Nutmeg Review 2026

What is Nutmeg?

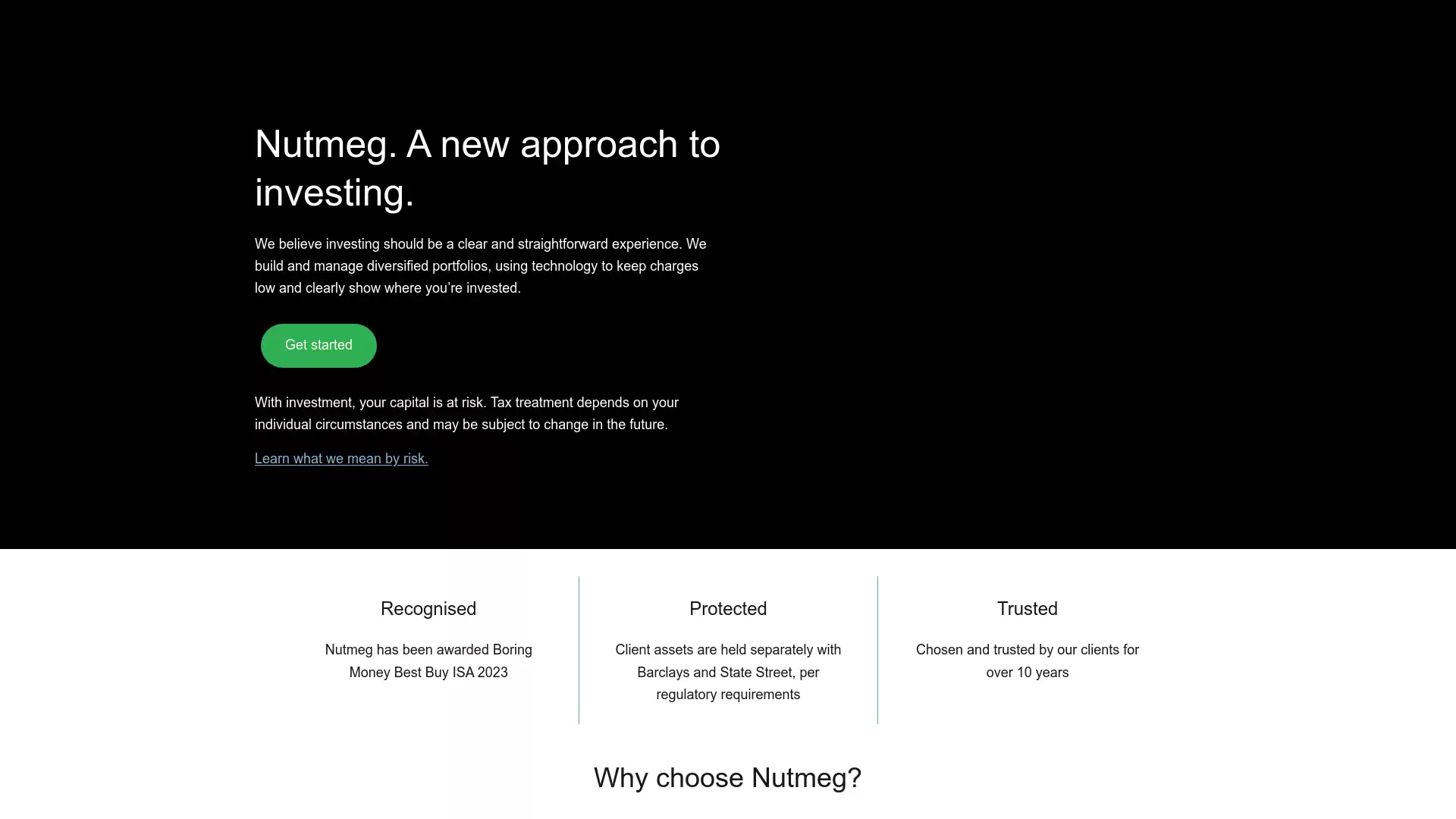

Nutmeg is a prominent player in the world of online trading. Founded in 2008, Nutmeg has grown to become a top-tier platform in the field of online trading. It provides a range of instruments for online trading, focusing on forex, indices, metals, stocks, and commodities. Nutmeg is headquartered in the USA and serves over 10,000 retail investors globally. It offers services in Forex trading, CFD trading, and Share Dealing trading. Nutmeg’s platform is highly professional and feature-rich, designed to cater to the needs of its diverse user base. The platform is known for its transparency and professionalism. It aids traders in making informed decisions in the fast-paced world of stock markets and online trading. Nutmeg plays the role of a direct investment partner, helping traders minimize losses and maximize returns. However, it’s crucial for traders to carefully assess Nutmeg as their broker, as this choice can significantly impact their success. Selecting the right broker is vital for investments to flourish. Nutmeg has proven to be a trustworthy and reliable broker, but traders should always be cautious of fraudulent and untrustworthy brokers. In conclusion, Nutmeg is a world-class broker that provides Financial Markets Access to its customers through various platforms like WebTrader, Desktop, Mobile & Apps. It has a strong reputation in the industry and is used by over 10,000 traders. Nutmeg offers a comprehensive guide to trading online, making it a preferred choice for many traders.

What is the Review Rating of Nutmeg?

- 55brokers: 55brokers rated Nutmeg with a score of 85. This rating was last checked at 2024-01-06 02:34:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Nutmeg with a score of 74. This rating was last checked at 2024-01-05 21:02:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Nutmeg?

Nutmeg, a financial trading platform and broker, offers several advantages in the context of forex trading:. Wide Range of Services: Nutmeg provides a variety of trading services including Forex trading, CFD trading, and Share Dealing trading. Global Presence: Founded in 2008, Nutmeg has grown to serve over 10,000 retail investors worldwide. Security Measures: All funds deposited to Nutmeg are held in segregated bank accounts for security. User-Friendly Tools: Instead of complex charts and graphs, Nutmeg provides more general tools for financial planning. Low Fees: Nutmeg is known for its low fees, which can be beneficial for traders. Tax Efficiency: Nutmeg’s services come with the same benefits and features as the GIA, shielding any potential returns from UK taxes like capital gains or dividend tax. Please note that while Nutmeg offers several advantages, it’s important to thoroughly research and consider all aspects of a trading platform before investing.

