JustMarkets Review 2026

What is JustMarkets?

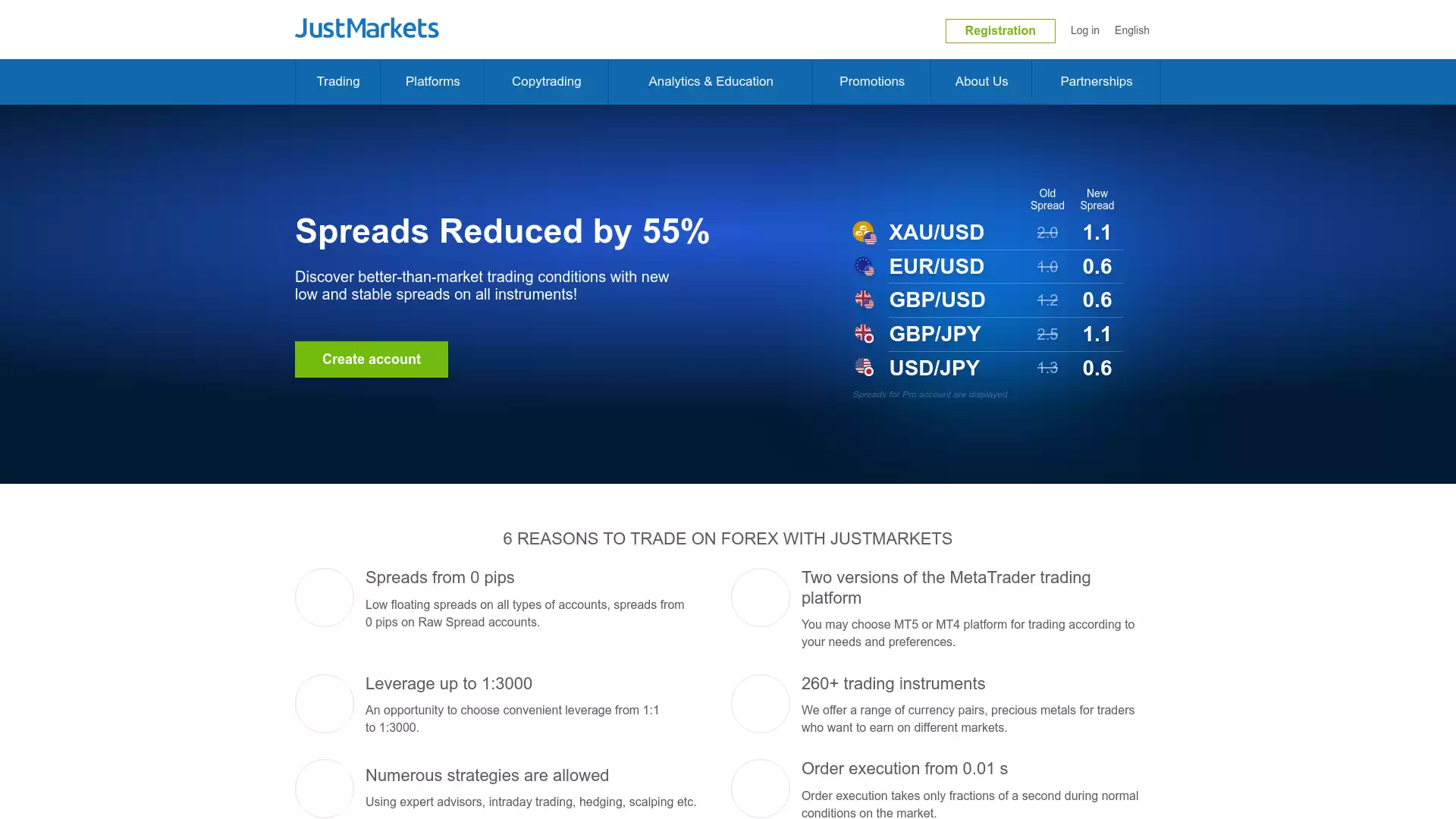

JustMarkets is an online broker that offers trading services for various financial instruments, such as forex, commodities, indices, stocks, and cryptocurrencies. The broker was formerly known as JustForex, but changed its name in 2021 to reflect its global expansion and vision. Here are some of the features and benefits of trading with JustMarkets:. Regulated by multiple authorities: JustMarkets is licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, the Cyprus Securities and Exchange Commission (CySEC) of Cyprus, and the Financial Services Commission (FSC) of Seychelles. This means that the broker complies with high standards of security, transparency, and customer protection. Low spreads and commissions: JustMarkets offers competitive pricing for its trading services, with spreads starting from 0.3 pips on its Raw Spread account and no commissions on its Standard account. The broker also provides a 120% deposit bonus for new clients, which can be used to trade more without risking extra money. Diversified product portfolio: JustMarkets offers over 260 trading instruments across various markets, including forex pairs (such as EUR/USD, GBP/USD, USD/JPY), precious metals (such as gold and silver), cryptocurrencies (such as Bitcoin and Ethereum), energies (such as oil and gas), stocks (such as Apple and Tesla), and indices (such as S&P 500 and DAX 30). User-friendly trading platforms: JustMarkets supports two versions of the MetaTrader trading platform: MT4 and MT5. These platforms are widely used by traders around the world for their advanced features, such as technical analysis tools, automated trading systems, market news, indicators, charts, etc. The broker also provides a web-based platform called JustForex WebTrader for easy access to the markets from any device. Fast order execution: JustMarkets claims to have a fast order execution speed of up to 0.01 seconds during normal market conditions. This means that traders can enter and exit trades quickly without experiencing delays or slippage. 24/7 customer support: JustMarkets provides a dedicated team of customer support agents who are available 24 hours a day, 7 days a week via phone, email, live chat, or social media. The broker also has a comprehensive FAQ section on its website that answers common questions about trading with JustMarkets. Loyalty program: JustMarkets rewards its loyal clients with various benefits and prizes through its Partner Loyalty Program. The program allows clients to earn points by trading with JustMarkets or referring other traders to the broker. These points can be redeemed for high-end luxury cars, international vacations, cash prizes up to $2000000 USD ,and more. . If you are interested in learning more about JustMarkets or opening an account with them , you can visit their website here. You can also read some reviews from other traders who have used their services here, here, here, or here.

What is the Review Rating of JustMarkets?

- 55brokers: 55brokers rated JustMarkets with a score of 85. This rating was last checked at 2024-01-06 03:42:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated JustMarkets with a score of 100. This rating was last checked at 2024-01-06 06:41:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated JustMarkets with a score of 94. This rating was last checked at 2024-01-06 13:53:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated JustMarkets with a score of 64. This rating was last checked at 2024-03-13 11:07:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of JustMarkets?

