Global Prime Review 2026

What is Global Prime?

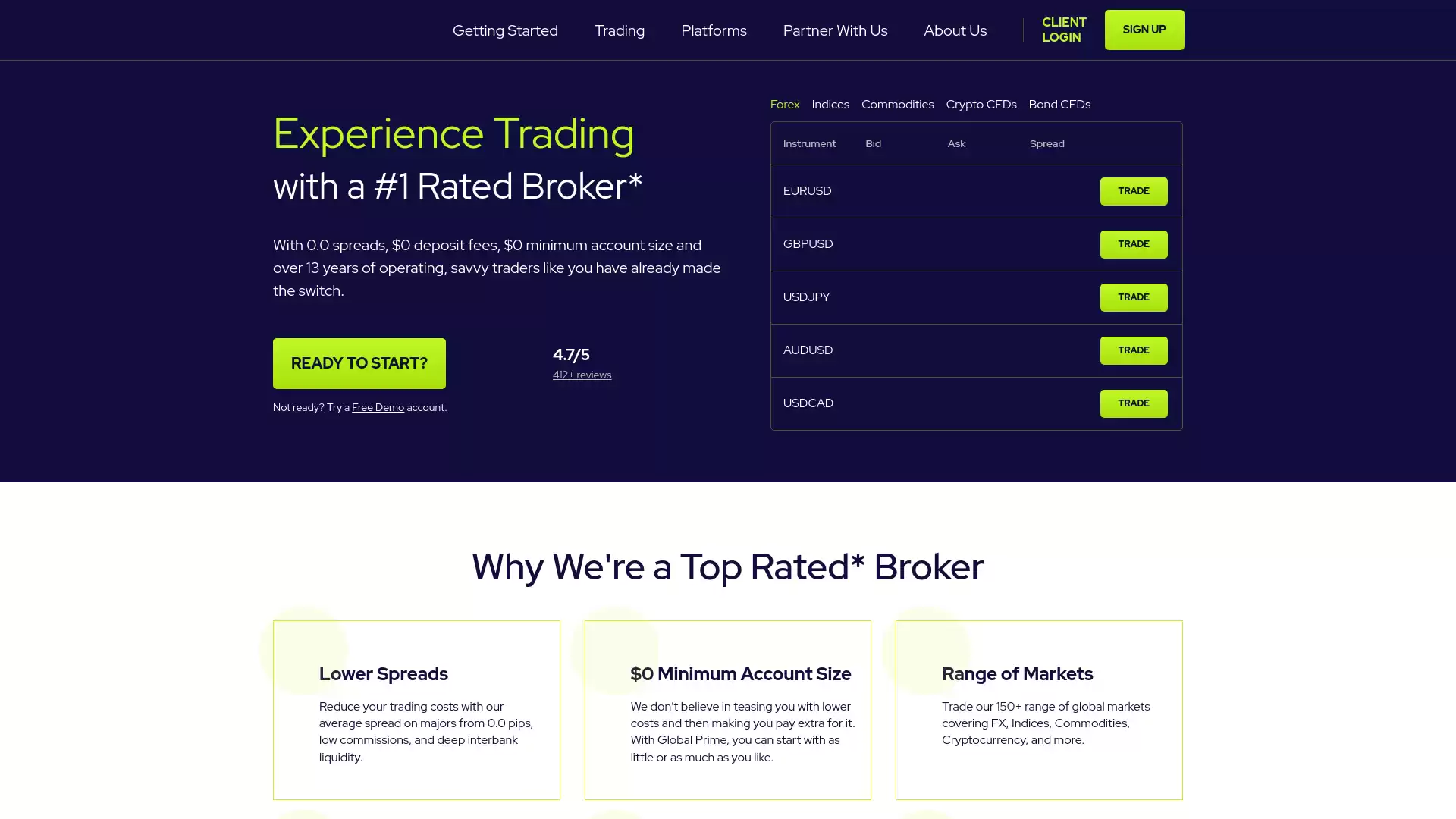

Global Prime is a highly-rated Forex and CFD broker. based in Australia. It specializes in providing low latency connectivity to tier-1 bank liquidity. , offering a regulated trading environment with a sophisticated execution model based on ECN connectivity. Global Prime offers a wide range of services and features that make it a top choice for traders. These include:. Competitive Spreads: Global Prime offers low spreads, with an average spread on majors from 0.0 pips. This, combined with low commissions and deep interbank liquidity, helps reduce trading costs. No Minimum Account Size: Traders can start with as little or as much as they like, with no minimum account size. Wide Range of Markets: Traders can choose from over 150 global markets, including Forex, Indices, Commodities, Cryptocurrency, and more. No Deposit Fees: Global Prime covers all deposit fees on all 20+ funding methods. 24/7 Support: The support team is available around the clock to assist traders. Low Latency: Global Prime uses X-Connected low latency servers within the NY4 datacentre to execute trades with fast execution speeds from as low as 10ms. Global Prime is fully licensed in Australia (ASIC) and Vanuatu (VFSC), and it segregates client funds in trusts with tier-1 banks like NAB and HSBC. This ensures the safety and security of client funds. In terms of trading platforms, Global Prime offers a variety of options to suit different trading needs. These include MetaTrader 4, which is available on Windows, Mac, Web, iOS, Android, and Web. Other platforms such as MetaTrader 5, cTrader, and TradingView are also expected to be introduced. In conclusion, Global Prime is a reliable and efficient Forex broker that offers a wide range of services and features to cater to the needs of different types of traders. Its commitment to providing low latency, competitive spreads, and a wide range of markets makes it a top choice for Forex trading.

What is the Review Rating of Global Prime?

- 55brokers: 55brokers rated Global Prime with a score of 83. This rating was last checked at 2024-01-06 07:07:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Global Prime with a score of 66. This rating was last checked at 2024-01-05 20:38:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Global Prime with a score of 84. This rating was last checked at 2024-01-06 14:21:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Global Prime with a score of 20. This rating was last checked at 2024-03-13 04:09:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Global Prime?

