: FIBO Group has an excellent reputation and a great history, with a large number of traders working with them in the Forex market. The company has won several awards, including “Best ECN Broker” at the Forex EXPO in 2014 and “The Most Trusted Forex Broker 2014” according to the International Investment and Finance Exhibition of China. Regulation: The broker is licensed by FSC. Jurisdiction - British and Virgin Islands ( SIBA/L/13/1063 ). Account Currency Options: FIBO Group allows traders to hold accounts in various currencies including EUR, USD, CHF, GBP, GLD, BTC, ETH. Low Minimum Deposit: The minimum deposit to start trading with FIBO Group is as low as $1. Leverage: FIBO Group offers leverage up to 1:1000. , allowing traders to maximize their potential profits. Competitive Spreads: FIBO Group offers competitive spreads, starting from 0-2.0 pips. Instruments: FIBO Group offers a variety of trading instruments including currencies, CFD, Spot Metals, Cryptocurrencies. Global Presence: FIBO Group has offices in major European countries, Central and East Asia. Annual Audit: FIBO Group undergoes an annual audit confirming the company’s compliance with the highest standards. Multiple Deposit and Withdrawal Options: FIBO Group offers a large selection of ways to replenish your account and withdraw funds. These advantages make FIBO Group a strong choice for both beginner and professional traders looking to navigate the Forex market.

What are the Cons of FIBO Group?

FIBO Group is a forex broker that has been operating since 1998 and offers a variety of trading instruments, platforms, and services. However, like any other broker, it also has some drawbacks that you should be aware of before opening an account with them. Here are some of the cons of FIBO Group:. High minimum deposit: FIBO Group requires a minimum deposit of $100 for its standard account and $500 for its ECN account. This can be a barrier for some traders who want to start with a low amount or who have limited funds available. Limited customer support: FIBO Group provides customer support via phone, email, and live chat. However, some users have reported that the response time is slow or that the support agents are not very helpful or knowledgeable. Moreover, FIBO Group does not have a dedicated phone number for its clients in some countries, such as the US and Canada. Restricted payment methods: FIBO Group accepts various payment methods, such as credit cards, bank transfers, e-wallets, and cryptocurrencies. However, some users have complained that the withdrawal process is complicated or that the fees are high. Additionally, FIBO Group does not accept some popular payment methods in some regions, such as Skrill and Neteller in Europe. Lack of regulation: FIBO Group is licensed by the Financial Services Commission (FSC) of the British Virgin Islands (SIBA/L/13/1063). This means that it is not regulated by any reputable authority in major financial centers, such as the UK or Australia. This can pose a risk for traders who want to trade with high leverage or who want to protect their funds in case of insolvency or fraud. Poor reputation: FIBO Group has received mixed reviews from its clients on various platforms. Some users praise its trading conditions, platforms, and services. , while others criticize its customer support, payment methods, and regulation. According to Trustpilot , FIBO Group has an average rating of 3.9 out of 10 based on 1.2K reviews. These are some of the cons of FIBO Group that you should consider before deciding to trade with them. Of course, you should also weigh the pros and cons according to your own preferences and goals. You can find more information about FIBO Group on their official website here^).

What are the FIBO Group Current Promos?

FIBO Group, a leading player in the Forex trading sector, is currently running a promotion that offers a 20% bonus on your first deposit. This promotion is valid from 16th August to 31st December 2023. The promotion is open to all clients of FIBO Group and applies to deposits made to their MT4 Fixed, MT4 NDD, or MT4 NDD No Commission accounts. This is a great opportunity for both new and existing traders to increase their trading capital and potentially enhance their trading performance. It’s important to note that terms and conditions apply to this promotion, and traders are advised to read these carefully before participating. As always, it’s crucial to understand that trading Forex involves risk, and it’s important to only trade with money that you can afford to lose. Stay tuned to FIBO Group’s website or social media channels for updates on this promotion and any future promotions they may offer. This is a great way to stay informed about opportunities to maximize your trading potential. Please note that the services of FIBO Group are not provided to residents of the United Kingdom, North Korea, and the USA. For a full list of countries where services are not provided, please refer to the documents for clients section on the FIBO Group’s website. Remember, trading in the Forex market can be a rewarding experience, but it’s important to trade responsibly. Good luck and happy trading!.

What are the FIBO Group Highlights?

FIBO Group is a global leader in the financial industry, offering a range of services and products that cater to the diverse needs of its clients. Here are some highlights:. Global Presence: FIBO Group has a strong presence in multiple markets, making it a truly global entity. Innovative Solutions: The company offers innovative solutions for wet room walls, providing a cost-efficient and eco-friendly alternative to other materials. Strong Financial Performance: FIBO Group has demonstrated strong financial performance, with significant growth in net sales and EBITDA. Efficiency Initiatives: The company has implemented long-term efficiency initiatives, which have resulted in margin expansion. Robust Growth: FIBO Group has experienced robust growth, particularly in international markets. Strong Financial Position: The company maintains a strong financial position, with a reported leverage ratio of 1.4 and a cash cover ratio of 11.6. High-Quality Products: FIBO Group is a leading supplier of high-quality, waterproof wall solutions. Please note that while FIBO Group is a global leader in its industry, it’s important to conduct your own research and consult with a financial advisor before making any investment decisions. This information is intended to provide a general overview of the company’s highlights and does not constitute financial advice.

Is FIBO Group Legit and Trustworthy?

