GMG Markets Review 2026

What is GMG Markets?

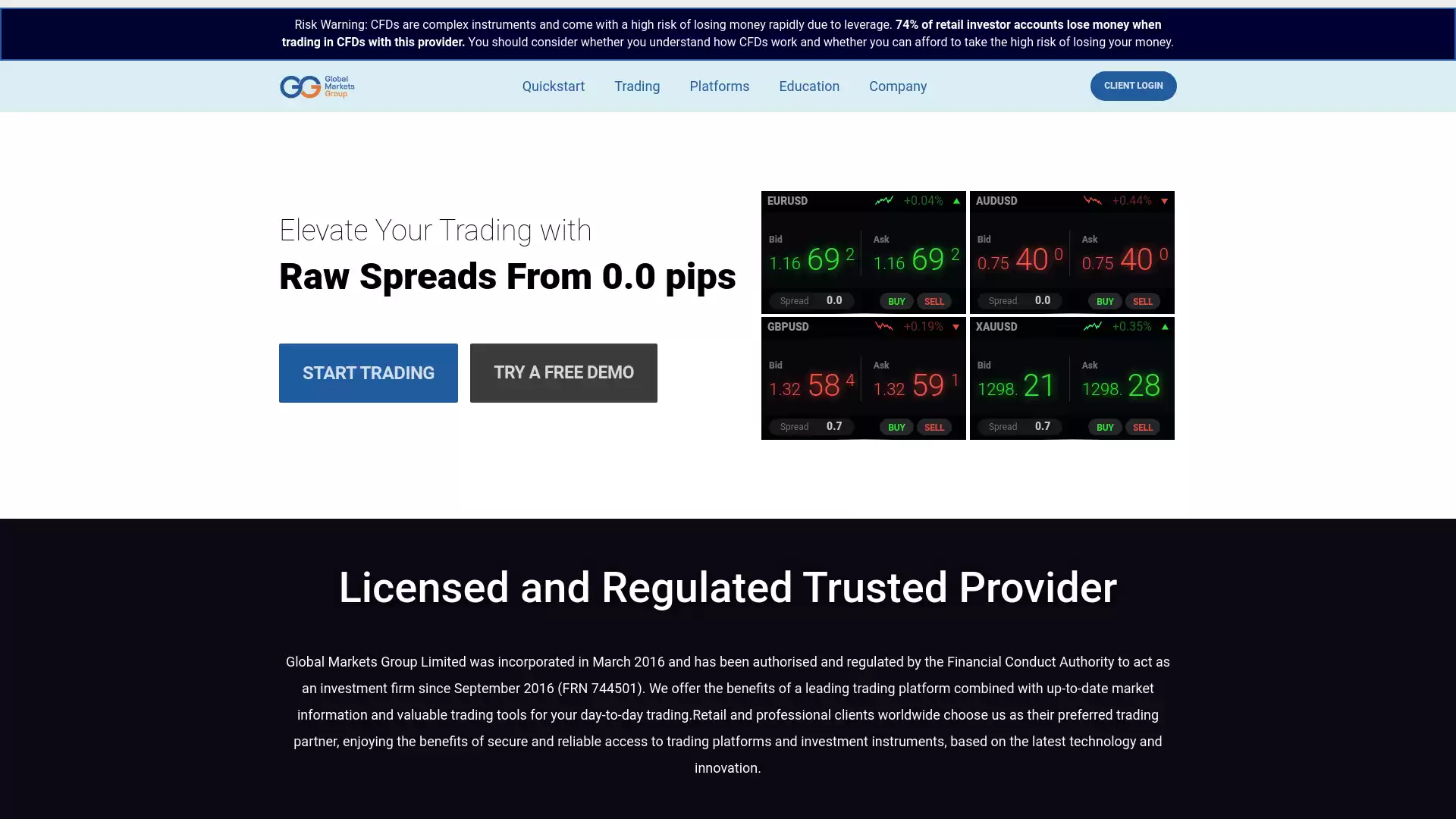

GMG Markets appears to refer to two distinct entities in the financial sector, each with a unique focus:. Global Markets Group (GMG). : This is an online trading platform that allows users to trade various financial instruments. It offers a range of features and services:. Trading Platform: GMG uses the MetaTrader 5 platform. , a popular choice among forex traders for its advanced technical analysis tools and automated trading capabilities. Markets: Users can trade in forex, commodities, and indices. The platform boasts of raw spreads from 0.0 pips. , which can be advantageous for traders looking for minimal trading costs. Account Types: GMG offers different types of accounts, including live accounts and demo accounts. This allows both experienced traders and beginners to engage with the platform at a level that suits their needs. Funding: The platform provides information on how to deposit and withdraw funds. , making it easier for users to manage their trading capital. GMG Markets. : This is a crypto trading firm and liquidity provider. It offers a range of services:. Cryptocurrency Projects: GMG partners with cryptocurrency projects, providing robust liquidity that helps enable their technology. Cryptocurrency Exchanges: GMG supplies liquidity to leading cryptocurrency marketplaces. , contributing to the success of these platforms. Financial Institutions: GMG also works with traditional financial institutions, offering crypto market expertise. It’s important to note that while both entities operate under the name “GMG Markets”, they cater to different areas of the financial market. The first is more focused on forex and other traditional markets, while the second is centered around cryptocurrencies. Always ensure to verify the entity you’re dealing with to avoid any confusion. Please note that this information is based on the data available as of 2023 and may have changed. Always do your own research before engaging with a financial platform.