Global Prime, an Australian broker headquartered in Sydney, offers a multitude of advantages for both novice and experienced traders in the forex market. Here are some of the key benefits:. Regulation: Global Prime is regulated by reputable financial regulators, including the Australian Securities and Investments Commission (ASIC, 385620) and the Vanuatu Financial Services Commission (VFSC, 303124). This provides a level of trust and security for traders. Trading Instruments: The broker provides access to a wide range of the most requested trading instruments. These include currencies, stocks, indices, commodities, metals, and cryptocurrencies. Spreads and Commissions: Global Prime offers competitive spreads from 0.1 pips for currency pairs. They also have a transparent commission structure with $3.50 commission per lot per trade. Account Currency Options: Traders have the flexibility to choose from multiple account currencies including USD, EUR, AUD, CAD, GBP, and SGD. Minimum Deposit: The minimum deposit requirement is quite accessible at $200. , making it easier for traders to start trading. Leverage: Global Prime offers leverage up to 1:200. , providing traders with the opportunity to maximize their trading potential. Registration: The registration process with Global Prime is quick and simple. , allowing traders to start trading in a short span of time. Awards: Global Prime has won several prestigious awards, including “Best Client Service” from AU Forex Awards and “Best Forex Analytics” from Australian Forex Awards. While these advantages make Global Prime a compelling choice for forex traders, it’s always recommended to thoroughly analyze the pros and cons before opening an account with any broker.

What are the Cons of Global Prime?

Global Prime, an Australian forex broker, has several disadvantages that potential clients should consider:. Limited Product Portfolio: Global Prime’s product portfolio is relatively slim. This limitation could restrict traders who wish to diversify their investments across a wide range of financial instruments. Limited Educational Tools: While Global Prime does offer some educational resources, these are limited in scope. This could be a disadvantage for novice traders who are looking to learn more about forex trading. No Investor Protection: Global Prime does not offer investor protection. This means that in the event of the broker’s insolvency, there is no guarantee that investors will be able to recover their funds. High Swap Fees: Global Prime’s swap fees can be high. Swap fees, also known as rollover or overnight fees, are charged on positions held for longer than a day. These fees can add up over time and eat into a trader’s profits. No Islamic Accounts: Global Prime does not offer Islamic accounts. This could be a disadvantage for traders who require swap-free accounts due to religious beliefs. Outdated Platform Design: Although Global Prime uses the MetaTrader platform, which is highly customizable and has a clear fee report, its design is considered outdated. Additionally, it lacks a two-step login and price alerts, which could be a disadvantage for traders who prioritize security and real-time market updates. Fees and Commissions: Global Prime charges a commission of $7 per 100k round turn. While this is considered reasonable in the industry, it could still be a significant cost for high-volume traders. In conclusion, while Global Prime has several advantages such as regulation by reputable financial regulators and a wide range of trading instruments, potential clients should weigh these against the aforementioned disadvantages before deciding to open an account.

What are the Global Prime Current Promos?

Global Prime, a leading Forex and CFD broker, offers a variety of promotions that cater to the diverse needs of its clients. Here are some of the key features:. Lower Spreads: Global Prime offers average spreads on majors from 0.0 pips, low commissions, and deep interbank liquidity. This reduces trading costs and provides a competitive edge to traders. No Minimum Account Size: Unlike other brokers that require a minimum deposit, Global Prime allows traders to start with any amount. This flexibility makes it accessible to both novice and experienced traders. Wide Range of Markets: Traders can access over 150 global markets, including Forex, Indices, Commodities, Cryptocurrency, and more. This extensive range provides ample opportunities for diversification. No Deposit Fees: Global Prime covers all deposit fees on over 20 funding methods. Traders can fund their accounts using various methods like Visa, MasterCard, PayPal, Neteller, Skrill, and more without incurring any additional costs. 24/7 Support: Global Prime provides round-the-clock support to its clients. Their dedicated team is always ready to assist traders on their journey, regardless of the time zone. Low Latency: Global Prime’s X-Connected low latency servers within the NY4 datacentre execute trades with fast execution speeds from as low as 10ms. This ensures that traders can capitalize on market movements in real-time. Trust and Security: Global Prime segregates client funds in trusts with tier-1 banks like NAB and HSBC. They are fully licensed in Australia (ASIC) and Vanuatu (VFSC), providing an added layer of security to their clients. Please note that the specifics of these promotions may change over time, and it’s always a good idea to check the official Global Prime website for the most up-to-date information.

What are the Global Prime Highlights?

The Global Prime Highlights are not available in the context of forex. However, there are some details available in the context of real estate and medical insurance. For more specific information related to forex, it is recommended to refer to reliable financial news sources or the official Global Prime website.

Is Global Prime Legit and Trustworthy?

Global Prime is a well-known name in the world of forex trading. It is an Australian company, part of Gleneagle Securities, and was originally established to assist traders using the MT4 platform. Regulation and Licenses Global Prime is regulated by several authorities, which adds to its credibility. It holds licenses from the Australian Securities and Investments Commission (ASIC), Vanuatu Financial Services Commission (VFSC), and the Seychelles Financial Services Authority (FSA). These regulatory bodies set high standards for financial firms, and Global Prime’s adherence to these regulations indicates its legitimacy. Trading Platforms Global Prime offers three trading platforms: MetaTrader4, Trader Evolution, and Trading View. These platforms cater to different trading needs and styles, offering flexibility to its users. Customer Reviews Customer reviews provide valuable insights into the experiences of actual users. Global Prime has received mixed reviews from its customers. Some traders praise the broker for its low spreads, fast trade execution, and excellent customer support. However, some users have raised concerns about issues such as high withdrawal fees and slippage. Conclusion In conclusion, while no broker can guarantee success in forex trading, Global Prime appears to be a legitimate and trustworthy broker. It is regulated by reputable authorities and offers a range of trading platforms. However, like any broker, it has its pros and cons, and traders should carefully consider these factors before deciding to trade with Global Prime. As always, it’s recommended to do thorough research and consider multiple sources of information before making a decision.

Is Global Prime Regulated and who are the Regulators?

