Just2Trade Review 2026

What is Just2Trade?

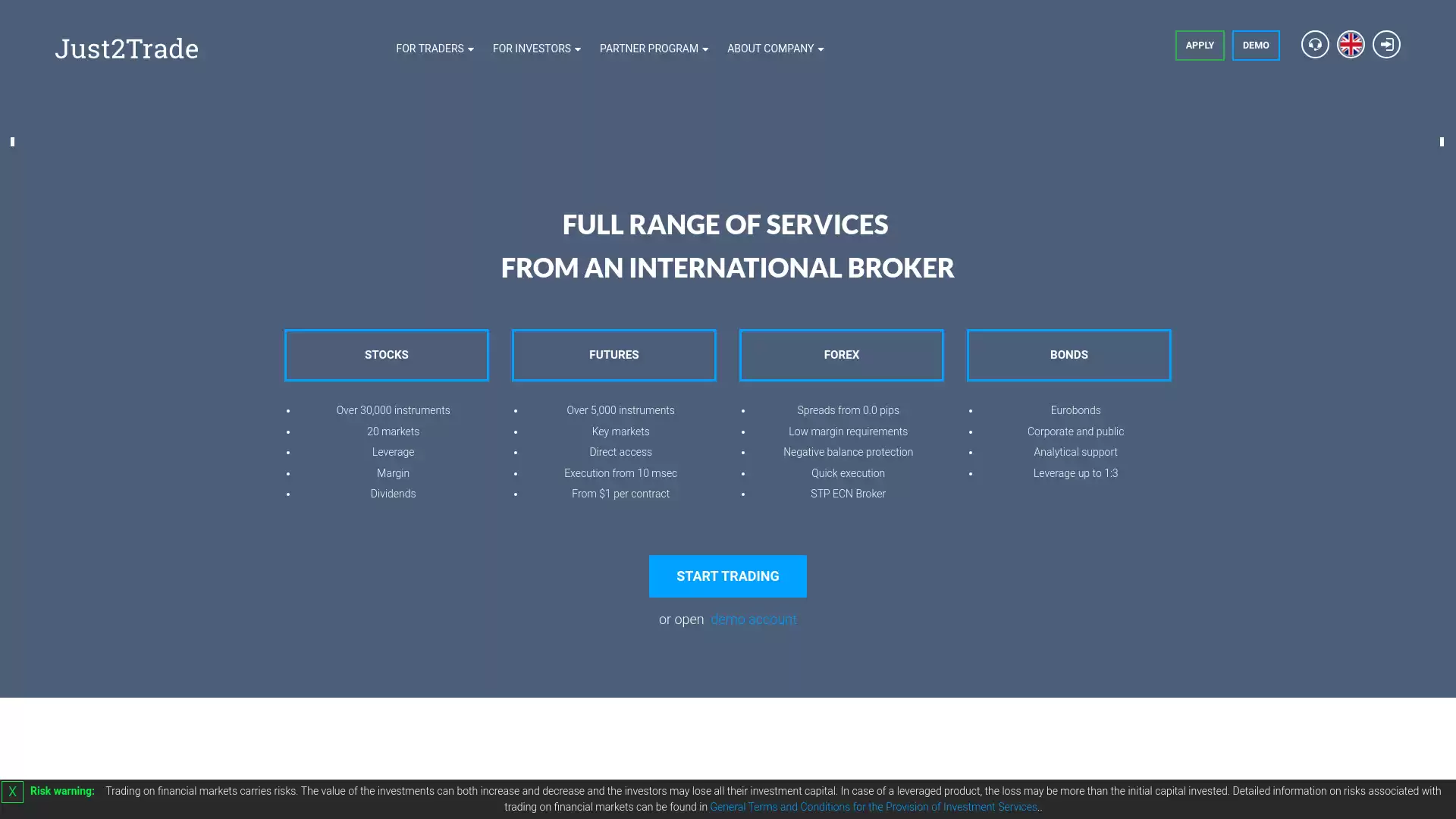

Just2Trade is a leading international brokerage company that provides traders with direct access to major global financial markets. It is known for its high-speed infrastructure, which includes an ultra-modern 100G network spanning multiple regions. This infrastructure ensures lightning-fast order execution, a crucial feature in today’s fast-paced markets. Just2Trade offers a wide range of services and opportunities for cooperation. These include becoming a referral agent or an introducing broker. It also provides the possibility of integrating third-party trading programs through the Open API. , opening up new avenues for collaboration and customization. The company is regulated in the US by FINRA, in the EU by CySEC, and in Russia by the Bank of Russia. Its global presence, with representatives and partners in Asia, Europe, and the USA, ensures that they are accessible and responsive to traders worldwide. Just2Trade’s Forex accounts cater to a wide range of traders, from beginners to professionals. It offers four account types, allowing traders to select the one that best suits their trading needs. Whether it’s a Forex Demo Account for practice or an MT5 Global Account for professional trading, Just2Trade has options for everyone. One of the key highlights of Just2Trade is their Direct Market Access (DMA) feature. This feature allows traders to access financial markets directly, eliminating intermediaries and enjoying benefits like low commissions, instant execution, and maximum liquidity. Just2Trade offers a staggering array of 128,000 tradable instruments. Their vast portfolio encompasses stocks, currencies, options, futures, CFDs, bonds, and cryptocurrencies. , ensuring clients have diverse investment opportunities. In terms of client fund protection, Just2Trade participates in the Securities Investor Protection Corporation (SIPC) in the US and the government’s Investors Compensation Fund in Cyprus. This ensures the protection of client funds. In conclusion, Just2Trade stands out as a full-range broker offering services across various asset classes. Its commitment to excellence, rigorous regulation, and diverse asset coverage make it a preferred choice for many traders in the Forex market.

