One Financial Markets Review 2026

What is One Financial Markets?

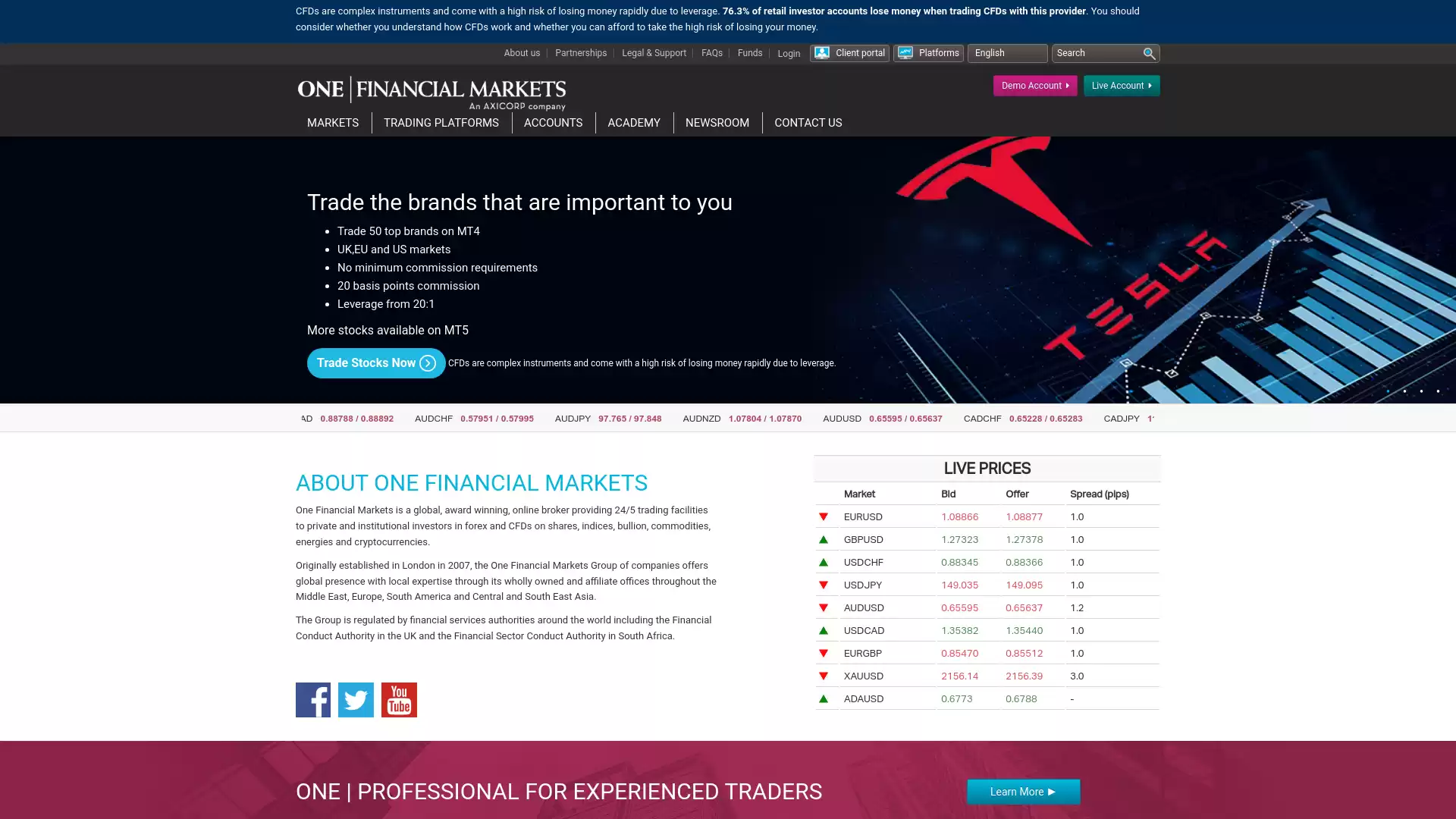

One Financial Markets is a global, award-winning online broker that provides 24/5 trading facilities to private and institutional investors. It offers trading in forex and CFDs on a wide range of assets including shares, indices, bullion, commodities, energies, and cryptocurrencies. Established in London in 2007, the One Financial Markets Group has expanded its presence globally with wholly owned and affiliate offices throughout the Middle East, Europe, South America, and Central and South East Asia. The group is regulated by financial services authorities worldwide, including the Financial Conduct Authority in the UK and the Financial Sector Conduct Authority in South Africa. One Financial Markets stands out for its commitment to providing a high level of client service. With a dedicated customer service team located around the world, they offer multi-lingual support 24 hours a day. The broker has been recognized with numerous awards that attest to the quality of its service and dedication to its clients. It also places a strong emphasis on education, offering award-winning educational resources to help traders gain confidence and knowledge in trading the financial markets. One Financial Markets offers a wide range of products for trading. Clients can trade Forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. They also provide leverage of up to 500:1 for their clients. In addition to its trading services, One Financial Markets offers a personal account management portal where clients can manage their accounts, make deposits, transfers, or withdrawals, open additional trading accounts, and more. In the context of forex trading, One Financial Markets provides a robust platform for currency trading with a wide range of currency pairs available. The broker’s strong regulatory oversight, global presence, and commitment to client service make it a reliable choice for forex traders.

What is the Review Rating of One Financial Markets?

- 55brokers: 55brokers rated One Financial Markets with a score of 82. This rating was last checked at 2024-01-06 16:48:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated One Financial Markets with a score of 62. This rating was last checked at 2024-01-06 19:04:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated One Financial Markets with a score of 56. This rating was last checked at 2024-01-06 00:44:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated One Financial Markets with a score of 64. This rating was last checked at 2024-03-12 21:00:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of One Financial Markets?

