LCG Review 2026

What is LCG?

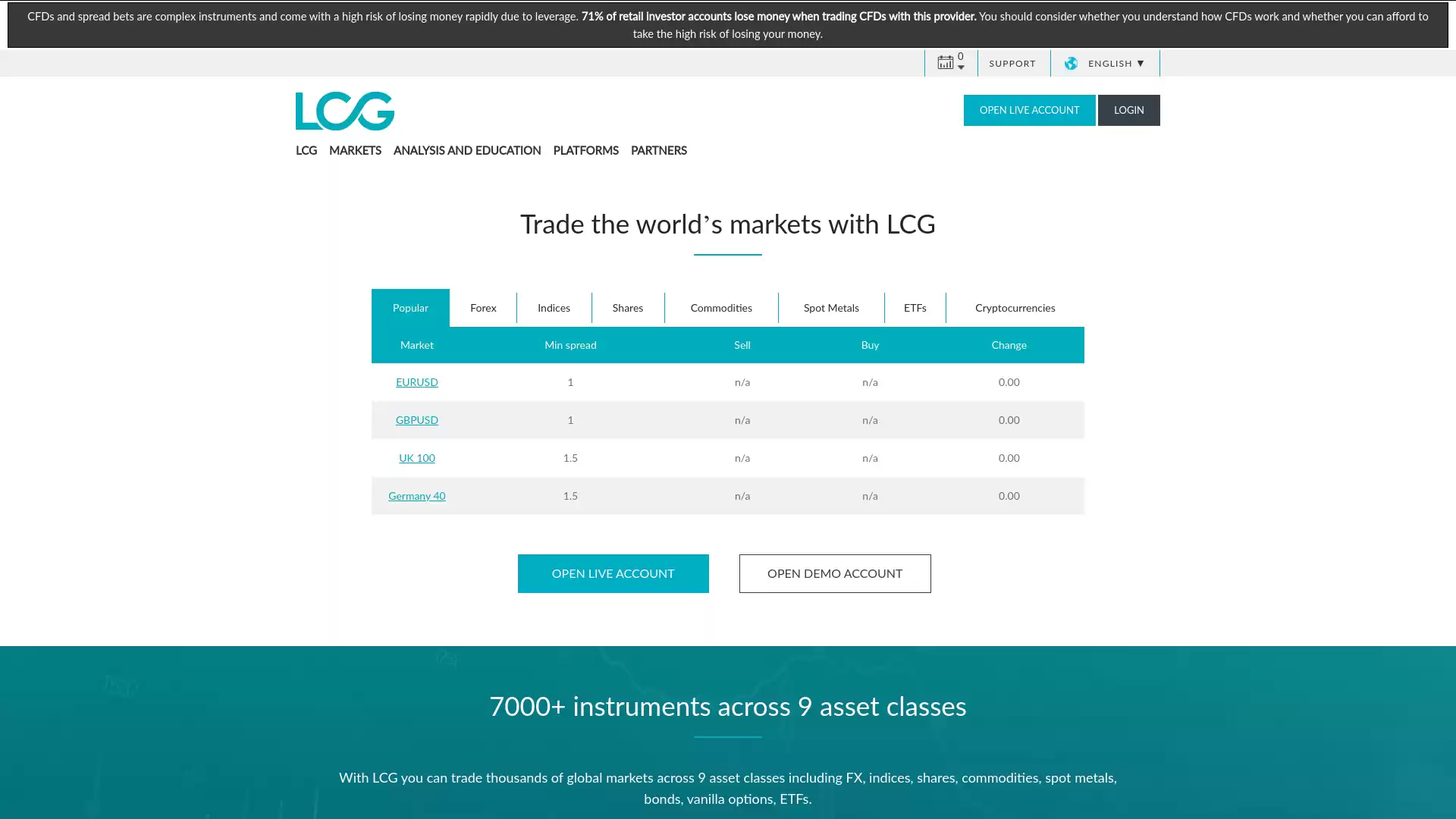

LCG, or London Capital Group, is a UK-based brokerage that offers trading in a variety of instruments. It is regulated in two jurisdictions, namely the UK and Cyprus. , and provides trading services to international traders. In the context of forex, LCG offers trading on over 60 forex pairs. , including major, minor, and exotic pairs. This makes it a versatile platform for forex traders. Forex trading with LCG is facilitated through CFDs, or Contracts for Difference. CFDs are complex instruments that come with a high risk of losing money rapidly due to leverage. As such, it’s important for traders to understand how CFDs work and whether they can afford to take the high risk of losing their money. LCG provides a competitive trading environment with spreads as low as 0.8 pips on major pairs. It also boasts high levels of liquidity, with Tier 1 banks as their liquidity providers. This means trades can be executed very efficiently. LCG uses the MetaTrader 4 platform, which is known for its stability, ease of use, and advanced features. A mobile version of the MT4 is also available, allowing traders to manage their trades on the go. In terms of customer trust and security, LCG has a strong reputation. It is regulated by CySEC, CYMA, and the FCA. , and all customer deposits and trading funds are held securely in Tier 1 banks. In their twenty years of trading, LCG has handled some $1 billion in deposits and over $20 trillion in executed trading volume. LCG’s customer support is responsive and efficient, with well-trained customer support agents available 24/7. They can be contacted via phone, email, or live chat. Additionally, LCG has a comprehensive FAQ section available to users of the platform. In summary, LCG is a well-regulated, secure, and versatile platform for forex trading. It offers a wide range of forex pairs, competitive spreads, and high liquidity, making it a strong choice for forex traders.

What is the Review Rating of LCG?

- 55brokers: 55brokers rated LCG with a score of 85. This rating was last checked at 2024-01-06 03:54:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated LCG with a score of 63. This rating was last checked at 2024-01-06 19:33:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated LCG with a score of 44. This rating was last checked at 2024-01-05 22:06:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated LCG with a score of 73. This rating was last checked at 2024-03-13 11:09:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of LCG?