FIBO Group, a well-established brokerage firm, has been in operation since 1998. It is regulated by multiple jurisdictions, including CySEC, FCA, FSA, FSC, and MiFID. The company’s headquarters are located in Cyprus. FIBO Group operates as a Market Maker/NDD. and offers a maximum leverage ratio of 1:1000. The minimum deposit amount is $50 USD. However, it’s important to note that FIBO Group does not provide services in Iraq, Australia, the United States, North Korea, Great Britain, Austria, and Belgium. The company has received positive reviews from its users. Users have praised the platform for its user-friendly interface, accurate quotes, and reliable customer support. Some users have also highlighted the wide range of trading instruments available. However, some users have reported slow customer support. Despite this, many users recommend FIBO Group as a reliable and trustworthy platform for trading forex and other financial instruments. In conclusion, FIBO Group appears to be a legitimate and trustworthy broker. However, potential users should conduct their own research and consider their individual trading needs before choosing a broker.

Is FIBO Group Regulated and who are the Regulators?

FIBO Group, a well-known name in the forex trading industry, operates under the regulatory oversight of several financial authorities. FIBO Markets Ltd., formerly known as FIBO Group Holdings Ltd., is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). The company holds a license with the number 118/10. As a member of the Investor Compensation Fund, FIBO Group provides an additional layer of financial security to its clients. The CySEC authorization allows FIBO Group to provide investment and ancillary services, or perform investment activities in relation to financial instruments. This includes the management of investment portfolios and asset management. In addition to CySEC, FIBO Group is also regulated by the UK’s Financial Conduct Authority (FCA) and the British Virgin Islands Financial Services Commission (BVI FSC). These top-tier regulators ensure that FIBO Group adheres to strict standards of operation, providing traders with a secure and transparent trading environment. In summary, FIBO Group operates under the strict regulations of multiple financial authorities, ensuring a high level of security and transparency for its clients. This makes it a reliable choice for forex traders worldwide.

Did FIBO Group win any Awards?

FIBO Group, an international financial and investment holding, is a significant player in online marginal trading services and products. With a history dating back to 1998, FIBO Group has consistently adhered to principles of transparent activities, protecting the interests of customers, and strict compliance with applicable laws and orders of national regulators. The company’s high level of service and transparency are widely recognized in the forex industry. This recognition is evident in the numerous awards and accolades FIBO Group has received over the years. These awards attest to the company’s expertise, know-how, and commitment to providing effective and profitable forex trading services. FIBO Group’s trading information for 2023 indicates that the company has successfully created an optimal combination of trading accounts and conditions to meet the needs of traders. The company offers low spreads starting from 0 pips for main instruments and 41 currency pairs. It also provides instant execution technology on MT4 NDD and cTrader NDD accounts. FIBO Group’s commitment to continuous improvement is reflected in its efforts to review the needs of each trader and enhance the services offered. Tools such as a currency calculator and daily market reviews are provided to help traders gather all the necessary market data for trading. In conclusion, FIBO Group’s long-standing presence in the forex market, coupled with its commitment to transparency and service excellence, has earned it numerous awards and recognition. This acknowledgment from the industry underscores FIBO Group’s position as a trusted and reliable forex broker.

How do I get in Contact with FIBO Group?

FIBO Group is a well-established player in the forex trading market, offering a platform that enables trading of more than 60 currency pairs. Here are the details on how to get in touch with them:. Head Office The head office of FIBO Group is located in Limassol, Cyprus. The address is 29 Agias Zonis, 1st Floor, 3027, Limassol, Cyprus. They operate from Monday to Friday, 09:00 AM – 06:00 PM Local Time. You can reach them at +357 25 030 930. or via email at service@fibomarkets.com. Branch Offices FIBO Group has several branch offices around the globe. Here are a few:. Munich, Germany: Theatinerstraße 11, 80333 München, Germany. You can contact them at 0800 183 0761. or service@fibogroup.de. Almaty, Kazakhstan: Office 1003, Floor 10, Block 4B, Business Centre “Nurly Tau”, Al-Farabi 17 Avenue, Almaty, Kazakhstan. You can contact them at +7 (727) 327-28-78. or kz@fibogroup.com. San José, Costa Rica: Multiplaza Boulevard KPMG BLDG, San Rafael de Escazú, San José, Costa Rica. You can contact them via email at service@fibogroup.com. Shanghai, China: Office № 3804-K, 38th Floor, No. 1601 Nanjing West Road, Jing’an District, Shanghai. You can contact them at 400-155-7215 13247370937. or china@fibogroup.com. Please note that the office hours for all locations are typically Monday to Friday, with weekends being non-working days. FIBO Group serves clients in over 100 countries worldwide, providing remote assistance through secure messaging, email, and phone. For more information, you can visit their website.

Where are the Headquarters from FIBO Group based?

FIBO Group is a global financial services company that offers trading platforms, investment products, and educational resources for forex traders. The company was founded in 1998 and has offices in several countries around the world. According to its website. , the headquarters of FIBO Group is located at: 29 Agias Zonis, 1st Floor, 3027, Limassol, Cyprus Head office of FIBO Markets Ltd. Office hours: Monday-Friday: 09:00 AM – 06:00 PM Local Time Non-working days: Saturday and Sunday Phone: +357 25 030 930 E-MAIL: service@fibomarkets.com FIBO Group serves clients in over 100 countries worldwide, providing remote assistance through secure messaging, email, and phone. The company offers various trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and FIBO Trader. It also provides investment products, such as currency pairs, commodities, indices, stocks, cryptocurrencies, and futures. Additionally, FIBO Group offers educational resources for forex traders of all levels, such as webinars, articles, videos, ebooks, and courses. FIBO Group is regulated by several authorities in different jurisdictions. Some of the regulators include the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA) of Saint Vincent and the Grenadines (SVGFSA), the Financial Sector Conduct Authority (FSCA) of South Africa (FSCA), and the Financial Services Commission (FSC) of Mauritius (FSC). FIBO Group also holds licenses from reputable organizations such as the International Organization for Standardization (ISO), the International Electrotechnical Commission (IEC), and the International Organization for Standardizationization (ISO). FIBO Group is one of the leading forex brokers in the industry. It has a reputation for providing reliable services to its clients. It also has a loyal customer base that includes many professional traders from different backgrounds. FIBO Group aims to provide its clients with a competitive edge in the forex market by offering them access to advanced trading tools and strategies. : [Find the office nearest to your location Fibo Group].