One Financial Markets is a globally recognized brand, offering a wide range of benefits to its users. Here are some of the key advantages:. Regulation: One Financial Markets is regulated by the Financial Conduct Authority (FCA) and other reputable international supervisory bodies. This provides a level of trust and security for traders. Cooperation: The company cooperates with both professional market participants and institutional clients, as well as private traders. This makes it a versatile platform suitable for various types of traders. Trading Instruments: One Financial Markets offers a wide range of Forex and CFD trading instruments, including American, British, and European stocks. This allows traders to diversify their portfolio and explore different markets. Trading Platforms: The broker provides advanced trading platforms including MT4 & MT5. These platforms are known for their user-friendly interface and advanced trading tools. Account Management: One Financial Markets provides an easy-to-use personal account management portal. This makes it easier for traders to manage their trades and monitor their progress. Education: The broker offers free education and access to Trading Central. This can be particularly beneficial for new traders who are still learning the ropes. Global Presence: Established in London in 2007, the One Financial Markets Group has established a global presence with local expertise through its wholly-owned and affiliate offices throughout the Middle East, Europe, South America, and Central and Southeast Asia. Currency Pairs: The broker offers a wide range of currency pairs (67), CFD on indices (15), commodities (5), energy resources (6), gold (7), cryptocurrencies (6), stocks (458). Please note that while One Financial Markets offers many advantages, it’s important to do your own research and consider your individual trading needs before choosing a broker.

What are the Cons of One Financial Markets?

One Financial Markets is a globally recognized brand, licensed around the world, and trusted by traders in over 100 countries. However, like any financial institution, it has its drawbacks. Here are some of the cons associated with One Financial Markets:. Lack of Micro Accounts: One Financial Markets does not offer cent (micro) accounts to its clients. This could be a disadvantage for novice traders or those with limited capital who wish to trade in smaller lot sizes for risk management purposes. High Minimum Deposit: The minimum deposit required to open a Standard account with One Financial Markets is $250. This might be considered high compared to other brokers in the industry, potentially making it less accessible for some traders. No Referral Program for Retail Traders: One Financial Markets does not have a referral program for retail traders. This means that traders cannot earn additional passive income by attracting new clients to the company. Risk of Trading CFDs: Trading Contracts for Difference (CFDs) comes with a high risk of losing money rapidly due to leverage. As per the broker’s own admission, 75.5% of retail investor accounts lose money when trading CFDs with this provider. Traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their money. Limited Leverage for Certain Accounts: The leverage offered by One Financial Markets is up to 1:30 on a Standard Account (UK), up to 1:400 on a Professional Account (UK), and up to 1:500 on a Standard Account (St Vincent). While this might be sufficient for some traders, others might find it limiting, especially those who prefer high-risk, high-reward strategies. It’s important for potential traders to thoroughly research and consider these factors before deciding to open an account with One Financial Markets. As always, it’s crucial to understand that trading in forex and other financial markets involves significant risk and isn’t suitable for everyone.

What are the One Financial Markets Current Promos?

One Financial Markets, a global online broker, offers a variety of trading promotions to both its clients and affiliates. These promotions are designed to cater to the diverse needs of traders, regardless of the size or nature of their accounts. Account and Referral Bonuses One Financial Markets provides account and referral bonuses. These incentives are designed to reward both new and existing clients who bring in new traders. Regular Competitions In addition to bonuses, One Financial Markets also hosts regular competitions. These events provide an exciting opportunity for traders to test their skills against others in the market. Promotions Offering Tighter Spreads One Financial Markets periodically offers promotions that feature tighter spreads on headline products. These promotions can help traders maximize their profits by reducing the cost of trading. Leverage of up to 500:1 One Financial Markets offers leverage of up to 500:1. This allows traders to control a large amount of money with a relatively small investment. Wide Range of Products Traders at One Financial Markets have access to a wide range of products. They can trade Forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. Please note that trading Forex and CFDs involves a high level of risk due to the leverage involved. It’s important to understand these risks before starting to trade.

What are the One Financial Markets Highlights?

One Financial Markets is a global, award-winning online broker that provides 24/5 trading facilities to private and institutional investors. It offers trading in forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. Key Highlights: Regulation: One Financial Markets is regulated by financial services authorities around the world, including the Financial Conduct Authority in the UK and the Financial Sector Conduct Authority in South Africa. Global Presence: Established in London in 2007, the company has a global presence with wholly owned and affiliate offices throughout the Middle East, Europe, South America, and Central and South East Asia. Trading Platforms: The company provides advanced trading platforms, including MT4 & MT5. Customer Service: It offers multi-lingual customer service support, trusted by traders in over 100 countries. Education: One Financial Markets provides free education and access to Trading Central. . One Financial Markets also provides insights into the state of the economy. For instance, it highlighted the annual report and letter from Warren Buffett of Berkshire Hathaway. The report showed record operating earnings in 2022, despite net income losses due to the bear market on Wall Street. Buffett reiterated his preference to focus on operating earnings, which he believes are a more accurate measure of a company’s growth. These highlights demonstrate One Financial Markets’ commitment to providing a comprehensive trading service to its clients, backed by robust regulatory oversight and a wealth of educational resources.

Is One Financial Markets Legit and Trustworthy?

In the context of forex, One Financial Markets is a legitimate and trustworthy broker with a reputable track record. It is regulated by the Financial Conduct Authority (FCA) in the UK, the Dubai Financial Services Authority (DFSA) in Dubai, and the Financial Sector Conduct Authority (FSCA) in South Africa. One Financial Markets has been providing retail 24/5 trading facilities and investment in forex and CFDs on indices, commodities, energies, bonds, and futures since 2007. The broker has a global presence with local expertise through owning or affiliate offices located in the Middle East, Europe, South America, and Central, and South East Asia with conducted offices in Dubai, Kuwait, Hong Kong, and Shenzhen. One Financial Markets offers a range of account types and instruments, including forex and CFD products such as trading of commodities, indices, cryptocurrencies, shares, and bullion. The broker provides competitive trading conditions, including a low minimum deposit of $250, competitive spreads, and leverage of up to 1:30. One Financial Markets also provides a good education for traders, including research and social trading. The broker has a wide range of deposit methods and easy digital account opening. However, it is important to note that One Financial Markets does not provide 24/7 support and the instrument range is limited and mainly traded as Forex and CFDs. In summary, One Financial Markets is a reliable broker with a good range of deposit methods, competitive trading conditions, and a good education for traders. It is regulated by multiple top-tier authorities and has a global presence with local expertise. Pros: Regulated by multiple top-tier authorities Competitive trading conditions Good education for traders Easy digital account opening Wide range of deposit methods . Cons: No 24/7 support Instrument range is limited and mainly traded as Forex and CFDs . Please note that this response is for informational purposes only and should not be construed as financial advice. It is always important to conduct your own research and due diligence before making any investment decisions. References: One Financial Markets Forex Broker Review (2023) ☑️. (n.d.). 55Brokers. https://55brokers.com/one-financial-markets-review/ .

