Hirose Financial Review 2026

What is Hirose Financial?

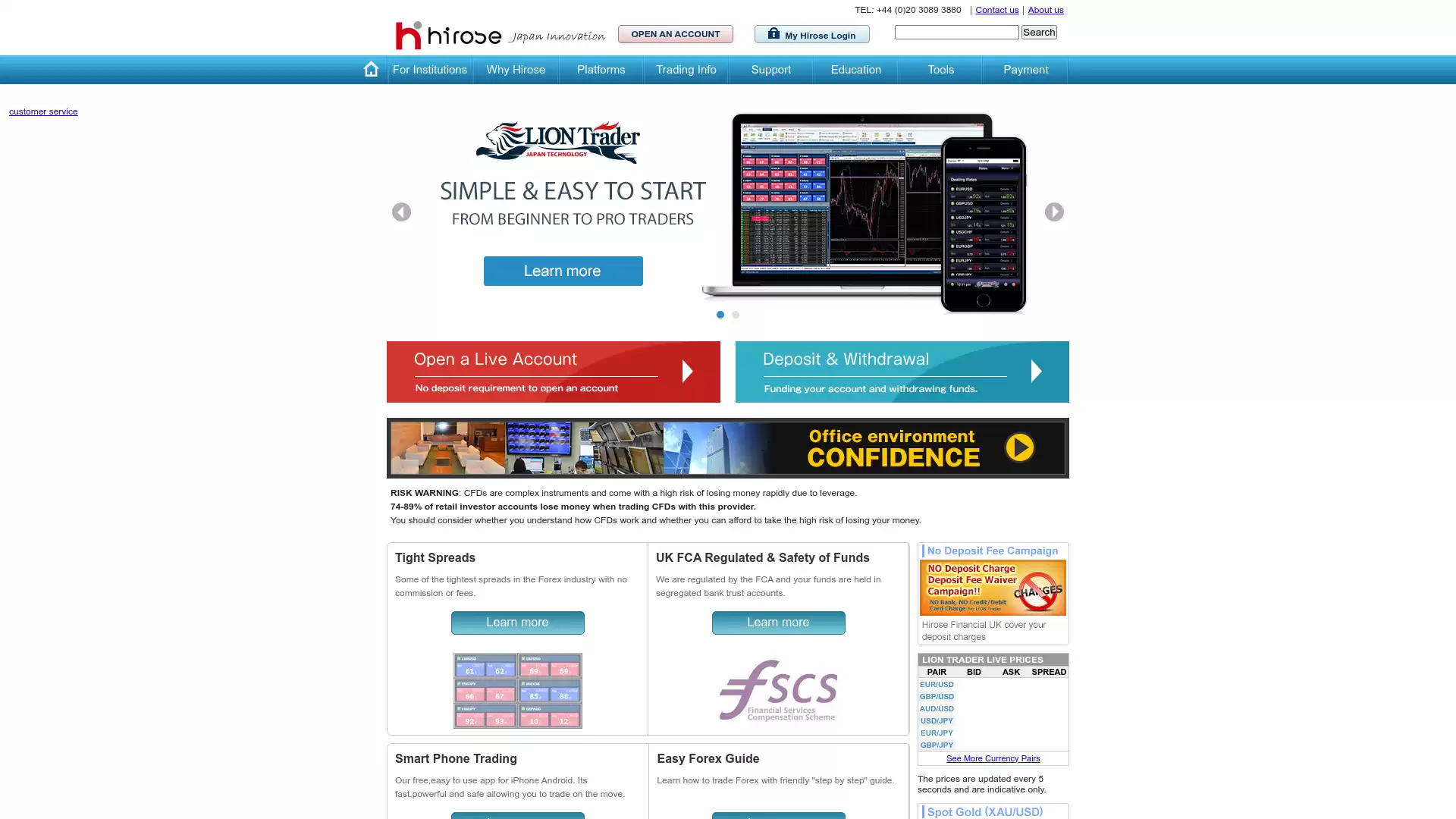

Hirose Financial is a UK-based provider of forex trading services. It is a subsidiary of the Japanese foreign exchange company Hirose Financial. , which is considered one of Japan’s largest over-the-counter (OTC) brokers. Hirose Financial UK offers forex trading on margin through its own online trading platform called LION Trader and through MetaTrader 4. The company provides some of the tightest spreads in the Forex industry with no commission or fees. The company is regulated by the Financial Conduct Authority (FCA) in the UK, and client funds are held in segregated bank trust accounts. This ensures the safety of funds, which is a crucial aspect for traders. Hirose Financial UK also offers a free, easy-to-use app for iPhone and Android. This app is fast, powerful, and safe, allowing users to trade on the move. For beginners, Hirose Financial UK provides a step-by-step guide on how to trade forex. They also offer Skype support for beginners. This comprehensive support system can be very helpful for those who are new to forex trading. In conclusion, Hirose Financial UK is a reputable forex trading service provider that offers a range of features to assist both new and experienced traders. Its tight spreads, safety measures, and supportive educational resources make it a strong choice for individuals interested in forex trading.

What is the Review Rating of Hirose Financial?

- 55brokers: 55brokers rated Hirose Financial with a score of 89. This rating was last checked at 2024-01-06 11:24:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Hirose Financial with a score of 63. This rating was last checked at 2024-01-06 02:36:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Hirose Financial with a score of 66. This rating was last checked at 2024-01-05 23:00:04. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Hirose Financial with a score of 71. This rating was last checked at 2024-03-13 22:10:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Hirose Financial?