What is the Review Rating of GMG Markets?

- Brokersview: Brokersview rated GMG Markets with a score of 40. This rating was last checked at 2024-01-06 07:24:02.

- Trustpilot: Trustpilot rated GMG Markets with a score of 74. This rating was last checked at 2024-01-06 16:29:03.

What are the Pros of GMG Markets?

GMG Markets, an established forex broker company based in Great Britain, offers several advantages. 1. Wide Array of Financial Products: GMG Markets differentiates itself by offering a wide array of globally traded financial products delivered through an STP model (Straight Through Processing). 2. Competitive Spreads and Commissions: GMG Markets offers competitive spreads and commissions across various asset classes on advanced and user-friendly trading platforms. 3. Global Presence: Since its inception in 2015, GMG Markets has grown rapidly and acquired a broad client base across Europe, Asia, South America, Africa, and Australia. 4. Account Types: GMG Markets offers multiple demo accounts and live account types. The Standard Account, popular with beginner traders, requires a minimum deposit of $200 and offers leverage of 1:30 with spreads from 1.1 pips. The Pro Account, catering to the needs of advanced traders, requires a minimum deposit of $10,000 and offers leverage of 1:400 with spreads from 0.1 pips plus a $10 commission per lot. 5. Regulatory Compliance: GMG Markets adheres to strict regulatory guidelines of the FCA. 6. Trading Platform: GMG Markets offers the popular MetaTrader4 (MT4) platform, which provides great charting with lots of custom tools. Please note that while GMG Markets is rated highly by some customers in personal online reviews, it’s always important to do your own research before opening an account or trading on their platform.

What are the Cons of GMG Markets?

GMG Markets, an established forex broker company based in Great Britain, offers a wide array of globally traded financial products delivered through an STP model (Straight Through Processing). However, there are several potential drawbacks to consider:. Lack of Transparency: GMG Markets’ website lacks detailed information on trading conditions, such as reference spreads, maximum leverage levels, minimum initial deposit, and transfer fees. This lack of transparency can make it difficult for traders to make informed decisions. Regulatory Concerns: GMG Markets has been flagged for having a suspicious regulatory license. This raises concerns about the broker’s credibility and the safety of traders’ investments. High Commission: GMG Markets charges a $10 commission per lot on its Pro Account. This high commission rate could eat into traders’ profits, especially for those who trade frequently. Limited Leverage: The maximum leverage offered by GMG Markets is 1:30 on its Standard Account, and 1:400 on its Pro Account. While this might be sufficient for some traders, others might find it limiting, especially those who employ high-leverage trading strategies. Spreads: GMG Markets’ spreads start as low as 0.1 pips. However, low spreads are typically associated with higher commission rates, which could offset any benefits gained from the low spreads. . It’s important for traders to thoroughly research and consider these factors before deciding to trade with GMG Markets.

What are the GMG Markets Current Promos?

GMG Markets, an established forex broker company based in Great Britain, offers a range of promotions and features that cater to both beginner and advanced traders. Standard Account The Standard Account is particularly popular with beginner traders. The features of this account include:. A minimum deposit of $200. Leverage of 1:30. Spreads from 1.1 pips. Pro Account The Pro Account is designed to meet the needs of advanced traders. The features of this account include:. A minimum deposit of $10,000. Leverage of 1:400. Spreads from 0.1 pips. A commission of $10 per lot. Both accounts offer the opportunity to trade a wide array of globally traded financial products delivered through an STP (Straight Through Processing) model. This includes currencies, stocks, commodities, futures, bonds, and digital assets. In addition to these account types, GMG Markets also offers multiple demo accounts. These accounts come with a balance of $100,000 in virtual money and feature real-time prices and trading conditions. They are free to open and can be used by traders for a period of 30 days. Please note that the number and type of accounts that a trader can open with a broker company usually differ according to the country in which the brokerage operates, the country of residence of the trader, and the regulatory authorities under whose jurisdiction it operates. For the most accurate and up-to-date information, please visit the official GMG Markets website.

What are the GMG Markets Highlights?

Global Markets Group (GMG) is a prominent player in the online forex trading industry. Here are some of the key highlights:. Trading Platform: GMG uses the MetaTrader 5 platform, which is renowned for its advanced features and user-friendly interface. Variety of Markets: GMG offers a wide range of markets for trading. This includes currencies, stocks, commodities, futures, bonds, and digital assets. Competitive Spreads: GMG offers raw spreads from 0.0 pips, which can be beneficial for traders looking for cost-effective trading. Account Types: GMG provides different types of trading accounts to cater to the diverse needs of traders. This includes RAW Trading and Standard Account. Funding: GMG offers convenient options for funds withdrawal and deposit. Please note that trading in forex involves risk, and it’s important to understand these risks before starting to trade. Always consider seeking advice from a financial advisor if you’re unsure about forex trading.

Is GMG Markets Legit and Trustworthy?

