TD365 Review 2026

What is TD365?

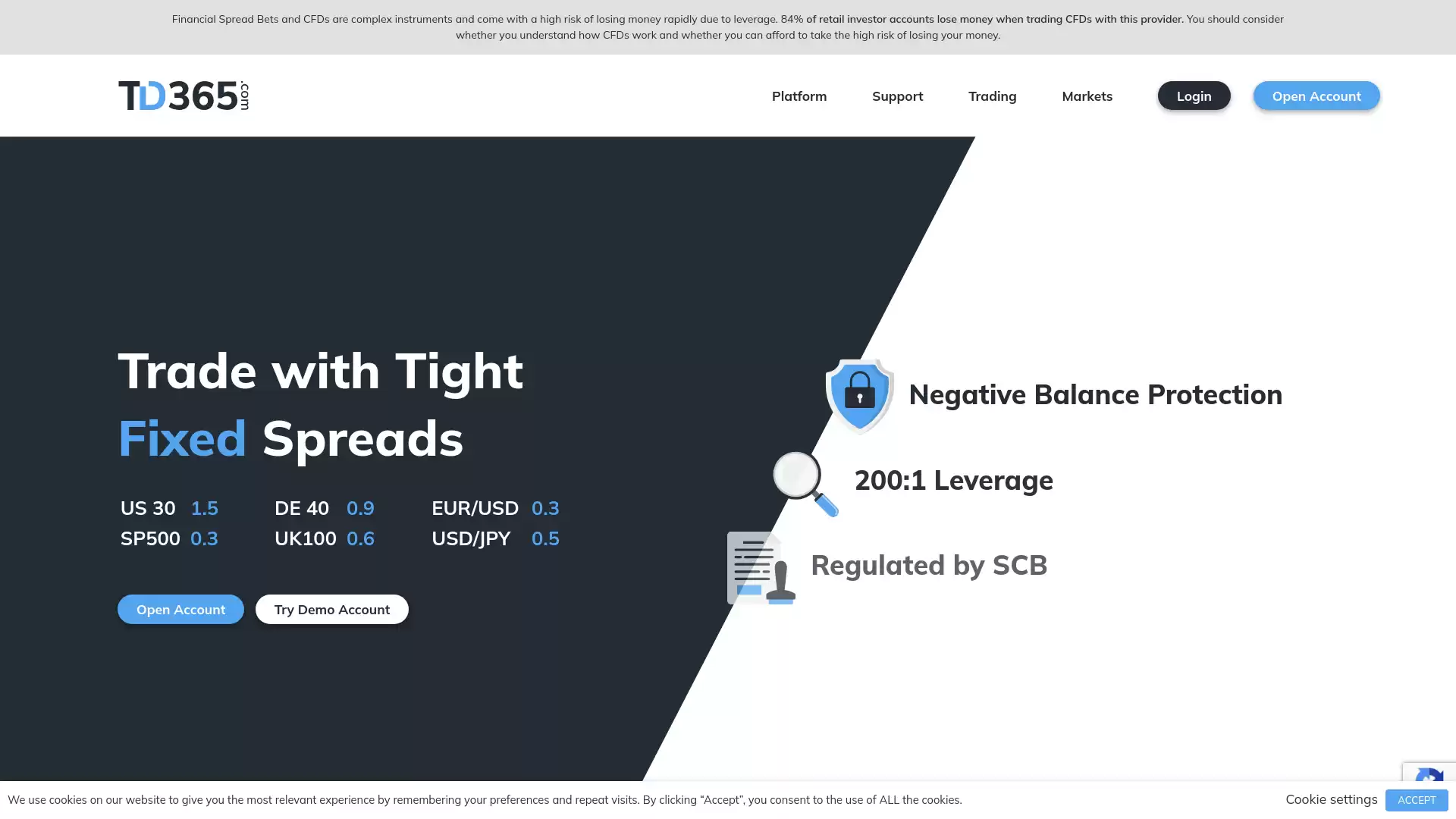

TD365, also known as TradeDirect365, is a trading brokerage company that provides an accessible and efficient platform for online trading. It offers a wide range of trading instruments across different asset classes, such as forex currency pairs, stocks, indices, commodities, cryptocurrencies, and bonds. The company is known for its simplicity and efficiency, blending these qualities to create a fair brokerage experience. It offers a leverage cap of 1:200, which can be risky for some but may also present a lucrative opportunity for others. This high leverage cap is possible because the broker is regulated in a nation that does not abide by the same legislations as in Europe (1:30 cap) or in Australia where the cap is currently at 1:30. TD365 is regulated by the Securities Commission of the Bahamas. As part of the regulation, all funds belonging to the clients are kept in segregated bank accounts, and their accounts have been upgraded with a negative balance protection mechanism meaning that their account balance may never go below zero. This makes it safe to trade and invest with TD365. The company offers two advanced yet user-friendly trading platforms: the popular MetaTrader 4 platform and the proprietary CloudTrade platform. These platforms are suitable for traders of all experience levels and different trading styles. The CloudTrade platform is a simplified version of almost any desktop trader, directed at more novice users. TD365 does not charge any commissions, not even on stocks. It offers some of the tightest spreads in the world, and they are fixed. The EUR/USD spread is said to be fixed at 0.6 pips, with no applicable commissions. However, the broker is clear that it applies commissions when trading with certain assets. In conclusion, TD365 is a reliable and efficient platform for online trading, offering a wide range of trading instruments, user-friendly trading platforms, and favorable trading conditions. It is regulated by the Securities Commission of the Bahamas, ensuring the safety of client funds.

What is the Review Rating of TD365?

- 55brokers: 55brokers rated TD365 with a score of 30. This rating was last checked at 2024-01-06 02:37:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated TD365 with a score of 30. This rating was last checked at 2024-01-06 10:14:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated TD365 with a score of 94. This rating was last checked at 2024-01-06 13:38:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of TD365?

