TMGM Review 2026

What is TMGM?

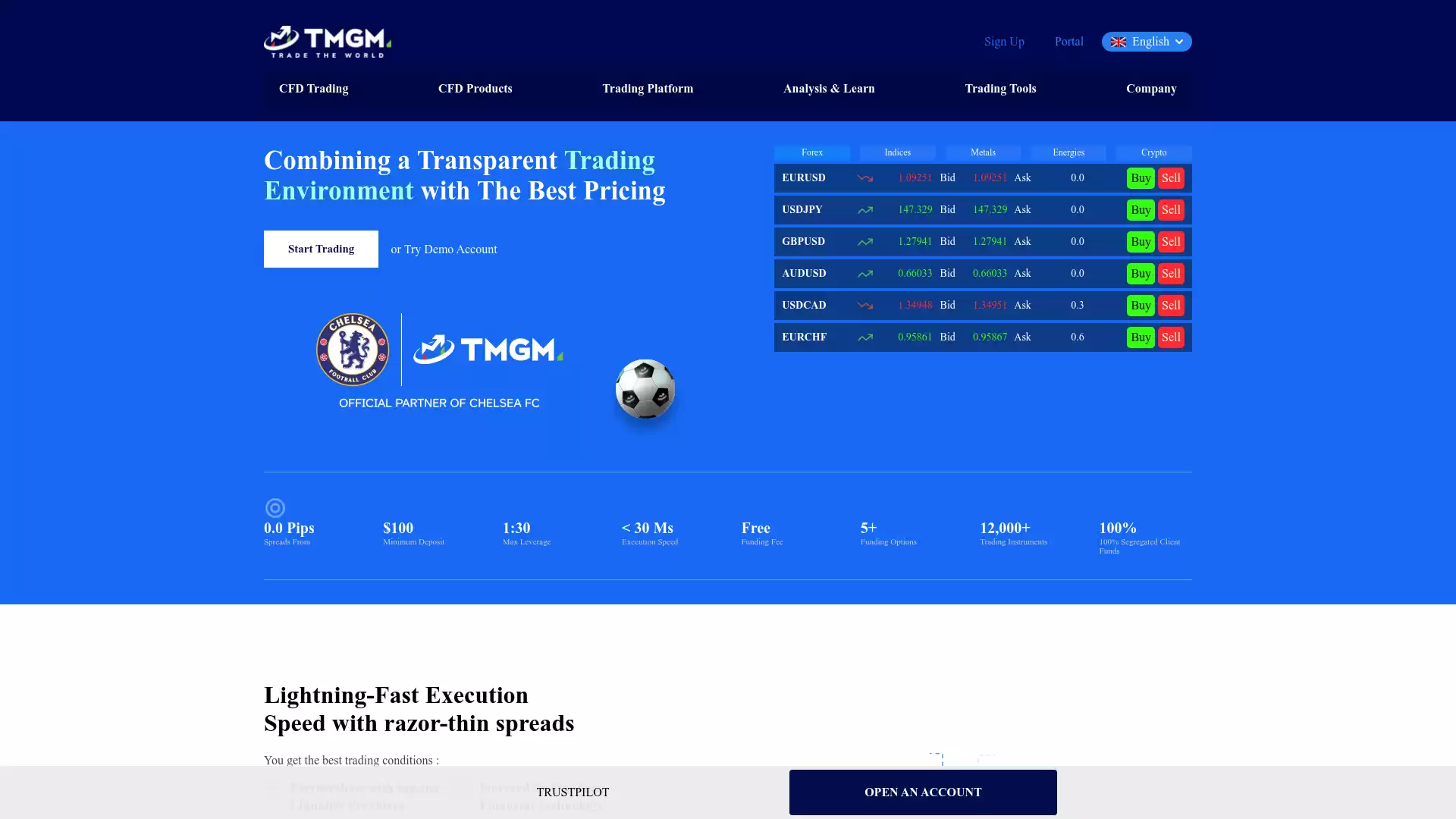

TMGM, formerly known as TradeMax Global Markets, is a multi-regulated forex broker with a strong presence in Australia and New Zealand. It is recognized for its low spreads with ECN pricing, MetaTrader 4, and DMA execution for stocks with IRESS. TMGM provides a transparent trading environment combined with competitive pricing. It offers the opportunity to trade over 60 currency pairs 24/5 with ultra-low spreads, fast execution, and up to 1:1000 leverage. TMGM’s proprietary aggregation engine helps consistently offer the best spreads. It benefits from the deep liquidity of its pool of top tier liquidity providers, ensuring the best rates are always available. TMGM is a good choice for those who are content with only CFD/forex trading and prefer the MetaTrader platform. It has a very strong selection of stock CFDs and a decent offering of forex pairs, all at low fees. It’s easy to open and fund your account, and the $100 minimum deposit is reasonable. Whether you’re a scalper, news trader, or EA trader, TMGM provides an optimal environment to fulfill your potential. You can rest assured that your funds are safe with TMGM, as it has four reputable licenses – ASIC, FMA, VFSC & FSC.

