FXCC Review 2026

What is FXCC?

FXCC, or Forex Central Clearing Corp., is a leading STP/ECN broker established in 2010. It specializes in Forex and CFDs, providing institutional-grade services and economical trading opportunities to retail clients interested in a wide range of products. FXCC operates under the regulation of CySEC and SVG. , and is a member of the EU’s Markets in Financial Instruments Directive (MiFid). It uses the renowned MetaTrader 4 platform. , and stands out by offering highly competitive spreads, a transparent execution model, and a welcoming environment for any trade strategy, devoid of any commission. One of the key features of FXCC is its ECN XL Account, also known as the “ZERO” account. This account type is characterized by variable spreads starting from 0.0 pips, maximum leverage of 1:500, depending on regulation, and devoid of trading commission and deposit fees. An exclusive swap-free account option is also available for Islamic traders. FXCC provides its clients with direct access to a liquid forex ECN model. In this model, all clients obtain the same access to the same liquid markets, where trades are executed instantaneously, without any delay, or re-quotes. Unlike Dealing Desk brokers, FXCC does not take the other side of client trades. FXCC’s extensive product range includes over seventy Forex pairs, cryptocurrencies, indices, metals, and energies. It also provides brokerage services for forex and CFD traders with more than 70 currency pairs; spot platinum, palladium, gold and silver; 8 of the top cryptocurrencies including Bitcoin, Ethereum, Litecoin and Ripple; 12 of the world’s leading stock indices; and spot WTI and Brent crude oil. In addition to its comprehensive product portfolio, FXCC offers a number of other advantages. These include premier trading conditions, instructive educational tools, and a commitment to client interests that makes it a reliable ally for traders.

What is the Review Rating of FXCC?

- 55brokers: 55brokers rated FXCC with a score of 80. This rating was last checked at 2024-01-06 08:00:08. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated FXCC with a score of 65. This rating was last checked at 2024-01-06 20:03:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated FXCC with a score of 88. This rating was last checked at 2024-01-05 22:12:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated FXCC with a score of 15. This rating was last checked at 2024-03-12 21:55:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of FXCC?

FXCC is a forex broker that offers ECN/STP trading, which means it connects traders directly to the interbank market and provides transparent and competitive pricing. FXCC has several advantages for forex traders, such as:. Low spreads and commissions: FXCC offers spreads from zero pips on its ECN accounts, which means traders can save on trading costs and enjoy higher profits. FXCC also does not charge any commissions on its ECN accounts, unlike some other brokers that may charge hidden fees or commissions. FXCC’s spreads are among the lowest in the industry and reflect its access to top liquidity providers. High leverage: FXCC allows traders to use up to 1:500 leverage on its ECN accounts, which means they can control larger positions with a smaller amount of capital. This can magnify both profits and losses, so traders should be careful and use risk management tools such as stop-loss orders and limit orders. FXCC’s leverage is higher than some other brokers that may offer lower leverage or restrict leverage for certain instruments. Free VPS: FXCC provides a free virtual private server (VPS) for its clients, which means they can run their trading robots or strategies 24/7 without interruption or latency. A VPS is a remote computer that hosts a trading platform and executes trades automatically based on predefined rules. A VPS can improve the performance and reliability of trading systems, especially for scalpers or day traders who need fast execution. MetaTrader 4 platform: FXCC supports the popular MetaTrader 4 (MT4) platform, which is one of the most widely used platforms in the forex market. MT4 offers advanced charting tools, technical indicators, automated trading features, market news, economic calendar, and more. MT4 also has a multi-account manager (MAM) feature that allows traders to manage multiple accounts from one interface. MT4 is available for desktop, web, and mobile devices. Educational resources: FXCC provides various educational resources for its clients, such as market analysis, webinars, articles, videos, tutorials, and FAQs. These resources can help traders learn more about forex trading strategies, techniques, tips, news events, and market trends. FXCC also has a ‘Trader’s Corner’ blog where it posts regular updates and insights on the forex market. These are some of the pros of FXCC that make it a good option for forex traders who are looking for low-cost trading with high leverage and access to the ECN market. However, there are also some cons of FXCC that potential clients should be aware of before opening an account with them. Some of the cons of FXCC are:. No U.S.-based clients: FXCC does not accept U.S.-based clients or U.S.-citizens as customers due to regulatory restrictions imposed by the U.S. authorities on forex brokers operating in their jurisdiction. This means that U.S.-based traders who want to trade with FXCC will have to use a third-party intermediary service such as an offshore subsidiary or an offshore entity. Only one trading platform: FXCC only supports MT4 as its trading platform for both forex and CFDs. This means that clients who want to trade other instruments such as stocks or cryptocurrencies will have to switch to another broker or platform that supports those markets. Limited customer support: FXCC only offers multilingual support via email or phone for its clients. This means that clients who prefer live chat or social media support may have.

What are the Cons of FXCC?

FXCC, a well-known forex broker, has several drawbacks that potential traders should be aware of. Here are some of the key cons:. Limited Trading Tools: FXCC only offers the MetaTrader 4 platform. This could be a disadvantage for traders who prefer a variety of platforms or specific analysis tools. The lack of diversity in trading platforms may limit the analytical capabilities of traders. Limited Market Selection: Compared to other brokers, FXCC’s selection of trading markets is relatively small. Notably, they do not offer share CFDs. This could be a significant drawback for traders interested in a wide range of markets. No Copy Trading Solution: FXCC does not offer a copy trading solution. This feature, which allows beginners to copy the trades of more experienced traders, can be a valuable learning tool. Its absence may make FXCC less appealing to novice traders. Does Not Accept U.S. Clients: FXCC does not accept U.S. based traders or U.S. citizens as clients. This geographical restriction could limit the broker’s reach and exclude potential traders. Higher-Than-Average Risk: FXCC is considered a broker with higher-than-average risk. This might deter conservative traders or those with a low-risk tolerance. In conclusion, while FXCC offers several advantages such as competitive spreads and ECN/STP broker model. , the cons listed above could make it less attractive to certain traders. As always, potential traders should conduct thorough research and consider their individual needs before choosing a forex broker.

