OspreyFX Review 2026

What is OspreyFX?

OspreyFX is an Electronic Communications Networks (ECN) forex broker. that provides a secure online trading environment. It offers industry-leading pricing and a wide range of tradable assets. Key Features:. Leverage: OspreyFX offers up to 1:500 leverage on Forex, Cryptos, Stocks, and Commodities. Tradable Assets: It provides over 120 tradable assets, including Forex, Crypto, Stocks, Indices, and Commodities. Execution: It offers full Straight Through Processing (STP) execution. Spreads: OspreyFX provides top-notch conditions for scalping and EAs with spreads from 0.1 pips. Liquidity: Traders can benefit from the institutional-grade liquidity of the top investment banks. Support: It offers 24/7 dedicated support. Trading Tools: It provides high-quality educational content, trading calculators, economic calendars, and more. Customer Reviews: Customer reviews on Trustpilot indicate mixed experiences. Some users praised the platform for its low latency, ultra-fast execution trade, and performance-driven technology. However, some users expressed dissatisfaction with their experiences. Please note that while OspreyFX offers a range of features and opportunities, trading in Forex and other financial instruments always carries a risk. It’s important to understand these risks and to trade responsibly.

What is the Review Rating of OspreyFX?

- 55brokers: 55brokers rated OspreyFX with a score of 40. This rating was last checked at 2024-01-06 06:50:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated OspreyFX with a score of 6. This rating was last checked at 2024-01-05 21:16:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated OspreyFX with a score of 24. This rating was last checked at 2024-03-12 15:43:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of OspreyFX?

OspreyFX, an offshore ECN broker, offers several advantages that make it a compelling choice for traders. Here are some of the key benefits:. Wide Range of Trading Instruments: OspreyFX offers over 200 trading instruments across a variety of asset classes. This includes CFDs on forex, commodities, indices, cryptocurrencies, US shares, and EU shares. Low Minimum Deposit: The broker has a low minimum deposit requirement, making it accessible to beginners in trading. Competitive Commissions and Spreads: OspreyFX offers trading at low spreads and commissions. Competitive spreads begin at just 0.4 pips. Multiple Account Types: The broker provides multiple account types to suit every trader. High Leverage: Particularly for forex trading, high leverage options are available. User-Friendly Navigation: The broker’s website is very user-friendly, making it easier for traders to find answers to their questions. Educational and Research Resources: OspreyFX provides lots of educational and research resources, creating a low-cost trading environment. Quick Customer Support: Despite not having a contact number, they offer a “get a call back” service in the customer support section. Funded Trading Accounts: OspreyFX stands out for its funded trading accounts where traders can keep up to 70% of profits. Please note that despite these positives, OspreyFX is not yet licensed by any regulatory authority. It’s always important to consider the regulatory status of a broker when making your decision.

What are the Cons of OspreyFX?

OspreyFX is an online ECN forex and CFD broker that offers its clients access to the MT4 and MT5 trading platforms and various trading instruments. However, like any other broker, it also has some drawbacks that you should be aware of before opening an account with them. Here are some of the cons of OspreyFX:. Unregulated broker: OspreyFX is not licensed by any regulatory authority, such as the FCA or ASIC. This means that there is no legal protection or recourse for traders in case of any disputes, fraud, or misconduct by the broker. You may also face difficulties in withdrawing your funds or resolving any issues with your account. No contact number: OspreyFX does not have a phone number to contact their customer support. You can only reach them via email or their online chat service. This may limit your ability to get timely and effective assistance in case of any problems or questions. Lack of stock instruments: OspreyFX does not offer CFDs on stocks from major US exchanges, such as the NYSE or NASDAQ. This may limit your trading opportunities and diversification if you are interested in investing in US companies. Inactivity fee charged after 60 days of no trading activity on the account: OspreyFX charges a monthly fee of $10 if you do not trade on your account for more than 60 days. This may discourage you from maintaining a regular trading schedule and losing money due to market fluctuations. Commission charges on some account types: OspreyFX has different account types with different spreads and commissions. The commission-free account has higher spreads than the standard account, which charges $6 per lot round turn. The commission-based accounts have lower spreads but charge $8 per lot round turn for ECN accounts and $10 per lot round turn for VIP accounts. . These are some of the cons of OspreyFX that you should consider before deciding to trade with them. Of course, there may be some pros as well, such as low minimum deposit requirements, fast account opening, multiple payment methods, crypto trading and funding options, etc. You should weigh the pros and cons carefully and do your own research before choosing a broker that suits your needs and preferences.

What are the OspreyFX Current Promos?

OspreyFX, a popular platform in the Forex market, is currently offering a variety of promotions to attract new traders and retain existing ones. Here are some of the key promotions:. Discount Codes: OspreyFX provides several discount codes that traders can use to get a percentage off their trades. For instance, there’s a code that offers a 41% discount. Another code provides a 20% discount. These codes are a great way for traders to save money on their trades. Giveaways and Contests: OspreyFX regularly holds giveaways and contests. These events provide traders with the opportunity to win prizes and bonuses. For example, there was a Cyber Monday Sale where traders could get 40% off on all Challenges. There was also a Black Friday promotion that offered a 35% discount on every Challenge. Funded Account Challenge: This is a unique promotion where traders can get a 35% discount on the Funded Account Challenge. This challenge allows traders to prove their trading skills and get a funded account if they succeed. These promotions not only provide financial benefits to traders but also create a competitive and exciting trading environment. They encourage traders to improve their trading skills and strategies. However, traders should always remember that trading involves risks and they should trade responsibly. Please note that these promotions are subject to terms and conditions and may change over time. Traders are advised to check the OspreyFX website or contact their customer service for the most current information.

What are the OspreyFX Highlights?