London Capital Group (LCG) is a British forex broker company that is based in Nassau, Bahamas. It was founded in 1996 and has since grown to become one of the leading providers of CFDs. Here are some of the key advantages of trading with LCG:. Trustworthy Broker: LCG has a high trust score of 80 out of 100. It is authorized and regulated by CySEC. , which adds to its credibility. Wide Range of Trading Instruments: LCG offers access to over 7000+ assets. , providing traders with a wide range of options to choose from. Competitive Spreads: LCG offers spreads that start from 0 pips. , which can lead to lower trading costs. Access to Unparalleled Forex Liquidity: This allows for faster execution of trades. Advanced Trading Platforms: Traders have access to the LCG Trader and MT4 trading platforms. , which are known for their user-friendly interfaces and advanced features. Complete Transparency and Anonymity: LCG provides complete transparency in its operations. , which can help traders make informed decisions. No Commission for Funding and Withdrawal of Capital: This can lead to cost savings for traders. Ability to Trade from Different Devices: Traders can trade from a PC, tablet, or smartphone. , providing flexibility and convenience. No Minimum Deposit Requirement: This makes it accessible to traders with different investment capacities. Customer Support: LCG offers round-the-clock customer support. , ensuring that traders can get assistance whenever they need it. In conclusion, LCG offers a range of benefits for forex traders, from competitive spreads to advanced trading platforms and excellent customer support. However, as with any broker, it’s important for traders to do their own research and consider their individual trading needs before choosing a broker.

What are the Cons of LCG?

While London Capital Group (LCG) is a reputable forex broker with a high trust score. , there are several potential drawbacks to consider:. Limited Passive Earnings Opportunities: LCG does not provide offers for passive earnings such as copying services or bonus programs. This could be a disadvantage for traders who prefer to diversify their trading strategies and income streams. Geographical Restrictions: The broker does not serve clients from certain countries. This limitation could exclude potential traders based on their location. Customer Support Availability: LCG’s customer support doesn’t operate on weekends. This could be problematic for traders who require assistance outside of the standard business hours. Commission and Spreads: The commissions on MT4 are nearly twice as high ($10.00 per $100.000), compared to LCG Trader ($45.00 per $1.000.000). Additionally, the spreads are not the most competitive, averaging 1.5 pips on the EUR/GBP. High Minimum Deposit for ECN Account: A high $10,000 minimum deposit is needed for the ECN account. This could be a barrier for traders with limited capital. Risk of Loss: Trading with LCG involves a high risk of losing money rapidly due to leverage. As per the provider’s statement, 70-71% of retail investor accounts lose money when trading CFDs. It’s important for potential traders to carefully consider these factors and conduct thorough research before choosing a forex broker. It’s also recommended to consult with a financial advisor or conduct thorough research to understand the risks associated with forex trading.

What are the LCG Current Promos?

LCG, a regulated broker with over 20 years of forex trading experience, offers a range of promotions and features that make it a competitive choice for forex trading. Competitive Spreads: LCG offers competitive spreads on over 60 currency pairs, including popular FX pairs such as EUR/USD, GBP/USD, and USD/JPY. The spreads start from as low as 0.8 pips on major pairs. , providing traders with the potential for cost-effective trading. High Liquidity: LCG provides access to unparalleled forex liquidity. This high liquidity, combined with the ability to trade with leverage, has increased the popularity of the forex market. Forex trades 24 hours per day, five days a week, making it one of the most fast-paced and potentially lucrative markets. Trading Platforms: LCG offers access to the LCG Trader and MT4 trading platforms. These platforms provide a range of tools and features designed to support effective trading. Account Types: LCG provides a range of account types, including ECN accounts. These account types cater to different trading needs and preferences, offering flexibility for traders. Education and Analysis: LCG provides a range of educational resources, including trading videos and technical analysis. These resources can support traders in making informed trading decisions. It’s important to note that forex trading involves a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with LCG. Traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their money.

What are the LCG Highlights?

LCG, or London Capital Group, is a renowned player in the forex trading sector. Here are some of the key highlights:. Forex Trading: LCG offers forex trading on over 60 currency pairs. This includes major, minor, Australasian, Scandinavian, and exotic currencies. The forex market operates 24 hours a day, five days a week, making it one of the most vibrant, fast-paced, and potentially lucrative markets. Competitive Spreads: LCG provides competitive pricing with spreads as low as 0.8 pips on major pairs. This allows traders to benefit from more opportunities in the forex market. Leverage: LCG allows traders to use leverage, which means that not all capital is needed to trade. This gives forex traders the opportunity to increase the size of their positions, amplifying potential profits and losses. Trading Platforms: LCG provides access to the LCG Trader and MT4 trading platforms. These platforms offer advanced features for forex trading. Transparency and Anonymity: LCG ensures complete transparency and anonymity in its operations. Risk Management: LCG provides tools for risk management, including stop-loss orders. These tools help protect forex trades against significant market fluctuations. Please note that forex trading involves high risk and it’s important to understand how CFDs work before engaging in forex trading.

Is LCG Legit and Trustworthy?

London Capital Group (LCG) is a well-established broker that has been in operation since 1996. It offers a broad selection of Contracts for Difference (CFDs) and spread betting instruments across several different asset classes, including forex. LCG is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the UK’s Financial Conduct Authority (FCA). These are two of the most respected regulatory bodies in the financial world, which adds a layer of trust and security for its users. The company provides two types of accounts: standard and Electronic Communications Network (ECN). The ECN account, which requires a minimum deposit of $10,000, allows clients to trade directly with market makers, potentially lowering the cost of the spread in liquid markets. LCG has been recognized for its customer service and functional simplicity, making it particularly appealing to novice traders. In fact, it was rated as the Best Forex Broker for Beginners. However, it’s worth noting that while many users have had positive experiences with LCG, some users have reported issues. These include technical problems with the trading platform and difficulties with withdrawals. In conclusion, while LCG is a regulated broker with a long history in the forex market, potential users should carefully consider these factors and conduct thorough research before opening an account. It’s always recommended to start with a small investment and only invest what you can afford to lose. Please note that this information is based on publicly available resources and may not be fully up-to-date or complete. Always conduct your own due diligence before making any investment decisions.