What is the Review Rating of TMGM?

- 55brokers: 55brokers rated TMGM with a score of 86. This rating was last checked at 2024-01-06 11:36:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated TMGM with a score of 58. This rating was last checked at 2024-01-06 17:50:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Forexbrokers: Forexbrokers rated TMGM with a score of 80. This rating was last checked at 2024-01-06 13:31:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated TMGM with a score of 84. This rating was last checked at 2024-01-05 23:11:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated TMGM with a score of 78. This rating was last checked at 2024-03-13 12:00:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of TMGM?

TMGM, a forex and CFD broker, has several advantages that make it a compelling choice for traders. Here are some of the key benefits:. Competitive Pricing: TMGM offers competitive pricing, particularly on its Edge account. This makes it an attractive option for traders looking to minimize their trading costs. Diverse Account Types: TMGM provides a variety of account types to cater to different trading needs. This flexibility allows traders to choose an account that best suits their trading style and requirements. Strong Selection of Stock CFDs and Forex Pairs: TMGM boasts a robust selection of stock CFDs and forex pairs. This wide range of offerings provides traders with ample opportunities to diversify their portfolios. MetaTrader Platform: TMGM primarily operates on the MetaTrader platform. Known for its advanced features and tools, MetaTrader is favored by many traders worldwide. Low Minimum Deposit: With a minimum deposit requirement of just $100. , TMGM makes forex and CFD trading accessible to a wide range of traders. Regulated by Top-Tier Authorities: TMGM is regulated by top-tier authorities, including the Australian Securities & Investment Commission (ASIC) and the Financial Markets Authority (FMA). This provides traders with an added layer of security and trust. Impressive Educational Toolset: Although currently unavailable, the TMGM Academy is an impressive educational tool that delivers quizzes and interactive content. This can be particularly beneficial for novice traders looking to enhance their trading knowledge. Please note that while TMGM offers many advantages, it’s important for traders to consider their individual trading needs and objectives before choosing a broker. It’s also recommended to thoroughly review the broker’s terms and conditions.

What are the Cons of TMGM?

TradeMax Global Markets (TMGM) is a well-known forex broker that offers a variety of trading services. However, like any other broker, it has its own set of drawbacks. Here are some of the cons associated with TMGM:. Limited Platform Optimization for Forex Trading: TMGM offers a small range of markets via the MetaTrader 4 (MT4) platform. While primarily a MetaTrader broker, it also offers the more exclusive IRESS platform. However, the majority of available symbols are segmented on the IRESS platform, which is not optimized for forex trading. This could potentially limit the trading experience for forex traders. High Deposit Requirement for IRESS Platform: The IRESS platform, which houses the majority of available symbols, requires a $5,000 deposit. This high deposit requirement could be a barrier for traders with a smaller budget. Absence of MetaTrader 5 (MT5): As of the latest information, MetaTrader 5 (MT5) has not yet launched at TMGM. This could be a disadvantage for traders who prefer the newer and more advanced features of MT5. Inactivity Fee: TMGM charges an inactivity fee if you don’t trade for more than six months. This could be a disadvantage for casual traders or those who trade less frequently. Limited Educational Content: Although TMGM is praised for its impressive education toolset, it still trails behind the best brokers in most categories. The lack of comprehensive educational content could be a disadvantage for beginner traders who are looking to learn and grow. Geographical Restrictions: Depending on the location, there might be geographical restrictions. This could limit the accessibility of TMGM’s services for traders in certain regions. Please note that this information is based on the latest available data and may change over time. It’s always a good idea to do thorough research and consider multiple sources before choosing a forex broker.

What are the TMGM Current Promos?

TMGM, a leading online trading platform, offers a range of promotions and features that make it an attractive option for both new and experienced traders. Competitive Pricing and Conditions TMGM provides competitive conditions for trading. It offers 0.0 pips spreads, a minimum deposit of $100, and a maximum leverage of 1:1000. The execution speed is less than 30 ms, ensuring quick and efficient trades. Wide Range of Trading Instruments With TMGM, traders have access to over 12,000 trading instruments. This includes forex pairs, indices, metals, energies, and cryptocurrencies. Flexible Funding Options TMGM offers more than 10 funding options. This flexibility allows traders to choose the method that best suits their needs. Plus, the funding fee is free. Crypto Trading TMGM has expanded its offerings to include crypto trading. Traders can now trade crypto 24/7. Trust and Regulation TMGM is a trusted and regulated broker. It is authorized by two Tier-1 regulators: the Australian Securities & Investment Commission (ASIC) and the Financial Markets Authority (FMA). Education and Support Although currently unavailable, the TMGM Academy is an impressive educational tool that delivers quizzes and interactive content. This can be particularly beneficial for new traders looking to enhance their knowledge. Please note that the details of these promotions and features may vary, and it’s always a good idea to check the official TMGM website. for the most up-to-date information.