Hirose Financial, a reputable online broker, offers several advantages in the context of forex trading. Regulation: Hirose Financial is regulated by the Financial Conduct Authority (FCA), ensuring a high level of security and trustworthiness. Low Minimum Deposit: The platform allows users to open a live account with a minimum deposit of just USD 1. Variety of Services: Hirose Financial provides a wide range of services, including trading in foreign currencies. User-Friendly Platform: The platform is easy to use and offers up to 50 built-in trading indicators. Multilingual Support: Hirose Financial offers a multi-language communication system, accommodating clients from many different countries. Educational Resources: Hirose Financial has an excellent training base, allowing users to learn to trade from scratch. Large Customer Base: Hirose Financial transacts more than $200 billion each month and has more than 200,000 customers across the globe. Updated Market Analysis: The platform provides access to updated market analysis, aiding users in making informed trading decisions. Various Trading Strategies: Hirose Financial supports various trading strategies such as scalping and long-term trading opportunities. These features make Hirose Financial a competitive choice for forex traders. However, potential users should also be aware of the risks involved in trading and ensure they understand these risks before beginning to trade.

What are the Cons of Hirose Financial?

Hirose Financial, a leading online brokerage firm, has several aspects that some users may consider as drawbacks:. Spreads: Hirose Financial is known for its competitive spreads during normal market hours. However, these spreads may widen due to low liquidity in the market connected to some news, upcoming end of a trading day, or some other common factors. This could impact the profitability of trades, especially for high-frequency traders. Pressure for Larger Funding: Some users have reported that they felt pressured into larger funding for premium services. While this might be a common practice among many brokers, it could be a concern for traders who prefer to start with a smaller investment. Account Opening Process: The account opening process at Hirose Financial involves several essential compliance checks to ensure that users understand the risks involved in trading. This process can take up to several days depending on individual circumstances. , which might be inconvenient for those who wish to start trading immediately. Leverage: Hirose Financial offers a maximum leverage of 1:30. While this might be sufficient for some traders, others, particularly those with a higher risk tolerance, might find this limiting. These points should be considered by potential users when deciding whether Hirose Financial is the right platform for their trading needs. It’s always recommended to thoroughly research and consider multiple platforms before making a decision.

What are the Hirose Financial Current Promos?

Based on the available information, it’s not possible to provide the current promotions of Hirose Financial. It’s recommended to visit their official website or contact their customer service for the most accurate and up-to-date information. Please note that promotions can change frequently, so it’s always a good idea to check back regularly. Also, remember to read the terms and conditions of any promotion carefully to ensure you understand the requirements.

What are the Hirose Financial Highlights?

Hirose Electric Group, a renowned entity in the financial world, has been consistently sharing its financial results, providing a transparent view of its performance. FY2023 Highlights In FY2023, Hirose Electric Group released its financial results for the 2nd quarter (Apr 2023-Sep 2023) on Nov 02, 2023. They also held a financial results briefing for the 2nd quarter of the fiscal year ending March 2024 on Nov 17, 2023. The financial results for the 1st quarter (Apr 2023-Jun 2023) were released on Aug 02, 2023. FY2022 Highlights In FY2022, the company presented its full-year financial results (Apr 2022 - Mar 2023) on May 09, 2023. They also shared their medium and long-term growth strategy for 2023. The financial results for the 3rd quarter (Apr 2022 - Dec 2022) were presented on Feb 02, 2023. FY2021 Highlights In FY2021, Hirose Electric Group presented its full-year financial results (Apr 2021 - Mar 2022) on May 09, 2022. They also shared their medium and long-term growth strategy for 2022. The financial results for the 3rd quarter (Apr 2021 - Dec 2021) were presented on Feb 03, 2022. These financial highlights provide a comprehensive view of Hirose Electric Group’s performance over the years. They reflect the company’s commitment to transparency and accountability, key factors in maintaining investor confidence and fostering sustainable growth. Please note that this information is based on the latest available data and may be subject to change.

Is Hirose Financial Legit and Trustworthy?

Hirose Financial is a UK-based retail foreign exchange broker that provides foreign exchange trading on margin through its own online trading platform called LION Trader. It was founded in 2004 and has its headquarters in the United Kingdom. To open a live account, a minimum deposit of at least USD 1 is required. Alternatively, Hirose Financial offers a demo account with which users can train and get to know the platform. The Financial Services Authority in the United Kingdom regulates it (FRN: 540244). Hirose Financial transfers all customer funds to a separate bank account and uses banks on level 1. Each new client must undergo several essential compliance audits to ensure that they understand the risks involved in trading and can trade. This includes providing a scanned color copy of a passport, driving license, or ID card, an expense bill or bank statement from the last three months with the address provided. However, it’s important to note that user reviews on Trustpilot rate Hirose Financial as average. Some users have praised Hirose Financial’s handling of majors and crosses. , while others have reported isolated sliding cases. In conclusion, Hirose Financial appears to be a legitimate and regulated forex broker. However, as with any financial decision, potential users should conduct their own research and consider multiple sources of information before opening an account. It’s also recommended to start with a demo account to familiarize oneself with the platform and understand the risks involved in forex trading.

Is Hirose Financial Regulated and who are the Regulators?