OspreyFX is a notable player in the financial markets, offering a range of features that make it a competitive choice for traders. Here are some of the key highlights:. Established Presence: OspreyFX has been active in the financial markets since 2018. , establishing a solid reputation over the years. Trading Platform: OspreyFX utilizes the MetaTrader 4 trading platform. , a popular choice among traders for its user-friendly interface and comprehensive features. Minimum Deposit: The minimum deposit at OspreyFX is 25 USD. , making it accessible for traders with varying levels of capital. Leverage: OspreyFX offers competitive leverage rates, with the maximum leverage reaching up to 1:500. Trading Options: OspreyFX provides a wide range of trading options, including Forex, Crypto, Stocks, Indices, and Commodities. Spreads: OspreyFX offers tight spreads, with the minimum spread on the EUR/USD currency pair being 0.8 pips. Customer Service: OspreyFX provides customer service via email and live chat. , ensuring that traders can get the support they need when they need it. Deposit and Withdrawal Methods: OspreyFX offers a variety of methods for depositing and withdrawing funds, including Wire transfer, VISA, MasterCard, Bitcoin, Instacoins, UPayCard, VLoad, and Zelle. Please note that while OspreyFX offers many advantages, it’s important to understand the risks associated with trading. Between 74% and 89% of retail investors lose money when trading CFDs. Always ensure you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is OspreyFX Legit and Trustworthy?

OspreyFX is a forex broker that has been active in the financial markets since 2018. It uses the MetaTrader 4 trading platform and requires a minimum deposit of 25 USD. However, the legitimacy and trustworthiness of OspreyFX are subjects of debate. On one hand, some users have reported a positive experience with OspreyFX. For instance, a user mentioned that they had a drama-free experience with OspreyFX, with pleasant day-to-day trading, deposits, transfers, withdrawals, and customer support. They also mentioned that they made $420 in commissions so far through their affiliate link. On the other hand, there are also negative reviews about OspreyFX. Some users have reported issues with withdrawals and customer service. One user mentioned that they had to contact OspreyFX for a week straight to resolve an issue with their withdrawal. Another user described OspreyFX as a company full of crooks that only commit evil. Moreover, OspreyFX is registered in an offshore zone. , which is a significant red flag for traders. Offshore registration often means less regulation and oversight, which can lead to potential issues for traders. Therefore, while OspreyFX’s offerings might be attractive, its offshore registration raises questions about its reliability and trustworthiness. In conclusion, while some users have had positive experiences with OspreyFX, the negative reviews and the broker’s offshore registration suggest that traders should exercise caution when dealing with OspreyFX. It’s always recommended to thoroughly research any broker before deciding to invest your money.

Is OspreyFX Regulated and who are the Regulators?

OspreyFX is an online ECN forex and CFD broker that has been operating since 2019. The company is based in St. Vincent and the Grenadines. Despite its offshore status and the lack of regulation, OspreyFX has gained considerable attention in the forex trading community. However, it’s important to note that as of now, OspreyFX is not regulated by any recognized financial regulatory authority. This means that while the company may offer attractive trading conditions, it does not provide the same level of investor protection as a regulated broker would. Despite this, OspreyFX claims to have applied for multiple regulations. It’s also worth noting that some sources suggest that OspreyFX is regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines. However, this information is contradictory as other sources clearly state that OspreyFX is not regulated. In conclusion, while OspreyFX offers a range of trading instruments and platforms, potential investors should be aware of the risks associated with trading with an unregulated broker. It’s always recommended to conduct thorough research and consider trading with a regulated broker for added security and peace of mind.

Did OspreyFX win any Awards?

OspreyFX, a prominent player in the Forex trading industry, has not directly won any awards. However, they have gained recognition for their innovative initiatives and competitions that provide traders with opportunities to win substantial prizes. One of their notable initiatives is the Funded Trader Challenge. This program allows traders to prove their skills and get funded up to $200,000. The challenge consists of three stages, each with specific requirements and benefits. Traders start with a demo stage to become familiar with the platform, then move on to a verification stage to further prove their skills, and finally, they get funded and can start trading with a real account. In addition to the Funded Trader Challenge, OspreyFX has also organized several live trading competitions. These competitions offer traders the chance to test their skills, compete, and earn big prizes. Some of the past competitions include:. Go for Gold Trading Competition: In this competition, traders had the opportunity to win one of two PlayStation 5s by trading gold or silver. Christmas Competition: This competition had five winners and a total giveaway of $1,900. New Year Competition: This competition allowed traders to turn $50 into $2,000. $80k Trader’s Competition: This was a major competition with a total prize giveaway of $80,000. These competitions and initiatives demonstrate OspreyFX’s commitment to providing exciting opportunities for traders to showcase their skills and earn significant rewards. While these are not traditional “awards,” they do contribute to the company’s reputation in the Forex trading industry. Please note that all information is accurate as of the last update and may be subject to change. For the most recent and detailed information, please visit the official OspreyFX website.

How do I get in Contact with OspreyFX?

OspreyFX, a renowned player in the forex market, offers multiple avenues for potential traders and customers to get in touch with them. Here are some of the ways you can contact OspreyFX:. Email Support One of the primary methods of communication with OspreyFX is through email. You can reach out to their support team at support@ospreyfx.com for any queries or assistance. Live Chat OspreyFX also offers a live chat feature on their website. This feature allows you to chat with their support team in real-time. To access the live chat, simply visit their website and click on the live chat bubble located at the bottom right of the page. Contact Form Another way to get in touch with OspreyFX is by filling out the contact form on their website. The form requires your first name, last name, email address, and phone number. Once you fill out and submit the form, a member of the OspreyFX support team will get back to you within 24 hours. Request a Callback If you prefer to speak directly with a support agent, OspreyFX offers a callback service. You can request a callback by filling out a form on their website, providing your first name, last name, email address, and phone number. One of their support agents will then call you back to assist with account sign up, general queries, and account management. Remember, OspreyFX is committed to providing excellent customer service and is available 24/7 to assist their traders.

Where are the Headquarters from OspreyFX based?

OspreyFX, a prominent player in the forex trading industry, is headquartered in a location that might surprise some. The company’s headquarters are situated in the Caribbean, specifically in Kingstown, St Vincent and the Grenadines. This location is at the Beachmont Business Centre, Suite 4, Kingstown, St Vincent and the Grenadines, K001. The company operates under the name Osprey Ltd, with the company number being 25288 BC 2019. Operating from an offshore location allows OspreyFX to offer its clients a high leverage of up to 500:1. This is particularly attractive to traders looking for high-risk, high-reward opportunities. Additionally, the company’s offshore status enables it to accept US traders who are seeking to avoid domestic regulatory restrictions. OspreyFX prides itself on offering 24/7 live customer support. Traders can get in touch with the company’s support team via email at [email protected]. The company promises to respond to all queries within 24 hours. In conclusion, OspreyFX, with its strategic location in St Vincent and the Grenadines, offers a unique proposition to forex traders worldwide. Its high leverage options and acceptance of US traders make it a noteworthy player in the forex trading industry.