What kind of Customer Support is offered by FIBO Group?

FIBO Group, a leading financial company with over 25 years of experience in the market, offers a range of customer support services to its clients. These services are designed to assist clients in navigating the complexities of forex trading and to ensure a smooth and efficient trading experience. The company’s customer support services are characterized by their accessibility and responsiveness. FIBO Group serves clients in over 100 countries worldwide, providing remote assistance through secure messaging, email, and phone. This global operation ensures that clients can access support services regardless of their location. One of the key aspects of FIBO Group’s customer support is its qualified customer support. The company’s support team is trained to handle a wide range of issues and inquiries related to forex trading. This includes technical issues related to the trading platform, questions about trading conditions, and guidance on making deposits and withdrawals. Another notable feature of FIBO Group’s customer support is its negative balance protection. This feature is designed to protect clients from losing more money than they have deposited into their trading account. This is particularly important in the volatile world of forex trading, where rapid market movements can result in significant losses. In addition to these services, FIBO Group also offers a range of trading platforms to its clients. These platforms, which include MetaTrader 4, are user-friendly and offer a range of features to assist clients in their trading activities. These features include low spreads, fast and flexible deposit and withdrawal options, and the ability to trade more than 60 currency pairs with low spreads and up to 200x financial leverage. Overall, FIBO Group’s customer support services are designed to provide clients with the resources and assistance they need to succeed in forex trading. The company’s commitment to customer service is reflected in its positive customer reviews, with one client noting their "user-friendly platform, tight spreads, and reliable customer support".

Which Educational and Learning Materials are offered by FIBO Group?

FIBO Group offers a comprehensive suite of educational and learning materials for those interested in Forex trading. These resources are designed to help both beginners and experienced traders navigate the complex world of foreign exchange. The educational materials provided by FIBO Group cover a wide range of topics, including the basics of Forex trading, understanding key concepts like currency pairs, exchange rates, pips spreads, and market participants. This foundational knowledge is crucial for anyone looking to get started in Forex trading. One of the standout offerings from FIBO Group is their ‘Forex for Beginners’ course. This course provides a thorough introduction to the foreign exchange markets, helping newcomers understand how Forex functions as a system of interbank settlements. It explains how banks, companies engaged in international trade, and anyone needing to exchange one currency for another can participate in this market. Furthermore, FIBO Group provides practical training on Forex trading. They offer tutorials on working with the MetaTrader4 (MT4) trading platform. This platform is widely used in the Forex trading community, and understanding how to use it effectively is a key skill for any trader. In addition to these educational resources, FIBO Group also provides a free demo account. This allows traders to practice their skills and strategies in a risk-free environment before they start trading with real money. This is a valuable resource for beginners who are still learning the ropes, as well as for more experienced traders looking to test new strategies. Finally, FIBO Group’s educational materials also cover more advanced topics, such as understanding spreads and pip in Forex, the difference between long and short positions, and the biggest fundamental analysis indicators. These topics are essential for anyone looking to take their Forex trading skills to the next level. In conclusion, FIBO Group offers a comprehensive suite of educational and learning materials that cater to both beginners and experienced Forex traders. These resources provide the knowledge and skills needed to navigate the complex world of Forex trading successfully.

Can anyone join FIBO Group?

FIBO Group is a well-established player in the forex trading market, offering a variety of services to its clients. Eligibility for FIBO Group Membership. Anyone interested in forex trading can join FIBO Group, provided they meet the minimum deposit requirement of 50 USD. The company offers trading accounts with low fixed spreads for trading on more than 32 currency pairs. Trading Platforms and Strategies. FIBO Group provides various trading platforms, including popular ones such as MetaTrader 4, MetaTrader 5, and cTrader. They do not impose restrictions on trading strategies, allowing clients to trade both manually or with the help of an expert advisor (EA). Managed Account (PAMM) Service. For beginners without any experience in trading, FIBO Group offers a Managed account (PAMM) service. This service allows beginners to earn profit on FOREX and CFD markets by becoming an investor and using the expertise accumulated by professional traders. FIBO Group supervises all deposit and withdrawal operations, profit distribution, and guarantees the timeliness of all transactions. Regulation and Compliance. FIBO Group, Ltd. is regulated by the Financial Services Commission (FSC) BVI, with license registration number: SIBA/L/13/1063. This ensures that the company adheres to the necessary regulatory standards, providing a secure and reliable trading environment for its clients. In conclusion, FIBO Group provides a comprehensive suite of forex trading services, making it a viable option for both experienced traders and beginners. However, potential clients should conduct their own due diligence and consider their financial situation and investment objectives before joining.

Who should sign up with FIBO Group?

