Forexcom Review 2026

What is Forexcom?

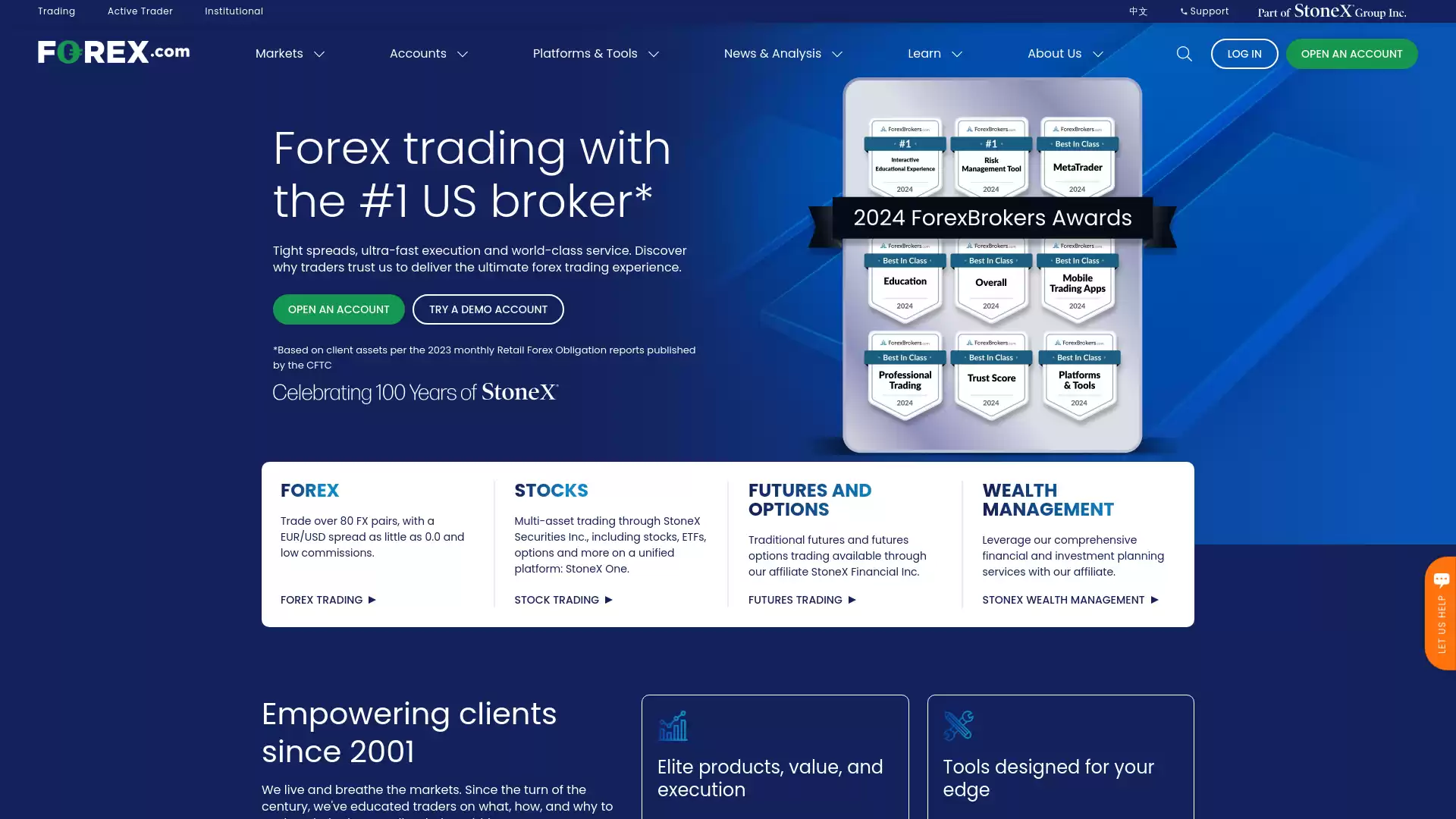

Forex.com is a leading online platform for forex trading. It is recognized as the No. 1 Forex Broker in the US. and is a trusted trading partner for over 1,000,000 traders worldwide. Forex.com offers trading in over 80 FX pairs. , with a EUR/USD spread as little as 0.0 and low commissions. The platform provides ultra-fast execution and world-class service. , making it a preferred choice for many traders. In addition to forex trading, Forex.com also offers multi-asset trading through SA Stone Wealth Management Inc., including stocks, ETFs, options and more on a unified platform: StoneX One. Traditional futures and futures options trading are available through their affiliate StoneX Financial Inc. Forex.com is not just about trading. It also offers comprehensive financial and investment planning services with their affiliate, StoneX Wealth Management. Since its inception in 2001, Forex.com has been dedicated to educating traders on what, how, and why to trade to help them realize their ambitions. Forex.com provides traders with exclusive data tools like Performance Analytics and SMART Signals. Traders can automate their trading strategies with ease via Capitalise.ai. The platform also offers industry-leading TradingView charts. , allowing traders to take full command of their analysis. Forex.com is a wholly-owned subsidiary of StoneX Group, a Fortune 100 financial giant with revenues exceeding $54 billion. As America’s number 1 broker. , Forex.com is regulated, financially stable and has been providing clients with trading services since 2001. Forex.com holds itself to the highest standards of corporate governance, financial reporting and disclosure. It is a publicly traded company under StoneX Group Inc. (NASDAQ: SNEX). Forex.com also offers a next-gen pricing model. Traders can take control of their trading needs with super-tight spreads as low as 0.0 for major pairs with a $7 USD commission per $100k USD traded. The platform also has an Active Trader program that pays monthly cash rebates on more products than ever. Forex.com’s app and platforms are designed to give traders every possible edge. They are intuitive and packed with tools and features, allowing traders to trade on the go with one-swipe trading, TradingView charts and exclusive tools like Performance Analytics and SMART Signals. In summary, Forex.com is a comprehensive trading platform that offers a wide range of trading options, advanced tools, and dedicated support. It is a trusted global leader in the forex trading industry.

What is the Review Rating of Forexcom?

