Fortrade Review 2026

What is Fortrade?

Fortrade is a UK-based derivatives brokerage firm. that was founded in 2013. It is a classic STP broker. and a global forex broker. that offers customers two trading platforms for trading forex and Contracts-for-Difference (CFDs). The broker’s core staff is situated in London and Watford in the UK and is led by CEO Nick Collison. They are all regulated by the Financial Conduct Authority (FCA). Fortrade offers a choice between the broker’s proprietary Fortrader platform and the popular MetaTrader 4 (MT4) platform. These platforms provide advanced trading tools for online currency and CFD trading. Fortrade now serves over 1,000,000 retail investors. for Forex trading, and CFDs trading. It’s important to note that CFDs are complex instruments with a high risk of losing money rapidly due to leverage. As per the data, 78% of retail investor accounts lose money when trading CFDs with this provider. Therefore, it’s crucial for traders to understand how CFDs work and whether they can afford to take the high risk of losing their money. Fortrade is focused on Eurozone clients. and consists of several independent licensed subsidiaries located mainly in European countries. The company also offers a range of products including currencies, stocks, indices, precious metals, energy products, agricultural products, US treasury certificates, ETFs, and digital currencies. In conclusion, Fortrade is a well-established and regulated broker that offers a wide range of trading options. However, the high risk associated with CFD trading means that it may not be suitable for all investors.

What is the Review Rating of Fortrade?

- 55brokers: 55brokers rated Fortrade with a score of 89. This rating was last checked at 2024-01-06 10:28:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Fortrade with a score of 74. This rating was last checked at 2024-01-06 20:03:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Fortrade with a score of 42. This rating was last checked at 2024-01-05 22:42:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Fortrade with a score of 14. This rating was last checked at 2024-03-13 03:47:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Fortrade?

Fortrade, a regulated online broker, offers several advantages that make it a compelling choice for both novice and experienced traders. Here are some of the key benefits:. 1. Wide Range of Trading Instruments: Fortrade offers a vast selection of trading instruments, including forex, commodities, stocks, indices, metals, energies, and ETFs. This diversity allows traders to diversify their portfolio and explore different markets. 2. User-Friendly Platforms: Fortrade provides user-friendly platforms such as the MetaTrader 4 platform and their very own Fortrader web, mobile, and desktop platforms. These platforms are designed to be accessible and easy to use, making trading simple for all. 3. Quality Trading Conditions: Fortrade offers quality trading conditions with no commission on trades, competitive spreads, and good execution speeds. This ensures that traders can execute their trades efficiently and cost-effectively. 4. Educational Materials and Market Analysis Tools: Fortrade provides a vast selection of educational materials and market analysis tools. These resources can help traders improve their trading skills and make informed trading decisions. 5. Regulation: Fortrade is regulated by several bodies, including the Investment Industry Regulatory Organization of Canada (IIROC), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and National Bank of the Republic of Belarus (NBRB). This regulation provides traders with a level of security and trust in the platform. 6. Scalable Platform: Fortrade’s strengths include a scalable platform and regulation of the top international regulatory bodies. This scalability ensures that the platform can handle a large volume of trades and users. 7. No Hidden Fees: Fortrade operates with transparency, with no hidden fees, commissions, or deposits. This transparency ensures that traders are aware of all costs associated with their trades. 8. Mobile Trading: Fortrade offers mobile apps for iOS and Android devices. This allows traders to manage their accounts on the go, ensuring they never miss a trading opportunity. 9. Support for Various Trading Strategies: Fortrade allows various trading strategies, including scalping, hedging, arbitrage, and algorithmic trading. This flexibility allows traders to choose the strategy that best suits their trading style and goals. In conclusion, Fortrade offers a comprehensive trading solution with a wide range of trading instruments, user-friendly platforms, quality trading conditions, and robust regulation. Whether you’re a novice trader or an experienced one, Fortrade has the tools and features to help you succeed in the world of forex trading.

What are the Cons of Fortrade?

While Fortrade offers a range of services and features, there are several potential drawbacks that traders should be aware of:. Limited Availability: Fortrade does not offer its services to clients from the USA and Belgium. This geographical restriction could limit the broker’s reach and potential user base. Dormant Account Fees: A fee of $10 is charged monthly from dormant accounts. This could be a disadvantage for traders who do not actively trade every month. Lack of Social Trading or Managed Accounts: Fortrade does not offer social trading or managed accounts for investors. This could be a drawback for traders who prefer to follow the strategies of other successful traders or have their accounts managed by professionals. Higher Minimum Deposit Requirement: The minimum deposit requirement is higher than some other brokers, which may deter beginners. No Cryptocurrency CFDs: Fortrade currently doesn’t offer cryptocurrency CFDs. This could be a disadvantage for traders interested in the dynamic and rapidly evolving cryptocurrency market. Withdrawal Duration: Withdrawals can take up to 15 business days for debit/credit cards. This could be inconvenient for traders who need quick access to their funds. Basic Platform: The platform may be too basic for some traders. While Fortrade does support the MT4 platform, some traders might find the proprietary Fortrader platform lacking in advanced features. Fees: Based on findings, fees are quite pleasant, however, maybe only for Commodities fees might be lower with other competitors, with typical spread for EUR USD pair 2 pips. It’s important for potential users to consider these factors when deciding whether Fortrade is the right broker for their trading needs.

What are the Fortrade Current Promos?