Who should sign up with FIBO Group?. FIBO Group is a leading online broker that offers forex and CFD trading with low spreads, high leverage and transparent conditions. It has over 25 years of experience in the market and operates globally with offices in Europe, Central and East Asia. FIBO Group is suitable for traders who are looking for:. A wide range of instruments to trade. FIBO Group offers more than 60 currency pairs, metals, indices, commodities, stocks and shares CFDs. You can choose from various trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader and Web Terminal. You can also access advanced tools and features, such as indicators, experts advisors, charts, news and events calendar. A competitive edge in the market. FIBO Group provides its clients with low spreads starting from 0 pips on some currency pairs. It also offers swaps competitive rates on some instruments. Moreover, it has a fast and flexible deposit and withdrawal system that allows you to fund your account in various ways, such as bank transfer, credit/debit card, Skrill, Neteller and more. A high level of security and regulation. FIBO Group is regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines under license number 20623 IBC 2012. It also complies with the European Securities and Markets Authority (ESMA) rules on investor protection. Furthermore, it uses SSL encryption technology to protect your personal and financial data from unauthorized access. A dedicated customer support team. FIBO Group has a qualified customer support team that is available 24/7 via phone, email or live chat. You can also find useful information and guidance on its website’s FAQ section or blog. Additionally, you can benefit from its educational resources, such as webinars, articles and videos that cover various topics related to forex trading. . If you are interested in signing up with FIBO Group, you can open a demo account or a live account online by filling out a simple form. You will need to provide some basic information about yourself and your trading preferences. You will also need to verify your identity by uploading some documents. Once your account is approved, you can start trading with real money on the forex market. FIBO Group is one of the best forex brokers for beginners as well as experienced traders. It offers excellent trading conditions that suit different styles and strategies. It also provides reliable customer service that ensures your satisfaction. Therefore, if you are looking for a reputable online broker that can help you achieve your trading goals, you should consider signing up with FIBO Group.

Who should NOT sign up with FIBO Group?

While FIBO Group has received positive reviews for its user-friendly platform, tight spreads, and reliable customer support. , it may not be the ideal choice for everyone. Here are some categories of individuals who might want to reconsider signing up with FIBO Group:. Individuals Seeking Immediate Customer Support: Some users have reported slow customer support. Therefore, individuals who require immediate assistance or those who value highly responsive customer service might find this aspect of FIBO Group less appealing. Mobile-First Traders: As of the latest reviews, FIBO Group does not have a dedicated mobile application. This could be a deterrent for traders who prefer to manage their investments on-the-go or those who rely heavily on mobile platforms for their trading activities. Traders Looking for Certain Investment Products: While FIBO Group offers a range of trading instruments, it may not cater to all types of investment products. Traders looking for specific investment products not offered by FIBO Group might need to look elsewhere. . In conclusion, while FIBO Group has many strengths, it may not be the perfect fit for everyone. Potential users should consider their individual needs, trading habits, and preferences before deciding to sign up with this platform.

Does FIBO Group offer Discounts, Coupons, or Promo Codes?

FIBO Group, a renowned name in the Forex trading industry, does offer various promotions and bonuses to its clients. One of the notable promotions is a 20% bonus on the first deposit. This promotion is valid from 16 August to 31 December 2023. Clients can avail this bonus when making a deposit to their MT4 Fixed, MT4 NDD, or MT4 NDD No Commission accounts. In addition to this, there are other platforms offering discounts and promo codes for FIBO Group. For instance, Code-fibo offers a 50% discount. They have a total of 4 active coupons available on their website, and the best coupon can save you 50% off your purchase. They are offering 3 amazing coupon codes right now, and with 1 additional deal, you can save big on all of your favorite products. Please note that these promotions and discounts are subject to change and it’s always a good idea to check the official FIBO Group website or other reliable sources for the latest information. It’s also important to read the terms and conditions of these promotions to understand the eligibility criteria and other details. In conclusion, FIBO Group does offer various discounts, coupons, and promo codes, making it an attractive choice for Forex traders looking for value-added services. These promotions not only provide financial benefits but also enhance the overall trading experience.

Which Account Types are offered by FIBO Group?

FIBO Group offers a wide range of trading account types, each designed to cater to a variety of strategies and trading styles. Here are the details:. MT4 Cent Account: This account type is ideal for those who are new to Forex trading and do not wish to invest a large amount of funds. All calculations are done in cents, which allows for a reduction in the scope of deals. MT4 Fixed Account: This account type offers fixed spreads, providing a predictable trading environment. MT4 NDD Account: The No Dealing Desk (NDD) account provides traders with direct access to the interbank market, offering more transparency. MT4 NDD No Commission Account: This account type offers all the benefits of an NDD account but without any commission fees. cTrader NDD Account: This account type is designed for use with the cTrader platform, offering direct market access with no dealing desk intervention. cTrader Zero Spread Account: This account type offers zero spreads on the cTrader platform, providing a cost-effective trading solution. MT5 NDD Account: This account type is designed for use with the MetaTrader 5 platform, offering direct market access with no dealing desk intervention. Each account type has its own set of conditions for commission, margin call, leverage, and minimum deposits. FIBO Group considers the needs of every trader, simplifies account management, and brings your trades to the market as quickly as possible.

How to Open a FIBO Group DEMO account?