- 55brokers: 55brokers rated Forexcom with a score of 92. This rating was last checked at 2024-01-06 10:27:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Forexcom with a score of 78. This rating was last checked at 2024-01-06 17:57:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Forexbrokers: Forexbrokers rated Forexcom with a score of 100. This rating was last checked at 2024-01-06 09:37:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Forexcom with a score of 92. This rating was last checked at 2024-01-05 22:42:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Forexcom with a score of 84. This rating was last checked at 2024-01-06 07:21:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Forexcom?

Forex.com is a well-regulated global forex and CFD broker, offering a range of benefits for traders. Here are some of the key advantages:. Regulation: Forex.com is regulated by multiple top-tier financial authorities, including the CFTC in the US, FCA in the UK, and ASIC in Australia. This provides a high level of trust and security for traders. Low Forex Fees: Forex.com offers competitive forex fees, making it an attractive choice for traders who deal with large volumes of currency. Variety of Currency Pairs: Forex.com provides a great variety of currency pairs for trading. This allows traders to diversify their portfolio and take advantage of different market conditions. Technical Research Tools: Forex.com offers diverse technical research tools. These tools can help traders analyze market trends and make informed trading decisions. Investor Protection: Forex.com offers investor protection of £85k to UK clients, and CAD 1 million to Canadian clients. This provides an additional layer of security for traders. Clean Track Record: Forex.com has a clean track record with no major regulatory incidents or fines. This further enhances its reputation as a reliable and trustworthy broker. Account Opening: Forex.com has a relatively low minimum deposit requirement of $100. , making it accessible for traders with different investment capacities. Demo Account: Forex.com provides a demo account. , allowing new traders to practice and get a feel for the platform before investing real money. However, it’s worth noting that Forex.com does have some limitations. For instance, it lacks some popular asset classes, such as real stocks or bonds. The desktop trading platform is also reported to be not very user-friendly. Despite these drawbacks, Forex.com remains a solid choice for both novice and experienced forex traders.

What are the Cons of Forexcom?

Forex.com is a popular forex trading platform that offers a range of tools and resources to help traders make informed trading decisions. However, like any other platform, it has its own set of pros and cons. Here are some of the cons of Forex.com:. 1. High Costs: While Forex.com offers competitive spreads, it is important to note that forex trading involves various costs, including spreads, commissions, and overnight financing charges. These costs can add up over time and impact your overall profitability. Additionally, Forex.com charges an inactivity fee if your account is dormant for a certain period, which may discourage infrequent traders. 2. Limited Product Offerings: While Forex.com provides a wide range of currency pairs to trade, it has a limited range of other financial instruments. If you are interested in trading stocks, commodities, or other asset classes, you may need to consider alternative platforms that offer a broader range of products. 3. Customer Support: While Forex.com offers customer support via live chat, phone, and email, some users have reported delays in response times and difficulties in reaching a representative. It is important to note that these cons are not unique to Forex.com and are common across many forex trading platforms. Therefore, it is important to carefully evaluate your trading needs and preferences before choosing a platform that is right for you.

What are the Forexcom Current Promos?

FOREX.com, a leading online forex trading platform, is currently offering several promotions. Here are the details:. 4.5% Interest: New and existing customers can earn up to 4.5% interest on their average daily available margin. This promotion is designed to reward traders for maintaining a higher margin balance, thereby providing them with more trading power. 5% Cashback: Traders who switch to FOREX.com can earn up to 5% cash back on their initial deposit. This cashback offer provides an immediate return on investment, making the switch to FOREX.com even more appealing. Active Trader Program: This program rewards high-volume traders with a range of benefits. These include cash rebates up to 15% and as high as $10 per million traded, interest payments up to 4.5% on the average daily available margin balance, waived bank fees for wire transfers, and access to exclusive events and product previews. 10% Cashback: For a limited time, traders can earn 10% cashback when they fund over $5,000. This promotion provides a significant incentive for traders to increase their investment with FOREX.com. $0 Commission for Stock CFDs: Traders can enjoy $0 commission on stock CFDs through December 31, 2023. This offer reduces trading costs and makes it more affordable to trade stock CFDs. Please note that terms and conditions apply to all promotions. Traders are advised to read these carefully before participating in any promotion. FOREX.com is committed to providing the most value for your money, and these promotions are just a part of that promise.

What are the Forexcom Highlights?

Forex.com is a leading platform for global trading news and market analysis. Here are some of the key highlights:. Bitcoin 2024 Fundamental Outlook Preview: An in-depth analysis of Bitcoin’s potential trajectory in 2024. Central Bank 2024 Outlook Preview: A comprehensive preview of what to expect from central banks in 2024. US Dollar Price Action Setups into 2024: Detailed insights into potential price action setups for the US Dollar against major currencies like EUR/USD, USD/JPY. Russell 2000 leads US stocks, Gold hits another all-time high: An analysis of the strong performance of the Russell 2000 index and the record-breaking rise of gold prices. Chinese markets end dull year on a downbeat note, yuan rallies: A review of the performance of Chinese markets and the rally of the yuan. AUD/USD, USD/JPY: US inflation report set to enhance soft landing narrative: A report on how the US inflation report could impact AUD/USD and USD/JPY. Gold Price Forecast: XAU/USD Sets the Stage for 2024 at Multi-Year Resistance: A forecast of gold prices for 2024, with a focus on XAU/USD. Russell 2000 continues recent run, Oil prices dip despite output cuts: An update on the continued strong performance of the Russell 2000 and the dip in oil prices despite output cuts. AUD/USD Rate Forecast: RSI Divergence Emerges: A forecast for the AUD/USD rate, highlighting the emergence of RSI divergence. USD/CAD outlook remains bearish as 2023 twilight looms: A bearish outlook for USD/CAD as 2023 comes to a close. Forex.com also offers award-winning platforms with fast, reliable execution and tight spreads on FX – as low as 0.0 for EUR/USD (plus a low $7 commission per 100k USD traded) with their RAW pricing account. Please note that during times of high volatility and/or low liquidity, spreads may be higher than the typical and as low as spreads published on the website.

Is Forexcom Legit and Trustworthy?