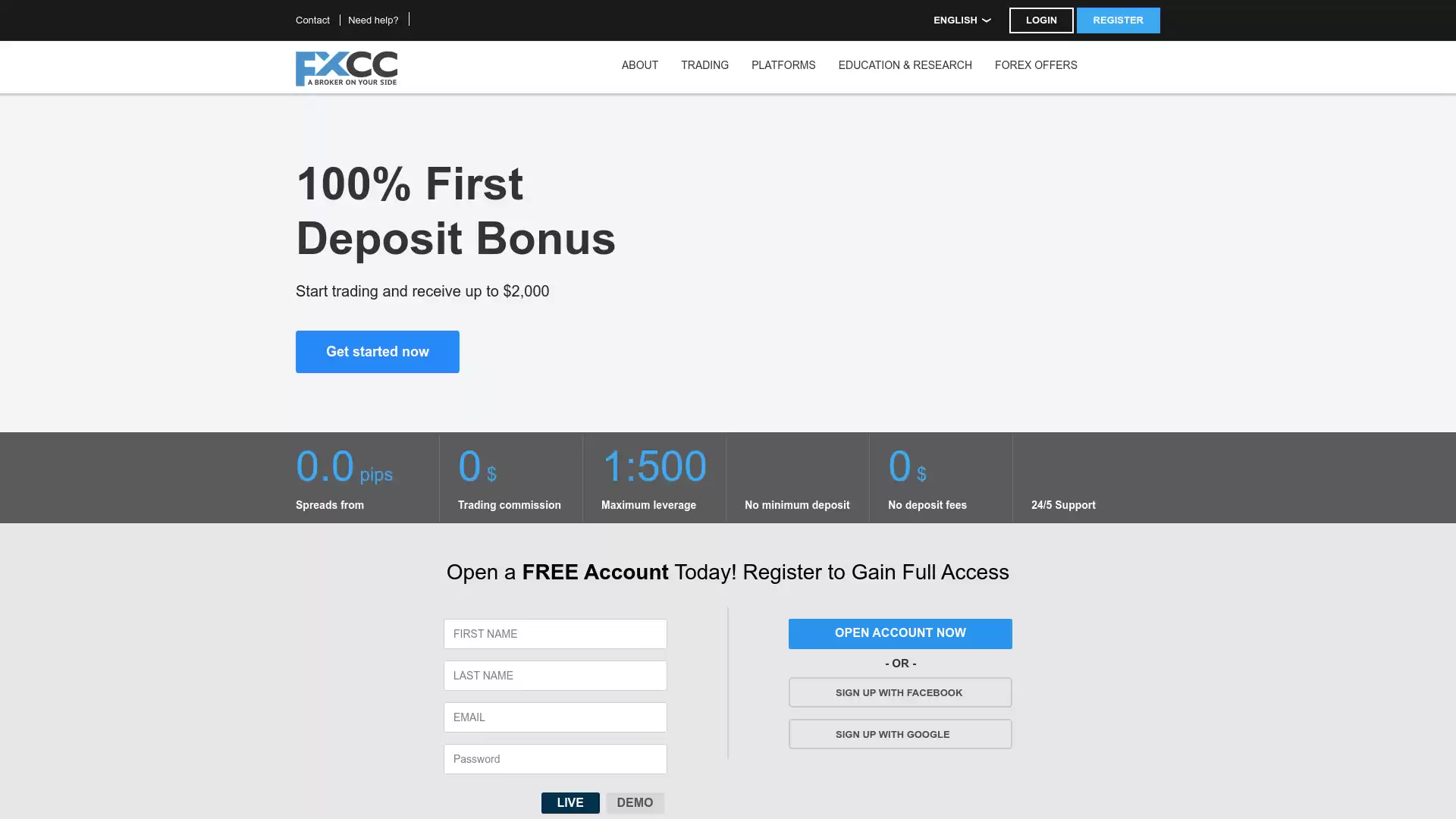

What are the FXCC Current Promos?

FXCC, a leading online Forex broker, offers several exciting promotions to both new and existing clients. These promotions are designed to enhance the trading experience and provide additional benefits to traders. 100% First Deposit Bonus. : This promotion offers a 100% bonus on the first deposit, up to $2,000. This is a fantastic opportunity for traders to increase their trading capital and take advantage of the interbank spreads and zero commission offered by FXCC. ECN XL Account. : The ECN XL account is a zero account that offers zero commissions, zero swaps, zero mark-up, and tight interbank spreads starting from as low as zero. This account type is perfect for traders looking for excellent trading conditions. Free VPS Service. : FXCC provides a free VPS service for traders who want to elevate their trading to a new level of professionalism. This service is especially beneficial for traders who use automated trading systems. Global Range of Funding Options with No Deposit Fees. : FXCC offers a wide range of funding options, including traditional methods like bank transfer, debit and credit cards, as well as global secure services like China Union Pay, Netbanx Asia, Skrill, Neteller, and Boleto. All transfer methods have the highest levels of security protocol embedded, ensuring the security and confidentiality of traders’ funds. Please note that all promotions are subject to terms and conditions, and traders are advised to read these carefully before participating. FXCC strives to provide unparalleled levels of customer service and a transparent and ethical business proposition, enabling traders to have the best possible base from which to potentially become successful.

What are the FXCC Highlights?

FXCC, a leading regulated and award-winning ECN Forex broker, offers a multitude of features that make it a top choice for forex traders. Here are some of the key highlights:. Forex ECN and Straight Through Processing: FXCC provides Forex ECN, straight through processing, which ensures that your orders are sent directly to liquidity providers without passing through a dealing desk. This can result in faster execution times and more competitive spreads. Liquidity Pool of Institutional Partners: FXCC has a liquidity pool of institutional partners. This means that they have agreements with major banks and financial institutions, which can provide more liquidity and better pricing for traders. Competitive Spreads and Pricing: FXCC offers tight spreads and competitive price quotes. They offer spreads as low as 0.0 pips and $0 commission. , which can significantly reduce the cost of trading. Security and Speed: FXCC provides unrivalled levels of security and speed. This ensures that your funds are safe and that your trades are executed quickly. Wide Range of Trading Instruments: FXCC offers a wide range of trading instruments, including Forex, Indices, Commodities, and Crypto. MetaTrader 4 Platform: FXCC provides access to the reliable MetaTrader 4 charting platform. This platform is popular among traders for its advanced charting tools, technical analysis indicators, and compatibility with EAs (Expert Advisors). Promotions and Bonuses: FXCC offers various promotions and bonuses, such as a 100% First Deposit Bonus up to $2000. Free VPS Service: FXCC offers a free VPS (virtual private server) service. This can enhance your trading performance with speed, security, and accessibility. Regulated by the CySEC: FXCC is a trustworthy broker regulated by the CySEC. , a top-tier European regulator. This adds an extra layer of security for traders. Please note that trading involves risk and it’s important to understand the risks involved before starting to trade.

Is FXCC Legit and Trustworthy?