GMG Markets, also known as Global Markets Global, is a forex broker company based in the United Kingdom. It was founded in 2015 and has since grown rapidly, acquiring a broad client base across Europe, Asia, South America, Africa, and Australia. The company differentiates itself by offering a wide array of globally traded financial products delivered through an STP (Straight Through Processing) model. This model provides traders with direct access to liquidity providers through low latency servers and a no requotes policy. GMG Markets offers competitive spreads and commissions across various asset classes on advanced and user-friendly trading platforms. The company provides a multitude of trading instruments, including FX, Indices, Gold, Silver, Energies, and Treasuries. As for the account types, GMG Markets offers multiple demo accounts and two types of live accounts: Standard and Pro. The Standard Account, popular with beginner traders, requires a minimum deposit of $200 and offers leverage of 1:30 and spreads from 1.1 pips. The Pro Account, tailored more towards the needs of advanced traders, requires a minimum deposit of $10,000, offers leverage of 1:400, and spreads from 0.1 pips with a $10 commission per lot. GMG Markets is regulated by the highly reputable Financial Conduct Authority (FCA) in the United Kingdom. This regulation ensures a transparent and secure trading environment, with strict security measures and technological solutions in place. Client funds are protected by the Financial Services Compensation Scheme (FSCS) and are held in segregated accounts at Tier One banks. However, it’s important to note that there have been some concerns raised about GMG Markets. A review from 2020 mentioned that GMG Markets was blacklisted in the UK as a clone firm and showed signs of being a scam. Therefore, while GMG Markets appears to have many positive aspects, potential investors should exercise caution and conduct thorough research before deciding to trade with this broker. It’s always recommended to use regulated brokers and ensure that they are not blacklisted by any regulatory authorities. Please note that this information is based on available resources as of 2023 and may not be up-to-date. Always conduct your own research or consult with a financial advisor before making investment decisions.

Is GMG Markets Regulated and who are the Regulators?

GMG Markets, a subsidiary of Global Markets Group Limited, is indeed regulated. The regulatory body overseeing GMG Markets is the Financial Conduct Authority (FCA) in the United Kingdom. The FCA is a highly respected regulatory body that ensures financial firms provide services that meet specific standards and conduct their business with integrity. Being regulated by the FCA means that GMG Markets must adhere to strict standards of operation, which includes maintaining adequate financial resources, implementing robust internal risk management, having effective procedures for handling complaints and disputes, and treating customers fairly. GMG Markets offers competitive spreads and commissions across various asset classes on advanced and user-friendly trading platforms. They offer a wide array of globally traded financial products delivered through an STP model (Straight Through Processing). GMG Markets provides multiple account types, including Standard and Pro accounts. The Standard Account, popular with beginner traders, requires a minimum deposit of $200 and offers a leverage ratio of 1:30. The Pro Account, tailored more towards the needs of advanced traders, requires a minimum deposit of $10,000 and offers a leverage ratio of 1:400. However, it’s important to note that since GMG Markets is regulated by the FCA, the broker is only allowed to offer a maximum leverage ratio of 1:30 for major currencies, 1:20 for minor currencies, and 1:10 for commodities. Professional traders who qualify for the Pro Account are authorized by GMG Markets for maximum leverage of 1:400. In conclusion, GMG Markets is a regulated forex broker, overseen by the FCA. This regulation ensures that they adhere to strict operational standards, providing a secure platform for forex trading.

Did GMG Markets win any Awards?

Based on the available information, it appears that there are no specific awards won by GMG Markets. The search results primarily reference the Garden Media Guild Awards. and the Geneva Management Group. , which are unrelated to GMG Markets in the context of forex. Therefore, it can be concluded that GMG Markets has not won any awards that are publicly recognized or reported. Please note that this information is accurate as of the last update and may change over time. For the most accurate and up-to-date information, it is recommended to directly contact GMG Markets or visit their official website.

How do I get in Contact with GMG Markets?

GMG Markets, also known as Global Markets Group, is a renowned platform in the world of forex trading. They offer a wide range of services including trading in forex, commodities, and indices. For those interested in reaching out to GMG Markets, there are several contact methods available:. Email: You can send an email to info@gmgmarkets.co.uk for general inquiries. Alternatively, you can also reach out to their support team at support@gmgfx.co.uk for specific queries related to forex trading. Phone: You can call them at +44 203 865 3306 if you prefer to speak directly with a representative. Address: Their registered and business office is located at 15 Bishopsgate, London, United Kingdom, EC2N 3AR if you wish to visit or send mail. . It’s important to note that forex trading involves a high risk of losing money rapidly due to leverage. Therefore, it’s crucial to understand the risks involved and consider seeking independent advice if necessary. Remember, the world of forex trading is complex and constantly evolving. Staying in touch with your trading platform, like GMG Markets, can help you stay updated and make informed trading decisions.

Where are the Headquarters from GMG Markets based?

GMG, a global well-being company, has its headquarters located in various parts of the world. The Dubai HQ is situated at Umm Hurair Rd Oud Metha, Dubai, United Arab Emirates. They also have offices in Hong Kong, Riyadh, Saudi Arabia, Singapore, and Kuala Lumpur, Malaysia. In the context of forex, the location of a company’s headquarters can influence its business operations. For instance, being based in Dubai, a major financial hub, provides GMG with access to a large and diverse market. This can potentially lead to increased business opportunities and growth. Moreover, GMG has recently expanded its presence in Asia. In January 2023, GMG opened its new Asian headquarters at The Exchange 106 Tower in Kuala Lumpur, Malaysia. This sprawling 28,000 sq. ft. Asian headquarters will oversee regional operations and is expected to be a catalyst for further expansion and growth. It’s worth noting that the company’s strategic locations across different continents allow it to operate in various time zones, which is a significant advantage in the forex market that operates 24 hours a day. This geographical diversity also enables GMG to cater to a broad customer base and mitigate risks associated with economic fluctuations in a specific region. In conclusion, GMG’s multiple headquarters around the globe, coupled with its ambitious growth plans, position it well in the global market, including the forex market. It will be interesting to see how the company leverages these advantages in the future. Please note that this information is based on the latest available data as of 2023 and may be subject to change.