Opening a FIBO Group DEMO account involves a few steps. Here’s a detailed guide:. Step 1: Sign Up First, you need to create your Client Area. To do this, indicate your email address and phone number in the sign-up form on the site. An email will be sent to the address you specified with your username and password to access your Client Area. Step 2: Verification Next, you need to verify your account and confirm your identity. This includes confirmation of your email, phone number, and identity. To verify your email, click the link in the message sent to your email address. To confirm your phone, enter the SMS code sent to you in your Client Area. To confirm your identity, fill out a form and upload copies of documents. Step 3: Open Demo Account Log in to the Fibo Group Client Area. Select the “Demo-accounts” menu on the left, and click "Open Demo Account". Select the account type, currency, capital, and leverage, click “Yes” on experience in a real account, and click "Open". You will then receive the demo account login details. Step 4: Deposit Funds Depositing funds to your account is the last step before starting trading. Go to the “Deposit funds” section. To deposit via bank transfer or bank card, follow the instructions provided. Remember, you can use all the features of forex trading, invest, withdraw your profits, or become a partner only after you have fully verified your account. Happy trading!.

How Are You Protected as a Client at FIBO Group?

As a client at FIBO Group, you are protected in several ways:. Regulatory Compliance: FIBO Group is regulated by the Financial Conduct Authority. This ensures that the company adheres to strict standards and regulations designed to protect clients. Investor Compensation Fund: FIBO Group is a member of the Investor Compensation Fund. This means that clients can receive up to €20,000 in compensation per client. Segregation of Funds: FIBO Group practices fund segregation. This means that client funds are kept separate from the company’s own funds, providing an additional layer of security. Data Protection: FIBO Group is committed to protecting the personal data of its clients. The company is eligible to disclose the personal data of the Clients to the federal or state regulating and law enforcement authorities under which jurisdiction FIBO Group is located, as a response to appropriate legal requests to provide such information, as well as to disclose such information where requested by the Court Order. High-Quality Trading Platforms: FIBO Group offers high-quality trading platforms. These platforms are designed to provide a secure and efficient trading environment. Multiple Account Types: FIBO Group offers multiple account types. This allows clients to choose the account type that best suits their trading needs and risk tolerance. Long-term Market Experience: FIBO Group’s extensive market experience gives its clients the confidence and assurance that their investments are in the right hands. The company has also built a reputation for itself as a trustworthy and reliable broker, thanks to its transparent and fair trading practices. In conclusion, FIBO Group provides a secure and regulated environment for forex trading, with multiple measures in place to protect its clients. These include regulatory compliance, membership in the Investor Compensation Fund, fund segregation, data protection, high-quality trading platforms, multiple account types, and long-term market experience.

Which Funding methods or Deposit Options are available at FIBO Group?

FIBO Group, a renowned Forex broker, offers a variety of funding methods and deposit options for the convenience of its clients. Here are the details:. Bank Transfers. Currencies: EUR, USD. Commission: Depends on sending bank’s conditions. Deposit Time: Transfers are normally processed within 2-5 days. Transfer Time: Up to 3 business days. Credit Card. Currencies: USD, EUR. Deposit Commission: 0%. Withdrawal Commission: 2.5% + 1.5 EUR. Deposit Time: Once the payment cleared. Transfer Time: Within several minutes, up to 2–3 days. Payment Systems and Online Payments. Currencies: USD, EUR. Deposit Commission: 4.9%. Withdrawal Commission: Varies, ranges from 0.8% to 3.9%. Deposit Time: Once the payment cleared or inside office hours. Transfer Time: Within several minutes after the withdrawal application is completed. Cryptocurrency. Currencies: BTC, ETH, BCH, XRP. Deposit Commission: 0%. Withdrawal Commission: Bitcoin/Ethereum network commission. Deposit Time: Inside office hours, once the transaction is confirmed by the Bitcoin network. Transfer Time: Within 2 business days, excluding the day the application was submitted. In addition to these, FIBO Group also supports other deposit methods such as SWIFT, Connectum, RegularPay, Neteller, Skrill, WebMoney, and CashU. Please note that the conditions for these methods may vary. For the most accurate and up-to-date information, it’s recommended to check the official FIBO Group website or contact their customer service.

What is the Minimum Deposit Amount at FIBO Group?

FIBO Group, a renowned player in the Forex market, offers various account types to cater to the diverse needs of traders. The minimum deposit amount varies depending on the type of account. For the MT4 NDD No Commission account, the minimum deposit amount is 100 EUR. On the other hand, for the MT4 NDD account, the minimum deposit requirement is 300 USD. It’s important to note that having a larger trading capital provides more flexibility and better risk management capabilities. In addition to these, FIBO Group also offers trading accounts with low fixed (MT4 Fixed) spreads for trading on more than 32 currency pairs. For CFD trading, which includes commodities and indices, the minimum deposit is 50 USD. However, as of March 15th, FIBO Group has announced that the minimum deposit amount shall be 50 US dollars or equivalent in other currency. This change aims to make trading operations more accessible. Please note that while FIBO Group does charge some deposit fees, which consist of bank transfers between 35-50 USD, most other deposit methods are free. Withdrawal fees start from 0.5%. In conclusion, the minimum deposit amount at FIBO Group depends on the type of account and the method of deposit. It’s always recommended to check the latest information on the official FIBO Group website or contact their customer service for the most accurate details. Remember, investing in Forex involves risks and it’s important to trade responsibly. Happy trading!.

Which Withdrawal methods are available at FIBO Group?