Is One Financial Markets Regulated and who are the Regulators?

Yes, One Financial Markets is indeed a regulated entity. It operates under the trading name of Axi Financial Services (UK) Ltd, a company registered in England with company number 6050593. The primary regulator for One Financial Markets is the Financial Conduct Authority (FCA) in the UK. The FCA is a highly respected financial regulatory body, empowered under the UK Government’s Financial Services Act to supervise and regulate financial services business in and from the United Kingdom. The FCA provides oversight to ensure markets run fairly, smoothly, and efficiently. It enforces securities laws to maintain market integrity. Additionally, One Financial Markets is also regulated by the Financial Sector Conduct Authority in South Africa. This highlights the global reach of One Financial Markets and its commitment to adhering to high regulatory standards in different jurisdictions. Regulation is an integral part of financial markets, providing necessary supervision of designated financial firms and markets. It ensures that market participants can trade without constantly looking over their shoulders. In conclusion, One Financial Markets is a regulated entity, with the FCA in the UK and the Financial Sector Conduct Authority in South Africa as its primary regulators. This regulation provides assurance to its clients and partners about its commitment to transparency, fairness, and integrity in its operations.

Did One Financial Markets win any Awards?

Yes, One Financial Markets has won several awards for its service and quality in the forex and CFD industry. According to its website, some of the awards are:. Best Forex Customer Service 2018 JFEX Awards. Best FSA Regulated Broker Saudi Money Expo. Best Education Product Saudi Money Expo. Best Broker - Online Trading Middle East. Best Institutional Broker. Best FX Services Broker. Top International FX Broker 2015. These awards demonstrate that One Financial Markets is a reputable and reliable broker that offers a wide range of products, competitive margins, and excellent customer support. If you are interested in trading forex and CFDs with One Financial Markets, you can open a live account or a demo account on their website. You can also access their market library, education, news, and analysis to enhance your trading skills and knowledge.

How do I get in Contact with One Financial Markets?

One Financial Markets, a leading player in the forex trading industry, provides multiple avenues for potential clients, existing customers, and interested parties to get in touch with them. Here are the details:. Head Office: The head office of One Financial Markets is located at 1 Finsbury Market, London, EC2A 2BN, United Kingdom. You can reach them via telephone at +44 (0) 203 544 9646. They also have a fax number: +44 (0) 203 857 2001. Email: For general queries about One Financial Markets, their products and services, or for information about the status of your application, you can contact their Client Services Department at clientservices@ofmarkets.com. Specific Departments: For more specific queries, you can contact the relevant department. The Partners department can be reached at partners@ofmarkets.com and the Marketing department at marketing@ofmarkets.com. Office Hours: Their London office is open 24 hours a day, 5 days a week. , ensuring they can cater to clients across different time zones. Remember, forex trading involves significant risk of loss and is not suitable for all investors. It’s important to fully understand the risks involved before engaging in forex trading.

Where are the Headquarters from One Financial Markets based?

One Financial Markets is an online broker providing 24/5 trading facilities to retail and institutional investors in forex and CFDs on indices, commodities, energies, bonds and futures. The company was founded in 2007 and is headquartered in London, England. The exact address of the headquarters is 20 Midtown, 20 Procter Street, London, WC1V 6NX, United Kingdom. One Financial Markets has a global presence with local expertise through its wholly owned and affiliate offices throughout the Middle East, Europe, South America and Central and South East Asia. The company is authorized and regulated by other global regulators, including the UK’s Financial Conduct Authority (FCA) and Financial Services Board (FSB) in South Africa. In summary, One Financial Markets is an online forex and CFDs broker headquartered in London, England. The company’s headquarters is located at 20 Midtown, 20 Procter Street, London, WC1V 6NX, United Kingdom. One Financial Markets has a global presence with local expertise through its wholly owned and affiliate offices throughout the Middle East, Europe, South America and Central and South East Asia. The company is authorized and regulated by other global regulators, including the UK’s Financial Conduct Authority (FCA) and Financial Services Board (FSB) in South Africa.

What kind of Customer Support is offered by One Financial Markets?

One Financial Markets, a globally recognised brand trusted by traders in over 100 countries, offers a comprehensive customer support system. Contact Information: The UK Head Office of One Financial Markets is located at 1 Finsbury Market, London, EC2A 2BN, United Kingdom. They can be reached via telephone at + 44 (0) 203 544 9646 or fax at + 44 (0) 203 857 2001. Customer Service: One Financial Markets prides itself on its dedicated customer service team. This team is located around the world, offering multi-lingual support 24 hours a day. This ensures that no matter where traders are located or what time zone they are in, they can always get the help they need. Products and Services: One Financial Markets provides a wide range of products for trading. Traders can trade Forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. This wide range of offerings allows traders to diversify their portfolios and find the trading opportunities that best suit their strategies. Leverage: Traders who open an account with One Financial Markets can enjoy leverage of up to 500:1. This high level of leverage can allow traders to control large positions with a relatively small amount of capital. Awards: The group has been presented with a number of awards that recognise the quality of their service and dedication to their clients. These awards serve as a testament to One Financial Markets’ commitment to providing top-notch customer support and reliable trading services. In the context of forex trading, the comprehensive customer support offered by One Financial Markets can be a significant advantage. Forex markets are open 24 hours a day, five days a week, and having access to round-the-clock, multi-lingual support can be invaluable for traders.