JustMarkets, formerly known as JustForex, is a well-regarded online brokerage that offers a variety of financial products. Here are some of the key advantages of trading with JustMarkets:. Wide Selection of Financial Products: JustMarkets offers a broad range of trading instruments, including Forex, metals, cryptocurrencies, energies, stocks, and indices. High Leverage: JustMarkets provides high leverage up to 1:3000, which can potentially amplify profits. Competitive Spreads: The platform offers competitive Forex spreads from 0.6 pips. User-Friendly Trading Platforms: JustMarkets supports MetaTrader MT4 and MT5 platforms, which are widely recognized for their comprehensive features and user-friendly interfaces. Low Minimum Deposit: The minimum deposit to start trading is as low as $10 USD. Regulated: JustMarkets is regulated by multiple financial authorities, including FSA, FSCA, CySEC, and FSC. Negative Balance Protection: The broker provides negative balance protection, which means you cannot lose more money than you have deposited in your account. Multilingual Support: JustMarkets offers 24/7 support in multiple languages. Islamic Swap-Free Accounts: JustMarkets accommodates traders of the Islamic faith with swap-free accounts. Please note that while JustMarkets offers many advantages, it’s important to consider your individual trading needs and goals before choosing a broker. Always perform your own due diligence. Happy trading!.

What are the Cons of JustMarkets?

JustMarkets, formerly known as JustForex, is a popular online brokerage company that offers a wide selection of financial goods. However, like any other platform, it has its own set of drawbacks. Here are some of the cons associated with JustMarkets:. Limited Selection of Trading Instruments: JustMarkets primarily focuses on forex trading, offering a range of major and minor currency pairs. However, compared to other platforms, the selection of trading instruments is relatively small. No PAMM Accounts: PAMM (Percentage Allocation Management Module) accounts allow investors to have their funds managed by a more experienced trader. Unfortunately, JustMarkets does not offer this feature. Withdrawal Delays: Some users have reported experiencing delays when attempting to withdraw their funds. Customer Support: There have been instances where it takes time to receive a response from the technical support. Few Passive Income Options: JustMarkets offers limited options for generating passive income. Withdrawal Fees: Users may be charged fees when withdrawing their funds. Occasional Difficulties with the Trading Platform: Some users have reported occasional difficulties when working with the trading platform. Lack of Tier-1 Regulation: While JustMarkets is regulated by several entities, it lacks regulation from top-tier authorities like the FCA UK or ASIC. Limited Product Offerings: Compared to its competitors, JustMarkets has a limited portfolio of CFD offerings. Please note that while these cons are significant, they should be weighed against the platform’s pros before making a decision. It’s also important to remember that the suitability of a trading platform can vary greatly depending on individual trading needs and goals.

What are the JustMarkets Current Promos?

JustMarkets, a renowned forex broker, offers a variety of promotions to its clients. Here are some of the current promotions:. Welcome Bonus: JustMarkets provides a $30 bonus to kickstart your trading journey. 120% Deposit Bonus: This promotion offers a 120% bonus on your deposit with no limits on the bonus you can get. The bonus size depends on your deposit amount. For deposits up to $100, you get a 50% bonus. For deposits from $100 to $500, you get a 100% bonus. For deposits from $500 and more, you get a 120% bonus. Just Invite Friends: You can earn up to $25 for every lot traded by your referrals. 0% Fees on Deposits and Withdrawals: JustMarkets covers all expenses, which may occur when you deposit or withdraw funds. These promotions are designed to enhance your trading experience and maximize your profits. Please visit the official JustMarkets website for more details.

What are the JustMarkets Highlights?

JustMarkets, a multi-asset online CFD broker founded in 2012, is headquartered in Limassol, Cyprus. The broker specializes in trading forex pairs, commodities, indices, stocks, and cryptocurrencies. Regulation: JustMarkets is highly regulated with entities regulated by FSA, FSCA, CySEC, and FSC. These entities provide negative balance protection and hold clients’ funds in segregated accounts. The CySEC entity provides access to the Investor Compensation Fund. Fees: JustMarkets offers attractive fees at its Pro Account compared to the industry average. Platforms: The broker supports the globally renowned MetaTrader 4 and MetaTrader 5 platforms. It also offers copy trading features and an additional risk management tool: price gap protection. Markets: The broker provides a well-rounded array of tradable instruments, although the total number of instruments available is modest. Deposits and Withdrawals: Clients of JustMarkets have access to a diverse range of deposit and withdrawal options, available in multiple currencies, including cryptocurrencies. Accounts: The broker offers a choice between spread-based and commission-based accounts. Support: JustMarkets’ support team provides quick and professional answers. In addition, the broker has developed a chatbot that answers common questions. Education and Research: The broker offers only basic support in these areas. JustMarkets features a minimum deposit of $10, ideal for beginners embarking on their trading journey. Additionally, it offers a Cent Account designed specifically for novice traders, along with reliable 24/7 customer support and copy trading features. Advanced traders will benefit from attractive spreads with the Pro Account, access to both MT4 and MT5 trading platforms, and a variety of deposit and withdrawal options.

Is JustMarkets Legit and Trustworthy?

JustMarkets, formerly known as JustForex, is a well-established brokerage company that has been in operation since 2012. It is regulated by the Seychelles Financial Services Authority (FSA) under license No. SD088. , which adds to its credibility. The company offers a wide selection of financial products on an easy-to-use website. It caters to both new and seasoned investors with its extensive range of trading tools and affordable prices. JustMarkets accepts all trading styles and Expert Advisors on MetaTrader 4 and 5. Customer reviews of JustMarkets are generally positive. Many customers have praised the company’s excellent support, low spreads, and fast deposit and withdrawal processes. However, some customers have reported issues with bank withdrawals due to unreliable payment partners. , and there have been complaints about the quality of customer support. In terms of safety protocols, JustMarkets stores client funds in segregated accounts to avoid financial mismanagement. The company’s internal procedures are based on the PCI DSS security standard. , which is a widely recognized information security standard for organizations that handle branded credit cards. In conclusion, based on the available information, JustMarkets appears to be a legitimate and trustworthy online brokerage company. However, as with any financial decision, potential investors should conduct their own research and consider their individual financial circumstances before choosing a brokerage. Please note that this information is based on available web search results and may not be fully up-to-date or comprehensive. Always conduct your own due diligence when making financial decisions.

Is JustMarkets Regulated and who are the Regulators?

JustMarkets is indeed a regulated entity, providing a secure and transparent environment for trading activities. The company operates under the regulatory oversight of several financial authorities, ensuring that clients can trade with confidence and peace of mind. Regulatory Authorities:. Seychelles Financial Services Authority (FSA): Just Global Markets Ltd., with registration number 8427198-1, is a Securities Dealer regulated by the Seychelles FSA under a Securities Dealer License number SD088. Cyprus Securities and Exchange Commission (CySEC): JustMarkets Ltd, with registration number HE 361312, is a Cyprus Investment Firm authorized and regulated by the CySEC with license number 401/21. Financial Sector Conduct Authority (FSCA): Just Global Markets (PTY) Ltd, with registration number 2020/263432/07, is authorized by the FSCA in South Africa as a Financial Service Provider (FSP) with FSP number 51114. Financial Services Commission (FSC): Just Global Markets (MU) Limited, with registration number 194590, is an Investment Dealer (Full Service Dealer, Excluding Underwriting) regulated by the FSC in Mauritius under a License number GB22200881. These regulatory bodies ensure that JustMarkets adheres to strict guidelines to guarantee the safety and security of clients’ funds. The regulations also provide relatively good client protection measures. In the context of forex trading, these regulations are particularly important. They ensure that JustMarkets operates within the legal frameworks set by these authorities, providing traders with a secure platform for forex trading. The company’s adherence to these regulations also signifies its commitment to maintaining high standards of conduct in the forex market. Please note that while JustMarkets is regulated, trading in forex involves risk, and it’s important for traders to understand these risks before engaging in trading activities.