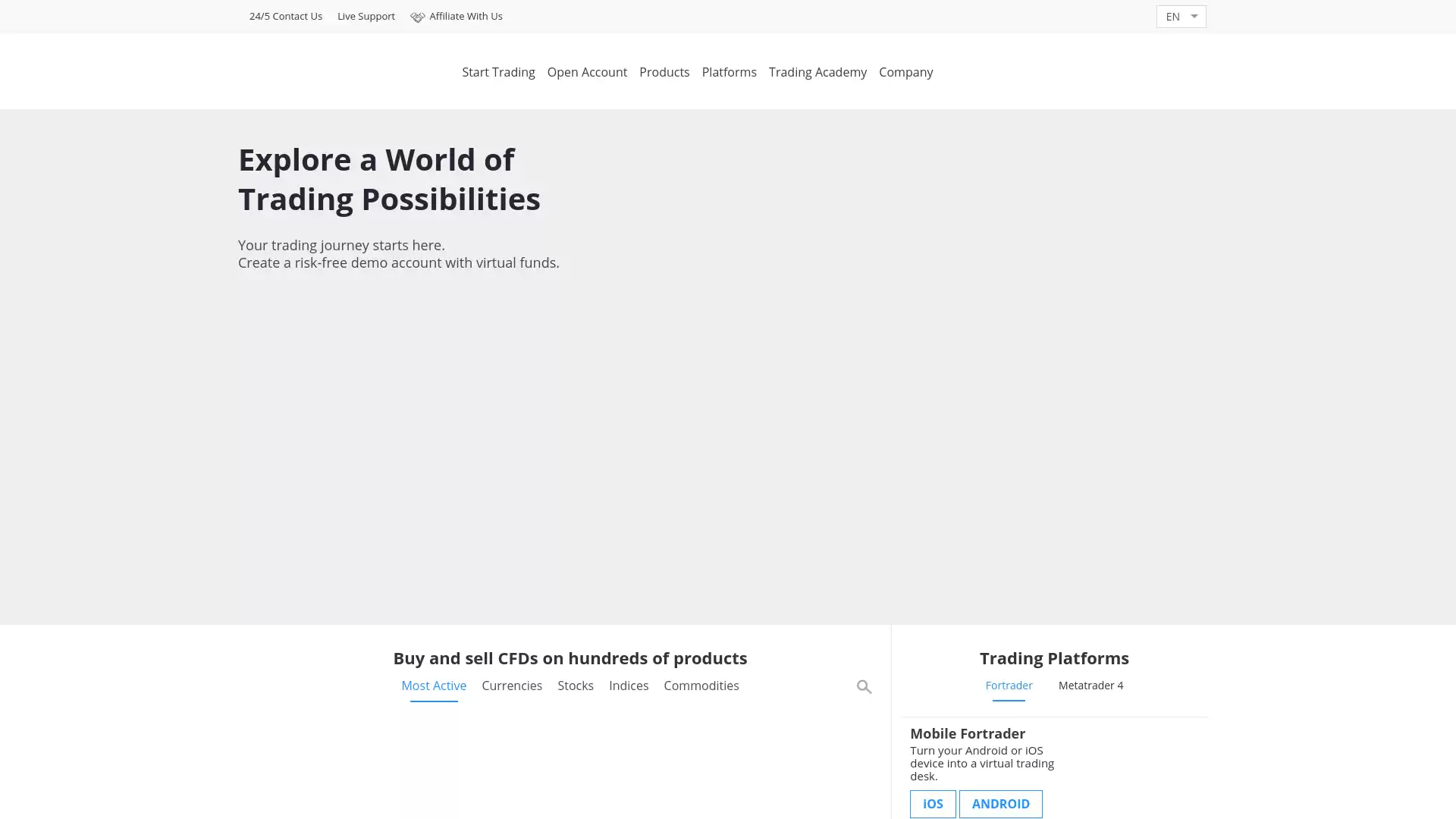

Fortrade, a leading and internationally regulated broker, offers a variety of trading promotions, limited bonuses, and special offers. These promotions are designed to provide traders with an enhanced trading experience and the opportunity to maximize their investments. Getting Started with Forex Trading. Fortrade provides a simple three-step process for new users to start trading Forex. Create a New Account: Visit the account page and create a free new demo account. Go to Fortrader: You can connect to Webtrader on any browser, or download the free mobile app. Start Trade Practice: Choose products and start trading with virtual money risk-free. Trading Platforms. Fortrade offers advanced online currency and trading platforms. These include:. Fortrader: A secure trading platform accessible from any browser in the world. Metatrader 4: A popular trading platform known for its user-friendly interface and advanced trading features. Mobile Fortrader: Turn your Android or iOS device into a virtual trading desk. Market Analysis. Fortrade provides daily market review and analysis for CFD instruments. This includes session analysis for various currency pairs like EUR-USD, GBP-USD, USD-JPY, and AUD-USD. It also includes analysis for commodities like Gold and Crude Oil, and indices like USA500. Online Seminars. Fortrade conducts online seminars to educate traders about various aspects of trading. The most recent seminar was on "Oil prices after OPEC meeting. What next for Crude?". Please note that trading involves risk and 83% of retail investor accounts lose money when trading CFDs with this provider. It’s important to understand how CFDs work and whether you can afford to take the high risk of losing your money.

What are the Fortrade Highlights?

Fortrade is a prominent player in the field of online currency and CFD trading. Here are some of the key highlights:. Daily Market Review & Analysis: Fortrade provides daily market reviews and analysis for a wide range of CFD instruments. This includes analysis for the EU and US sessions, covering various currency pairs like EUR-USD, GBP-USD, USD-JPY, AUD-USD, and USD-CAD. They also provide analysis for commodities like Gold and Crude Oil, as well as indices like USA500 and GER40. Advanced Trading Platforms: Fortrade offers advanced trading platforms for online currency and CFD trading. This includes their proprietary Web Fortrader, iOS and Android apps, as well as support for MetaTrader4 across web, desktop, and mobile. Educational Resources: Fortrade has a comprehensive trading academy with resources for both beginners and advanced traders. This includes eBooks, trading courses, video tutorials, and a range of trading strategies. Trading Central Analysis: Fortrade provides Trading Central analysis, offering insights and forecasts to help traders make informed decisions. Financial Performance: In 2022, Fortrade reported revenues of £32.3 million, marking a 14% increase from the previous year. However, net profit for the year was £824K, down 23% from £1.1 million in 2021. Please note that trading in CFDs carries a high level of risk and may not be suitable for all investors. It’s important to understand how CFDs work and consider whether you can afford to take the high risk of losing your money.

Is Fortrade Legit and Trustworthy?