What is the Review Rating of Just2Trade?

- 55brokers: 55brokers rated Just2Trade with a score of 82. This rating was last checked at 2024-01-06 11:13:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Just2Trade with a score of 64. This rating was last checked at 2024-01-06 18:49:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Just2Trade with a score of 84. This rating was last checked at 2024-01-05 22:50:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Just2Trade?

Just2Trade is a well-regarded brokerage firm that offers a variety of advantages for forex traders. Here are some of the key benefits:. Wide Selection of Markets: Just2Trade provides access to a broad range of markets, making it a versatile platform for forex traders. Competitive Commissions and Fees: The firm is known for its low commissions and fees, which can enhance profitability for traders. Variety of Trading Platforms: Traders can choose from multiple trading platforms, including MT4, MT5, CQG, Sterling Trader Pro, and ROX. Regulated Broker: Just2Trade is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing an added layer of security for its clients. Customer Support: The firm offers 24/7 customer support, ensuring that help is available whenever it’s needed. Education Center: Just2Trade supports novice traders with a full-fledged education center. Negative Balance Protection: The firm offers accounts with special terms of negative balance protection. No Brokerage Fee: Just2Trade provides accounts with no brokerage fee. Access to Cryptocurrency Trading: In addition to forex, traders can also access cryptocurrency markets. Passive Income Opportunities: Just2Trade offers sources of passive income. However, it’s worth noting that the availability of products and services may vary by country. Also, the firm’s educational materials may be somewhat limited. Despite these minor drawbacks, Just2Trade remains a strong choice for forex traders due to its wide range of offerings and competitive pricing structure.

What are the Cons of Just2Trade?

Just2Trade, a well-regulated broker offering trading in forex and access to a number of stock exchanges, has its own set of drawbacks that potential investors should be aware of. Limited Educational Resources One of the main disadvantages of Just2Trade is the lack of educational materials. This can be a significant drawback for novice traders who are still learning about forex trading and could benefit from comprehensive educational resources. Limited Trading Signals Another limitation of Just2Trade is in the area of trading signals. The broker offers a limited choice of instruments for which signals are provided. This could potentially limit trading opportunities for investors. High Fees for Trading Signals In addition to the limited choice of instruments, the fees for trading signals are also high. This could eat into the profits of traders, especially those who rely heavily on trading signals for their investment decisions. Questions About Signal Profitability There are also questions about the profitability of the signals provided by Just2Trade. This could be a concern for traders who are looking for reliable and profitable trading signals. Different Opportunities for Customers from Different Countries Just2Trade claims it provides services for customers from 130 countries. However, the selection of products and services differs for each country. This could potentially lead to confusion and dissatisfaction among customers. Low Quality Delivery of Information on the Website The delivery of information on the Just2Trade website has been described as of low quality. This could potentially lead to misunderstandings and misinterpretations of the information provided. Confusing Structure of Accounts The structure of accounts at Just2Trade has been described as confusing. This could potentially lead to difficulties in account management for traders. In conclusion, while Just2Trade offers a wide selection of markets, low commissions and fees, and different trading platforms to choose from, it also has several drawbacks. These include limited educational resources, limited trading signals, high fees for trading signals, questions about signal profitability, different opportunities for customers from different countries, low quality delivery of information on the website, and a confusing structure of accounts. Potential investors should carefully consider these factors when deciding whether to trade with Just2Trade.

What are the Just2Trade Current Promos?

Just2Trade, a company known for accommodating high-budget investments in the stock market, is currently offering a promotion where trades are priced at $2.50. This offer is available to all customers nationwide. The commission structure of Just2Trade is straightforward and easy to understand. They offer several platforms, with the primary platform being web-based Just2Trade+, which is available to all customers at no charge. To earn the $2.50 per trade bonus, one needs to open a Just2Trade account and maintain a minimum balance of $2,500. The charges for different types of trades are as follows. ADRs and ETFs: $2.50 per trade. Exchange Listed Stocks Under $1.00 & OTC Securities: $2.50 per trade + $0.003 per share for the entire order. International Stocks: $2.50 per trade + $75.00 Foreign Stock Transaction Fee. Mutual Funds: $12.50 per trade. The trading capability ceases if the equity falls under $2,000. For balances between $2,000-$2,499, the charge is $4.00 per trade. Just2Trade was originally founded in 2007 as a deep discount broker with a focus on very active, high-volume traders. It was acquired by Russian-owned WhoTrades, Inc. in 2015, which specializes in online and social trading. Traders who need access to stocks, options, futures, futures options, and international markets are likely to see the most value with a Just2Trade account.

What are the Just2Trade Highlights?

Just2Trade is a leading international brokerage company that provides traders with direct access to major global financial markets. Here are some of the key highlights:. Trust and Safety: Just2Trade is committed to trust and safety. It operates within established financial guidelines, ensuring transparency and integrity. It employs cutting-edge encryption techniques to guard both data and financial transactions. Client funds are maintained in segregated accounts, safeguarding them against potential institutional adversities. Tradable Instruments: Just2Trade offers a suite of tradable instruments, catering to various trading inclinations and methodologies. Forex trading is definitively addressed, with a plethora of currency pairs, touching on major, minor, and exotic spectra. Trading Platforms: Just2Trade provides an uncomplicated, user-friendly platform for straightforward trade execution. It offers an impressive suite of account types, ensuring an adaptable and rewarding trading environment for its diversified clientele. Cost-effectiveness: Just2Trade is known for its competitive spreads, underscoring the broker’s commitment to cost-effectiveness. Regulation: A salient feature of Just2Trade is its regulated status, a testament to its dedication to operate within established financial guidelines. Direct Market Access: Just2Trade provides direct access to financial markets, eliminating intermediaries and offering traders the advantage of low commissions, instant execution, and maximum liquidity. Diverse Asset Coverage: Just2Trade offers services across various asset classes, including stocks, bonds, futures, options, mutual funds, Forex, and cryptocurrencies. Client Fund Protection: Your funds are safeguarded through the Securities Investor Protection Corporation (SIPC) in the US and the government’s Investors Compensation Fund in Cyprus. In essence, for the pragmatic trader seeking efficient simplicity, Just2Trade is a commendable choice.