What kind of Customer Support is offered by GMG Markets?

GMG Markets, also known as Global Markets Group, is a leading online forex trading platform. They offer a comprehensive customer support system to assist their clients with various needs and inquiries related to forex trading. Contact Information: GMG Markets has a global presence with offices in Dubai, Hong Kong, Riyadh, Singapore, and Malaysia. They can be reached via telephone, facsimile, and email. This allows clients from different parts of the world to get in touch with them easily. Trading Support: GMG Markets provides support for a wide range of trading activities. They offer a platform for trading currencies, stocks, commodities, futures, bonds, and digital assets. This diverse portfolio allows traders to choose the type of trading that best suits their needs and expertise. Trading Platform: GMG Markets uses the MetaTrader 5 trading platform. This platform is widely recognized in the forex trading industry for its advanced features and user-friendly interface. It provides traders with a powerful tool to execute trades efficiently and effectively. Account Support: GMG Markets offers support for both live and demo accounts. This means that whether you’re a seasoned trader or a beginner trying out forex trading, you can get the necessary support from GMG Markets. They also provide guidance on how to deposit and withdraw funds from your account. In conclusion, GMG Markets offers a robust customer support system that caters to the diverse needs of forex traders. Their global presence, comprehensive trading support, advanced trading platform, and dedicated account support make them a reliable choice for forex trading.

Which Educational and Learning Materials are offered by GMG Markets?

GMG Markets, also known as Global Markets Group Limited, offers a comprehensive suite of educational and learning materials for those interested in forex trading. The Basics of Trading: This foundational course provides an introduction to forex trading. It covers the essential concepts and principles every trader needs to understand before they start trading. Technical Analysis Guide: This guide dives into the methodologies and strategies used in technical analysis. It’s designed to help traders understand and interpret market trends and price patterns, which are crucial for making informed trading decisions. Fundamental Analysis Guide: This guide focuses on the economic factors that affect forex markets. It teaches traders how to analyze economic indicators, news events, and other fundamental data to predict market movements. How to use MetaTrader 5: MetaTrader 5 is a popular trading platform used by forex traders worldwide. This guide provides a detailed walkthrough of the platform’s features and functionalities, helping traders navigate and utilize the platform effectively. Expert Advisors & VPS Trading: This section introduces traders to automated trading systems, also known as Expert Advisors (EAs), and Virtual Private Server (VPS) trading. EAs can automate trading strategies, while VPS allows traders to run their EAs 24/7 without needing their computers to be on. These educational resources are designed to equip traders with the knowledge and skills they need to navigate the forex market confidently and make informed trading decisions.

Can anyone join GMG Markets?

GMG Markets, an established forex broker company based in Great Britain. , offers a platform for trading a wide array of globally traded financial products. The company, founded in 2015, has rapidly grown and acquired a broad client base across Europe, Asia, South America, Africa, and Australia. GMG Markets differentiates itself by offering its services through an STP model (Straight Through Processing), which allows for direct and fast processing of trade orders. This model, combined with competitive spreads and commissions across various asset classes, and advanced, user-friendly trading platforms, makes GMG Markets an attractive choice for many traders. However, not everyone can join GMG Markets. The number and type of accounts that a trader can open with a broker company usually differ according to the country in which the brokerage operates, the country of residence of the trader, and the regulatory authorities under whose jurisdiction it operates. GMG Markets offers the choice of multiple demo accounts. These accounts usually have a balance of $100,000 virtual money that sport real-time prices and trading conditions. These demo accounts are free to open and can be used by traders for a period of 30 days. The following live account types can be opened with GMG Markets. : Standard Account: Minimum deposit: $200, Leverage: 1:30, Spread: From 1.1 pips. Pro Account: Minimum deposit: $10,000, Leverage: 1:400, Spread: From 0.1 pips + $10 commission per lot. . The Standard Account is popular with beginner traders, whereas the Pro Account focuses more on the needs of the advanced trader. The process to open an account can be started from links on the company homepage. It is a straightforward process that consists of a few steps. Since GMG Markets is regulated by the FCA, the broker is only allowed to offer a maximum leverage ratio of 1:30 for major currencies, 1:20 for minor currencies, and 1:10 for commodities. Professional traders who qualify for the Pro Account are authorized by GMG Markets for maximum leverage of 1:400. In conclusion, while GMG Markets offers a wide range of trading options and account types, not everyone can join due to regulatory restrictions and specific account requirements.

Who should NOT sign up with GMG Markets?

GMG Markets is a subsidiary company of Global Markets Group Limited, a corporation that is regulated and overseen by the Financial Conduct Authority (FCA) in the United Kingdom. They offer online forex trading. and specialize in providing liquidity, trading, and risk management solutions. However, forex trading is not suitable for everyone due to its inherent risks. Here are some categories of individuals who might want to reconsider signing up with GMG Markets:. Novice Traders: Forex trading is complex and requires a good understanding of the market. Novice traders who lack knowledge and experience in forex trading might find it challenging to navigate the forex market and could potentially incur significant losses. Risk-Averse Individuals: Forex trading involves substantial risk. The use of leverage in forex trading can result in losses that exceed a trader’s initial investment. Therefore, individuals who are not comfortable with taking high risks should not engage in forex trading. Individuals Without Capital: Real trading is possible with a minimum deposit of $200 at GMG Markets. Individuals who do not have the necessary capital to invest should not sign up. Individuals Seeking Quick Profits: While forex trading can yield high profits, it can also lead to substantial losses. Individuals seeking quick profits without understanding the market dynamics might end up losing their investment. Individuals Not Willing to Monitor Market Conditions: Forex prices can change dramatically due to the differential between currency values, interest rates, and time differences between the opening and settlement of a contract. Individuals who are not willing or able to monitor these market conditions regularly might not be suitable for forex trading. Remember, it’s important to understand the risks associated with forex trading and to trade responsibly. It’s recommended to gain a solid understanding of forex trading, perhaps through a demo account, before trading with real money.