Fortrade, a multi-asset, multi-regulated broker, has been in operation since 2013 and has built a solid reputation as a professional, trustworthy broker. It offers trading opportunities on a wide range of instruments including stocks, bonds, commodities, forex, indices, cryptocurrencies, and ETFs. Regulation: Fortrade is regulated by several regulatory bodies including the FCA, CySEC, ASIC, NBRB, and IIROC. This strong regulatory oversight adds to its credibility and trustworthiness. Trading Platforms: Fortrade supports the market-leading MetaTrader 4 platform and also offers a proprietary platform. This gives traders a choice of platforms to suit their trading style and needs. Trading Opportunities: Fortrade offers Forex trading, and CFDs trading. It provides access to a wide range of markets, including forex, stocks, bonds, indices, commodities, and cryptocurrencies. Minimum Deposit: The minimum deposit with Fortrade is $100. This makes it accessible to a wide range of traders, from beginners to more experienced ones. In conclusion, based on the information available, Fortrade appears to be a legitimate and trustworthy broker. However, as with any financial decision, potential traders should conduct their own due diligence before deciding to trade with Fortrade.

Is Fortrade Regulated and who are the Regulators?

Fortrade is indeed a regulated brokerage company. It is overseen by multiple regulatory bodies, ensuring its operations adhere to the stringent standards set by these authorities. Regulatory Bodies: Fortrade is regulated by the following authorities:. The Financial Conduct Authority (FCA) in the United Kingdom. The Cyprus Securities and Exchange Commission (CySEC) in Cyprus. The Australian Securities and Investments Commission (ASIC) in Australia. The Investment Industry Regulatory Organization of Canada (IIROC). The National Bank of the Republic of Belarus (NBRB). Company Overview: Fortrade has been operating as a Straight Through Processing (STP) broker since 2013. The company comprises several independent licensed subsidiaries, primarily located in European countries. Fortrade’s offices are situated in London, Sydney, and Cyprus, and since 2018, it also maintains an office in Minsk, Belarus. Trading Conditions: Fortrade offers a range of trading conditions. Account currency options include USD, EUR, and GBP. The minimum deposit starts from $100. Leverage is available up to 1:100. Spreads start from 2 pips for currency pairs. Trading instruments include currency pairs, cryptocurrencies, Contracts for Difference (CFDs) on equity and commodity assets, Exchange-Traded Funds (ETFs), and US Treasuries. The Margin Call/Stop Out levels are set at 100%/50%. Advantages of Trading with Fortrade: Fortrade offers several advantages for traders. Transparency with a uniform account and flexible trading terms. No restrictions on strategies applied, including scalping, hedging, arbitrage, and algorithmic trading on MetaTrader 4 (MT4). The proprietary browser platform, ForTrader, is designed for trading stock assets such as stocks, ETFs, and derivatives. It also offers non-standard assets. In conclusion, Fortrade’s regulation by multiple reputable authorities provides a secure environment for traders. However, as with all investments, potential traders should conduct thorough research and consider the associated risks before trading.

Did Fortrade win any Awards?

Fortrade, a global financial trading platform and broker, has been recognized for its achievements in the industry. Over the nine years of its operation, Fortrade has won numerous industry awards. One of the most notable achievements of Fortrade was successfully tripling their revenue from 2015 to 2016. However, it’s important to note that not all sources agree on this point. Some sources suggest that Fortrade has not received any industry awards. This discrepancy could be due to different criteria or standards used by different awarding bodies or reviewers. Regardless of the awards, Fortrade has built a solid reputation as a professional, trustworthy broker since its inception in 2013. They offer CFD trading on hundreds of asset classes, including currencies, indices, stocks, and commodities. Their education tools, such as webinars, training videos, and ebooks, are among the most extensive of any brokerage. In conclusion, while there is some disagreement about the awards Fortrade has received, there is no doubt about the company’s commitment to providing a high-quality trading platform and educational resources for its users. Whether you’re a beginner or an experienced trader, Fortrade offers a range of tools and services to help you navigate the world of forex trading. Please note that trading involves risk and it’s important to understand these risks before starting to trade.

How do I get in Contact with Fortrade?

Fortrade is a leading provider of online forex and CFD trading services. They offer advanced trading platforms for the trading of currencies, indices, stocks, and commodities. There are several ways to get in touch with Fortrade:. Email: You can reach them via email at [email protected]. Phone: They have several phone numbers listed for contact: +44 204 571 7564 +44 203 966 4506 +44 203 966 4506 +357 25 262083 These numbers are available for contact 24/5. Chat: They also offer a chat service for immediate assistance. . Fortrade’s offices are located at 43-45 Dorset Street, London, W1U 7NA, United Kingdom. Their office address is Michelin House, 81 Fulham Road, London. SW3 6RD. Before getting in touch with Fortrade, it’s important to understand that trading forex and CFDs involves significant risk and may not be suitable for all investors. Trading such products is risky and you may lose all of your invested capital.

Where are the Headquarters from Fortrade based?

Fortrade, a prominent player in the world of online trading solutions, has its headquarters based in London, England. The exact location is at the Michelin House, 81 Fulham Rd. Established in 2013, Fortrade has been providing a variety of services including training, market analysis, stock trading, and financial assets. Their strategic location in one of the world’s leading financial hubs allows them to stay at the forefront of the forex market, offering their clients up-to-date and comprehensive trading solutions. In addition to their London headquarters, Fortrade has a global presence with offices in Vancouver, BC, Canada at the 1200 Waterfront Centre, 200 Burrard Street, P.O. Box 48600, in Limassol, Cyprus at Office 504, 79 Athinon Street, and in Quatre Bornes, Plaines Wilhems District, Mauritius. This international footprint enables Fortrade to cater to a diverse clientele and understand the nuances of different financial markets. In the dynamic and fast-paced world of forex trading, Fortrade’s strategic locations and comprehensive services position them as a reliable and efficient platform for traders worldwide. Their commitment to providing quality online trading solutions continues to make them a preferred choice for many in the forex market.

What kind of Customer Support is offered by Fortrade?