Did JustMarkets win any Awards?

JustMarkets, a renowned international broker, has indeed been recognized with prestigious awards, reflecting its commitment to excellence in the forex trading industry. JustMarkets has been honored as the Best Broker in Africa at the Ultimate Best Brokers & B2B Fintech Awards 2023. This award is a testament to the high level of service JustMarkets provides in various regions across the globe. The recognition underscores the company’s dedication to its clients and its drive to become the most customer-focused broker in the world. In addition to this, JustMarkets was also titled as the Best Broker in Asia in 2022. This accolade further demonstrates the company’s commitment to providing top-tier services in different regions. JustMarkets offers a wide range of assets, tight spreads, and four different account types to its customers. It also provides MetaTrader 4 and 5, making it accessible to clients in over 200 countries. The company’s dedication to customer service is reflected in its 24/7 support in three different languages: English, Indonesian, and Malaysian. These awards and the company’s commitment to its clients make JustMarkets a leading choice for forex traders worldwide. The company continues to strive for excellence, aiming to provide everyone with an easy and transparent way to trade and invest.

How do I get in Contact with JustMarkets?

If you want to get in contact with JustMarkets, a forex broker that offers various trading platforms and services, you have several options to choose from. Here are some of the ways you can reach them:. You can send an email to their support department at support@justmarkets.com. They are available 24/7 and support languages such as English, Indonesian, Malaysian, Spanish, Portuguese, and Italian. You can call their phone numbers for English support: +248 4632027 or +230 52970330. These numbers may incur carrier charges. You can request a callback by filling out a form on their website. You can use their live chat feature on their website or on their social media platforms such as Telegram, Viber Messenger, Line, Instagram, and iMessage. You can also contact them via email if you want to become their partner. Their partner email address is partners@justmarkets.com. You can find more information about JustMarkets and their contact details on their website. or on other sources such as Justmarkets.eu, JustMarkets, or JustMarkets. I hope this helps you get in touch with JustMarkets and learn more about their forex trading services. ?.

Where are the Headquarters from JustMarkets based?

JustMarkets, a prominent player in the forex market, has its headquarters located in Cyprus and Seychelles. Established in 2012. , JustMarkets has been providing a platform for forex and CFDs trading over the internet. The company is regulated by the FSA (Seychelles) and CySEC. , ensuring that it operates within the guidelines set by these regulatory bodies. This adds a layer of trust and reliability for its users. JustMarkets offers a wide range of trading instruments. It provides access to 65 currency pairs, 8 metals, 11 indices, 3 energies, 165 shares, and 14 cryptocurrency pairs. The availability of these assets depends on the type of account a trader holds. The company offers several types of accounts to cater to the diverse needs of its users. These include the Cent, Pro, Standard, and Raw Spread accounts. Each of these accounts has its own unique features and benefits, providing flexibility for traders of all levels. JustMarkets has made a significant effort to ensure the security of its users’ transactions. It uses multiple servers, complex backup systems, and SSL encryption to ensure the speed and security of all transactions done on its website and platforms. In conclusion, JustMarkets, with its headquarters in Cyprus and Seychelles, provides a robust and secure platform for forex trading. Its wide range of trading instruments and flexible account types make it a preferred choice for many traders.

What kind of Customer Support is offered by JustMarkets?

JustMarkets offers a comprehensive and robust customer support system to ensure a seamless trading experience for its users. 24/7 Support JustMarkets provides round-the-clock support, available 24/7. This ensures that traders can get assistance whenever they need, regardless of their time zone or trading hours. Multilingual Support The support team at JustMarkets is multilingual, catering to a global clientele. They offer support in several languages including English, Indonesian, Malaysian, Spanish, and Portuguese. Multiple Contact Channels JustMarkets offers multiple channels for users to reach out to their support team. These include email at support@justmarkets.com. , phone support with numbers provided for English support. , and a callback request option. They also offer support through various messengers including Live Chat, Telegram, Viber, Messenger, Line, Instagram, and iMessage. Partner Support For those interested in partnerships, JustMarkets has a dedicated contact channel at partners@justmarkets.com. FAQs and Trading Platforms JustMarkets also provides a comprehensive FAQ section on their website. that answers frequently asked questions concerning Forex trading, the company, trading terms, products, and services. They also offer the option to open real or demo accounts and download MT5 and MT4 trading platforms. Back Office Verification For any issues related to back office verification, users can contact customer support via chat or email at support@justmarkets.com. In conclusion, JustMarkets has a well-rounded customer support system that caters to the diverse needs of its users, ensuring a smooth and efficient trading experience.

Which Educational and Learning Materials are offered by JustMarkets?

JustMarkets, a global Forex and CFD trading company, offers a wide range of educational materials to help both novice and experienced traders navigate the complex world of currency and cryptocurrency markets. Comprehensive Learning Resources: JustMarkets provides comprehensive educational resources on its website. These resources are designed to help traders understand the intricacies of trading in various financial markets, including Forex, Gold, Oil, Indices, Metals, Cryptos, and Shares. Webinars: JustMarkets offers webinars as part of its educational resources. These webinars provide traders with the opportunity to learn from experts in the field and gain insights into various trading strategies and market trends. Forex Articles: The broker provides a collection of Forex articles. These articles cover a wide range of topics related to Forex trading, providing traders with the knowledge they need to make informed trading decisions. Educational Videos: JustMarkets also offers educational videos. These videos provide visual learners with a more engaging way to understand complex trading concepts and strategies. Daily Forecasts: JustMarkets provides daily forecasts as part of its educational resources. These forecasts can help traders anticipate market movements and plan their trading strategies accordingly. Economic Calendar: An economic calendar is another valuable resource offered by JustMarkets. This tool helps traders keep track of important economic events that could impact the financial markets. Market News: Staying updated with the latest market news is crucial for successful trading. JustMarkets provides up-to-date market news to help traders stay informed about the latest market trends and events. In conclusion, JustMarkets offers a wide range of educational and learning materials designed to help traders succeed in the complex world of Forex and other financial markets.

Can anyone join JustMarkets?