Is Just2Trade Legit and Trustworthy?

Just2Trade is a well-regulated broker offering trading in forex and access to a number of stock exchanges. It is regulated by the Cyprus Securities and Exchange Commission. This regulatory oversight provides a level of credibility and transparency, ensuring a secure trading environment. However, user reviews on Just2Trade are mixed. Some users have praised the platform for its low fees, sophisticated yet simple-to-use trading platform, and the diversity of tradable instruments. They have also appreciated the Direct Market Access (DMA) feature, which allows traders to access financial markets directly, eliminating intermediaries. On the other hand, some users have reported issues with the platform’s reliability, citing instances where the platform froze or crashed. There have also been complaints about the company’s customer service and risk management practices. In conclusion, while Just2Trade is a legitimate broker with a range of offerings, potential users should carefully consider these factors and conduct thorough research before deciding to use their services. It’s always recommended to start with a small investment or a demo account to get a feel for the platform and its services. As with any investment, it’s important to understand the risks involved and to only invest what you can afford to lose. Please note that this information is based on available resources and may not be fully up-to-date or complete. For the most accurate information, it’s recommended to visit the official Just2Trade website or contact their customer service directly.

Is Just2Trade Regulated and who are the Regulators?

Just2Trade is indeed a regulated broker, providing assurance to its clients of its legitimacy and adherence to financial standards. The company is registered with several regulatory bodies, including the Financial Industry Regulatory Authority (FINRA), the National Futures Association (NFA), and the Cyprus Securities and Exchange Commission (CySEC). Just2Trade is owned by Lime Trading (CY) Ltd, which is also regulated by CySEC and the European Securities and Markets Authority (ESMA). It is a member of the Investor Compensation Fund, providing additional protection to customers should the broker be unable to meet its obligations. In the context of forex trading, Just2Trade offers a decent range of 60+ major, minor, and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders. Just2Trade’s commitment to excellence is reinforced by rigorous regulation from esteemed authorities, including the NFA, CySEC, FINRA, and the Bank of Russia. This commitment is further demonstrated by the company’s membership in the Investor Compensation Fund, which provides an additional layer of protection for its clients. In conclusion, Just2Trade is a regulated broker, providing its clients with the assurance of operating under the oversight of several respected financial regulatory bodies. This regulation, combined with a diverse offering of forex pairs and competitive trading conditions, makes Just2Trade a reliable choice for forex traders.

Did Just2Trade win any Awards?

Just2Trade, a leading international investment company, has indeed been recognized for its exceptional services in the forex industry. In May 2023, Just2Trade was honored with the prestigious Forextop award, ranking it as one of the top 10 FX brokers worldwide. This award is a testament to the company’s commitment to providing top-notch trading conditions, customer service, and a variety of services. Furthermore, Just2Trade received the highest score (5 stars) in the “Trading conditions”, “Customer service” and “Variety of services” areas according to the rating of langyabang.com. , a leading China-based financial portal. This portal, created in 2015, is positioned as a leader on Asian markets in providing financial information, analysis of brokerage services, and private investor education. In addition to the Forextop award, Just2Trade has also been recognized as the Best Customer Service broker. This award further underscores the company’s dedication to providing excellent customer service and its commitment to meeting the needs of its clients. These awards and recognitions highlight Just2Trade’s commitment to excellence in the forex industry and its dedication to providing its clients with the best possible trading experience.

How do I get in Contact with Just2Trade?

Just2Trade is a well-known online discount stock brokerage service that provides a variety of low-cost trading solutions and online investing tools. In the context of forex trading, contacting Just2Trade can be crucial for both beginners and experienced traders alike. To get in touch with Just2Trade, there are several methods available:. Telephone: Just2Trade’s contact number is +357 25055966. This can be a quick and direct way to reach out to their customer service for any immediate queries or concerns. Email: For non-urgent matters or detailed queries, reaching out to Just2Trade via email can be a good option. However, the specific email addresses for customer service or general inquiries are not readily available from the search results. Website: Visiting the official Just2Trade website. can provide additional contact information, as well as access to their range of services and tools. It’s also a good way to stay updated with any changes or updates in their contact methods. Remember, it’s always important to ensure that you’re contacting Just2Trade through their official channels to protect your personal information and investments. Always double-check the contact information from reliable sources.

Where are the Headquarters from Just2Trade based?

Just2Trade, a renowned online broker platform, is headquartered at One Penn Plaza, 16th Floor, New York, New York, 10119, United States. This platform supports traders across the globe with personal finance technology, allowing them to connect, share information, and control their trading securely from a simple user interface. In the context of forex, Just2Trade provides a platform for traders to engage in forex trading. It offers a user-friendly interface that allows traders to securely control their trading activities. This is particularly important in the fast-paced world of forex trading, where real-time information and secure trading platforms are crucial for success. Just2Trade’s strategic location in New York, a major financial hub, positions it well to serve its global clientele in the forex market. The company’s headquarters in the heart of New York City provides it with access to one of the world’s largest financial markets, making it a preferred choice for many forex traders.

What kind of Customer Support is offered by Just2Trade?