FIBO Group, a renowned Forex broker, offers a variety of withdrawal methods to cater to the diverse needs of its clients. Here are the details:. Bank Transfers. Currency: EUR, USD. Commission: Depends on sending bank’s conditions. Deposit time: Transfers are normally processed within 2-5 days. Transfer time: Up to 3 business days. Applications processing: 3-5 business days. Credit Card. Currency: USD, EUR. Commission: 2.5%+1.5 EUR. Applications processing: Within 2 business days, excluding the day the application was submitted. Transfer time: Within several minutes, up to 2–3 days. Payment Systems and Online Payments. Currency: USD, EUR. Commission: 2%, but not less than 1 USD/EUR. Applications processing: Within 2 days, excluding the date the request is submitted. Transfer time: Within 2 business days, excluding the day the application was submitted. Cryptocurrency. Currency: BTC, ETH, BCH, XRP. Commission: Bitcoin network commission. Applications processing: Within 2 business days, excluding the day the application was submitted. Transfer time: Once the payment cleared. Please note that according to Regulations on non-trading (Financial) transactions, it is assumed that the Client shall withdraw funds from its trading account in the same currency and by the same method the trading account of this Client was credited. In addition to these, FIBO Group also supports withdrawal methods such as Bank Wire (BankTransfer/SWIFT), Bitcoin, Connectum, DixiPay, Neteller, Qiwi, RegularPay, Skrill, and WebMoney. The exact details of these methods can be found in the Client Area of FIBO Group’s website.

Which Fees are charged by FIBO Group?

FIBO Group, an international financial holding company operating since 1998, charges various types of fees. Here’s a detailed breakdown:. 1. Spreads: FIBO Group provides both fixed and floating spreads. The spreads start from 0.3 pips for EUR/USD. The spreads can be broken down as follows. MT4 Cent Account: Spreads from 0.6 pips. MT4 Fixed Account: Spreads from 2 pips. MT4 NDD Account: Spreads from 0.0 pips and commissions of 0.003% from the amount of the transaction. MT4 NDD Commission-free Account: Spreads from 0.8 pips. cTrader Account: Spreads from 0.0 pips and commissions of 0.003% from the amount of the transaction. MT5 NDD Account: Spreads from 0.0 pips commissions of 0.003% from the amount of the transaction. 2. Deposit Fees: FIBO Group charges deposit fees. These consist of bank transfers between $35-50, though most other deposit methods are free. 3. Withdrawal Fees: Withdrawal fees start from 0.5%. FIBO Group charges withdrawal fees depending on the payment method used. Both deposit and withdrawal fees are charged at the same amount for the same payment methods. For instance, Skrill has a 3.9% commission, and CashU has a 7% commission. Please note that all the information is subject to change and it’s always a good idea to check the latest on the official FIBO Group website. Your capital is at risk when investing in Forex.

What can I trade with FIBO Group?

FIBO Group, an international financial holding company operating since 1998. , offers a wide range of trading opportunities in the Forex market. Here are the key offerings:. Forex Trading FIBO Group provides trading on the Forex market with optimal trading conditions that best meet the needs of traders. They offer low spreads starting from 0 pips for main instruments and 41 currency pairs. Trading Platforms FIBO Group offers multiple trading platforms including MetaTrader4, MetaTrader5, cTrader, and WebTerminal MT4. These platforms support Instant Execution technology (on MT4 NDD and cTrader NDD accounts Market Execution technology is applied). Trading Conditions The minimum lot is 1,000 units of base currency (0.01 of a standard lot) and the minimum deposit is 0 USD or equivalent amount in another currency. The leverage ranges from a minimum of 1:1 to a maximum of 1:1000 (minimum margin is 0.1% of the trade volume). Financial Instruments FIBO Group offers a complete set of financial instruments for trading comprising 41 Forex currency pairs. The main major currency pairs include EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, USD/CAD, and NZD/USD. Account Currency FIBO Group allows account currency in EUR, USD, CHF, GBP, GLD, BTC, ETH. Deposit and Withdrawal FIBO Group provides quick deposit and withdrawal of funds through bank transfers in Euro and US Dollars, and credit card electronic payments. Security FIBO Group ensures transfer and trading security. Awards FIBO Group has won “Best ECN Broker” at the Forex EXPO in 2014 and “The Most Trusted Forex Broker 2014” according to the International Investment and Finance Exhibition of China. In conclusion, FIBO Group provides a comprehensive platform for Forex trading with a wide range of financial instruments, flexible trading conditions, and robust security measures. Whether you’re a novice or an experienced trader, FIBO Group offers opportunities to grow and diversify your portfolio.

Which Trading Platforms are offered by FIBO Group?

FIBO Group offers a variety of trading platforms, each with its unique features and tools, catering to the diverse needs of forex traders. Here are the details:. MetaTrader 4: This platform has all the necessary trading tools, including a wide range of instruments and indicators for technical analysis, news feed, online quotes, and charts. It allows traders to manage multiple windows with their own indicators and studies. Traders can work with a few types of charts – lines, Japanese candles, and bars. It also offers automated trading opportunities and more than 50 built-in technical indicators. cTrader: The cTrader platform provides access to forex markets using the NDD (No Dealing Desk) technology. It allows users to trade with international banks directly, avoiding any intermediaries. The average speed of order execution is less than one millisecond, which grants users the opportunity to make transactions at the exact moment with minimum slippage. This becomes possible due to the cloud technology and placing servers on one platform with the majority of quotes aggregators and liquidity providers. MetaTrader 5: MetaTrader 5 has a new trading system, a distributed architecture, high productivity, and flexibility. The platform fully corresponds with the latest international practices of online trading via the NDD (No Dealing Desk) technology. Characteristic features of the NDD technology from FIBO Group Ltd are modern technologies of order processing, tight spreads, and attractive swaps. Liquidity is provided by the Company’s partner Sucden Financial. In addition, the number of digits after the decimal point has increased from 4 to 5. Each of these platforms is designed to provide traders with a seamless and efficient trading experience, whether they are professional traders or newbies.