TradeDirect365, also known as TD365, is a trading platform that offers a variety of advantages for forex traders. Here are some of the key benefits:. Low Commission Fees and Tight Fixed Spreads: TD365 is known for its low commission fees and tight fixed spreads. This makes it a cost-effective choice for traders, especially those who trade frequently. Single Currency Trading Account: TD365 offers a single currency trading account. This eliminates the need to pay any currency conversion fees if you are depositing funds in the same currency, making it easier to calculate the profit or loss on your trade. Advanced Trading Platforms: TD365 provides traders with advanced trading platforms, such as the MT4 and CloudTrade platforms. These platforms are designed to be easy to use, making them suitable for traders of all experience levels. Wide Range of Trading Instruments: TD365 offers a vast selection of trading instruments across different asset classes, such as forex, indices, commodities, cryptocurrency, stocks, and more. This allows traders to diversify their portfolio and take advantage of different market conditions. Negative Balance Protection: TD365 operates a Negative Balance Protection policy. This means your account balance cannot go into negative, providing an extra layer of financial security for traders. Regulated by Reputable Financial Authorities: TD365 is regulated by reputable financial authorities. This assures traders of the safety of their invested funds. Responsive Client Support: TD365 provides a responsive client support team. This ensures that traders can get the help they need when they need it. . In conclusion, TD365 offers a range of benefits for forex traders, from low fees and a wide range of trading instruments, to advanced trading platforms and strong regulatory oversight. Whether you’re a novice trader or a seasoned pro, TD365 has features and services that can help you navigate the forex market.

What are the Cons of TD365?

TD365, also known as TradeDirect365, is a popular trading platform that offers a wide range of financial instruments across different asset classes. However, like any trading platform, it has its own set of drawbacks. Here are some of the cons associated with TD365:. Lack of Copy Trading: TD365 does not offer copy trading. This feature, which allows users to copy the trades of successful traders, can be particularly useful for beginners who are still learning the ropes or those who prefer a more passive trading approach. No Islamic Account: TD365 does not provide an Islamic account option. This could be a significant drawback for traders who need to comply with Sharia law, which prohibits certain types of financial transactions, including those involving interest. Limited Commodities: The range of commodities available for trading on TD365 is not as extensive as on some other platforms. This could limit trading options for those who specialize in commodities trading. Regulatory Concerns: TD365 is regulated by the Securities Commission of the Bahamas, SIA-F216. However, it does not hold a top-tier license from one of the leading financial authorities, such as FCA, ASIC, or CySEC. This could raise concerns about the security of the funds deposited with the broker. Slippage and Selective Behaviour: Some users have reported experiencing slippage and selective behaviour with TD365. Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. This could impact the profitability of trades, particularly in volatile market conditions. . In conclusion, while TD365 offers a range of benefits such as tight fixed spreads, low commission fees, and advanced trading platforms, potential users should also consider these drawbacks when deciding whether this platform is the right fit for their trading needs.

What are the TD365 Current Promos?

TD365, a leading provider in the financial trading sector, offers a range of features and benefits that can enhance the trading experience for both novice and experienced traders. One of the key offerings is the Single Currency Trading Account which simplifies trading and saves on FX conversion fees. With this account, everything you trade is in your base currency. This means that no matter what instrument you trade across the platform, the base currency you select applies to every trade. This unique feature allows traders to trade all products from a single currency, making it much easier to calculate the profit or loss on your trade. Another significant advantage of trading with TD365 is the absence of conversion fees back to the base currency when a trade is completed. This not only saves money on each trade but also simplifies the trading process. TD365 also offers a CloudTrade trading platform that can be accessed on any device – mobile, PC, laptop, or tablet. This platform is web-based, so it can be used on any device where internet access is available. The CloudTrade App makes it super easy to trade on the move. Moreover, TD365 operates a Negative Balance Protection policy. This means your account balance cannot go into negative. This policy provides an additional layer of financial security for traders. It’s important to note that Financial Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Therefore, traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their money. Please visit the official TD365 website for the most accurate and up-to-date information on current promotions and offerings.

What are the TD365 Highlights?

TD365 is a global trading platform that offers a wide range of financial instruments for trading. Here are some of the highlights:. Trading Platform: TD365 provides a cutting-edge Contract for Difference (CFD) trading platform. They offer videos for every level of trader with expert tips and analysis from real-world traders. Financial Instruments: With TD365, you can trade the world’s major financial instruments. These include:. Indices. Stocks. Commodities. Cryptocurrencies. Forex Trading: In the context of Forex, TD365 offers trading in major currency pairs such as EUR/USD, GBP/USD, USD/JPY, and AUD/USD. Educational Content: TD365’s YouTube channel provides educational content on various aspects of trading. This includes how to build a watchlist, how to close a CFD position, how to place a guaranteed stop loss, how to place a stop loss order, and how to place a trade. Please note that trading involves risk and it’s important to understand these risks before starting. Always consider seeking advice from a financial advisor if you’re unsure. Happy trading!.

Is TD365 Legit and Trustworthy?

TD365, a forex trading platform, has been the subject of various reviews and discussions online. The legitimacy and trustworthiness of TD365 can be evaluated based on several factors, including user reviews, regulatory oversight, and the broker’s offerings. User Reviews. TD365 has received a number of positive reviews on Trustpilot. Users have praised the platform for its fast execution and chart loading, fixed spread, and active customer service. However, it’s important to note that user reviews should be taken with a grain of caution as they can be subjective and may not reflect the experience of all users. Regulatory Oversight. TD365 is regulated by the Securities Commission of the Bahamas, SIA-F216. However, it does not hold a top-tier license from one of the leading financial authorities, such as FCA, ASIC, or CySEC. Regulatory oversight is a crucial factor in determining the trustworthiness of a broker. A reputable regulatory authority helps ensure that the broker complies with industry standards and follows proper financial practices, which can help protect your investments. Broker’s Offerings. TD365 mentions a range of opportunities that come with trading with the broker. The broker mentions that it enables its clients to trade the most popular markets with low spreads on its CloudTrade platform. In addition, TD365 offers traders negative balance protection, high leverage of 200:1, a single currency Trading Account, and other benefits. However, the broker’s website lacks sufficient educational resources. Traders may need to take the initiative to explore alternative information sources to acquire the necessary skills and knowledge. In conclusion, while TD365 has received positive user reviews and offers a range of trading opportunities, the lack of a top-tier license from a leading financial authority raises questions about its legitimacy and trustworthiness. Therefore, potential investors should conduct thorough research and exercise caution when considering TD365 as their forex trading platform.