What kind of Customer Support is offered by OspreyFX?

OspreyFX, a prominent player in the forex market, offers a comprehensive customer support system to cater to the diverse needs of its traders. 24/7 Live Customer Support OspreyFX provides round-the-clock live customer support. Traders can reach out to the support team at any time by filling in a form available on their website. The support team is committed to responding within 24 hours. Live Chat In addition to the form-based contact method, OspreyFX also offers a live chat feature. Traders can initiate a live chat by clicking on the Live Chat bubble located at the bottom right of their website. This feature allows for real-time interaction with the support team, providing immediate assistance to traders. Call Back Service OspreyFX also offers a call back service. Traders can request a call back from the support team for assistance with account sign up, general queries, and account management. To use this service, traders need to fill in a form on their website, providing their contact details and consent to terms and conditions. Account Management Assistance The customer support at OspreyFX extends to assisting traders with account management. This includes help with signing up for an account and managing existing accounts. In conclusion, OspreyFX’s customer support system is designed to provide timely and effective assistance to its traders, ensuring a smooth and efficient trading experience. The multiple contact methods, including 24/7 live support, live chat, and call back service, coupled with account management assistance, make OspreyFX’s customer support a reliable resource for traders.

Which Educational and Learning Materials are offered by OspreyFX?

OspreyFX offers a comprehensive suite of educational and learning materials for those interested in Forex trading. These resources are designed to cater to both beginners and advanced traders, providing them with the knowledge and skills needed to navigate the Forex market successfully. One of the key offerings is the Forex Squad, an easy-to-use training platform that provides traders with everything they need to know to trade the Forex market. This platform is suitable for anyone who wants to learn to trade Forex, brush up on their knowledge, understand how the financial markets operate, or turn Forex trading into earning potential. OspreyFX’s partnership with Forex Squad allows traders to access E-learning materials for free. The learning process is simplified into three easy steps: signing up with OspreyFX, navigating to Education and clicking Join Forex Squad, and then starting the learning journey. The educational content covers a wide range of topics, including the basics of Forex trading, advanced Forex trading, Forex strategy tools and indicators, technical analysis, fundamental analysis, trading psychology, and tips to trade like a pro. Additionally, OspreyFX provides a library of educational content for beginners to advanced traders. This library includes topics such as the basics of precious metals trading, the benefits and risks of demo accounts vs live accounts, short selling, how to prepare a Forex news calendar, and more. OspreyFX also offers a set of trading calculators to help traders manage risk and monitor each trade position. These calculators provide an accurate assessment of the market, which can be a valuable tool for traders. Overall, OspreyFX’s educational and learning materials provide a comprehensive and accessible resource for anyone looking to enhance their Forex trading skills and knowledge.

Can anyone join OspreyFX?

OspreyFX, a prominent player in the forex market, offers a platform for trading a wide range of assets, including Forex, Crypto, Stocks, Indices, and Commodities. However, the eligibility to join OspreyFX is subject to certain conditions. Firstly, the prospective trader must be over 18 years of age. This is a standard requirement across most trading platforms to ensure legal compliance and protect minors. Secondly, OspreyFX is not available in certain regions and countries. Therefore, the trader’s location could affect their ability to join the platform. It’s advisable for potential users to check if their country is on the list of restricted countries on the OspreyFX website. Thirdly, the minimum deposit to start trading on OspreyFX is 25 USD. This makes the platform accessible to a wide range of traders, from beginners to seasoned professionals. Lastly, while not a requirement for joining, it’s worth noting that OspreyFX is an ECN broker offering up to 1:500 leverage. This high leverage can amplify both profits and losses, so it’s crucial for traders to have a solid understanding of risk management. In conclusion, while anyone over 18 years of age, not residing in a restricted country, and able to make the minimum deposit can technically join OspreyFX, successful trading on the platform requires a good understanding of forex trading and risk management principles. As with any investment, potential traders should do their due diligence before starting to trade on OspreyFX or any other platform. Please note that OspreyFX is an overseas-based broker that is not regulated. This does not automatically imply any fraudulent activities, but potential traders should exercise caution when dealing with such providers.

Who should sign up with OspreyFX?

OspreyFX, an offshore ECN broker established in 2019, offers a wide range of trading instruments and platforms, making it an attractive option for various types of traders. Here are some key points to consider:. 1. Variety of Trading Instruments: OspreyFX offers over 200 trading instruments across multiple asset classes, including forex, commodities, indices, cryptocurrencies, US shares, and EU shares. This wide selection caters to traders with diverse investment interests. 2. User-Friendly Platforms: The broker provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are known for their user-friendly interfaces and comprehensive features, catering to both novice and experienced traders. 3. Low Trading Costs: OspreyFX offers a low-cost trading environment with competitive commissions and low spreads. This can be beneficial for traders who execute a high volume of trades. 4. Accessibility: With a minimum deposit requirement of just $10. , OspreyFX makes forex trading accessible to individuals with varying levels of capital. 5. Education and Research Resources: The broker provides a wealth of educational and research resources. This can be particularly useful for beginners who are still learning about forex trading. However, it’s important to note that OspreyFX is currently unregulated. While they have applied for multiple regulations, they are not yet licensed by any regulatory authority. This might be a point of concern for traders who prioritize regulatory oversight. Despite this, many clients claim to have a sense of security during their experience. In conclusion, OspreyFX could be a good fit for traders who value a wide range of trading instruments, user-friendly platforms, low trading costs, and educational resources. However, the lack of regulation might be a deterrent for some. As always, potential users should conduct thorough research and consider their individual trading needs and risk tolerance before signing up with any broker.

Who should NOT sign up with OspreyFX?