Just2Trade, a leading international brokerage company, provides its clients with direct access to major world financial markets. In the context of forex trading, Just2Trade offers a variety of services and features that are beneficial for both beginners and experienced traders. Customer Support: Just2Trade provides customer support 24/7 via email, phone, or live chat on each page of the website. The customer support team is ready to assist with any inquiries or issues that may arise during the trading process. Trading Platforms: Just2Trade offers a wide range of platforms including MetaTrader4 and MetaTrader5, mobile apps for Android and iOS-based smartphones, web platforms, ROX, and CQG platforms. These platforms provide all the necessary tools for quality trading. Trading Services: With Just2Trade, clients can trade forex, stocks, futures, cryptocurrencies, Eurobonds, and even participate in US IPOs. They provide access to 20 stock markets and even to stock IPOs. Account Types: Just2Trade provides different types of accounts, suitable for both beginners and professionals. This allows traders to choose an account type that best suits their trading style and experience level. Deposit and Withdrawals: This broker offers different deposit and withdrawal methods including Bank card, Wire transfer, China Union Pay, Skrill, Neteller, Alipay, Klarna, Qiwi wallet, Yandex Money. It’s important to note that while some users have had positive experiences with Just2Trade, others have reported less satisfactory experiences. As with any financial service, potential users are advised to thoroughly research and consider the risks before deciding to trade with Just2Trade.

Which Educational and Learning Materials are offered by Just2Trade?

Just2Trade, a brokerage firm based in Cyprus, offers a wide range of educational and learning materials to its clients. These resources have been significantly expanded in recent years, reflecting the company’s commitment to education. Forex trading is a key focus area for Just2Trade. The company offers a wide range of currency pairs, including major, minor, and exotic options. This diverse offering allows forex traders to have a rich and varied trading experience. Just2Trade provides several research materials to its clients. These include an economic calendar, trading central, stock exchange forecasts, market analytics, and trading signals. However, it’s worth noting that the broker does not provide comprehensive educational and learning materials, seminars, or webinars, which are crucial for beginner traders. Despite the limitations in its educational offerings, Just2Trade has made a name for itself in the industry due to its competitive trading costs and spreads, 24/7 customer support, and a range of powerful trading tools. In conclusion, while Just2Trade offers a range of educational and learning materials, there is room for improvement, particularly for beginner traders. Nevertheless, the company’s commitment to expanding its educational resources, coupled with its robust trading platform and competitive costs, make it a solid choice for both novice and seasoned traders.

Can anyone join Just2Trade?

Just2Trade, a trademark of LimeTrading (CY) Ltd., is a brokerage firm that offers access to trade Forex, CFDs, Stocks, Futures, Bonds, Metals, and more. The company, based in Cyprus, has been offering its trading services since 2007 and has gained the trust of over 155,000 clients from 130 countries. One of the most attractive offerings from Just2Trade is the low margins and no hidden fees policy. Just2Trade offers over 30,000 trading instruments with spreads starting from 0 pips and a full range of powerful trading tools. Just2Trade is a regulated broker with good trading software and trading capabilities, suitable for robot or auto trading. There is a good range of trading solutions and STP execution. However, there are some limitations in education, and sometimes third-party software will be required for certain research tools. The minimum required deposit for Just2Trade is $100. Just2Trade leverage is offered according to CySEC regulation which operates as a subsidiary of the European MiFID: European traders are eligible to use a maximum of up to 1:30 for major currency pairs. There are three account types designed by Just2Trade. In conclusion, Just2Trade is considered a reliable broker with good trading solutions. The broker offers a range of trading instruments to trade with competitive spreads and fees. Just2Trade Overall Ranking is 8.2 out of 10 based on testing and compared to over 500 brokers.

Who should sign up with Just2Trade?

Just2Trade is a platform that caters to a wide range of traders in the Forex market. Here are some key points that make Just2Trade an attractive choice:. 1. High-Speed Infrastructure: Just2Trade’s high-speed infrastructure, with an ultra-modern 100G network spanning multiple regions, ensures lightning-fast order execution. This level of speed is crucial in today’s fast-paced markets, where every second counts. 2. Regulatory Oversight: Just2Trade is regulated in the US by FINRA, in the EU by CySEC, and in Russia by the Bank of Russia. Their global presence with representatives and partners in Asia, Europe, and the USA ensures that they are accessible and responsive to traders worldwide. 3. Diverse Account Types: Just2Trade’s Forex accounts cater to a wide range of traders, from beginners to professionals. The choice of four account types allows traders to select the one that best suits their trading needs. 4. Direct Market Access: One of the key highlights of Just2Trade is their Direct Market Access (DMA) feature. This means that traders can access financial markets directly, eliminating intermediaries and enjoying benefits like low commissions, instant execution, and maximum liquidity. 5. Diverse Asset Coverage: Just2Trade offers access to a staggering array of 128,000 tradable instruments, including stocks, currencies, options, futures, CFDs, bonds, and cryptocurrencies. This ensures traders have diverse investment opportunities. 6. Client Fund Protection: Just2Trade’s commitment to regulatory compliance is reinforced by their participation in the Securities Investor Protection Corporation (SIPC) in the US and the government’s Investors Compensation Fund in Cyprus. In conclusion, Just2Trade is a suitable platform for anyone interested in Forex trading, whether they are beginners or experienced professionals. Its high-speed infrastructure, regulatory oversight, diverse account types, direct market access, diverse asset coverage, and client fund protection make it a reliable and versatile platform for Forex trading.

Who should NOT sign up with Just2Trade?