Which Trading Instruments are offered by FIBO Group?

FIBO Group offers a wide range of trading instruments that cater to both novice and experienced traders. These instruments are designed to provide a platform for traders to grow and diversify their portfolio. Forex: FIBO Group offers trading accounts with low fixed spreads for trading on more than 32 currency pairs. They use NDD order execution technology accounts: MT4 NDD and cTrader NDD. They also offer various trading platforms for PC, MAC, Android, and iOS smartphones. Managed Accounts (PAMM): This service allows beginners without any experience on trading to earn profit on FOREX and CFD markets by becoming an investor and using the expertise accumulated by professional traders. FIBO Group supervises all deposit and withdrawal operations, profit distribution, and guarantees the timeliness of all transactions. CFD: FIBO Group offers most liquid assets for CFD trading: commodities and indices. They offer minimum deposit of 50USD, no commissions, no requotes, reasonable margin requirements, low spreads, micro-lots, and Meta Trader terminal. Trading Platforms: FIBO Group offers various trading softwares, including popular platforms such as MetaTrader 4, MetaTrader 5, and cTrader. They have no restrictions on trading strategies therefore you may trade both “manually” or with the help of an expert advisor (EA). In conclusion, FIBO Group provides a comprehensive suite of trading instruments that include forex, commodities, indices, and CFDs, among others. These instruments are designed to cater to a wide range of trading strategies and investment goals.

Which Trading Servers are offered by FIBO Group?

FIBO Group, a leading player in the online forex trading market since 1998. , offers a variety of trading platforms to cater to the diverse needs of traders worldwide. MetaTrader 4 is one of the most popular trading platforms offered by FIBO Group. It provides a wide range of instruments and indicators for technical analysis, an online news feed, real-time quotes, and charts. Traders can manage multiple windows with their own indicators and studies, and work with different types of charts such as lines, Japanese candles, and bars. The platform also supports automated trading and allows traders to create their own indicators with the built-in MQL4 editor. MetaTrader 5 is another platform offered by FIBO Group. It features a new trading system, a distributed architecture, high productivity, and flexibility. The platform fully corresponds with the latest international practices of online trading via the NDD (No Dealing Desk) technology. It offers trading on Forex, Spot metals, and four types of order execution. FIBO Group also offers cTrader, a platform that provides access to forex markets using the NDD (No Dealing Desk) technology. It allows users to trade with international banks directly, avoiding any intermediaries. The average speed of order execution is less than one millisecond, which grants users the opportunity to make transactions at the exact moment with minimum slippage. In terms of server location and latency, the majority of brokers, including FIBO Group, have their servers located in key locations such as New York, London, and Amsterdam. The latency to FIBO Group’s servers from these locations are as follows: Amsterdam: 0.61 ms, Frankfurt: 1.22 ms, London: 5.67 ms, New York: 81.08 ms.

Can I trade Crypto with FIBO Group? Which crypto currencies are supported by FIBO Group?

Yes, you can trade cryptocurrencies with FIBO Group. They provide an opportunity to invest and trade in some of the market’s most popular cryptocurrencies. Here are the cryptocurrencies supported by FIBO Group:. Bitcoin (BTC): Bitcoin is the leading decentralized digital currency. Ethereum (ETH): Ethereum is an open platform based on blockchain with the use of smart contracts. Ethereum Classic (ETC). Litecoin (LTC): Litecoin is much like bitcoin, characterized by a higher speed of creation and bigger amount. Zcash (ZEC): Zcash is a decentralized cryptocurrency that provides a high level of confidentiality. Dash (DASH): Dash is a new version of bitcoin, works faster and better protects user sensitive data. Monero (XMR): Monero appeared in 2014, its main features are confidentiality, decentralization, and scalability. FIBO Group offers several advantages for trading cryptocurrencies:. Income on the fluctuation of the cryptocurrency price. MT4 trading platform. Market Execution. Tight spreads with no commission. Leverage of 1:25. Customer support in 15 languages. CFD on 9 cryptocurrencies. Deposit your account in BTC, BCH via BITPAY with no commission. Convert cryptocurrency into $ and another currency at a competitive internal rate. FxWirePro free news feed. Please note that trading in cryptocurrencies involves risk, just like any other investment option. It’s always recommended to do thorough research and consider your financial situation before investing. In the context of forex, trading cryptocurrencies with FIBO Group is similar to trading other currencies. You can trade based on the price fluctuations of the cryptocurrency, similar to how you would trade based on the fluctuations of foreign currencies in the forex market. However, it’s important to note that cryptocurrencies can be much more volatile than traditional fiat currencies. This can result in both higher potential returns and higher potential risks. It’s also worth noting that FIBO Group offers a demo account. This can be a great way to practice your trading strategies without risking real money. I hope this information helps! If you have any other questions, feel free to ask.

What is the Leverage on my FIBO Group Trading Account?