Is LCG Regulated and who are the Regulators?

London Capital Group (LCG) is a well-established online trading platform that provides its clients with a secure trading environment. It is regulated by several financial authorities, ensuring its operations adhere to strict standards of conduct and transparency. Regulatory Authorities: LCG is regulated by the following authorities:. The UK Financial Conduct Authority (FCA). The FCA is one of the most respected regulatory bodies in the world, known for its stringent rules and supervision. The Cyprus Securities and Exchange Commission (CySEC). CySEC is another prominent regulatory authority within the European Union, ensuring compliance with financial laws and regulations. The Securities Commission of the Bahamas. This regulator oversees the operations of companies in the financial sector within the Bahamas. Why Regulation Matters: Regulation is crucial in the forex trading industry. It ensures that brokers operate in a transparent and fair manner. A regulated broker must adhere to strict standards set by the regulatory bodies, which cover areas such as client fund segregation, company capital requirements, and more. This provides traders with an added layer of security and trust. LCG’s Offerings: LCG offers a broad selection of trading instruments across several asset classes, including forex, indices, spot metals, stocks, commodities, CFDs, exchange-traded options, ETFs, bonds, and interest rates. It also provides dynamic leverage up to 1:500 and spreads from 0 pips. Safety Measures: In addition to regulation, LCG also offers negative balance protection to prevent clients from going into a negative balance when trading with leverage. This is an important safety measure in forex trading, where high leverage can lead to significant losses. In conclusion, LCG is a regulated and secure online trading platform. Its regulation by multiple respected authorities, coupled with its comprehensive offerings and safety measures, make it a reliable choice for forex traders. Please note that trading involves risk and isn’t suitable for everyone. Always consider your individual circumstances before engaging in forex trading.

Did LCG win any Awards?

The search results do not provide any specific information about LCG winning any awards in the context of forex. However, it’s important to note that the information available might not be up-to-date or complete. For the most accurate information, it’s recommended to check the official LCG website or contact them directly. Please note that awards and recognitions can play a significant role in the reputation and credibility of a forex trading platform. They can reflect the platform’s commitment to providing excellent service, innovative technology, and a reliable trading environment. However, they should not be the sole factor in choosing a forex trading platform. Other factors such as the platform’s features, fees, customer service, and user reviews should also be considered.

How do I get in Contact with LCG?

LCG, or London Capital Group, is a leading provider of online trading services. They’re well-known in the forex industry for their advanced trading platforms and their commitment to providing a superior trading experience for their clients. Here’s how you can get in touch with them:. Business Address: LCG’s business address is 5 North Buckner Square, Olde Towne Sandyport, Sandyport Marina Village, West Bay Street, Nassau, Bahamas. Customer Support: You can reach LCG’s customer support by phone at +1 (0) 242 601 6866. Their customer support is open from Monday to Friday, from 5.00 to 22.00 (GMT). You can also contact them via email at customerservices.bhs@lcg.com. Dealing Desk: For trading-related inquiries, you can contact LCG’s dealing desk by phone at +1 (0) 242 601 0203. The dealing desk is open from Sunday 22:00 (GMT) to Friday 22:00 (GMT). Data Protection Matters: For data protection matters, you can contact LCG’s Data Protection Officer, Mr. Philip Dorsett, by phone at +1 (0) 242 601 5141 or via email at dpobhs@lcg.com. Please note that trading CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Where are the Headquarters from LCG based?

LCG, a key player in the forex market, has its headquarters located in two different places. The first one is London, where LGC operates out of 19 countries worldwide. This location is extensively accredited to quality standards such as GMP, GLP, ISO 13485, ISO 17034, ISO 17043, ISO/IEC 17025, and ISO 9001. The second headquarters is in Rockville, 6000 Executive Blvd #410, United States. This location further strengthens LCG’s global presence in the forex market. These strategic locations allow LCG to effectively cater to the needs of its diverse client base, providing them with robust forex trading solutions. The company’s commitment to maintaining high-quality standards underscores its reputation as a reliable forex trading partner. Please note that while LCG has a strong presence in the forex market, it’s always important for traders to conduct their own research and consider multiple factors when choosing a forex trading platform. Factors such as trading costs, platform reliability, customer service, and regulatory compliance should all be taken into account. In conclusion, with its dual headquarters in London and Rockville, LCG continues to make significant strides in the forex market, offering traders a reliable, high-quality trading experience.

What kind of Customer Support is offered by LCG?

London Capital Group (LCG) offers a comprehensive customer support system to cater to the needs of its clients, particularly those involved in forex trading. The support system is designed to provide assistance and address the concerns of clients in a timely and efficient manner. Customer Support Contact LCG provides a dedicated customer support contact. Clients can reach out to the support team via phone or email. The customer support phone line is open from Monday to Friday, from 5:00 to 22:00 (GMT). The customer support email is customerservices.bhs@lcg.com. Business Address LCG’s business address is 5 North Buckner Square, Olde Towne Sandyport, Sandyport Marina Village, West Bay Street, Nassau, Bahamas. This information is essential for clients who may want to visit the office or send mail. Dealing Desk LCG also provides a Dealing Desk contact. The Dealing Desk phone line is open from Sunday 22:00 (GMT) to Friday 22:00 (GMT). This service is particularly useful for forex traders who need to make quick decisions based on market movements. Data Protection Matters For data protection matters, clients can contact the Data Protection Officer, Mr. Philip Dorsett, via email at dpobhs@lcg.com or phone at +1 (0) 242 601 5141. Support for Complex Instruments LCG provides support for complex instruments like CFDs and spread bets. These instruments come with a high risk of losing money rapidly due to leverage. LCG ensures that 71% of retail investor accounts are aware of the risks involved when trading CFDs with this provider. Support for Forex Trading In the context of forex trading, LCG offers a range of support services. These include providing information about forex spot metals, indices, shares, commodities, bonds & interest rates, vanilla options, ETF, ECN accounts, leverage information, and payment methods. Education and Analysis LCG provides educational resources and analysis tools to help clients make informed trading decisions. These include economic calendars, latest news, technical analysis, trading videos, glossaries, and FAQs. Platform Tutorials LCG offers platform tutorials for LCG Trader and MT4. These tutorials guide users on how to navigate and utilize the platforms effectively for trading. In conclusion, LCG’s customer support system is comprehensive, catering to the various needs of its clients, particularly those involved in forex trading. The support system is designed to ensure that clients have the necessary resources and assistance to make informed trading decisions.