Is TD365 Regulated and who are the Regulators?

TD365, also known as TradeDirect365, is indeed a regulated entity. It is overseen by two main regulatory authorities. The Australian Securities and Investment Commission (ASIC): The Australian arm of TradeDirect365 is operated by Finsa Pty Ltd and falls under the jurisdiction of ASIC. ASIC is Australia’s Financial Services regulator. The Securities Commission of the Bahamas: The global entity TD365.com is a registered business name of Trade Nation Ltd, which is authorized and regulated by the Securities Commission of the Bahamas. This regulator, despite technically being an offshore regulator, takes its job seriously. As part of the regulation, all funds belonging to the clients are kept in segregated bank accounts. Their account has been upgraded with a negative balance protection mechanism meaning that their account balance may never go below zero. This ensures the safety of the funds of the traders and investors. Moreover, a minimum of $300,000 must be held by all regulated entities at all times in order to comply with Securities Commission of the Bahamas guidelines. This is no measly amount of cash, so the commission’s regulated brokers are hard at work. In terms of trading, TD365 offers a stable set of tradeable instruments, including forex currency pairs, commodities, cryptocurrencies, indices, and stocks. The EUR/USD spread is said to be fixed at 0.6 pips, with no applicable commissions. However, the broker is clear that it applies commissions when trading with certain assets. All in all, it’s safe to trade and invest with TD365.

Did TD365 win any Awards?

Based on the information available, there is no specific mention of TD365 winning any awards. TD365 is a platform that offers global asset selection and provides fixed spreads on everything on their CloudTrade platform – Stocks, Forex, Indices, Crypto, and Commodities. They are known for their instant execution speed and their demo account is a true replica of their real platform. However, the absence of any mention of awards does not necessarily reflect on the quality of their service. It’s always recommended to do thorough research and consider multiple factors when choosing a trading platform. Please note that trading involves risk and it’s important to understand the terms before starting.

How do I get in Contact with TD365?

TD365, a renowned platform in the world of forex trading, provides multiple avenues for customers to get in touch with them. Their commitment to customer service is evident in their 24/5 availability, ensuring that traders can receive assistance at any time during the trading week. Contact Information: Email: One of the most direct ways to contact TD365 is through their email address, which is support@td365.com. This method allows for detailed queries and is ideal for non-urgent matters. Phone: For immediate assistance, customers can reach out to TD365’s customer support line. The contact number for overseas customers is +44 203 180 5566, and for customers within The Bahamas, the toll-free number is +18449073258. Please note that all calls are recorded for security, audit, and compliance reasons. . Office Locations: Main Office: TD365’s main office is located at Bayview House, 1st Floor, 308 East Bay Street, PO BOX CB-12407 Nassau, New Providence, The Bahamas. Service Office and Payment Processor: Trade Nation Financial UK Ltd, Floor 6, 14 Bonhill Street, London, EC2A 4BX, United Kingdom. . Whether you’re a seasoned trader or a beginner in the forex market, TD365’s dedicated support team is ready to assist with your trading needs. Remember, trading involves risk and it’s important to understand the markets and instruments you are trading with.

Where are the Headquarters from TD365 based?

TD365, a prominent player in the world of forex trading, has its headquarters strategically located in two different parts of the world. The primary headquarters of TD365 is situated in the heart of the Caribbean, at Bayview House, 1st Floor, 308 East Bay Street, PO BOX CB-12407 Nassau, New Providence, The Bahamas. This location offers a strategic advantage, being in close proximity to the financial hub of the Americas. In addition to its primary location, TD365 also maintains a service office and payment processor in the United Kingdom. This office is located at Trade Nation Financial UK Ltd, Floor 6, 14 Bonhill Street, London, EC2A 4BX, United Kingdom. This presence in one of the world’s leading financial centers enables TD365 to stay connected with the European market and provide efficient services to its clients. TD365 offers its clients the opportunity to trade in a variety of financial instruments. These include major indices, stocks, forex commodities, and cryptocurrencies. This diverse portfolio allows traders to take advantage of market movements across a broad spectrum of assets. Please note that trading in financial spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It’s important for traders to understand how these instruments work and whether they can afford to take the high risk of losing their money. In conclusion, TD365, with its strategic locations and diverse offerings, is well-positioned to serve the needs of forex traders around the globe. As always, traders should exercise caution and make informed decisions when engaging in forex trading.

What kind of Customer Support is offered by TD365?

TD365 offers a comprehensive customer support system that is designed to cater to the needs of its clients, particularly those involved in forex trading. Availability: The customer support team at TD365 is available 24/5, from Monday 7am to Saturday 7am. This ensures that clients have access to assistance almost all week, which is crucial given the 24/5 nature of forex markets. Contact Methods: Clients can reach out to the customer support team through various channels. For clients within Australia, they can call 1800 886 514 (press 2). For clients outside Australia, they can reach the team at +61 2 8310 4713. Additionally, clients can also contact the team via email at support@TradeDirect365.com.au. Support Features: TD365 provides professional phone, email, and live chat support. This multi-channel approach ensures that clients can choose the method of communication that is most convenient for them. Additional Resources: Apart from direct support, TD365 also offers a range of educational content on their website. This includes a FAQs section, comprehensive user guides, videos, articles, and a handy glossary. These resources can be particularly useful for forex traders, both seasoned and beginners, as they provide valuable insights into the basics of forex trading and the specific features offered by TD365. Security Measures: It’s worth noting that all calls to the customer support team are recorded for security, audit, and compliance reasons. This is an important measure that helps ensure the safety and security of the clients’ accounts and transactions. In conclusion, TD365’s customer support is designed to provide a seamless and supportive trading experience for its clients, particularly those in the forex market. The availability of the support team, the variety of contact methods, the wealth of educational resources, and the emphasis on security all contribute to making TD365 a reliable platform for forex trading.