Does GMG Markets offer Discounts, Coupons, or Promo Codes?

GMG Markets is known for offering various discounts, coupons, and promo codes to its customers. Here are some of the offers that have been available:. Up to 51% off: Customers have been able to enjoy up to 51% off on selected GMG products. This offer also included free return. 25% off: GMG items were available at up to 25% off, along with free P&P. 50% off: By signing up at GMG, customers could get 50% off on ORGS Raising Founds Products. Free Shipping: Selected GMG products were available at 51% off with free shipping. Special Christmas Deals: GMG offered exclusive deals during the Christmas season. Please note that these offers may vary and it’s always a good idea to check the latest offers from GMG Markets. Also, remember that investing in forex markets involves risk, and it’s important to do thorough research and consider getting advice from a financial advisor before making any investment decisions. Please note that the information provided is based on the data available as of December 2023. and may have changed. Always check the official GMG Markets website or contact their customer service for the most accurate and up-to-date information.

Which Account Types are offered by GMG Markets?

GMG Markets, also known as Global Markets Group, offers two types of accounts for forex trading. These accounts cater to different types of traders, from novices to industry veterans. The first type of account is designed with less experienced traders in mind. This account type provides a user-friendly platform for those who are new to forex trading. It offers a range of features to help beginners understand and navigate the complexities of forex markets. These include educational resources, easy-to-use trading tools, and dedicated customer support. The second type of account is tailored for seasoned traders. This account type offers more advanced features, including sophisticated trading tools and analytics. It allows experienced traders to execute complex strategies and manage their trades with greater precision. Both account types provide access to a wide range of tradable assets, including currencies, stocks, commodities, futures, bonds, and digital assets. They also offer a secure trading environment, ensuring that traders can carry out their trading activities safely. It’s important to note that the specific features and benefits of each account type may vary. Traders are advised to review the terms and conditions of each account type carefully before making a decision.

How to Open a GMG Markets LIVE Account?

Opening a GMG Markets LIVE Account involves a few simple steps. Here’s a detailed guide:. Personal Details: The first step is to fill in your personal details. This includes your country of residence, first name, and last name. About Yourself: The next step is to tell more about yourself. This could include information about your financial status, trading experience, and risk tolerance. Trading Account Configuration: After providing personal details, you’ll need to configure your trading account. This could involve choosing the type of account you want (e.g., ECN, Standard, Islamic), the platform you prefer (e.g., MetaTrader 4, MetaTrader 5), and the base currency for your account. Answer a Few Questions: You may be asked to answer a few questions to assess your suitability for forex trading. These questions could be related to your understanding of forex markets, your trading goals, and your risk appetite. Open Account and Start Trading: Once you’ve completed the above steps, you can open your account and start trading. It’s important to note that the estimated time to complete these steps is approximately 2 minutes. Remember, GMG Markets provides a fast account opening process and instant funding. They are a Forex CFD Provider covering 6 asset classes and 2000+ products. Please note that the information provided here is based on the latest available data and may vary. Always check the official GMG Markets website for the most accurate and up-to-date information.

How to Open a GMG Markets DEMO account?

Opening a GMG Markets DEMO account involves a few simple steps. Here’s a detailed guide:. Step 1: Visit the GMG Markets Website Start by visiting the official GMG Markets website. Step 2: Navigate to the Demo Account Section Look for the “Demo Account” section on the website. This is usually located in the main navigation menu or within the “Accounts” section. Step 3: Click on ‘Add Account’ Once you’re in the “Demo Account” section, click on the “Add account” button. Step 4: Fill in Your Personal Details You’ll be asked to fill in your personal details. This typically includes your first name, last name, and country of residence. Step 5: Configure Your Trading Account Next, you’ll need to configure your trading account. This may involve choosing your account type, currency, and leverage. Step 6: Answer a Few Questions You might be asked to answer a few questions about your trading experience. This is to ensure that you understand the risks involved in forex trading. Step 7: Open Account and Start Trading Finally, click on the “Open account and start trading” button. The estimated time to complete this process is about 2 minutes. Remember, a demo account allows you to practice trading without risking real money. It’s a great way to familiarize yourself with the forex market and the trading platform. GMG Markets provides popular trading platforms like MetaTrader 4 and MetaTrader 5. Please note that the exact process may vary slightly depending on the website’s layout and design. Always ensure that you’re on the official GMG Markets website before providing any personal information.

How Are You Protected as a Client at GMG Markets?