Which Educational and Learning Materials are offered by One Financial Markets?

One Financial Markets offers a comprehensive suite of educational and learning materials through its One Trading Academy. This is a module-based learning programme designed to help both beginners and experienced traders gain confidence and knowledge in trading the financial markets independently. The Academy’s curriculum is divided into six key modules:. Introduction to the Markets: This module provides a broad overview of financial markets, market participants, types of products, and types of investors. What is CFD Trading? This module explains the concept of Contract for Difference (CFD) trading. It covers the mechanics of CFDs, including entry and exit prices, time limits, and the process of buying and selling. It also provides a CFD trading example and discusses the advantages and potential pitfalls of CFD trading. What is Forex? This module provides an introduction to the Foreign Exchange Market, also known as Forex, Spot FX, Spot, or simply FX. It covers topics such as Forex regions and their operating hours, quotes in Forex, the bid, the ask, the spread, going long or going short, and how to calculate profit and loss in the market. Analysis: This module delves into the principles of trading analysis. It covers both technical and fundamental analysis, basics of the fundamentals, interest rates, money supply, inflation, and economic release. Risk: Details about this module are not available in the search results. Trading Psychology: Details about this module are not available in the search results. . These modules are designed to develop trading confidence and are provided free of charge. They can be delivered on a one-to-one or group basis. It’s important to note that while these educational resources can provide valuable insights and knowledge, trading in financial markets involves risk, and it’s crucial for individuals to fully understand these risks before engaging in trading activities.

Can anyone join One Financial Markets?

One Financial Markets is a global, award-winning, online broker that provides 24/5 trading facilities to private and institutional investors in forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. The company was originally established in London in 2007 and offers global presence with local expertise through its wholly owned and affiliate offices throughout the Middle East, Europe, South America, and Central and South East Asia. The company is regulated by financial services authorities around the world, including the Financial Conduct Authority in the UK and the Financial Sector Conduct Authority in South Africa. This ensures that they adhere to strict regulatory standards designed to protect investors. One Financial Markets offers a wide range of products for trading. These include Forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. They offer leverage of up to 500:1 when you open an account with them. However, it’s important to note that CFDs and FX are high-risk leveraged products. Trading these products comes with a high risk of losing money rapidly due to leverage. Therefore, potential investors should check their eligibility and ensure they understand the risks involved before deciding to trade with One Financial Markets. In terms of customer service, One Financial Markets has a dedicated customer service team located around the world, offering multi-lingual support 24 hours a day. They also provide educational resources to help investors gain confidence and knowledge on trading the financial markets. In conclusion, while anyone can apply to join One Financial Markets, it’s crucial that potential investors understand the risks involved and check their eligibility before deciding to trade with them. As always, it’s recommended to seek independent financial advice before making any investment decisions.

Who should sign up with One Financial Markets?

One Financial Markets is a platform that caters to a wide range of traders, offering accounts suitable for different types of trading needs. Here are some categories of individuals who might find One Financial Markets beneficial:. Beginner Traders: With an initial deposit of just $250, One Financial Markets provides access to a wide range of FX and CFD products through a choice of platforms. This makes it an excellent choice for beginner traders looking to dip their toes into the world of forex trading. Experienced Traders: For more seasoned traders, One Financial Markets offers a “professional” account, which requires a minimum opening balance of $1000. This account offers higher leverage up to 400:1. , providing experienced traders with the opportunity to maximize their trading potential. Risk-Averse Traders: One Financial Markets offers negative balance protection for its standard account. , making it a safe choice for traders who wish to limit their financial risk. Mobile Traders: For traders who prefer to trade on the go, One Financial Markets offers mobile trading platforms, ONE MT4 Mobile and ONE MT5 Mobile. , allowing users to stay connected to the markets wherever they are. Demo Traders: For individuals who wish to practice their trading skills in a risk-free environment, One Financial Markets offers a demo account. In conclusion, One Financial Markets is a versatile platform that caters to a wide range of traders, from beginners to professionals, offering a variety of account types to suit different trading needs and styles. Whether you’re new to forex trading or an experienced trader looking for a platform with higher leverage options, One Financial Markets could be a good fit for you.

Who should NOT sign up with One Financial Markets?

One Financial Markets is a global online broker providing 24/5 trading facilities to retail and institutional investors. However, it may not be suitable for everyone. Here are some categories of people who might want to reconsider signing up with One Financial Markets:. 1. Novice Traders One Financial Markets’ conditions are more suitable for experienced and professional traders. Novice traders or those who are new to the world of forex trading might find the platform challenging to navigate. 2. Traders with Limited Capital The minimum deposit required to open an account with One Financial Markets is $250. This might be a significant amount for traders with limited capital or those who are not willing to risk a large sum of money. 3. Traders who Prioritize Customer Service There have been complaints about the customer service of One Financial Markets. Traders who value prompt and efficient customer service might be dissatisfied with their experience. 4. Traders who Trade in Indices and Commodities The commissions for indices and commodities trading are reportedly high. Therefore, traders who primarily deal in these might find One Financial Markets expensive. 5. Traders who are Risk-Averse Some traders have reported significant losses due to huge slippages. Risk-averse traders or those who prefer to maintain tight control over their trades might want to consider other options. In conclusion, while One Financial Markets offers a wide range of services, it might not be the best fit for everyone. Potential users should carefully consider their trading needs, financial situation, and risk tolerance before signing up.

Does One Financial Markets offer Discounts, Coupons, or Promo Codes?

Based on the information available, there are no specific discounts, coupons, or promo codes for One Financial Markets. It’s always a good idea to check the official website or contact customer service for the most accurate and up-to-date information. Please note that promotional offers can vary and may be subject to terms and conditions. It’s also worth mentioning that many financial institutions offer various types of incentives, so it’s always worth exploring different options in the forex market.