FXCC, or FX Central Clearing, is a Forex broker that has been in operation since 2010. It is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the SVG FSA of St. Vincent & the Grenadines. This regulation by respected financial authorities indicates that FXCC is a low-risk trading company and not a scam. FXCC operates on an ECN/STP trading model. This means that all orders, stops, limits, and trades are executed with counterparties. FXCC does not take the other side of the trade, which is a significant factor in establishing trust with a broker. This model creates a transparent trading environment with minimal interference from the broker. Customer reviews of FXCC are generally positive. Users have praised the broker’s trading conditions, currency pairs, and demo account. They have also highlighted the broker’s no dealing desk approach, affordable platform, and excellent customer service. FXCC offers competitive pricing with favorable trading conditions. They provide raw spreads, zero commissions, fast withdrawals, state-of-the-art security, low-latency servers for rapid trade execution, and a 100% first deposit bonus. These features contribute to a top-notch trading experience. However, it’s important to note that conditions for traders might vary depending on the jurisdiction. Also, the broker provides only the MT4 platform and no other alternatives. The range of instruments is strictly limited to forex and CFD. , and the education section is relatively poor. In conclusion, based on the available information, FXCC appears to be a legitimate and trustworthy Forex broker. However, as with any financial decision, potential users should conduct their own research and consider their individual trading needs before choosing a broker.

Is FXCC Regulated and who are the Regulators?

FXCC is a regulated forex broker that offers trading services in various financial instruments, such as currencies, commodities, indices, and cryptocurrencies. FXCC has two main entities: FX Central Clearing Ltd and Nevis Central Clearing Ltd, which operate under different jurisdictions and regulations. FX Central Clearing Ltd is a Cyprus Investment Firm (CIF) that is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the Investment Services and Activities and Regulated Markets Law of 2007 (Law 144 (I)/2007). FX Central Clearing Ltd provides services to the residents of countries from the European Economic Area (EEA) only. FX Central Clearing Ltd is also a member of the Association of Cyprus International Investment Firms (ACIIF), a representative body of Cyprus Investment Firms (CIFs). FX Central Clearing Ltd applies the Markets in Financial Instruments Directive (MiFID), which provides a harmonized regulatory environment for investment services across the EEA. Nevis Central Clearing Ltd is an International Business Corporation that is incorporated in Nevis as per the Nevis Business Corporation Ordinance, 2017. Nevis Central Clearing Ltd does not provide service to residents of the EEA countries and USA. Nevis Central Clearing Ltd complies with all the requirements of incorporation under the Nevis Business Corporation Ordinance, 2017. FXCC also has a registered entity in Vanuatu, which is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 14576. This entity does not offer trading services to clients outside of Vanuatu. FXCC claims to be committed to provide transparency in trading and keeping clients’ funds safe. FXCC also offers various features and benefits to its clients, such as low spreads, high leverage, fast execution, multiple account types, free education materials, and customer support. FXCC has been in the market since 2010 and has received positive reviews from some online sources. However, FXCC also has some drawbacks and risks that potential clients should be aware of before opening an account with them. Some of these include limited regulation scope, lack of transparency on fees and commissions, high minimum deposit requirement ($500), restricted payment methods, poor customer service quality, and frequent technical issues. FXCC is a forex broker that operates under different regulations depending on its entity. Clients should carefully read the terms and conditions of each entity before choosing one to trade with. Clients should also do their own research and due diligence before investing their money with any broker.

Did FXCC win any Awards?

FXCC, a leading regulated and award-winning ECN Forex broker. , has indeed been the recipient of several trading awards. Their reputation and popularity have been recognized by many judges in the industry, who have exacting, high standards. The recognition FXCC has received is truly global. They have been nominated for awards in various regions including Europe, the UAE, Asia, and the Middle East. This widespread international validation is a testament to FXCC’s determination to be a multilingual broker, offering an unparalleled level of service globally. It’s important to note that these awards are not just for show. They reflect FXCC’s commitment to providing excellent service to its clients. For instance, FXCC provides clients with access to a liquid Forex model (ECN), ensuring all trades are executed immediately, with no delays or re-quotes. This differentiates FXCC from Dealing Desk brokers, as client orders, stops, limits, and trades are executed with counter-parties, meaning FXCC is firmly on the client’s side. Moreover, FXCC offers optimal conditions, educational tools, and the use of the MetaTrader 4 platform. Their most popular trading account, the “ECN XL Account”, offers variable spreads from 0.0 pips, with maximum leverage 1:500 depending on regulation. This demonstrates FXCC’s commitment to providing competitive forex spreads and transparent pricing. In conclusion, FXCC’s multiple awards and nominations across various regions, coupled with their commitment to providing excellent service and optimal trading conditions, solidify their position as a leading, globally recognized Forex broker. Their awards serve as a testament to their high standards and dedication to their clients’ success in the Forex market.

How do I get in Contact with FXCC?

FXCC, a renowned player in the forex trading industry, is committed to providing top-notch support to its clients. They have a dedicated team ready to assist you in every step of your trading experience. Their multilingual customer support is available 24 hours a day, from Monday to Friday. This ensures that traders from around the globe can get the help they need, regardless of their location or time zone. To get in touch with FXCC, you can use the following contact details:. Address: Suite 7, Henville Building, Main Street, Charlestown, Nevis. Telephone: +44 203 150 0832. Fax: +44 203 150 1475. Email: info@fxcc.net. . Whether you have a question about forex trading, need assistance with your trading account, or want to stay connected with FXCC, their team is ready to help. Remember, successful forex trading requires not just a good strategy and execution, but also timely support and assistance. With FXCC’s commitment to trader support, you can focus on what matters most - your trading.

Where are the Headquarters from FXCC based?

FXCC, also known as FX Central Clearing Ltd, is a renowned STP/ECN broker specializing in Foreign Exchange (Forex) and CFDs. The company was founded in 2010. by a group of foreign exchange market professionals. The headquarters of FXCC are based in Yermasoyia, Limassol, Cyprus. More specifically, the address is 2 Samou Street Amorosa Ctr Fl 2, Limassol, Limassol, 4043, Cyprus. This strategic location in the heart of Europe allows FXCC to operate within the European Union (EU) and the broader Europe, Middle East, and Africa (EMEA) regions. FXCC’s mission is simple yet ambitious: To become the world’s favourite Forex broker. With its headquarters in Cyprus, a country known for its robust financial services sector, FXCC is well-positioned to achieve this goal. For any inquiries, FXCC can be reached at their phone number +357 25870750. or via email at support@fxcc.net. As a key player in the forex market, FXCC competes with other prominent brokers and trading platforms. However, its commitment to providing high-quality services and maintaining an active operating status. sets it apart in the competitive landscape of forex trading.

What kind of Customer Support is offered by FXCC?