Global Prime is indeed a regulated entity. It is supervised by two main regulatory bodies. Australian Securities and Investments Commission (ASIC): Global Prime is authorised to deal in securities, derivatives, and foreign exchange contracts in Australia under the Australian Financial Services License No. 385620. Vanuatu Financial Services Commission (VFSC): Gleneagle Securities Pty Limited, trading as Global Prime FX, is a registered Vanuatu company (Company Number 40256) and is regulated by the VFSC. These regulatory bodies enforce strict requirements and standards that Global Prime must adhere to, enhancing the safety of the broker. This regulation provides important safeguards with respect to the fairness of pricing and trading conditions that Global Prime provides. Global Prime is a trading name of FMGP Trading Group Pty Ltd (ABN 74 146 086 017) and is licensed to carry on a financial services business in Australia. It is also a registered Vanuatu company (Company Number 40256) trading as Global Prime FX. Please note that the information provided is based on the data available as of the year 2023 and may be subject to change. Always verify the regulatory status of a broker with the respective regulatory bodies. If you’re uncertain about your broker’s regulatory entity, reach out to their customer support team.

Did Global Prime win any Awards?

Based on the available information, it appears that Global Prime has not won any awards. However, it’s always a good idea to check their official website or contact them directly for the most accurate and up-to-date information. Please note that this information is accurate as of the last update in 2023.

How do I get in Contact with Global Prime?

Global Prime, a trusted Forex and CFD broker, has a dedicated team of specialists ready to assist you 24/7. Contact Information: Email: For general support, you can reach them at support@globalprime.com any time. Phone: You can also contact them via phone at +61 (2) 8379 3622 for immediate assistance. . Depending on the nature of your enquiry, Global Prime has specific email addresses to ensure a prompt and appropriate response: Accounts: For account-specific enquiries, including payments, you can email accounts@globalprime.com. Institutional: For general corporate and institutional-related enquiries, you can email institutional@globalprime.com. Compliance: For general compliance and legal-related enquiries, you can email compliance@globalprime.com. Marketing: For general marketing/advertising-related enquiries, you can email marketing@globalprime.com. . Physical Address: Global Prime’s physical address is FMGP Trading Group Pty Ltd, Level 10, 627 Chapel St, South Yarra 3141, Australia. Global Prime is committed to providing exceptional customer service and is ready to assist with any questions about Forex and CFD trading.

Where are the Headquarters from Global Prime based?

Global Prime, a renowned name in the world of Forex and CFD providers, is headquartered in Sydney, New South Wales, Australia. The exact location is 35 Grafton St Bondi Jct Ste 604. Established in 2010. , Global Prime has set a new standard in online trading through the promotion of trading conditions that empower traders. Traders around the globe choose Global Prime for its world-class pricing and execution, institutional-grade post-trade transparency, and its focus on community interaction. With a revenue of $5.1 million. and a team of 14 dedicated employees. , Global Prime continues to make strides in the finance industry, particularly in the sectors of finance and lending & brokerage. The company’s commitment to providing top-notch services to its clients has solidified its position as a trusted provider in the Forex market. Please note that this information is based on the latest available data and may be subject to change.

What kind of Customer Support is offered by Global Prime?

Global Prime, a trusted Forex and CFD broker, offers a comprehensive customer support system to ensure that its clients receive prompt and appropriate assistance. Their dedicated team of specialists is ready to help 24/7. Contact Channels. Global Prime provides multiple channels for clients to reach out to them. Email Support: Clients can send their queries to support@globalprime.com. For account-specific inquiries, including payments, clients can email accounts@globalprime.com. For general corporate and institutional-related inquiries, institutional@globalprime.com. is the contact email. Compliance and legal-related inquiries can be sent to compliance@globalprime.com. , and for marketing/advertising-related inquiries, clients can reach out to marketing@globalprime.com. Phone Support: Clients can also reach Global Prime via phone at +61 (2) 8379 3622. Trading Platforms. In addition to customer support, Global Prime offers world-class trading platforms. MetaTrader 4: This platform is popular among regular traders for its simplicity and among sophisticated traders for its plethora of features. It’s available on Windows, Mac, Web, iOS, and Android. MyFXBook Autotrade: This social trade copying service allows traders to subscribe and copy other trading systems directly into a Global Prime trading account. MetaTrader 5: This is the latest and most robust version of MetaTrader, offering more trading instruments, more features, more efficiency, and no restrictions. It’s available on Windows, Linux, Mac, Android, and iOS. TradingView: This platform is popular for staying up-to-date with the market, chatting with other like-minded traders, getting market insights on trends and trading setups, plausible market strategies, and likely market behavior. cTrader: This intuitive trading platform is designed for professional traders. It includes advanced charting and analysis tools unavailable on MetaTrader. It’s available on Windows, Web, Android, and iOS. Global Prime is committed to providing fast, friendly assistance to its clients. Whether you’re a beginner or an experienced trader, Global Prime’s customer support and trading platforms are designed to provide a seamless trading experience.

Which Educational and Learning Materials are offered by Global Prime?

Global Prime, a renowned name in the Forex trading industry, offers a wide range of educational and learning materials to help traders navigate the complex world of Forex trading. These resources are designed to equip traders with the knowledge and skills they need to make informed trading decisions. Trading Platforms: Global Prime provides access to several trading platforms, each with its unique features and benefits. These platforms include:. MetaTrader 4: One of the most popular trading platforms in the world, MetaTrader 4 is easy to use for regular traders but also comes packed with a plethora of features useful to more sophisticated traders. MyFXBook Autotrade: This is a social trade copying service that allows traders to subscribe and copy other trading systems directly into a Global Prime trading account. MetaTrader 5: The latest and most robust version of MetaTrader, MT5 offers more trading instruments, more features, more efficiency, and no restrictions. TradingView: With millions of users worldwide, TradingView is a popular platform that provides market insights on trends and trading setups, plausible market strategies, and likely market behavior. cTrader: Designed for professional traders, cTrader offers advanced charting and analysis tools, expanded Depth of Market features, more indicators, and more time frames. . These platforms are available on various devices, including Windows, Mac, Android, and iOS. In addition to these platforms, Global Prime is planning to introduce more platforms in the future, including Meta Trader 5, cTrader, and Trading View. By providing a variety of platforms and educational resources, Global Prime empowers traders to enhance their trading skills and make informed decisions in the Forex market.

Can anyone join Global Prime?