Forex.com is indeed a legitimate and trustworthy platform for forex trading. It is regulated by multiple top-tier financial authorities, including the Commodity Futures Trading Commission (CFTC) in the US, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) in Australia. Forex.com has a clean track record with no major regulatory incidents or fines. It provides a secure trading environment with safety measures in place to protect client funds. The platform offers low forex fees, a great variety of currency pairs, and diverse technical research tools. However, it’s worth noting that its product portfolio is limited to forex and CFDs, and the desktop trading platform may not be user-friendly for some users. Customer reviews on Trustpilot give Forex.com an excellent rating of 4.7. Users have praised the platform for its customer service, with many highlighting the helpfulness and efficiency of the support team. However, it’s important to note that the services available on Forex.com’s platform are defined by the user’s location. In conclusion, Forex.com is a reliable platform for forex trading, backed by strong regulation and positive user reviews. As with any investment, potential users should conduct their own research and consider their financial goals before trading.

Is Forexcom Regulated and who are the Regulators?

Forex.com is indeed a regulated provider. It adheres to the strictest standards and is regulated in multiple jurisdictions worldwide. This ensures that the company operates ethically and fairly, providing a secure environment for traders. Forex.com has been a registered Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA # 0339826) since 2004. The company firmly supports regulatory oversight and undergoes regular audits. Forex.com is regulated by several bodies across the globe. Here is a list of the regulatory bodies and the countries they are located in:. United States: The National Futures Association (NFA), Commodities Futures Trading Commission (CFTC). Canada: Canadian Investment Regulatory Organization (CIRO). United Kingdom: Financial Conduct Authority (FCA). Australia: The Australian Securities and Investments Commission (ASIC). Singapore: The Monetary Authority of Singapore (MAS). Japan: The Financial Services Agency (FSA). Cayman Islands: Cayman Islands Monetary Authority (CIMA). Cyprus: Cyprus Securities & Exchange Commission (CySEC). Forex.com’s parent company, StoneX Group, is NASDAQ-listed and subject to the highest standards of corporate governance, financial reporting, and disclosure. StoneX Group has a proven record of financial strength and stability, with resources to continue to innovate and lead the industry forward. Forex.com maintains capital levels well in excess of those required by the regulator to help ensure it is well-capitalized in times of economic uncertainty. In addition, it has an established global liquidity plan that provides access to significant resources from the StoneX group of companies as well as an external revolving credit facility. All customer deposits at Forex.com are kept separate from the company’s own operating funds and distributed across a global network of custodian banks and brokers. Customer assets on deposit, obligations to customers, and excess funds on deposit supporting such customer obligations are reported to the NFA on a daily basis. In conclusion, Forex.com is a fully regulated provider, adhering to the strictest standards and regulated in multiple jurisdictions worldwide. It is committed to providing a secure and fair trading environment for its customers.

Did Forexcom win any Awards?

Forex.com, a leading player in the forex industry, has indeed been recognized with numerous awards for its trading platforms, products, and services. These accolades reflect the company’s commitment to providing high-quality offerings to its clients. In 2023, Forex.com was recognized as “Best in Class” in several categories in the ForexBrokers.com 2023 Annual Review. These categories included Overall, Mobile Trading Apps, Offering of Investments, and a “Best New Tool” for Performance Analytics. The company also received the “Best HNW Service” award at the 2022 Dubai Forex Expo and was named the “Best CFD Broker” at the 2022 Rankia Awards. In 2021, Forex.com continued to garner recognition, winning the “Best HNW Service” award at the Dubai Forex Expo, the “Best Broker In North America” award at the InvestinGoal Best Broker Awards, and the “Best Forex Platform” award at the ADVFN International Financial Awards. Forex.com’s educational offerings were also recognized, with the company winning the “Best Education” award at the 2021 Online Personal Wealth Awards. In 2020, Forex.com was named the “Best Brokerage (Forex)” at the Benzinga Global Fintech Awards and received awards for its Mobile Platform/App at the Investment Trends UK Leverage Trading Report Awards. These awards, among many others, underscore Forex.com’s dedication to providing exceptional service and innovative solutions in the forex industry. Please note that these awards are not inclusive of all brokers and only the brokers that chose to participate in the given events were considered for such awards.

How do I get in Contact with Forexcom?

Forex.com, a leading online platform for foreign exchange (forex) trading, offers several ways for customers and interested individuals to get in touch with them. Live Chat: The fastest way to contact Forex.com is via live chat. You can start a new chat with their Client Services specialists who will be happy to assist you with any questions you may have. Email: Forex.com provides different email addresses for different purposes. For new accounts, you can reach them at global.support@forex.com or newaccounts@forex.com depending on your location. Existing customers can also use these email addresses for support. Phone: You can also reach Forex.com by phone. The international number for new accounts, existing customers, and account opening is 1.908.315.0653. For customers in the UK, the freephone number is 0800 032 1948 and the international number is +44 207 429 7900. Corporate Address: Forex.com’s corporate address is 30 Independence Blvd Suite 300 (3rd floor), Warren, New Jersey, 07059. Before reaching out, it’s important to have your questions or concerns clearly outlined to ensure a productive conversation. Whether you’re a seasoned trader or just starting out in the forex market, Forex.com’s support team is equipped to assist you.

Where are the Headquarters from Forexcom based?

Forex.com, a renowned player in the forex trading industry, has its headquarters based in the United States. Specifically, the corporate address is located at 30 Independence Blvd Suite 300 (3rd floor), Warren, NJ 07059. In addition to this location, Forex.com also has a significant presence in Bedminster, New Jersey, with an address at 135 US Hwy 202/206, Bedminster, New Jersey, 07921. Forex.com offers a range of services including forex and metals trading platforms, tight spreads, quality executions, powerful trading tools, and 24-hour live support. These services are designed to cater to the needs of forex traders globally, making Forex.com a key player in the forex trading industry. Please note that while Forex.com is based in the United States, it serves clients globally and may have additional offices or operations in other countries. For the most accurate and up-to-date information, it’s recommended to contact Forex.com directly.

What kind of Customer Support is offered by Forexcom?