Which Educational and Learning Materials are offered by LCG?

LCG, or the LGC Group, offers a variety of educational and learning materials. These resources are designed to provide comprehensive training and knowledge enhancement for individuals interested in various fields, including analytical sciences. One of the key offerings is the Praxis course, developed in collaboration with Learning Science. This interactive web-based course provides cost-effective training on practical skills for analytical scientists. It’s an excellent resource for those looking to enhance their practical knowledge and skills in the field. In addition to the Praxis course, LGC also offers a wide range of reference standards for various application areas. These standards are a result of LGC’s long history in measurement science and their sustained investment in manufacturing capabilities. These reference materials can be invaluable for professionals seeking to ensure the accuracy and reliability of their measurements. Moreover, LGC has a significant portfolio of catalogue reference standards that cater to a wide variety of application areas. This extensive catalogue allows professionals to find the exact standards they need for their specific applications. However, it’s important to note that while LGC offers a wealth of educational and learning materials, the specific offerings in the context of forex trading are not explicitly mentioned in the available resources. For detailed and specific forex trading educational materials, it would be advisable to refer to resources that specialize in financial and forex trading education.

Can anyone join LCG?

Large-scale generation certificates (LGCs) are a part of the Renewable Energy Target scheme, and they represent a significant aspect of the renewable energy sector. The process of joining or participating in the LGC scheme is not open to everyone, but rather specific entities that meet certain criteria. The nominated person for an accredited power station may create LGCs for eligible electricity generated by the power station. Eligible electricity is electricity generated from the power station’s renewable energy sources. One LGC can be created per megawatt hour (MWh) of eligible electricity generated by a power station. The amount of electricity generated by a power station is to be calculated using the large-scale generation certificate general formula. A nominated person can create LGCs by submitting a ‘claim’ in the REC Registry. The Clean Energy Regulator (CER) determines the eligibility of LGCs created through a ‘validation’ process. Eligible LGCs will then be registered in the REC Registry. Registered LGCs can be sold or transferred to entities with liabilities under the Renewable Energy Target or other companies looking to voluntarily surrender LGCs. Liable entities are companies (mainly electricity retailers) that are required to purchase and surrender LGCs to the CER each year. This is in fulfillment of their obligations under the Renewable Energy (Electricity) Act 2000 (REE Act). LGCs are sold to liable entities (and other companies or individuals) in the market at a price agreed by those parties. In the context of forex, it’s important to note that the LGC market operates similarly to a commodity market. The price of LGCs can fluctuate based on supply and demand dynamics, much like currency prices in the forex market. Therefore, entities involved in the LGC market, like forex traders, need to carefully monitor market conditions and regulatory changes that could impact the value of their holdings. Please note that this information is based on the rules and regulations as of December 2023, and may be subject to change. Always consult with a professional or trusted source for the most up-to-date and accurate information.

Who should sign up with LCG?

LCG, or London Capital Group, is a leading provider of online trading services. It’s an ideal platform for various types of traders, particularly those interested in forex trading. Here’s a detailed look at who might consider signing up with LCG:. Experienced Traders: LCG is a great fit for experienced traders who understand the complexities of forex trading. The platform offers advanced charting tools, a wide range of currency pairs, and competitive spreads, making it a preferred choice for seasoned forex traders. Risk-Tolerant Traders: Forex trading, like all forms of trading, involves risk. LCG provides access to high leverage, which can lead to significant profits but also substantial losses. Therefore, traders who are comfortable with a high-risk, high-reward approach might find LCG suitable. Traders Seeking Diverse Markets: While LCG specializes in forex trading, it also offers a broad range of other markets including indices, commodities, and shares. This diversity can be appealing to traders looking to branch out from forex and explore other trading opportunities. Traders Valuing Customer Support: LCG has a reputation for providing excellent customer service. This can be particularly beneficial for traders who value readily available support when navigating the forex market. Traders Preferring Online Platforms: LCG offers a robust online trading platform, making it a good choice for traders who prefer to trade via the web. However, it’s important to note that forex trading is high risk and may not be suitable for everyone. Potential traders should consider their financial situation, risk tolerance, and trading experience before signing up with LCG. As always, it’s recommended to start with a demo account before trading with real money.

Who should NOT sign up with LCG?

London Capital Group (LCG) is a well-established UK-based forex and CFD broker that offers a wide range of asset classes and a seamless trading experience. However, it may not be suitable for everyone. Here are some categories of people who might want to reconsider signing up with LCG:. 1. U.S. Traders LCG does not accept U.S. traders. This is a common practice among many forex brokers due to the regulatory requirements in the U.S. 2. High-Volume Traders While LCG offers a choice between standard or electronic communications network (ECN) accounts, the latter requires a minimum deposit of $10,000. This might be a deterrent for traders who deal in high volumes but do not wish to commit such a large initial deposit. 3. Traders Seeking Fixed Spreads LCG operates on a floating spread model. This means that the spread will fluctuate based on market conditions. Traders who prefer fixed spreads for better cost predictability might find this aspect less appealing. 4. Inactive Traders LCG charges inactivity fees. Therefore, traders who do not plan to trade regularly and keep their account active might end up losing money due to these fees. 5. Traders Looking for Diverse Platform Options LCG’s online offering to the consumer is primarily through its LCG Trader platform and the ubiquitous MT4 platform. Traders seeking more diverse platform options might find this limiting. In conclusion, while LCG is a reputable broker with competitive fees and a focus on customer service, it might not be the best fit for everyone. Potential clients should consider their trading needs, financial situation, and personal preferences before deciding to open an account with LCG.