Global Prime is a well-regarded platform in the world of forex trading, offering a range of benefits to its users. However, not everyone can join Global Prime as there are certain eligibility criteria that need to be met. Global Prime Pro Account. The Global Prime Pro Account is designed for sophisticated traders who require higher leverage. This account offers a range of benefits including:. Higher Leverage: With a Global Prime Pro Account, you can enjoy increased leverage (~1:100), allowing you to take larger positions and potentially increase your returns. Priority Access: Get prompt access to new trading products and services ahead of their release to retail clients. Trading Rebates: Gain access to trading rebates based on trading volume and referrals. Fund Protection: Global Prime takes the safety of its clients’ funds very seriously, which is why it holds all client funds in segregated accounts with top-tier banks. Dedicated Account Manager: As a Global Prime Pro Account holder, you will have a dedicated account manager to assist you with any questions or concerns you may have. Eligibility Criteria. To qualify for the Global Prime Pro Account, you will need to meet one of the eligibility criteria below. Pass the Pro knowledge quiz. Trading statements showcasing that you have executed at least 20 trades per quarter and a notional volume of $1,000,000 AUD per quarter in 4 quarters within the last 2 years. In conclusion, while Global Prime offers a range of benefits to its users, it’s important to note that not everyone can join. Prospective users must meet certain eligibility criteria to take advantage of the platform’s features. It’s always recommended to thoroughly review these criteria and consider your own trading goals and experience before deciding to join.

Who should sign up with Global Prime?

Global Prime is a multi-regulated trading broker that caters to a wide range of traders, from beginners to seasoned professionals. Here are some key points to consider:. Forex Trading: Global Prime offers access to 48 forex pairs, including majors, minors, and exotics. Traders can enjoy tight spreads from 0.9 with no commission or from 0 with a $7 round turn. Range of Markets: With over 150+ global markets covering FX, Indices, Commodities, Cryptocurrency, and more, Global Prime provides a comprehensive trading platform. Low Latency: Global Prime boasts low latency with execution speeds from as low as 10ms. , which is crucial for high-frequency traders. Copy Trading: Global Prime offers an exclusive copy trading service, allowing traders to interact with and copy the trades of experienced investors. Crypto Trading: Global Prime offers a good range of 35 crypto tokens with impressive commissions of 0.1%. Trust and Regulation: Global Prime is fully licensed in Australia (ASIC) and Vanuatu (VFSC), and it segregates client funds in trusts with tier-1 banks like NAB and HSBC. Customer Support: Global Prime offers 24/7 customer support. , which is a significant advantage for traders operating in different time zones. Minimum Deposit: Traders can get started with a $200 minimum deposit. In conclusion, Global Prime is suitable for traders who value a wide range of markets, low latency, copy trading options, and strong regulatory oversight. Whether you’re a beginner or a seasoned trader, Global Prime offers a robust platform for your trading needs.

Who should NOT sign up with Global Prime?

While Global Prime is a well-regarded forex broker with a strong reputation for reliability and competitive spreads. , it may not be the ideal choice for everyone. Here are some types of traders who might want to consider other options:. Beginners and Casual Traders: Global Prime might not be the best fit for beginners or casual traders. The platform lacks comprehensive educational tools. , which are crucial for new traders learning the ropes. Casual traders who don’t trade frequently might not benefit from the low forex fees and might find better value with brokers that offer more robust educational resources. Traders Looking for a Wide Product Portfolio: Global Prime has a relatively slim product portfolio. Traders interested in diversifying their investments across a wide range of asset classes might find Global Prime limiting. Traders Who Prefer Strong Investor Protection: Global Prime does not offer investor protection. This could be a significant drawback for traders who prioritize financial security and the assurance that their investments are protected. Traders Who Are Sensitive to Slippage: Some traders have reported experiencing slippage with Global Prime. While slippage can occur with any broker, those who trade in highly volatile markets and are sensitive to slippage might want to consider this factor. Traders Who Prefer Lower Withdrawal Fees: Global Prime charges high withdrawal fees. Traders who frequently withdraw their earnings might find these fees burdensome over time. In conclusion, while Global Prime offers several advantages such as low forex fees, fast account opening, and free deposit and withdrawal. , it might not be the best choice for everyone. As always, traders should carefully consider their individual trading needs and objectives when choosing a forex broker.

Does Global Prime offer Discounts, Coupons, or Promo Codes?

No. Based on the information available, there are no discounts, coupons, or promo codes offered by Global Prime. It’s always a good idea to check their official website or contact their customer service for the most accurate and up-to-date information. Please note that terms and conditions may apply to any promotions they might offer. It’s also important to remember that trading forex involves risk, and it’s crucial to understand these risks before starting. Always trade responsibly.

Which Account Types are offered by Global Prime?

Global Prime offers two main types of accounts for trading in the forex market. The first type is the Standard Account. This account offers spreads from 0.9 pips and does not charge any commission. The minimum trade size is 0.01 lot, and the maximum trade size is 1000 lots. The stopout level for this account is 120%. This account supports scalping, Expert Advisors (EAs), and hedging. The account can be denominated in various currencies including USD, AUD, GBP, EUR, CAD, SGD, and JPY. The second type is the Raw Account. This account offers spreads from 0.0 pips and charges a commission of $3.5. Like the Standard Account, the minimum trade size is 0.01 lot, and the maximum trade size is 1000 lots. The stopout level for this account is also 120%. This account also supports scalping, EAs, and hedging. The account can be denominated in the same currencies as the Standard Account. Both account types offer a range of benefits. These include tight spreads, reduced risk of slippage, faster execution on orders, tighter bid-offer spreads, access to global markets, personalized support, and low latency. Global Prime does not have a minimum deposit requirement, making trading accessible to everyone. They also offer a demo account for those who want to practice trading. Funding the account can be done via the GP Hub. There is an overnight financing charge to keep your position open. Withdrawals can also be done from within the GP Hub. Please note that the information provided is valid as of the time of this search. Any information provided after this date may be subject to change, and we cannot guarantee the accuracy or completeness of such information.

How to Open a Global Prime LIVE Account?