As a client at GMG Markets, you are protected in several ways:. 1. Regulatory Oversight GMG Markets is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. This means that the company must adhere to strict regulatory standards designed to protect clients and ensure fair trading practices. 2. Segregation of Client Funds Your funds are held in segregated accounts with reputable banking institutions in the UK. This means that your money is kept separate from the company’s own funds, providing an additional layer of security. 3. Client Money Rules All client funds are subject to the Client Money Rules of the FCA. These rules set out the requirements for holding client assets, including organizational requirements, segregation methodology, records, reconciliation, and acknowledgement of trust. 4. Financial Services Compensation Scheme (FSCS) The FSCS is a compensation fund of last resort for customers of authorized financial services firms. It is designed by the UK government to act as a “safety net” and usually covers private (retail) investors and small businesses if they have been clients of a financial firm which becomes insolvent. 5. Secure Trading Environment GMG Markets provides a secure and reliable access to trading platforms and investment instruments, based on the latest technology and innovation. In conclusion, as a client at GMG Markets, you are protected by a combination of regulatory oversight, segregation of client funds, adherence to Client Money Rules, coverage by the FSCS, and a secure trading environment. This comprehensive protection provides peace of mind and ensures a safe and fair trading experience.

Which Funding methods or Deposit Options are available at GMG Markets?

Unfortunately, the specific funding methods or deposit options for GMG Markets are not explicitly mentioned in the search results. However, it is known that GMG Markets is a fully authorized and licensed broker by the Financial Conduct Authority (FCA), which means they are required to adhere to strict financial standards, including the safeguarding of client funds. Client funds are protected in segregated accounts held with reputable banking institutions in the UK. For more specific information about the deposit options at GMG Markets, it would be best to directly contact their customer service or check their official website. Please note that the availability of certain deposit methods can vary depending on the client’s country of residence. It’s always important to understand the terms and conditions associated with each deposit method. In the context of forex trading, funding an account is a crucial step as it allows traders to participate in the forex market. The deposit options provided by a broker can greatly affect the convenience and speed of starting to trade. Common deposit methods in the industry include bank transfers, credit/debit cards, and various online payment systems. Each of these methods has its own advantages and considerations, such as transaction fees, processing times, and ease of use. Remember, it’s essential to ensure that any broker you choose to trade with, including GMG Markets, is regulated by a reputable financial authority. This provides a level of protection for your funds and ensures that the broker operates with transparency and fairness.

What is the Minimum Deposit Amount at GMG Markets?

GMG Markets, an established forex broker company based in Great Britain, offers a wide array of globally traded financial products delivered through an STP model (Straight Through Processing). The company has grown rapidly since its inception in 2015 and has acquired a broad client base across Europe, Asia, South America, Africa, and Australia. GMG Markets offers the choice of multiple demo accounts according to sources on the internet. These accounts usually have a balance of $100,000 virtual money that sport real-time prices and trading conditions. The following live account types can be opened with GMG Markets. Standard Account. Minimum deposit: $200. Leverage: 1:30. Spread: From 1.1 pips. Pro Account. Minimum deposit: $10,000. Leverage: 1:400. Spread: From 0.1 pips + $10 commission per lot. The Standard Account is popular with beginner traders, whereas the Pro Account focuses more on the needs of the advanced trader. The process to open an account can be started from links on the company homepage. It’s important to note that GMG Markets is a fully authorized and licensed by the FCA (Financial Conduct Authority) broker. This enables the company to deliver a transparent and secure trading environment. Fund protection is delivered with segregated accounts held at Tier One banks. In conclusion, GMG Markets offers a competitive and secure platform for forex trading. The minimum deposit for a Standard Account is $200, making it accessible for beginner traders, while the Pro Account caters to more advanced traders with a minimum deposit of $10,000.

Which Withdrawal methods are available at GMG Markets?

GMG Markets, a subsidiary of Global Markets Group Limited, offers its account holders various methods for withdrawing funds. These methods are designed to provide convenience and ease of use for traders involved in forex and CFD trading. Wire Transfer: This is a traditional and reliable method of transferring funds. It involves sending money directly from your bank account to GMG Markets’ account. Skrill: Skrill is a digital wallet that allows fast and secure online transactions. It’s a popular choice among forex traders due to its ease of use and quick processing times. Neteller: Similar to Skrill, Neteller is another widely used digital wallet. It offers secure online transactions and is accepted by many forex brokers. Credit and Debit Cards (Visa/MasterCard): GMG Markets also accepts withdrawals through Visa and MasterCard credit and debit cards. This method is convenient for many traders as it allows them to use their existing bank cards. Please note that the availability of these withdrawal methods may depend on your region. It’s always a good idea to check with GMG Markets for the most accurate and up-to-date information. Also, keep in mind that while GMG Markets strives to process withdrawals quickly, the processing times can vary depending on the method used.

Which Fees are charged by GMG Markets?

GMG Markets, a subsidiary company of Global Markets Group Limited, is a Forex and CFD Broker that offers a variety of financial products through an STP model (Straight Through Processing). Here are the key fees associated with trading on GMG Markets:. Spread Fee: Like other CFD brokers, GMG Markets charges a spread fee. The minimum spread for EUR/USD is 1.1 pips. For the most current spread charges, it’s recommended to visit the GMG Markets website. Deposit and Withdrawal Methods: GMG Markets accepts deposits and withdrawals through Wire Transfer, Skrill, Neteller, and Credit and Debit cards (Visa/MasterCard). The minimum deposit is $200. Trading Platforms: GMG Markets offers two trading platforms for FX and CFD trading - MT4 and MT5. Both platforms are well-known in the forex world and provide a good environment for traders. Account Types: GMG Markets offers multiple account types. The Standard Account requires a minimum deposit of $200, offers leverage up to 1:30, and has spreads from 1.1 pips. The Pro Account requires a minimum deposit of $10,000, offers leverage up to 1:400, and has spreads from 0.1 pips plus a $10 commission per lot. Please note that trading with GMG Markets involves risk, and 74–89% of retail investor accounts lose money when trading CFDs. It’s important to understand how CFDs work and whether you can afford to take the high risk of losing your money.