What are the Cons of Nutmeg?

Nutmeg, a worldwide financial trading platform and broker, has several drawbacks that potential investors should consider. Limited Learning Materials: Nutmeg offers limited availability of learning materials. This could be a disadvantage for new investors who are looking to learn more about forex trading and investment strategies. Customer Support: Nutmeg does not provide 24/7 customer support. This could potentially impact accessibility and assistance for users at any time. Fees: Smaller portfolios may face relatively higher fees. This could be a disadvantage for investors with smaller amounts of capital. Exposure to Market Volatility: Like any investment platform, Nutmeg exposes investors to market volatility. This could lead to potential losses, especially for those who are not familiar with the forex market. Minimum Investment Requirement: There’s a minimum investment fee for Nutmeg accounts. This could be a barrier for individuals who are looking to start investing with a smaller amount of capital. Complex Features: Some Nutmeg trading features can be complex when trading on mobile or using the Nutmeg online trading platform. This could be a disadvantage for users who prefer a more straightforward trading experience. It’s important for potential investors to consider these factors when deciding whether to use Nutmeg for their forex trading needs. As with any investment platform, it’s crucial to do thorough research and understand the risks involved before making any investment decisions.

Is Nutmeg Regulated and who are the Regulators?

Nutmeg, a prominent player in the financial sector, is indeed regulated. The company’s regulatory information can be found on their official website. They provide disclosures under the Investment Firms Prudential Regime (IFPR), which can be accessed on the J.P. Morgan Chase disclosure page. The document titled “Annual IFPR (MIFIDPRU8) Disclosures Nutmeg” is particularly relevant. Forex market regulators establish guidelines for forex brokers, including companies like Nutmeg, to ensure investor protection and maintain order in the trading arena. These regulators are responsible for conducting periodic audits, reviews, and inspections of the financial, legal, and customer-related activities of forex market players. Some of the best-known forex regulators include the Financial Conduct Authority (FCA) in the UK, the Swiss Financial Market Supervisory Authority (Finma), BaFin in Germany, Consob in Italy, and the CNMV in Spain. These regulatory bodies play a crucial role in overseeing the operations of forex brokers and ensuring they adhere to the established guidelines. In conclusion, Nutmeg operates within a regulated environment, adhering to the guidelines set by forex market regulators. This ensures that they maintain high standards of operation, providing assurance to their customers and stakeholders.