Opening a Global Prime LIVE account involves a few steps. Here’s a detailed guide:. Step 1: Start the Process First, navigate to the Global Prime website. Look for the option that says “Ready to Start” and click on it. Step 2: Complete the Registration Next, you’ll be presented with options to customize your account type. This includes choosing between a Standard Account and a Raw Account. The Standard Account offers spreads from 0.9 pips and no commission, while the Raw Account offers 0.0 pips spread and a $3.5 commission. Both account types allow a minimum trade of 0.01 lot and a maximum trade of 1000 lots. After selecting your preferred account type, you’ll need to complete your personal information. This is a crucial step as it ensures that your account is set up correctly and securely. Step 3: Verify the Account Once you’ve filled out all the necessary information, you’ll need to verify your account. This is a standard procedure for most financial platforms and is done to ensure the security of your account and your funds. Additional Information Global Prime prides itself on making trading accessible to everyone, so there are zero minimum deposit requirements. You can also try out trading with a Global Prime demo account before committing to a live account. Funding your account can be done via the GP Hub. Simply click the ‘Payments’ tab on the left sidebar and select “Deposit” from the list of tabs available. Each day at 0:00 MetaTrader server time, there will be an overnight financing charge to keep your position open. This is updated daily and available in your MetaTrader platform. Withdrawals can be submitted from within the GP Hub. Click on the “Payments” tab on the left sidebar and select “Withdrawal” from the list of options available. With Global Prime, you can access 150+ global markets from Forex to Cryptocurrencies with low rates and competitive leverage. Every live account holder will have a dedicated trading expert on hand to help them navigate the markets and make the most out of the platforms. Now that you know how to open a Global Prime LIVE account, you’re ready to start trading!.

How Are You Protected as a Client at Global Prime?

How Are You Protected as a Client at Global Prime? If you are looking for a reliable and trustworthy forex and CFD broker, you may want to consider Global Prime. Global Prime is a trading name of FMGP Trading Group Pty Ltd, which is regulated by ASIC and VFSC in Australia, and has been operating since 2010. Global Prime offers a range of products with low trading costs and no minimum account size, as well as excellent customer support and education resources. One of the most important aspects of choosing a broker is how they protect your money as a client. At Global Prime, we take the safety of our clients’ funds very seriously, which is why we hold all client funds in segregated accounts with top-tier banks. This provides an additional layer of security to ensure your funds are always protected. Client Money Laws: Every financial services regulator enforces their own unique set of laws, rules and protections around client money. This means the Global Prime entity you are contracted with will determine the statutory protections afforded to your money held with us and what those funds can be used for. For example, in Australia, we are authorised by ASIC to deal in securities, derivatives and foreign exchange contracts, as well as provide general advice to retail and wholesale clients. We also comply with the ASIC Client Money Reporting Rules 2017, which require us to report certain information about our clients’ money held with us. We do not use client money for hedging or any other purpose other than meeting our obligations to our clients. Segregated Client Trust Accounts: All client money is managed in accordance with client money laws and kept separate from company funds. Client money is held in segregated Client Trust Accounts with HSBC (Europe’s largest bank by total assets, regulated by the UK’s FCA and PBR) and National Australia Bank (NAB) (AA rated Australian bank regulated by APRA and ASIC). These banks have strict policies and procedures to safeguard your funds from any unauthorized access or misuse. They also provide regular audits and reports on their compliance with these policies. No Fees: Global Prime does not charge any fees for deposits or withdrawals. If funding with a bank wire or transfers from Australia to our Australian account also incur no fees. However, please note that payment to and from international banks may incur a transfer fee which are independent of Global Prime. If you are transferring from an international bank account to our Australian trust account, the fees will likely be USD $20-$30. Please note that at certain banks, they may use what is called an “intermediary bank” (which GP has no control over) which charge their own fees for forwarding the funds to us. We apologise, but GP is not responsible for these fees should they be charged. Third Party Payments: Global Prime does not accept payments from third parties. Please ensure all deposits into your Global Prime trading account come from a bank account in the same name. Payments from a joint bank account will be accepted if the account holder is one of the parties on the bank account. Customer Support: We have a dedicated team of customer support agents who are available 24/7 via phone, email or live chat. They can assist you with any questions or issues you may have regarding your trading account or our services. They can also provide you with market updates, trading tips and educational resources. We hope this answer has given you some insight into how we protect your money as a client at Global Prime. If you want to learn more about us or open an account today, please visit our website [here]. Thank you for choosing Global Prime!.

Which Funding methods or Deposit Options are available at Global Prime?

Global Prime, a leading Forex and CFD broker, offers a variety of funding methods and deposit options for its clients. Here are the details:. Visa: Instant processing with a minimum deposit of $10. The processing currencies include USD, AUD, GBP, EUR, SGD, CAD, and JPY. There are no fees associated with this deposit option. MasterCard: Similar to Visa, MasterCard also offers instant processing with a minimum deposit of $10. The processing currencies are the same as Visa, and there are no fees. Crypto: Global Prime accepts cryptocurrency deposits. The processing is instant with a minimum deposit of $10. The processing currencies are USD and EUR. There are no fees associated with this deposit option. PayPal: PayPal is another instant deposit option with a minimum deposit of $10. The processing currencies include USD, AUD, GBP, EUR, and SGD. There are no fees. Neteller: Neteller offers instant processing with a minimum deposit of $10. The processing currencies include USD, AUD, GBP, EUR, SGD, and JPY. There are no fees. Please note that some deposit options may not be available based on your country or territory. Global Prime covers the merchant fees for Neteller, PayPal, Skrill, and Credit Card deposits on behalf of its clients - in some cases up to 4% of the deposit amount. However, please keep in mind that there are Foreign Exchange Conversion fees when depositing. If you are funding with a bank wire, transfers from Australia to Global Prime’s Australian account also incur no fees. However, payment to and from international banks may incur a transfer fee which are independent of Global Prime. If you are transferring from an international bank account to Global Prime’s Australian trust account, the fees will likely be USD $20-$30. Global Prime does not accept payments from third parties. Please ensure all deposits into your Global Prime trading account come from a bank account in the same name. Payments from a joint bank account will be accepted if the account holder is one of the parties on the bank account. To avoid any delay, please ensure you include your reference number as this helps Global Prime match your funds. Withdrawals can be made from inside the GP Hub. Withdrawal requests submitted before 10 AM AEST/11 AM AEDT (00:00 GMT) will be processed the same day. Any request after will be processed the next business day. Withdrawals usually take a couple of business days.

What is the Minimum Deposit Amount at Global Prime?