Does LCG offer Discounts, Coupons, or Promo Codes?

Based on the search results, there is no specific information available about discounts, coupons, or promo codes offered by LCG in the context of forex. It’s recommended to check their official website or contact their customer service for the most accurate and up-to-date information. Please note that promotions and offers can vary based on location and time. Always ensure to read the terms and conditions associated with any promotional offer.

Which Account Types are offered by LCG?

LCG offers a variety of account types to cater to the diverse needs of traders. Here are the details:. Islamic Accounts: Also known as swap-free accounts, these are designed for clients following the Muslim faith and Sharia law. These accounts imply no swap or rollover interest on overnight positions. To apply for a swap-free account, one must complete the registration process. ECN Accounts: These accounts offer trade from 0 pips with no requotes and direct market access. They provide access to unparalleled forex liquidity. To qualify for an ECN account, one must maintain a $10,000 account balance. These accounts offer complete transparency and anonymity. CFD Trading Accounts: These accounts allow trading CFD contracts across a wide range of asset classes, including forex, shares, indices, spot metals, futures, bonds, and interest rates. They offer a choice of two world-class platforms available on any of your devices. They provide access to a wealth of analysis, research, and educational material. Please note that CFD trading is high risk and may not be suitable for everyone. Losses can exceed your deposits. It’s important to consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

How to Open a LCG LIVE Account?

Opening a LCG LIVE account is a straightforward process that involves a few key steps. Here’s a detailed guide:. Step 1: Visit the LCG Website Go to the LCG website. You will find an ‘Open Account Now’ button at the top of most pages. Step 2: Apply for an Account Click on the ‘Open Account Now’ button to start the application process. The application should take no more than 3 minutes. Step 3: Identity and Address Verification As part of the security procedures, LCG will run an online check on your identity and address. This will not affect your credit rating. Step 4: Choose Account Type LCG offers deposit accounts. As soon as you have made your first deposit, you’ll be able to start trading. If you would like to set up a corporate, joint, or foreign currency account, you can contact the Sales team. Step 5: Nominate a Trader (Optional) If you wish, you can nominate a family member, business partner, or friend to trade on your account by completing a Power of Attorney form. Step 6: System Requirements Ensure your system meets the minimum requirements for trading. Step 7: Make a Deposit The minimum deposit to start trading is 100. You can deposit funds using a variety of methods, including debit/credit cards, bank transfer, and online payment services Skrill and Neteller. Step 8: Start Trading Once your account is set up and funded, you can start trading. Remember, it’s your responsibility to ensure you have sufficient margin to maintain your open positions and to make further deposits if necessary. That’s it! You’re now ready to start trading with your LCG LIVE account.

How to Open a LCG DEMO account?

Opening a demo account with London Capital Group (LCG) is a straightforward process that allows you to familiarize yourself with the dynamics of the LCG online trading platform. Here’s a step-by-step guide:. Step 1: Visit the LCG Website Start by visiting the official LCG website. Navigate to the section for opening a demo account. Step 2: Provide Personal Details You will be asked to provide some personal details. These typically include: Title First name Last name Country of residence Mobile phone number Email address . Step 3: Set a Password Next, you will need to set a password for your account. The password must be at least 8 characters and contain at least one digit, one upper and lower case character. Step 4: Confirm Your Password Re-enter your password to confirm it. Step 5: Optional Email Preferences If you wish, you can opt to receive research, education, and promotional material from LCG via email. This is optional and can be selected based on your preference. Step 6: Account Creation Once you’ve entered all the necessary information, your demo account will be created. You may need to verify your account by clicking on a verification link sent to your registered email address. Step 7: Start Trading Now that your demo account is set up, you can start trading. Remember, trading in forex and other financial instruments involves risk. Use your demo account to understand how these markets work and to develop your trading strategies. Remember, a demo account is a great way to practice and learn about forex trading without risking real money. It can help you understand the dynamics of the market and develop effective trading strategies. Happy trading!.

How Are You Protected as a Client at LCG?

As a client at LCG, you can enjoy a high level of protection and security for your trading activities. LCG is a UK-based broker that is regulated by the Financial Conduct Authority (FCA), one of the most reputable financial regulators in the world. The FCA ensures that LCG complies with strict rules and standards to protect its clients from fraud, mismanagement, and market abuse. One of the main benefits of trading with LCG is that it offers negative balance protection, which means that you cannot lose more money than you have in your account. This is a rare feature among forex brokers, and it gives you peace of mind when trading with LCG. If your account balance falls below zero due to unfavorable market movements or other reasons, LCG will automatically close your positions and return your funds to your account. Another benefit of trading with LCG is that it provides access to over 7000 markets across 9 different asset classes, including forex, commodities, shares, indices, bonds, options, ETFs, and cryptocurrencies. You can trade a wide range of instruments with competitive spreads and low margin requirements. You can also choose between standard or electronic communications network (ECN) accounts, depending on your trading style and preferences. ECN accounts allow you to trade directly with other market participants rather than through a dealing desk. This can lower the cost of the spread in liquid markets and give you more control over your execution. However, ECN accounts also require a minimum deposit of $10,000 and may incur additional charges for guaranteed stops or overnight financing costs. LCG also offers advanced trading tools for professional clients through its web-based platform LCG Trader and its downloadable platform MetaTrader 4 (MT4). These platforms offer a range of features and functions that can enhance your trading experience and performance. For example, you can use technical indicators, charting tools, automated trading systems (Expert Advisors), market news feeds, economic calendars, and more. In addition to these benefits, LCG also provides excellent customer service to its clients. You can contact LCG via email, phone, or live chat at any time during the day or night. You can also access various learning resources on their website or YouTube channel to improve your trading skills and knowledge. By choosing LCG as your forex broker partner, you can be assured that you are dealing with a reliable and trustworthy company that cares about your satisfaction and success. LCG has been in the industry for over 20 years and has established itself as one of the leading forex brokers in the UK. It has also received numerous awards and recognitions from various organizations for its quality service and performance. If you are looking for a forex broker that offers high levels of protection and security for your trading activities while providing access to a wide range of markets and instruments at competitive prices then look no further than London Capital Group. Visit their website today to open an account or learn more about their services.