What can I trade with GMG Markets?

GMG Markets, a subsidiary company of Global Markets Group Limited, offers a wide range of trading options. Here’s a detailed overview:. Forex Trading Forex, or foreign exchange, is a significant part of GMG Markets’ offerings. Traders can engage in forex trading with a variety of currency pairs, including but not limited to EUR/USD, USD/JPY, GBP/USD, and AUD/USD. Commodities Commodities are another asset class that traders can invest in through GMG Markets. This includes a wide range of commodities, although the specific options are not listed in the sources. Indices Indices, which are portfolios of stocks representing a particular market or a portion of it, are also available for trading. Shares GMG Markets provides the opportunity to trade CFDs on shares. This allows traders to speculate on the rising or falling prices of fast-moving global financial markets (or instruments such as shares, indices, commodities, currencies, and treasuries. Treasuries Treasuries, or government bonds, are also part of GMG Markets’ trading options. These fixed-interest securities issued by governments are considered a safe and secure investment. Trading Platforms For FX and CFD trading, GMG Markets offers two trading platforms - MT4 and MT5. Both platforms are well-known in the forex world and provide a good environment for traders. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It’s important to consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Which Trading Platforms are offered by GMG Markets?

GMG Markets, a subsidiary company of Global Markets Group Limited, offers two main trading platforms for Forex and CFD trading. MetaTrader 4 (MT4). : This platform is popular in the forex world and provides a good environment for traders. It can be downloaded to any computer or accessed via a web browser or a mobile application. MetaTrader 5 (MT5). : This platform is also well-known in the forex world and provides a conducive environment for traders. Like MT4, MT5 can also be downloaded to any computer or accessed via a web browser or a mobile application. Both platforms are known for their robust charting capabilities and the availability of custom tools. They offer a leverage of up to 1:400, which can be considered suitable for most traders. The minimum deposit for real trading is $200. The methods of deposit and withdrawal include Wire Transfer, Skrill, Neteller, and Credit and Debit cards (Visa/MasterCard). As for the spreads, the minimum spread for EUR/USD is 1.1 pips. For the most current spread charges, you can visit the GMG Markets website. Please note that trading in Forex and CFDs carries a high level of risk and may not be suitable for all investors. Always consider your level of experience and risk tolerance before engaging in such trades.

Which Trading Instruments are offered by GMG Markets?

GMG Markets, also known as Global Markets Group Limited, offers a wide range of trading instruments. Here are the key offerings:. Forex: GMG Markets provides a platform for trading in the foreign exchange market. This includes major currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Indices: Indices are another key trading instrument offered by GMG Markets. Indices trading allows investors to speculate on the price movements of entire stock markets. Commodities: GMG Markets offers the opportunity to trade in various commodities. This includes precious metals like gold and silver, as well as energy commodities. Treasuries: Treasuries, or government bonds, are also part of GMG Markets’ trading instrument offerings. These are considered a safe haven for investors, especially during times of market volatility. Shares: GMG Markets provides a platform for trading shares, allowing investors to take a position on the future value of individual companies. CFDs: Contract for Differences (CFDs) are complex instruments that come with a high risk of losing money rapidly due to leverage. GMG Markets offers CFD trading in forex, shares, commodities, and treasuries. Please note that trading in these instruments involves significant risk and may not be suitable for all investors. It’s important to fully understand the risks involved before engaging in trading activities.

Which Trading Servers are offered by GMG Markets?

GMG Markets, a renowned name in the world of forex trading, offers a range of trading servers to cater to the diverse needs of traders worldwide. MetaTrader 4 and MetaTrader 5 are the two primary trading platforms offered by GMG Markets. These platforms are well-known in the forex world and provide a conducive environment for traders. Both MT4 and MT5 can be downloaded to any computer or accessed via just a web browser or a mobile application. The MetaTrader 5 platform is particularly highlighted on the GMG Markets website. It is promoted with the tagline "Be your best trader with Raw Spreads From 0.0 pips". This suggests that GMG Markets offers competitive spreads, which is a crucial factor for forex traders. In terms of server location, one of the servers, named itexsys-Demo MT4, is located in the United Kingdom. This information is particularly important for traders as the server location can impact the latency in trade execution. In addition to forex, GMG Markets also allows trading in a variety of other financial instruments. Traders can trade currencies, stocks, commodities, futures, bonds, and digital assets safely and securely. This wide range of tradable assets makes GMG Markets a versatile platform for both beginner and experienced traders. It’s worth noting that GMG Markets is not just limited to forex and CFD trading. They also have a presence in the cryptocurrency market. They partner with leading cryptocurrency marketplaces to supply liquidity. , which indicates their commitment to providing a comprehensive trading experience. In conclusion, GMG Markets offers a robust trading environment with its MetaTrader platforms and a variety of trading servers. Their commitment to offering raw spreads and a wide range of tradable assets makes them a preferred choice for many forex traders. As always, traders should conduct their own due diligence before choosing a trading platform.

Can I trade Crypto with GMG Markets? Which crypto currencies are supported by GMG Markets?