Forex.com offers a comprehensive customer support system that is dedicated to providing the information you need, when you need it. Contact Information Forex.com provides multiple ways for customers to get in touch with their support team. They offer toll-free numbers for new accounts and existing customers, as well as international numbers. Customers can also reach out via email. Support Center Forex.com’s support center is available 24 hours a day. It provides help with their products, services, markets, and more. Frequently Asked Questions Forex.com has a section dedicated to frequently asked questions. This section provides answers to common questions such as how to open an account, how to retrieve a forgotten username or password, how to download the Forex.com app, and more. Glossary Forex.com provides a glossary for a complete guide to trading terms and vocabulary. This is particularly useful for those who are new to trading. Account Types Information about the different types of accounts offered by Forex.com, including how much money is needed to open an account and how long a demo account lasts, is also provided. In conclusion, Forex.com’s customer support is designed to provide comprehensive assistance to its users, ensuring they have the information and help they need to navigate the world of forex trading.

Which Educational and Learning Materials are offered by Forexcom?

Forex.com offers a comprehensive suite of educational and learning materials to help both novice and experienced traders navigate the world of forex trading. These resources are designed to equip traders with the knowledge and skills they need to trade effectively and successfully. Trading Academy: Forex.com’s Trading Academy is a valuable resource for traders at all levels. It offers interactive online trading courses that range from beginner to advanced. The academy covers key concepts behind trading, how to identify and harness opportunities, and how to take your trading to the next level. Trading Lessons: The platform provides a variety of lessons on topics such as financial markets, creating a forex trading plan, understanding technical analysis, and the Fibonacci theory. These lessons are designed to help traders develop a comprehensive understanding of the forex market and its dynamics. Self-Assessment: Forex.com also offers a self-assessment tool that helps traders determine their level of trading proficiency. This can be a useful starting point for beginners who are unsure where to start their trading journey. Platform Tutorials: To help traders get the most out of their platform, Forex.com provides short and informative video guides. These tutorials cover a range of topics, including how to use the Forex.com App, an introduction to web trading, technical analysis, and charting tips for beginners. Webinars: Forex.com hosts live trading webinars, providing traders with the opportunity to learn from experts in real-time. Glossary: The platform features a comprehensive glossary, allowing traders to look up the meaning of hundreds of trading terms. This can be particularly useful for beginners who are still familiarizing themselves with forex trading jargon. Demo Account: Forex.com allows users to practice as they learn with $50,000 in virtual funds. This demo account enables traders to gain hands-on experience without risking real money. In conclusion, Forex.com provides a wide range of educational and learning materials that cater to traders of all levels. Whether you’re a beginner looking to understand the basics of forex trading or an experienced trader seeking to refine your strategies, Forex.com has resources to support your trading journey.

Can anyone join Forexcom?

Forex.com, a leading online platform for foreign exchange (forex) trading, offers opportunities for individuals to participate in the dynamic world of currency trading. However, it’s important to understand the eligibility criteria and requirements before joining. Eligibility Criteria. Forex.com requires potential traders to provide valid identification during the account creation process. This could be a passport, a driver’s license, or a national ID. Other types of ID may be considered on a case-by-case basis. Trading Requirements. Once an account is established, traders must meet certain qualifying trade requirements. These requirements vary depending on the market and the type of trade. For instance, in the currency market, a qualifying trade for all currency pairs (excluding HKD) is equal to 200,000 in volume. This volume can be achieved through any combination of opening and closing trades. In the metals market, the volume required for spot silver (all XAG pairs) is 10,000 ounces, and for spot gold (all XAU pairs), it’s 200 ounces. The commodities and indices markets have their own specific volume requirements. Conclusion. In conclusion, while Forex.com opens the door to the forex market for many individuals, it’s crucial to understand and meet the platform’s specific requirements. As with any financial endeavor, potential traders should thoroughly research and consider their options before diving into forex trading. Please note that this information is based on the data available as of 2023 and may be subject to change. Always refer to the official Forex.com website for the most accurate and up-to-date information.

Who should NOT sign up with Forexcom?

Forex.com is a well-established global online broker that caters to individuals seeking to trade the retail FX and CFD markets. However, it may not be the right fit for everyone. Here are some types of traders who might want to consider other options:. Traders interested in popular asset classes beyond forex: Forex.com provides a wide range of offerings, including commodities, indices, individual stocks, bonds, ETFs, gold & silver, cryptocurrencies, and futures. However, it lacks some popular asset classes, such as real stocks or bonds. Traders who are interested in these asset classes might want to explore other platforms that offer a more comprehensive selection. Traders who prefer a user-friendly desktop platform: While Forex.com offers a range of technical research tools, some users have found their desktop trading platform to be not as user-friendly. Traders who prioritize a seamless and intuitive trading experience might prefer platforms known for their user-friendly interfaces. Traders who frequently trade stock CFDs: Forex.com’s fees for stock CFDs are considered high. Therefore, frequent traders of stock CFDs might find other platforms with lower fees more cost-effective. Traders who prefer a flat fee structure: Forex.com’s fee structure includes spread costs, commissions, overnight financing costs, and inactivity fees. Traders who prefer a simpler, flat fee structure might find this system complicated and potentially more expensive, depending on their trading habits. Remember, choosing a trading platform is a personal decision that should be based on your individual needs, preferences, and trading goals. It’s always a good idea to do thorough research and consider multiple options before making a decision.

Does Forexcom offer Discounts, Coupons, or Promo Codes?

Forex.com, a major player in the online investing and trading apps industry, does offer various promotional deals and discounts. However, it’s important to note that these offers can vary and may not always be available. Promotional Offers Forex.com has been known to offer promotional discount codes, although these are issued very rarely. For instance, in December 2023, Forex.com offered a 50% discount. Exclusive Offers Forex.com also provides exclusive offers for new account holders. These exclusive offers are typically available upon account creation. Competitor Codes Forex.com has been known to offer up to 50% off on investing and trading apps with instant Forex competitor codes. Cashback Offers Switching to Forex.com could earn customers up to 5% cash back on their initial deposit. Interest on Margin New and existing customers can earn up to 4.5% interest on their average daily available margin. It’s recommended to regularly check Forex.com’s promotions page or sign up for their newsletter to stay updated on the latest offers. Please note that terms and conditions apply to these offers. Remember, investing in forex markets involves risk, and it’s important to understand these risks before starting. Always consider seeking advice from a financial advisor if you’re unsure. Happy investing!.

Which Account Types are offered by Forexcom?