Which Educational and Learning Materials are offered by TD365?

TD365, a trading platform, offers a variety of educational and learning materials to help traders navigate the world of forex. Trading Video Guides: These guides provide visual aid to traders, helping them understand complex trading concepts and strategies. User Guides: These guides offer step-by-step instructions on how to use the TD365 platform effectively. CFD Trading Tips: Contract for Difference (CFD) trading can be complex and these tips provide traders with insights to make informed trading decisions. FAQ Section: This section addresses commonly asked questions about trading with TD365, providing quick answers to traders. These resources are designed to enhance the trading experience of users, providing them with the necessary knowledge and skills to trade forex and other financial instruments. It’s important to note that trading involves risks and it’s crucial to understand these risks before engaging in any trading activity.

Can anyone join TD365?

TD365, also known as TradeDirect365, is a popular platform for trading various financial instruments, including Forex. It offers a wide range of assets for trading, including indices, stocks, commodities, and cryptocurrencies. TD365 operates under the business name of Trade Nation Ltd, which is authorised and regulated by the Securities Commission of the Bahamas. This implies that it adheres to strict regulatory standards, providing a secure environment for traders. One of the key features of TD365 is its fixed spreads, which are offered on all assets on their CloudTrade platform. This can be particularly beneficial for Forex traders, as it allows for greater predictability in trading costs. TD365 also offers a demo account, which is a true replica of their real platform. This can be an excellent way for potential traders to familiarise themselves with the platform and practice their trading strategies without risking real money. However, it’s important to note that while TD365 offers a wide range of trading opportunities, trading in financial markets involves risks. Potential traders should ensure they understand these risks and seek independent advice if necessary before deciding to trade. In conclusion, while TD365 appears to be accessible to anyone interested in trading Forex and other financial instruments, potential traders should conduct their own due diligence and consider their individual financial circumstances and risk tolerance before deciding to join.

Who should sign up with TD365?

TD365 is a trading platform that caters to a wide range of traders, from novices to experienced professionals. Here’s a detailed look at who might benefit from signing up with TD365:. 1. Traders Seeking High Leverage: TD365 offers a leverage cap of 1:200. This high leverage can be risky for some, but it also presents a potentially lucrative opportunity for others, especially those with a solid understanding of risk management. 2. Diverse Asset Traders: TD365 provides a stable set of tradable instruments, including forex currency pairs, commodities, cryptocurrencies, indices, and stocks. This diversity allows traders to diversify their portfolios and explore different markets. 3. Cost-Conscious Traders: The EUR/USD spread at TD365 is said to be fixed at 0.6 pips, with no applicable commissions. However, the broker does apply commissions when trading with certain assets. Despite this, the costs are relatively low compared to the potential gains, making TD365 a good choice for cost-conscious traders. 4. Traders Prioritizing Safety: TD365 claims to be regulated by the Securities Commission of the Bahamas. All client funds are kept in segregated bank accounts, and accounts have been upgraded with a negative balance protection mechanism. This means that account balances may never go below zero, providing an additional layer of security for traders. 5. Users of MetaTrader4 and CloudTrade Platforms: TD365 offers access to the popular MetaTrader4 platform, as well as their in-house web-based platform, CloudTrade. These platforms cater to different types of traders, with MetaTrader4 being favored by more experienced traders and CloudTrade being a good starting point for novices. 6. Traders Seeking Excellent Customer Service: Reviews of TD365 highlight the platform’s prompt and great customer service. This can be particularly beneficial for new traders who may require assistance as they navigate the platform. In conclusion, TD365 is a versatile platform that can cater to a wide range of traders. Its high leverage, diverse asset offerings, competitive costs, regulatory oversight, platform options, and excellent customer service make it a compelling choice for anyone interested in forex trading. However, as with any trading platform, potential users should conduct their own research and consider their individual trading needs and goals before signing up.

Who should NOT sign up with TD365?

TD365 is a popular platform for forex trading, offering a wide range of financial instruments. However, it may not be suitable for everyone. Here are some categories of individuals who might want to reconsider signing up with TD365:. 1. Individuals Unfamiliar with CFDs TD365 primarily deals with Contracts for Difference (CFDs), which are complex instruments that come with a high risk of losing money rapidly due to leverage. It’s reported that 67.3% to 87.3% of retail investor accounts lose money when trading CFDs with this provider. Therefore, individuals who do not fully understand how CFDs work, or those who cannot afford to take the high risk of losing their money, should think twice before signing up. 2. Individuals Residing in Certain Countries TD365 accepts customers globally, but there are restrictions for residents of the United States or any countries where CFD services are contrary to local regulations. Therefore, individuals residing in such countries would not be able to sign up with TD365. 3. Individuals Unable to Verify Their Identity Before TD365 can approve an application, it must verify the identity of the applicant, otherwise known as completing Know Your Customer (KYC) procedures. Individuals who cannot provide satisfactory proof of identity would not be able to open an account with TD365. 4. Individuals Seeking Personal Financial Advice TD365 is not a financial adviser and all services are provided on an execution-only basis. Therefore, individuals seeking personal financial advice might not find what they’re looking for with TD365. 5. Individuals with Negative Reviews While many users have positive experiences with TD365. , some reviews have raised concerns about TD365’s reliability and commitment to regulatory standards. Therefore, individuals who prioritize these factors might want to consider other platforms. In conclusion, while TD365 offers a range of benefits such as a wide range of stock CFDs, no minimum deposit, and no inactive fees. , it’s important for potential users to consider their personal circumstances, understanding of CFDs, and the risks involved before signing up. As always, it’s recommended to do thorough research and consider multiple sources of information before making a decision.