FXCC, a renowned player in the forex market, offers a comprehensive customer support system. Their support is designed to assist traders in every step of their trading experience. 24/7 Multilingual Customer Support FXCC provides round-the-clock customer support from Monday to Friday. Their support team is multilingual, catering to a global clientele. This ensures that language is never a barrier in receiving quality support. Contact Channels FXCC can be contacted through various channels. They have a main office and international call centres. The contact details are as follows:. Address: Suite 7, Henville Building, Main Street, Charlestown, Nevis. Telephone: +44 203 150 0832. Fax: +44 203 150 1475. Online Support In addition to phone support, FXCC also offers online support. Traders can log in to their accounts for direct assistance. Forex Trading Queries FXCC’s customer support is well-equipped to answer questions about forex trading and forex trading accounts. This ensures that traders have all the necessary information to make informed trading decisions. Stay Connected FXCC encourages traders to stay connected with them. They are ready to assist with any queries regarding new or existing accounts. In conclusion, FXCC’s customer support is comprehensive, accessible, and tailored to the needs of forex traders. Their commitment to providing quality support makes them a reliable choice for traders.

Which Educational and Learning Materials are offered by FXCC?

FXCC offers a comprehensive collection of Forex eBooks as part of its educational program. These eBooks are considered as a highly popular online educational resource suitable for all traders, regardless of their level of experience. Each eBook is a complete guide that helps traders understand key trading concepts and create a Forex trading strategy tailored to their individual goals. Here are some of the topics covered:. The Right Trading Strategy to Match your Lifestyle: This eBook focuses on breaking the myth of matching your personality to trading. It provides tried and tested strategies to ensure that your trading matches the strategy chosen. Traders Mindset: This eBook emphasizes the importance of having your emotions under control when trading Forex. It explains the steps to reach a state of mind where one can eliminate emotional decisions which may lead to trading losses. Money Management: This eBook describes the importance of perfecting money management as an integral part of a trading plan. It provides examples of the results and consequences of right and wrong risk management. Straight Through Processing (STP): This eBook focuses on STP and the benefits of this model for the clients. How to Build a Winning Trading Plan: This eBook emphasizes the importance of creating a rock-solid trading plan, on which the foundations of individual development and success will be built. Technical and Fundamental Analysis: This eBook provides a brief overview of the various aspects of fundamental and technical trading. The use of Stop Orders: This eBook explains how to limit and control your losses through the effective use of stop orders. These eBooks are offered for free as part of FXCC’s educational program. They are designed to help traders develop a successful trading plan and make well-informed trading decisions.

Can anyone join FXCC?

FXCC, or Forex Central Clearing, is a renowned player in the forex trading industry. It offers a variety of services and features to its clients, including the opportunity to participate in forex trading. However, not everyone can join FXCC. There are certain eligibility criteria that need to be met. Eligibility Criteria. The eligibility criteria for joining FXCC are as follows:. Client Type: Both new and existing clients of FXCC are eligible. Account Type: The client must hold an ECN XL account. First Qualified Deposit: The client must make the first qualified deposit. A qualified deposit refers to the first deposit operation that adds new funds to the client’s wallet through means of payment offered by FXCC. Balance adjustments, withdrawal of available balance and re-sending it again, Introducer/Affiliate/Partner rebates or commissions will not be considered new funds. Opt-in: The client must elect to opt-in to take part in the offer by expressly confirming their decision by submitting a request by email at support@fxcc.net. First Deposit Bonus. FXCC offers a 100% First Deposit Bonus for the first qualified deposit made by eligible clients in their respective wallet with FXCC during the promotion period. The bonus can be found in the “My Wallet Balances” section of the client’s cabinet and can be transferred to any trading account and back to the wallet with the equal proportion to the balance at any time. The maximum amount of First Deposit Bonus credited by FXCC to any particular eligible client at any time cannot exceed $2,000 US (or equivalent). Withdrawal. Withdrawal from the eligible client’s wallet will result in the bonus being automatically cancelled and removed in the same proportion to the withdrawn amount. FXCC reserves the right to decline any bonus request at its sole discretion, without the need to provide any justification or explaining the reasons for such a decline. In conclusion, while anyone can apply to join FXCC, not everyone will be accepted. The eligibility criteria are quite specific and must be met in order to become a member. It’s also important to note that FXCC has the right to decline any bonus request at its sole discretion. Therefore, potential clients should carefully read and understand the terms and conditions before deciding to join FXCC. It’s always a good idea to consult with a financial advisor or do thorough research before making any major financial decisions.

Who should sign up with FXCC?

FXCC, or Forex Central Clearing, is a reputable online brokerage platform that offers a variety of services and features to traders of different backgrounds. Here are some key points to consider when deciding whether to sign up with FXCC:. 1. Wide Market Access: FXCC provides access to a wide range of markets, including forex, indices, cryptos, energies, and metals. This broad market access allows traders to diversify their portfolios and explore different trading opportunities. 2. High Leverage: FXCC offers high leverage up to 1:500. , which can amplify potential profits. However, it’s important to note that while high leverage can increase profits, it can also magnify losses. 3. User-Friendly Platform: FXCC uses the reliable MetaTrader 4 charting platform. , which is known for its user-friendly interface and advanced trading tools. This makes it a good choice for both beginners and experienced traders. 4. Low Trading Fees: FXCC has competitive trading fees, with spreads as low as 0.0 pips and no commission. This can help traders maximize their profits. 5. Educational Resources: FXCC offers a variety of educational resources, including a ‘Trader’s Corner’ blog. These resources can be particularly beneficial for new traders looking to learn more about the forex market. 6. Trustworthy Broker: FXCC is regulated by the Cyprus Securities and Exchange Commission (CySEC). , a top-tier European regulator. This means that FXCC adheres to strict regulatory standards, providing traders with an added layer of security. 7. No Minimum Deposit: FXCC allows traders to get started with a $0 minimum deposit. , making it accessible to traders with different budget constraints. In conclusion, FXCC is a good option for traders looking for a trustworthy broker that offers wide market access, high leverage, a user-friendly platform, low trading fees, and valuable educational resources. However, as with any investment, it’s important to do your own research and consider your financial goals and risk tolerance before signing up with a broker.

Who should NOT sign up with FXCC?

FXCC, or Forex Central Clearing, is a well-regarded forex broker that offers a range of services and features. However, it may not be the right choice for everyone. Here are some types of traders who might want to consider other options:. Beginners: FXCC’s trading conditions are often praised by experienced traders. , but beginners might find the platform challenging to navigate. Some users have reported losing their deposit along with the bonus. , which could be a significant setback for those new to forex trading. MT5 Users: FXCC currently only offers MetaTrader 4 (MT4) accounts. Traders who prefer using MetaTrader 5 (MT5) for its additional features and capabilities might be disappointed. Traders Seeking Comprehensive Documentation: Some users have noted the absence of certain documents on FXCC’s website. Traders who value transparency and easy access to all necessary information might find this lack of documentation concerning. Risk-Averse Traders: While FXCC offers attractive features like low spreads and zero commission. , forex trading involves substantial risk. Traders unwilling to risk their capital might want to explore other investment avenues. Remember, it’s essential to do thorough research and consider your individual trading needs and goals before choosing a forex broker. It’s also a good idea to try out a demo account before committing to a platform. Happy trading! ?.