Forex.com offers a range of account types to cater to the diverse needs of traders. Here are the details:. 1. Spread-Only Account This account type is ideal for traders looking for the traditional forex-trading experience. It offers ultra-competitive spreads with no hidden costs. Traders have the opportunity to reduce costs by up to 15% with cash rebates. 2. RAW Pricing Account The RAW pricing account is for traders who seek ultra-tight spreads, as low as 0.0 on major pairs, with fixed $7 USD commissions. It offers exceptional quality trade executions. 3. MetaTrader Account Forex.com elevates your MT5 experience with this account type. It offers competitive spreads with no commissions. Traders can join the Active Trader program to earn cash rebates of up to $10 per million traded. 4. Corporate Account Forex.com offers corporate accounts for businesses to access the global markets, with multiple authorized traders for one account. In addition to these, Forex.com also offers more finely-tuned experiences tailored to individual needs, such as joint accounts. Each account type has its own features and benefits, making Forex.com a versatile platform for all types of forex traders.

How to Open a Forexcom LIVE Account?

Opening a Forex.com LIVE account involves a series of steps that are designed to ensure the security and accuracy of your trading experience. Here’s a detailed guide on how to do it:. Step 1: Visit the Forex.com Website Start by visiting the Forex.com website. This is where you’ll find all the information you need about the different types of accounts they offer. Step 2: Choose the Account Type Forex.com offers several types of accounts, each with its own features and benefits. These include the Spread-Only Account, MetaTrader 5 Account, MetaTrader 4 Account, and RAW Pricing Account. Choose the one that best suits your trading style and financial goals. Step 3: Fill Out the Application Form Once you’ve chosen the type of account you want, you’ll need to fill out an application form. This will require some personal information such as your name, address, date of birth, and tax ID number. Step 4: Verify Your Identity Forex.com will attempt to verify your identity instantly. If they can’t, they will reach out to you to request further supporting information or documentation. Step 5: Fund Your Account The minimum initial deposit required is at least 100 of your selected base currency. However, Forex.com recommends you deposit at least 1,000 to allow you more flexibility and better risk management when trading your account. Step 6: Start Trading Once your account has been opened and funded, you can start trading. Forex.com offers over 80 currency pairs, unleveraged gold and silver, and more. Remember, Forex.com also offers a demo account where you can practice your trading strategies with up to $50,000 in virtual funds. This can be a great way to familiarize yourself with the platform and refine your trading strategy before you start trading with real money. If you have any more questions, Forex.com has a comprehensive FAQ section on their website. , or you can start a chat with their support.

How to Open a Forexcom DEMO account?

Opening a Forex.com demo account is a straightforward process that allows you to practice trading risk-free with $50,000 in virtual funds. Here’s a step-by-step guide:. Step 1: Visit the Website Go to the Forex.com website. Look for the option to open a demo account. Step 2: Fill in Your Details Fill in your full name and email address. These details will be used to send you your username and password. Step 3: Agree to the Disclosures and Privacy Policy Before you can proceed, you’ll need to agree to the Disclosures and Privacy Policy. Make sure to read these documents carefully to understand your rights and responsibilities. Step 4: Submit Your Application Click on the ‘Submit’ button to send your application. You should receive an email with your username and password shortly after. Step 5: Start Trading Once you receive your login details, you can start trading. The demo account provides a risk-free environment for you to hone your skills and improve your trading strategies. You’ll have access to real-time pricing and the ability to trade over 80+ FX pairs. Note: The demo account lasts for 90 days. If you have any questions, you can visit the Demo Accounts FAQ section or start a chat with their support. Remember, the purpose of a demo account is to provide a platform for you to learn and practice. It’s a great way to familiarize yourself with the dynamics of forex trading before you start trading with real money. Happy trading! ?.

How Are You Protected as a Client at Forexcom?

As a client at Forex.com, you are protected in several ways:. Regulation: Forex.com is regulated by many financial authorities, including the top-tier FCA in the UK. This means that the broker must adhere to strict standards of conduct and transparency, providing an additional layer of protection for clients. Negative Balance Protection: Forex.com (U.K.) offers client account protection, such as ESMA-mandated negative balance protection. This feature prevents users from losing more money than they have in their accounts, no matter how far their open positions drop. , stopping them from becoming indebted to their broker. Investor Protection: Forex.com provides investor protection of £85k to UK clients, CAD 1 million to Canadian clients. This protection is provided if an authorized firm is unable to pay claims against it. Risk Management Tools: Forex.com also offers guaranteed stop loss orders. This tool allows you to set a specific price at which your position will automatically close, limiting potential losses. Transparent Fees: Forex.com has a well-organized and navigable website with fully disclosed services and fees. This transparency allows clients to make informed decisions about their trading activities. Account Security: Forex.com uses advanced security protocols to protect client data and funds. This includes encryption technology and secure servers. Customer Support: Forex.com provides robust customer support to assist clients with any issues or concerns. This includes live chat, phone support, and email support. Remember, while these protections can help mitigate risk, trading forex and CFDs is still inherently risky and not suitable for all investors. Always ensure you understand the risks involved before trading.

Which Funding methods or Deposit Options are available at Forexcom?

Forex.com offers a variety of funding methods to cater to the diverse needs of its clients. Here are the details:. Bank Transfer (ACH). : This is a recommended method for funding your Forex.com account. You can transfer a maximum of $10,000 or currency equivalent per transaction and funds will typically be available immediately for trading. The minimum transaction for bank transfers is $100 per transaction. Forex.com accepts USD and does not charge a fee for bank transfers. Wire Transfer. : There is no minimum or maximum deposit amount for wire transfers. Wire transfers may take up to 1-2 business days for domestic wires and 2-5 days for international wires before they are available for trading. Forex.com accepts USD, EUR, CAD, JPY, CHF, AUD, and GBP. Forex.com does not charge fees for incoming wires. However, your bank may charge a service fee. Credit/Debit Card. : You can easily fund your account via credit card or debit card. The minimum per transaction is $100 or currency equivalent, and the maximum per transaction is $10,000 or currency equivalent. Accepted currencies include USD, EUR, and GBP. The processing time is typically immediate and there are no fees. Neteller/Skrill. : To fund your account, you will need to have an active e-wallet with Neteller or Skrill. The minimum per transaction is $100 or currency equivalent, and the maximum is $10,000. Accepted currencies include USD, EUR, and GBP. The processing time is typically immediate and there are no fees. Please note that Forex.com cannot accept deposits from third parties. Also, keep in mind that if you have deposited funds using multiple methods, you must exhaust the total deposit amounts based on the following order: Bank Transfer, Debit Card, Wire. Excess funds may be withdrawn via bank transfer or wire.