Which Funding methods or Deposit Options are available at LCG?

London Capital Group, known as LCG, is a renowned CFD provider that offers its clients a wide range of trading instruments across various asset classes, including Forex. When it comes to funding methods and deposit options, LCG provides a variety of fast, secure payment methods. These include debit/credit cards, bank transfer, and online payment services such as Skrill and Neteller. Debit/Credit Cards: LCG accepts all major debit and credit cards, excluding American Express and some International Visa Electron cards. It’s important to note that there is a 2% charge for payments made by credit card. Bank Transfer: This is another common method used by traders. It’s secure and usually takes a few business days to process. Online Payment Services: LCG also accepts payments through online services like Skrill and Neteller. These platforms are known for their speed and security, making them popular choices among traders. It’s worth noting that the minimum deposit to start trading is $0. However, traders need to fund their account with enough to cover the margin requirement for the trade they wish to open. Lastly, LCG is regulated under CySec, and clients under this regulation are able to use either bank transfers or Visa/MasterCards, which will include an additional 2% commission for credit card deposits. In conclusion, LCG offers a range of deposit options to cater to the diverse needs of its clients. Whether you prefer using debit/credit cards, bank transfers, or online payment services, LCG has got you covered.

What is the Minimum Deposit Amount at LCG?

The minimum deposit amount at London Capital Group (LCG) is $100. This deposit is required to start trading, and it covers the margin requirement for the trade you wish to open. LCG offers a variety of fast, secure payment methods, including debit/credit cards, bank transfer, and online payment services Skrill and Neteller. There is a 2% charge for payments made by credit card. LCG provides access to a broad selection of CFDs and spread betting instruments across several different asset classes. They also offer a choice between standard or electronic communications network (ECN) accounts. ECNs enable clients to trade directly with market makers, which can lower the cost of the spread in liquid markets. Please note that it is the client’s responsibility to ensure they have sufficient margin to maintain their open positions and to make further deposits if necessary. In the context of forex trading, the minimum deposit requirement is particularly relevant as it determines the trader’s capacity to open and maintain positions. The deposit acts as a safety net for both the trader and the broker, ensuring that the trader can cover any losses incurred during trading. It’s important to remember that forex trading involves significant risk, and traders should only invest money that they can afford to lose. As always, it’s recommended to do thorough research and consider seeking advice from a financial advisor before starting to trade. For more information, you can visit the LCG website. or contact their customer service.

Which Withdrawal methods are available at LCG?

LCG, or London Capital Group, offers a variety of withdrawal methods for its users. Here are the details:. 1. Online Request Form You can request a withdrawal from your LCG account by completing the online request form in your My LCG area. Completing this form online will ensure your withdrawal amount will be automatically debited from your trading account balance. 2. Debit/Credit Cards LCG accepts all major debit and credit cards, except for American Express and some International Visa Electron cards. The processing time for withdrawals to debit cards is usually within 30 minutes. There is no fee for withdrawals to debit cards. For credit cards, there is a 2% fee. , and the processing time is also usually within 30 minutes. 3. Bank Transfer Funds are credited into your trading account within one working day from the time LCG receives funds into their bank account. There is no fee for deposits or withdrawals via bank transfer. Please note that you need to have a verified account with LCG in order to be able to withdraw funds from the LCG platform. Also, as part of LCG’s security procedures, they will run an online check on your identity and address. This will not affect your credit rating. In the context of forex trading, these withdrawal methods provide flexibility and convenience, allowing traders to retrieve their funds in a timely and efficient manner. It’s important to remember that forex trading involves significant risk, and traders should be aware of this before engaging in trading activities. Please note that all information is subject to change and it’s always a good idea to check the official LCG website or contact their customer service for the most up-to-date information.

Which Fees are charged by LCG?

LCG, or London Capital Group, charges various fees for its services. Here’s a detailed breakdown:. Trading Fees LCG charges a commission of $45 per $1,000,000 traded on all symbols on LCG Trader and $10 per lot on MT4. These fees are applied in the context of forex trading. Spreads LCG offers competitive spreads that start from 0.0001 pips on EUR/USD majors. The spread can vary depending on the account type that the trader is using. Overnight Financing LCG charges an overnight financing fee at a rate of 0.04% per day. This fee is charged for each position open at 22:00 (UK time) each day. Account Types LCG offers two types of accounts: Classic and ECN. The Classic Account does not require a minimum deposit and does not charge commissions. The spreads for this account start from 1.45 on EUR/USD. The ECN Account requires a maintained balance of $10,000 at all times, offers spreads from 0.0 pips, and charges a commission of $45 per $1,000,000 traded. Deposit and Withdrawal Fees LCG does not charge any fees for deposits or withdrawals. However, a deposit fee of 2% will be charged. Inactivity Fee LCG charges an inactivity fee of $20 per month. Please note that trading forex involves a high level of risk, and it’s important to understand the costs involved before you start trading. Always consider whether you can afford to take the high risk of losing your money.

What can I trade with LCG?

London Capital Group (LCG) offers a wide range of trading options across multiple asset classes. Here’s a detailed breakdown:. Forex: LCG provides the opportunity to trade contracts for difference (CFDs) on over 60 currency pairs, including major, minor, and exotic pairs. This includes popular pairs like EUR/USD, GBP/USD, and USD/JPY. They offer fast execution, top-tier liquidity, and competitive pricing, with spreads as low as 0.8 pips on major pairs. Indices: You can invest in the world’s most popular stock indices with LCG. This includes trading multiple company stocks in a single instrument with spot and futures indices. They offer tight spreads on popular indices like the UK 100 (FTSE), Wall Street (DJI), and Germany 40 (DAX). Shares: LCG allows for the trading of CFDs on over 4,000 global shares. This includes some of the world’s largest companies such as Amazon, Facebook, and Google. Traders can benefit from dividends payments. Commodities: LCG offers a diverse range of commodities including metals, energies, and agricultural commodities. Popular instruments include Gold, Silver, US Crude (WTI), Brent, Coffee, and Sugar. Spot Metals: Traders can invest in spot metals like Gold and Silver. Bonds & Interest Rates: LCG provides the opportunity to trade in bonds and interest rates. Vanilla Options: LCG offers trading in vanilla options. Exchange-Traded Funds (ETFs): LCG provides the opportunity to trade in ETFs. It’s important to note that CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. As per LCG, 71% of retail investor accounts lose money when trading CFDs with this provider. Therefore, traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their money.