GMG Markets is a well-established firm that specializes in providing liquidity, trading, and risk management solutions. They have a strong presence in the crypto market and have built long-term relationships with their clients by offering exceptional service, expertise, and trading capabilities. However, it’s important to note that GMG Markets does not feature any Contracts for Difference (CFDs) on cryptocurrencies. This means that while they are deeply involved in the crypto market, they do not offer direct trading of cryptocurrencies through their platform. In the context of forex, GMG Markets is a subsidiary company of Global Markets Group Limited, a corporation that is regulated and overseen by the Financial Conduct Authority (FCA) in the United Kingdom. They offer solid spreads on most assets and feature a free demo account for practice trading. Their trading platforms include MetaTrader 4 and MetaTrader 5, which are well-known in the forex world and provide a good environment for traders. As for the specific cryptocurrencies supported by GMG Markets, the information is not explicitly stated in the available resources. GMG Markets is known to partner with leading cryptocurrency marketplaces to supply liquidity. , but the exact cryptocurrencies involved in these partnerships are not specified. In conclusion, while GMG Markets has a significant presence in the crypto market, they do not offer direct trading of cryptocurrencies on their platform. For those interested in trading cryptocurrencies, it would be advisable to reach out to GMG Markets directly for the most accurate and up-to-date information.

What is the Leverage on my GMG Markets Trading Account?

GMG Markets, also known as Global Markets Group, is a UK-based forex broker regulated by the UK’s Financial Conduct Authority. It offers two types of accounts: Standard and Pro. The Standard Account requires a minimum deposit of $200 and offers a maximum leverage of 1:400. This high leverage can be considered suitable for most traders. However, it’s advised to use such a level with caution, as it can lead to losses. The Pro Account, on the other hand, is designed for professional traders. It requires a minimum deposit of $10,000 and offers a maximum leverage of 1:50. The Pro Account also charges a $10 commission per lot. Leverage in forex trading is expressed as a ratio, such as 50:1, 200:1, or 500:1. For instance, if a trader has $1,000 in a trading account and is trading ticket sizes of 200,000 USD/JPY, that leverage will equate to 200:1. It’s important to note that while high leverage can increase potential profits, it can also amplify losses. Therefore, it’s crucial to understand the risks associated with using high leverage in forex trading. Please note that the information provided is based on the latest available data and may be subject to change.

What kind of Spreads are offered by GMG Markets?

GMG Markets, a subsidiary company of Global Markets Group Limited. , offers variable spreads for its clients. Standard Account The Standard account offers spreads starting as low as 1 pip. For the EUR/USD pair, a typical feature spread is 1.1 pips. Notably, no commission is charged for this account. Pro Account The Pro account delivers spreads for the EUR/USD pair from 0.1 pips. However, a commission is charged at $10 per lot. Other Details GMG Markets also offers different leverage for different clients. For instance, the standard account has a maximum leverage of 1:400, while the Pro account has a leverage of 1:50. Real trading is possible with a minimum deposit of $200. Please note that the spreads and other conditions may vary and it’s always a good idea to check the latest information on the GMG Markets website.

Does GMG Markets offer MAM Accounts or PAMM Accounts?

In the world of Forex trading, MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts are popular tools that allow fund managers to manage multiple accounts from a single master account. MAM accounts enable fund managers to trade Forex, Indices, Shares, Commodities, and more using CFDs on behalf of their clients. When a trade is executed on the master account, it is instantly replicated on all eligible sub-accounts, resulting in significant time savings, improved efficiency, and reduced chances of errors. On the other hand, PAMM accounts allow investors to allocate funds to account (money) managers, which can then be traded from one master account. The PAMM system is predominantly used in forex, providing investors with the opportunity to profit from trading, without needing to carry out technical analysis or take positions themselves. However, based on the information available, it’s unclear whether GMG Markets offers MAM or PAMM accounts. For the most accurate and up-to-date information, it’s recommended to directly contact GMG Markets or visit their official website.

Does GMG Markets allow Expert Advisors?

GMG Markets and Expert Advisors. GMG Markets, officially known as Global Markets Group Limited, is a well-established forex broker company based in Great Britain. It offers a wide array of globally traded financial products delivered through an STP model (Straight Through Processing). Expert Advisors and GMG Markets. Expert Advisors (EAs) are automated trading systems that operate within the MetaTrader platform. They are designed to implement automated trading strategies based on pre-set parameters. EAs can be particularly useful for forex traders, as they can monitor the markets 24/7, identify trading opportunities, and execute trades automatically. According to the information available, GMG Markets does allow the use of Expert Advisors. This is a significant feature for many traders, as EAs can help to automate trading strategies, potentially leading to more efficient and effective trading. Trading Platforms. GMG Markets provides its clients with access to the MetaTrader 5 platform. This platform is widely recognized for its advanced trading features, technical analysis tools, and the ability to use Expert Advisors. Account Types. GMG Markets offers multiple account types, including the Standard Account and the Pro Account. The Standard Account, with a minimum deposit of $200, offers leverage of 1:30 and spreads from 1.1 pips. The Pro Account, aimed at more advanced traders, requires a minimum deposit of $10,000, offers leverage of 1:400, and has spreads from 0.1 pips plus a $10 commission per lot. Regulation and Security. GMG Markets has been authorized and regulated by the Financial Conduct Authority (FCA) to act as an investment firm since September 2016. This regulation provides traders with an additional layer of security and trust when trading with GMG Markets. In conclusion, GMG Markets does allow the use of Expert Advisors, making it a viable choice for traders who wish to automate their trading strategies. As always, traders should conduct their own due diligence before choosing a forex broker.