The minimum deposit amount required to register a Global Prime Professional live trading account is $200 USD. This minimum deposit amount required for Standard Account registration will depend on the payment system chosen. Global Prime offers a variety of deposit options, including Visa, MasterCard, Crypto, PayPal, and Neteller, all of which have a minimum deposit of $10. The processing time for these deposits is instant, and they can be made in various currencies including USD, AUD, GBP, EUR, SGD, CAD, and JPY. It’s important to note that Global Prime does not charge any fees for deposits. If funding with a bank wire, transfers from Australia to their Australian account also incur no fees. However, payment to and from international banks may incur a transfer fee which are independent of Global Prime. If you are transferring from an international bank account to their Australian trust account, the fees will likely be USD $20-$30. Please keep in mind that Global Prime does not accept payments from third parties. All deposits into your Global Prime trading account must come from a bank account in the same name. Payments from a joint bank account will be accepted if the account holder is one of the parties on the bank account. In conclusion, Global Prime offers a range of deposit options with varying minimum amounts, making it accessible for traders with different financial capabilities. It’s always recommended to check the specific details and potential fees associated with your chosen payment method before making a deposit.

Which Withdrawal methods are available at Global Prime?

Global Prime, a well-regarded Forex and CFD broker, offers a variety of withdrawal methods to its clients. These methods are designed to provide convenience and ease of use, ensuring that clients can access their funds whenever they need them. Withdrawal Methods. Global Prime supports several withdrawal methods. These include:. Visa: This is an instant withdrawal method. The minimum withdrawal amount is $10. The processing currencies include USD, AUD, GBP, EUR, SGD, CAD, and JPY. MasterCard: Like Visa, this is also an instant withdrawal method with a minimum withdrawal amount of $10. The processing currencies are the same as those for Visa. Crypto: This method allows for instant withdrawal with a minimum amount of $10. The processing currencies are USD and EUR. PayPal: This is another instant withdrawal method. The minimum withdrawal amount is $10, and the processing currencies include USD, AUD, GBP, EUR, and SGD. Neteller: This method allows for instant withdrawal with a minimum amount of $10. The processing currencies include USD, AUD, GBP, EUR, SGD, and JPY. Wire Transfer, Skrill, POLi, FasaPay, Credit Card, BPAY: These methods are also supported by Global Prime. Withdrawal Process. Withdrawals can be made from inside the GP Hub. Withdrawal requests submitted before 10 AM AEST/11 AM AEDT (00:00 GMT) will be processed the same day. Any request after will be processed the next business day. Withdrawals usually take a couple of business days. However, there may be delays with your bank which are outside of Global Prime’s control. Fees and Charges. Global Prime does not charge any fees for withdrawals. However, please note that payment to and from international banks may incur a transfer fee which are independent of Global Prime. If you are transferring from an international bank account to Global Prime’s Australian trust account, the fees will likely be USD $20-$30. Please note that Global Prime does not accept payments from third parties. All deposits into your Global Prime trading account must come from a bank account in the same name. In conclusion, Global Prime offers a variety of withdrawal methods to cater to the diverse needs of its clients. Whether you prefer to use traditional banking methods or modern digital payment platforms, Global Prime has got you covered.

Which Fees are charged by Global Prime?

Global Prime is a forex and CFD broker that offers competitive pricing and execution for traders. However, there are some fees that traders should be aware of before opening an account with Global Prime. Here are some of the main fees that Global Prime charges:. Spreads: These are the differences between the buy and sell prices of a currency pair or an asset. Global Prime offers spreads from 0.0 pips to 0.4 pips, depending on the account type and market conditions. Spreads can affect the profitability of a trade, as they represent the cost of borrowing or lending the asset. Commissions: These are fixed fees that traders pay for each trade they make. Global Prime does not charge any commissions for its Standard account, which is suitable for beginners and experienced traders who trade less than 10 times per month. However, Global Prime does charge commissions for its ECN account, which is ideal for active traders who trade more than 10 times per month. The commission rate varies depending on the currency pair and the market conditions, but it is usually around $2 per lot round turn. Swap fees: These are interest payments or receipts that traders receive or pay for holding a position over rollover or end of day. Swap fees depend on the currency pair, the direction of the trade (long or short), and the interest rate differential between the two currencies. Swap fees can vary significantly depending on market volatility and economic events. For example, on Wednesday, which is a triple swap day for FX pairs due to market closure on Saturday and Sunday, swap rates can be up to 6 times higher than normal. Financing fees: These are fees that traders pay to hold a position on CFD trades. They reflect the cost of borrowing or lending the underlying asset(s) that relate to the position(s). Financing fees also depend on market volatility and economic events. For example, if dividends are paid out on an index, then long positions will receive a positive adjustment, while short positions will receive a negative adjustment. Transfer fees: These are fees that traders pay when they deposit or withdraw funds from their Global Prime account. Global Prime does not charge any fees for deposits made via bank wire transfer or transfers from Australia to its Australian account. However, payment to and from international banks may incur a transfer fee which are independent of Global Prime. The transfer fee varies depending on the bank and the currency involved. These are some of the main fees that Global Prime charges its clients. By understanding these fees, traders can make informed decisions about their trading strategy and risk management. Trading forex involves significant risk of loss and is not suitable for all investors. Please read our terms & conditions carefully before opening an account with Global Prime. If you have any questions or feedback, please feel free to contact me again ?.

What can I trade with Global Prime?

Global Prime is a leading broker that offers a wide range of financial instruments for trading. Forex Trading Forex trading is a specialty of Global Prime. They offer access to popular currency markets such as EURUSD, GBPUSD, AUDUSD, USDCHF, USDJPY, and USDCAD. Traders can go long or short on forex trades, and trading is available 24/5. They offer a wide range of FX pairs, including majors, minors, and exotics. Micro lot trading (10c per pip) is also available. Trading Conditions Global Prime offers competitive spreads and they regularly compare which providers have the best price. They offer flexible leverage depending on where you live and which Global Prime entity you trade with. They also provide traders with competitive rates across their range of markets. Other Financial Instruments In addition to Forex, Global Prime provides access to other financial instruments. These include Gold, Indices, Commodities, Oil, Bond CFDs, and Crypto CFDs. They offer access to over 150 global markets covering FX, Indices, Commodities, Cryptocurrency, and more. Account Features Global Prime offers two types of accounts: Standard and Raw Spread. Both types of accounts offer access to 150+ global markets including FX, Indices, Commodities, Digital Currencies and more. There are no order distance restrictions and all trading styles are allowed. Please note that while Global Prime offers a wide range of trading options, it does not offer trading in real stocks and ETFs.