OspreyFX is a forex broker and prop firm that offers funded accounts, affiliate accounts, and a proprietary trading platform. However, not everyone should sign up with OspreyFX, as there are some drawbacks and risks involved. Here are some reasons why you should avoid OspreyFX: OspreyFX is unregulated. OspreyFX does not have any licenses or certifications from any reputable financial authorities, such as the FCA, ASIC, CySEC, or NFA. This means that OspreyFX is not subject to any oversight or regulation by these bodies, which could expose traders to potential fraud, manipulation, or mismanagement of their funds. Unregulated brokers also have less protection for traders in case of disputes or complaints. OspreyFX has some regulatory concerns. According to some sources. , OspreyFX has been involved in some legal issues and investigations in the past. For example, in 2019, OspreyFX was accused of being part of a forex scam called “The Forex Club” by the US Department of Justice. In 2020, OspreyFX was sued by a former employee for breach of contract and fraud. These incidents could damage the reputation and credibility of OspreyFX and affect its ability to operate legally and safely. OspreyFX has low profit splits. OspreyFX claims that it offers a 70/30 profit split for its funded accounts, meaning that traders can keep 70% of their profits after meeting the profit target. However, this does not include the fees that traders have to pay upfront to open an account with OspreyFX. These fees can range from $220 to $999 depending on the account type. Therefore, the actual profit margin for traders could be much lower than 70/30. OspreyFX has high minimum deposits. To open an account with OspreyFX, traders have to deposit at least $25k for the basic account, $50k for the starter account, $100k for the pro account, or $200k for the advance account. These amounts are quite high compared to other brokers in the industry. Moreover, these deposits are refundable only if traders fail to meet their performance targets within a specified time frame. In conclusion, OspreyFX is not a suitable broker for everyone. It has some advantages such as competitive leverage rates and spreads, modern trading tools, and various tradeable assets. However, it also has many disadvantages such as being unregulated. , having regulatory concerns. , having low profit splits, and having high minimum deposits. Therefore, you should do your own research before signing up with OspreyFX or any other broker.

Does OspreyFX offer Discounts, Coupons, or Promo Codes?

Yes, OspreyFX does offer discounts, coupons, and promo codes. Here are some details:. OspreyFX Coupon Codes. The best OspreyFX coupon code available is CYBER41. This code gives customers 41% off. Another OspreyFX coupon code is CHARISFX20 which offers 20% off. There are 7 active OspreyFX coupon codes as of December 2023. Additional Discounts. There is a discount code SBOCOUPON20 for 20% OFF for new customers. There are also offers like MOVINGAVERAGE50 which provides 50% off the normal price on select list of funded trading programs. How to Apply OspreyFX Coupon Codes. To apply these coupon codes, you need to enter the code at the checkout page. Please note that these codes and discounts can change and it’s always a good idea to check for the latest offers. Also, some of these codes might be single-use or may have expired, so their effectiveness can vary. In the context of forex, these discounts can significantly reduce the cost of trading and increase potential profits. However, it’s important to remember that trading forex involves risk, and discounts should not be the sole factor in choosing a forex broker. Always consider factors like security, customer service, and trading platform quality as well. Please note that this information is accurate as of December 2023 and may have changed. Always check the official OspreyFX website or reliable coupon websites for the most current information.

Which Account Types are offered by OspreyFX?

OspreyFX offers four distinct account types, each tailored to different trading needs and styles. These account types are:. Standard ECN Account: This account type is characterized by medium spreads on major pairs and a commission of $7.00. It’s a great choice for traders who prefer a balance between cost and performance. Pro ECN Account: The Pro ECN account offers low spreads with a slightly higher commission of $8.00. This account type is ideal for professional traders who prioritize tight spreads. VAR Account: The VAR account stands out for having no commission and higher spreads. This account type may appeal to traders who prefer a straightforward cost structure without the added complexity of commissions. Mini Account: The Mini account offers smaller lot sizes (Contract size is x100 smaller) with a commission of $1.00. This account type is perfect for beginners or those who prefer to trade in smaller volumes. Each account type comes with its own set of features and benefits, allowing traders to choose the one that best fits their trading strategy and risk tolerance. With OspreyFX, traders can benefit from multiple account types within one trading account. Please note that different account types are only available for Forex and certain symbols. Also, the .mini pairs are available for Indexes at a $7 commission rate. In terms of trading conditions, all account types offer up to 1:500 leverage, a minimum lot size of 0.01, and a maximum lot size of 1000. However, each account type comes with different minimum deposit requirements, as well as spreads and commission fees. OspreyFX’s flexible account offerings make it a suitable choice for a wide range of traders, from beginners to seasoned professionals. Whether you prioritize low spreads, no commissions, or smaller lot sizes, there’s an account type for you at OspreyFX.