Hirose Financial is indeed a regulated entity. The primary regulatory body overseeing Hirose Financial is the Financial Conduct Authority (FCA). This UK-based regulatory authority is known for its stringent standards and rigorous oversight, ensuring that financial institutions under its purview adhere to the highest levels of transparency and integrity. Hirose Financial UK Ltd, a subsidiary of Hirose Tusyo Inc., based in Japan, operates under the regulatory framework established by the Capital Requirements Directive (CRD) and the Capital Requirement Regulation (CRR). This framework, also known as “CRD IV”, implements the Basel III agreement in the EU and consists of three “Pillars”:. Pillar 1 sets out minimum capital requirements firms are required to meet for credit, market, and operational risk. Pillar 2 requires firms and their regulatory supervisors to consider whether a firm should hold additional capital against risks not covered in Pillar 1. Pillar 3 requires firms to publicly disclose certain details of their risks, capital, and risk management arrangements. Hirose Financial UK Ltd is a BIPRU 125k Limited Licence Firm-FCA FRN 540244. The firm’s overall risk management arrangements and its approach to assessing its capital and liquidity adequacy are described in its Pillar 3 disclosures. In terms of its business model, Hirose Financial UK operates a No Dealing Desk (NDD) or straight-through processing (STP) model. This means that client orders are routed directly to liquidity providers (banks or other financial institutions), and Hirose does not act as a market maker. Hirose Financial’s trading platform, LION, is based on the Act Forex (ActTrader) system. It also provides traders with custom indicators, trading algos/EAs, and programmable strategies as an alternative to MetaTrader. In summary, Hirose Financial is a well-regulated broker, providing a transparent and trustworthy platform for forex trading. Its adherence to FCA regulations and its commitment to maintaining high standards of operation make it a reliable choice for traders.

Did Hirose Financial win any Awards?

Based on the information available, there is no evidence to suggest that Hirose Financial has won any awards. It’s always a good idea to check the company’s official website or contact them directly for the most accurate and up-to-date information. Please note that while Hirose Financial may not have won any specific awards, this does not necessarily reflect on the quality of their services or their reputation in the financial industry. Many factors can contribute to a company’s success and reputation, including their financial performance, customer service, and business practices. It’s important to consider all of these aspects when evaluating a company.

How do I get in Contact with Hirose Financial?

Hirose Financial UK Ltd. is a leading provider of forex trading services. They are committed to supporting their clients and making the trading environment as smooth as possible. Contact Methods:. Live Chat: The customer support team can be reached via live chat. The chat button is situated at the top of every page on their website. Email: For all sorts of inquiries such as account opening, technical support, introducing brokers, general inquiries, complaints, and more, they can be reached by email. The customer support email is info@hiroseuk.com. Phone: They can also be contacted by phone. The contact number is +44 (0)20 3089 3880. Please note that the call may be recorded for quality assurance purposes. Contact Us Form: There is a ‘Contact Us’ form on their website. If you require a callback from them, particularly if you reside outside of the U.K., you can specify the contact time and provide your phone number. Skype: They offer additional support through their Skype screen sharing facility. You can fill in the request form with any queries or comments, specify a convenient time for them to contact you, and provide your Skype ID. Office hours for general inquiries are Monday to Friday from 9:00 am to 6:00 pm. Hirose Financial UK Ltd. treats personal information provided in this form in a secure and proper manner. They will not use it other than to respond to your queries/comments. Forex Trading with Hirose Financial:. Hirose Financial UK Ltd. offers forex trading with some of the tightest spreads in the Forex industry with no commission or fees. They are regulated by the FCA and your funds are held in segregated bank trust accounts. They also offer a free, easy-to-use app for iPhone and Android, allowing you to trade on the move. If you are a beginner, they will guide you to learn to trade Forex step-by-step. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Where are the Headquarters from Hirose Financial based?

The headquarters of Hirose Financial UK Ltd. are located at 25 Finsbury Circus, London, GB-LND, EC2M 7EE, GB. This entity is a legal entity registered with the London Stock Exchange LEI Limited. Hirose Financial UK Ltd. is a subsidiary of the Hirose Tusyo of Japan, which was established in 2004 and is one of the largest OTC FX providers and award-winning FX brokers. It’s worth noting that Hirose Financial UK Ltd. is authorized and regulated by the Financial Conduct Authority (FCA), FRN 540244. The parent company, Hirose Electric Co., Ltd., is based in 2-6-3 Nakagawa Chuoh, Tsuzuki-ku, Yokohama 224-8540, Japan. The company was founded on August 15, 1937. As of the year ended March 31, 2023, the company had a paid-up capital of 9,404,000,000 yen and sales of 183,224,000,000 yen. The company employs 4,944 people. Hirose Electric Co., Ltd. is involved in the manufacture and sale of a wide variety of high-performance connectors for applications which include computers, peripheral equipment, terminal equipment, mobile/wired/wireless communications equipment, office automation equipment, consumer equipment, control equipment, and automotive uses. In the context of forex, Hirose Financial UK Ltd. provides forex trading services. It offers a variety of platforms for trading forex, including its own platform, LION Trader, and the popular MetaTrader 4 platform. The company offers competitive spreads and no commission on trades. It also provides educational resources for forex traders.

What kind of Customer Support is offered by Hirose Financial?

Hirose Financial UK Ltd. is committed to providing a smooth trading environment for its clients. The customer support team can be reached via live chat, e-mail, or phone. Contact Form: Clients can fill in a contact form with any queries or comments. This is particularly helpful for those residing outside of the U.K. who require a callback. Live Chat: The dedicated team can be reached using the Chat button situated at the top of every page on the website. E-mail: All sorts of inquiries such as account opening, technical support, introducing brokers, general inquiries, complaints, and more, can be answered by e-mail. The customer support email is info@hiroseuk.com. Phone: The customer support team can be reached at +44 (0)20 3089 3880. Skype Screen Sharing: Additional support is provided through the Skype screen sharing facility. Office hours for general inquiries are Monday to Friday from 9:00 am to 6:00 pm. Hirose Financial UK Ltd. is regulated by the FCA and client funds are held in segregated bank trust accounts. They offer some of the tightest spreads in the Forex industry with no commission or fees.