Which Trading Platforms are offered by Global Prime?

Global Prime is a forex broker that offers a range of trading platforms for its clients. According to its website. , Global Prime offers the following trading platforms: MetaTrader 4: This is one of the most popular and widely used trading platforms in the world. It allows traders to access global markets, customize their charts, use automated trading systems, and backtest their strategies. MetaTrader 4 is available on Windows, Mac, Web, iOS, and Android devices. MyFXBook Autotrade: This is a social trading service that enables traders to subscribe and copy other trading systems directly into their Global Prime account. Traders can choose from thousands of systems based on various indicators and statistics, and monitor their performance in real time. MetaTrader 5: This is the latest and most advanced version of MetaTrader, which offers more trading instruments, features, efficiency, and flexibility than its predecessor. MetaTrader 5 supports more time frames, more order types, more indicators, more expert advisors, and more market depth. MetaTrader 5 is expected to be available soon on Windows, Linux, Mac, Android, and iOS devices. cTrader: This is an intuitive and professional trading platform that provides advanced charting and analysis tools for traders. cTrader has features such as expanded depth of market data, more indicators, more time frames, faster execution speeds, and direct market access. cTrader is available on Windows Web Android iOS devices. TradingView: This is a web-based platform that allows traders to access real-time data charts tools social network features market insights trends analysis strategies education resources TradingView has over 12 million users 5 million ideas published 30 million charts created TradingView also supports automated trading backtesting paper trading alerts notifications TradingView is available on any device with a web browser. Global Prime claims that it combines the world’s most popular trading platforms with its market-leading pricing and execution for an unrivalled trading experience. It also says that it will introduce more platforms in the coming year including Meta Trader 5 cTrader Trading View. However some reviews suggest that Global Prime may not be as reliable or transparent as it advertises. , so traders should exercise caution before signing up with this broker.

Which Trading Instruments are offered by Global Prime?

Global Prime offers a wide range of trading instruments, providing traders with a diverse portfolio to choose from. Here’s a detailed look at the instruments they offer:. Forex: As a multi-asset broker, Global Prime provides access to over 40 forex pairs. This allows traders to speculate on the price movements of various currency pairs, offering opportunities for profit in both rising and falling markets. Commodities: Global Prime offers trading in various commodities, including gold and oil. Commodities trading allows traders to speculate on the future price of these resources, which can be influenced by factors such as supply and demand, geopolitical events, and economic indicators. Indices: Global Prime offers Index CFDs, allowing traders to speculate on the price movements of major global stock market indices. These include popular indices like the S&P 500, GER40, and UK100. Trading indices as leveraged CFDs with tight spreads allows traders to capitalize on macroeconomic trends. Bond CFDs: Global Prime also offers Bond CFDs. These allow traders to speculate on the price movements of various bonds, without the need to own the underlying asset. Crypto CFDs: For those interested in the volatile world of cryptocurrencies, Global Prime offers Crypto CFDs. This allows traders to speculate on the price movements of popular cryptocurrencies without the need to own the actual cryptocurrency. In addition to these instruments, Global Prime also offers a range of trading platforms to execute trades. These include MetaTrader 4, MyFXBook Autotrade, and the upcoming MetaTrader 5, TradingView, and cTrader platforms. Each platform offers unique features and tools to assist traders in their trading activities. Please note that the information provided is valid as of February 2023. Any information provided after this date may be subject to change, and we cannot guarantee the accuracy or completeness of such information.

Which Trading Servers are offered by Global Prime?

Global Prime, a renowned forex broker, offers a variety of trading servers to cater to the diverse needs of traders worldwide. Here’s a detailed look at the trading servers offered by Global Prime:. MetaTrader 4: This is one of the most popular and widely used trading platforms in the world. It’s simple to use for regular traders, yet packed with a plethora of features, making it useful for more sophisticated traders too. It’s available on Windows, Mac, Web, iOS, and Android. MyFXBook Autotrade: This is a social trade copying service, allowing traders to subscribe and copy other trading systems directly into a Global Prime trading account. It offers one of the largest selections of financial indicators and statistics compared to other social trading platforms. MetaTrader 5: This is the latest and most robust version of MetaTrader, enabling more trading instruments, more features, more efficiency, and no restrictions. It’s available on Windows, Linux, Mac, Android, and iOS. TradingView: With 12+ million users, 5+ million ideas published, and 30+ million charts created, the TradingView platform is easily the world’s most popular trading platform. It offers market insights on trends and trading setups, plausible market strategies, and likely market behavior. cTrader: This is an intuitive trading platform designed for professional traders. It includes advanced charting and analysis tools unavailable on MetaTrader, such as expanded Depth of Market features, more indicators, and more time frames. It’s available on Windows, Web, Android, and iOS. In terms of server location and latency, Global Prime’s server is located in New York with a latency of just 1.53ms. This low latency ensures fast trade execution, which is crucial for forex trading. Please note that the information provided is valid as of February 2023. Any information provided after this date may be subject to change.

Can I trade Crypto with Global Prime? Which crypto currencies are supported by Global Prime?

Yes, you can trade cryptocurrencies with Global Prime. Global Prime offers crypto CFDs (Contract for Difference) trading. With Global Prime’s crypto CFDs, you can access over 35 coins. The trading of cryptocurrencies is done with 0.1% commissions. , which is significantly lower than most crypto exchanges. This allows you to trade on margin with far lower costs. You can go long or short on BTC and ETH, and take advantage of crypto’s volatile market. Global Prime’s crypto CFDs cover a good range of 35 tokens. The tokens include Bitcoin, Ethereum and other popular choices. However, the exact list of supported cryptocurrencies is not specified in the search results. When you trade a Crypto CFD, because you are trading the derivative of the asset, you can short it without first holding it. The other major benefit is that with a Crypto CFD you can use leverage to increase your position size without needing more capital. Please note that each day at 0:00 MetaTrader server time, there will be an overnight financing charge to keep your position open. This is updated daily and available in your MetaTrader platform. When you are trading a Crypto CFDs you will not receive any staking rewards. In conclusion, Global Prime provides a platform for trading a wide range of cryptocurrencies with competitive commissions and the ability to leverage your trades. However, it’s important to understand the risks associated with trading crypto CFDs and to consider whether it’s the right investment for you.