Which Trading Platforms are offered by LCG?

LCG, a renowned Forex and CFD broker, offers two primary trading platforms. LCG Trader: This is a next-generation web-based trading platform designed to handle thousands of assets simultaneously. It provides a fast and reliable trading experience, along with a world-class charting package. LCG Trader allows you to trade all of LCG’s 7000 instruments across 9 different asset types directly from your desktop. Developed specifically for multi-asset trading, LCG Trader enables easy trading of any asset offered by LCG from anywhere and almost any device. It supports trading in Forex, stocks, indices, spot metals, futures, bonds, and interest rates. MetaTrader 4 (MT4): This platform is also offered by LCG. It is one of the most popular platforms in the forex trading world, known for its user-friendly interface, advanced charting features, technical analysis tools, and automated trading capabilities. Both platforms are available on desktop, tablet, and mobile devices. , providing traders with the flexibility to trade on the go. They offer competitive pricing across a wide variety of markets. Please note that trading in Forex and CFDs is high risk and may not be suitable for everyone. Losses can exceed your deposits. It’s important to understand how these instruments work and whether you can afford to take the high risk of losing your money.

Which Trading Instruments are offered by LCG?

LCG is one of the UK’s leading CFD and spread betting providers, offering a wide range of trading instruments across various asset classes. In this article, we will focus on the trading instruments offered by LCG in the context of forex, which is one of the most popular and liquid markets in the world. Forex, or foreign exchange, is the market where currencies are traded against each other. The exchange rate between two currencies reflects the relative value and strength of each currency. Forex traders can profit from the fluctuations in exchange rates by speculating on whether a currency pair will rise or fall in value. LCG offers over 60 currency pairs for forex trading, including some of the most traded and volatile ones such as EUR/USD, GBP/USD and USD/JPY. These pairs are also known as majors, minors and exotics, depending on their liquidity and market activity. LCG provides competitive spreads on these pairs, as well as tight spreads on some of the more exotic ones such as USD/ZAR and EUR/TRY. LCG also offers access to other forex-related instruments such as spot metals, bonds and interest rates. Spot metals are physical commodities that can be bought or sold at their current market price, such as gold, silver and platinum. Bonds are debt securities issued by governments or corporations that pay a fixed rate of interest over a specified period of time. Interest rates are the cost of borrowing or lending money in a given market. LCG allows traders to trade these instruments using CFDs (contracts for difference), which are derivatives that enable traders to speculate on the price movements of an underlying asset without owning it. CFDs offer leverage, which means that traders can control a larger position with a smaller amount of capital. However, leverage also magnifies both profits and losses, so traders should be aware of the risks involved. LCG also offers vanilla options on some of its forex instruments, which are contracts that give traders the right but not the obligation to buy or sell an underlying asset at a specified price (strike) before or on a certain date (expiry). Options can be used to hedge against adverse price movements or to generate income from favourable ones. In summary, LCG offers a variety of trading instruments for forex traders, including major pairs, minors and exotics; spot metals; bonds; interest rates; vanilla options; and ETFs (exchange-traded funds). These instruments can help traders diversify their portfolio, enhance their risk management and take advantage of different market opportunities.

Which Trading Servers are offered by LCG?

LCG, a renowned financial services provider, offers a couple of trading platforms that serve as their trading servers. These platforms are designed to cater to the diverse needs of Forex and CFD traders. LCG Trader. is one of the primary trading servers offered by LCG. This platform is the next generation of web-based trading platforms, designed to manage thousands of assets simultaneously. It allows you to trade in all of their 7,000 instruments across 9 different asset types directly from your desktop. Developed specifically for the multi-asset trading world, LCG Trader enables easy trading with any asset offered by LCG from anywhere and from almost any device. You can trade in Forex, stocks, indices, spot metals, futures, bonds, and interest rates with LCG Trader. The LCG Trader platform offers a fast, reliable trading experience and a world-class charting package. It provides competitive pricing across a wide variety of markets. The platform is equipped with the latest technology and offers the best spreads. It also has apps that allow you to trade from all your devices. In addition to LCG Trader, LCG also offers a transparent trading platform. for Forex & CFD traders. This platform supports manual, copy, and algo trading, and it has been developed by Spotware. These platforms, with their advanced features and user-friendly interfaces, make LCG a preferred choice for many Forex traders. They offer a comprehensive trading experience, catering to both novice and experienced traders. Please note that trading in Forex and CFDs involves a high level of risk, and it’s important to understand the risks involved before starting to trade.

Can I trade Crypto with LCG? Which crypto currencies are supported by LCG?

Yes, you can trade cryptocurrencies with London Capital Group (LCG). LCG has introduced the trading of Contracts for Difference (CFDs) on popular cryptocurrencies. The cryptocurrencies supported by LCG include Bitcoin and Ethereum, which can be traded as pairs against fiat currencies including the Dollar, Euro, Swiss Franc, Pound, and Yen. This allows clients to take a position on some of the most popular and volatile markets. It’s important to note that trading CFDs on cryptocurrencies comes with a high risk due to leverage. According to LCG, 71% of retail investor accounts lose money when trading CFDs with this provider. Therefore, it’s crucial to understand how CFDs work and whether you can afford to take the high risk of losing your money. In the context of forex, trading cryptocurrencies with LCG is similar to trading other currency pairs. The value of a cryptocurrency is paired against a fiat currency, and traders can speculate on the price movements of this pair. For example, Bitcoin can be traded as BTC/USD, BTC/GBP, BTC/EUR, BTC/JPY, and BTC/CHF. Please note that the information provided is based on the data available as of 2023 and may be subject to change. Always do your own research and consider your financial situation carefully before engaging in cryptocurrency trading.