Does TD365 offer Discounts, Coupons, or Promo Codes?

No. There is no information available about TD365 offering discounts, coupons, or promo codes. It’s always a good idea to check the official website or contact customer service for the most accurate and up-to-date information. Please note that terms and conditions may apply to any offers. Always read the fine print to understand what is included and what limitations may apply. It’s also worth noting that offers can change frequently, so what is available today may not be available tomorrow. Stay informed and make the most of any opportunities that come your way. Happy trading!.

Which Account Types are offered by TD365?

TD365 offers a variety of account types to cater to the diverse needs of its clients. Here are the details:. Personal Accounts: These are designed for individual traders who want to engage in forex trading. The broker offers a stable set of tradable instruments, including forex currency pairs. The EUR/USD spread is said to be fixed at 0.6 pips, with no applicable commissions. However, the broker is clear that it applies commissions when trading with certain assets. Company and Trust Accounts: These accounts are suitable for businesses and trusts that wish to participate in forex trading. The leverage cap is at 1:200, which may be risky for some but also a lucrative chance for others. This high leverage cap is because the broker is regulated in a nation that does not abide by the same legislations as in Europe (1:30 cap) or in Australia where the cap is currently at 1:30. Self-Managed Super Funds (SMSF) Accounts: These accounts are designed for SMSFs that want to invest in forex. As part of the regulation, all funds belonging to the clients are kept in segregated bank accounts. Their account balance may never go below zero due to the negative balance protection mechanism. TD365 also offers two different account types: Single Currency Spread Trading (SCT) Account. The available payment methods are credit cards, debit cards, and bank transfers. There is no minimum deposit requirement. All in all, it’s safe to trade and invest with TD365. Please note that trading forex involves risk, and it’s important to understand these risks before starting to trade.

How to Open a TD365 LIVE Account?

Opening a TD365 LIVE Account is a straightforward process that involves a few key steps. This account provides access to a range of financial markets, including forex. Step 1: Visit the TD365 Website Start by visiting the official TD365 website. On the homepage, you will find an option to open a new account. Step 2: Complete the Online Application Form Click on the ‘open account’ button to access the online application form. Fill out this form with the required details. Step 3: Understand the Risks It’s important to note that financial spread bets and CFDs are complex instruments. They come with a high risk of losing money rapidly due to leverage. As such, ensure you understand how CFDs work and whether you can afford to take the high risk of losing your money. Step 4: Start Trading Once your account is set up, you can start trading. TD365 offers a range of trading options, including forex trading. With Single Currency Trading, no matter what instrument you trade across the platform, the base currency you select applies to every trade. Additional Features TD365 also offers a free 27-hour online trading video course with world-renowned trader Al Brooks. Furthermore, the platform provides Single Currency Trading Accounts and Fixed spreads. Remember, trading involves risks and it’s important to trade responsibly.

How to Open a TD365 DEMO account?

If you are interested in trading forex with TD365, you might want to open a demo account first. A demo account is a great way to practice your trading skills, test your strategies, and familiarize yourself with the platform without risking any real money. Here are the steps to open a TD365 demo account: Go to the TD365 website and click on the “Open Free Demo Account” button. Fill in your personal details, such as your name, email address, phone number, and country of residence. Choose a password and agree to the terms and conditions. Verify your email address by clicking on the link sent to you by TD365. Login to your demo account using your username and password. Start trading with $50,000 virtual funds on various forex pairs, indices, commodities, and cryptocurrencies. Some of the benefits of opening a TD365 demo account are: You can trade with tight fixed spreads and no commissions on most instruments. You can access advanced trading tools and features, such as GSLO (guaranteed stop loss order), one-click trading, market sentiment analysis, and more. You can learn from the educational resources provided by TD365, such as webinars, videos, articles, and ebooks. You can withdraw your virtual funds at any time without any restrictions or fees. Opening a TD365 demo account is easy and free. You can use it as long as you want to improve your trading skills and confidence. However, if you want to trade with real money, you will need to open a live account first. To do that, you will need to provide some documents for verification purposes. You can find more information about opening a live account on the TD365 website. If you have any questions or feedback, please let me know. ?.

How Are You Protected as a Client at TD365?

TD365.com is a forex trading platform that offers a variety of financial instruments, including indices, stocks, forex, commodities, and cryptocurrencies. As a client at TD365.com, you can enjoy the following benefits: Regulated and licensed: TD365.com is regulated by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. This means that your funds are held in segregated accounts and protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person. You can also trade with confidence knowing that TD365.com follows strict compliance standards and adheres to the best practices of the industry. Diversified and flexible trading options: TD365.com allows you to trade over 250 instruments across various markets, including major currency pairs, minor pairs, crosses, metals, energies, indices, stocks, and cryptocurrencies. You can choose from different account types depending on your trading style and preferences. For example, you can open a single currency trading account to simplify your trading and save on FX conversion fees. You can also access advanced trading tools such as technical analysis indicators, charting features, market news, economic calendar, and more. Competitive spreads and leverage: TD365.com offers low spreads starting from 0 pips on some of the most popular instruments. You can also benefit from high leverage up to 1:500 on some of the major currency pairs. This means that you can amplify your profits or losses depending on the market movements. However, you should be aware of the risks involved in trading with leverage as it can magnify your losses as well as your gains. Customer support and education: TD365.com provides 24/7 customer support via phone, email, live chat, and social media. You can contact them anytime if you have any questions or issues regarding your account or trading activities. You can also access a wealth of educational resources on their website to learn more about forex trading and improve your skills. They offer articles, videos, webinars, ebooks, glossary terms. , FAQs. , and more. In conclusion, TD365.com is a reputable forex trading platform that offers a range of benefits for its clients. However, you should always do your own research before choosing any broker or platform. You should also understand how forex trading works and whether you can afford to take the high risk of losing money rapidly due to leverage. Forex trading is not suitable for everyone and may result in losses that exceed your deposits.