Which Educational and Learning Materials are offered by Hirose Financial?

Hirose Financial, a Forex trading provider, offers a range of educational and learning materials beneficial for traders of all levels. Trading Manuals: Comprehensive guides that cover the basics of Forex trading, providing traders with the necessary knowledge to navigate the Forex market. Essential Trading Components: These materials delve into the crucial elements of trading, such as understanding market trends, risk management, and trading strategies. Technical Analysis Overviews: Hirose Financial provides overviews of technical analysis, a critical tool for predicting future price movements based on past market data. Economic Indicators: Traders are provided with insights into economic indicators, which are vital for understanding the economic performance of a particular country or region. Demo Account: Hirose Financial offers a demo account where traders can practice their trading skills in a risk-free environment. These educational resources equip traders with the knowledge and skills necessary to trade Forex instruments effectively. It’s worth noting that Hirose Financial uses advanced trading technology offering non-dealing desk (NDD) execution. The broker executes orders through 15 liquidity providers that are fed into an aggregator, while the charge is incorporated into the variable spread without any commission charges. This makes it a convenient option for traders. However, Hirose Financial does not offer 24/7 customer support. Additionally, the broker has a limited number of trading instruments available on its platforms. , which may not be sufficient for some traders who are looking for a diverse range of assets to trade. Despite these limitations, Hirose Financial is a well-regulated broker that offers traders competitive spreads and fees as well as safe trading conditions.

Can anyone join Hirose Financial?

Hirose Financial, a reputable broker in the forex industry, is accessible to individuals who understand the risks associated with forex trading. It’s important to note that trading with Hirose Financial, like any forex trading, carries a high risk. In fact, 74-89% of retail investor accounts lose money when trading CFDs with this provider. Hirose Financial UK Ltd. is authorised and regulated by the Financial Conduct Authority, with FCA registration number 540244. This regulation provides a level of trust and security for traders. Hirose Financial UK Ltd. is a subsidiary of Hirose Tusyo Inc., a Japanese broker that has been operating for over eight years. By establishing an office in London, Hirose became the first Japanese broker to get regulated in the United Kingdom. Hirose Financial offers a proprietary platform called LION Trader, which is available in desktop, web, and mobile editions. The platform provides access to online currency trading with no dealing desk intervention. As an STP broker, Hirose forwards your orders directly to banks and other liquidity providers, resulting in extremely fast execution speed. The broker provides two types of trading accounts: live and practice. Interestingly, one is not required to make a deposit to open a live account. Live accounts can be created in GBP, USD, and EUR. Once a payment is made, customers can start trading with as little as 3 GBP, 4 EUR, or 5 USD. If a trader deposits GBP/EUR/USD 500 or more, they can participate in the broker’s FX Rebate program. With Hirose, you can only trade forex – CFDs, precious metals, and other non-forex instruments cannot be traded with this broker. However, traders have a choice of 50 currency pairs. As far as spreads are concerned, Hirose offers pretty tight spreads. For example, the typical spreads between 0:00 GMT to 19:00 GMT are 0.7 pips for EUR/USD, 0.6 pips for USD/JPY, and 0.9 pips for EUR/GBP, EUR/GBP, and AUD/USD. In conclusion, while Hirose Financial is open to anyone who understands the risks of forex trading, it’s crucial for potential traders to consider whether they can afford the high risk of losing their money. The company provides a range of resources and features to support its traders, but ultimately, success in forex trading depends on the individual’s understanding of the market and their trading strategy.

Who should sign up with Hirose Financial?

Hirose Financial is a suitable platform for a wide range of individuals interested in Forex trading. Here are some categories of people who might find Hirose Financial beneficial:. Experienced Forex Traders: Hirose Financial offers some of the tightest spreads in the Forex industry with no commission or fees. This can be advantageous for experienced traders who understand the market and are looking to maximize their profits. Beginners in Forex Trading: Hirose Financial provides a step-by-step guide to Forex trading. This can be beneficial for beginners who are looking to understand the basics of Forex trading. They also offer a demo account for practice. Tech-Savvy Traders: Hirose Financial uses high-performance order execution processing achieved using Japan Technology. This can be beneficial for tech-savvy traders who value efficient and reliable technology in their trading platform. Risk-Averse Individuals: Hirose Financial is regulated by the Financial Conduct Authority (FCA), and client funds are held in segregated bank trust accounts. This can provide peace of mind for risk-averse individuals who want to ensure the safety of their funds. Mobile Traders: Hirose Financial offers a free, easy-to-use app for iPhone and Android. This can be beneficial for traders who prefer to trade on the move. In conclusion, Hirose Financial caters to a wide range of individuals, from beginners to experienced traders, and those who value technology, safety, and mobility in their Forex trading platform. However, it’s important to note that Forex trading involves significant risk, and it’s crucial to understand these risks before signing up.

Who should NOT sign up with Hirose Financial?