Just2Trade, a Cyprus-based brokerage firm, offers a wide range of trading services and has gained the trust of over 155,000 clients from 130 countries. However, it may not be the right choice for everyone. Here are some reasons why certain individuals might want to reconsider signing up with Just2Trade:. Lack of Educational Materials: Just2Trade has been criticized for its lack of educational materials. This could be a significant drawback for beginners in the Forex market who are looking to learn and understand the intricacies of trading. Access to User Account: Access to a user account is granted only after you open a trading account and get verified. This complicates the process of getting familiar with the broker, especially for those who prefer to explore the platform before making a commitment. Floating Spreads: While Just2Trade declares tight spreads, they are, in fact, floating and tend to widen. This could impact the profitability of trades, particularly for high-frequency traders. Language Barrier: Detailed regulations and documents are provided in English only. This could pose a challenge for non-English speakers. Different Opportunities for Customers from Different Countries: Just2Trade claims it provides services for customers from 130 countries. However, the selection of products and services differs for each country. This could lead to discrepancies in the trading experience based on the trader’s location. In conclusion, while Just2Trade offers competitive trading conditions and a wide range of trading instruments, it may not be the ideal choice for Forex beginners, non-English speakers, and those who prefer fixed spreads. As always, potential traders should conduct thorough research and consider their individual trading needs before choosing a Forex broker.

Does Just2Trade offer Discounts, Coupons, or Promo Codes?

Just2Trade, a renowned online brokerage firm, does offer various discounts, coupons, and promo codes. These promotional offers can be beneficial for traders, especially those involved in forex trading, as they can help reduce trading costs and enhance profitability. One of the notable offers from Just2Trade is a deposit bonus of 2000 USD. This can significantly boost the trading capital of forex traders, allowing them to take larger positions in the market and potentially earn higher profits. In addition to the deposit bonus, Just2Trade also offers a 50% discount on commissions. Lower trading commissions can greatly benefit forex traders as it reduces the cost of trading, thereby increasing net profits. It’s important to note that these promo codes and discounts are subject to terms and conditions, and traders should ensure they understand these before availing of the offers. To use a promotional code on Just2Trade, traders typically need to enter the code during the deposit process. The discount or bonus is then applied to their account. In conclusion, Just2Trade does provide various promotional offers that can be advantageous for forex traders. However, the availability and specifics of these offers may vary, and it’s recommended to check the Just2Trade website or contact their customer service for the most accurate and up-to-date information.

Which Account Types are offered by Just2Trade?

Just2Trade offers three main account types, each with unique trading conditions and designed to provide a dynamic trading experience. Forex and CFD Standard Account This account is designed for beginner traders. It features:. A minimum deposit of USD 100. Leverage up to 1:500. Spreads from 0.5 pips and commission-free trading. Negative balance protection. Forex ECN Account This account caters to experienced traders who want to take advantage of the high execution speeds offered by Just2Trade. It features:. A minimum deposit of USD 200. Leverage up to 1:500. Spreads from 0.0 pips and commissions charged up to USD 3 per lot. MT4 Global Account This account is specifically for professional traders and offers the opportunity to trade through one of the most modern and powerful platforms designed for both Forex and MetaTrader 5 stock exchanges. It features:. A minimum deposit of USD 100. Leverage up to 1:500. Just2Trade is an ECN and STP broker based in Cyprus that has been in operation since 2006. It is strictly regulated by CySEC and offers various online trading solutions and services. The broker serves more than 155,000 clients from 130 countries and caters to both retail and institutional traders. The ultra-modern 100G network that Just2Trade uses covers Europe, America, Asia, and Russia, allowing the broker to maximize their order execution speeds from 0.05 seconds. Direct market access is provided to traders, which includes competitive commissions, maximum liquidity from various liquidity providers aggregated from major banks, and tight spreads starting from 0.0 pips.

How to Open a Just2Trade LIVE Account?

Just2Trade is a reputable broker that offers a variety of tradeable financial instruments along with other trading services. Here are the steps to open a Just2Trade LIVE account:. Navigate to the Just2Trade website: The first step is to navigate to the Just2Trade website. Click on the ‘Apply’ page: Once on the website, select and click on the ‘Apply’ page. Enter the required personal data: This includes your name, email, phone number, etc. Verify your personal data: You will need to upload documentation for verification. This could include residential proof, ID, etc. Complete the electronic quiz: This quiz confirms your trading experience. Just2Trade provides three main account types, each with their own unique trading conditions. Forex and CFD Standard Account: Designed for beginner traders, this account requires a minimum deposit of US Dollar 100 and offers leverage up to 1:500. Forex ECN Account: This account caters to experienced traders who would like to take advantage of the high execution speeds offered by Just2Trade. It requires a minimum deposit of US Dollar 200. MT5 Global Account: This account caters specifically to professional traders and offers the opportunity to trade through one of the most modern and powerful platforms designed for both Forex and MetaTrader 5 stock exchanges. Each account type has its own commission, fees, margin calls, leverage, and minimum deposits. Choose the one that best fits your trading needs and experience level. Once your account is set up, you can start trading a variety of instruments across numerous asset classes.

How to Open a Just2Trade DEMO account?

Opening a Just2Trade DEMO account is a straightforward process that allows traders to practice forex trading in a risk-free environment. Here’s a step-by-step guide:. Navigate to the Just2Trade Website: Start by heading over to the Just2Trade website. Select the ‘Demo’ Option: On the homepage, look for the ‘Demo’ banner located in the top right corner and click on it. Fill Out the Online Application: You’ll be redirected to a new page containing an online application. Here, you’ll need to provide your First and Last name, a selected password, email address, and cellphone number. Accept the Terms and Conditions: Before applying, you must accept the Privacy Policy and the Terms and conditions. Register for the Demo Account: After accepting the terms, click ‘Register’. You’ll then be redirected to a new page providing you with your account number and the password you selected. Download the Trading Platform: To make use of the demo account you’ve created, you’ll first have to download the trading platform. Just2Trade demo accounts are available on MetaTrader 4 and 5, which are supported on Windows, iOS, and mobile. Log In to Your Demo Account: Use your credentials to log into your Just2Trade demo account on the trading platform. Remember, a demo account is a great tool for beginner traders to familiarize themselves with a live trading environment. It provides a comprehensive and risk-free environment for traders to build up their trading skills, actively participate in trades, and develop their own trading strategies. More advanced traders can also use demo accounts to explore what Just2Trade has to offer.