Fortrade, a prominent player in the field of online currency and CFD trading, offers a comprehensive customer support system to cater to the needs of its diverse clientele. Live Chat and Email Support Fortrade’s customer care team is readily available to assist clients with any issues they may encounter. They offer a live chat function, providing real-time assistance to users. In addition to this, customers can also reach out to the support team via email. Phone Support For those who prefer a more direct line of communication, Fortrade provides the option to speak with their support team over the phone. This allows for immediate resolution of queries and fosters a personal connection between the company and its clients. Trading Conditions Overview Fortrade ensures that its clients are well-informed about their Forex and CFD trading conditions. All instruments are displayed in an easy-to-view or print PDF format. , providing users with a clear understanding of their trading environment. Positive Customer Reviews Fortrade’s commitment to providing excellent customer service is reflected in their positive customer reviews. Users have praised the responsive and helpful service provided by Fortrade, citing it as a standout feature compared to other platforms. In conclusion, Fortrade’s customer support system is robust and well-rounded, offering multiple channels of communication to ensure that all client queries and issues are addressed promptly and efficiently. This commitment to customer satisfaction positions Fortrade as a reliable choice for online currency and CFD trading.

Which Educational and Learning Materials are offered by Fortrade?

Fortrade, a renowned online trading platform, offers a comprehensive suite of educational and learning materials to help traders navigate the world of forex trading. These resources are designed to enhance trading skills and understanding of the market. Video Tutorials: Fortrade’s Online Academy provides a series of video tutorials. These tutorials cover a wide range of topics, including: How to change your password on the Fortrade Trading Platform. How to use the Desktop Fortrader trading platform. Understanding MetaTrader 4 Basics. What is leverage and how it is used in trading. What does it mean to hedge a trade. How to trade on financial markets using pending order. Understanding rollover and how Fortrade handles it. What is fundamental analysis and its importance in trading decisions. Technical Analysis - Part One and Part Two. How to use the Economic Calendar in trading. How to use patterns for trading. Trading Strategies with Moving Averages - Part I and Part II. . Trading Webinars: Fortrade also hosts trading webinars. These webinars are conducted by expert analysts and cover real-time market analysis, forex terminology, and trading strategies. These educational materials are designed to cater to both novice and experienced traders, providing them with the necessary tools and knowledge to make informed trading decisions.

Can anyone join Fortrade?

Fortrade is a platform that offers advanced trading platforms for online currency and CFD trading. However, it’s important to note that trading with Fortrade involves significant risk. According to their website, 78% of retail investor accounts lose money when trading CFDs with this provider. Therefore, it’s crucial that potential traders understand how CFDs work and whether they can afford to take the high risk of losing their money. To join Fortrade, one would typically follow these steps. Create a new account: Visit the account page and create a free new demo account. Go to Fortrader: You can connect to Webtrader on any browser, or download their free mobile app. Start demo trading: Choose products and start trading with virtual money risk-free. It’s worth mentioning that Fortrade offers a range of products for trading including currencies, stocks, indices, commodities, and more. They also provide various trading tools and educational resources to help traders navigate the financial markets. In conclusion, while anyone can technically join Fortrade, it’s important to be aware of the risks involved and to have a good understanding of how CFDs work before starting to trade. It’s always recommended to start with a demo account to get a feel for the platform and the trading process.

Who should sign up with Fortrade?

Fortrade is a platform that caters to a wide range of traders, from beginners to professionals. Here’s a detailed look at who should consider signing up with Fortrade:. Beginners: Fortrade is often recommended for those new to the trading scene. The platform is praised for its user-friendly interface and the ease of starting trades. It also provides comprehensive educational resources, which are particularly helpful for beginners. Forex Traders: With over 60 currency pairs available for trading. , Fortrade is a good choice for Forex traders. The spreads on major pairs like USD/GBP and EUR/USD average a reasonable 2 pips. CFD Traders: Fortrade offers a wide range of leveraged CFDs covering various asset classes including forex, stocks, bonds, indices, commodities, and cryptocurrencies. Traders can access leverage up to 1:30. Tech-Savvy Traders: Along with its own unique Fortrade platforms, Fortrade also provides more advanced traders with the industry-standard MT4 platform. This makes it a suitable choice for tech-savvy traders looking for a platform that supports advanced trading strategies. Traders Seeking Customer Support: Fortrade stands out for its great customer support. The customer service team receives accolades for being responsive and knowledgeable, addressing issues efficiently when they arise. However, potential users should be aware of certain limitations. Some reviews point out that withdrawal times can be slower than expected. , and there is an inactivity fee after 3 months of inactivity. Also, Fortrade offers only one account type. , which might not suit all traders. In conclusion, Fortrade is a reliable broker that offers a wide range of trading options, making it a good choice for both beginners and experienced traders. However, as with any financial decision, potential users should carefully consider their individual trading needs and circumstances before signing up.

Who should NOT sign up with Fortrade?

Fortrade, a worldwide financial trading platform and broker, has been serving over 1,000,000 retail investors in Forex and CFDs trading since its establishment in 2014. However, it’s important to note that this platform may not be suitable for everyone. Here are some categories of individuals who might want to reconsider signing up with Fortrade:. 1. Individuals with Limited Financial Knowledge: Forex trading is a complex field that requires a deep understanding of financial markets and trading strategies. Individuals who lack financial acumen, budgeting skills, or life skills might find it challenging to navigate the intricacies of Forex trading. 2. Individuals Seeking Quick Withdrawals: Some users have reported slower than expected withdrawal times. If quick access to funds is a priority, these individuals might want to consider other platforms. 3. Individuals Looking for Multiple Account Types: Fortrade offers only one type of account. Traders seeking a variety of account options, such as ECN or DMA accounts, might find Fortrade’s offerings limited. 4. Individuals from Certain Countries: It’s important to note that Fortrade’s services are not available in all countries. Therefore, individuals residing in countries where Fortrade does not operate should not sign up. 5. Inactive Traders: Fortrade charges an inactivity fee after 3 months of inactivity. Therefore, individuals who do not plan to trade regularly might want to consider other platforms that do not charge inactivity fees. In conclusion, while Fortrade has many strengths, including being regulated by multiple authorities and offering negative balance protection. , it may not be the right fit for everyone. As with any financial decision, it’s crucial for individuals to conduct thorough research and consider their specific needs and circumstances before choosing a trading platform.