JustMarkets is a popular platform for trading Forex, CFDs, Gold, and Oil. It offers a range of features that make it an attractive option for both new and experienced traders. Here are some key points to consider:. Eligibility JustMarkets is open to anyone interested in trading. However, certain promotions and programs may have specific eligibility requirements. For instance, their IB reward program is only open to partners working under the IB program. New traders can open a welcome account to qualify for a 30 USD welcome bonus. Trading Account Types JustMarkets offers different types of accounts: Standard Cent, Standard, Pro, Raw Spread. This variety allows traders to choose the account type that best suits their trading style and risk tolerance. Trading Conditions JustMarkets provides favorable trading conditions, including spreads from 0 points and trading leverage up to 1:3000. These conditions can help traders maximize their potential profits. Trading Instruments JustMarkets offers a wide range of trading instruments. Traders can choose from a variety of currency pairs and precious metals, providing plenty of opportunities to diversify their trading portfolio. Order Execution Order execution on JustMarkets is fast, taking only fractions of a second during normal market conditions. This can be a significant advantage in the fast-paced world of Forex trading. Promotions and Bonuses JustMarkets offers various promotions and bonuses to its traders. These can provide additional benefits and incentives for trading. In conclusion, JustMarkets is a versatile platform that caters to a wide range of traders. Its user-friendly interface, diverse account types, and competitive trading conditions make it a popular choice for those interested in Forex trading. However, potential traders should always conduct their own research and consider their financial situation before starting to trade.

Who should sign up with JustMarkets?

JustMarkets is a platform that caters to a wide range of individuals interested in forex trading. Here are some categories of people who might find JustMarkets beneficial:. 1. Forex Traders: JustMarkets offers a range of currency pairs, precious metals for traders who want to earn on different markets. They provide low floating spreads on all types of accounts, including spreads from 0 pips on Raw Spread accounts. 2. Traders Seeking Leverage: JustMarkets provides an opportunity to choose convenient leverage from 1:1 to 1:3000. This can be particularly attractive to traders who wish to maximize their potential returns. 3. Traders Using Various Strategies: JustMarkets allows the use of numerous strategies including expert advisors, intraday trading, hedging, scalping, etc. This flexibility can be beneficial for traders who employ a variety of trading strategies. 4. Traders Looking for Fast Execution: Order execution on JustMarkets takes only fractions of a second during normal conditions on the market. This can be crucial for traders who rely on quick execution for their trading strategies. 5. Traders Seeking Bonuses: JustMarkets offers a 120% deposit bonus with no limits on the bonus you can get. They also offer a $30 welcome bonus to start your trading journey. 6. Traders Interested in Social Trading: JustMarkets offers social trading services, allowing traders to earn on Forex without the experience of trading by copying the orders of professionals on their trading account. 7. Traders Looking for a Variety of Account Types: JustMarkets offers different types of accounts: Standard Cent, Standard, Pro, Raw Spread. Each account type has its own trading terms and conditions. 8. Traders Seeking a Reliable Platform: JustMarkets offers two versions of the MetaTrader trading platform. Traders may choose the MT5 or MT4 platform for trading according to their needs and preferences. 9. Traders Seeking a User-Friendly Interface: JustMarkets provides a Back Office where traders can open and manage trading accounts, deposit, transfer, and withdraw funds, as well as analyze trading statistics. 10. Traders Looking for Positive Reviews: JustMarkets has received positive reviews from users who have praised the platform for its low spreads, easy and fast deposits/withdrawals, and excellent support. In conclusion, JustMarkets is a comprehensive forex trading platform that caters to a wide range of traders with its diverse offerings. Whether you’re a seasoned trader or a beginner, JustMarkets has features and services that can help enhance your trading experience.

Who should NOT sign up with JustMarkets?

Who should NOT sign up with JustMarkets? JustMarkets is a forex broker that offers trading services in various instruments, such as currency pairs, CFDs, indices, commodities, and stocks. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) and provides access to the MetaTrader5 platform. However, not everyone is suitable for trading with JustMarkets. Here are some reasons why you might want to avoid signing up with this broker: High minimum deposit requirement: To open a live trading account with JustMarkets, you need to deposit at least $100. This might be too high for some traders who are just starting out or have a limited budget. Moreover, the broker does not offer any bonuses or promotions for new clients, which can reduce the incentive to trade with them. Limited payment options: JustMarkets supports various payment methods, such as credit cards, bank transfers, Skrill, Neteller, WebMoney, and others. However, some of these options might have high fees or processing times that can affect your trading experience. For example, Skrill charges 3% + $0.30 per transaction. , while Neteller charges 2% + $0.30 per transaction. Additionally, some payment methods might not be available in your country or region. Lack of customer support: JustMarkets claims to have a professional and friendly customer support team that is available 24/7 via phone, email, and live chat. However, some users have reported that the support agents are not very helpful or responsive when it comes to resolving issues or answering questions. Furthermore, the broker does not provide any educational resources or market analysis tools that can help traders improve their skills and knowledge. High spreads and commissions: JustMarkets offers two types of accounts: Pro and Raw Spread. The Pro account has lower spreads but higher commissions of $3 per side or lot. , while the Raw Spread account has higher spreads but no commissions. Both accounts have a minimum order volume of 0.01 lots or 1000 base currency units. The average spread for EUR/USD on the Pro account is 0.6 pips. , while on the Raw Spread account it is 0+ pips. These spreads are relatively high compared to other brokers in the market. In conclusion, JustMarkets is a forex broker that has some advantages but also some drawbacks that might make it unsuitable for some traders. Therefore, before signing up with this broker, you should carefully consider your trading goals, preferences, risk appetite, and budget. You should also compare JustMarkets with other brokers in terms of regulation, fees, platforms, instruments, customer service quality and availability.

Does JustMarkets offer Discounts, Coupons, or Promo Codes?

Yes, JustMarkets does offer discounts, coupons, and promo codes. Here are some of the promotions they have:. 10 USD or 30 USD Promo Code: This promotion is applicable to both new and registered JustMarkets clients. To receive the 30 USD bonus, a client needs to deposit at least 100 USD into their Standard or Pro account. For the 10 USD bonus, a deposit of at least 30 USD is required. The bonus can be used as additional margin for trading and it supports drawdown. The maximum period to use the bonus funds is 20 calendar days from the moment the bonus funds are received. 120% Deposit Bonus: JustMarkets also offers a 120% deposit bonus. The bonus sizes are based on the deposit amount: a bonus of 50% for deposits up to $100, a bonus of 100% for deposits between $100 and $500, and a bonus of 120% for deposits of $500 and above. Referral Program: JustMarkets has a referral program where you can earn up to $25 for every lot traded by your referrals. Please note that these promotions are subject to terms and conditions, and it’s important to read the rules carefully before participating. Also, the availability of these promotions may vary, so it’s recommended to check the JustMarkets website for the most current information.

Which Account Types are offered by JustMarkets?