How Are You Protected as a Client at Just2Trade?

Just2Trade is a multi-regulated broker that provides a high level of protection for its clients. Regulatory Oversight Just2Trade is regulated by several esteemed authorities, including the Financial Industry Regulatory Authority (FINRA) in the US, the Cyprus Securities and Exchange Commission (CySEC) in the EU, and the Bank of Russia. This rigorous regulation ensures that Just2Trade adheres to strict standards of operation. Client Fund Protection The protection of client funds is paramount for Just2Trade. They participate in the Securities Investor Protection Corporation (SIPC) in the US and the Cyprus government’s Investors Compensation Fund, which provide assurance and instill a sense of security in investments. Direct Market Access Just2Trade offers Direct Market Access (DMA). This feature allows traders to access financial markets directly, eliminating intermediaries. Benefits of DMA include low commissions, instant execution, and maximum liquidity. Diverse Trading Instruments Just2Trade provides access to a staggering number of tradable instruments, including stocks, currencies, options, futures, CFDs, bonds, and cryptocurrencies. This diversity allows clients to never feel limited in their investment choices. Account Types Just2Trade caters to a wide range of traders, from beginners to professionals, by offering a choice of four account types. Whether it’s a Forex Demo Account for practice or an MT5 Global Account for professional trading, Just2Trade has options for everyone. In conclusion, Just2Trade provides a comprehensive suite of protections for its clients, making it a reliable choice for those interested in forex trading.

Which Funding methods or Deposit Options are available at Just2Trade?

Just2Trade, a brokerage firm based in Cyprus, offers a wide range of deposit options for its clients. These options are designed to provide flexibility and convenience, catering to the diverse needs of traders worldwide. Bank Wire Transfers. : This traditional method of transferring funds is accepted by Just2Trade. It’s a reliable option, but it may take a few business days for the funds to appear in the trading account. Credit/Debit Cards. : Just2Trade accepts payments from both credit and debit cards. This is a quick and convenient way to fund a trading account. Online Payment Platforms. : Just2Trade supports several online payment platforms. These include Skrill, Neteller, and PayPal. These platforms offer a fast and secure way to transfer funds. : Just2Trade also accepts SWIFT payments. This is an international payment method that allows for the transfer of funds across different countries. The minimum required deposit for Just2Trade is $100. However, higher account types may require larger amounts of funds. It’s important for traders to check the specific requirements for their account type. In the context of forex trading, these deposit options provide traders with the flexibility to fund their accounts in a way that suits their individual needs. Whether a trader prefers the traditional method of bank wire transfers, the convenience of credit/debit cards, or the speed and security of online payment platforms, Just2Trade has an option to suit. It’s worth noting that while Just2Trade offers a range of deposit options, the availability of these methods may vary depending on the trader’s location. Therefore, it’s recommended that traders check the available deposit options in their specific region.

What is the Minimum Deposit Amount at Just2Trade?

Just2Trade, a Cyprus-based broker, is known for its competitive investing services and is regulated by one of the strictest and most demanding regulating entities, CySEC. The minimum deposit amount to open a real trading account with Just2Trade is 100 US dollars. However, the minimum deposit for first-time traders might vary based on the trading account type selected. The deposit activation can take up to 72 hours. They do not charge any fees when deposits are made into the trader’s account. Traders have a wide variety of payment methods which includes, but is not limited to, Bank Wire Transfer, Credit/Debit Cards, Neteller, and Skrill. Just2Trade supports three deposit currencies in which traders can fund their accounts including: USD, EUR, and RUB. Payments made in any other currency apart from the base currencies of the various accounts may be subjected to conversion rates charged by their payment provider. Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by following these steps. Log into the Client Portal and select ‘Deposit’. Select the deposit method along with the amount. After the trader has made their selection, they will be redirected to the payment processor page to confirm their deposit. Traders should take note that with making deposits by using Bank Wire Transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week. Bank Wire Transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week. It’s important to note that the minimum deposit for trading US options on Just2Trade is $3,000.

Which Withdrawal methods are available at Just2Trade?

Just2Trade, a well-regulated platform with a global clientele of more than 10,000 users, offers a variety of withdrawal methods. These methods are usually processed within 1 to 10 days. However, the available withdrawal methods can differ depending on the country in which Just2Trade operates. Currency conversion fees may apply if the base currency of the withdrawal method is not the same as the base currency of the Just2Trade account. The supported withdrawal methods at Just2Trade include:. Yandex Money. Wire Transfer. UnionPay. Mastercard. Credit Card. It’s important to note that when a withdrawal request is made, the funds will be returned to the same method of payment that was used to initially fund the Just2Trade account, unless an alternative withdrawal method is chosen. If multiple methods of payment were used, Just2Trade will transfer the funds to these methods based on the order in which the various methods of payment were used. Before withdrawing funds, it is essential to complete the verification process for the live Just2Trade account. This is necessary for safety reasons and because Just2Trade is legally required to verify the identity of their customers. Once the account has been validated, customers can withdraw their positive balances at any time. Withdrawal requests are processed on the nearest following business day if they were submitted after the cutoff time or on a non-business day. On a typical business day, the last time to make a withdrawal is at 11:00 am Eastern European Time, which corresponds to 1:00 pm London Standard Time for Just2Trade account holders. Please be aware of potential costs associated with Just2Trade withdrawals. These costs are necessary to process each withdrawal request.