What is the Minimum Deposit Amount at Forexcom?

Forex.com, a global forex and CFD broker, is regulated by many financial authorities, including the top-tier UK FCA. Its parent company, StoneX Group Inc., is listed on the NASDAQ Stock Exchange. The minimum deposit at Forex.com is $100. This means that you have to deposit at least $100 to be able to start trading. After you have completed the registration and verification process, you need to fund your account to start trading. Forex.com charges $0 for deposits. You can only deposit funds from accounts that are in your name. Forex.com is a reliable broker regulated by at least one top-tier regulator. At Forex.com, there is an inactivity fee, with the following conditions: $/€/AUD 15, £12 or JPY 1500 per month after one year of inactivity. At Forex.com, the following base currencies are available: EUR, USD, GBP, PLN, CHF. Forex.com recommends deposits of at least $1,000 and $2,500 for its commission-free and commission-based accounts, respectively. Forex.com also offers an STP Pro account, where Forex.com notes a recommended minimum deposit of $25,000.

Which Withdrawal methods are available at Forexcom?

Forex.com offers a variety of withdrawal methods for its users. Here are the details:. Bank Transfer: This is one of the primary methods for withdrawing funds from Forex.com. The minimum withdrawal amount is 100 of your account’s base currency, or the remaining amount if less than 100. There is a $25,000 per transaction limit on bank transfers. Bank transfer may take up to 48 hours to process. Credit/Debit Card: You can also withdraw funds to the credit/debit card that you used for depositing funds. The maximum withdrawal amount is $50K or transaction up to the amount funded. Debit card withdrawals are limited to the amount of total net deposits, with a per transaction limit of $50,000. Processing by Forex.com is typically immediate, but the receiving bank may take up to 48 business hours to process. Wire Transfer: Wire transfers may take up to two business days within the US and five business days for international wires. You can withdraw a maximum of $25,000 per transaction if you are withdrawing via bank transfer or debit card. Wire transfers have no restriction on transaction size. Please note that deposited funds must be returned to the originating funding source in the following order: Credit/Debit Card, Wire Transfer. Excess funds may be withdrawn via bank transfer. In the event you add a new bank account to withdraw excess funds, Forex.com will require evidence of the account by uploading a bank statement. Remember, a withdrawal of funds will result in a reduction of funds available to be used for margin to maintain open positions. This may result in the liquidation of any or all of your open positions. It is your responsibility to ensure that the account holds enough margin to maintain open positions. Please note that the processing time only reflects the time it takes Forex.com to complete the withdrawal during normal business hours. Your bank may take additional time to credit the funds to your account. For more detailed information, you can visit the Forex.com’s official website or contact their customer service.

Which Fees are charged by Forexcom?

Forex.com charges a variety of fees that traders should be aware of. Here’s a detailed breakdown:. Account Types and Associated Costs Forex.com offers two types of accounts: the Standard account and the RAW Spread account. The costs associated with each account type are as follows:. Standard Account: For traditional traders, the cost to trade is the bid/ask spread. The FX spreads are variable, with EUR/USD as low as 1.0. RAW Spread Account: Major FX pairs can go as low as 0.0 with low commissions. The FX spreads are the tightest, with majors as low as 0.0. Commissions Commissions are only charged for equities. For FX trading on a RAW Spread Account, a fixed $5 per $100k USD is traded. Volume discounts are available, with multi-asset rebates on FX, Indices, Commodities, Metals, cryptocurrencies, and Equities, up to $50 per million traded. Rollover Rates Rollovers, typically the interest charged or earned for holding positions overnight, are only applied to open trades at 5pm ET. Forex.com strives to keep trading costs low by sourcing institutional rollover rates and passing them to traders at a competitive price. Inactivity Fees Forex.com charges an inactivity fee of $15 (or 15 base currency equivalent, or 1500 JPY) per month if there is no trading activity or no open positions for a period of 12 months or more. Other Charges Other direct charges that traders may encounter include spreads, potential further adjustments, rollovers and financing adjustments, dividend adjustments, inactivity fees, borrowing costs, and commodity basis adjustments. Please note that trading with Forex.com will involve fees from $15 USD, spreads from 0.01 pips, and commission-free trading depending on the account type selected. A minimum deposit fee of $100 USD will be required.

What can I trade with Forexcom?

Forex.com is a leading online trading platform that provides access to a wide range of financial instruments. Here are the key categories of assets you can trade with Forex.com:. Forex Trading Forex.com offers traders access to over 80 currency pairs. These include:. Major pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF. These are the most commonly traded pairs and are characterized by high liquidity and low volatility. Minor pairs, which include currencies of smaller economies such as the New Zealand dollar (NZD), Canadian dollar (CAD), and the Swiss franc (CHF). These pairs are less frequently traded, but can offer higher volatility and profitability. Exotic pairs, which include currencies from emerging economies such as the Turkish lira (TRY), South African rand (ZAR), and Mexican peso (MXN). These pairs can offer high volatility, but also come with higher risk due to their lower liquidity. Commodities Trading Forex.com offers traders access to a wide range of commodities. This includes:. Precious metals such as gold, silver, and platinum. These are popular among traders due to their safe-haven status and long-term value. Energy products such as crude oil and natural gas. These commodities are heavily influenced by geopolitical events and can offer high volatility. Agricultural products such as corn, soybeans, and wheat. These commodities are influenced by factors such as weather patterns, supply and demand, and government policies. Indices Trading Indices are a measure of the performance of a group of stocks in a specific market. Forex.com offers traders access to a variety of indices, including the S&P 500, Dow Jones Industrial Average, and the NASDAQ Composite. These indices are popular among traders due to their high liquidity, low volatility, and ability to track the performance of the broader economy. Cryptocurrencies Trading Forex.com offers traders access to a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrencies are digital assets that operate independently of central banks and can offer high volatility and profitability. However, they also come with higher risk due to their lack of regulation and potential for price manipulation. In conclusion, Forex.com offers traders access to a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. With over 80 currency pairs available, traders can choose from major, minor, and exotic pairs to suit their trading style.