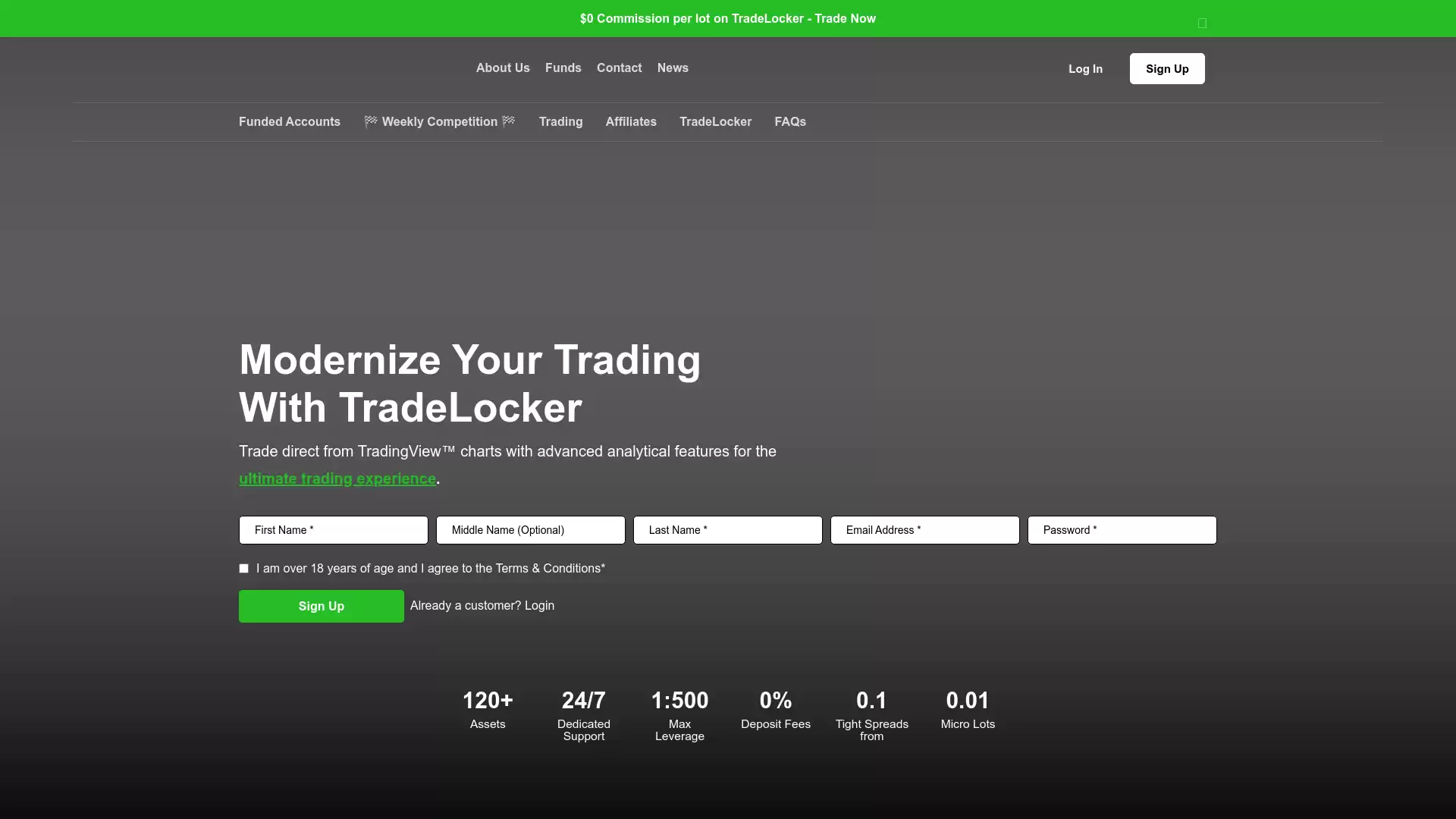

How to Open a OspreyFX LIVE Account?

Opening a live account with OspreyFX, a lightning fast ECN forex broker offering up to 1:500 leverage on Forex, Cryptos, Stocks, and Commodities. , involves a few simple steps. Step 1: Visit the OspreyFX Website Start by visiting the official OspreyFX website. This is where you’ll find all the information you need about the different types of accounts they offer. Step 2: Choose the Right Account OspreyFX offers several types of accounts, each with its own features and benefits. For instance, the ECN Account offers market execution, trading from a chart, stop orders and trailing stop, a tick chart, and trading history. You can compare the different accounts to find one that suits your trading style. Step 3: Sign Up Once you’ve chosen the right account, you can proceed to sign up. You’ll need to agree to the Terms & Conditions before you can start trading. Step 4: Fill in the Required Fields You’ll be redirected to the Signup page, where you’ll need to fill in the required fields. Make sure you fill in all the boxes. Any missing information will be marked in red. Step 5: Start Trading After you’ve completed the signup process, you can start trading. The powerful TradeLocker trading system allows you to implement strategies of any complexity. Remember, trading involves risk and it’s important to understand the markets and your chosen trading strategy before you start trading live.

How to Open a OspreyFX DEMO account?

Opening a demo account with OspreyFX is a straightforward process that allows you to start trading with unlimited funds and flexible leverage up to 1:500. Here’s a step-by-step guide:. Step 1: Visit the OspreyFX Website Navigate to the official OspreyFX website. Step 2: Sign Up for a Demo Account Look for the option to sign up for a demo account. This will allow you to start trading with an unlimited amount of funds. Step 3: Agree to the Terms & Conditions Before you can start trading, you’ll need to agree to the terms and conditions. Step 4: Choose Your Trading Platform OspreyFX offers an unlimited number of MetaTrader Demo Accounts. and TradeLocker Demo Accounts. Choose the platform that best suits your trading needs. Step 5: Enter Your Details You’ll need to enter your name and email address. Step 6: Select Your Preferred Currency, Leverage, and Balance Choose your preferred currency, leverage, and balance. Step 7: Open Your Demo Account Finally, click on “Open Demo Account” to start trading. Please note that if you spend all your funds on a Demo Account, you will need to create a new account because the funds on a Demo Account cannot be topped up. Remember, a demo account is a great way to practice your trading strategies without risking real money. Happy trading! ?.

How Are You Protected as a Client at OspreyFX?

As a client at OspreyFX, you are protected in several ways:. 1. Segregated Fund Accounts OspreyFX ensures that your funds are always segregated and protected. Any and all funds deposited by clients are held either in the name of the client and/or held in the name of OspreyFX for the client in an independent bank account. This ensures that OspreyFX’s own funds and assets and client funds are tracked separately. At any time, they can quickly and accurately distinguish the funds which are being held for one client from those being held for another, as well as being able to distinguish their own funds. Client funds are kept off-balance and are never used to pay creditors in the unlikely event that OspreyFX were to close its doors. 2. Banking with Tier-One Banking Institutions OspreyFX works closely with its payment service providers to ensure fast and flawless deposits and withdrawals. They are currently connected with banks worldwide, including top financial institutions. 3. Risk Management OspreyFX regularly pinpoints, analyzes, monitors and regulates each type of risk connected with its day-to-day operations. The ongoing performance evaluation of the policies and procedures which they have in place allows OspreyFX to be able to cover all of their financial and capital requirements with ease. 4. STP Execution Model OspreyFX practices the STP execution model. This means that whenever clients execute a trade, there will be no dealing desk manipulation, nor any re-quotes. This also eliminates the possibility of any conflicts of interest. 5. Two-Factor Authentication (2FA) OspreyFX provides the option to enable Two-Factor Authentication (2FA) for added security. 6. Leverage OspreyFX offers leverage ranges at the disposal of their clients, which are 1:500 for Forex and Metals, 1:100 for Cryptos, 1:200 for energies, 1:50 for Indices, and 1:20 for stocks. In conclusion, OspreyFX takes several measures to protect its clients, including segregated fund accounts, banking with tier-one institutions, risk management, STP execution model, two-factor authentication, and offering leverage. These measures ensure that clients’ funds are secure and that they can trade with confidence.

Which Funding methods or Deposit Options are available at OspreyFX?

