Spread Co Review 2026

What is Spread Co?

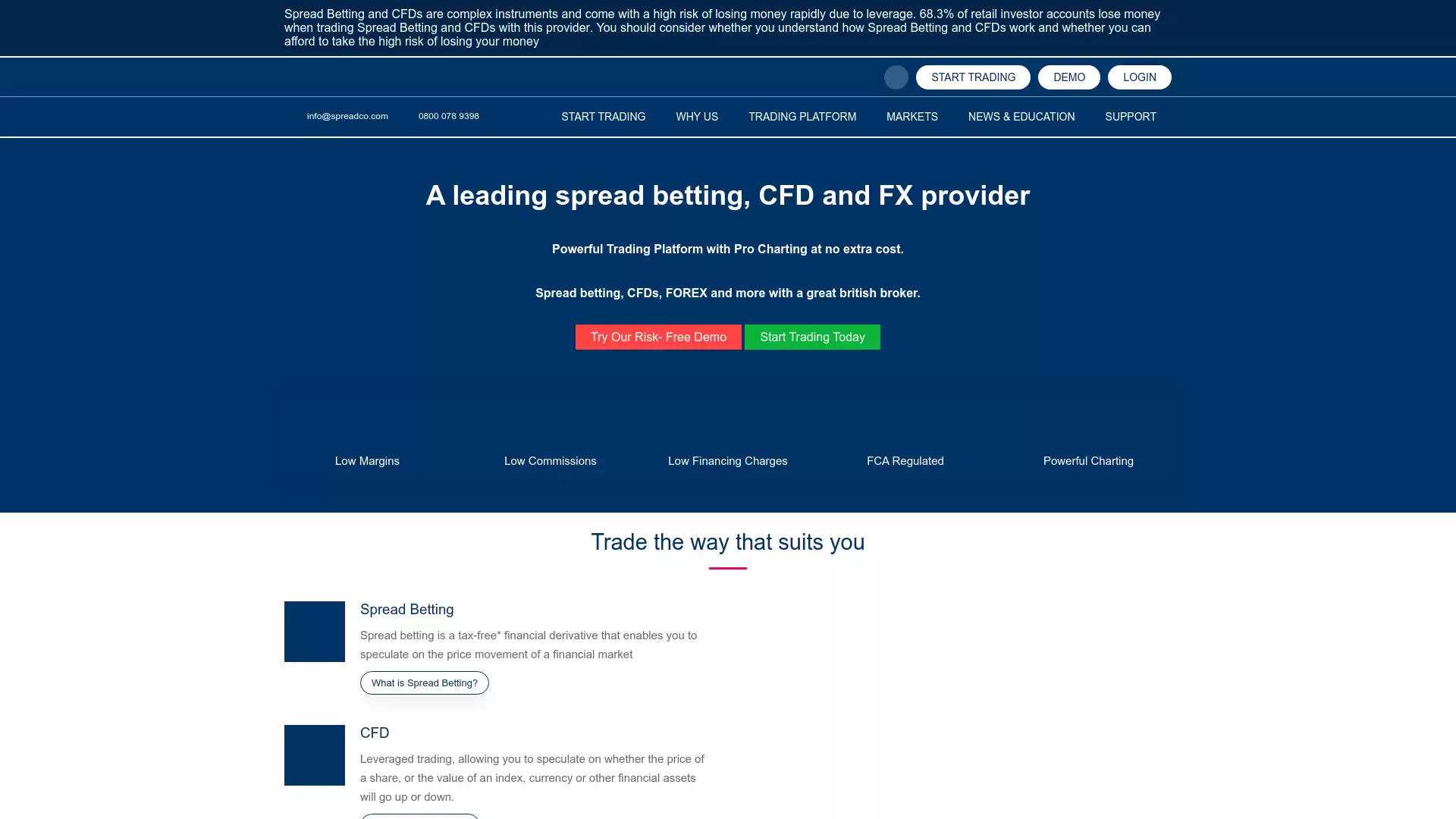

Spread Co is a leading provider of spread betting, Contract for Difference (CFD), and Forex (FX) trading. It offers a powerful trading platform with professional charting at no extra cost. Spread Co provides a range of financial derivatives that enable you to speculate on the price movement of a financial market. These include:. Spread Betting: This is a tax-free financial derivative that allows you to speculate on the price movement of a financial market. CFD Trading: This is leveraged trading, allowing you to speculate on whether the price of a share, or the value of an index, currency, or other financial assets will go up or down. Forex Trading: Also known as foreign exchange, FX or currency trading, this is a decentralized global market where all the world’s currencies trade. You can trade on the strength of one currency against another. Spread Co offers trading on over 35 forex currency pairs, indices, equities, commodities, oil, gold, and silver. It provides tight, fixed spreads starting at just 0.6 points, and low margins starting at just 3.33%, giving you up to 30:1 and 200:1 for professional accounts. You can stake from £1 per point. The company provides reliable platforms for desktop, tablet, and mobile, allowing you to monitor your trades on multiple devices. It also offers 24-hour access with spread betting and CFDs. Spread Co is regulated by the Financial Conduct Authority (FCA). It provides dedicated account managers based in the UK for all its clients. The company also offers a range of educational resources to help improve your spread betting or CFD trading skills. In the context of Forex, Spread Co provides a platform for foreign exchange trading, which is the largest and most actively-traded financial market in the world. Forex trading isn’t about buying or selling currencies, it’s about betting on a change in the exchange rate between two currencies – whether it will rise or fall. When you trade forex, you’re making a bet that one currency will rise or fall against another. Please note that when you trade on the price of a financial instrument with Spread Co, you do not actually own the underlying asset. However, you are entitled to some of the benefits, such as dividends, rights issues, etc., as if you were an owner of the underlying asset. The main difference is that you will not receive any voting rights on individual equities.

What is the Review Rating of Spread Co?

- 55brokers: 55brokers rated Spread Co with a score of 70. This rating was last checked at 2024-01-06 07:55:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Spread Co with a score of 52. This rating was last checked at 2024-01-05 20:41:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Spread Co with a score of 92. This rating was last checked at 2024-01-05 22:12:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Spread Co with a score of 71. This rating was last checked at 2024-03-14 11:35:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Spread Co?