Which Account Types are offered by One Financial Markets?

One Financial Markets, a renowned financial service provider, offers two primary types of accounts to cater to the diverse needs of traders. These accounts are designed to provide access to a wide range of Forex and Contract for Difference (CFD) products through various platforms. The first type is the Standard Account. This account can be opened with an initial deposit of just $250. It provides access to a wide range of FX and CFD products through a choice of platforms. The leverage offered is up to 30:1 (3%), and the liquidation level is set at 50%. This account also offers negative balance protection. The second type is the Professional Account. This account requires a minimum opening balance of $1000. The leverage offered is significantly higher, up to 400:1 (0.25%), and the liquidation level is 20%. However, this account does not offer negative balance protection. Both account types are regulated by the Financial Conduct Authority (FCA) and provide access to the Financial Services Compensation Scheme (FSCS). They are available on both MT4 and MT5 platforms. In addition to these, One Financial Markets also offers a risk-free Demo Account. This allows traders to develop their trading skills in a risk-free environment. Please note that Forex and CFDs are high-risk leveraged products. It’s important to understand the risks involved before starting to trade. If you have any questions, One Financial Markets offers live chat support.

How to Open a One Financial Markets LIVE Account?

Opening a One Financial Markets LIVE account involves a straightforward process. Here’s a detailed step-by-step guide:. Step 1: Application Form To begin, you need to complete the online application form. Alternatively, you can download a physical form and send it, along with your supporting ID documentation, to the One Financial Markets head office. Step 2: Familiarize Yourself with the Terms Before completing the application form, it’s important to familiarize yourself with the following. Terms and Conditions. Risk Warning. Client Classification and Protections Notice. Best Execution Policy. Step 3: Supporting Documentation for Individual Accounts All application forms must be accompanied by proof of residential address and proof of identity. This includes:. Proof of Address: A certified copy of a recent (no more than 4 months old) utility bill or bank statement stating your name and residential address. Bills and statements printed off the internet are not acceptable. Proof of Identity: A certified copy of your valid passport, National ID card, or photocard driver’s license. Step 4: Supporting Documentation for Corporate Accounts If you’re opening a corporate account, you’ll need to provide additional documents. These include:. Legal Structure/Company Documents: Certified copy of Certificate of Incorporation, Copy of Memorandum of Association, Copy of Articles of Association. Ownership/Control: List of all officers, directors, and shareholders (including percentage holding) on company letterhead, Board Resolution approving account with One Financial Markets, Individual ID for each director and authorized person named above, Individual ID for majority shareholders and anyone with >25% holding. Please note that certification may be carried out by a lawyer, Notary Public, Consulate, or Embassy official and be stamped as “true copy of the original”. All copies must be clear and certification must be legible, dated, and signed with the full name and address of the certifier included. Once you’ve completed these steps, you’re ready to start trading on the global financial markets through One Financial Markets’ suite of trading platforms. Remember, forex trading involves significant risk and it’s important to understand these risks before you start trading. Happy trading!.

How to Open a One Financial Markets DEMO account?

If you are interested in forex trading, you might want to open a demo account with One Financial Markets, a regulated and award-winning broker that offers competitive trading conditions and a dedicated account manager. A demo account is a great way to practise your trading skills in a risk-free environment, test your strategies, and learn about the trading platform. Here are the steps to open a One Financial Markets demo account: Complete the online application form. You can find the form on their website. or [here]. You will need to provide some basic information such as your country, platform, name, surname, email address, phone number, and whether you wish to receive marketing emails. You will also need to agree to their privacy notice and terms and conditions. Receive your free MT4 user guide. When you sign up for a demo account, you will get a free MT4 user guide that will teach you about the essentials of the ONE MT4 trading platform. The user guide will cover topics such as how to install and configure the software, how to use the charting tools, how to place orders, how to manage your account settings, and more. Login to your demo account. Once you have completed the application form and received your user guide, you can login to your demo account using your username and password. You can access your demo account from any device that supports MT4 or from their mobile apps. You can also switch between different currency pairs and time frames. Start trading. Now that you have opened your demo account, you can start trading with virtual funds of $10,000. You can use any of the available markets such as forex pairs, indices, commodities, stocks, cryptocurrencies, etc. You can also use various tools and features such as indicators, expert advisors (EAs), stop loss orders, take profit orders, etc. However, please note that this is not real money trading and any losses or profits are not reflected on your real account balance. We hope this answer has helped you understand how to open a One Financial Markets demo account. If you have any questions or feedback, please feel free to contact them directly through their website. or live chat. Happy trading!.

How Are You Protected as a Client at One Financial Markets?

As a client at One Financial Markets, you are protected in several ways:. Client Money Protection: One Financial Markets treats your money in accordance with the FCA’s Client Money Rules. This means that your money is kept in a segregated account, separate from the company’s own money. This ensures that your funds are secure and cannot be used by the company for its own operational expenses. Financial Ombudsman Service: As an individual, you still have rights for redress if you remain dissatisfied with the outcome of a complaint to One Financial Markets. This means that if you have a dispute with the company, you can take your complaint to the Financial Ombudsman Service, an independent body that resolves disputes between consumers and financial firms. Financial Services Compensation Scheme: As an individual, you remain eligible for compensation from the FSCS for up to £85,000 (or equivalent) that you hold with One Financial Markets. This means that if the company were to fail, you could claim compensation from the FSCS. Professional Client vs Retail Client: One Financial Markets offers different levels of protection for professional and retail clients. For example, professional clients can maintain their existing margin rates, while retail clients are subject to leverage limits of between 30:1 and 5:1. However, it’s important to note that professional clients lose certain protections, such as the obligation for One Financial Markets to provide current risk warnings and to prioritize the overall price and cost of a transaction. Qualifying as a Professional Client: To be classified as a professional client, One Financial Markets assesses your expertise, experience, and knowledge. You must also satisfy at least two of the three quantitative criteria: trading CFDs or forex an average of 10 times in each of the last four quarters, holding an investment portfolio exceeding €500,000, or having worked in the financial sector for at least one year. In conclusion, One Financial Markets provides several layers of protection for its clients, ensuring that your funds are secure and that you have avenues for redress in case of disputes. However, it’s important to understand the differences in protection between retail and professional clients, and to consider whether you meet the criteria for professional client status.