What are the TMGM Highlights?

TradeMax Global Markets (TMGM) is a leading online trading platform that offers a wide range of financial instruments for trading. Here are some of the key highlights:. Diverse Trading Instruments: TMGM provides access to over 12,000 trading instruments across seven asset classes, including Forex, Futures, Indices, Metals, Energy, Shares, and Crypto. Transparent Trading Environment: TMGM is known for its transparent trading environment. It offers competitive pricing and lightning-fast execution speed. MetaTrader 4 (MT4) Platform: TMGM primarily operates via the MetaTrader 4 (MT4) platform, which is renowned for its user-friendly interface and advanced trading features. IRESS Platform: In addition to MT4, TMGM also offers the exclusive IRESS platform, providing a more sophisticated trading experience. Education Toolset: TMGM stands out for its impressive education toolset, which can be beneficial for both novice and experienced traders. Partnership with Chelsea FC: TMGM has partnered with Chelsea FC to create activations that drive brand awareness and understanding of TMGM as an FX provider. Secure Fund Management: TMGM ensures secure fund management by holding client funds in a Tier 1 Bank. Please note that while TMGM offers a wide range of services and features, it’s important for potential users to understand their own trading needs and objectives, and to consider these in the context of the platform’s offerings.

Is TMGM Legit and Trustworthy?

TradeMax Global Markets (TMGM) is a forex broker that has been in operation since 2013. It is regulated by top-tier financial regulators, including the Australian Securities and Investments Commission (ASIC). This regulatory oversight provides a level of trust and legitimacy to the broker’s operations. TMGM offers a wide range of trading platforms and has a strong selection of stock CFDs and forex pairs. The broker’s services are particularly suited to active traders due to its low forex fees. However, it’s worth noting that there is an inactivity fee for accounts that remain dormant for more than six months. Customer reviews of TMGM are mixed. Some customers praise the broker for its fast deposit and withdrawal process. , while others have reported issues with customer service. It’s important for potential clients to consider these reviews when deciding whether to trade with TMGM. In conclusion, while TMGM is considered a legitimate and trustworthy broker. , potential clients should carefully consider the broker’s fees, product portfolio, and customer reviews before deciding to open an account.

Is TMGM Regulated and who are the Regulators?

TMGM, a prominent player in the forex market, is regulated by several financial regulatory bodies globally. This ensures that they adhere to strict standards and provide a secure trading environment for their clients. Australian Securities and Investment Commission (ASIC). : ASIC is an independent government body that enforces and regulates company and financial services laws. Their focus is to protect Australian consumers, investors, and creditors. TMGM holds an AFSL license (No. 436416) issued by ASIC. Financial Markets Authority (FMA). : The FMA is the New Zealand government agency responsible for enforcing securities, financial reporting, and company law as they apply to financial services and securities markets. Trademax Global Markets (NZ) Limited, a part of TMGM, has a Derivatives Issuer License (FSP 569807) issued by the FMA. Vanuatu Financial Services Commission (VFSC). : The VFSC regulates banking and financial services in Vanuatu. TMGM holds a Vanuatu Financial License (No. 40356) issued by the VFSC. Financial Services Commission, Mauritius (FSC). : The FSC is the integrated regulator for the non-bank financial services sector and global business in Mauritius. Trademax Global Markets (International) Pty Ltd, a part of TMGM, holds an Investment Dealer (Full Service Dealer, excluding Underwriting) Licence and a Global Business Licence (Licence No. GB22201012) issued by the FSC. In addition to these regulatory bodies, TMGM has in place an external independent auditor to ensure compliance with regulatory obligations and operational processes. Client funds are held in an Australian ADI (authorized deposit-taking institution) which has an AA rating. The National Australia Bank (NAB) is one of the top 4 largest financial institutions in Australia and is highly ranked worldwide. In conclusion, TMGM’s regulation by multiple financial regulatory bodies globally demonstrates its commitment to providing a secure and reliable trading environment for its clients.

Did TMGM win any Awards?

TMGM, a prominent player in the forex trading industry, has indeed been recognized for its excellence. One of the notable recognitions is being nominated for the “Best Forex Broker in Asia” by Traders Awards. This nomination is a testament to TMGM’s commitment to providing top-tier forex trading services in the Asian market. In addition to this, TMGM also hosts a Trading Competition. This competition, which runs from 30th October 2023 to 2nd February 2024, offers a total prize pool of $246,900 USD. The competition is divided into several sub-groups (Blue, Red, Black, and Ares), each with its own set of requirements and rewards. The top 10 participants in each sub-group are awarded certificates, while the top 3 receive trophies. This competition not only encourages active trading but also recognizes the skills and efforts of its participants. Furthermore, TMGM has a Rewards program. that offers exclusive benefits to its members. Members earn points for every lot they trade, which can be redeemed for various rewards including top-rated trending products. This program is currently available to several countries across the globe. In conclusion, TMGM has indeed won recognition in the forex trading industry through its nominations, competitions, and rewards programs. These initiatives highlight TMGM’s commitment to excellence and customer satisfaction in the forex trading industry.