OspreyFX, a popular platform in the Forex trading world, offers a variety of deposit methods to cater to the diverse needs of its users. Bitcoin: One of the deposit methods available is Bitcoin. Users can deposit directly via Bitcoin by creating a deposit request inside their account and following the on-screen prompts. Once the Bitcoin lands, it will be auto-credited to the user’s account. Crypto: Apart from Bitcoin, OspreyFX also accepts other cryptocurrencies. This provides flexibility for users who prefer to use digital currencies for their transactions. Credit/Debit Cards: Users can fund their trading using major credit cards. If a user deposits by card, they must withdraw the same amount by card before taking profits via another method. Credit and Debit cards offer traders a method of payment that allows them to avoid the risks associated with paper money. These methods can be even more secure than funding via credit card as it does not include any interest on the amount deposited. PayRedeem: PayRedeem is another deposit option available at OspreyFX. This method adds to the array of options that users can choose from, based on their convenience. OspreyFX prioritizes the profit potential of its users and strives to provide a swift and seamless trading experience. They are constantly adding payment methods to enhance the convenience of depositing funds. Users can choose the deposit method that suits them best and start trading with ease. Please note that when depositing via credit or debit card, the total amount that can be legally funded back to your card is the same amount that you fund your trading account with. You can take all other profits out using either Bitcoin or Wire/Bank Transfer. OspreyFX works with leading financial providers, and there is a large array of companies and brands available to their clients. They work with big providers such as Visa, MasterCard, American Express, and countless other providers. The advantage of attaching your debit card to your trading account is that it provides instant access to your profits. Once you have closed a trade, you can withdraw the cash from an ATM soon after. In conclusion, OspreyFX offers a wide variety of deposit and withdrawal methods, catering to the diverse needs of its users. Whether you prefer traditional methods like credit/debit cards or modern methods like Bitcoin and other cryptocurrencies, OspreyFX has got you covered.

What is the Minimum Deposit Amount at OspreyFX?

OspreyFX, a popular online forex broker, offers a variety of deposit methods to cater to the diverse needs of its traders. The minimum deposit amount required to open a live trading account with OspreyFX varies depending on the deposit method:. For cryptocurrencies like Bitcoin, Litecoin, Ethereum, Ripple, DogeCoin, Tether (ERC20), Tether (TRC20), and USD Coin (TRC20), the minimum deposit amount is $10. The minimum deposit amount for PayRedeem depends on the PayRedeem tier level. For deposits made via Credit/Debit Card through various third-party providers, the minimum deposit amount ranges from $25 to $50. It’s important to note that every deposit method has its own minimum and maximum amount that needs to be deposited. This flexibility allows traders to choose the deposit method that best suits their financial situation and trading strategy. OspreyFX is known for its user-friendly interface and offers trading via the MetaTrader platforms for web, desktop, and mobile app. With a minimum deposit requirement of just $50. , OspreyFX provides an accessible platform for individuals who are new to forex trading or those who prefer to start with a smaller investment. Moreover, OspreyFX is an electronic communications networks (ECN) forex broker that offers online trading of Forex, Cryptos, CFD’s, Stocks, and Commodities with full straight through processing (STP) execution. This means that traders can expect a swift and seamless trading experience. In conclusion, OspreyFX’s low minimum deposit requirement, coupled with its diverse deposit methods and user-friendly trading platform, make it an attractive choice for both novice and experienced forex traders. As always, potential traders should conduct thorough research and consider their financial situation before starting to trade. Happy trading.

Which Withdrawal methods are available at OspreyFX?

OspreyFX, a popular forex trading platform, offers several methods for withdrawing funds. These methods are designed to provide flexibility and convenience to its users. Credit or Debit Cards The total amount funded to an OspreyFX account using a chosen Credit or Debit card is the total amount that can be legally returned to that card. This cap is set by anti-money laundering guidelines, not by OspreyFX. Bitcoin Profits can be taken out using Bitcoin. Users can create a withdrawal request inside their account and the OspreyFX team will process it the same day. The progress of the transaction can be tracked on blockchain.info. Wire/Bank Transfer Wire Transfer is another method available for users. Users can transfer money from their OspreyFX Wallet to their bank account. OspreyFX charges $25 for banking fees on withdrawals of up to 5K. Wire transfers can take up to 6 days but OspreyFX will have it processed on their end within 1 business day. For all current withdrawal methods, users need to sign-up and login, navigate to withdrawals, choose the method and follow the instructions. Please note that when a withdrawal is requested from an OspreyFX account, the funds will be returned to the same method of payment that was used to initially fund the OspreyFX account, unless an alternative OspreyFX withdrawal method is chosen.

Which Fees are charged by OspreyFX?

OspreyFX, a popular trading platform, charges a variety of fees that traders should be aware of. These fees are not standard across all trading platforms and may differ from other brokerage companies. Commission Fees: OspreyFX charges commission fees on their trading assets. These fees are subject to change as they are frequently monitored. The platform offers multiple instruments and forex pairs for all traders. Deposit Fees: While OspreyFX does not charge any deposit fee for any provided payment method, the cryptocurrency wallet’s service charges per transaction may apply. The deposit fees will vary depending on your 3rd party deposit method, the currencies involved with your OspreyFX deposit, the amount you are depositing to OspreyFX and your country of residence. Withdrawal Fees: OspreyFX does not charge any withdrawal fee. However, the blockchain might apply service charges. Inactivity Fee: OspreyFX does not charge an inactivity fee for dormant non-trading accounts. Spreads: The spreads are below the industry average for the standard account from 0.8 – 0.9 pips for major pairs. This is very attractive and enables traders to enjoy maximum profits with commission-free trading. Other Fees: OspreyFX does not charge account fees for standard OspreyFX trading accounts. There may be small fees when making deposits to OspreyFX. It’s important for traders to have a clear understanding of all OspreyFX commissions and fees when trading live financial markets. The OspreyFX trading platform imposes a variety of OspreyFX spreads and fees, depending on the type of financial instrument traded on OspreyFX or withdrawal methods requested on OspreyFX. Please note that all information is based on the data available as of 2023 and may be subject to change.

What can I trade with OspreyFX?

OspreyFX is a versatile ECN broker that offers a wide range of trading options. Here’s a detailed overview:. Forex: OspreyFX provides the opportunity to trade on major, minor, and exotic FX pairs. Major pairs include AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, and USD/JPY. There are also numerous FX crosses and exotic pairs available. Cryptocurrencies: OspreyFX offers a secure platform for trading a variety of digital currencies. When trading cryptocurrencies with OspreyFX, you’re trading on the price movement of the chosen digital coin, rather than physically purchasing the currency. Stocks: You can trade on a variety of stocks from different markets. This includes both EU and US shares. Indices and Commodities: OspreyFX allows for trading on various global indices and commodities. OspreyFX offers up to 1:500 leverage on Forex, Cryptos, Stocks, and Commodities. This high leverage can increase the potential for profit, but it also comes with increased risk. It’s important for traders to understand and manage this risk effectively. In addition to a wide range of trading options, OspreyFX also provides a number of features to support traders. This includes 24/7 dedicated support, fast and easy funding options, deep liquidity from leading, tier one, liquidity providers, and exclusive trading tools. Please note that trading involves risk and isn’t suitable for everyone. Always do your own research and consider your financial situation carefully before trading.