Which Funding methods or Deposit Options are available at One Financial Markets?

One Financial Markets, a renowned player in the forex trading industry, offers a variety of funding methods and deposit options to cater to the diverse needs of its global clientele. Bank Transfers: Clients can transfer funds directly to One Financial Markets’ bank account via wire transfer. This method is available for both UK and international clients. The minimum deposit amount for bank transfers is not specified. The transfer time for UK bank transfers is 1 to 3 working days, while international SWIFT bank wire transfers may take 2 to 5 working days. Debit/Credit Card Payments: One Financial Markets accepts online deposits using debit or credit cards. The minimum deposit amount for card payments is $50, €35, or £30. Deposits made within the portal are processed immediately, while those made outside the portal are processed within 15 minutes. E-Wallets: Clients can also transfer funds from their e-wallets. Specific e-wallet services such as Neteller and Skrill are available for clients outside the UK and EEA. The minimum deposit amount for e-wallet transactions is $50. , and the transactions are processed the same day. It’s important to note that third-party payments and cash deposits are not permitted. Clients are advised to always state their client ID and any applicable promotional code in the reference. One Financial Markets also provides a feature to transfer funds between landing and trading accounts. The landing account acts as a wallet that is independent from the trading accounts, allowing clients more flexibility to control their funds when trading on multiple accounts. Please note that the information provided here is based on the latest available data and may be subject to change. For the most accurate and up-to-date information, clients are advised to log in to their client portal on the One Financial Markets website.

What is the Minimum Deposit Amount at One Financial Markets?

One Financial Markets is a forex broker that offers various payment methods for its clients to fund their trading accounts. The minimum deposit amount depends on the method of payment and the currency of the account. Here is a summary of the minimum deposit amounts for different currencies and payment methods:. GBP: No minimum deposit required for UK bank transfers, but there are remitting bank charges only. The transfer time is 1 to 3 working days for next day payment, or same day for same day payment. The minimum withdrawal amount is £30, with a £1 charge for next day payment, or £20 for same day payment. USD: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is $50 (or equivalent), with no additional charge. EUR: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is €35 (or equivalent), with no additional charge. AED: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is AED 100 (or equivalent), with no additional charge. HKD: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is HKD 500 (or equivalent), with no additional charge. JOD: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is JOD 1000 (or equivalent), with no additional charge. KWD: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is KWD 1000 (or equivalent), with no additional charge. SGD: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is SGD $50 (or equivalent), with no additional charge. ZAR: No minimum deposit required for international SWIFT bank wire transfers, but there are remitting bank charges only. The transfer time is 2 to 5 working days. The minimum withdrawal amount is ZAR $250 (or equivalent), with no additional charge. . To fund your account via online card deposits, you need to have a $50 (or equivalent) minimum balance in your account. You can use credit/debit cards from Visa or Mastercard within the client portal, or outside the portal. Online card deposits have a processing fee of $50 per transaction. Online card deposits can be credited immediately or within up to 10 days depending on the method. You can also use Neteller or Skrill as online payment methods outside the UK and EEA, which have no additional fees and can be credited immediately or same day depending on the method. Neteller and Skrill also allow you to transfer funds between your accounts within the client portal, which has no fees and can be done immediately or same day depending on the method. You can find more information about online payments on the One Financial Markets website. I hope this answer helps you understand the different options and requirements for funding your account at One Financial Markets. If you have any questions or feedback, please feel free to contact me again.

Which Withdrawal methods are available at One Financial Markets?

One Financial Markets, a renowned player in the Forex market, offers a streamlined process for fund withdrawals. The platform is designed to ensure that the withdrawal process is as smooth and efficient as possible for its users. To initiate a withdrawal, users need to log in to their client portal. Once logged in, they can navigate to the “Transfers” tab at the top of the screen. From there, they can select the “Withdraw Funds” tab on the right-hand side. This allows users to specify the “From Account”, “To Account”, and “Amount” for the withdrawal. It’s important to note that the funds will be returned to the same method of payment that was used to initially fund the One Financial Markets account. This is in line with the company’s policy that fund withdrawals are paid back to the source of the original deposit. In the event that the account was funded by credit or debit card, a fund withdrawal will only be made in respect of the corresponding amount, back to the card. Requests for payments initially made by card to subsequently be paid back to a bank account will be declined. If the account was funded with more than one card, the withdrawal will be made back to those cards from which the original payment was received. One Financial Markets endeavors to process all requests for funds withdrawals on the same day of receipt, or the next business day if receipt is on a non-business day. However, immediate payment cannot always be guaranteed. Please note that users must have funds in their landing account for the withdrawal request to be approved. Withdrawals will not be approved if the trading accounts are in deficit. Overall, One Financial Markets provides a user-friendly and efficient withdrawal process, making it a reliable choice for Forex traders.

Which Fees are charged by One Financial Markets?

One Financial Markets, a renowned Forex trading platform, charges various fees associated with trading. These charges are calculated and applied in different ways, depending on the type of trading product. Forex Trading: In the context of Forex trading, One Financial Markets charges a variable spread starting from 1 pip on the USD/EUR. It’s important to note that no commissions are charged when trading Forex. Traders have the flexibility to trade both mini and micro-lots. Financing Fees: Financing fees are another aspect of the fee structure at One Financial Markets. These fees are calculated on the last day of every month using the applicable exchange rates or instrument price and their rate adjustment of LIBOR + 1%. The financing fee charge is calculated as follows: Volume in lots x financing fee x minimum price increment. CFDs: When it comes to trading Contracts for Difference (CFDs), commissions are charged, but the exact amount is not specified. Non-Interest Account: One Financial Markets also offers the possibility of having a ‘non-interest’ account. However, the specifics of how this type of account operates and any associated fees are not clearly stated. It’s always recommended for traders to thoroughly understand the fee structure of any trading platform before starting to trade. This helps in making informed trading decisions and managing trading costs effectively.