Does Fortrade offer Discounts, Coupons, or Promo Codes?

Fortrade, a mid-size personal investing & trading store, does offer discounts, coupons, and promo codes, although they are not frequently issued. In the context of forex trading, these offers can provide traders with financial advantages, such as reduced trading costs or additional trading capital. Here are some details:. Promo Codes: Fortrade had a promo code that offered a $200 discount in November 2023. However, it’s important to note that these codes are not always available. Discounts: Fortrade occasionally offers discounts on its services. For instance, there were offers for up to 5% off. and up to 30% off. available at different times. Competitor Codes: Fortrade also acknowledges competitor codes, which could provide up to $200 off Personal Investing & Trading. Partnerships: Fortrade has partnerships with major retail websites, where additional deals can be found. For example, deals were available on eBay, offering up to 50% off TurboTax. , and on Walmart, offering up to 20% off Fortrade. Please note that these offers are subject to change and may not always be available. It’s recommended to check Fortrade’s official website or authorized coupon sites for the latest offers. Remember, while discounts and promo codes can provide financial benefits, it’s crucial to understand the terms and conditions associated with these offers. Always ensure that the offer aligns with your trading strategy and goals. Happy trading!.

Which Account Types are offered by Fortrade?

Fortrade, a premier provider of products, services, and platforms for online foreign exchange and CFD trading. , offers a single live trading account type. This account type is available to all traders, with no special conditions attached. The minimum deposit required to open a Fortrade Account is $100 USD. Trading accounts can be maintained in various currencies including USD, EUR, GBP, TRY, AUD, and CAD. In addition to the standard live trading account, Fortrade also offers an Islamic, Swap-Free account option on request. This account type adheres to the principles of Islamic law, which prohibits earning or paying interest. Fortrade offers Extended Swap-free status by default to all applicable trading accounts created by clients in non-Islamic countries. For beginners or those looking to practice forex trading in a risk-free environment, Fortrade provides a free demo trading account. This demo account does not expire, allowing users to practice at their own pace. Fortrade is regulated and supervised by the Financial Services Commission (FSC), ensuring that client funds are fully protected in accordance with the strictest rules and regulations. The platform offers a wide range of trading instruments including more than 50 currencies, 300 stock CFDs, and dozens of indices and commodities. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As a retail client, you can lose all, but not more than the balance of your trading account due to Fortrade’s negative balance protection.

How to Open a Fortrade LIVE Account?

Opening a Fortrade LIVE account involves a few steps. Here’s a detailed guide:. Step 1: Create a New Account To start, visit the Fortrade account page. Here, you’ll find the option to create a new account. This is your first step towards setting up a LIVE trading account. Step 2: Access Fortrader Once your account is set up, you can access Fortrader. Fortrader is an online trading platform that you can connect to from any browser. It provides a reliable trading solution via an internet connection and a few clicks of your mouse. Step 3: Download the Mobile App For those who prefer trading on the go, Fortrade offers a mobile app. You can turn your Android or iOS device into a virtual trading desk, making smart and successful trading decisions from the palm of your hand. Step 4: Start Trading Now that your account is set up and you have access to Fortrader, you can start trading. Choose from a variety of products and start trading with real money. Remember, trading involves risk and it’s important to make informed decisions. Fortrade offers a range of resources to help you stay informed, including live-streaming price quotes, charts, built-in indicators, and more. Please note that this guide is based on the information available as of 2023 and the process may vary. Always refer to the official Fortrade website for the most accurate and up-to-date information.

How to Open a Fortrade DEMO account?

Opening a Fortrade DEMO account is a straightforward process that allows beginners to practice forex trading in a 100% risk-free environment. Here are the steps to open a Fortrade DEMO account:. Create a New Account: Visit the account page on the Fortrade website and create a free new demo account. Go to Fortrader: You can connect to Webtrader on any browser, or download the free mobile app provided by Fortrade. Start Trading Practice: Choose products and start trading with virtual money risk-free. The Fortrade demo account does not expire, and it comes with virtual funds of €10,000. This allows you to practice trading as much as you want without any risk. Fortrade is a premier provider of products, services, and platforms for online foreign exchange and CFD trading. They offer a wide range of trading instruments including more than 50 currencies, 300 stock CFDs, and dozens of indices and commodities. Fortrade is regulated and supervised by the Financial Services Commission (FSC), and client funds are fully protected in accordance with the strictest rules and regulations. This ensures a safe and secure trading environment. Customer reviews indicate that Fortrade offers excellent tutorials and great customer support. However, some users have mentioned a lengthy withdrawal process and the unavailability of MT5. In conclusion, a Fortrade demo account is an excellent tool for beginners to practice forex trading in a risk-free environment. It provides a realistic trading experience with a wide range of trading instruments. The account does not expire, allowing users to practice as much as they want.

How Are You Protected as a Client at Fortrade?

As a client at Fortrade, you are protected in several ways:. Regulation: Fortrade is a regulated broker, which means it must adhere to strict regulatory standards designed to protect clients. Partnership with Tier 1 Banks: Fortrade partners with Tier 1 banks, which are the most financially stable and secure institutions globally. This partnership offers reliability, efficient payment processing, reduced counterparty risks, and better protection for client funds. User-friendly Interface: Fortrade’s platform has a flexible and user-friendly interface that allows you to control and customise your trading environment in a way that best suits your trading style and strategies. Education and Support: Fortrade provides educational resources and support to help you understand the market, trading strategies, and platform functionality. Risk Management Tools: Fortrade offers various risk management tools to help you manage your trading risks effectively. Transparency: Fortrade is transparent about its fees, charges, and trading conditions, which helps you make informed trading decisions. Remember, while these protections are in place, trading Forex and CFDs involves a high level of risk, and it’s possible to lose more than your initial investment. Always trade responsibly and consider your risk tolerance and financial circumstances before trading.

Which Funding methods or Deposit Options are available at Fortrade?