Hirose Financial is a UK-based retail foreign exchange broker that provides foreign exchange trading on margin through its own online trading platform called LION Trader. It was founded in 2004 and is regulated by the Financial Services Authority in the United Kingdom. However, there are certain individuals who might want to reconsider signing up with Hirose Financial. Beginners or Novice Traders Hirose Financial might not be the best choice for beginners or novice traders. The platform requires a minimum deposit of at least USD 1 to open a live account. While this might seem like a low barrier to entry, beginners might find the platform’s features and trading functions overwhelming. Additionally, each new client must undergo several essential compliance audits. , which can be daunting for someone new to forex trading. Risk-Averse Individuals Forex trading involves a high level of risk due to the leverage provided by brokers. Hirose Financial is no exception. Individuals who are risk-averse might want to avoid signing up with Hirose Financial. Some users have reported that they take high risks. , which might not be suitable for individuals who prefer safer investment options. Individuals Seeking Personalized Customer Service While Hirose Financial has an average rating of 3.3. , it might not meet the expectations of individuals seeking personalized customer service. The company does not have a history of asking for reviews. , which might indicate a lack of engagement with its customers. In conclusion, while Hirose Financial might be a suitable choice for some, it might not be the best fit for beginners, risk-averse individuals, and those seeking personalized customer service. As with any financial decision, potential clients should conduct thorough research and consider their individual financial circumstances before signing up with a forex broker. 124.

Does Hirose Financial offer Discounts, Coupons, or Promo Codes?

Hirose Financial, a well-regulated Forex broker, is known for its low trading fees. The company, regulated in various jurisdictions including Japan, the UK, and Malaysia, provides FX services to more than 200,000 clients worldwide. It is one of the largest in the industry in terms of trading volume, transacting over 200 billion USD monthly. The broker offers low trading fees and there are no commissions or any hidden fees. This fact attracts both professional and beginner traders alike. The available platforms are MetaTrader 4 and LION Trader. However, it should be mentioned that the broker is offering mainly Forex pairs, and there are 2 metals available for trading. Despite the search, no specific discounts, coupons, or promo codes for Hirose Financial were found. However, the low trading fees and absence of hidden charges can be seen as a form of discount offered by the company. It’s always a good idea for interested traders to check the official Hirose Financial website or contact their customer service for the most accurate and up-to-date information.

Which Account Types are offered by Hirose Financial?

Hirose Financial, a well-regulated Forex broker, offers a variety of account types to cater to the diverse needs of traders. Live Account: This is the primary account type offered by Hirose Financial. It is designed for traders who wish to engage in real-time trading with real money. The Live Account has its own set of conditions for commission, margin calls, leverage, and minimum deposits. Micro (MT4) Account: This account type is specifically designed for traders who prefer to use the MetaTrader 4 platform. It allows traders to start trading with micro lots. Micro (LION Trader) Account: Similar to the Micro (MT4) Account, this account type is for traders who prefer to use the LION Trader platform. LION Binary Options: This account type is tailored for traders who wish to trade binary options. Demo Account: Hirose Financial also offers a demo account. This is a risk-free account type that allows traders to practice trading strategies and get familiar with the platform without risking real money. Each account type has its unique features and advantages, providing traders with a range of options to choose from based on their trading needs and preferences. It’s important to note that the availability of certain account types may depend on the trader’s location and the regulations in place.

How to Open a Hirose Financial LIVE Account?

Opening a Hirose Financial LIVE account involves a series of steps. Here’s a detailed guide:. Step 1: Application Start by visiting the Hirose Financial website. Look for the “Open an Account” page. Fill in the required personal data, including your name, email, and phone number. Step 2: Documentation You’ll need to provide identification for account verification. This can be a non-expired, government-issued ID with your full name and date of birth. Acceptable forms of ID include a government-issued passport, photo driving license (both sides), or photo national identity card (both sides). In addition to your ID, you’ll need to provide proof of residency. This document should clearly show your name, your current home address, and issue date, and it must have been issued within the last 6 months. Acceptable documents for this include a bank or credit card statement, or a utility bill (telephone, electricity, water, or gas). Step 3: Verification Once you’ve uploaded your documents, they will be verified by Hirose. After verification, Hirose will create a unique account username and password and send them to you via email. Step 4: Deposit Funds To deposit funds into your trading account, you can choose from several methods including credit/debit card, Skrill (Moneybookers), Neteller, Fasapay, or bank wire transfer. Step 5: Start Trading Once the funds are deposited, you can start trading. Please note that Hirose Financial UK Ltd is not regulated in the United States, and so is unable to open accounts for US citizens or residents. Also, Hirose UK is unable to accept applications for live accounts from residents of Japan. If you have any queries regarding the account opening process, feel free to contact Hirose Financial. They can be reached via email at info@hiroseuk.com. , or by phone. Remember, trading in forex markets involves significant risk. Make sure you understand these risks before you start trading.

How Are You Protected as a Client at Hirose Financial?

Hirose Financial, a Forex trading provider, offers a range of FX trading instruments to over 200,000 clients worldwide. Here are some key points on how clients are protected at Hirose Financial:. Regulation and Licensing Hirose Financial UK Ltd. is authorized by the Financial Conduct Authority (FCA), with registration number 540244. This regulation ensures that the broker adheres to strict standards set by the FCA, providing an additional layer of protection for clients. Safety of Funds Hirose Financial prioritizes the safety of the client’s funds. Client funds are held in segregated bank trust accounts. , which means that client money is kept separate from the company’s own funds. This is a standard practice that provides a high level of security for client funds. Trading Technology Hirose Financial uses advanced trading technology offering non-dealing desk (NDD) execution. The broker executes orders through 15 liquidity providers that are fed into an aggregator. This ensures fast and efficient execution of trades, reducing the risk of slippage. Trading Platforms Hirose Financial provides access to two leading industry platforms: MT4 and LION Trader. These platforms are known for their reliability and robustness, providing traders with a secure environment to execute their trades. Risk Warning Hirose Financial provides clear risk warnings to its clients. It is important for clients to understand that Forex trading involves significant risk and it’s possible to lose money rapidly due to leverage. In conclusion, Hirose Financial provides several layers of protection for its clients, including FCA regulation, segregated client funds, advanced trading technology, reliable trading platforms, and clear risk warnings. However, it’s important for clients to understand the risks involved in Forex trading.