Leverage is a key feature of your FIBO Group Trading Account. It’s a financial instrument that allows you to participate in transactions that are many times higher than your capital, investing only a small percentage of your own funds. Definition of Leverage Leverage is borrowed funds allocated by a broker for trading. It forms the basis of margin trading, which is extremely popular in the Forex market. With leverage, a trader can use funds significantly exceeding his net worth. This can increase the trader’s income, but there is also a risk of loss of both part or all funds. How Leverage Works The leverage is prescribed in the contract with the broker and depends on many factors, including the platform used, the specific asset, and the broker itself. For example, a 1:10 leverage works like this: a broker gives you funds that are 10 times bigger than your own. Thanks to this, you can open transactions with capital that is 10 times larger. The profit from such a transaction with leverage may exceed the profit of the transaction without leverage by 10 times. Features of Trading with Leverage Margin trading is characterized by several key features, reflecting both its pros and cons. Minimum invested capital: When trading, you don’t pay the full cost at the conclusion of transactions, but only part of it. Accessibility of tools: Access to the most popular assets costs money. With leverage, you can play on the difference in rates without entering the market for these assets. Education responsibility: Leverage allows you to trade with minimal capital, but as you know: the more profit — the greater the risk. Leverage trading raises interest rates without the risk of losing significant amounts of equity, and thereby educates the trader, helps to better assess the danger and the chances of getting better income. Leverage on FIBO Group Trading Account FIBO Group offers a maximum leverage ratio of 1:1000 with a minimum deposit amount of $50 USD. The leverage on MT4 NDD account is 1:400. It’s important to note that with increasing profits, costs also increase. For example, with a leverage of 1:10 and a deposit of 1000 USD, the costs will be 100 USD. Getting the most convenient leverage is an important aspect for a successful trading session and maximizing profit. Please remember, excellent trading comes with experience, so it’s recommended to experiment with different levels of leverage in order to choose the most convenient and efficient trading strategy.

What kind of Spreads are offered by FIBO Group?

FIBO Group, an international financial holding company operating since 1998, offers a wide range of services for trading and investing. The company has been recognized for its high-quality services, winning awards such as “Best ECN Broker” at the Forex EXPO in 2014 and “The Most Trusted Forex Broker 2014” according to the International Investment and Finance Exhibition of China. FIBO Group provides both fixed and floating spreads. The spreads, fees, minimum deposit, and other trading conditions strongly depend on the type of trading account. Here are the details of the spreads offered by FIBO Group for different account types. MT4 Cent Account: Spreads start from 0.6 pips. MT4 Fixed Account: Spreads start from 2 pips. MT4 NDD Account: Spreads start from 0.0 pips and commissions of 0.003% from the amount of the transaction. MT4 NDD Commission-free Account: Spreads start from 0.8 pips. cTrader Account: Spreads start from 0.0 pips and commissions of 0.003% from the amount of the transaction. MT5 NDD Account: Spreads start from 0.0 pips and commissions of 0.003% from the amount of the transaction. It’s important to note that the lower the fees and the tighter the spread, the more profitable it is to trade with the broker. This is crucial for both beginners and experienced traders, as the fees can significantly impact your profit. Please note that the spreads are dynamic and are for informational purposes only.

Does FIBO Group offer MAM Accounts or PAMM Accounts?

FIBO Group, a well-known player in the Forex market, offers a variety of trading account types to cater to different strategies and trading styles. Among these offerings, FIBO Group provides Managed Accounts, also known as PAMM accounts. A PAMM account is a type of trading account that allows the manager to use their own capital along with the total capital of investors for management in order to make a profit. This type of account is intended for investors who wish to invest alongside an experienced trader. The process is straightforward: a trader signs up as a PAMM manager and opens one or multiple PAMM accounts. An investor then signs up with FIBO Group, selects one or multiple accounts for investment, and transfers their funds to them. FIBO Group’s PAMM service is not limited to traditional assets. They have also launched a PAMM service for cryptocurrencies, allowing money managers to open a PAMM crypto account and trade CFDs on a suite of cryptocurrencies. However, it’s important to note that while PAMM accounts offer potential benefits, they also carry risks. The performance of a PAMM account depends on the skill and experience of the manager. Therefore, potential investors should carefully review the rating and performance of managed accounts before making an investment decision. As for MAM accounts, there is no explicit mention of them in the search results. It’s recommended to directly contact FIBO Group for the most accurate and up-to-date information regarding their offerings. Please note that investing in Forex and other financial markets involves risk, and it’s important to understand these risks before opening an account. Always consider seeking advice from a financial advisor if you’re unsure.

Does FIBO Group allow Expert Advisors?

FIBO Group, a renowned player in the Forex market, does indeed permit the use of Expert Advisors (EAs) for trading. This is a significant feature as EAs, also known as Forex robots, are vital tools for traders who wish to automate their trading strategies. Expert Advisors and FIBO Group. FIBO Group’s policy explicitly states that clients may trade with any Forex Expert Advisor of their choice. This flexibility allows traders to leverage the power of automated trading systems, which can execute trades based on predefined criteria without the need for manual intervention. Benefits of Using Expert Advisors. The use of Expert Advisors offers several benefits. These include the ability to execute trades 24/7, eliminate emotional trading decisions, backtest strategies, and react instantly to market movements. By allowing EAs, FIBO Group provides its clients with the opportunity to take full advantage of these benefits. FIBO Group’s Trading Platforms. FIBO Group offers the MetaTrader 4 (MT4) platform, which is known for its compatibility with EAs. On MT4 Fixed accounts, FIBO Group acts as a market maker, providing quotes with fixed spreads starting from 2 pips. Traders that prefer expert advisors may find it useful as long as the fixed spreads allow them to test a strategy and apply it to automated trade. In conclusion, FIBO Group’s allowance of Expert Advisors enables traders to automate their Forex trading, potentially enhancing their trading efficiency and effectiveness. This feature, combined with the firm’s robust trading platforms, makes FIBO Group a compelling choice for traders looking to leverage automated trading systems.