Which Trading Platforms are offered by Forexcom?

Forex.com offers a variety of trading platforms to cater to the diverse needs of traders. Here are the details:. Mobile Trading Apps Forex.com’s mobile trading apps are intuitive, secure, and offer super-fast execution. Traders can buy and sell with a single swipe, access exclusive Performance Analytics, build multiple personalized watchlists, and customize layouts to suit their trading style. The apps also feature over 80 technical indicators and drawing tools for creating custom templates. Traders can stay updated with integrated news and analysis from Reuters, market analysis, and an economic calendar. Web Trading Platform Forex.com’s web trading platform provides everything a trader needs. It allows trading from charts and access to advanced risk management tools. The platform is easily accessible from all modern browsers, with no plugins or downloads required. It features TradingView charts, smart trade tickets, and actionable trade opportunities and identified patterns from the Trading Central research portal. Traders can create new orders directly from the charts and click and drag to edit existing orders. The platform offers over 80 technical indicators, 14 time intervals, multiple chart types, and over 50 drawing tools. MetaTrader 4 and MetaTrader 5 In addition to its proprietary platforms, Forex.com also offers the third-party trading platforms MetaTrader 4 and MetaTrader 5. Additional Tools Forex.com provides additional tools such as SMART Signals and Capitalise.ai for automated strategy creation, NinjaTrader for advanced charting and trading management, and API trading for those who prefer to build and execute custom strategies. Forex.com’s execution statistics represent orders executed on Forex.com’s platforms during market hours. If the price moves in a trader’s favor while the order is being processed, Forex.com will execute the trade at the better price. The average execution speed is 0.02-0.03 seconds. , and traders can trade EUR/USD as low as 1.0-1.2 pips. Please note that multiple factors may impact execution speed, including but not limited to market conditions, platform type, network connectivity, trading strategies, and account type.

Which Trading Instruments are offered by Forexcom?

Forex.com offers a wide range of trading instruments and tools to help traders navigate the forex market. Here are some of the key offerings:. SMART Signals: These are ready-made trading recommendations powered by advanced machine learning technology. Performance Analytics: This tool uses cutting-edge behavioral science to explore your performance and helps you refine your skills. Capitalise.ai: This tool allows you to automate your trading strategies with ease and access backtesting, simulation, strategy tips and much more – no coding expertise necessary. Advanced Charts: A must-have for technical traders, Forex.com’s charts, powered by TradingView, come with over 80 indicators, 50 drawing tools, 14 time intervals, and a host of customization features. Market News and Analysis: Keep your finger on the pulse of the global marketplace with high-quality journalism and in-depth analysis at the touch of a button. Trading Central: Found in the Market Analysis tab of Forex.com’s platform, this research portal gives you a summary of technical analysis, lets you gauge news sentiment, and offers its own trading opinions. Reuters News: Get a live streaming news feed straight to the platform. Economic Calendar: Know when all the major economic events occur. Alerts: Set alerts and get notifications on the platform, via push or email, when a market reaches a certain level. In addition to these tools, Forex.com also offers mobile and web trading platforms that are intuitive, secure, and equipped with super-fast execution. The mobile trading app allows you to buy and sell with a single swipe, access Performance Analytics, build multiple personalized watchlists, and customize your layouts to suit your trading style. The web trading platform offers everything a trader needs, including trade from charts, advanced risk management tools, and a fully equipped customizable platform. Please note that while I strive to provide accurate and up-to-date information, it’s always a good idea to visit the Forex.com website or contact their customer service for the most current information.

Which Trading Servers are offered by Forexcom?

Forex.com offers two main trading servers, namely MetaTrader 4 (MT4). and MetaTrader 5 (MT5). MetaTrader 4 (MT4). is a popular trading platform that provides a suite of over 20 apps, giving traders professional-grade control and flexibility over their trading strategy. It also offers access to nine Expert Advisors (EAs), including Sentiment Trader, for automated strategies tailored to traders’ specifications. MT4 also features integrated Reuters news, real-time platform features with no third-party bridges, and an optimized environment for building algorithms. MetaTrader 5 (MT5). is another trading platform offered by Forex.com. It provides faster and more efficient trading than MT4 due to its 64-bit, multi-threaded platform. It also has a simpler search function, allowing traders to find a market name instantly. MT5 offers access to 15 custom indicators, such as integrated Pivot Points, and an array of advanced charting tools. It also provides a range of CFD stocks, previously unavailable in MT4. Both platforms offer automated trading with EAs, allowing traders to build their own algorithms in an optimized environment. They also provide advanced charts with 30 indicators for technical analysis, nine timeframes, and graphical objects. In addition to desktop versions, both MT4 and MT5 are available for web and mobile, offering complete control of your account on iPhone or Android. They provide one-tap trading, accelerating the order execution process with no secondary confirmation. In conclusion, Forex.com offers robust trading servers with a suite of tools and features that cater to the needs of forex traders, providing them with a high degree of flexibility, oversight, and control over their trading strategies.

Can I trade Crypto with Forexcom? Which crypto currencies are supported by Forexcom?

Yes, you can trade cryptocurrencies with Forex.com. Forex.com offers trading on cryptocurrency CFDs. You can trade without needing to own the cryptocurrency itself. This allows you to speculate on price movements without owning any cryptocurrencies. Forex.com supports trading with the following cryptocurrencies. Bitcoin. Ethereum. Litecoin. Ripple. These cryptocurrencies are available on the Forex.com and MT5 platforms. However, they are not available on the MT4 platform. You can trade these cryptocurrencies with fixed spreads, low margin, competitive financing, and reliable trade executions. Forex.com is a trading name of GAIN Global Markets Inc., which is authorized and regulated by the Cayman Islands Monetary Authority (CIMA). It’s part of StoneX Group Inc., a NASDAQ-listed Fortune 100 company with over a century in the financial markets. Please note that with increased leverage comes increased risk. Cryptocurrencies represent a new asset class that is prone to extreme volatility. It’s important to understand what influences their prices and how you can effectively trade with them.