Which Funding methods or Deposit Options are available at Hirose Financial?

Hirose Financial, a well-regarded entity in the forex trading industry, offers a variety of funding methods and deposit options for its clients. The options are designed to cater to the diverse needs of traders and ensure a smooth trading experience. Bank Wire Transfer: This is a traditional and reliable method of transferring funds. The minimum deposit requirement for a bank wire transfer is 50 GBP/EUR/USD. The processing time for this method is typically 2-3 business days. Credit/Debit Card: Hirose Financial accepts Visa and Mastercard for deposits. The transactions are instant, and the minimum deposit requirement is 50 GBP/EUR/USD. Skrill: This is a popular e-wallet option among forex traders. The deposits are processed within 15 minutes, and the minimum deposit requirement is 20 GBP/EUR/USD. Neteller: Similar to Skrill, Neteller is another widely used e-wallet option. The deposits are also processed within 15 minutes, and the minimum deposit requirement is 20 GBP/EUR/USD. It’s important to note that the minimum deposit amount required to open a real trading account at Hirose Financial is $20. This makes it an accessible platform for most traders. However, the minimum deposit for first-time traders might vary based on the trading account type selected. In conclusion, Hirose Financial provides a range of deposit options to cater to the diverse needs of forex traders. Whether you prefer traditional bank transfers or modern e-wallet solutions, Hirose Financial has got you covered.

What is the Minimum Deposit Amount at Hirose Financial?

Hirose Financial, a well-regarded entity in the forex trading industry, has a minimum deposit requirement that is designed to accommodate traders of various financial capacities. The minimum deposit amount required to open a real trading account with Hirose Financial is $20. This is an extremely affordable minimum deposit requirement that should present a low barrier of entry to most traders. However, it’s important to note that the minimum deposit for first-time traders might vary based on the trading account type selected. Hirose Financial offers several ways to deposit and withdraw funds, including credit and debit cards (Visa and Mastercard), and the minimum deposit for these methods is $50 USD/EUR/GBP. In addition to its affordable minimum deposit requirement, Hirose Financial also offers a range of other features that make it a popular choice among forex traders. These include a demo trading account, a maximum leverage of 1:30, and support for the MetaTrader 4 and LION Trader platforms. Please note that deposit activation can take up to 72 hours. For more detailed information, it’s recommended to visit the official Hirose Financial website or contact their customer service.

Which Withdrawal methods are available at Hirose Financial?

Hirose Financial offers several withdrawal methods for its clients. These methods are designed to provide flexibility and convenience for traders. Wire Transfer The minimum amount that can be withdrawn via wire-transfer is 50 (USD, GBP, or EUR). This must be the trader’s profit and cannot include any Trading Credits that have been given. The minimum withdrawal amount for an International Wire Transfer is 50GBP, 50 USD, or 50 EUR. There is an £8.50 bank charge per transaction. Credit/Debit Card Withdrawals can also be made via Credit/Debit Card. The minimum withdrawal amount for this method is 20 GBP, 20 USD, or 20 EUR. Skrill (Moneybookers) Skrill is another withdrawal method offered by Hirose Financial. The minimum withdrawal amount for Skrill is 20 GBP, 20 USD, or 20 EUR. NETELLER NETELLER is also available for withdrawals. The minimum withdrawal amount for NETELLER is 20 GBP, 20 USD, or 20 EUR. The maximum withdrawal limit is 5,000USD per transaction. FasaPay FasaPay is available for Indonesian clients only. The minimum withdrawal amount for FasaPay is 20 GBP, 20 USD, or 20 EUR. Please note that funds will not be debited from the trading account at the time the withdrawal request is made. Hirose Financial processes withdrawal requests once a day after 05:00AM (GMT) and it is at this point in time that funds will be debited from the trading account.

Which Fees are charged by Hirose Financial?

Hirose Financial, a well-regulated Forex broker, is known for its low trading fees. The broker does not charge any commissions or hidden fees. , which is a significant advantage for both professional and beginner traders. The broker offers several ways to deposit and withdraw funds. The currencies accepted are USD, EUR, and GBP. The minimum deposit and account activation amount is 50 USD/EUR/GBP. The deposit fees are subject to the Deposit Fee Waiver Campaign. The processing time for deposits is instant. The withdrawal fees are free. , and the minimum withdrawal amount is 20 USD/EUR/GBP. In terms of trading fees, Hirose Financial does not charge any other commissions or fees outside of the spread when transacting a trade. The spreads vary depending on the selected trading platform. The average Lion Trader spreads are 8 pips on EUR/USD, 9 pips on GBP/USD, and 7 pips on USD/JPY. The average MT4 spreads are 9 pips on EUR/USD, 9 pips on GBP/USD, and 9 pips on USD/JPY. Added to these competitive spreads, the broker provides commission-free trading. Overnight fees, or swap fees, are also charged to positions held overnight. However, customers are not charged inactivity fees. , which is competitive. It’s important to note that Hirose Financial does not document any inactive fees. In conclusion, Hirose Financial is a Forex broker that offers low trading fees and a transparent fee structure, making it a popular choice among traders worldwide.

What can I trade with Hirose Financial?