Does FXCC offer Discounts, Coupons, or Promo Codes?

FXCC, a renowned player in the forex trading industry, does indeed offer various promotional offerings. These promotions are designed with the client in mind, aiming to enhance their trading experience. 100% First Deposit Bonus: One of the notable promotions is the 100% first deposit bonus. Traders can start trading and receive up to $2,000. This is a fantastic opportunity for traders to earn exclusive bonuses and trade with the World’s Best Trading Account, the XL Account. The XL Account offers interbank spreads and no commission. To avail of this bonus, traders simply need to open an account, make a deposit, and they can receive an incredible 100% deposit bonus up to $2,000. Additional Promotions: FXCC strives to provide new and existing real clients with various promotional offerings. These promotions are created to provide the best possible base for clients to potentially become successful traders. Security and Funding Options: FXCC also offers a global range of funding options with no deposit fees. Along with the standard, traditional methods of funding through bank transfer, debit, and credit cards, FXCC also offers an unrivalled suite of options from global secure services. All transfer methods have the highest levels of security protocol embedded, ensuring your security and confidentiality is protected. In conclusion, FXCC not only provides a platform for forex trading but also offers attractive promotions and secure funding options to enhance the trading experience of its clients.

Which Account Types are offered by FXCC?

FXCC offers a variety of account types to cater to the diverse needs of traders. Here are the details:. ECN XL Account This account type offers variable spreads starting from 0.0 pips. There is no commission and no minimum deposit requirement. The lot size starts from 0.01 and the maximum leverage is 1:500. This account type also offers free funding and a 100% first deposit bonus. It supports ECN type execution and allows the use of Expert Advisors (EA). Hedging is allowed and an Islamic account option is available. ECN Promo Account This account type is similar to the ECN XL account with variable spreads starting from 0.0 pips. It also has no commission and no minimum deposit requirement. The lot size starts from 0.01 and the maximum leverage is 1:500. This account type also offers free funding and a 100% first deposit bonus. It supports ECN type execution and allows the use of Expert Advisors (EA). Hedging is allowed and an Islamic account option is available. Demo Account FXCC also offers a demo account for new or experienced traders to practice their forex trading skills or test new strategies with zero investment. This account provides real-time prices and real forex market volatility. It offers access to a full-featured Metatrader4 trading platform and allows practice trading with $10,000 virtual funds. Islamic, Swap-Free Trading Account In addition to the above, FXCC also provides an Islamic, Swap-Free Trading Account. This account type is designed to respect the principles of Islamic law that prohibit ‘Riba’ or interest. All account types allow trading in Forex, Metals, Energies, and Indices. They also support scalping and news trading. The available base currencies are USD, EUR, and GBP. The funding fee is waived. The stop out level is set at 50%. The server locations include New York, London, Germany, and Hong Kong. Please note that terms and conditions apply for the bonuses. It’s always recommended to understand these terms before opening an account. For more detailed information, you can visit the official FXCC website.

How to Open a FXCC LIVE Account?

Opening a live account with FXCC, a renowned forex broker, involves a few straightforward steps. Here’s a detailed guide:. Step 1: Start the Process The first step is to navigate to the FXCC website. Look for the blue “Register” button located at the top right of the landing page. Clicking on this button will initiate the registration process. Step 2: Open Trading Account The next step is to open a trading account. The process for opening a live account is the same as that for a demo account. Step 3: Choose Account Type FXCC offers a range of ECN accounts to suit all traders. You can choose from various account types such as ECN XL, ECN Standard, and ECN Advanced. Each account type comes with its own features and benefits. Step 4: Complete Registration After choosing the account type, complete the registration process by providing the necessary details. Step 5: Fund Your Account Once your account is set up, the next step is to fund it. FXCC offers easy funding options. Step 6: Start Trading With your account funded, you’re now ready to start trading. FXCC provides a variety of platforms and supports trading of forex, metals, indices, and energies. Remember, FXCC is a regulated and licensed broker, offering real ECN/STP, security of funds, and 24/5 support. It also allows for easy withdrawal. Please note that trading involves risk and it’s important to understand the risks involved before you start trading. It’s also recommended to start with a risk-free demo trading account to practice your forex trading skills or test new strategies with zero investment. I hope this guide helps you in opening a live account with FXCC. Happy trading!.

How to Open a FXCC DEMO account?

Opening a FXCC DEMO account is a straightforward process that allows you to practice forex trading in a risk-free environment. Here’s a step-by-step guide:. Visit the FXCC Website: Navigate to the official FXCC website. Select ‘Open Demo Account’: Look for the option to open a demo account. This is typically found in the main navigation menu or in the account section of the website. Fill in Your Details: You’ll be asked to provide some basic information. This usually includes your name, email address, and phone number. Choose Your Trading Parameters: Select your preferred trading parameters. This might include the type of currency you’d like to trade in. , and the amount of virtual money you’d like to start with. Submit Your Application: Once you’ve filled in all the necessary information, submit your application. Check Your Email: After submitting your application, check your email for a confirmation message. This email will contain details on how to access your demo account. Start Practicing: Now that your demo account is set up, you can start practicing your trading strategies in a risk-free environment. Remember, a demo account is an excellent way to learn about forex trading without risking real money. It allows you to understand the dynamics of the forex market, test your trading strategies, and become comfortable with the trading platform before you start trading with real money. Happy trading!.

How Are You Protected as a Client at FXCC?

As a client at FXCC, you are protected in several ways:. 1. Membership in the Investor Compensation Fund (ICF). : FXCC is a member of the ICF, which provides protection for client money. 2. High Standards of Legal Compliance. : FXCC is committed to the highest standards of international legal compliance. The company’s legal framework complies with the requirements necessary for both European and international scope. 3. Security and Monitoring. : FXCC guarantees the safety and security of clients’ trading accounts. All financial requests are closely monitored to ensure funds safety and smooth operational procedures. 4. Regulation and Licensing. : FXCC is a fully regulated broker since 2010, committed to treating clients fairly with a focus on providing customer protection and trading security. 5. Trust and Transparency. : FXCC operates on a true STP/ECN model, warranting transparency and no conflict of interest. 6. Private Data Protection. : FXCC uses state-of-the-art Secure Sockets Layer (SSL) network security protocol to keep all clients’ private information safe. 7. Risk Management. : FXCC regularly identifies, assesses, and controls each type of risk associated with its operations. 8. Client Fund Segregation. : All client funds are held in segregated accounts, completely separate from any and all FXCC corporate accounts. 9. Leading International Banks. : Client funds are secured in leading international banks. Please note that this information is based on the details available on the FXCC website as of the last update and may be subject to change. For the most accurate and up-to-date information, please visit the official FXCC website or contact their customer service directly.