How do I get in Contact with TMGM?

TMGM, a leading Forex broker, offers several ways to get in touch. Phone: TMGM can be reached at the phone number +61 280368388. Email: For email inquiries, TMGM’s support email is support@tmgm.com. Physical Address: TMGM’s physical location is at Level 28, One International Tower, 100 Barangaroo Avenue, 2000 Sydney NSW Australia. Website: TMGM’s website also provides contact information. Live Chat: TMGM offers a live chat service. It’s important to note that TMGM’s customer service is available 24/7. , ensuring that all queries are addressed promptly. Please remember that Forex trading involves significant risk and may not be suitable for all investors. Carefully consider your financial situation and experience level before trading. For more information, please visit TMGM’s official website.

Where are the Headquarters from TMGM based?

TradeMax Global Markets, commonly known as TMGM, is a renowned financial services company that specializes in forex trading, commodity trading, and meta-trading. TMGM is regulated by the Australian Securities and Investments Commission (ASIC), AFSL no. 436416. The headquarters of TMGM is located at Level 28, One International Tower, 100 Barangaroo Avenue, 2000 Sydney, NSW Australia. This strategic location in one of the world’s leading financial hubs enables TMGM to provide top-notch service to its global clientele. Since its inception in 2015. , TMGM has been committed to providing its clients with the best possible trading experience. This commitment is evident in their innovative approach to forex brokerage and their dedication to research and development. TMGM’s exceptional customer service is another factor that sets it apart in the competitive forex market. Clients can easily reach out to TMGM’s dedicated team for assistance. In conclusion, TMGM, with its headquarters in Sydney, Australia, continues to be a leader in the forex trading industry, offering a wide range of services to its global clientele.

What kind of Customer Support is offered by TMGM?

TMGM, a leading Forex broker, offers exceptional customer service. The support team can be reached via various channels, ensuring that clients’ needs are addressed promptly and efficiently. Contact Channels TMGM’s customer support can be reached through email at support@tmgm.com. This allows clients to send detailed queries or concerns, which the support team can address comprehensively. In addition to email, TMGM also provides live chat support. This real-time communication channel is ideal for immediate assistance and quick resolution of issues. Availability One of the key strengths of TMGM’s customer service is its 24/7 availability. This ensures that clients from different time zones can receive assistance whenever they need it. Support Scope TMGM’s customer support covers a wide range of issues. For instance, if a client’s account goes into negative balance, they are advised to get in touch with the support team either via live chat or email. Client Feedback TMGM values client feedback and uses it to improve their services. They believe in maintaining open lines of communication with their clients, which is reflected in their commitment to providing top-notch customer service. In conclusion, TMGM’s customer support is comprehensive, accessible, and client-focused, making it a reliable partner for Forex traders. It’s clear that TMGM places a high priority on customer satisfaction, making it a preferred choice for many in the Forex trading community.

Which Educational and Learning Materials are offered by TMGM?

TMGM, a renowned financial services provider, offers a range of educational and learning materials to its users. However, it’s important to note that the offerings are somewhat limited, particularly for those who are new to the world of investing. Demo Account One of the key educational tools provided by TMGM is a demo account. This allows users to gain practical trading experience in a risk-free virtual environment. It’s an excellent way for beginners to familiarize themselves with trading mechanics and strategies without risking real money. Educational Texts TMGM also provides quality educational texts. These texts can be a valuable resource for users, providing them with essential knowledge about various aspects of trading and financial markets. However, it’s worth noting that TMGM does not offer general educational videos or platform tutorial videos. This could be a drawback for visual learners who prefer video content for learning. In conclusion, while TMGM does offer some educational resources, they are somewhat limited. Therefore, users may need to seek additional educational materials elsewhere to supplement their learning.

Can anyone join TMGM?

TradeMax Global Markets, commonly known as TMGM, is a renowned online trading platform that offers a transparent trading environment with optimal pricing. TMGM provides access to over 12,000 products across seven assets, including Forex, Futures, Indices, Metals, Energy, Shares, and Crypto. However, not everyone can join TMGM. There are specific eligibility criteria that need to be met. According to the information available, to be eligible to join TMGM, an individual must either have net assets of at least A$2.5 million or a gross income of at least AUD 250,000 per year for each of the last two financial years. These criteria ensure that only individuals with a certain level of financial stability and income can participate in trading on TMGM. This is likely to mitigate the risk associated with trading and ensure a secure trading environment for all participants. It’s important to note that trading involves significant risk and may not be suitable for everyone. Potential traders should carefully consider their financial situation and risk tolerance before deciding to trade on TMGM or any other platform. For those who meet the eligibility criteria and decide to proceed, TMGM offers a demo account for individuals to familiarize themselves with the platform and its features. This can be a valuable tool for beginners and experienced traders alike to practice their trading strategies without risking real money. In conclusion, while TMGM offers a wide range of trading opportunities, it’s not open to everyone. The platform has specific eligibility criteria to ensure a secure and stable trading environment.