Which Funding methods or Deposit Options are available at TD365?

TD365 is a forex broker that offers a variety of funding methods and deposit options for its clients. According to the web search results, some of the available payment methods are: Credit cards: TD365 accepts credit cards from Visa, Mastercard, and American Express. The minimum deposit amount is $1 and there are no fees for using this method. Debit cards: TD365 also accepts debit cards from Visa, Mastercard, and American Express. The minimum deposit amount is $1 and there are no fees for using this method. Bank transfers: TD365 allows clients to deposit funds via bank transfer using SWIFT or SEPA. The minimum deposit amount is $1 and there are no fees for using this method. TD365 does not charge any inactivity fees or withdrawal fees for its clients. However, the processing time and the exchange rate may vary depending on the payment method chosen by the client. TD365 also does not specify any limits on the maximum or minimum withdrawal amounts. TD365 is regulated by the Securities Commission of the Bahamas, which ensures the safety and security of its clients’ funds. TD365 also offers negative balance protection, which means that its clients’ account balance will never go below zero in case of market fluctuations. TD365 provides its clients with various trading platforms, such as MT4, MT5, and CloudTrade. These platforms offer advanced features and tools for trading forex and other financial instruments. TD365 also offers educational resources, research reports, and customer support to help its clients improve their trading skills and performance. If you are interested in trading with TD365, you can visit their website here or read some reviews about them here, here, or here.

What is the Minimum Deposit Amount at TD365?

TD365 is a well-regarded trading platform that offers a variety of financial instruments, including forex currency pairs. The platform is regulated by the Securities Commission of the Bahamas. , ensuring a secure and reliable trading environment for its users. The minimum deposit amount at TD365 varies depending on the source. Some sources suggest that there is no minimum deposit requirement. , while others indicate a minimum deposit of $5. or even $1. It’s always recommended to check the latest information directly from the TD365 platform to ensure accuracy. TD365 provides leverage levels up to 1:200. , which can be risky for some but may also present lucrative opportunities for others. The platform offers both fixed and variable spreads. , and the EUR/USD spread is said to be fixed at 0.6 pips. In terms of trading platforms, TD365 offers the popular MetaTrader4 as well as their in-house web-based platform, CloudTrade. These platforms cater to both novice and experienced traders, offering a range of functionalities to suit different trading needs. As part of the regulation, all funds belonging to the clients are kept in segregated bank accounts, and their account have been upgraded with a negative balance protection mechanism meaning that their account balance may never go below zero. This provides an additional layer of security for traders using the TD365 platform. In conclusion, TD365 is a versatile trading platform that caters to a wide range of trading needs. Whether you’re a novice trader looking for a user-friendly platform to start your trading journey, or an experienced trader seeking advanced trading functionalities, TD365 has got you covered. Always remember to trade responsibly and ensure that you’re fully aware of the risks involved in forex trading.

Which Withdrawal methods are available at TD365?

TD365, a forex trading platform, offers a straightforward and efficient withdrawal process. The available withdrawal methods at TD365 are credit cards, debit cards, and bank transfers. These methods are not only used for depositing funds but also for withdrawing them. This simplicity in the financial transactions is a refreshing aspect of TD365’s operations. One of the key aspects of TD365’s withdrawal process is its efficiency. The company aims to process all withdrawal requests within a day. However, it’s important to note that third-party bank fees may apply depending on the banking group. As part of its commitment to providing a secure trading environment, TD365 ensures that all client funds are kept in segregated bank accounts. This means that the clients’ funds are kept separate from the company’s own funds, providing an additional layer of security for the traders. Moreover, TD365 has implemented a negative balance protection mechanism. This means that a client’s account balance may never go below zero. This feature provides traders with the assurance that they will not lose more money than they have deposited into their accounts. In conclusion, TD365 offers a simple, efficient, and secure withdrawal process, making it a reliable choice for forex traders.

Which Fees are charged by TD365?

TD365, a popular trading platform, has a fee structure that is designed to be straightforward and competitive. Here are the key points:. Commission-Free Trading: One of the main advantages of TD365 is that it offers commission-free trading. This means that traders do not have to pay a separate fee for each trade they make. This can be particularly beneficial for active traders who make a large number of trades. Spread Costs: While TD365 does not charge a commission, it does make money through the spread, which is the difference between the buy and sell price of a financial instrument. The spread can vary depending on the market and the specific instrument being traded. No Minimum Deposit: TD365 does not require a minimum deposit to start trading. This makes it accessible to traders of all levels, from beginners to experienced professionals. Inactivity Fees: Specific information about inactivity fees was not found. Traders should check the latest terms and conditions on the TD365 website to ensure they are aware of any potential charges. Other Fees: For trading ASX stock CFDs, if you execute 2 round turn trades (or 4 single legs) within the calendar month, the AUD$27.50 per month fee is waived. Please note that while this information is accurate as of the time of writing, fees can change and it’s always a good idea to check the latest information on the TD365 website or contact their customer service for the most up-to-date details. Happy trading!.

What can I trade with TD365?