Which Funding methods or Deposit Options are available at FXCC?

FXCC, a reputable forex broker, offers a variety of secure funding options to cater to the diverse needs of its global clientele. These deposit methods are designed to provide convenience, security, and speed, ensuring a seamless trading experience. 1. Traditional Methods: Bank Transfer: This is a standard method of funding, where you can transfer funds directly from your bank account to your FXCC account. The processing time for deposits is within 1 hour, while withdrawals take 5-10 working days to clear. Debit and Credit Cards: FXCC accepts major debit and credit cards. This method provides instant deposit within 1 hour. However, the withdrawal process takes a bit longer, typically around 5-10 working days. . 2. E-payment Systems: Skrill and Neteller: These are popular e-payment systems that offer instant deposits. The minimum deposit amount is $0, and the maximum is determined by the client’s personal account limit. Withdrawals are processed in real time. Rapid Transfer and Sofort: These are also available as funding options, providing instant deposit and real-time withdrawal. . 3. Cryptocurrency: Bitcoin (BTC), Ethereum (ETH), and Tether (USDT): FXCC also accepts deposits in cryptocurrencies. The minimum deposit amounts are 0.0005 BTC and 0.005 ETH. The processing time for both deposits and withdrawals is within 15 minutes. . 4. Other Global Secure Services: China Union Pay and Netbanx Asia: These services cater to clients in Asia, offering real-time deposit and withdrawal. Boleto: This is a payment method popular in Brazil, also offering real-time deposit and withdrawal. . It’s worth noting that FXCC offers a “zero deposit fee” promotion, meaning that FXCC will pay the deposit fees charged by the payment processor when you deposit funds with them through any of FXCC’s acceptable payment methods. However, FXCC reserves the right to not pay your deposit fees or reclaim any deposit fees paid by FXCC for your funds in case of any form of abuse is found relating to the “zero deposit fee” promotion. Please note that the company’s minimum withdrawal amount per method is $50 unless otherwise specified. Also, for first deposits made with FXCC, you should consider the account type required minimum. Before choosing a deposit method, it’s important to consider the processing times, fees, and limits associated with each option. Always ensure that the chosen method aligns with your trading goals and strategies.

What is the Minimum Deposit Amount at FXCC?

FXCC, a renowned player in the Forex trading industry, offers different account types, each with its own minimum deposit requirement. The minimum deposit amount varies depending on the account type you choose:. XL Account: The minimum deposit for an XL Account is 100 USD. Standard Account: For a Standard Account, the minimum deposit is 10,000 USD. Advanced Account: An Advanced account requires a minimum deposit of 100,000 USD. . It’s important to note that while FXCC does not require a minimum deposit, it is recommended to deposit at least 500 USD when registering a live trading account. FXCC provides a variety of deposit methods, each with its own set of deposit limits. For instance, one method allows a minimum deposit of 20 USD with a maximum daily limit of 10,000 USD, weekly limit of 25,000 USD, and monthly limit of 45,000 USD. Another method has a minimum deposit limit of 500 USD with no maximum limit. FXCC’s flexible deposit options and competitive minimum deposit requirements make it a preferred choice for many Forex traders. However, potential traders should consider their individual financial circumstances and trading goals before deciding on the appropriate deposit amount.

Which Withdrawal methods are available at FXCC?

FXCC, a renowned player in the Forex market, offers a variety of withdrawal methods to cater to the diverse needs of its global clientele. These methods include:. Credit/Debit Card: A widely accepted and convenient method for transactions. However, it’s important to note that the funds may take up to five to ten business days to reflect on your card statement. Skrill: An e-wallet that is popular among Forex traders. Withdrawals via Skrill will reflect on your account statement once processed. Neteller: Another e-wallet service that is commonly used in the Forex market. Similar to Skrill, withdrawals via Neteller will reflect on your account statement once processed. Sofort: A real-time banking solution that allows for quick and easy transactions. Rapid Transfer: As the name suggests, this method allows for rapid transfer of funds. CASHU: A digital payment solution that is widely used in North Africa and the Middle East. Neosurf: A prepaid card service that allows users to make online purchases without providing personal information. Netbanx Asia: A payment gateway that caters specifically to the Asian market. Bank Wire: A traditional method of transferring funds. It’s important to note that profits will be withdrawn using Bank Wire Transfer. It’s worth noting that in order to comply with the Anti-Money Laundering Directive, withdrawal requests will only be sent the same way the funds were received and up to the initial deposited amounts. Profits will be withdrawn using Bank Wire Transfer. For example, if you have funded your account with 1000 USD using Neteller, and now you wish to withdraw 1500 USD, FXCC will refund your initial 1000 USD to Neteller and the 500 USD profit can then be withdrawn via Bank Wire Transfer. Please bear in mind that the processing time for each withdrawal method may vary. It’s always recommended to check with the payment method provider for any queries. Remember, the company’s minimum withdrawal amount per method is $50 unless otherwise specified. In conclusion, FXCC provides a wide range of withdrawal methods to ensure a smooth and convenient trading experience for its users. Always remember to choose a withdrawal method that best suits your trading needs and preferences. Happy trading!.

Which Fees are charged by FXCC?

FXCC, a well-regulated ECN/STP Broker, offers a range of financial services to its clients. The broker is known for its competitive fees, spreads, and commission structures, which are designed to accommodate the needs of different types of traders. Fees: Trading with FXCC involves fees from $3 USD. These fees are applicable depending on the account type that traders select. Spreads: FXCC offers spreads from 1.3 pips to 1.5 pips. The spread is the difference between the bid price and the ask price of a currency pair. It represents the cost of trading on the forex market. Commissions: FXCC is known as a “commission-free” broker. This means that traders do not have to pay any commission on their trades, depending on the account type they select. Inactivity Fee: An inactivity fee of $5 USD will apply. This fee is charged when there is no trading activity in a client’s account for a certain period of time. FXCC also offers a range of secure funding options including Credit/Debit Cards, Bank Wire transfers plus Skrill, and Neteller. The deposit and withdrawal fees for these methods are as follows:. Credit/Debit Cards: No deposit or withdrawal fee. Bank Wire Transfer: No deposit fee. Withdrawal fee ranges from $30 USD to $45 USD. Skrill: No deposit fee. Withdrawal fee is 2.7%. Neteller: No deposit fee. Withdrawal fee is 2.0%. . It’s important to note that FXCC reserves the right to not pay your deposit fees or reclaim any deposit fees paid by FXCC for your funds in case of any form of abuse is found relating to the “zero deposit fee” promotion. Overall, FXCC’s fee structure is designed to provide a fair and transparent trading environment for its clients. It’s always recommended for traders to understand the fee structure of their broker before starting to trade.

What can I trade with FXCC?