Who should sign up with TMGM?

TMGM is a suitable choice for individuals who are interested in CFD/forex trading and prefer the MetaTrader platform. It offers a strong selection of stock CFDs and a decent offering of forex pairs, all at low fees. The account opening process is easy and fast, and the minimum deposit of $100 is reasonable. Here are some key points to consider:. Forex Trading: TMGM provides access to over 50 forex pairs. , making it a good choice for forex traders. The broker offers competitive pricing with low forex fees. CFD Trading: TMGM has a very strong selection of stock CFDs. This makes it an attractive option for traders looking for a wide range of trading opportunities. Account Types: TMGM offers a flexible choice between no commission or zero spreads. , catering to different trading strategies and preferences. Trading Platforms: TMGM supports MetaTrader 4 and MetaTrader 5. , which are popular platforms in the forex trading community. Minimum Deposit: The minimum deposit at TMGM is $100. , which is a reasonable entry point for most traders. Regulation: TMGM is regulated by the top-tier ASIC in Australia. , providing traders with a certain level of trust and security. However, there are a few considerations to keep in mind:. Product Portfolio: TMGM’s product portfolio is limited to forex, CFDs, and crypto. Therefore, it may not be the best choice for investors interested in other assets like stocks, funds, and bonds. Inactivity Fee: TMGM charges an inactivity fee if you don’t trade for more than six months. This means it’s better suited to active traders. Platform Preference: While TMGM supports MetaTrader, some traders may find its design and functionality limiting. In conclusion, TMGM is a good choice for active traders interested in forex and CFD trading, especially those who prefer using the MetaTrader platform. However, it may not be the best fit for long-term investors or those interested in a wider range of assets.

Who should NOT sign up with TMGM?

TradeMax Global Markets (TMGM) is a well-regulated forex broker with a strong selection of stock CFDs and forex pairs, all at low fees. However, it may not be the right choice for everyone. Here are some categories of traders who might want to consider other options:. Long-term investors: TMGM primarily offers CFD/forex trading and lacks assets outside forex, CFDs, and crypto. Therefore, those looking to invest in stocks, funds, and bonds may not find what they need with TMGM. Infrequent traders: TMGM charges an inactivity fee if there is no trading activity for more than six months. This could be a deterrent for casual or infrequent traders. Users of certain trading platforms: TMGM supports the MetaTrader platform, which some traders might find poorly designed or limited in functionality. Traders who prefer other platforms or have most of their indicators programmed for MT5 might be disappointed, as TMGM has been promoting MT5 for over a year but has not yet released it. Traders requiring immediate withdrawal: While TMGM generally processes withdrawals swiftly, there have been reports of occasional slowdowns, sometimes taking more than 24 hours. Traders who require immediate access to their funds might want to consider this. . It’s important for potential users to consider these factors and their individual trading needs before signing up with a forex broker like TMGM.

Does TMGM offer Discounts, Coupons, or Promo Codes?

Based on the available information, it is not clear whether TMGM offers discounts, coupons, or promo codes. TMGM is a top Forex and CFD trading broker that provides a transparent trading environment with competitive pricing. However, the specific details about discounts, coupons, or promo codes are not explicitly mentioned on their website. It is recommended to visit the official TMGM website or contact their customer service for the most accurate and up-to-date information.

Which Account Types are offered by TMGM?

TMGM, a forex broker established in Australia, offers a variety of trading accounts to match every trading style across all levels of experience. The broker has consolidated all its world-class trading conditions into six powerful account types. Edge Account: This account type offers variable spreads from 0.0 pips and charges $7 per round turn. The minimum deposit is $100, and the minimum lot size is 0.01 lot. The maximum leverage is 1:1000. Classic Account: This account type offers 1.0 pips with no commission. The minimum deposit is $100, and the minimum lot size is 0.01 lot. The maximum leverage is 1:1000. In addition to the Edge and Classic accounts, TMGM offers four other account types. Standard Account: This account type offers 1.6 pips with no commission. The minimum deposit is $100, and the minimum lot size is 0.01 lot. The maximum leverage is 1:400. Premium Account: This account type offers 1.1 pips with no commission. The minimum deposit is $100, and the minimum lot size is 0.01 lot. The maximum leverage is 1:400. Pro Account: This account type offers 0.7 pips with no commission. The minimum deposit is $100, and the minimum lot size is 0.01 lot. The maximum leverage is 1:200. Raw Spread Account: This account type offers 0.0 pips and charges $7 per round turn. The minimum deposit is $100, and the minimum lot size is 0.01 lot. The maximum leverage is 1:200. All these account types allow hedging and are compatible with Expert Advisor (EA) tools. They also offer Islamic account options. TMGM provides advanced trading platforms like MT4, MT5, and IRESS, with unique features and benefits tailored for all types of traders.

How to Open a TMGM LIVE Account?