Forex Trading with TD365: When it comes to forex trading, TD365 offers a comprehensive range of options for traders. Whether you’re an experienced investor or just starting out, TD365 provides a platform that caters to your needs. Here are the key features:. Tight Spreads: TD365.com provides very tight spreads on major forex pairs. This means you can trade with minimal cost, making it ideal for both short-term and long-term strategies. High Leverage: With TD365, you can trade forex with leverage of up to 200:1. This allows you to control larger positions with a smaller amount of capital. For example, with just 0.5% margin requirement, you can open a position. Fixed Spreads: TD365.com offers fixed spreads, providing predictability and stability for traders. This is especially useful during volatile market conditions. . Here are some of the forex pairs you can trade with TD365:. AUD/USD: Australian Dollar against the US Dollar EUR/USD: Euro against the US Dollar GBP/USD: British Pound against the US Dollar USD/JPY: US Dollar against the Japanese Yen And many more… . Remember that forex trading involves risk, and it’s essential to understand how CFDs work before you start. Always consider your risk tolerance and financial situation before trading. Disclaimer: Financial Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Which Trading Platforms are offered by TD365?

TD365, a renowned trading platform, offers two main platforms for trading. The first one is MetaTrader 4 (MT4). , a popular choice among traders worldwide. MT4 is known for its advanced charting capabilities, numerous built-in indicators, and the ability to run automated trading strategies. It offers variable spreads and allows trading in 12 indices, 26 FX pairs, 4 commodities. The second platform offered by TD365 is their proprietary platform known as CloudTrade. This platform is web-based and also available as a mobile app. It offers fixed spreads and allows trading in a wider range of markets compared to MT4. These include 23 indices, 33 FX pairs, 11 commodities, and 11 cryptocurrencies. However, it does not support automated trading. Both platforms are designed to cater to the needs of different types of traders, offering a range of essential benefits, functionalities, and features. They allow users to trade all the available Trading Products with ease. Please note that while both platforms allow trading in forex, the number of FX pairs available for trading differs between the two platforms. In conclusion, whether you’re a beginner or an experienced trader, TD365’s trading platforms can provide you with the tools and features you need to navigate the forex market effectively.

Which Trading Instruments are offered by TD365?

TD365 offers a wide range of trading instruments. Here are the details:. Indices: TD365 provides the opportunity to trade on various global indices. These include Wall St 30, DE40, UK 100, Japan 225, and many more. This allows traders to speculate on the performance of these market indices. Stocks: Traders have access to stocks from different regions including the UK, US, and Europe. This offers a broad spectrum for stock trading, enabling traders to diversify their portfolio. Forex: TD365 offers over 30 forex pairs for trading. Major FX pairs like EUR/USD, EUR/GBP, & AUD/USD are included. This wide range of currency pairs provides traders with the opportunity to speculate on the foreign exchange market. Commodities: Commodities like Gold, Silver, Brent Crude Oil and US Light Crude Oil can be traded. This allows traders to speculate on the price of these commodities. Cryptocurrencies: TD365 also offers the opportunity to trade on cryptocurrencies. This includes popular cryptocurrencies like Bitcoin and Ethereum. In conclusion, TD365 offers a comprehensive range of trading instruments, catering to the needs of both beginners and experienced traders. Whether you’re interested in forex, stocks, indices, commodities, or cryptocurrencies, TD365 has got you covered.

Which Trading Servers are offered by TD365?

TD365 is a trading platform that offers various features and benefits for forex traders. According to their website, TD365 provides the following trading servers:. CloudTrade: This is a web-based platform that allows traders to access live pricing, intuitive charts, advanced order types, account history, and high/low figures from the day. CloudTrade also supports mobile devices and has a free demo account. CloudTrade is available for all markets, including indices, stocks, forex, commodities, and cryptocurrencies. MetaTrader 4: This is the world’s most popular online trading platform that supports FX, indices, and commodities. MetaTrader 4 has a user-friendly interface, powerful tools, and extensive market information. MetaTrader 4 also allows traders to use automated trading systems (EAs) or expert advisors. MetaTrader 4 is available for fixed spreads or variable spreads. TD365 claims to offer competitive spreads, fast execution, low commissions, and reliable customer support. TD365 also has a loyalty program that rewards traders with cashback and bonuses.

Can I trade Crypto with TD365? Which crypto currencies are supported by TD365?

Yes, you can trade cryptocurrencies with TD365. TD365 offers a platform for trading the most popular cryptocurrencies in a safe and secure manner. The cryptocurrencies supported by TD365 include, but are not limited to:. Bitcoin: Bitcoin is the first and most well-known cryptocurrency. It operates on a decentralized peer-to-peer network. Ethereum (Ether): Ethereum is a decentralized, open-source blockchain featuring smart contract functionality. Ether is the native cryptocurrency of the platform. Cardano: Cardano is a cryptocurrency network and open source project that aims to run a public blockchain platform for smart contracts. EOS: EOS.IO is a blockchain protocol powered by the native cryptocurrency EOS. The protocol emulates most of the attributes of a real computer including hardware. Ripple: Ripple is both a platform used for the peer-to-peer transfer of currencies (RippleNet), and a digital currency (ripple XRP). Please note that trading in cryptocurrencies comes with its own set of risks. Financial Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In the context of forex, trading cryptocurrencies is similar to trading fiat currencies. Instead of trading currency pairs like EUR/USD, you’re trading crypto pairs like BTC/ETH. Cryptocurrencies can be traded for one another, and this is commonly referred to as ‘crypto-to-crypto’ trading. Remember, trading involves risk and it’s important to understand these risks before starting. Always trade responsibly.

What is the Leverage on my TD365 Trading Account?