FXCC, a well-regulated ECN/STP Broker. , provides a wide range of trading options for its clients. Here’s a detailed overview:. Forex Trading FXCC offers competitive fees with spreads as low as 0.0 pips and $0 commission. Over 70 currency pairs are available, providing more opportunities than most competitors. Indices Trade a dozen major indices, including the Dow Jones, NASDAQ, S&P, and DAX. Prices are competitive with zero commissions and a minimum price fluctuation of 0.01. Commodities FXCC allows trading on spot platinum, palladium, gold, and silver. Also, spot WTI and Brent crude oil can be traded. Cryptocurrencies Trade eight of the most popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. High leverage up to 1:10 is available on BTC and 1:5 on other cryptos. CFDs Trade currencies, metals, energies, indices, and cryptos with flexible leverage. 24/5 customer support is available to assist new clients while the MT4 platform comes with free tutorials and user guides. FXCC employs an electronic communications network/straight-through processing (ECN/STP) model. , so you get tight forex dealing spreads from top Interbank liquidity providers. The broker supports the popular MetaTrader 4 trading platform with multiple terminal capabilities and a multi-account manager. You can also access the FXCC MT4 platforms on Android and iOS smartphones and tablets. In addition to access to daily market analysis and market education resources, you can get a 100% first deposit bonus of up to $2,000 when you open an FXCC XL account. If you want to check out this broker’s services and trading platform, just open a free demo account with no minimum deposit. Please note that trading involves risk and it’s important to understand these risks before starting to trade.

Which Trading Platforms are offered by FXCC?

FXCC, a leading regulated and award-winning ECN Forex broker, offers a variety of trading platforms to cater to the diverse needs of traders worldwide. MetaTrader 4 is one of the most popular trading platforms offered by FXCC. It is highly regarded for its reliability, robustness, and reactivity. The platform contains all the necessary trading tools and resources to allow traders to conduct research and analysis, enter and exit trades, and use third-party automated trading software, Expert Advisors (EAs). Moreover, MetaTrader 4 has perfected its own programming language - MQL4, enabling traders to programme their own automated trading robots. FXCC also offers MetaTrader 4 Mobile, which surpasses the standards of other mobile apps. This platform offers the widest range of devices for Forex trading. It allows traders to access the FX markets on all preferred devices; mobiles, tablets, laptops, PCs, and through using remote servers. The MetaTrader 4 Multi Terminal is another platform provided by FXCC. It is intended for simultaneous management of multiple accounts. This platform is particularly useful for traders who manage multiple trading accounts or fund managers who require simultaneous access to multiple accounts. Lastly, FXCC offers the MAM (Multi Account Manager) platform. This platform is designed for professional traders who use sub-accounts to manage clients’ funds. MAM allows managing multiple accounts from a single interface. In conclusion, FXCC offers a range of platforms, each with its unique features and benefits, catering to the diverse needs of traders. Whether you are a part-time trader looking to maximise your potential and opportunity for success, or consider yourself to be a full-time professional, FXCC has the right solution for you.

Which Trading Instruments are offered by FXCC?

FXCC, a renowned forex trading platform, offers a wide range of trading instruments to its clients. Here’s a detailed list:. Currency Pairs: FXCC provides its clients with 30 currency pairs. These include but are not limited to:. AUD CAD (Australian Dollar vs. Canadian Dollar). AUD CHF (Australian Dollar vs. Swiss Franc). AUD JPY (Australian Dollar vs. Japanese Yen). AUD NZD (Australian Dollar vs. New Zealand Dollar). AUD USD (Australian Dollar vs. US Dollar). CAD CHF (Canadian Dollar vs. Swiss Franc). CAD JPY (Canadian Dollar vs. Japanese Yen). CHF JPY (Swiss Franc vs. Japanese Yen). EUR AUD (Euro vs. Australian Dollar). EUR CAD (Euro vs. Canadian Dollar). EUR CHF (Euro vs. Swiss Franc). EUR GBP (Euro vs. British Pound). EUR JPY (Euro vs. Japanese Yen). EUR NZD (Euro vs. New Zealand Dollar). EUR USD (Euro vs. US Dollar). GBP AUD (British Pound vs. Australian Dollar). GBP CAD (British Pound vs. Canadian Dollar). GBP CHF (British Pound vs. Swiss Franc). GBP JPY (British Pound vs. Japanese Yen). GBP NZD (British Pound vs. New Zealand Dollar). GBP USD (British Pound vs. US Dollar). NZD CAD (New Zealand Dollar vs. Canadian Dollar). NZD CHF (New Zealand Dollar vs. Swiss Franc). NZD JPY (New Zealand Dollar vs. Japanese Yen). NZD USD (New Zealand Dollar vs. US Dollar). USD CAD (US Dollar vs. Canadian Dollar). USD CHF (US Dollar vs. Swiss Franc). USD JPY (US Dollar vs. Japanese Yen). Spot Metals: Apart from currency pairs, FXCC also offers Spot Gold and Spot Silver. Other Products: FXCC also allows trading in precious metals like Gold, Silver, Platinum, and Palladium. It also offers trading in Crude Oil Brent Cash, West Texas, and Natural Gas. Indices in the UK, US, Europe, and Asia are also available for trading. Please note that the availability of these trading instruments may vary based on the type of account held by the client. For more information, it’s always best to check the official FXCC website or contact their customer service.

Which Trading Servers are offered by FXCC?

FXCC, a leading ECN Forex broker, offers a range of trading servers to its clients. These servers are designed to enhance trading performance by providing speed, security, and accessibility. Speed: FXCC provides VPS hosting as an extremely affordable and manageable alternative method of experiencing connection speeds that are very close to the fastest available for trading applications. This results in significantly improved trade-order execution. Security: Whether trading on (and through) MetaTrader, or using advanced bespoke backend and trading software, security is a critical aspect of VPS application trading. Windows’ Server VPS templates are continuously updated to protect both servers and users from intruders and other threats. In terms of physical hardware, great care is taken to prevent critical failures. Accessibility: Having your own dedicated server to run your trading applications, helps to ensure the smooth running of your trading. Tools and protocols are generally built in to the overall VPS service, such as Remote Desktop access which allows users to easily connect to their dedicated server. Traders can access trading platforms from different devices: PCs, laptops, tablets, and smartphones, without interrupting the software running on the VPS. FXCC offers the following platforms: MetaTrader 4, MetaTrader 4 Mobile, MetaTrader 4 multi terminal and MAM (multi account manager). The server locations include New York, London, Germany, and Hong Kong. The latency from the FXCC server located in New York to various locations is as follows: Amsterdam: 84.82 ms, Frankfurt: 92.48 ms, London: 67.98 ms. In conclusion, FXCC provides a comprehensive suite of trading servers and platforms, ensuring optimal performance for forex trading.