JustMarkets is a forex broker that offers various account types for traders who want to trade online. The account types differ in terms of minimum deposit, leverage, spread, commission, and available instruments. Here is a summary of the account types offered by JustMarkets:. Standard Cent: This account type is suitable for beginners who want to practice trading with virtual money. The minimum deposit is 10 USD and the leverage is up to 1:3000. The spread is floating from 0.3 pips and there is no commission. The available instruments are 36 forex pairs, 4 metals, and 9 indices. Standard: This account type is ideal for traders who want to trade with real money and access a wide range of instruments. The minimum deposit is 100 USD and the leverage is up to 1:3000. The spread is floating from 0.3 pips and there is no commission. The available instruments are 65 forex pairs, 8 metals, and 9 indices. Pro: This account type is designed for experienced traders who want to trade with low spreads and high leverage. The minimum deposit is 100 USD and the leverage is up to 1:3000. The spread is floating from 0.1 pips and there is no commission. The available instruments are 65 forex pairs, 8 metals, 11 indices, 2 energies, and 63 shares. Raw Spread: This account type offers the lowest spreads in the market, starting from zero pips. However, there is a commission of $3 per lot per side for each trade. The minimum deposit is also 100 USD and the leverage is up to 1:3000. The available instruments are the same as in the Pro account. Islamic: This account type follows the Sharia law and does not charge or pay any interest on overnight positions or swaps on margin calls or withdrawals. It also has swap-free options for Muslims who do not want to deal with interest-based transactions. Demo: This account type allows traders to open a free demo account without any deposit or verification. It simulates real trading conditions and provides access to all the trading platforms and tools offered by JustMarkets. . You can find more details about each account type on the official website of JustMarkets. You can also compare them using this table:. Account TypeMinimum DepositLeverageSpreadCommissionInstruments Standard Cent10 USD1:3000Floating from 0.3 pipsNoNoNoNoNoNoNoNoNoNoNoNoNoNo Standard100 USD1:3000Floating from 0.3 pipsNo Pro

How to Open a JustMarkets LIVE Account?

Opening a JustMarkets LIVE account involves a series of steps. Here’s a detailed guide:. Step 1: Registration To start, visit the official website of JustMarkets. Click on the “Register” button at the top right of the home page. You will be required to enter your country of residence and email address. Step 2: Back Office Access After registration, you will be automatically redirected to the Back Office. This is where you can manage your trading accounts, deposit, transfer, and withdraw funds, as well as analyze trading statistics. Step 3: Account Creation In the “Account Operations” menu, click “My accounts.” On the “Live” page in the “Trading account” section, click "Open New Account". Step 4: Personal Details Fill in all the fields in the “Provide personal details” section. This step is only for clients who have not filled out this information before. If you have already provided the required personal details, proceed to the next step. Step 5: Account Type Selection Select the desired account type on the preferred platform page in the “Open New Account” section and click "Open Real Account". JustMarkets offers several account types, each with different trading terms. Step 6: Currency and Leverage Select the base currency of your Real Account. Define the necessary leverage. Note that you will be able to change the leverage level in the Back Office in the future. Step 7: Password Setup Set the main password, which contains from 6 to 15 symbols, including at least one Latin letter and one digit. Click "Create Account". Step 8: Trading Platform Access Use your trading account number as a login to the MetaTrader 4 / MetaTrader 5 trading platform or its web version, WebTrader. Use the main password to execute trades or investor password sent to your email, to monitor trading activity on the account. Remember, you can create an unlimited amount of trading accounts of different types inside your Back Office. Inactive accounts which have no funds and haven’t had trading and non-trading activities for more than 90 days will be archived without prior notice. Please note that this information is based on the details available as of the time of this response and may be subject to changes. Always refer to the official JustMarkets website for the most accurate and up-to-date information.

How to Open a JustMarkets DEMO account?

Opening a JustMarkets DEMO account is a straightforward process that allows you to practice Forex trading in a simulated market environment. Here’s a step-by-step guide:. Step 1: Log in to your Back Office. If you don’t have an account yet, sign up. Step 2: In the menu “Account Operations,” click the “My accounts” tab. Step 3: On the “Demo” page in the “Trading account” section, click "Open New Account". Step 4: Select the desired account type on the preferred platform page in the “Open New Account” section and click the “Try Demo” button. Step 5: Select the currency of your Demo Account. Step 6: Define the necessary leverage. Note that you will be able to change the leverage level in the Back Office in the future. Step 7: Set the main password, which contains from 6 to 15 symbols, including at least one Latin letter and one digit. Step 8: Set the desired balance of your Demo Account. Step 9: Click the “Create Account” button. From that point, you can sign in to your forex demo account with MetaTrader 4/MetaTrader 5. With a JustMarkets demo account, you can trade over 100 instruments, including currency pairs, stocks, indices, metals, and energy commodities. It’s a great way to develop your trading style, test expert advisors, and enjoy trading without extra hassle.

How Are You Protected as a Client at JustMarkets?

As a client at JustMarkets, you are protected in several ways:. 1. Stability of Work JustMarkets ensures stable operation in any market situation. This stability is maintained even in the face of significant market events, such as the decision by the Central Bank of Switzerland to cancel the upper limit of EUR/CHF. 2. Liquidity Liquidity for JustMarkets is provided by 18 of the world’s largest banks. This ensures that clients always get the best prices from the price float offered by these banks. 3. Qualified Staff JustMarkets employs highly qualified professionals with over 10 years of experience in the financial sector. These professionals are always ready to provide qualified support to clients. 4. Segregated Accounts The funds of JustMarkets clients are kept in segregated bank accounts. This means that the company’s own funds and the funds of its clients are kept separate. 5. Data Transfer Protection Data transfer is protected via an SSL security connection with encryption of information. This prevents third parties from intercepting user data while working with the website. 6. Protection from Negative Balance JustMarkets compensates clients for losses that exceed the amount of funds in their trading accounts. This means that if a negative balance occurs due to a sharp market movement, it will be set to zero to protect clients from unexpected losses. 7. International Security Standard The company’s internal procedures are based on the PCI DSS security standard. This involves a comprehensive approach to ensuring the security of clients’ data. 8. Multilevel System of Servers The company’s infrastructure, which consists of multiple servers, supports uninterrupted system operation. A complex data backup scheme helps prevent loss of clients’ information (personal data, transaction history, etc.) in any situation. 9. Data Storage Protection User data is protected not only during transfer between the company’s website and the browser, but also through encryption of all stored information. This helps prevent unauthorized access to client data. In conclusion, JustMarkets provides a secure trading environment, which is one of the most important concerns for its clients. The company’s regulations guarantee relatively good client protection measures. The broker stores client funds in segregated accounts to avoid financial mismanagement. The internal procedures of the company are based on the PCI DSS security standard.

Which Funding methods or Deposit Options are available at JustMarkets?