TD365, an online forex broker registered in the Bahamas. , offers a maximum leverage of 1:200. This high leverage cap is due to the broker being regulated in a nation that does not abide by the same legislations as in Europe (1:30 cap) or in Australia where the cap is currently at 1:30. Leverage is one of the significant benefits of CFD trading, allowing traders to control larger positions with a smaller amount of capital. However, it’s important to note that while leverage can amplify profits, it can also magnify losses. Therefore, a leverage of 1:200, although potentially lucrative, can be very risky. TD365 offers a stable set of tradeable instruments, including forex currency pairs, commodities, cryptocurrencies, indices, and stocks. The EUR/USD spread is said to be fixed at 0.6 pips, with no applicable commissions. However, the broker does apply commissions when trading with certain assets. The broker claims to be regulated by the Securities Commission of the Bahamas, and there is evidence to support this claim. As part of the regulation, all funds belonging to the clients are kept in segregated bank accounts, and their accounts have been upgraded with a negative balance protection mechanism meaning that their account balance may never go below zero. In terms of trading platforms, TD365 offers two options: the CloudTrade platform and MetaTrader4 (MT4). The CloudTrade platform allows clients to trade Indices, Commodities, Stocks, and Forex. In conclusion, while the leverage of 1:200 offered by TD365 can be an attractive feature for some traders, it’s crucial to understand the risks associated with high leverage. It’s always recommended to have a solid risk management strategy in place when trading with leverage.

What kind of Spreads are offered by TD365?

TD365, a renowned trading platform, offers a variety of spreads across different forex pairs. These spreads are fixed and are offered 24/5. Here are some of the key offerings:. EUR/AUD: The spread for EUR/AUD is 19 from 22:00 GMT. EUR/CAD: The spread for EUR/CAD is 18 from 22:00 GMT. EUR/CHF: The spread for EUR/CHF is 13 from 22:00 GMT. EUR/GBP: The spread for EUR/GBP is 10 from 22:00 GMT. EUR/JPY: The spread for EUR/JPY is 13 from 22:00 GMT. EUR/NZD: The spread for EUR/NZD is 22 from 22:00 GMT. EUR/USD: The spread for EUR/USD is 5 from 22:00 GMT. EUR/ZAR: The spread for EUR/ZAR is 80 from 22:00 GMT. . It’s important to note that these spreads are subject to change and traders should always check the latest spreads on the TD365 platform. TD365 also offers spreads for other forex pairs involving GBP and USD:. GBP/AUD: The spread for GBP/AUD is 24 from 22:00 GMT. GBP/CAD: The spread for GBP/CAD is 25 from 22:00 GMT. GBP/CHF: The spread for GBP/CHF is 18 from 22:00 GMT. GBP/JPY: The spread for GBP/JPY is 20 from 22:00 GMT. GBP/NZD: The spread for GBP/NZD is 30 from 22:00 GMT. GBP/USD: The spread for GBP/USD is 8 from 22:00 GMT. GBP/ZAR: The spread for GBP/ZAR is 95 from 22:00 GMT. AUD/USD: The spread for AUD/USD is 6 from 22:00 GMT. NZD/USD: The spread for NZD/USD is 8 from 22:00 GMT. . These offerings make TD365 a competitive choice for forex traders. However, it’s always recommended to stay updated with the latest spreads on the TD365 platform.

Does TD365 offer MAM Accounts or PAMM Accounts?

TD365 is a well-known platform in the world of forex trading. However, based on the information available, it does not explicitly state whether it offers MAM (Multi-Account Manager) or PAMM (Percentage Allocation Management Module) accounts. MAM Accounts are designed for fund managers and allow them to manage multiple accounts from a single master account. They are particularly useful in the forex market, where there is a need for large-scale, high-speed trading. On the other hand, PAMM Accounts are a type of forex trading account used by money managers to trade in an investor’s stead. PAMM accounts are a hassle-free method for individuals to pick and choose their money managers for forex trading. While TD365 offers a range of trading options, including indices, stocks, forex, commodities, and cryptocurrencies. , there is no explicit mention of MAM or PAMM accounts. Therefore, it would be advisable for potential investors to contact TD365 directly for the most accurate and up-to-date information. Remember, while MAM and PAMM accounts can offer significant benefits, they also carry risks. The success of these accounts is heavily dependent on the performance of the money manager. Therefore, potential investors should thoroughly research and consider these factors before deciding to invest in MAM or PAMM accounts.

Does TD365 allow Expert Advisors?

Yes, TD365 does allow the use of Expert Advisors (EAs). TD365 is an Australian-based CFD broker that has been providing traders with secure access to the global financial markets. They offer a vast selection of trading instruments across different asset classes, such as forex, indices, commodities, cryptocurrency, stocks, and more. The broker provides traders with innovative trading platforms, such as the MT4 and CloudTrade platforms. The MT4 platform, which is known as the world’s most popular trading platform, offers a full set of features, including Expert Advisors. However, it’s important to note that TD365 does not offer fixed spreads on the MT4 platform but offers very tight and competitive variable spreads. The commission starts at a low USD $1.50 per side across FX, Commodities, and Indices. In conclusion, if you’re a trader who uses Expert Advisors in your trading strategy, TD365 could be a suitable platform for you. However, as always, it’s important to thoroughly research and consider all aspects of a trading platform before deciding to use it.

Does TD365 offer Copytrading?

TD365 does indeed offer Copytrading. This feature allows traders to mimic the strategies and trades of expert traders, which can be particularly beneficial for novice traders or those looking to diversify their trading strategies. The Copytrading feature is facilitated through TD365’s TradeCopier App. This application enables users to follow the trades of expert traders, effectively copying their trading strategies. It’s a smarter and simpler way to trade, especially for those who may not have the time or expertise to devise their own trading strategies. However, it’s important to note that Financial Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In fact, 84% of retail investor accounts lose money when trading CFDs with this provider. Therefore, traders should consider whether they understand how CFDs work and whether they can afford to take the high risk of losing their money before engaging in Copytrading. In addition to Copytrading, TD365 also offers the world’s most popular trading platform, MT4. Traders can trade FX, Indices, and Commodities on MT4 with TD365 using tight, variable spreads and low commissions. The platform also offers a full set of features, including Expert Advisors (EAs), further enhancing the trading experience. In conclusion, TD365 does offer Copytrading, providing traders with the opportunity to leverage the expertise of seasoned traders. However, as with all trading activities, it comes with risks and should be undertaken with a clear understanding of these risks.