What is the Leverage on my Forexcom Trading Account?

Leverage on a Forex.com trading account refers to the ability to control a large position with a small amount of capital. It is usually denoted by a ratio. For example, if your account has a leverage of 50:1, that means you can trade a position of $50,000 with only $1,000. Please note that increased leverage increases risk. Forex.com offers margin rates as low as 3.3%, which is a leverage ratio of 30:1. This means you can open a position worth up to 30 times more than the deposit required to open the trade. Before you trade with Forex.com, it’s important to understand the risks of leverage. The margin requirements at Forex.com differ according to platform (Forex.com or MetaTrader), market, asset class, and position size. You can find out the specific margin of each instrument in its Market Information Sheet on the Forex.com desktop platform. To calculate the amount of funds required to cover the margin requirement when you open a trade, simply multiply the total notional value of your trade (quantity x price of instrument) by the margin factor. For example, say the margin requirement for EURUSD is 0.5%. The current buy price of EURUSD is 1.300 and you wish to buy 1 standard lot (100,000). The total value of the position is $130,000 (100,000 x 1.300). $650 would therefore be allocated from your account to open the position ($130,000 x 0.5%). Forex.com provides additional tools to help customers calculate and monitor MMR: Margin Calculator and Margin Indicator. The Margin Calculator can be used to manually calculate MMR at any time and monitor each position’s margin requirement separately. The Margin Indicator allows you to visually review your account’s total MMR. Please note that the Forex.com platform does not support changing from the default leverage setting of 50:1. If you wish to change your account leverage or margin, you need to fill out a Margin Change Request Form and submit it to global.support@forex.com.

What kind of Spreads are offered by Forexcom?

Forex.com, a popular forex trading platform, offers a variety of spreads to cater to the diverse needs of its traders. Variable Spreads. Forex.com operates on a variable spread model. This means that the spreads fluctuate with market conditions. The average spreads for major currency pairs start from 1.3 pips. However, these spreads may widen during volatile market conditions. Fixed Spreads. In addition to variable spreads, Forex.com also offers fixed spreads. These spreads remain constant regardless of market volatility. This can be advantageous for traders who prefer predictability in their trading costs. Account Types and Spreads. Forex.com offers a few different account types to choose from. This includes both standard and professional accounts, as well as the DMA account. For standard account trading, the spreads often start from as little as 1 pip. FX Spreads. For FX trading, Forex.com offers variable spreads as low as 1.0. They also offer their tightest spreads for majors as low as 0.0. Commissions and Rebates. Forex.com charges a fixed commission of $5 per $100k USD traded on FX. They also offer multi-asset rebates on FX, Indices, Commodities, Metals, cryptocurrencies, and Equities, up to $50 per million traded. In conclusion, Forex.com provides a range of spread options to suit different trading strategies and market conditions. Whether you prefer the predictability of fixed spreads or the potential cost-efficiency of variable spreads, Forex.com has options to fit your needs.

Does Forexcom offer MAM Accounts or PAMM Accounts?

Forex.com does indeed offer MAM (Multi-Account Manager) accounts. Before we delve into the specifics of Forex.com’s offerings, let’s first understand what MAM and PAMM accounts are. MAM stands for Multi-Account Manager and PAMM stands for Percentage Allocation Management Module. These types of accounts allow fund managers to manage multiple accounts from a single account without having to create an investment fund. The performance (profits and losses) of a MAM or PAMM account manager is distributed among the managed accounts. The clients’ managed accounts are connected to the account manager’s main account and all trades made by the manager are reflected proportionally in the clients’ accounts. In a MAM account, the manager can allocate trades on a fixed basis, which means that he can define the number of lots traded by each individual account. This fixed allocation can also be done using a LAMM (Lot Allocation Management Module) account. The manager can also change the amount of leverage applied to the sub-accounts if his clients want to take on a greater level of risk. A PAMM account, on the other hand, features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a PAMM account, an investor can also allocate a percentage of his account to one or more managers. The manager’s PAMM account is a large “main account”, whose capital is equal to the sum of the sub-accounts. The manager’s trades are automatically replicated in the sub-accounts according to a percentage basis. To ensure the security of investors’ funds, client deposits remain in their own trading accounts, the manager does not have access to these accounts and therefore cannot make any withdrawals. The individual investors are the only ones who are able to make deposits & withdrawals to/from these managed accounts. However, the performance fees that are earned by account managers are automatically withdrawn from clients’ accounts, in accordance with the terms of the contract. In conclusion, Forex.com does offer MAM accounts. , providing a flexible and secure platform for fund managers and investors alike. However, it’s always important for investors to thoroughly research and understand the terms and conditions associated with these types of accounts before making a decision.

Does Forexcom allow Expert Advisors?

Yes, Forex.com does allow the use of Expert Advisors (EAs). EAs are automated programs that are written by traders or programmers with the purpose of assisting traders in the Forex market on their trading decisions. Forex.com provides a suite of over 20 EAs to give you professional-grade control and flexibility over your trading strategy. All EAs are provided by FX Blue and included with a Forex.com MetaTrader account. These EAs offer a range of features including:. Custom indicators including integrated Pivot Points and Highs and Lows. Chart-in-Chart lets you view multiple products on one chart window. Nine Expert Advisors including Sentiment Trader and an Alarm Manager. Alarm Manager that allows you to set platform, email, or SMS alerts based on a wide range of parameters. Correlation Matrix to manage risk more effectively with a grid of correlations between all tradable markets. Correlation Trader for analysis and execution combined to streamline your strategy. Market Manager to manage your account and market information all from one convenient window. Mini Terminal to focus on a specific market with a deal ticket integrated into your chart. Sentiment Trader that provides live sentiment data from FXBlue.com’s user database. Session Map to find the action with a map highlighting active trading sessions around the globe. Tick Chart Trader for ultra-fast market entry and exit. By using EAs, traders can remove the psychological factor from their trading decisions, which aims to decrease stress and improve the performance of an account, especially for beginners. However, because EAs are manually created by traders or programmers, they may not be able to measure the fundamental effects of the market. As a result, EAs may not perform very well when it comes to unforeseen events, and traders tend to monitor their EAs on a continuous basis.