Spread Co, a UK-based online forex broker, offers several advantages that make it a competitive choice in the market. Here are some of the key benefits:. Competitive Spreads and Low Margins: Spread Co differentiates itself by offering competitive spreads and low margins to the growing CFD and spread betting community. This is particularly beneficial for traders as it helps keep the costs of trading down and maximizes gains. Fixed Spreads: Unlike some competitors, Spread Co’s spreads don’t change throughout the trading day. They can be as low as 0.8 for EURUSD. Fixed spreads provide more certainty when closing a position on volatile markets. Robust Trading Platforms: Spread Co provides robust, custom-built trading platforms that are available on mobile, tablet, and desktop devices. This allows traders to access their accounts and trade from anywhere, at any time. Dedicated Relationship Manager: Spread Co assigns a dedicated relationship manager to its clients. This manager assists in increasing the clients’ working knowledge of both the trading platform and provides relevant market updates. Wide Range of Assets: Spread Co gives traders access to a full range of assets in the global financial markets – equities, indices, currencies, and commodities. This diversity allows traders to diversify their portfolios and spread their risk. Regulated by Top-Tier Regulators: Spread Co is regulated by top-tier regulators, including the Financial Conduct Authority (FCA). This ensures that the broker operates under strict regulatory guidelines, providing traders with a secure and transparent trading environment. 0% Financing on Short Index Positions: Spread Co clients benefit from 0% financing on short index positions. This can lead to higher profitability in each trading strategy. Please note that while Spread Co offers many advantages, it’s important for each trader to consider their individual trading needs and objectives before choosing a forex broker.

What are the Cons of Spread Co?

Here are some of the potential drawbacks of Spread Co, particularly in the context of forex trading:. Higher-than-average risk: Spread Co is considered a broker with higher-than-average risk. This could be a significant concern for traders who prefer to minimize their risk exposure. User dissatisfaction: According to some reviews, many clients of Spread Co are not satisfied with the company’s work. This could be indicative of potential issues with customer service or trading conditions. Limited trading instruments: While Spread Co does offer a range of trading instruments, the selection, particularly of forex pairs, may not be as extensive as what is offered by some other brokers. Commissions and fees: One of the major drawbacks of a raw spread account, which Spread Co offers, is its commissions. While you won’t get charged with high spreads, you’ll still get charged a fixed or variable commission which can take a big chunk out of your earnings if you’re placing too many smaller trades. Trading limits during news releases: Fixed spread accounts, like those offered by Spread Co, often have trading limits during news releases. This could limit trading opportunities for those who like to trade based on news events. Charges on transactions: Spread Co charges a 2% fee when traders fund their accounts using Credit Cards while withdrawals through Skrill will be charged at a 1% fee of the transaction value. These transaction fees could add up over time and eat into your trading profits. Outdated trading platform: Some users have found Spread Co’s trading platform to be clunky and outdated. A user-friendly and up-to-date trading platform is crucial for efficient trading. Please note that while these points highlight some potential drawbacks of Spread Co, it’s important to do thorough research and consider your individual trading needs and goals before choosing a forex broker. It’s also recommended to test out a broker’s services using a demo account before committing to a live trading account.

What are the Spread Co Current Promos?

Spread Co, a leading provider of spread betting, CFD, and Forex trading, offers a range of promotions and features that make it an attractive choice for traders. Low Margins, Low Commissions, and Low Financing Charges Spread Co offers competitive trading conditions with low margins, low commissions, and low financing charges. This makes it a cost-effective choice for traders looking to maximize their profits. Powerful Trading Platform with Pro Charting Traders at Spread Co have access to a powerful trading platform that comes with professional charting at no extra cost. This allows traders to analyze market trends and make informed trading decisions. Range of Markets Spread Co provides a wide range of markets for traders to explore. This includes equities, indices, commodities, and Forex pairs. Traders can choose the markets that best suit their trading strategies and risk tolerance. Dedicated Account Manager Every client at Spread Co is assigned a dedicated account manager. This ensures that traders receive personalized service and support, enhancing their trading experience. Risk-Free Demo For those new to trading or looking to test out Spread Co’s platform, the broker offers a risk-free demo. This allows traders to practice their strategies and get a feel for the platform without risking real money. Educational Resources Spread Co provides a range of educational resources to help traders improve their skills. This includes trading guides and FAQs that cover a variety of topics, from the basics of Forex trading to more advanced strategies. Please note that all trading involves risk, and losses can exceed deposits. It’s important to understand the risks involved and seek independent advice if necessary. Always refer to the official Spread Co website for the most up-to-date and accurate information.

What are the Spread Co Highlights?

Spread Co is a leading provider in the financial market, offering services in spread betting, CFDs, and Forex. Here are some of the key highlights:. Powerful Trading Platform: Spread Co provides a powerful trading platform with professional charting at no extra cost. This platform is easy to use and allows you to personalize your trading experience. It offers access to thousands of trades worldwide and expert financial analysis. Low Margins and Low Stakes: Spread Co operates with low margins and low stakes, making it accessible for a wide range of investors. No Hidden Costs: Spread Co prides itself on transparency, with no hidden costs. Tight Fixed Spreads: Spread Co offers tight fixed spreads on UK100 and Euros. Zero Holding Cost on Short Index Positions: Spread Co does not charge for holding short index positions. Dedicated Account Manager: Spread Co provides a dedicated account manager for all its clients. Forex Trading: Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world’s currencies trade. Spread Co allows you to trade on the strength of one currency against another. Risk Management: Spread Co’s online trading platform has built-in tools such as stop loss and limit orders to help manage risk effectively. Customizable Interface: The platform interface is customizable, allowing you to choose the features you use most. Great Charting Tools: Spread Co offers a wide range of indicators to help you get a better picture of what’s happening in the markets. No Software to Download: With no software to download, trading becomes more efficient. Please note that Spread Betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Is Spread Co Legit and Trustworthy?