Fortrade, a global financial trading platform, offers a variety of funding methods and deposit options for its clients. These options are designed to provide flexibility and convenience, catering to the diverse needs of its vast user base. Credit and Debit Cards. Fortrade accepts all major credit and debit cards. This is one of the most popular and convenient ways to deposit funds into a Fortrade account. The process is straightforward and typically allows for immediate access to the deposited funds. Bank Transfers. Bank transfers are another common method for depositing funds into a Fortrade account. While this method may take a bit longer for the funds to become available in the user’s account, it is a reliable and secure option. PayPal. Fortrade also accepts PayPal as a funding method. This digital payment service provides a quick and easy way for users to deposit funds. It’s a popular choice among users who prefer digital wallets for their transactions. Neteller. Neteller is another digital wallet option accepted by Fortrade. Known for its speed and security, Neteller is a preferred choice for many users, especially those involved in online trading. Please note that the availability of these funding methods and deposit options can depend on the user’s country of residence. Therefore, it’s recommended to check the specific available payment methods on the Fortrade website or in the Fortrade Members area. In the context of forex trading, having a variety of deposit options is crucial. It allows traders to choose a method that best suits their financial situation and trading strategy. Whether a trader prefers using a credit card for its convenience, a bank transfer for its security, or a digital wallet for its speed, Fortrade aims to cater to these preferences and provide a seamless trading experience. Please note that withdrawal times from Fortrade may vary between 5 and 15 days, depending on the method of withdrawal selected. This is an important consideration for traders who need to have timely access to their funds. In conclusion, Fortrade offers a wide range of deposit options to cater to the diverse needs of its users. Whether you’re a novice trader or a seasoned professional, Fortrade aims to provide a convenient and secure platform for your trading activities.

What is the Minimum Deposit Amount at Fortrade?

Fortrade, a premier provider of products, services, and platforms for online foreign exchange and CFD trading, offers a wide range of trading instruments. These include more than 50 currencies, 300 stock CFDs, and dozens of indices and commodities. Minimum Deposit The minimum deposit required to open a Fortrade Account is $100 USD. This makes it accessible for many traders, from beginners to more experienced ones. It’s important to note that while the minimum deposit is set at $100, Fortrade recommends that traders make an initial minimum deposit of at least £500. This is likely to ensure that traders have sufficient capital to manage their risk effectively. Account Types Fortrade makes a single live trading account type available. This simplifies the process for traders as they do not have to navigate through multiple account types to find one that suits their trading needs and financial capabilities. In addition to the standard account, Fortrade also offers an Islamic, Swap-Free account option on request. This caters to traders who must comply with the Islamic law that prohibits earning interest on overnight positions. Deposits and Withdrawals Fortrade accepts a wide range of deposit options including all major credit/debit cards, bank transfers, and Neteller. This provides flexibility for traders as they can choose a deposit method that is most convenient for them. As for withdrawals, they may take between 5 and 15 days, depending on the method of withdrawal selected. Safety and Security When it comes to safety and security, Fortrade is regulated and supervised by the Financial Services Commission (FSC). Client funds are fully protected in accordance with the strictest rules and regulations. This provides assurance to traders that their funds are safe and that the broker operates under a high standard of accountability and transparency. In conclusion, Fortrade, with its low minimum deposit requirement and a range of trading instruments, presents a viable option for traders looking to venture into the world of forex and CFD trading.

Which Withdrawal methods are available at Fortrade?

Fortrade, a prominent player in the online currency and CFD trading industry, offers its users a variety of withdrawal methods. Here’s a detailed look at these methods:. Bank Wire Transfer Bank Wire Transfer is one of the most common methods for withdrawing funds from a Fortrade account. Users simply need to log in, navigate to the “Deposits/Withdrawals” section located inside the drop-down menu in the right corner of the screen, select Bank Wire Transfer as the preferred withdrawal method, and enter the amount and any other account information that may be required. It’s important to note that all requests are processed within two business days of being submitted. However, withdrawals made by Bank Wire Transfer usually take 3-5 business days to reach your account. Credit/Debit Cards Another popular withdrawal method at Fortrade is via credit or debit cards. The process is similar to that of Bank Wire Transfer, with users needing to select their credit/debit card as the preferred withdrawal method in the “Deposits/Withdrawals” section. Withdrawals to credit/debit cards can sometimes take up to 15 business days. Neteller Fortrade also accepts Neteller as a withdrawal method. As with the other methods, users need to select Neteller as the preferred withdrawal method in the “Deposits/Withdrawals” section. The processing time for Neteller withdrawals may vary. It’s worth noting that due to anti-Money Laundering regulations, funds can only be remitted to the same account used to initially fund your trading account. Additionally, any International Telegraphic Transfer (TT) Fees incurred by Fortrade are passed on to the customer. Most International TTs are approximately $40. In conclusion, Fortrade offers a range of withdrawal methods to cater to the diverse needs of its users. Whether it’s through Bank Wire Transfer, credit/debit cards, or Neteller, users have multiple options to access their funds. However, it’s crucial to be aware of the processing times and potential fees associated with each method to ensure a smooth and efficient withdrawal process.

Which Fees are charged by Fortrade?

Fortrade, a leading online broker for CFDs, forex, commodities and more, charges several types of fees for its services. Here’s a detailed breakdown:. Trading Fees: Trading with Fortrade involves fees from $10 USD. These fees are associated with the trading activities and vary depending on the account traders selected. Spreads: Fortrade charges spreads from 2 pips. The spread is the difference between the buy and sell price of a financial instrument at any given time. Commission: Fortrade offers commission-free trading depending on the account traders selected. However, commission fees at Fortrade depend on the trading instrument and the type of account you hold. Some instruments, like forex and indices, are commission-free, while others, such as shares and cryptocurrencies, carry a commission. Inactivity Fee: An inactivity fee is charged for accounts with no trading activity for a specified period of time. This fee can be easily avoided by simply maintaining regular trading activity. Deposit and Withdrawal Fees: Fortrade deposit fees are quite competitive, with most payment methods charging zero fees. However, some payment providers may impose their own fees. Withdrawal fees at Fortrade are also relatively low. The exact fee depends on the withdrawal method and the amount requested. Please note that all these fees are subject to change and it’s always a good idea to check the latest fee structure on the Fortrade’s website. Also, always check with your payment provider for any additional charges before depositing funds into your Fortrade account.