What is the Leverage on my Global Prime Trading Account?

The leverage on your Global Prime Trading Account depends on the type of account you hold. For a Global Prime Pro Account, you can enjoy increased leverage of approximately 1:100. This allows you to take larger positions and potentially increase your returns. The key difference for the Global Prime Pro Account holders is the freedom to choose leverage up to approximately 1:500. However, the maximum leverage cap offered by Global Prime tops out between 1:100 – 1:200. The 1:200 option seems to be reserved for those that have received special approval, so it seems that most retail clients will only be able to trade up to the 1:100 option. In the context of forex, the leverage for major forex is 1:500 and for minor forex is also 1:500 for a professional account. For a retail account, the leverage for major forex is 1:30 and for minor forex is 1:20. Please note that higher leverage can potentially lead to higher returns, but it also comes with higher risk. Therefore, it’s important to manage your risk appropriately when trading with leverage. Always remember that past performance is not indicative of future results. I hope this information helps! If you have any other questions, feel free to ask.

What kind of Spreads are offered by Global Prime?

Global Prime is a leading Australian based forex broker that specialises in offering prime of prime trade execution and spreads. According to its website, Global Prime combines tier-1 bank, non-bank and ECN liquidity to give clients tight spreads across its range of global markets 24/5. Spreads at Global Prime are variable starting from 0.0 pips. Typical spreads on leading pairs EUR/USD are 0.1 and 0.6 on GBPUSD. Typical spreads on FTSE100 are 0.84 and 1 on the Nasdaq 100. Global Prime offers two types of accounts for forex trading: Standard and Zero. The Standard account has no commission but higher spreads, while the Zero account has lower spreads but charges a commission of $3 per lot round turn. The minimum deposit for both accounts is $200. Global Prime also offers swap-free accounts for Islamic traders who do not want to pay or receive interest on their positions. Global Prime supports MetaTrader 4 as its main trading platform, which is one of the most popular and user-friendly platforms in the forex industry. MetaTrader 4 allows traders to access various tools and features such as charting, indicators, expert advisors, automated trading, market news, and more. Global Prime also provides a web-based platform called Myfxbook Auto Trade System, which enables traders to create and execute customised trading strategies using historical data and live market conditions. Global Prime is regulated by several authorities in different jurisdictions, such as Australia, Hong Kong, British Islands, Cayman islands, and Vanuatu. This means that Global Prime has to comply with strict rules and standards regarding client funds security, segregation of duties, anti-money laundering measures, fair trading practices, and dispute resolution mechanisms. Global Prime also offers excellent customer support through various channels such as phone, email, live chat, social media, and online resources. Global Prime is a reputable and reliable forex broker that offers competitive spreads and trading conditions for its clients. If you are looking for a broker that can provide you with fast execution speed, low fees, diverse liquidity sources, advanced trading platforms, and professional customer service, you may want to consider Global Prime as your forex partner.

Does Global Prime offer MAM Accounts or PAMM Accounts?

In the world of forex investing, MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts are emerging trends. Both of these are types of investment accounts that allow retail investors to tap into the expertise of professional traders, while facilitating traders in expanding their audience reach. However, according to the information available, Global Prime only provides one ECN Account for individuals, joint, corporate, and trusts. Let’s delve deeper into what MAM and PAMM accounts are:. MAM Accounts: A MAM forex broker account allows professional traders to manage multiple client accounts from a single master account. The master account is controlled by the trader, and is linked to several sub-accounts, each owned and controlled by a different individual investor. The funds of the investors are pooled together and managed by the trader. As the trader executes trades in the master account, the same trades are automatically replicated on the individual sub-accounts according to the allocation percentage. Traders can also make manual adjustments to allocation percentages, designate different volumes to different sub-accounts, or group sub-accounts together for different trading strategies. While the master account is controlled by the trader, the investor has full control over their own sub-account. Investors can view their sub-accounts in real time, and can intervene to alter or close trades placed by the trader. Investors can also choose to deposit and withdraw funds from their sub-accounts at any time. PAMM Accounts: A PAMM account is a type of investment account offered by some forex brokers, which allows retail investors to allocate their funds to be managed by experienced traders. An investor deposits funds into a PAMM account, which are then pooled together with funds from other investor accounts. The appointed trader or investment manager then makes investment decisions on behalf of the group. Each investor’s share in the account is proportional to the size of their investment, and the profits or losses are distributed accordingly. The trader typically charges a management fee for their services, which are deducted from the account’s profits. PAMM accounts allow investors to take advantage from the expertise of professional traders without having to actively manage their investments on their own. Additionally, qualified traders who manage PAMM accounts will be screened and vetted by forex brokers beforehand. While MAM and PAMM share some commonalities, they are both different money management solutions that cater to different needs for investors and traders alike. Therefore, when choosing between the two, it’s important to understand their core differences and what to look out for.

Does Global Prime allow Expert Advisors?

Yes, Global Prime does allow the use of Expert Advisors (EAs). EAs are automated trading systems that can analyze the markets and execute trades based on pre-defined rules. This feature is particularly useful for traders who wish to automate their trading strategies. Global Prime offers world-class trading on platforms such as MetaTrader 4 (MT4). MT4 is one of the most popular and widely used trading platforms in the world. It’s surprisingly simple to use for regular traders, but comes packed with a plethora of features, making them useful to more sophisticated traders too. In addition to MT4, Global Prime also offers WebTrader for MetaTrader 4, which allows trading directly from your browser on any device. They will also be introducing more platforms in the coming year including Meta Trader 5, cTrader, and Trading View. Moreover, Global Prime is also High-Frequency Trading (HFT) and scalper friendly. This means that traders who employ high-frequency trading strategies or scalping strategies can also benefit from trading with Global Prime. It’s important to note that the information provided is valid as of February 2023. Any information provided after this date may be subject to change, and we cannot guarantee the accuracy or completeness of such information. In conclusion, Global Prime provides a robust platform for forex traders, offering a range of features including the use of Expert Advisors. Whether you’re a beginner or an experienced trader, Global Prime’s offerings can cater to your trading needs.