Can I trade Crypto with FXCC? Which crypto currencies are supported by FXCC?

Yes, you can trade cryptocurrencies with FXCC. They offer the opportunity to buy and sell the most popular cryptocurrencies instantly on the MT4 platform. The platform provides best-in-class execution and competitive spreads. The cryptocurrencies supported by FXCC are as follows. Bitcoin (BTC): Minimum price fluctuation is 0.01, contract size is 1 BTC, minimum trade size is 0.01, and leverage is 1:10. Bitcoin Cash (BCH): Minimum price fluctuation is 0.01, contract size is 1 BCH, minimum trade size is 0.01, and leverage is 1:5. Ethereum (ETH): Minimum price fluctuation is 0.01, contract size is 1 ETH, minimum trade size is 0.01, and leverage is 1:5. Litecoin (LTC): Minimum price fluctuation is 0.01, contract size is 1 LTC, minimum trade size is 0.01, and leverage is 1:5. Monero (XMR): Minimum price fluctuation is 0.01, contract size is 1 XMR, minimum trade size is 0.01, and leverage is 1:5. ZCash (ZEC): Minimum price fluctuation is 0.01, contract size is 1 ZEC, minimum trade size is 0.01, and leverage is 1:5. Dash (DAS): Minimum price fluctuation is 0.01, contract size is 1 DAS, minimum trade size is 0.01, and leverage is 1:5. Ripple (XRP): Minimum price fluctuation is 0.00001, contract size is 100 XRP, minimum trade size is 0.01, and leverage is 1:5. Please note that trading in the Forex market, CFD, and cryptocurrency involves high risks and is not suitable for everyone. Before investing money, you need to adequately assess the level of your expertise and be aware of the risks, particularly in the context of trading with leverage.

What is the Leverage on my FXCC Trading Account?

Leverage in forex trading is a tool that allows traders to control larger positions than what their account balance would otherwise allow. At FXCC, leverage is provided to traders to enhance their trading capacity and increase their potential return on investment. Leverage is essentially a loan provided by the broker to the trader. Without the facility of leverage, many retail traders wouldn’t have the required capital in their accounts to trade effectively. For instance, if a trader wants to trade a standard lot of USD/JPY without margin, they would need $100,000 in their account. But if the margin requirement is only 1%, they would only need $1,000 in their account. The leverage, in this case, would be 100:1. The leverage you use on any forex trade will depend on the restrictions your broker allows you to apply and the level of risk versus reward you want to take on. For example, a scalper might access higher leverage levels but require less margin in their account because their trades are short term, and the overall risk per euro or dollar on each trade is far less than a swing trader. However, it’s important to note that leverage is a double-edged sword. While it can magnify profits, it can also magnify losses. Therefore, forex traders must learn to manage this force and employ risk management strategies to mitigate potential forex losses. As for the specific leverage on your FXCC trading account, it can vary. For non-EU clients, FXCC offers leverage up to 1:500. For professional traders, leverage up to 1:100 is available. However, the exact leverage you can use will depend on various factors, including your trading style, risk tolerance, and the specific guidelines laid down by regulatory bodies. In conclusion, leverage is a powerful tool in forex trading that can significantly enhance your trading capacity and potential returns. However, it’s crucial to use it responsibly and in conjunction with effective risk management strategies to protect your trading capital.

What kind of Spreads are offered by FXCC?

FXCC, a regulated broker, offers tight spreads to its clients. In the context of Forex, a spread is the difference between the purchase price and the sale price of an asset. There are two types of prices on the market: Bid - the amount that the buyer of the monetary asset plans to spend, and Ask – the price that the seller of a monetary asset plans to accept. The spread is the difference between these two, the ‘bid and ask’, that occurs during the transaction. From the point of view of an online broker, Forex spread is one of the primary income sources, along with commissions and swaps. The spread is calculated as the difference between the buying price and the selling price, measured in points or pips. In Forex, a pip is the fourth digit after the decimal point in the exchange rate. The size of the spread varies with each broker and by the volatility and volumes associated with a particular instrument. The most traded currency pair is the EUR/USD and usually, the lowest spread is on EUR/USD. The spread can be fixed or floating and is proportional to the volume placed in the market. FXCC provides a unique tool that shows the history of spread. Traders can see the spread spikes and the time of spike in a single glimpse. This tool reveals the clients’ precise average spread over recent sessions. Trading with FXCC will involve fees from $3 USD, spreads from 1.3 pips to 1.5 pips, and commission-free trading depending on the account type traders select. An inactivity fee of $5 USD will apply.

Does FXCC offer MAM Accounts or PAMM Accounts?

FXCC, a well-established broker founded in 2010 and regulated by the CySEC. , offers a Multi Account Manager (MAM) solution. The MAM software, known as MetaFx MAM, is designed for professional traders with multiple accounts and asset managers. It provides a simple and secure way to manage multiple forex trading accounts. The FXCC MAM application is ideally suited for professional traders or money managers who need to trade MT4 multiple accounts simultaneously. It also caters to traders needing to view account status and history for multiple accounts, and those making group trades on behalf of multiple accounts. The MAM solution supports instant execution, broker control, and simple server updates through a server-side plugin. It allows Expert Advisor (EA) trading of managed accounts from the client side. The software also supports unlimited trading accounts and standard and mini lot accounts for the best allocation advantage. The MAM software offers extremely flexible options for trade allocations. These include lot allocation, percentage allocation, proportional by balance, proportional by equity, and percent allocation. However, there is no explicit information available about FXCC offering Percentage Allocation Money Management (PAMM) accounts. PAMM accounts are a type of forex trading account where investors allocate funds to account (money) managers, who then trade the investments from one master account. This allows investors to profit from trading without needing to carry out technical market analysis or execute the trades themselves. In conclusion, while FXCC offers a robust MAM solution, it’s unclear whether they provide PAMM accounts. For the most accurate and up-to-date information, it’s recommended to directly contact FXCC or visit their official website.

Does FXCC allow Expert Advisors?

Yes, FXCC does allow the use of Expert Advisors (EAs) in forex trading. FXCC is a trading platform that describes itself as a broker on your side. It provides a user-friendly experience for both beginners and experienced traders. The platform is designed to be on the client’s side, ensuring that all trades made by every user are executed at the rate at which they made it. One of the key features of FXCC is its compatibility with Expert Advisors. Expert Advisors are tools that help a lot in trading by keeping track of analytics. These automated trading systems allow traders to set specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. FXCC also offers other features that enhance the trading experience. For instance, it provides a VPS service by BeeksFX, ensuring higher security at the user’s end. It also supports ECN, which is one of the most important features provided by FXCC. In conclusion, FXCC not only allows the use of Expert Advisors but also provides a range of features that support and enhance automated trading.