JustMarkets offers a variety of funding methods and deposit options for its users. Here are the details:. Cards and Banks. Available currencies: EUR, USD, AED, GHS, OMR, TRY, AUD, HKD, PHP, TTD, BBD, HRK, PKR, UGX, BGN, HUF, PLN, USD, BHD, ILS, QAR, ZAR, CAD, JPY, RON, ZMW, CHF, KES, SAR, CZK, MWK, SEK, DKK, MXN, SGD, EUR, NOK, THB, GBP, NZD, TND. Amount per transaction: Minimum - 10 USD/EUR, Maximum - 50,000 USD. Fee: 0%. Processing time: 1-6 banking days. Worldwide Wallets. Available currencies: EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, RUB, SGD, TWD. Amount per transaction: Minimum - 10 USD. Fee: 0%. Processing time: within 5 minutes. Cryptocurrencies. Available cryptocurrencies: BTC, BCH, ETH, USDC, USDT, BUSD, BNB, DOGE, LTC, XRP. Amount per transaction: Minimum - 15 USD for USDC, USDT, BUSD, and 30 USD for others. Fee: 0%. Processing time: within 30 minutes. Local Banks, Cards, Mobile Money. Available currencies: MYR, IDR, THB, VND, PHP, NGN, ZAR, UGX, KES, RWF, GHS, XAF, TZS, EUR, USD, COP, BRL. Amount per transaction: Minimum - 10 USD, Maximum varies. Fee: 0%. Processing time: within 30 minutes to up to 1 banking day. Local Wallets. Available currencies: USD, IDR. Amount per transaction: Minimum - 10 USD. Fee: 0%. Processing time: within 30 minutes. Please note that the availability of these options may vary depending on your location.

What is the Minimum Deposit Amount at JustMarkets?

JustMarkets, a well-known platform in the forex trading industry, offers a variety of deposit options to cater to the diverse needs of its global clientele. The minimum deposit amount at JustMarkets varies depending on the type of account and the deposit method used. For Standard Accounts, the minimum deposit is as low as $1. This low entry barrier makes it accessible for beginners in forex trading who might want to start with a smaller investment. For those who opt for Pro and Raw Spread accounts, the minimum deposit requirement is $100. These accounts are typically chosen by more experienced traders who are willing to invest a higher amount for better trading conditions. In terms of deposit methods, JustMarkets provides a wide range of options, including Cards, Banks, Wallets, and Cryptocurrencies. The minimum deposit for these methods is typically $10 or equivalent in other currencies. However, for some local banks, cards, and mobile money options, the minimum deposit can be as low as $10. It’s worth noting that JustMarkets does not charge any fees for deposits, and the processing time is usually within 30 minutes for most methods. For bank transfers, it could take 1-6 banking days. In conclusion, JustMarkets offers flexible deposit options with varying minimum amounts to cater to the needs of different types of forex traders. Whether you’re a beginner looking to dip your toes in the forex market or an experienced trader planning to invest a larger amount, JustMarkets has options to suit your needs.

Which Withdrawal methods are available at JustMarkets?

JustMarkets, a renowned platform in the forex trading industry, offers a variety of withdrawal methods to cater to the diverse needs of its clients. These methods are designed to provide convenience, speed, and security to all users. Worldwide Cards and Banks JustMarkets allows withdrawals through worldwide cards and banks. The available currencies for this method are EUR and USD. The minimum amount per transaction is 5 EUR or 5 USD, and the maximum is 5,000 EUR or 5,000 USD. The processing time for this method is typically 1-2 hours. Worldwide Wallets Another popular withdrawal method at JustMarkets is through worldwide wallets. This method supports multiple currencies including EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, RUB, SGD, and TWD. The minimum amount per transaction is 5 EUR or 5 USD, and the maximum is 8,500 EUR or 10,000 USD. The processing time for this method is also 1-2 hours. Cryptocurrencies JustMarkets also supports withdrawals in cryptocurrencies. The cryptocurrencies supported include BTC, BCH, ETH, USDC, USDT, BUSD, BNB, DOGE, LTC, and XRP. The minimum amount per transaction varies from 15 USD to 30 USD depending on the cryptocurrency. The processing time for this method is typically within 30 minutes. Local Banks, Cards, and Mobile Money JustMarkets also allows withdrawals through local banks, cards, and mobile money. This method supports multiple currencies including MYR, IDR, THB, VND, PHP, NGN, ZAR, UGX, KES, RWF, GHS, XAF, TZS, EUR, USD, COP, and BRL. The minimum and maximum amounts per transaction, as well as the processing time, vary depending on the specific local method. To initiate a withdrawal from your JustMarkets trading account, you typically need to log in to your account on the broker’s platform and submit a withdrawal request. The specific withdrawal options and processing times can vary depending on your chosen method. Please note that all the information provided here is based on the latest available data and may be subject to change. Always check the official JustMarkets website or contact their customer service for the most accurate and up-to-date information.

Which Fees are charged by JustMarkets?

JustMarkets, a well-known forex broker, offers a variety of account types, each with its own fee structure. Here’s a detailed breakdown:. Spreads: The spread list that JustMarkets offers starts from 0.0 pips on EUR/USD. The spreads that traders can expect will depend on the type of account, the market conditions on the day of trading, and the financial instrument that is being traded. Here are the typical spreads for different account types. MT4 Standard Cent Account – variable spreads from 0.3 pips. MT4 and MT5 Standard Account – variable spreads from 0.3 pips. MT4 and MT5 Pro Account – variable spreads from 0.1 pips. MT4 and MT5 Raw Spread Account – variable spreads from 0.0 pips. Commissions: The only commissions that JustMarkets charges are on the Raw Spread Account, and these are charged at a flat rate to cover the broker fees for facilitating the trade. Traders can expect commissions of 3 units of the base currency per lot per side when they use the Raw Spread Account on both MT4 and MT5. Overnight Fees: Overnight fees, also known as swap fees or rollovers, are either credited or debited depending on the financial instrument being held and whether the trader is holding a long or short position. The overnight fees are determined by the financial instrument, position size, whether the trader holds a long/short position and the duration that they hold their position for. Deposit Fees: JustMarkets charges deposit fees of 1% on cryptocurrency deposits. Withdrawal Fees: JustMarkets does not charge any withdrawal fees. Please note that all fees are subject to change and it’s always a good idea to check the latest fee structure on the JustMarkets website. Also, remember that trading involves risk and it’s important to understand the costs associated with your trading activities.

What can I trade with JustMarkets?

JustMarkets offers a wide range of trading options for its users. Here are some of the key offerings:. Forex Trading Forex, or foreign exchange, is a significant part of JustMarkets’ offerings. They offer a range of currency pairs for traders who want to earn on different markets. CFDs In addition to Forex, JustMarkets also offers Contract for Difference (CFD) trading. This allows traders to speculate on the rising or falling prices of fast-moving global financial markets. Precious Metals JustMarkets provides the opportunity to trade in precious metals. This includes gold (XAU/USD), which is often seen as a safe-haven asset in times of market volatility. Trading Conditions JustMarkets offers favorable trading conditions with low floating spreads on all types of accounts, and spreads from 0 pips on Raw Spread accounts. They also provide leverage up to 1:3000. Trading Platforms JustMarkets offers two versions of the MetaTrader trading platform. Traders can choose between MT5 or MT4 platform according to their needs and preferences. Account Types JustMarkets offers different types of accounts: Standard Cent, Standard, Pro, Raw Spread. You can open a trading account in USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, and even ZAR. Order Execution Order execution at JustMarkets takes only fractions of a second during normal conditions on the market. Bonuses and Promotions JustMarkets offers deposit and no deposit bonuses for trading on Forex, competitions for traders. They also offer a $30 bonus to start your trading journey. Please note that while JustMarkets offers a wide range of trading options, trading in Forex and other financial instruments involves a high level of risk and may not be suitable for all investors. It’s always recommended to fully understand the risks involved before starting to trade.