Which Trading Platforms are offered by OspreyFX?

OspreyFX, a well-known ECN broker, offers its clients access to two of the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely used by traders and are known for their advanced charting capabilities, extensive range of technical analysis tools, and ability to run expert advisors (EAs). MT4 and MT5 are market-leading platforms offered by many of the best brokers. They provide a secure ECN trading environment which permits traders to trade exclusively online. At OspreyFX, traders can benefit from institutional grade liquidity of the top investment banks, as well as completely transparent dark pool liquidity execution venues. In addition to Forex, OspreyFX allows traders to trade over 120 assets including Crypto, Stocks, Indices, and Commodities. They offer up to 1:500 leverage across these assets. This wide range of tradable assets and high leverage make OspreyFX a versatile platform for traders. OspreyFX also provides top-notch conditions for scalping and EAs with spreads from 0.1 pips. They offer fast and easy funding options, including deposit using Credit or Debit card, Bank Transfer or Crypto. Their dedicated client support team is available 24/7 to assist with any queries. In summary, OspreyFX offers a comprehensive trading experience with its advanced platforms, wide range of tradable assets, high leverage, and excellent customer support. Whether you’re a seasoned trader or just starting out, OspreyFX has the tools and resources to help you excel in the trading arena.

Which Trading Instruments are offered by OspreyFX?

OspreyFX offers a wide range of trading instruments to its clients. Here are the details:. Forex: OspreyFX provides access to 55 forex pairs. This includes major pairs like AUDUSD, EURUSD, GBPUSD, NZDUSD, USDCAD, USDCHF, and USDJPY. They also offer a variety of cross pairs and exotic pairs. Cryptocurrencies: OspreyFX offers trading in 31 cryptocurrencies. This includes popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The lot sizes for cryptocurrencies vary, with 1 for BTCUSD and BITUSD, 10 for DASHUSD, EOSUSD, ETHUSD, LTCUSD, NEOUSD, XMRUSD, ZECUSD, BATUSD, BCHUSD, BNBUSD, and SOLUSD, 100 for AVAUSD, OMGUSD, IOTAUSD, and ETCUSD, 1000 for ADAUSD and DOTUSD, and 10,000 for TRXUSD, XLMUSD, XRPUSD, DOGEUSD, and SHBUSD1000. Indices: OspreyFX offers trading in 9 indices. This includes popular indices like FTSE 100, IBEX 35, and Dow Jones 30. The lot size for indices is 100. Stocks: OspreyFX offers trading in 37 stocks. This includes popular stocks like Apple, Amazon, and Adidas. The lot size for stocks is 100. Metals: OspreyFX offers trading in metals like gold, silver, and platinum. The lot sizes for metals are 100 for XAUUSD and XAUEUR, 5,000 for XAGUSD, and 25,000 for COPPER. Commodities: OspreyFX offers trading in commodities like gas and oil. The lot sizes for energies are 10,000 for NGAS and 1,000 for UK and US OIL. In addition to these, OspreyFX also offers trading in futures with a lot size of 1000. They also provide free trading tools such as Margin Calculator, Swaps Calculator, Pip/Point Value, and Currency Converter for the convenience of its clients. Please note that the lot sizes mentioned above are subject to change and it’s always a good idea to check the latest information on the OspreyFX website.

Which Trading Servers are offered by OspreyFX?

OspreyFX, a well-known ECN forex broker, offers a variety of trading servers to its users. One of the key servers they offer is the Osprey-Live4 MT4 Server. , which is located in Singapore. This server is part of the MetaTrader 4 (MT4) platform, a market-leading platform offered by many of the best brokers. In addition to MT4, OspreyFX also provides the MetaTrader 5 (MT5) platform. These platforms are renowned for their reliability and are widely used in the forex trading industry. OspreyFX’s trading environment is secure and permits traders to trade exclusively online. They provide institutional grade liquidity from top investment banks, as well as completely transparent dark pool liquidity execution venues. This ensures that traders can benefit from industry-leading pricing. Furthermore, OspreyFX offers a leverage of up to 1:500 on Forex, Cryptos, Stocks, and Commodities with full STP execution. This high leverage can provide traders with the opportunity to maximize their profits. In conclusion, OspreyFX offers robust and reliable trading servers, making it a preferred choice for many forex traders. Their commitment to providing a secure trading environment, coupled with their provision of industry-leading platforms like MT4 and MT5, sets them apart in the forex trading industry.

Can I trade Crypto with OspreyFX? Which crypto currencies are supported by OspreyFX?

OspreyFX is a well-established forex broker that also offers cryptocurrency trading. This allows individuals to buy, trade, and invest in digital currencies without any involvement from banks or other financial institutions. The cryptocurrencies supported by OspreyFX include but are not limited to:. Bitcoin (BTC). Ethereum (ETH). Litecoin (LTC). OmiseGO. Monero. Ripple (XRP). Dogecoin. Shiba Inu. Cardano (ADA). Solana (SOL). Polkadot (DOT). Avalanche (AVAX). Stellar Lumens. Ethereum Classic. Binance Coin. Bitcoin Cash. Basic Attention Token. When a client trades cryptocurrencies on the OspreyFX trading platform, they are in fact trading on the price movement of the chosen digital coin, rather than physically purchasing the currency. This is a common practice in forex trading where traders speculate on the price movements of currency pairs. OspreyFX offers a secure way to trade from a wide selection of digital currencies. They provide a variety of advantages for trading cryptos such as starting trading with $10, 1:100 leverage, lightning-fast tight spreads, low commission, and the ability to trade as high as 10 lots. They also allow open multiple positions, hedging, scalping, and news trading. In conclusion, OspreyFX provides a comprehensive platform for trading a wide variety of top cryptocurrencies, making it a suitable choice for individuals interested in diversifying their trading portfolio beyond traditional forex markets.