What is the Leverage on my LCG Trading Account?

Leverage is a key aspect of trading with LCG (London Capital Group). It’s a tool that allows traders to control larger positions with a smaller amount of capital. In the context of forex trading, leverage can significantly increase the potential for profit, but it also carries a high level of risk, as losses can exceed the original investment. LCG’s Leverage. LCG offers a maximum leverage of 1:500. This means that for every dollar in your account, you can control up to $500 in trading positions. This high level of leverage can enable traders to take advantage of even small movements in the forex market. How LCG’s Leverage Works. Leverage is calculated on a per symbol basis. For example, if a trader has 400 lots Buy on GBPUSD, and then starts trading USDCHF, the margin requirement for USDCHF will not be affected by the existing GBPUSD positions. Leverage Tiers. LCG has different tiers of leverage, which are calculated based on notional USD volume traded. The margin group of each instrument can be found from the “spread and costs” tables of each market. Risks of Using Leverage. While leverage can amplify profits, it can also amplify losses. It’s important to note that 71% of retail investor accounts lose money when trading CFDs with LCG. Therefore, it’s crucial to understand how CFDs work and whether you can afford to take the high risk of losing your money. Regulation. LCG is regulated by the Securities Commission of Bahamas (SCB) with License No. SIA-F194. This regulation helps to ensure that LCG adheres to certain standards of transparency and accountability. In conclusion, leverage is a powerful tool in forex trading that can enhance profitability, but it also increases risk. It’s essential to fully understand the implications of leverage before using it in your trading strategy. As always, it’s recommended to use risk management tools and techniques to protect your capital.

What kind of Spreads are offered by LCG?

London Capital Group (LCG) is a renowned financial services company that offers a wide range of trading services, including forex trading. In the context of forex, LCG provides competitive spreads, which are crucial for traders as they represent the cost of trading. Spreads LCG offers spreads starting from 0 pips. This means that under certain market conditions, the difference between the bid and ask price, which is the spread, can be as low as zero. This is particularly beneficial for traders as it allows them to enter and exit positions at the prices they desire. Leverage Another important aspect of forex trading with LCG is the leverage offered. LCG provides a maximum leverage of 1:500. This high level of leverage allows traders to control a large position with a relatively small amount of capital, potentially magnifying profits. However, it’s important to note that leverage can also magnify losses. Trading Instruments LCG offers a wide range of trading instruments. Traders can choose from forex pairs, spot metals, indices, shares, commodities, bonds, interest rates, vanilla options, and ETFs. This diversity allows traders to diversify their portfolio and spread their risk across different markets. Account Specifications LCG provides detailed account specifications, including information about spreads, trading times, minimum trade sizes, and margin requirements. This transparency helps traders make informed decisions about their trading strategies. Deposits/Withdrawals LCG offers various methods for deposits and withdrawals, including bank wire transfers, Visa/MasterCard, UnionPay, Neteller, and Skrill. This flexibility makes it convenient for traders to fund their accounts and withdraw their profits. In conclusion, LCG offers competitive spreads and a wide range of trading services, making it a viable choice for forex traders. However, as with all forms of trading, it’s important for traders to understand the risks involved and trade responsibly.

Does LCG offer MAM Accounts or PAMM Accounts?

The query about whether LCG offers MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts could not be directly answered due to the lack of specific information about LCG’s offerings in the search results. However, it’s important to understand what MAM and PAMM accounts are in the context of forex trading. MAM Accounts. A MAM account allows professional traders to manage multiple client accounts from a single master account. The master account is controlled by the trader and is linked to several sub-accounts, each owned and controlled by a different individual investor. The funds of the investors are pooled together and managed by the trader. As the trader executes trades in the master account, the same trades are automatically replicated on the individual sub-accounts according to the allocation percentage. Traders can also make manual adjustments to allocation percentages, designate different volumes to different sub-accounts, or group sub-accounts together for different trading strategies. PAMM Accounts. A PAMM account is a type of investment account offered by some forex brokers, which allows retail investors to allocate their funds to be managed by experienced traders. An investor deposits funds into a PAMM account, which are then pooled together with funds from other investor accounts. The appointed trader or investment manager then makes investment decisions on behalf of the group. Each investor’s share in the account is proportional to the size of their investment, and the profits or losses are distributed accordingly. The trader typically charges a management fee for their services, which are deducted from the account’s profits. Choosing between MAM and PAMM should be based on factors such as your experience level, goals, and objectives. Both can be used by retail investors who invest for personal investment, as well as professional traders with a career managing investments on behalf of clients. It’s recommended to reach out to LCG directly for the most accurate and up-to-date information regarding their account offerings.

Does LCG allow Expert Advisors?

London Capital Group (LCG) is a UK-based online brokerage that offers a broad selection of CFDs and spread betting instruments across several different asset classes. One of the key features that sets LCG apart from its competition is its focus on customer service, which is particularly beneficial for beginner traders. LCG provides two main trading platforms: LCG Trader and MetaTrader 4 (MT4). LCG Trader is a web-based platform that offers a more streamlined and intuitive experience, making it a better choice for newer traders. However, advanced traders are likely to use LCG’s MT4 platform. The MT4 platform is known for its flexible trading technology, which includes Expert Advisors (EAs). EAs are software programs that automate trading and analytical processes on the MT4 platform. They allow traders to develop, test, and apply trading algorithms and strategies, which can be particularly useful in the fast-paced world of forex trading. Therefore, to answer your question, yes, LCG does allow the use of Expert Advisors through its MT4 platform. It’s important to note that while LCG offers a wide range of products and stable trading platforms, it does not accept U.S. traders. Additionally, the company offers a choice between standard or electronic communications network (ECN) accounts, though the latter requires a minimum deposit of $10,000. In conclusion, LCG’s commitment to providing advanced technology and professional services, coupled with its allowance of Expert Advisors on its MT4 platform, makes it a strong choice for both beginner and advanced forex traders.