Hirose Financial offers a variety of trading options for its clients. The primary focus is on Forex Trading. They provide some of the tightest spreads in the Forex industry with no commission or fees. The platform allows trading on a variety of currency pairs including EUR/USD, GBP/USD, AUD/USD, USD/JPY, EUR/JPY, and GBP/JPY. In addition to Forex, Hirose Financial also offers Binary Options trading. Their in-house trading platform, the LION Binary PRO, provides two types of options. The classic call/put option offers three expiration terms from 3 minutes to 30 minutes, while “anytime” options last between 30 seconds to 60 minutes. Hirose Financial also provides a range of tools and resources to assist traders. This includes a free, easy-to-use app for iPhone and Android that allows trading on the move. They also offer a step-by-step guide to Forex trading. , as well as strategies for successful Binary Options trading. It’s important to note that trading with Hirose Financial involves a high risk of losing money due to the complexity of CFDs. As per their risk warning, 74-89% of retail investor accounts lose money when trading CFDs with this provider. Therefore, traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their money. Hirose Financial is regulated by the Financial Conduct Authority (FCA), and client funds are held in segregated bank trust accounts. This provides an additional layer of security and trust for its clients.

Which Trading Platforms are offered by Hirose Financial?

Hirose Financial, a well-regulated Forex broker. , offers several trading platforms to cater to the needs of its diverse clientele. These platforms include MetaTrader 4. and LION Trader. MetaTrader 4 is a platform designed for experienced Forex traders. It offers high performance order execution processing achieved using Japan Technology. With over 200,000 global clients transacting over $200 billion a month, Hirose Financial is a recognised leader in order execution processing. The platform offers competitive spreads with no commission fee, fast execution speed, unrestricted use of Expert Advisors (EAs), and the ability to trade Spot Gold against the US Dollar. It also supports over 30 languages. LION Trader, on the other hand, is a platform developed in-house by Hirose Financial, originally in Japan. It is designed for beginners in Forex. The platform offers two types of options: the classic call/put option with three expiration terms from 3 minutes to 30 minutes, and “anytime” options that last between 30 seconds to 60 minutes. Both platforms offer a range of features to enhance the trading experience. For instance, MetaTrader 4 provides over 50 built-in indicators and charting tools, and allows trading of 46 currency pairs. LION Trader, meanwhile, offers a unique binary options trading experience. It’s important to note that Hirose Financial is regulated in various jurisdictions, including Japan, the UK, and Malaysia. The broker provides FX services to more than 200,000 clients worldwide and is one of the largest in the industry in terms of trading volume, transacting over 200 billion USD monthly. Overall, Hirose Financial’s trading platforms are designed to provide a comprehensive and user-friendly trading experience for both novice and experienced traders alike.

Which Trading Instruments are offered by Hirose Financial?

Hirose Financial, a renowned foreign exchange company, offers a wide selection of trading instruments. The primary focus is on Forex trading. Forex trading at Hirose Financial involves a variety of financial instruments. There are 66 currency pairs available for trading. This extensive selection allows traders to diversify their portfolio and choose pairs that align with their trading strategy and market knowledge. Trading at Hirose Financial is facilitated through two powerful and reliable trading platforms: MetaTrader 4 and LionTrader. These platforms are equipped with various trading tools, including charting indicators. Traders can trade in lots, which provides flexibility in terms of the trading denomination. One of the key features of Hirose Financial is the competitive spreads. The company strives to offer the best prices by passing on the prices offered by its liquidity providers. However, it’s important to note that spreads may widen during times of low market liquidity. Another notable aspect is the risk management tools provided by Hirose Financial. Traders have access to features like Stop, Limit, Pending, and Trailing Stops. These tools can help traders manage their risk effectively and protect their investments. The minimum trade size at Hirose Financial is 1,000 units (0.01 Lot). This low entry barrier makes it accessible for traders with different investment capacities. The leverage offered is up to 1:100. , allowing traders to maximize their potential profits. Lastly, Hirose Financial does not charge any commissions. This cost-effective trading environment can contribute to enhancing the overall trading experience. In conclusion, Hirose Financial offers a comprehensive suite of trading instruments and features, making it a viable choice for both private and institutional customers interested in Forex trading.

Which Trading Servers are offered by Hirose Financial?

Hirose Financial, a well-regulated Forex broker, offers two powerful and reliable trading platforms to investors. These platforms are MetaTrader 4 and LION Trader. MetaTrader 4 is a popular trading platform among Forex traders due to its user-friendly interface, diverse technical analysis tools, and the capability to use automated trading systems. It’s worth noting that Hirose Financial provides a limited 30-day access to MetaTrader 4. LION Trader, also known as ActTrader, is Hirose Financial’s own online trading platform. This platform is known for its robustness and variety of features that cater to both beginner and experienced traders. LION Trader is available for a limited 14-day period. Hirose Financial is regulated in various jurisdictions, including Japan, the UK, and Malaysia. It provides FX services to more than 200,000 clients worldwide and transacts over 200 billion USD monthly. The broker offers low trading fees and there are no commissions or any hidden fees. The available trading markets are mainly Forex pairs, and there are 2 metals available for trading. It should be noted that crypto derivatives, indices, or CFDs on stocks are not offered by this broker. In terms of account types, Hirose Financial allows traders to start opening accounts with as little as 20 USD. There are no inactivity fees and trading fees are low. However, an Islamic account, also known as a swap-free account, is not available. Hirose Financial is committed to ensuring the safety of its clients’ funds. It offers negative balance protection and keeps funds on segregated bank accounts. In conclusion, Hirose Financial is a reputable Forex broker that offers MetaTrader 4 and LION Trader as its trading servers. It provides a safe and reliable trading environment with low trading fees, making it a good choice for both professional and beginner Forex traders.