Which Trading Platforms are offered by JustMarkets?

JustMarkets offers a variety of trading platforms, each designed to cater to the specific needs of traders. Here’s a detailed look at each of them:. MetaTrader 5 (MT5): This is the latest trading platform by MetaQuotes Software Corp. It is intuitive and offers a host of innovative features, making trading more comfortable and faster. MetaTrader 5 for Android: This version works on all phones and tablets with the Android operating system. It may not be as convenient as the desktop version, but it’s a great solution if you need to urgently open/close a position or monitor the Expert Advisor. MetaTrader 5 for iOS: This version is officially supported by the company and offers an almost complete set of features from the “desktop” version of the program. You can analyze quotes, draw forecast lines and figures, use indicators, and create new orders directly from your phone. MetaTrader 4 (MT4): This trading platform for PC is designed for conducting trading operations and technical analysis on the Forex market. It has the most complete list of functions and instruments. MetaTrader 4 for Android: This version is ideal for traders who use devices with the Android operating system. It supports the opening of any type of orders, trading history, interactive charts, technical analysis, and the necessary basic set of indicators. MetaTrader 4 for iOS: This version is ideal for traders who use devices with the iOS operating system. It supports the opening of any type of orders, trading history, interactive charts, technical analysis, and the necessary basic set of indicators. MetaTrader WebTrader: This provides instant online access to the global financial markets for trading both on demo and real accounts, without the need for installing the terminal. A Forex trading platform is a special software that monitors the Forex market, places and manages orders, and overall maintains a trading account. It is a means of communication between a broker and a trader, and an access point to the Forex itself. All popular Forex trading platforms are free, however, some are proprietary to a certain broker. We advise beginners to start with a more generic and widely supported platform – then they will have transferable skills and will be able to trade with any existing platform. Forex trading platforms bring the whole exchange to your pocket, allowing you to trade while doing your own thing. Here’s a short list of what you can do with them. Trade on Forex. Manage your accounts. Analyze market tendencies. Receive the latest Forex news and real-time signals. In shorthand, Forex trading platforms make you a part of the Forex market without the need of going to the exchange physically.

Which Trading Instruments are offered by JustMarkets?

JustMarkets offers a wide range of trading instruments that cater to various trading styles and strategies. Here’s a detailed overview:. Forex Trading JustMarkets provides a robust selection of over 65 forex pairs. This includes major, minor, and exotic currency pairs. , offering traders a broad spectrum of opportunities in the forex market. The broker also offers very tight spreads starting from 0.1 with no commission on the Pro account. Precious Metals In addition to forex, JustMarkets also offers trading in precious metals. This allows traders to diversify their portfolios and hedge against market volatility. Indices JustMarkets provides access to various global indices. Indices trading can be an effective way for traders to speculate on the world’s top financial markets. Stocks JustMarkets offers a selection of over 65 global stocks. as well as 11 stock indices. , both of which are tradeable via CFDs. This gives traders the opportunity to speculate on the price movements of individual companies. CFDs JustMarkets traders can access CFDs on over 170 instruments. including forex, stocks, indices, and commodities with ultra-tight spreads, very high leverage up to 1:3000 from the offshore entity, and no commission fees. Cryptocurrencies JustMarkets also offers popular digital currencies with low spreads. The crypto market can be analyzed using leading software and a suite of advanced charts and technical analysis tools. Copy Trading JustMarkets offers copy trading services directly through the Investor Wallet. This allows less experienced traders to copy the orders of professionals on their trading account. In conclusion, JustMarkets offers a comprehensive suite of trading instruments, making it a versatile platform for both beginner and experienced traders. Whether you’re interested in forex, precious metals, indices, stocks, CFDs, cryptocurrencies, or copy trading, JustMarkets has you covered.

Which Trading Servers are offered by JustMarkets?

JustMarkets, a renowned name in the forex trading industry, offers a range of trading servers to its clients. These servers are designed to provide a seamless and efficient trading experience. The first server, known as Justforex-Live, was available for trading accounts opened before August 18, 2020. This server was a part of JustMarkets’ strategy to expand its technical capacity and improve the trading experience for its clients. Following the success of the first server, JustMarkets launched a second server, Justforex-Live2, for trading accounts opened after August 18, 2020. This new server was introduced to optimize the trading infrastructure and enhance the performance and stability of the MetaTrader 4 platform. In addition to these, JustMarkets has also launched a third server, JustForex-Live3, as part of the company’s strategy to expand its technical capabilities. This server was designed to optimize the trading infrastructure, improve trading performance, and provide a noticeable positive impact on all users through the increased performance and stability of the MetaTrader 4 platform. All these servers offer a full and complete set of JustMarkets products under the same conditions as on all existing servers. This ensures that clients have a consistent and reliable trading experience across all servers. JustMarkets is committed to constantly upgrading its services to provide the best trading conditions for its clients. With the launch of these servers, JustMarkets has significantly improved its customers’ trading experience with a stable and high-speed connection to the trading platform. In conclusion, JustMarkets offers a range of trading servers, each designed to provide a seamless and efficient trading experience. These servers are a testament to JustMarkets’ commitment to providing the best trading conditions for its clients. Whether you are a seasoned trader or a beginner, JustMarkets has a server that will meet your trading needs.

Can I trade Crypto with JustMarkets? Which crypto currencies are supported by JustMarkets?

JustMarkets, previously known as JustForex, is a multi-asset broker that offers a wide range of trading opportunities. It provides a platform for trading forex pairs, commodities, indices, stocks, and cryptocurrencies. JustMarkets supports the globally renowned MetaTrader 4 and MetaTrader 5 platforms. These platforms offer a suite of advanced charts and technical analysis tools that can be used to analyze the crypto market. JustMarkets has expanded its pool of cryptocurrencies with new additions. As of September 15, 2022, they added three popular symbols: Kusama (KSMUSD), Solana (SOLUSD), and Polygon (MATUSD). These digital assets are available in the trading terminal on Standard, Pro, and Raw Spread accounts. In terms of forex trading, JustMarkets offers a good selection of 65+ forex pairs, which can be traded through the MT4 and MT5 platforms. High leverage is available from the offshore branch, and the broker also offers very tight spreads starting from 0.1 with no commission on the Pro account. JustMarkets is regulated by multiple entities including CySEC, FSA, FSC Mauritius, and FSCA. This ensures a secure trading environment for its users. In conclusion, JustMarkets provides a comprehensive platform for trading various assets including cryptocurrencies. It’s important to note that trading involves risk and it’s crucial to understand the market before making any investment.

What is the Leverage on my JustMarkets Trading Account?