Opening a TMGM Live Account is a straightforward process that can be completed in a few steps. This process is designed to ensure that all necessary information is collected and that the account is set up correctly for trading. Step 1: Personal Information Start by heading over to the TMGM website. Click on the “Get Started” button located in the top-right corner. This will lead to a form where you need to enter your personal details such as your name, email address, phone number, and country of residence. Step 2: Additional Details After entering your personal details, click “Next”. You will then be asked to provide additional information such as your date of birth and your full address. Step 3: Choose Account Type and Base Currency Next, choose the account type and base currency. TMGM offers a variety of trading accounts to match every trading style across all levels of experience. They have consolidated all their world-class trading conditions into two powerful account types: EDGE and CLASSIC. Step 4: Provide Proof of Identity and Country of Residence As part of the account setup process, you will need to provide proof of your identity and the country of residence. This is a standard requirement for all financial institutions and is designed to prevent fraud and ensure the security of all transactions. Step 5: Fund Your Account Finally, fund your account. Once your account is set up and funded, you are ready to start trading. By following these steps, you can open a TMGM Live Account and start your journey in the world of forex trading.

How to Open a TMGM DEMO account?

Opening a TMGM Demo account is a straightforward process that allows individuals to practice trading in a risk-free environment. Here’s a step-by-step guide:. Visit the TMGM Website: The first step is to navigate to the TMGM website. Sign Up: On the homepage, look for the option to sign up or try a demo account. Enter Personal Information: Fill in the required personal information. This typically includes your name, email, and country of residence. Choose Account Type: Select the ‘TMGM-Demo’ server. This will set up a demo account where you can practice trading with virtual funds. Confirm Registration: After completing the registration, TMGM will send a confirmation email. This email will contain the login information needed to access the demo account. Log In to MetaTrader 4: Download and open MetaTrader 4 on your desktop. Navigate to ‘File’ on the top left corner, then click on ‘Open an Account’. Enter the login information provided in the registration confirmation email. Start Trading: With the demo account set up, you can now start trading. The demo account provides a realistic trading environment where you can practice trading currency pairs and CFDs. Remember, the purpose of a demo account is to provide a platform for beginners to practice trading and for experienced traders to try out new strategies without any financial risk. It’s important to note that while the demo account aims to replicate the real trading environment as closely as possible, there may be slight differences in trading conditions. Please note that this information is based on the process outlined on the TMGM and related websites as of the last update and may be subject to changes.

How Are You Protected as a Client at TMGM?

TradeMax Global Markets (TMGM) is a forex broker that places a strong emphasis on ensuring the reliability and security of its platform. Here are some key points about how clients are protected at TMGM:. Segregation of Client Funds TMGM offers 100% segregation of client funds. This means that client funds are kept separate from the company’s own funds, providing an additional layer of security and peace of mind. This segregation safeguards client investments from unforeseen market events. Regulatory Oversight TMGM maintains regulatory oversight by bodies such as the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). This oversight ensures that TMGM adheres to strict standards of operation. Negative Balance Protection TMGM provides negative balance protection. If the balance on a client’s account goes into negative due to trading losses, the client will not be held responsible for the deficit. Professional Liability Insurance TMGM provides professional liability insurance (PI insurance) for customers. This insurance protects the financial security of customers and meets the common requirements of multiple regulations. However, it’s important to note that TMGM does not offer access to investor protection. Investor protection guarantees the return of your money if your broker goes bankrupt. Also, TMGM does not operate in a country that has an established investor protection scheme in place. Overall, while TMGM provides several measures to protect its clients, potential clients should also do their own due diligence and understand the risks involved in forex trading.

Which Funding methods or Deposit Options are available at TMGM?

TMGM, a renowned forex trading platform, offers a variety of funding methods and deposit options to cater to the diverse needs of its users. Funding Methods:. Bank Transfers: This traditional method of transferring funds is supported by TMGM. The processing time for bank transfers typically ranges from 1-3 working days. Credit/Debit Cards: TMGM accepts deposits made through credit and debit cards. The processing time for these transactions is usually instant. Electronic Wallets: TMGM supports various electronic wallets, providing a quick and convenient way for users to fund their accounts. Like credit/debit card transactions, the processing time for electronic wallet transactions is typically instant. Deposit Options:. TMGM supports deposits in multiple currencies, including USD, EUR, GBP, AUD, NZD, and CAD. The minimum deposit amount in these currencies is typically $100 or equivalent. It’s important to note that TMGM does not charge any transaction fees for deposits. However, users should be aware that intermediary bank charges may apply. In conclusion, TMGM provides a wide range of funding methods and deposit options, making it a flexible and user-friendly platform for forex trading.

What is the Minimum Deposit Amount at TMGM?