Spread Co is a financial trading platform that has been operating in the market since 2005. It is regulated by the Financial Conduct Authority (FCA) in the UK. , which adds a layer of credibility to its operations. However, it’s important to note that regulation alone does not guarantee the honesty of a broker. Many users have shared their positive experiences with Spread Co on various platforms. For instance, a user named Raveendranathan Velichapatt, who has been trading forex on the platform since 2014, mentioned that he never had any problems and always recommends the platform to his friends. Another user, Charles Harvey, has been using Spread Co for many years and appreciates the reliability of the platform, the instant fills on trades, and the sensible leverage. He also praised the speed of response from their customer service teams and the quick cash back to bank accounts. The platform offers Web Trader and MetaTrader 4 as trading platforms. The minimum deposit required to start trading with Spread Co is 100 USD. They offer a variety of tradable assets, including forex, stocks, commodities, and indices. The minimal spread on the currency pair EUR/USD is 0.8 pips on a standard account. However, it’s important to remember that trading involves risks. Between 74-89% of retail investor accounts lose money when trading CFDs. Therefore, potential traders should consider whether they can afford to take the high risk of losing their money. In conclusion, based on the available information, Spread Co appears to be a legitimate and trustworthy platform for forex trading. However, as with any financial decision, potential traders should conduct thorough research and consider their financial situation before starting to trade.

Is Spread Co Regulated and who are the Regulators?

Spread Co is indeed a regulated entity. It is a limited liability company registered in England and Wales, with its registered office at 22 Bruton Street, London W1J 6QE. The company number is 05614477. The primary regulator for Spread Co is the Financial Conduct Authority (FCA), as indicated by the company’s registration number 446677. The FCA is a financial regulatory body in the United Kingdom, but operates independently of the UK government. Its mandate includes the regulation of financial firms providing services to consumers and maintaining the integrity of the financial markets in the UK. Spread Co provides a range of information about its terms and agreements, risk warnings, privacy policy, conflicts of interest, compensation scheme, complaints policy, and terms of business on its website. This transparency is a key aspect of regulatory compliance, ensuring that customers are well-informed about the terms of their engagement with the company. In the context of forex trading, regulation is crucial. It ensures that trading practices are fair, transparent, and in the best interests of the customer. Regulatory oversight can help protect traders from fraudulent practices and provide a level of assurance that the trading platform is reliable and trustworthy. It’s important to note that while Spread Co is regulated by the FCA, forex trading involves significant risk. Traders should always ensure they understand these risks before engaging in forex trading.

Did Spread Co win any Awards?

Based on the information available, it is not clear whether Spread Co has won any specific awards. Spread Co is a financial spread betting and CFD provider based in the UK. The company was founded in 2006 by Ajay Pabari, the former CFO of CMC Markets. Spread Co’s platform is custom-built and developed in-house for both professional and retail clients to trade financial markets. However, the available sources do not mention any awards won by Spread Co. For the most accurate and up-to-date information, it is recommended to visit Spread Co’s official website or contact them directly.

How do I get in Contact with Spread Co?

Spread Co, a leading provider of spread betting, CFD, and Forex services, offers several ways for clients and prospective traders to get in touch. Client Services For expert help and support, you can reach out to Spread Co’s Client Services. They are available from Monday to Friday, 8am-5:30pm (UK time). You can call them on +44 (0) 1923 832 682 or email at cs@spreadco.com. Sales Team If you’re considering opening a new account or need assistance with trading, the Spread Co Sales Team is ready to help. They can be reached at +44 (0) 1923 832 659 from Monday to Friday, 9am-5pm (UK time), or via email at salesteam@spreadco.com. Dealing Team For trade-related queries, you can contact the Spread Co Trading team at +44 (0) 1923 832 609. They are available from Sunday 10pm to Friday 10pm (UK time). Alternatively, you can email them at info@spreadco.com. Live Chat Spread Co also offers a Live Chat feature on their website. This allows you to ask questions or provide feedback about Spread Co’s services. Please note that opening hours can change on bank and national holidays. If you’re a client, Spread Co will email you in advance to let you know. In the context of Forex trading, Spread Co provides a powerful trading platform with professional charting at no extra cost. They offer the opportunity to trade on the strength of one currency against another. This makes Spread Co a viable choice for both new and experienced Forex traders.

Where are the Headquarters from Spread Co based?

Spread Co Ltd is a company that operates in the Financial Services industry. It is a key player in the world of forex, providing a platform for trading and investment services. The company is known for its robust technology, user-friendly interface, and comprehensive customer support, making it a preferred choice for many traders and investors. The headquarters of Spread Co Ltd is located in Chuudoujiawatachou, Kyoto, Japan. This strategic location allows the company to tap into the rich financial and technological ecosystem of Japan, one of the world’s leading economies. The company employs between 21-50 people and generates an annual revenue of between $5M-$10M. This speaks volumes about the company’s stability and growth potential in the competitive forex market. In conclusion, Spread Co Ltd, with its headquarters in Kyoto, Japan, is a significant player in the financial services industry, particularly in the forex market. Its strategic location, robust technology, and comprehensive services make it a preferred choice for many traders and investors globally. Please note that this information is based on the latest available data as of 2023.

What kind of Customer Support is offered by Spread Co?

Spread Co, an online spread betting and CFD broker specializing in forex, commodities, equities, and indices, offers a range of customer support options. Contact Methods. Email: Customers can reach out to Spread Co via email at cs@spreadco.com. WhatsApp: Spread Co also provides support through WhatsApp at +44 7575 674341. Live Chat: A live chat engine is available at the bottom of the contact page for immediate assistance. Telephone: Customer service is available from Monday to Friday, 8 am-6 pm at +44 (0)1923832682. Trading Platform Spread Co offers a proprietary trading platform powered by TradingView. The platform is accessible through major web browsers with no software download requirements. Additionally, clients can access the free mobile application or iPad app. The online platform features include expert financial analysis, direct trading from charts, a fully customizable interface, a wide range of technical indicators, market movement alerts and watch lists, custom charts using live industry data, and access to risk management tools including stop losses and limit orders. Assets Spread Co offers clients trading opportunities in the following global markets. Forex: 38 currency pairs. Equities: 1,000 global equities. Commodities: Precious metals and energies. ETFs: 100+ including technology and commodities. ADRs: Trade shares in companies in over 20 countries. Indices: Trade on the largest stock exchanges including UK100, US30, and NDQ100. The broker also offers the opportunity to trade Mini Markets which offer smaller stake sizes from just 10p. These markets are the most liquid and a popular way for traders to get familiar with spread betting. Reviews Spread Co has received positive reviews from its users. Users have praised the reliability of the platform, the responsiveness of the account manager, the promptness of order execution, and the tight spreads. The speed of response from their customer service teams and the quick cash back to bank accounts have also been highlighted. In conclusion, Spread Co provides a comprehensive customer support system, a robust and user-friendly trading platform, and a wide range of trading opportunities, making it a reliable choice for forex trading.

Which Educational and Learning Materials are offered by Spread Co?

Spread Co, a leading provider of spread betting, CFD, and Forex trading. , offers a variety of educational and learning materials to help both novice and experienced traders. Forex Trading Forex, also known as foreign exchange, FX, or currency trading, is a decentralized global market where all the world’s currencies trade. Spread Co provides comprehensive guides on Forex trading, helping traders understand how to trade on the strength of one currency against another. Learning Materials Regardless of your experience level, Spread Co provides guides that can help improve your spread betting or CFD trading skills. These guides cover a wide range of topics, from the basics of trading to more advanced strategies. Trading Platform Spread Co offers a powerful trading platform with professional charting at no extra cost. The platform allows traders to monitor their trades on multiple devices, making it easy to place a trade at home and keep an eye on it while on the go. Demo Account For those new to online trading, Spread Co offers a demo account. This allows users to practice trading online with no personal risk. Live Accounts Spread Co also offers live accounts geared towards Forex, CFD, and spread trading. The application process is straightforward and can be done online. Customer Support Spread Co is dedicated to supporting its clients, providing phone and email support to attend to any questions or concerns. In conclusion, Spread Co provides a comprehensive suite of educational and learning materials, making it a great choice for anyone interested in Forex trading. Whether you’re a beginner looking to learn the basics or an experienced trader seeking to refine your strategies, Spread Co has resources to support your trading journey.

Can anyone join Spread Co?

Spread Co is a platform that offers opportunities for individuals interested in forex trading. Here are some key points about joining Spread Co and its features:. Eligibility and Joining Process Anyone can start trading or join Spread Co’s risk-free demo. The process of joining is straightforward and user-friendly, catering to both beginners and experienced traders. Forex Trading with Spread Co Forex trading with Spread Co offers several advantages. The platform provides fixed spreads that do not change throughout the trading day. This feature provides more certainty when closing a position on volatile markets. Trading Features Spread Co offers tight, fixed spreads as low as 0.6 points. Traders can stake from £1 per point. The platform provides access to trade over 38 currencies, including popular pairs like GBP/USD and EUR/USD. Leverage Spread Co offers low margins starting at just 3.33%, which gives you up to 30:1 and 200:1 for professional accounts. This feature allows traders to potentially increase their profits. Trading Hours The forex market is available 24 hours a day, five days a week. This allows traders to respond quickly to market changes and take advantage of different time zones. Risk Control Options Spread Co provides risk control options that let traders limit their exposure to market volatility. This feature is particularly useful in the fast-paced forex market. Support Spread Co offers quality support at no extra cost. This ensures that traders have the necessary assistance when they need it. In conclusion, Spread Co provides a comprehensive platform for forex trading. Its features are designed to cater to the needs of diverse traders, making it a suitable choice for anyone interested in forex trading.

Who should sign up with Spread Co?

Spread Co is an online spread betting and CFD broker that specializes in forex, commodities, equities, and indices. It offers a proprietary trading platform powered by TradingView, designed to meet the needs of all clients. Here are some reasons why different types of traders might consider signing up with Spread Co:. Forex Traders: Spread Co offers trading on 38 currency pairs. Forex, also known as foreign exchange, FX, or currency trading, is a decentralized global market where all the world’s currencies trade. Traders can speculate on the strength of one currency against another. Equity Traders: Spread Co provides access to over 1,000 global equities. This makes it a good choice for traders interested in buying and selling shares of companies. Commodity Traders: Spread Co offers trading opportunities in precious metals and energies. This is ideal for traders who want to speculate on the price movements of these commodities. Index Traders: Spread Co allows trading on the largest stock exchanges including UK100, US30, and NDQ100. This is suitable for traders who want to speculate on the overall direction of the market. Beginners: Spread Co offers Mini Markets which offer smaller stake sizes from just 10p. These markets are the most liquid and a popular way for traders to get familiar with spread betting. Advanced Traders: Spread Co’s platform includes a wide range of technical indicators, the ability to set market movement alerts and watch lists, and access to risk management tools including stop losses and limit orders. Mobile Traders: Spread Co offers a free mobile application and iPad app. This allows traders to monitor their trades on multiple devices. In conclusion, Spread Co caters to a wide range of traders, from beginners to advanced, across various markets. It’s a trustworthy spread betting broker, authorised by the Financial Conduct Authority (FCA), a highly respectable regulator. However, potential users should always consider their individual trading needs and objectives, and possibly seek independent advice, before deciding to sign up with any trading platform.

Who should NOT sign up with Spread Co?

Spread Co is a UK-based broker that offers spread betting, CFD trading and forex trading. Spread betting and CFD trading are complex instruments and come with a high risk of losing money rapidly due to leverage. Forex trading is the largest and most actively-traded financial market in the world, worth an estimated $4 trillion in daily turnover. Before signing up with Spread Co, you should consider the following factors:. Your trading experience and knowledge. Spread Co is not suitable for beginners or inexperienced traders. You need to have a good understanding of how the markets work, how to analyse them, and how to manage your risk. You also need to be aware of the tax implications of spread betting and CFD trading in your jurisdiction. Your trading goals and strategy. Spread Co offers different types of accounts, platforms, markets and tools to suit different trading styles and preferences. You need to choose the account type that matches your risk appetite, capital size, frequency of trading, and preferred market access. You also need to have a clear trading plan that defines your entry and exit points, stop loss levels, take profit targets, and risk-reward ratio. Your financial situation and objectives. Spread Co requires you to deposit a minimum amount of money into your account before you can start trading. The minimum deposit varies depending on the account type you choose. You also need to consider the costs involved in spread betting and CFD trading, such as spreads, commissions, financing charges, overnight fees, swap rates, etc. These costs can eat into your profits or increase your losses over time. Your personal circumstances and preferences. Spread Co is regulated by the FCA in the UK. , which means it has to comply with certain rules and standards regarding client protection, disclosure of information, record keeping, etc. However, this does not guarantee that you will be able to recover your funds if something goes wrong with your broker or if you lose more than you can afford. You also need to consider whether you prefer a desktop-based platform or a mobile app for your trading device. . In conclusion, Spread Co is not for everyone. It is only suitable for traders who have sufficient experience, knowledge, capital, discipline and risk management skills. It is also important that you read their terms and conditions carefully before signing up with them. , as they may change from time to time without notice. : SpreadCo Terms & Conditions.

Does Spread Co offer Discounts, Coupons, or Promo Codes?

Based on the search results, there is no specific information available about Spread Co offering discounts, coupons, or promo codes. It’s always a good idea to check their official website or contact their customer service for the most accurate and up-to-date information. Please note that the availability of such offers can vary and may be subject to terms and conditions. Always ensure to read the fine print before making any financial decisions. It’s also worth noting that promotional offers can change frequently, so what may not be available today could be offered in the future. Stay updated by regularly checking their website or subscribing to their newsletter if available. Remember, investing in forex involves risk, and it’s important to make informed decisions. Always consider seeking advice from a financial advisor or doing thorough research before making any investment decisions.

Which Account Types are offered by Spread Co?

Spread Co offers a variety of account types to cater to the diverse needs of traders. Here are the details:. 1. Spread Betting Account This account provides access to over 1000 markets, including indices, FX, commodities, and equities. Key features include:. Tax-free profits. Spreads from 0.8. Negative balance protection. 0% financing on short index positions. Professional charting package for free. Minimum stakes from just £1. Retail margins from 3.33% on all major FX and from 5% on indices. 2. CFD Account The CFD account enables trading across a wide range of markets offered by Spread Co, including shares, commodities, forex, and more. Key features include:. No stamp duty when trading CFDs. 0% financing on short index positions. No commissions. Equities charges start as low as 5 basis points (0.05%) for FTSE 100 Equities. 3. Mini Markets This feature allows trading major FX and indices from just 10p per point. Key features include:. Trade from 10p per point. Minimum stakes from just £1. Retail margins from 3.33% on all major FX and from 5% on indices. In addition to these, Spread Co also classifies accounts as Retail or Professional. By default, an account is classified as Retail, but on request, it can be converted to a Professional account, benefiting from increased leverage and lower stop out levels. Please note that tax treatment depends on individual circumstances and tax laws can change or may differ in a jurisdiction other than the UK.

How to Open a Spread Co LIVE Account?

Opening a Spread Co LIVE account is a straightforward process that can be completed in less than 3 minutes. Here’s a step-by-step guide:. Step 1: Complete the Online Form Start by filling out the online application form. This form will ask for your personal details and financial information. Ensure that all the information provided is accurate to avoid any issues during the verification process. Step 2: Verification After you’ve completed the form, Spread Co will check and verify your application. This is a standard procedure to ensure the security of your account and comply with financial regulations. Step 3: Account Details Once your application has been verified, Spread Co will email your account details to you. Make sure to keep these details safe as you’ll need them to access your account. With a Spread Co LIVE account, you’ll have access to global markets for equities, indices, currencies, and more. The platform offers low stake sizes, low margins, and tight, fixed spreads. It also provides 0% financing on short index positions. , making it an attractive option for forex trading. Spread Co ensures the safety of your money by keeping it in a segregated bank account. They operate under the rules of the Financial Conduct Authority and store and use your personal data in accordance with the Data Protection Act. Remember, contracts for difference and spread betting carry a high degree of risk to your capital. Always make sure you understand the risks involved before you start trading. I hope this guide helps you in opening a Spread Co LIVE account. Happy trading!.

How to Open a Spread Co DEMO account?

Opening a Spread Co DEMO account is a straightforward process that allows you to practice Spread Betting, Forex, and CFD trading. Here’s a step-by-step guide:. Step 1: Navigate to the Spread Co Homepage Start by visiting the Spread Co homepage. Look for the option to “Start Trading” and click on it. Step 2: Select the Account Type Choose the DEMO account option. This type of account is designed for traders who are new to spread betting, forex, and CFD trading. Step 3: Complete the Online Application Form Fill in the online application form. The form will ask for your personal information. Make sure to provide accurate details. Step 4: Account Verification After submitting the form, Spread Co will check your application. This process ensures the information you provided is correct. Step 5: Account Activation Once your application is approved, you will receive an email from Spread Co. This email will contain a link to activate your account. Click on the link to activate your DEMO account. Step 6: Start Practicing With your DEMO account activated, you can now start practicing trades. The DEMO account comes with £25,000 virtual funds. , allowing you to develop your strategies with no risk. Remember, the DEMO account is a great opportunity to learn about online trading without risking your own money. It also gives you a chance to experience Spread Co’s trading platforms. You can try out some of the powerful charting features, and see first-hand how stop loss and limit orders can help you manage risk. When you’re ready, opening a live trading account is simple, and Spread Co will help you every step of the way. Happy trading!.

How Are You Protected as a Client at Spread Co?

As a client at Spread Co, you are protected in several ways:. Regulation by the Financial Conduct Authority (FCA). : Spread Co is regulated by the FCA, the UK’s financial industry regulator. This means that Spread Co must adhere to strict standards and regulations to ensure the protection of its clients. Financial Services Compensation Scheme and the Financial Ombudsman Service. : As a client of an FCA regulated firm, you can use the services of the Financial Services Compensation Scheme and the Financial Ombudsman Service if you have a complaint. Segregated Bank Accounts. : All client money is kept in a separate bank account, with Barclays Bank, from the company’s own funds. This is a requirement of the FCA’s client asset rules and ensures that client funds can only be used for the purpose they were originally intended for. Protection in the Event of Insolvency. : Spread Co only uses its own funds for hedging and does not pass segregated client money to hedging counterparties. In the unlikely event that Spread Co becomes insolvent, any money held in the segregated account won’t be included in Spread Co’s assets and can’t be claimed by any other creditor. This means it can be easily returned to clients. Rigorous Systems for Managing Client Funds. : Spread Co has rigorous systems in place to manage client funds securely and effectively. In the context of forex trading, these protections are particularly important. Forex trading involves significant risk, and the protections offered by Spread Co help to mitigate some of these risks and provide reassurance to clients. It’s important to note that while these protections can provide significant security, they cannot eliminate all risks associated with forex trading.

Which Funding methods or Deposit Options are available at Spread Co?

Spread Co, a London-based online trading provider, offers its clients a variety of funding methods to facilitate their trading activities. These methods are designed to provide convenience and ease of use, ensuring that clients can focus on their trading activities. Credit/Debit Card: Clients can fund their Spread Co account using their credit or debit card via the trading platform. This method is quick and convenient, allowing clients to instantly deposit funds into their account. However, it’s important to note that Spread Co does not accept American Express or Diners Club. Bank Transfer: Clients can also fund their account via bank transfer. To do this, they can transfer funds from their online bank to any of Spread Co’s segregated client money trust accounts. The account name is Spread Co Limited and the bank address is Barclays Bank PLC, Acorn House, 36-38 Park Royal Road, London, NW10 7WJ, UK. The Swift Code is BARCGB22. When making the payment, clients should quote their trading account number as reference. This will ensure that the funds are transferred in a timely manner. It’s also important to note that Spread Co does not accept cash or cheque payments. Spread Co accepts deposits in multiple currencies including Sterling, Euros, and US Dollars. The respective account numbers and IBAN for international transfers are as follows. Sterling Account Number: 93524140, IBAN: GB47 BARC 2093 0293 5241 40 Euros Account Number: 73394399, IBAN: GB26 BARC 2093 0273 3943 99 US Dollars Account Number: 49080022, IBAN: GB62 BARC 2093 0249 0800 22 . It’s crucial that clients ensure they fund their account using a credit/debit card or bank account in their name. In the context of forex trading, these funding methods allow traders to efficiently manage their capital and ensure they have sufficient funds to maintain their positions in the forex market. By offering a variety of deposit options, Spread Co caters to the diverse needs of forex traders, making it a preferred choice for many.

What is the Minimum Deposit Amount at Spread Co?

The minimum deposit amount required to register a live trading account with Spread Co is $200. This minimum deposit is equivalent to R 3200 ZAR at the current exchange rate between the US Dollar and the South African Rand at the time of writing. Spread Co accepts USD, EUR, and GBP as deposit currencies. Traders can fund their accounts with Spread Co using the following available deposit methods. Bank wire transfer. Debit and credit card. Skrill. Please note that Spread Co does not accept cash or cheque payments. They are also unable to accept American Express or Diners Club. In terms of forex trading, Spread Co offers a competitive environment with a wide range of currency pairs. However, please remember that forex trading involves significant risk and it’s important to understand these risks before starting trading. Always consider your financial situation and risk tolerance before making a deposit and starting to trade. Please note that the information provided is based on the latest available data and may be subject to change. For the most accurate and up-to-date information, please visit the official Spread Co website or contact their customer service directly.

Which Withdrawal methods are available at Spread Co?

Spread Co, a leading provider of spread betting, CFDs, and FOREX. , offers several methods for withdrawing funds from your account. Bank Transfer: This is a common method for withdrawing funds. It’s important to note that you can only withdraw funds to accounts that are in your name. Credit/Debit Cards: Spread Co allows withdrawals to the same card that was used to make the deposit. There is a maximum withdrawal amount of £25,000 for cards, although Mastercard has a lower limit of £2,500. However, there is no limit on the number of withdrawals you can make in a day. Cheques: Customers can request their withdrawals through cheques. Direct Debit: If the initial deposit was made via direct debit, then this can also be used to make a withdrawal. Please note that there is a minimum withdrawal amount of £50 in place at Spread Co. This does not take into account money that is being used to support margins on any open trading positions that you have. So, you must have £50 in available funds in order to make a withdrawal. Unfortunately, e-wallets are not offered as a withdrawal method at Spread Co. This is due to the regulations that require customer identity and funding sources to be verified. As for withdrawal fees, there are no charges in place for standard withdrawals with Spread Co. However, there are two situations that will incur a small Spreadex withdrawal fee. The first is if you make your withdrawal to an international bank account that uses a currency other than sterling. In conclusion, Spread Co offers a variety of withdrawal methods to cater to the needs of its customers. It’s always recommended to check with the provider for the most up-to-date information.

Which Fees are charged by Spread Co?

Spread Co, a leading financial services provider, charges various fees for its services. Here’s a detailed breakdown:. Commission Charges: Spread Co charges commission on stocks, which ranges between 0.05% and 0.075%. Spreads: The company offers spreads from 0.8 pips. Account Fees: Spread Co does not charge any account fees. Deposit and Withdrawal Fees: Deposits and withdrawals are generally free of charge. However, a 2% fee is charged when traders fund their accounts using Credit Cards. Withdrawals through Skrill will be charged at a 1% fee of the transaction value. Inactivity Fee: Spread Co does not charge an inactivity fee. Overnight Interest: This is charged/paid on any FX & bullion position depending on the currency pair and the applicable rate in the interbank markets applicable to the period of the rollover. Other cash markets are debited/credited with a financing rate of 2.0 percent +/- overnight currency funding rate. No overnight charges are applicable to future markets. Interest on Deficit Balances: Deficit balances will be charged at the currency base rate plus 2.0 percent. Dividend Adjustment: For equity or index positions held through a dividend adjustment, a relevant debit or credit would be transacted depending on the direction of each net open position. Please note that these fees are subject to change and it’s always a good idea to check the latest on Spread Co’s official website or contact their customer service for the most accurate information. Also, remember that trading involves risk and it’s important to understand the costs associated with it.

What can I trade with Spread Co?

With a Spread Co account, you can trade on a wide range of global markets. Here are the details:. 1. Equities You can trade around one thousand global equities. Unlike buying shares, you can make a profit from equity trades when the price of shares is rising and falling. 2. Indices You can access the world’s major indices, such as the UK, US, Japan, and Germany. Our spreads start from as low as 0.8* for spread betting on the UK100 (FTSE 100) and US30 (DJIA Index) during market hours. Margins start at £25 on UK100, with a minimum stake size of £1. 3. Currencies You can tap into the world’s largest trading market – estimated at around $4 trillion every day. Choose from 40 currency pairs with fixed spreads from 0.8* on EURUSD. Trade 24 hours a day, five days a week. 4. Commodities Commodity trading, like gold and silver, and US Crude Oil futures, can help you diversify your portfolio. Get access to commodity markets, with competitive margins – from £80 on Spot Gold for spread bets, and tight spreads from just 2.5 points for Spot Silver. In addition to these, Spread Co also offers spread betting and Contracts for Difference (CFDs) which work in a very similar way. However, there are important differences when it comes to tax on your gains. For instance, there is no capital gains tax on any profits from spread betting. , but there is a capital gains tax liability on profits from CFDs. Please note that all the information provided is based on the details available on the Spread Co website. and may vary. Always check the latest information on the official website or consult with a financial advisor before making any trading decisions.

Which Trading Platforms are offered by Spread Co?

Spread Co offers a variety of trading platforms, each designed to cater to the specific needs of traders. Here are the key platforms:. Online Trading Platform: This platform is easy to use and puts you in control. It allows you to personalize your trading experience and provides access to thousands of trades worldwide along with expert financial analysis. You can place a trade directly from a chart, manage your risk with stop loss and limit orders, and hedge your trades by placing long and short positions on the same market. The platform also allows you to set up watch lists and get alerts on market movements and activity that interests you. SaturnTrader Platform: The SaturnTrader platform’s charting is powered by TradingView. This platform allows you to populate your trading screen with the features you find most useful, create your own charts using live industry data, and even change your color scheme. It also offers a fully customizable interface. Mobile/Tablet App: Spread Co’s mobile/tablet app lets you take your trading with you. You can manage positions, place stop/limit orders, and trade multiple markets simultaneously with ease. You can open and close positions directly from the app, so you never need to miss a great trading opportunity. MetaTrader 4: In addition to its proprietary platforms, Spread Co also offers MetaTrader 4. , a popular platform in the forex trading community. Each of these platforms is designed to provide an optimal trading experience, whether you’re at home, in the office, or on the go. They offer powerful charting tools powered by TradingView Inc. , and there’s no software to download. This means you’ll never have to wait for an update, making trading more efficient. In the context of forex trading, these platforms provide access to a wide range of currency pairs, allowing traders to take advantage of market movements. The platforms also offer various risk management tools, such as stop loss and limit orders, which are crucial in the highly volatile forex market. Please note that while this information is accurate as of my last update in 2021, you should visit the Spread Co website or contact their customer service for the most current information.

Which Trading Instruments are offered by Spread Co?

Spread Co, a leading provider in the financial market, offers a variety of trading instruments. Here’s a detailed look at their offerings:. Spread Betting: This is a tax-free financial derivative that allows you to speculate on the price movement of a financial market. CFD (Contract for Difference): This is a leveraged trading instrument, allowing you to speculate on whether the price of a share, or the value of an index, currency or other financial assets will go up or down. FOREX (Foreign Exchange): Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world’s currencies trade. You can trade on the strength of one currency against another. In addition to these, Spread Co also offers trading on a range of global indices including the FTSE 100 (through their UK100 and UK100 Future indices), the Dow Jones Industrial Average (through their US30 and US30 Future indices), and other global indices such as Japan 225 (Nikkei), NDQ100 (NASDAQ), US500 (S&P 500) and Germany40 (DAX). Moreover, Spread Co provides access to trade on company shares, commodities, and more esoteric products such as Exchange Traded Funds (ETFs) and American Depositary Receipts (ADRs). Please note that trading with Spread Co comes with certain benefits such as low margins, low stakes, no hidden costs, and a powerful trading platform with pro charting at no extra cost. However, Spread Betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Which Trading Servers are offered by Spread Co?

Spread Co offers a variety of trading servers to cater to the diverse needs of its clients. Here’s a detailed look at their offerings:. SaturnTrader Platform The SaturnTrader platform is Spread Co’s proprietary trading platform. It’s designed to meet the needs of all clients and is powered by TradingView. The platform is accessible through major web browsers, with no software download requirements. Alternatively, clients can access the free mobile application or iPad app. Key Features. Expert Financial Analysis: The platform provides access to expert financial analysis. Trade Directly from Charts: Users can place trades directly from charts. Fully Customisable Interface: The platform interface can be customised to suit individual preferences. Wide Range of Technical Indicators: A wide range of indicators are available to help users get a better picture of market movements. Market Movement Alerts and Watch Lists: Users can set alerts for market movements and create watch lists. Live Industry Data: Users can create custom charts using live industry data. Risk Management Tools: The platform includes built-in risk management tools such as stop losses and limit orders. Assets Spread Co offers trading opportunities in several global markets. Forex: Spread Co offers trading on 38 currency pairs. Equities: The platform provides access to 1,000 global equities. Commodities: Users can trade precious metals and energies. ETFs: Over 100 ETFs are available, including technology and commodities. ADRs: Users can trade shares in companies in over 20 countries. Indices: Users can trade on the largest stock exchanges including UK100, US30 and NDQ100. Mini Markets In addition to the above, Spread Co also offers the opportunity to trade Mini Markets which offer smaller stake sizes from just 10p. These markets are the most liquid and a popular way for traders to get familiar with spread betting. In conclusion, Spread Co provides a comprehensive and customisable trading platform that caters to the diverse needs of its clients, offering a wide range of assets for trading, including forex.

Can I trade Crypto with Spread Co? Which crypto currencies are supported by Spread Co?

Yes, you can trade cryptocurrencies with Spread Co. Spread Co is a provider of forex trading, CFD, and spread betting services. When spread betting on cryptocurrencies, you trade on the underlying value of the currency rather than actually buying the currency itself. The cryptocurrencies supported by Spread Co include:. Bitcoin (BTC). Ether (ETH). Ripple (XRP). Litecoin (LTC). Spread Co offers a competitive spread for Bitcoin, starting from a 40 point spread. This means that the difference between the bid and ask price is relatively small, which can be advantageous for traders. In the context of forex, the spread is essentially the discrepancy between the selling price and the purchase price of an asset. Spread Co, like most brokers, charges a fee based on the spread. For example, Spread Co’s minimum EUR/USD spread is 0.8 pips, which is slightly higher when compared to the average EUR/USD spread of 0.70 pips. Please note that trading cryptocurrencies involves risk, just like any other type of investment. It’s important to understand the market and the specific characteristics of the cryptocurrency you are trading. Always do your own research and consider seeking advice from a financial advisor before making any investment decisions.

What is the Leverage on my Spread Co Trading Account?

Leverage in the context of a Spread Co trading account refers to the use of borrowed funds or financial derivatives to amplify potential investment returns. Specifically, the leverage ratio on a Spread Co trading account is 1:30. , which means for every dollar of your own money, you can trade with $30. This is a representation of the position value in relation to the investment amount required. Spread Co, founded in 2006, is a London-based online trading provider that offers access to trade spread betting, CFD, and Forex through currencies, equities, indices, and commodities. The company differentiates itself by offering competitive spreads and low margins to the growing CFD and spread betting community. By offering fixed rather than variable spreads, Spread Co allows its clients to take greater control of their trading, coupled with low trading charges to provide for higher profitability in each trading strategy. The minimum deposit for a Spread Co trading account is $200. The company provides easy digital account opening, and there are good trading conditions with tight fixed spreads and a selection of platforms. There are various options to deposit or withdraw funds. However, it’s worth noting that trading instruments are limited to Forex and CFDs, fees for Stock CFDs are higher, and there is no 24/7 support. In conclusion, leverage is a powerful tool that can magnify both gains and losses. It’s important to understand how it works and the risks involved before trading with leverage. Always remember, while leverage can increase potential returns, it can also amplify losses. Therefore, it’s crucial to manage risk effectively when trading with leverage. Please note that the information provided here is based on the data available as of 2023 and may be subject to change. Always refer to the latest information from the official Spread Co website or consult with a financial advisor for personalized advice.

What kind of Spreads are offered by Spread Co?

Spread Co offers a variety of spreads that cater to different financial markets, including forex. Here are some key features:. Tight, Fixed Spreads: Spread Co offers tight, fixed spreads starting as low as 0.6 points. This feature is particularly beneficial for traders who prefer to know the exact spread they will be dealing with before entering a trade. Forex Spreads: In the context of forex, Spread Co provides competitive margins for Contracts for Difference (CFDs), starting at just 3.33%. This low margin allows traders to potentially achieve higher leverage in their forex trading. Low Margins: Spread Co offers low margins starting at just 3.33%, which can provide up to 30:1 and 200:1 for professional accounts. This means that traders only need to stake a fraction of the position value to place a trade. Wide Range of Markets: Spread Co provides access to a wide range of markets, including forex, indices, shares, and commodities. This diversity allows traders to spread their investments across various markets. No Hidden Fees: Spread Co prides itself on transparency, with no hidden fees. This ensures that traders are aware of all costs associated with their trading activities. Reliable Platforms: Spread Co offers reliable platforms for desktop, tablet, and mobile, ensuring that traders can access their accounts and trade from anywhere. 24-hour Access: Forex markets are open around the clock from 10pm on Sunday until 10pm on Friday. This allows traders to respond to market changes in real-time. Please note that trading in forex and other financial markets involves risk, and it’s important to understand these risks before starting to trade.

Does Spread Co offer MAM Accounts or PAMM Accounts?

Spread Co, a UK-based NDD Broker regulated and authorized through the reputable FCA, provides two main account types: a Forex/CFD Account and a Spread Betting Account. These account types also have subaccount categories, each with its own set of conditions for commission, margin calls, leverage, and minimum deposits. However, there is no explicit mention of MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts being offered by Spread Co. To understand the significance of this, let’s delve into what MAM and PAMM accounts are. Both MAM and PAMM are types of investment accounts that allow retail investors to tap into the expertise of professional traders. They facilitate traders in expanding their audience reach and cater to different needs for investors and traders alike. A MAM account allows professional traders to manage multiple client accounts from a single master account. The master account is controlled by the trader and is linked to several sub-accounts, each owned and controlled by a different individual investor. The funds of the investors are pooled together and managed by the trader. As the trader executes trades in the master account, the same trades are automatically replicated on the individual sub-accounts according to the allocation percentage. On the other hand, a PAMM account is a type of investment account offered by some forex brokers, which allows retail investors to allocate their funds to be managed by experienced traders. An investor deposits funds into a PAMM account, which are then pooled together with funds from other investor accounts. The appointed trader or investment manager then makes investment decisions on behalf of the group. While both MAM and PAMM accounts offer unique advantages, it appears that Spread Co does not explicitly offer these types of accounts. However, they do provide a powerful, user-friendly, flexible trading platform and dedicated UK-based account managers to assist traders. They also offer competitive and favorable trading conditions, which consist of both tight and fixed spreads, and competitive, low trading commissions. This information should assist traders in making an informed decision when choosing a forex broker. It’s always recommended to reach out to the broker directly for the most accurate and up-to-date information.

Does Spread Co allow Expert Advisors?

The information available does not explicitly state whether Spread Co allows the use of Expert Advisors (EAs). EAs are automated programs created by traders or programmers to assist in forex market trading decisions. They can be divided into two main categories: EAs that provide trading signals to aid traders in their decisions, and EAs that place automatic trades under conditions set by the designer. EAs aim to decrease stress for traders by placing automatic orders, thereby removing the psychological factor. This can improve the performance of an account for beginners who may lack the necessary experience in fundamental and technical analysis. However, because EAs are manually created by traders or programmers, they may not be able to measure the fundamental effects of the market. As a result, EAs may not perform very well when it comes to unforeseen events, and traders tend to monitor their EAs on a continuous basis. While many brokers have integrated Expert Advisor into their trading platform. , it’s crucial to do your due diligence and research the reputation, track record, and trustworthiness of any broker, including Spread Co. You must also ensure the broker’s profile, trading tools, fees, and regulation align with your needs and goals. In conclusion, it is recommended to directly contact Spread Co for a definitive answer regarding their policy on EAs. This will ensure you have the most accurate and up-to-date information.