Which Fees are charged by Just2Trade?

Just2Trade, a trading platform, imposes a variety of fees depending on the type of financial instrument traded or withdrawal methods requested. Here are the details:. Commissions and Fees: Just2Trade’s commissions and fees are not standard across all trading platforms. They start from US Dollar 2 per lot with spreads from 0.0 pips. Deposit Fees: Just2Trade does not charge any deposit fees. However, deposit fees may vary depending on your 3rd party deposit method, the currencies involved with your deposit, the amount you are depositing, and your country of residence. Withdrawal Fees: Just2Trade does not charge withdrawal fees from verified accounts. However, withdrawal fees are charged on some payment methods. Inactivity Fee: Just2Trade charges an inactive fee of $15 per quarter. Account Fees: Just2Trade does not charge account fees for standard trading accounts. It’s important to note that when evaluating buy and sell orders on Just2Trade, the trading fees that are incurred should be checked so that you are aware of them. The lower the fees, the tighter the spread, the more profitable it is to trade with the broker. This is important both for beginners and experienced traders, as the fees can make your profit considerably lower.

What can I trade with Just2Trade?

Just2Trade, a trademark of LimeTrading (CY) Ltd., is a brokerage firm that offers a wide range of trading instruments. Forex Trading Forex trading is definitively addressed at Just2Trade. The firm offers a plethora of currency pairs, touching on major, minor, and exotic spectra. This paves the way for forex aficionados to have an enriched experience. Other Tradable Instruments In addition to Forex, Just2Trade offers access to trade Contracts for Difference (CFDs), Stocks, Futures, Bonds, and Metals. The firm offers over 30,000 trading instruments. Trading Platform Just2Trade provides a full range of powerful trading tools. The firm offers multiple platforms including MT4, MT5, CQG, Sterling Trader Pro, and ROX. Account Types Just2Trade offers three types of accounts. This ensures an adaptable and rewarding trading environment for its diversified clientele. Regulation Just2Trade is a Cyprus-based company that offers its trading services since 2007 and has gained the trust of over 155,000 clients from 130 countries. It is authorized by CySEC (Cyprus) license no. 281/15. Fees and Spreads One of the most attractive offerings from Just2Trade is the low margins and no hidden fees policy. The firm offers competitive trading costs and spreads. In conclusion, Just2Trade is a reliable broker with good trading solutions. The broker offers a range of trading instruments to trade with competitive spreads and fees.

Which Trading Platforms are offered by Just2Trade?

Just2Trade offers a range of trading platforms that cater to both novice and seasoned traders. These platforms include MetaTrader 4, MetaTrader 5, and their proprietary Just2Trade Online platform. MetaTrader 4 and MetaTrader 5 are market-leading platforms, widely recognized for their great functionality and user-friendly design. They are especially popular among forex traders due to their advanced charting tools, automated trading capabilities, and extensive back-testing environment. The Just2Trade Online platform is designed for straightforward trade execution. It is appreciated for its simplicity and efficiency, making it less daunting for unseasoned traders. It also appeals to cost-conscious traders due to its competitive spreads. In addition to these platforms, Just2Trade also offers CQG, Sterling Trader Pro, and ROX trading platforms. These platforms further expand the trading possibilities for Just2Trade’s clients. Just2Trade’s commitment to providing a secure and rewarding trading environment is evident in its diverse platform offerings. Whether you’re a pragmatic trader seeking efficient simplicity or a seasoned trader looking for advanced features, Just2Trade has a platform to suit your needs.

Which Trading Instruments are offered by Just2Trade?

Just2Trade offers a comprehensive suite of trading instruments, catering to a wide range of trading inclinations and methodologies. Forex Trading: Forex trading is definitively addressed, with a plethora of currency pairs, touching on major, minor, and exotic spectra. This paves the way for forex aficionados to have an enriched experience. Other Tradable Instruments: In addition to Forex, Just2Trade provides access to a broad array of other trading instruments. These include stocks (both US and global), ADRs, ETFs, futures, futures options, mutual funds, and bonds. The platform also supports trading in commodities, indices, metals, energies, options, bonds, futures, CFDs. , and even cryptocurrencies. The diversity of tradable instruments offered by Just2Trade is staggering. With access to 128,000 tradable instruments. , it ensures that traders never feel limited in their investment choices. Just2Trade’s commitment to providing a wide range of trading instruments, combined with its sophisticated platform features, makes it a commendable choice for both trading neophytes and market veterans.

Which Trading Servers are offered by Just2Trade?

Just2Trade, a leading online discount stock brokerage service, offers a variety of trading servers to its clients. These servers provide the necessary tools for quality trading. The company offers several platforms for trading, including Web, MetaTrader 4, MetaTrader 5, CQG, and FIX API (protocol). Each of these platforms is designed to cater to different trading needs and preferences. In addition to these platforms, Just2Trade also provides a demo server located in the United States. This demo server allows traders to practice their trading strategies in a risk-free environment before they start trading with real money. Just2Trade’s trading servers are known for their reliability and speed. They offer tight spreads on major currency pairs, making them an excellent choice for forex trading. It’s worth noting that Just2Trade is regulated by the Cyprus Securities and Exchange Commission (CySEC). , ensuring a secure and transparent trading environment for its clients. In conclusion, Just2Trade offers a wide range of trading servers, each designed to cater to different trading needs and preferences. Whether you’re a beginner or an experienced trader, Just2Trade has a server that’s right for you.

Can I trade Crypto with Just2Trade? Which crypto currencies are supported by Just2Trade?