What can I trade with One Financial Markets?

One Financial Markets is a global, award-winning online broker that provides 24/5 trading facilities to private and institutional investors. Here are the key offerings:. Forex: One Financial Markets offers a wide range of forex trading options. Traders can trade various currency pairs, enjoying leverage of up to 500:1. CFDs on Shares: Traders can trade Contracts for Difference (CFDs) on shares from top brands and companies. They offer trading on 50 leading stocks from one platform on MT4, with more stocks available on MT5. Indices: One Financial Markets allows trading on various global indices. Bullion: Trading in precious metals like gold and silver is also available. Commodities: Traders can trade in various commodities. Energies: Trading options also include various energy commodities. Cryptocurrencies: One Financial Markets offers cryptocurrency trading with up to 200:1 leverage on Bitcoin and Ethereum, and up to 100:1 leverage on Litecoin, Stellar, Ripple, Chainlink, and other coins. Please note that Forex and CFDs are high-risk leveraged products. It’s important to understand the risks involved in trading these financial instruments. One Financial Markets provides educational resources to help traders gain confidence and knowledge on trading the financial markets.

Which Trading Platforms are offered by One Financial Markets?

One Financial Markets offers a variety of trading platforms to cater to the diverse needs of forex traders. Here are the details:. ONE MT4: This is a world-leading platform preferred by the majority of retail traders. It’s fully equipped to support your trading needs with unparalleled immediacy, reliability, and integrity. Being a downloadable platform, it puts less pressure on internet connection compared to browser-based platforms. It also permits the use of Expert Advisor assistance. ONE WEB TRADER: This platform provides a seamless trading experience without the need for any downloads or installations. It’s a browser-based platform, making it accessible from any device with an internet connection. ONE MT4 MOBILE: For traders who prefer to manage their trades on the go, One Financial Markets offers the ONE MT4 Mobile platform. This platform provides all the functionality of the desktop version, optimized for a mobile interface. Each of these platforms is designed to provide traders with access to the forex market, along with a wide range of trading tools. These include technical analysis from one of the world’s leading independent technical analysis research houses, Trading Central. This provides investors with all the necessary tools to help make informed trading decisions through their series of insightful technical analysis reports and daily newsletters. Please note that forex trading involves significant risk, and it’s important to understand these risks before starting to trade.

Which Trading Instruments are offered by One Financial Markets?

One Financial Markets, a global, award-winning online broker, provides 24/5 trading facilities to private and institutional investors. The firm offers a wide range of trading instruments, catering to diverse trading needs and strategies. Forex and CFDs: One Financial Markets specializes in forex and Contracts for Difference (CFDs) trading. CFDs are complex instruments that come with a high risk of losing money rapidly due to leverage. They allow traders to speculate on the rising or falling prices of fast-moving global financial markets or instruments, including shares, indices, commodities, currencies, and treasuries. Shares: Traders can trade CFDs on shares of the top 50 brands on the MT4 platform. These include brands from the UK, EU, and US markets. There are no minimum commission requirements, and the commission is 20 basis points. More stocks are available on the MT5 platform. Indices, Bullion, Commodities, Energies, and Cryptocurrencies: In addition to forex and shares, One Financial Markets also offers trading facilities for indices, bullion, commodities, energies, and cryptocurrencies. This wide range of instruments allows traders to diversify their portfolios and hedge against market volatility. Trading Platforms: One Financial Markets provides online forex trading through the MetaTrader 4 Platform. The MT4 platform is highly regarded for its wide-ranging functionality, which accommodates the demands of all traders and their personal trading strategies. The firm also offers the MT5 platform for trading. In conclusion, One Financial Markets offers a comprehensive suite of trading instruments, making it a preferred choice for many traders globally.

Which Trading Servers are offered by One Financial Markets?

One Financial Markets, a global online broker, offers a variety of trading servers to cater to the diverse needs of private and institutional investors in forex and CFDs. ONE MT4 is one of their primary offerings. This platform is highly regarded for its wide-ranging functionality, which accommodates the demands of all traders and their personal trading strategies. As a downloadable platform, it puts less pressure on internet connection compared to browser-based platforms. The ONE MT4 platform supports trading needs with unparalleled immediacy, reliability, and integrity. It permits the use of Expert Advisor assistance, further enhancing its appeal to traders. The platform has specific download requirements, including an operating system of Windows 7 or above, a CPU requirement of 1.0 GHz, a minimum of 512 RAM, a screen resolution requirement of a minimum of 1024 x 768, and internet requirements of a modem/connection speed of 36.6 Kbps or faster. In addition to ONE MT4, One Financial Markets also offers ONE WEB TRADER and ONE MT4 MOBILE. , providing traders with flexibility and convenience to trade from anywhere. Please note that forex and CFDs are high-risk leveraged products. It’s important for traders to understand the risks involved before engaging in trading activities. For more detailed information, you may want to visit the official website of One Financial Markets.

Can I trade Crypto with One Financial Markets? Which crypto currencies are supported by One Financial Markets?