Can I trade Crypto with Hirose Financial? Which crypto currencies are supported by Hirose Financial?

Hirose Financial, a UK-based retail foreign exchange broker, is a subsidiary of the Japanese company Hirose Tusyo. It is a globally acclaimed online trading platform with a staggering monthly revenue exceeding 90 billion US dollars. Its superior services have rightfully earned it a reputation as one of the world’s top financial brokers. Hirose Financial offers the opportunity to trade Forex, Crypto, Metals, and CFD currency pairs on one platform. However, the specific cryptocurrencies supported by Hirose Financial are not explicitly mentioned in the available resources. The platform provides a variety of trading tools and platforms, including ActTrader, MT4, and MT Mobile. These platforms offer over 45 forex currency pairs, CFD, bitcoin, gold, and silver for personal investment and trading options. In terms of regulation, Hirose is well-regulated by world-recognized financial authorities. This ensures the safety of funds as they are held in segregated bank trust accounts. The platform also offers in-depth education through its comprehensive trading catalog and provides expert advisors to its users. However, it’s worth noting that some traders have expressed dissatisfaction with Hirose’s interface, describing it as not interactive, not carefully thought out, and too cluttered with information. In conclusion, while Hirose Financial does offer the opportunity to trade cryptocurrencies, the specific cryptocurrencies supported are not explicitly stated in the available resources. It is recommended to directly contact Hirose Financial for the most accurate and up-to-date information.

What is the Leverage on my Hirose Financial Trading Account?

Hirose Financial UK, a subsidiary of Hirose Tusyo of Japan, is a Forex trading company regulated by the Financial Conduct Authority (FCA). It offers online trading services for the foreign exchange market, allowing clients to trade various currency pairs. The concept of leverage is integral to Forex trading. Leverage is a mechanism that allows traders to control larger positions in the market with a smaller amount of capital. It can potentially amplify trading positions, but it’s important to remember that while it can lead to significant profits, it can also result in large losses. At Hirose Financial UK, clients can trade Forex with a leverage of up to 1:30. This means that for every unit of currency deposited, a trader can control 30 units in the market. For example, if a trader has a GBP base Trading Account with Hirose’s Lion Trader platform and they buy 1 lot of GBPUSD, they would need to have 33 GBP available in their account. It’s crucial for traders to understand the risks involved with leverage and to manage it effectively. As with all financial products traded on margin, they carry a high degree of risk to capital. Therefore, Forex trading may not be suitable for all traders or investors.

What kind of Spreads are offered by Hirose Financial?

Hirose Financial, a Forex trading company regulated by the FCA, offers a variety of spreads for its clients. The spreads start from as low as 0.7 pips. This means that the difference between the buying and selling prices of currency pairs or other instruments can be as minimal as 0.7 pips. Hirose Financial provides online trading services for the foreign exchange market, allowing clients to trade various currency pairs. They offer both major and minor currency pairs, as well as exotic currency pairs. The company aims to deliver consistently low spreads, and there are no hidden charges or fees. The typical spreads are a reflection of their pricing consistency from GMT 00:00 to GMT 19:00. In terms of base currencies, Hirose Financial offers GBP, USD, and EUR. The margin is 3.33% for Major pairs and 5.00% for Minor pairs. The Margin Call (Stop out) is 50% of the initial margin. It’s important to note that online trading involves significant risk, and traders may lose all of their invested capital. Therefore, it’s crucial for traders to understand the risks involved before engaging in Forex trading.

Does Hirose Financial offer MAM Accounts or PAMM Accounts?

Hirose Financial, a well-known forex trading platform, does not appear to offer either MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts based on the available information. MAM Accounts allow traders to hand over their investments to skilled fund managers in the financial markets, while also maintaining a level of control over trades. The best MAM account managers offer competitive performance indicators, flexibility, and access to reputable platforms such as MT4. However, Hirose Financial is not listed among the brokers offering MAM accounts. PAMM Accounts, on the other hand, are a type of managed account that uses a pooled money trading system. Investors allocate funds in desired proportion to the money manager, who then manages it along with the funds from other investors. Despite the popularity and benefits of PAMM accounts, there is no evidence to suggest that Hirose Financial offers this service. It’s important for investors to carefully consider their options when choosing a forex broker. While Hirose Financial may offer a range of other services and account types, those specifically seeking MAM or PAMM accounts may need to explore other brokers.

Does Hirose Financial allow Expert Advisors?

Hirose Financial, a well-established broker since 2010. , offers a trading platform with tools for both new traders and seasoned experts. One of the key features of this platform is the allowance of Expert Advisors. Expert Advisors (EAs) are automated trading systems that can execute trades according to programmed trade logic. These EAs can place stop and take profit orders, making them a valuable tool for forex traders. Hirose Financial’s platform, MetaTrader 4, is particularly noted for its high-performance order execution processing. This is achieved using Japan Technology. , which allows for fast execution speed and unrestricted use of EAs. Moreover, Hirose Financial provides support for over 30 languages. , making it accessible to a global clientele. The platform also offers competitive spreads with no commission fee. , further enhancing its appeal to traders. In addition to forex, Hirose Financial UK offers a Gold FX product XAU/USD with 1:20 and all costs in the spread on their MetaTrader4 platform. This diversification of trading instruments adds to the versatility of the platform. In conclusion, Hirose Financial does allow the use of Expert Advisors on its trading platform. This feature, along with the platform’s other advantages, makes Hirose Financial a viable choice for both novice and experienced forex traders. However, as with any trading platform, potential users should conduct thorough research and consider their individual trading needs before choosing to trade with Hirose Financial.