JustMarkets offers its clients the opportunity to trade on leverage ranging from 1:1 to 1:3000. This allows traders to apply various trading strategies regardless of the size of their deposit. However, it’s important to note that the leverage conditions are different for different types of trading accounts. The margin requirement for your account is tied to the amount of leverage you use. Changing leverage will cause margin requirements to change. Just as spreads may change depending on market conditions, the amount of leverage available to you can also vary. This can happen for a number of reasons. For instance, accounts with an equity of $0 – $999 can access a maximum forex leverage of 1:3000. As the equity increases, the maximum leverage decreases. For equity between $1,000 – $4,999, the maximum leverage is 1:2000. For equity between $5,000 – $39,999, the maximum leverage is 1:1000. For equity of $39,999 or more, the maximum leverage is 1:500. There are also certain conditions under which the maximum leverage is reduced. For example, from 5 minutes before the publication of high-impact economic news until 5 minutes after, margin requirements for new positions opened on affected trading instruments are calculated with reduced maximum leverage. An increased margin rule also applies to some trading instruments during rollovers, weekends, and public holidays. JustMarkets offers several account types, each with different trading conditions. All account types, including Standard, Pro, and Raw Spread, offer leverage up to 1:3000. However, the minimum deposit, spread, and commission vary between account types. In conclusion, the leverage on your JustMarkets Trading Account depends on the type of account and the amount of equity in the account. It’s important to understand these conditions and how they affect your trading strategy.

What kind of Spreads are offered by JustMarkets?

JustMarkets, a well-regarded forex trading platform, offers a variety of spreads that cater to different types of traders. The spreads offered by JustMarkets start from 0.0 pips on EUR/USD. The spreads that traders can expect when they choose JustMarkets to facilitate their trades will depend on the type of account, the market conditions on the day of trading, and the financial instrument that is being traded. Here are the typical spreads that can be expected:. MT4 Standard Cent Account – variable spreads from 0.3 pips. MT4 and MT5 Standard Account – variable spreads from 0.3 pips. MT4 and MT5 Pro Account – variable spreads from 0.1 pips. MT4 and MT5 Raw Spread Account – variable spreads from 0.0 pips. The only commissions that JustMarkets charges are on the Raw Spread Account, and these are charged at a flat rate to cover the broker fees for facilitating the trade. Traders can expect commissions of 3 units of the base currency per lot per side when they use the Raw Spread Account on both MT4 and MT5. JustMarkets also charges overnight fees, also known as swap fees or rollovers, which are either credited or debited depending on the financial instrument being held and whether the trader is holding a long or short position. The overnight fees are determined by the financial instrument, position size, whether the trader holds a long/short position and the duration that they hold their position for. JustMarkets offers Muslim traders the option of an Islamic account on all account types, exempting them from earning/paying interest that is prohibited by Sharia law. JustMarkets does not charge any withdrawal fees. However, deposit fees of 1% are charged on cryptocurrency deposits. Please note that the spreads and fees mentioned above are subject to change based on market conditions and other factors. Always check the latest information on the JustMarkets website or contact their customer service for the most accurate details. Happy trading!.

Does JustMarkets offer MAM Accounts or PAMM Accounts?

JustMarkets offers Multi Account Manager (MAM) accounts. The MAM software allows fund managers, money managers, and portfolio managers to manage multiple trading accounts simultaneously using a single trading account. It provides all the features of the regular MT4 platform, including the usage of charting packages and expert advisors. All processing is centralized and server-based, allowing hundreds of accounts to be traded with one click and virtually no delay in allocations. To start with a MAM account, you need to register and fund your live account with a minimum of $5,000. A minimum of 2 investors is needed to be present with a total investment of $5,000. After that, you can start executing bulk orders in your managed accounts with your master account. Professionals who have decided to partner with JustMarkets as money managers can easily handle an unlimited number of clients using the master account. Performance fees will be accrued and debited automatically from clients’ trading accounts in accordance with the limited power of attorney, which makes the process both transparent and comfortable. Clients who decide not to trade by themselves, but rather provide the funds to be managed by the MM will be able to check how the investment is increasing through the money manager’s trading. An investor adds moneys to his/her account and has full access to observe the trading process conducted by the account manager. Another benefit that JustMarkets MAM solution allows is that investor can have several accounts connected to different money managers. However, there is no mention of JustMarkets offering PAMM (Percentage Allocation Management Module) accounts. PAMM accounts allow fund managers to manage multiple accounts from a single account without having to create an investment fund. The performance (profits and losses) of a PAMM or MAM account manager is distributed among the managed accounts. The clients’ managed accounts are connected to the account manager’s main account and all trades made by the manager are reflected proportionally in the clients’ accounts. Please note that JustMarkets does not participate in any trading decisions made by money managers and does not make any warranties, representations, and assumes no obligations with regard to any trading strategy or performance of the chosen money manager.

Does JustMarkets allow Expert Advisors?

Yes, JustMarkets does allow the use of Expert Advisors. Expert Advisors (EAs) are automated trading systems that operate within the MetaTrader platform. EAs are capable of analyzing market conditions and executing trades without human intervention. JustMarkets supports all trading styles on MetaTrader 4 and 5, and places no restrictions on the use of Expert Advisors. This means that traders can use EAs to automate their trading strategies, whether they are focused on intraday trading, hedging, scalping, or other strategies. The use of EAs can offer several advantages. For one, it allows for trading to be carried out according to a precise algorithm, eliminating the influence of human emotions on trading decisions. This can lead to more consistent trading results. Additionally, EAs can operate around the clock, allowing traders to take advantage of trading opportunities that may arise at any time. However, it’s important to note that the effectiveness of an EA can depend on a variety of factors, including the quality of the EA itself and the specific settings used. Therefore, traders should carefully consider these factors when deciding to use an EA. In conclusion, JustMarkets provides a supportive environment for traders who wish to use Expert Advisors in their Forex trading. This flexibility, combined with the platform’s other features, makes JustMarkets a compelling choice for both beginner and experienced Forex traders.

Does JustMarkets offer Copytrading?

JustMarkets, a renowned name in the forex trading industry, has indeed introduced a Copytrading service. This service is designed to expand opportunities for traders to make a profit in both active and passive ways. Novice traders can automatically copy the trades of professionals, study their strategies, and capitalize on their success. This feature provides an excellent learning opportunity for beginners, allowing them to gain experience by observing and replicating the strategies of seasoned traders. On the other hand, experienced traders can earn additional income by allowing others to copy their trades. This not only provides an additional revenue stream for successful traders but also fosters a community where knowledge and strategies are shared. The JustMarkets Copytrading service has been in open beta testing since February 23, 2022. During this period, JustMarkets has been collecting real-time data and user feedback to improve the service. In addition to the web-based platform, JustMarkets has also launched a Copytrading app, available for both Android and iOS users. The app offers features such as the ability to follow top traders, choose how to copy trades, and protect investments from market volatility. It also provides a secure platform to save and reinvest funds. In conclusion, JustMarkets does offer a Copytrading service. This service is a game-changer in the forex trading industry, providing both novice and experienced traders with new opportunities for profit and learning.