TMGM, an Australian forex broker regulated by both ASIC and VFSC, has a minimum deposit requirement of $100. This deposit can be made in several major currencies, including USD, AUD, EUR, GBP, NZD, and CAD. This means that depositing using a major currency eliminates the need for conversion. TMGM supports a wide range of payment providers, allowing clients to use the payment method that’s most convenient for them. Deposits are processed instantly for most methods, and there are no fees for deposits. However, it’s important to note that not all deposited funds will appear in the client’s account instantly. In terms of withdrawal, the minimum withdrawal amount is also $100. The processing time for withdrawals is typically one working day. While there are no fees for withdrawals, intermediary bank charges may apply. It’s also worth noting that TMGM charges a $30 inactivity fee per month if the account balance falls below $500 or if it remains inactive for over six months. In conclusion, TMGM offers a low barrier to entry with a minimum deposit requirement of just $100, making it accessible for individuals who are looking to start their journey in forex trading. However, potential clients should be aware of the inactivity fee and ensure that they are able to maintain activity on their account to avoid this charge.

Which Withdrawal methods are available at TMGM?

TMGM, a renowned forex trading platform, offers a variety of withdrawal methods to cater to the diverse needs of its clients. The options available for withdrawal are as follows:. Bank Transfer: This is a traditional and widely accepted method of transferring funds. It is reliable and can be used for large transactions. Credit/Debit Cards: TMGM supports withdrawals to most major credit and debit cards. This is a convenient option for many traders as it allows for quick access to funds. Paytrust: This is an online payment method that is gaining popularity due to its ease of use and fast transaction times. Neteller: A well-known e-wallet service, Neteller offers quick and easy withdrawals. Sticpay: This is another e-wallet service that is known for its convenience and speed. Skrill: Skrill is a globally recognized e-wallet service that is commonly used in the forex trading community. Fasapay: This is an Indonesian e-wallet service that is becoming increasingly popular in the forex trading world. UnionPay: This is a Chinese financial services corporation that offers bank card services. It is a popular choice for many traders in Asia. RMB Instant: This is a service that allows for instant transfers in Renminbi, the official currency of China. Broker to Broker: This method allows for the transfer of funds between different brokers. It’s important to note that the processing time for most withdrawal methods is typically one working day. However, the exact time may vary depending on the specific method chosen and the policies of the intermediary bank. TMGM does not charge any fees for withdrawals, but intermediary bank charges may apply. Please note that the minimum withdrawal amount for most methods is $100 or its equivalent in other currencies. For the most accurate and up-to-date information, it’s recommended to check TMGM’s official website or contact their customer service.

Which Fees are charged by TMGM?

TMGM, a popular forex trading platform, is known for its generally low fees. Here’s a detailed breakdown:. Forex Trading Fees: TMGM’s forex trading fees are considered low, making it suitable for frequent trading. For example, the EURUSD and GBPUSD pairs have a fee structure as follows. EURUSD: The Edge account charges a $3.50 commission per lot per trade plus spread cost. The average spread cost during peak trading hours is 0.1 pips. GBPUSD: The Edge account charges a $3.50 commission per lot per trade plus spread cost. The average spread cost during peak trading hours is 0.3 pips. CFD Trading Fees: For S&P 500 CFD, the fees are built into the spread, with an average spread cost of 0.2 points during peak trading hours. Inactivity Fee: TMGM applies a $30 inactivity fee per month if your account balance falls below $500 or if it remains inactive for over six months. Withdrawal Fee: TMGM generally doesn’t charge a withdrawal fee. It’s important to note that 68% of retail investor accounts lose money when trading CFDs with this provider. As always, consider whether you can afford the high risk of losing your money before engaging in forex trading.

What can I trade with TMGM?

TMGM, a regulated broker, offers a wide range of trading products across multiple asset classes. Forex Trading TMGM provides access to the foreign exchange market, with a selection of 50 currency pairs. This includes major, minor, and exotic pairs, allowing traders to take advantage of the 24/5 forex market. CFD Trading Contract for Difference (CFD) trading is another offering from TMGM. CFDs allow traders to speculate on the rising or falling prices of fast-moving global financial markets. This includes forex, indices, commodities, shares, and treasuries. Crypto Trading TMGM also offers cryptocurrency trading. Traders can take a position on the future value of a range of cryptocurrencies including Bitcoin, Ethereum, and more. Shares Trading In addition to forex, CFDs, and cryptos, TMGM provides the opportunity to trade on more than 10,000 stocks. This allows traders to speculate on the world’s most popular companies without owning the underlying asset. Metals, Energies, and Futures Traders can diversify their portfolio with TMGM by trading CFDs on metals like gold and silver, energies such as oil and gas, and futures. Please note that trading involves risk and isn’t suitable for everyone. Always consider your personal circumstances before trading.

Which Trading Platforms are offered by TMGM?