One Financial Markets is a global, award-winning online broker providing 24/5 trading facilities to private and institutional investors in forex and CFDs on shares, indices, bullion, commodities, energies, and cryptocurrencies. They offer a trading platform for cryptocurrency, where you can invest in cryptos 24/7 with up to 200:1 leverage. Cryptocurrencies are one of the world’s fastest-growing investment asset classes. Following the rise of Bitcoin (BTC) – whose value soared from $1,000 to almost $20,000 in a few months – interest in cryptocurrencies has soared. The creation of new digital currencies, combined with traditionally volatile markets, has turned cryptos into a popular and widely accepted form of investment. With One Financial Markets, you can buy and sell a wide range of crypto coins 24/7, with no commission. Please note that cryptocurrencies are only available to Professional clients, or to Retail clients as “close only” positions. Some of the most popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), but there are many others. Each of these cryptos has subtle differences, making it near-impossible to describe ALL cryptocurrencies collectively. One Financial Markets offers Bitcoin (BTC) trading alongside other major cryptocurrencies. They offer up to 200:1 leverage on Bitcoin and Ethereum, and up to 100:1 leverage on Litecoin, Stellar, Ripple, Chainlink, and other coins. In conclusion, One Financial Markets provides a platform for trading a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Stellar, Ripple, Chainlink, and others. This makes it a viable option for those interested in diversifying their investment portfolio to include digital assets. However, potential investors should be aware of the risks associated with trading cryptocurrencies, given their volatility and the fact that they are not recognized as legal tender in the same way as fiat currencies.

What is the Leverage on my One Financial Markets Trading Account?

Leverage is a key aspect of trading with One Financial Markets, particularly in the context of forex trading. It’s important to understand that leverage can significantly amplify both profits and losses. What is Leverage?. Leverage in forex trading is a tool that allows traders to open positions much larger than their own capital. The trader needs only to invest a certain percentage of the position, which is affected by many factors and changes between instruments, brokers, and platforms. Leverage is expressed as a ratio, for instance 30:1, 100:1, or 500:1. Depending on the country and the specific regulations, maximum leverage can vary. Leverage at One Financial Markets. The specific leverage available on a One Financial Markets trading account can vary. The company’s website mentions that Contract for Difference (CFDs) are complex instruments and come with a high risk of losing money rapidly due to leverage. It’s noted that 75.5% of retail investor accounts lose money when trading CFDs with this provider. However, the exact leverage ratio is not specified on the website. Understanding the Risks. While leverage can amplify profits, it also increases the potential for losses. The higher the leverage, the higher the level of risk. The use of leverage in trading is often likened to a double-edged sword, since it magnifies both gains and losses. Conclusion. In conclusion, while One Financial Markets does offer leveraged trading, the specific leverage ratio isn’t clearly stated on their website. It’s crucial for traders to understand the implications of leveraged trading and ensure they manage their risk effectively. As always, it’s recommended to seek advice from a financial advisor or conduct thorough research before engaging in leveraged trading.

What kind of Spreads are offered by One Financial Markets?

One Financial Markets, a forex and CFDs broker headquartered in London, UK, offers a variety of spreads to its traders. The spreads that traders can expect from One Financial Markets start from 0.7 pips EUR/USD. The spreads will differ between financial instruments, depending on the market conditions, position size, and account type that traders use when they trade. One Financial Markets’ spread list is transparent and competitive. Here are some details about the spreads and fees:. Forex: The spread starts from 1 pip on the USD/EUR. Zero commissions are charged when trading forex. Traders can trade both mini and micro-lots and there are no overnight fees. CFDs: CFDs have commissions that are charged but the exact amount is not specified. . It’s important to note that market prices can widen at illiquid times of the day or when major news or economic data is released. The ‘indicative’ spread shows the tightest spread available for any given product. The ‘average’ and ‘typical’ spread shows the average (mean) and the most common (mode) respectively in a 24-hour period and are updated daily. Overall, One Financial Markets provides a range of competitive spreads, making it a viable choice for traders in the forex market.

Does One Financial Markets offer MAM Accounts or PAMM Accounts?

One Financial Markets is a forex and CFD broker that offers two types of accounts: standard and professional. However, it does not offer MAM or PAMM accounts, which are alternative ways of managing multiple trading accounts using a single terminal or platform. MAM stands for Multiple Account Manager, which allows traders to combine individual trader accounts into a large pool of managed funds that can be traded from one master account. MAM accounts make use of combining individual trader accounts into a large pool of managed funds that comprises of individual trader accounts as well as investor accounts. PAMM stands for Percentage Allocation Money Manager, which allows investors to allocate funds to account (money) managers, who can then trade from one master account using the pooled funds. PAMM accounts are predominantly used in forex, providing investors with the opportunity to profit from trading, without needing to carry out technical analysis or take positions themselves. One Financial Markets does not offer MAM or PAMM accounts because it is an offshore broker that is registered with the VFSC and FMA. These regulators do not allow brokers to offer these services, as they may pose risks to investors’ funds and personal information. One Financial Markets also does not provide any copy trading service for aspiring investors who want to follow the strategies of successful traders. If you are looking for a broker that offers MAM or PAMM accounts, you may want to consider other options such as ForexChief. , Coinexx. , Skilling.com. , or Vantage. These brokers have different features and benefits that may suit your trading style and goals. However, you should always do your own research and due diligence before choosing a broker or opening an account. Trading forex and CFDs involves high risk and is not suitable for everyone.

Does One Financial Markets allow Expert Advisors?

One Financial Markets and Expert Advisors. One Financial Markets, a global online broker, does permit the use of Expert Advisors (EAs) as a system to assist clients in making their investment decisions. What are Expert Advisors?. Expert Advisors (EAs) are automated trading systems written in MQL4 programming language and designed for operation under MetaTrader 4. They monitor and trade financial markets using algorithms, finding opportunities according to the parameters set by the user. EAs can either notify the user about these opportunities or open a position automatically. One Financial Markets’ Policy on Expert Advisors. While One Financial Markets allows the use of EAs, it has specific policies in place. The company reserves the right to suspend or cancel its trading services and void any trades with clients who are deemed to be trading on materially incorrect prices or abusing their price feeds. Furthermore, One Financial Markets does not accept EAs that are written with the intention of sniping, hyperactivity, or any other actions designed to take advantage of non-directional trading-related activities. Conclusion. In conclusion, while One Financial Markets does allow the use of Expert Advisors, it has specific policies to ensure fair and ethical trading practices. Traders considering using EAs with One Financial Markets should be aware of these policies to ensure their trading activities align with the company’s guidelines.