What can I trade with Fortrade?

Fortrade offers a wide range of trading possibilities. Here’s a detailed list of what you can trade with Fortrade:. Currencies: Fortrade offers trading in a variety of currency pairs. This includes major, minor, and exotic currency pairs, providing a comprehensive platform for forex trading. Stocks: You can trade Contract for Differences (CFDs) on hundreds of stocks. These stocks are traded in stock exchanges across Europe, the US, Australia, and Hong Kong. Indices: Fortrade provides the opportunity to trade on several indices. This allows traders to speculate on the price movements of major global markets. Commodities: Trading in commodities is facilitated through CFDs. This includes precious metals like gold and silver, energy products like oil and gas, and agricultural products. Cryptocurrencies: Fortrade also offers the ability to trade in cryptocurrencies. This includes popular digital currencies like Bitcoin, Ethereum, and others. US Treasuries and ETFs: Traders can also trade in US treasuries and a variety of Exchange-Traded Funds (ETFs). Please note that trading in CFDs carries risks and may not be suitable for everyone. Always ensure you understand these risks before you start trading.

Which Trading Platforms are offered by Fortrade?

Fortrade, a leading online forex and CFD broker, offers a variety of trading platforms to cater to the diverse needs of traders worldwide. Desktop Fortrader: This platform allows trading of various currencies and CFDs with intuitive software. It boasts accuracy and functionality of fully automated transaction execution. Traders can download the platform for secure and easy online trading. It provides live rates, charts, and built-in indicators to enhance trading strategies and maximize capital. Mobile Fortrader: This platform is designed for traders on the go. It turns any Android or iOS device into a virtual trading floor. It enables traders to make successful trading decisions from the palm of their hand. It increases the chances of profiting from both rising and falling markets. Web Fortrader: This platform provides direct access to international financial markets without the need for software installation. It is a reliable solution for internet trading, accessible within a few clicks, regardless of the browser type or version. With Web Fortrader, traders can open, modify, and close transactions - at the office, on vacation, or anywhere else. It is fully synchronized, fast, and easy to use. In addition to these, Fortrade also offers MetaTrader 4 (MT4). This platform can be downloaded to Mac or Windows devices and can be used as a web trader. It is one of the most popular trading platforms in the forex industry due to its advanced charting capabilities, multiple language support, automated trading ability, and the ability to customize and backtest trading strategies. Each of these platforms is designed to provide traders with a seamless and efficient trading experience, whether they are trading from their desktop, mobile device, or directly from the web.

Which Trading Instruments are offered by Fortrade?

Fortrade, a multi-asset, multi-regulated broker, offers a wide range of trading instruments. Here are the details:. Forex Trading Fortrade offers over 60 currency pairs, including a good selection of majors, minors, and exotics. Trading takes place via MT4 or Fortrade’s proprietary, low-latency terminal, and spreads on the USD/GBP pair average a reasonable 2 pips. Stock Trading Fortrade offers leveraged CFDs on a wide range of stocks from the UK, US, Hong Kong, Australia, and a range of European companies with variable spreads and no commissions. CFDs are derivative contracts that do not entail ownership of the underlying stock. Professional traders can also access a decent list of Direct Market Access stocks. CFD Trading Fortrade’s list of leveraged CFDs covers a wide range of asset classes including forex, stocks, bonds, indices, commodities, and cryptocurrencies. Traders can access leverage up to 1:30 and will trade with zero commission, fast execution, and low latency on MetaTrader 4 or the bespoke platform. Crypto Trading Fortrade offers CFD trading on the largest cryptos by market cap paired with USD. Crypto CFD availability depends on local regulations and they are not offered in jurisdictions including the UK due to restrictions. In addition to the above, Fortrade also offers trading opportunities in commodities, indices, ETFs, and bonds. The brand is known for its strong regulatory oversight, helpful educational content, and support for the market-leading MetaTrader 4 platform. It’s a good pick for newer traders.

Which Trading Servers are offered by Fortrade?

Fortrade, a leading provider in the world of online currency and CFD trading, offers its users a variety of advanced trading platforms. These platforms are designed to cater to the diverse needs of traders, providing them with a robust and reliable environment for trading in the forex market. Fortrader is one of the primary trading platforms offered by Fortrade. It is a user-friendly platform that provides traders with a wide range of tools and features to enhance their trading experience. Traders can access Fortrader from any browser in the world, making it a convenient choice for those who prefer web-based trading. In addition to Fortrader, Fortrade also offers the MetaTrader 4 (MT4) platform. MT4 is one of the most popular trading platforms in the forex industry, known for its advanced charting capabilities, automated trading features, and a wide range of technical indicators. The Fortrade MT4 WebTrader is accessible from both PC and Mac browsers, without any download required. This provides traders with access to multiple CFD asset classes including forex, stocks, commodities, indices, ETFs, and Bonds. Furthermore, Fortrade has made trading more accessible by offering mobile versions of their platforms. The Mobile Fortrader turns your Android or iOS device into a virtual trading desk, allowing you to trade on the go. Similarly, the MT4 Android App provides traders with the flexibility to manage their trades from their Android devices. To help traders practice their trading strategies, Fortrade provides a demo account with a €10,000 virtual investment, available on either the Fortrader or MetaTrader 4 platforms. This allows traders to familiarize themselves with the platforms and test their trading strategies in a risk-free environment. In conclusion, Fortrade offers a variety of trading servers, each designed to provide traders with a secure, reliable, and advanced trading environment. Whether you’re a beginner or an experienced trader, Fortrade has a platform that can cater to your trading needs.

Can I trade Crypto with Fortrade? Which crypto currencies are supported by Fortrade?