TradeMax Global Markets (TMGM) offers a selection of trading platforms to cater to the diverse needs of traders worldwide. These platforms are designed to provide flexibility, convenience, and a wide range of trading tools. MetaTrader 4 (MT4) is one of the platforms offered by TMGM. It is an industry standard and is perfect for both discretionary and algorithmic traders. MT4’s flexible offerings of mobile, tablet, desktop, and web app make it the platform of choice for many traders. Following its predecessor’s impressive reputation, MetaTrader 5 (MT5) is another platform provided by TMGM. MT5 provides additional trading timeframes, order flexibility, and strategy testing speeds. TMGM also offers iRESS, a next-generation web-based trading platform. The combination of an MT4 and iRESS accounts allows traders to trade more than 10,000 stocks with TMGM. These platforms are designed to provide all the essential trading features and are suitable for both novice and experienced investors.

Which Trading Instruments are offered by TMGM?

TMGM, a well-regulated and reputable brand, offers a vast range of trading instruments. Forex: TMGM provides the opportunity to trade over 50 forex pairs, including popular major, minor, and exotic pairs. This selection is attractive for traders who can choose between the MT4, MT5, or IRESS platforms. Indices: Traders have access to a variety of indices. These include US500, US30, GER30, UK100, and JPN225. Metals: TMGM offers trading in metals such as gold (XAUUSD), silver (XAGUSD), and platinum (XPTUSD). Energies: Energy commodities like Brent Crude Oil (XBRUSD) and Texas Intermediate (XTIUSD) are also available for trading. Shares: TMGM’s IRESS account provides access to around 10,000 stock CFDs, sourced from 12 global exchanges in the US, UK, Australia, EU, Hong Kong, and Japan. This is one of the best ranges of equities of any CFD broker. Crypto: TMGM allows trading CFDs on 12 major cryptocurrencies including BTC and ETH in pairs with USD. The dozen tokens on offer is very respectable for a CFD broker. Futures: TMGM also offers futures trading. In conclusion, TMGM provides a diverse range of trading instruments, catering to the needs of various types of traders. It combines a transparent trading environment with competitive pricing. , making it a preferred choice for many traders.

Which Trading Servers are offered by TMGM?

TMGM offers a range of trading servers to ensure optimal performance for their clients. These servers are designed to maintain a constant connection to the forex markets, providing traders with the reliability they need. One of the key offerings is the TMGM Sponsored Forex VPS. This Virtual Private Server (VPS) is capable of running up to 3 MT4 platforms simultaneously. It boasts a latency of 1ms to TMGM trade servers, ensuring rapid execution of trades. The ForexVPS servers come with a 100% Uptime Guarantee during market hours. In addition to these features, TMGM provides 24/5 live chat and email support. ForexVPS.net also assists clients in installing third-party applications, including MT4 platforms, Expert Advisors (EAs), and signals. All VPS use SSD drives, which offer much faster data retrieval and execution than a standard hard drive. Another notable feature is the NY4 Servers. These servers are strategically located to ensure lightning-speed execution. It’s important to note that the TMGM VPS is available for free to current clients if 7 lots are traded before the month-end review. For new clients, a minimum deposit of USD$3,000 is required for Basic and USD$20,000 for High Frequency. These offerings make TMGM a robust choice for traders looking for reliable, high-performance trading servers. Whether you’re running multiple MT4 platforms or seeking low-latency execution, TMGM’s server offerings are designed to meet a wide range of trading needs.

Can I trade Crypto with TMGM? Which crypto currencies are supported by TMGM?

TMGM is a platform that allows the trading of cryptocurrencies. It is a trusted and regulated broker, providing access to cryptocurrencies while being protected under the ASIC and VFSC regulations. The platform supports trading of the most popular cryptocurrencies on margin without the need for a digital wallet. The cryptocurrencies supported by TMGM include:. Bitcoin (BTC). Bitcoin Cash (BCH). Ethereum (ETH). Ripple (XRP). Polkadot (DOT). Litecoin (LTC). Binance Coin (BNB). Chainlink (LNK). Uniswap (UNI). Stellar (XLM). Tezos (XTZ). Dogecoin (DOGE). Cardano (ADA). Polygon (MATIC). Solana (SOL). Avalanche (AVAX). Compound (COMP). Golem (GLM). Kusama (KSM). TMGM provides the opportunity to trade these cryptocurrencies as CFDs (Contracts for Difference), similar to forex trading. This means that traders do not need to hold the actual cryptocurrency, but instead, they agree to pay or accept the difference in price between when they open the position and when they close it. The platform offers up to 1:20 leverage for cryptocurrency CFDs. This allows traders to potentially achieve larger profits (or losses) with a smaller initial investment. Furthermore, TMGM’s platform is designed to automate crypto strategies, enabling traders to respond quickly to the volatile and fast-moving crypto markets. In conclusion, TMGM provides a comprehensive platform for trading a wide range of cryptocurrencies as CFDs, offering features such as high leverage, automated trading strategies, and regulatory protection.

What is the Leverage on my TMGM Trading Account?

Leverage is a crucial concept in forex trading, and TMGM offers different leverage levels depending on the trading instrument. For forex trading, TMGM provides a high leverage of up to 1:1000. However, it’s important to note that while high leverage can amplify profits, it can also magnify losses. