Strifor Review 2026

What is Strifor?

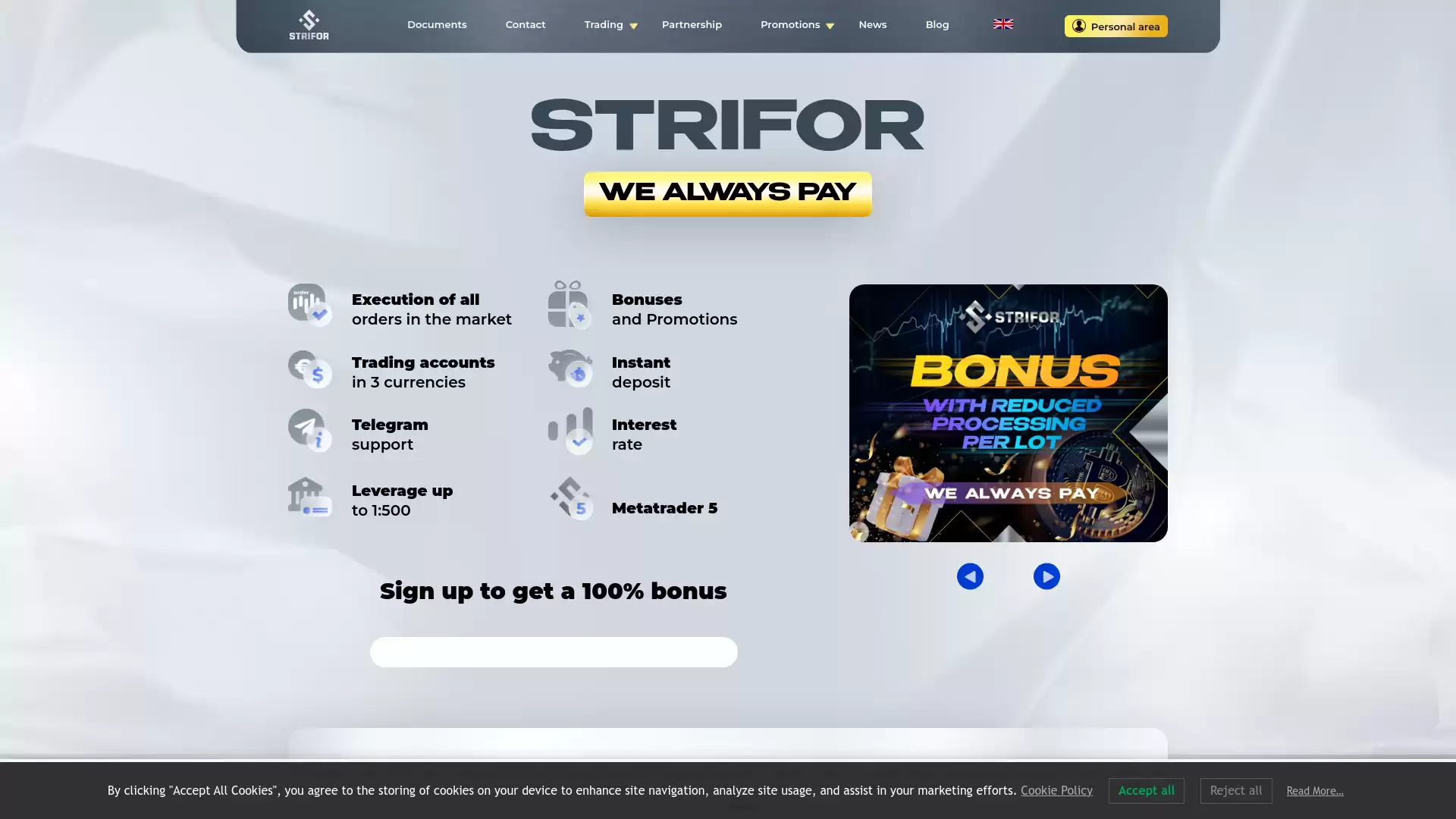

Strifor is a platform that provides a unique blend of cutting-edge trading instruments, classic options, and reliable CFDs. It is a forex broker that uses Metatrader 5 (MT5) as their trading platform in PC, Web, and Mobile versions. Strifor offers over 65 forex currency pairs, CFDs, commodities, oil, gold, silver, stocks, indices, and cryptocurrencies for personal investment and trading options. Strifor provides clients the opportunity to earn commission bonuses based on the trading activities of their referred clients. The platform also offers bonuses and promotions, and trading accounts can be in USD, EUR, or USDt. One of the key features of Strifor is the execution of all orders in the market. The platform also supports instant replenishment in cryptocurrency. Strifor’s leverage can go up to 1:500. , providing traders with the flexibility to trade at various levels of risk. Strifor also provides detailed financial data and updates. For example, in November, Strifor reported a turnover of 3,204 billion dollars, a turnover in lots of 33026, and 84.75% profitable trades. Strifor is not available in certain countries, including Brazil, the United Kingdom, Iran, Japan, North Korea, Myanmar, and the United States. Payment options include Ethereum, Tether (USDT), USD Coin (USDC), Dai (DAI), and Bitcoin. In conclusion, Strifor is a comprehensive trading platform that offers a wide range of financial instruments and services. It provides a unique blend of traditional and modern trading options, making it a preferred choice for many traders.

What is the Review Rating of Strifor?

- Brokersview: Brokersview rated Strifor with a score of 0. This rating was last checked at 2024-01-05 20:55:03.

- Trustpilot: Trustpilot rated Strifor with a score of 84. This rating was last checked at 2024-01-05 23:52:02.

- Wikifx: Wikifx rated Strifor with a score of 12. This rating was last checked at 2024-03-14 12:01:02.

What are the Pros of Strifor?

Strifor, a broker initially registered in 2020, has expanded its services to the public and offers a range of advantages for its clients. Here are some of the key benefits:. Competitive Spreads and Low Commissions: Strifor offers competitive spreads that start at zero pips for the basic account type and vary according to the currency pair. For more advanced accounts, spreads start from 0.1 points. Commissions range from 5 to 8 dollars per lot, depending on the selected account type. Generous Referral Program: Strifor features a multi-level referral program that can yield up to an impressive 60% commission. Instant Support via Telegram: Customer support is accessible via Telegram and responds swiftly, albeit only during business hours. Wide Selection of Trading Instruments: Strifor offers a wide array of over 250 trading instruments. Promotions, Raffles, and Special Offers: Strifor provides a wide array of promotions, raffles, and special offers. Favorable User Reviews: Strifor has received positive reviews from users, highlighting aspects such as comfortable commissions and spreads, prompt support, and a wide range of trading options. Please note that while these advantages make Strifor an enticing broker, it’s important to consider all aspects of a broker before making a decision. For instance, Strifor exclusively accepts cryptocurrency for deposits, and support is not provided 24/7. Some traders may also desire leverage options greater than the available 1:500.

What are the Cons of Strifor?

Strifor, a Forex broker, has several drawbacks that potential investors should be aware of. Here are some of the key concerns:. Offshore Broker Status: Strifor is an offshore broker. This means it operates from a location that does not regulate its Forex markets. Offshore brokers are often associated with high risks, including the potential for scams. Lack of Licensing: Strifor is not licensed. This lack of regulation can pose significant risks to investors, as there are no guarantees for fund safety. Dangerous Bonus Policy: Strifor has a bonus policy that could potentially penalize withdrawals. This policy could make it difficult for investors to access their funds. High Leverage and Mediocre Spreads: The leverage offered by Strifor is considered dangerous, and the spreads are mediocre. High leverage can lead to significant losses, and mediocre spreads can impact profitability. Deposit Policies: Strifor’s deposit policies could potentially be weaponized against its traders. For instance, the broker exclusively accepts cryptocurrency for deposits. , which may not be convenient for all investors. Limited Support: Strifor’s customer support is not available 24/7. This could be problematic for investors who need assistance outside of business hours. Limited Leverage Options: Some traders may desire leverage options greater than 1:500, which Strifor does not offer. These factors contribute to the overall risk associated with investing through Strifor. It’s crucial for potential investors to thoroughly research and consider these risks before deciding to invest with this broker.

Is Strifor Regulated and who are the Regulators?

Strifor is a name that has been associated with the Forex market. However, it is crucial to note that Strifor is not regulated or authorized to operate by any major regulatory authority. This lack of regulation raises significant concerns about the safety and security of funds invested with this broker. Regulation in the Forex market is of paramount importance. It provides a level of assurance to investors about the legitimacy and reliability of a broker. Regulated brokers are required to adhere to strict standards and guidelines, which are designed to protect investors. These standards include maintaining a minimum net capital, providing negative balance protection, and keeping investor funds in segregated accounts. Unfortunately, Strifor does not meet these criteria. The broker operates from St. Vincent and the Grenadines, a location known for its lax regulatory environment. Brokers in this jurisdiction are not required to comply with any specific rules, as the government does not regulate its Forex markets. This lack of oversight makes it a haven for potentially fraudulent operations. Furthermore, Strifor’s trading conditions are not particularly attractive. The broker offers a leverage of 1:500 and a minimum deposit of $2000. These conditions, coupled with the absence of regulation, make it a high-risk choice for investors. In conclusion, due to the absence of regulatory oversight and the potential risks associated with investing in unregulated brokers, it is advisable to exercise caution when considering Strifor as a Forex broker.