Yes, you can trade cryptocurrencies with Fortrade. Fortrade is an online broker that facilitates Contract for Difference (CFD) trading. This includes trading of Bitcoin derivatives. When trading Bitcoin with Fortrade, you can open a trading position in two ways. Trade the currency on one of Bitcoin’s online exchanges. Trade Bitcoin derivatives in the form of a Contract for Difference (CFD) via an electronic, commission-free trading platform. There are several advantages to CFD trading on Bitcoin with Fortrade. Affordable and simple: Fortrade offers lower commissions and intuitive trading platforms. The power of leverage: Typically 1:10. To buy 1 Bitcoin worth more than $1,000, you only need $150 in your trading account. 24/5 availability: Fortrade provides around-the-clock trading opportunities. Short trading: You have the ability to ‘Sell’ the asset even when you’re not holding it, in the hope that its price will go down. In addition to Bitcoin, Fortrade also supports trading of other cryptocurrencies such as Ethereum. However, the specific list of supported cryptocurrencies may vary and it’s recommended to check their official website for the most accurate and up-to-date information. Please note that trading cryptocurrencies involves risk, just like any other investment. It’s important to understand the market and the specific risks associated with cryptocurrency trading before getting started. Always trade responsibly and consider seeking advice from financial professionals if needed.

What is the Leverage on my Fortrade Trading Account?

Verkennen. Leverage is a popular trading tool that allows investors to borrow capital to increase their position, greater than what is available from their cash balance. This is also known as margin trading. It can play a critical role since it can amplify your trading power in your trading endeavors and potentially add to your gains or result in sharp losses. When you are participating in the CFD market and you are interested in taking advantage of higher leverage, you will see that typical leverage in this arena differs between different regulations. For example, FCA regulations allow a range of between 2:1 and 30:1 leverage, while CySEC offers different leverage limits for different instruments. By utilizing leverage, you may potentially enhance your gains but at the same time, the very opposite could happen if shares tank, meaning that you will owe a more significant amount to the brokerage firm. For instance, by choosing the maximum available leverage with Fortrade, which is 200:1, traders can have 200 times the purchasing power on their deposits. This leverage is not actually that high since most competitors offer 500:1, 1000:1, or unlimited leverage. Please note that while leverage can increase your potential profits, it can also amplify your potential losses. It’s important to understand how it works and the risks involved before you start trading with leverage. Always trade responsibly.

What kind of Spreads are offered by Fortrade?

Fortrade, a premier provider of products, services, and platforms for online foreign exchange and CFD trading, offers a wide range of trading instruments. These include more than 50 currencies, 300 stock CFDs, and dozens of indices and commodities. Spreads: Trading with Fortrade involves spreads from 2 pips. This is a competitive offering in the forex market, where spreads can significantly impact profitability. The spread is the difference between the buy and sell price of a currency pair, and it represents the cost of trading. A lower spread means lower trading costs. Fees: In addition to spreads, Fortrade charges fees from $10 USD. It’s important to note that these fees can vary depending on the account type selected by the trader. Commission: Fortrade offers commission-free trading depending on the account traders selected. This means that traders do not have to pay any additional charges on their trades, which can help maximize their profits. Fortrade is regulated and supervised by the Financial Services Commission (FSC), and client funds are fully protected in accordance with the strictest rules and regulations. The minimum deposit required to open a Fortrade Account is $100 USD. In conclusion, Fortrade offers competitive spreads and fees, making it a viable choice for both new and experienced forex traders. However, as with any financial decision, potential traders should carefully consider their individual financial circumstances and risk tolerance before trading with Fortrade.

Does Fortrade offer MAM Accounts or PAMM Accounts?

In the world of Forex trading, MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts are popular tools that allow experienced traders to manage the funds of multiple investors on a single trading platform. MAM accounts allow a fund manager to manage multiple trading accounts from a single interface. This means that the manager can execute trades on all accounts simultaneously, ensuring that each account follows the same trading strategy. On the other hand, PAMM accounts allow investors to pool their funds together to be managed by a single trader, also known as a PAMM manager. The PAMM manager trades their own money along with the pooled funds of the investors. Profits or losses are divided among the investors according to their share in the total investment. However, based on the information available, it is not explicitly stated whether Fortrade, a provider of advanced trading platforms for online currency and CFD trading. , offers MAM or PAMM accounts. It would be best to contact Fortrade directly for the most accurate and up-to-date information regarding their account offerings. Remember, while MAM and PAMM accounts can potentially offer substantial profits, they also carry risks. Forex trading is inherently risky and unpredictable, and even skilled traders can experience losses. Therefore, it’s crucial to thoroughly research and consider these factors before deciding to invest in a MAM or PAMM account.

Does Fortrade allow Expert Advisors?

Fortrade, a prominent player in the world of online forex and CFD trading, does indeed allow the use of Expert Advisors (EAs) for its users. Fortrade’s Platform Compatibility Fortrade is compatible with MetaTrader 4 (MT4), one of the most popular trading platforms in the forex industry. MT4 is known for its advanced charting capabilities, automated trading features, and the ability to use EAs. EAs are software programs that automate trading strategies on behalf of the trader, allowing for trades to be placed automatically based on predefined parameters. Expert Advisors on Fortrade The use of EAs on Fortrade’s MT4 platform provides traders with a significant advantage. These EAs offer features including one-click trading, automatic trading, and a variety of order types. This means that traders can automate their trading strategies, allowing the EAs to monitor the markets and execute trades when certain conditions are met. This can be particularly beneficial in the fast-paced world of forex trading, where market conditions can change rapidly. Benefits of Using EAs on Fortrade The use of EAs can help traders to take advantage of market opportunities that they might otherwise miss. By automating their trading strategies, traders can ensure that they are always ready to act on market movements, even when they are not actively monitoring the markets themselves. Furthermore, EAs can help to eliminate the emotional aspect of trading, which can often lead to poor decision-making. Conclusion In conclusion, Fortrade does allow the use of Expert Advisors on its MT4 platform, providing traders with a powerful tool to automate their trading strategies and potentially increase their trading success. Whether you’re a novice trader looking to simplify your trading process, or an experienced trader looking to take your trading to the next level, the use of EAs on Fortrade could be a valuable addition to your trading toolkit.