Just2Trade is a platform that allows trading of cryptocurrencies. It is a crypto exchange and a forex brokerage. The platform offers competitive fees, low minimums, and a wide range of trading tools. It supports a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more. Just2Trade is not just a standard cryptocurrency exchange. It has a separate section for an asset and security brokerage, and also a cryptocurrency exchange part. It provides direct access to the markets, offers low commissions, instant execution, and maximum liquidity. However, it supports a small variety of cryptocurrencies. Also, a minimum deposit of $100 is required. Despite these, Just2Trade might be a great choice for those interested in purchasing some crypto coins. In the context of forex, Just2Trade offers access to a decent range of 60+ major, minor, and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders. In conclusion, Just2Trade is a reliable platform for trading cryptocurrencies and forex. It offers a variety of features and tools that can benefit its users. However, it supports a limited number of cryptocurrencies and requires a minimum deposit.

What is the Leverage on my Just2Trade Trading Account?

Just2Trade is an international brokerage firm that provides traders with access to various market instruments, including Forex. The leverage on a Just2Trade trading account can go up to 1:500. This high leverage allows traders to trade larger positions with a smaller amount of capital. However, it’s important to note that while higher leverage can amplify profits, it can also amplify losses. Just2Trade offers a variety of account types, each with different features and benefits. For instance, the Forex and CFD Standard Account requires a minimum deposit of $100, offers leverage up to 1:500, and spreads from 0.5 pips. On the other hand, the Forex ECN Account requires a minimum deposit of $200, offers the same leverage, but has spreads from 0.0 pips. Just2Trade is regulated by the Cyprus Securities and Exchange Commission (CYSEC) with license no. 281/15. This regulation provides a level of assurance for traders, as it means the broker must adhere to certain standards and practices. However, it’s crucial for traders to understand the risks associated with leveraged trading. While it can provide the potential for significant profits, it can also lead to substantial losses. Therefore, it’s recommended that traders have a solid understanding of leverage and risk management strategies before engaging in leveraged trading. In conclusion, Just2Trade offers high leverage up to 1:500, allowing traders to potentially achieve higher profits. However, this also comes with increased risk, and as such, traders should ensure they fully understand these risks before trading.

What kind of Spreads are offered by Just2Trade?

Just2Trade, a subsidiary of Finam Holdings, offers a variety of spreads depending on the type of trading account. The company has been operating since 2006 and is regulated by the Cyprus Securities and Exchange Commission (CySEC, 281/15), as well as the Federal Commission on Securities Market (FCSM) of Russia. The spreads, fees, minimum deposit, and other trading conditions strongly depend on the trading account type. Here are the details of the spreads offered by Just2Trade for different account types. Forex and CFD Standard Account: The minimum deposit is $100, with leverage up to 1:500. The spreads start from 0.5 pips, and there are no brokerage commissions. Forex ECN Account: The minimum deposit is $200, with leverage up to 1:500. The spreads start from 0.0 pips, and up to $3 brokerage commissions are charged per lot. MT5 Global Account: The minimum deposit is $100, with leverage up to 1:500. The spreads start from 0.0 pips, and up to $2 brokerage commissions are charged per lot. It’s important to note that Just2Trade does not charge any deposit fees, but withdrawal fees are charged on some payment methods. Additionally, Just2Trade charges an inactive fee of $15 per quarter. In conclusion, Just2Trade offers competitive spreads starting from 0.0 pips, making it a viable choice for both beginner and experienced traders. However, traders should be aware of other potential fees, such as withdrawal and inactivity fees.

Does Just2Trade offer MAM Accounts or PAMM Accounts?

Just2Trade, a reputable broker serving more than 155,000 clients from 130 countries. , does not offer MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts. MAM and PAMM accounts are types of managed accounts that allow fund managers to manage multiple accounts from a single account without having to create an investment fund. The performance (profits and losses) of a MAM or PAMM account manager is distributed among the managed accounts. The PAMM account features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. On the other hand, a MAM account allows you to use the percentage allocation method like a PAMM account, but it provides greater flexibility to allocate the trades and adjust the risk of each sub-account based on the clients’ risk profiles. However, Just2Trade provides three different account types, namely the Forex and CFD Standard account, the Forex ECN account, and the MT4 Global account. Each of these accounts has its own commission, fees, margin calls, leverage, and minimum deposits. In conclusion, while Just2Trade offers a variety of tradeable financial instruments along with other trading services. , it does not provide MAM or PAMM accounts for money managers.

Does Just2Trade allow Expert Advisors?

Just2Trade, a brokerage firm based in Cyprus, is known for its wide range of offerings in the trading sector. It provides access to trade Forex, CFDs, Stocks, Futures, Bonds, Metals, and more. One of the key features of Just2Trade is its support for auto trading. This implies that Just2Trade does allow the use of Expert Advisors (EAs), which are automated systems used in forex trading to predict market trends and execute trades. Just2Trade’s platform compatibility extends to several third-party platforms, including MT4 and MT5. , which are known for their support for EAs. This further strengthens the case for EA compatibility. Additionally, it’s worth noting that there is no restriction on the broker account. , which suggests flexibility in terms of trading strategies and tools, including EAs. However, while Just2Trade provides a robust platform for trading with a variety of tools, it’s important for traders to understand that the use of EAs also comes with risks. EAs operate based on predefined algorithms and may not always account for real-time market fluctuations or unprecedented events. Therefore, while EAs can be a powerful tool in forex trading, their use should be complemented with careful monitoring and strategic intervention when necessary. In conclusion, based on the information available, Just2Trade does appear to support the use of Expert Advisors in forex trading. As always, traders are advised to verify this information with the broker and understand the associated terms and conditions before proceeding.