What is the Leverage on my OspreyFX Trading Account?

OspreyFX, a lightning-fast ECN forex broker, offers a leverage of up to 1:500 on Forex, Cryptos, Stocks, and Commodities. This high leverage allows traders to control larger positions with a smaller amount of capital, potentially increasing the opportunity for profit. The specific leverage options provided by OspreyFX vary depending on the trading instrument. Forex: 1:500. Cryptos: 1:100. Stocks: 1:20. Metals: 1:200. Indices: 1:200. Energies: 1:200. However, if your trading account has equity of 500K USD or equivalent, the leverage for the below instruments are capped. Forex: 1:200. Cryptos: 1:50. Stocks: 1:20. Metals: 1:50. Indices: 1:50. Energies: 1:50. Please note that these leverage options may be subject to change during periods of market volatility. It’s always important to understand the risks associated with using high leverage, as it can also amplify potential losses. Always trade responsibly and consider your risk tolerance and financial situation. For more detailed information, you may want to visit the official OspreyFX website. or their FAQ page.

What kind of Spreads are offered by OspreyFX?

OspreyFX, a forex and CFD broker, offers a variety of spreads across different asset classes. Here are some details:. Forex Majors: OspreyFX provides real-time spreads on major forex pairs. For instance, the spread for AUD/USD is 10, EUR/USD is 9, GBP/USD is 10, NZD/USD is 10, USD/CAD is 11, USD/CHF is 10, and USD/JPY is 9. Forex Crosses and Exotics: While specific numbers aren’t available, OspreyFX does offer spreads on forex crosses and exotics. Indices, Metals, and Commodities: OspreyFX also offers spreads on various indices, metals, and commodities. However, the exact spreads for these asset classes aren’t specified. Cryptocurrencies: For cryptocurrencies, the lowest spreads are for XLMUSD from 0.10, BATUSD from 0.11, and AVAUSD from 0.22. Shares: Spreads are also offered on EU and US shares. , but the specific spreads aren’t mentioned. It’s important to note that the spreads are below the industry average for the standard account, starting from 0.8 – 0.9 pips for major pairs. This allows traders to enjoy maximum profits with commission-free trading. OspreyFX operates on a Market Making model, offering tight spreads and fast execution. However, as a counterparty to its clients’ trades, OspreyFX has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. Please note that the information provided may be subject to change due to the constant updating of the company’s services and policies. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action.

Does OspreyFX offer MAM Accounts or PAMM Accounts?

OspreyFX, a popular platform in the Forex trading world, currently does not offer either MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts. As of the latest update on 1st December 2023, these features are not available. However, it’s worth noting that OspreyFX has indicated that these features will be introduced in the near future. MAM and PAMM accounts are significant tools in the world of Forex trading. They allow money managers to manage multiple accounts from a single interface, which can be particularly useful for investors who wish to leverage the expertise of experienced traders. The absence of these features might limit some functionality for users of OspreyFX who are interested in these types of account management. Despite the current lack of MAM and PAMM accounts, OspreyFX offers a range of other features that cater to different types of Forex traders. For instance, they provide a Proprietary Funded Account as part of the OspreyFX Trading Challenge. This could be an alternative for traders looking for opportunities to trade with more capital. In conclusion, while OspreyFX does not currently offer MAM or PAMM accounts, they have expressed plans to introduce these features in the future. Traders interested in these account types should keep an eye on updates from OspreyFX. Meanwhile, they can explore other features and account types offered by OspreyFX.

Does OspreyFX allow Expert Advisors?

Yes, OspreyFX does allow Expert Advisors (EAs). OspreyFX is an ECN broker that offers CFD trading on a wide range of financial instruments. The broker provides access to two of the most popular trading platforms in the industry, MT4 and MT5. These platforms are known for their advanced charting capabilities, extensive range of technical analysis tools, and the ability to run Expert Advisors (EAs). OspreyFX operates the straight-through processing (STP) execution model. This means executable streaming prices (ESP) are dispatched from various liquidity providers directly to the broker’s platform without dealing desk intervention, rate manipulation, or re-quotes. This allows them to offer tight spreads and good execution speeds with minimal slippage. They also have very reasonable fees when compared with their direct competitors. At OspreyFX, traders can trade on institutional grade liquidity from some of the top global investment banks, hedge funds, as well as from completely transparent dark pool liquidity execution venues. This means that you will be able to trade on ultra-tight spreads, starting as low as 0.0 pips. OspreyFX has the ability to provide market-leading rates and trading conditions by way of the MT4 trading platform by supplying clients with true ECN connectivity. As a result of the large number of varied liquidity options, OspreyFX has become the broker of choice for many who trade in high volumes, scalpers, and those who simply demand the very best spreads alongside flawless execution. OspreyFX also provides top-notch conditions for scalping and EAs with spreads from 0.1 pips. In conclusion, if you are a trader who uses Expert Advisors (EAs) in your trading strategy, OspreyFX could be a suitable choice for you.

Does OspreyFX offer Copytrading?

Based on the information available, it does not appear that OspreyFX offers Copytrading services. OspreyFX is an offshore ECN broker that provides access to the MT4 and MT5 trading platforms and various trading instruments. Despite being an offshore company and lacking regulation, the broker has gained considerable attention. OspreyFX offers over 200 trading instruments over a variety of asset classes. There are multiple payment methods and low minimum deposit requirements for clients to get started. The broker has many account types to suit every trader and offers trading at low spreads and commissions. However, there is no mention of Copytrading services in the available resources. It’s important to note that while OspreyFX provides a range of services and features, including competitive leverage rates, flexible trading options, tight spreads, and many helpful resources. , Copytrading does not appear to be one of them. For those unfamiliar, Copytrading is a feature that allows traders to copy the trades of experienced and successful traders. This can be a valuable tool for new traders or those looking to diversify their trading strategies. While this feature can be found in some trading platforms, it does not appear to be offered by OspreyFX. Please note that while OspreyFX offers a range of services, it is not yet licensed by any regulatory authority. Therefore, potential users should exercise caution and conduct thorough research before choosing to trade with this broker. For those interested in Copytrading, there are other brokers available that do offer this service. As always, it’s important to conduct thorough research and consider multiple options before choosing a trading platform. In conclusion, while OspreyFX offers a range of trading services and features, Copytrading does not appear to be one of them based on the available information.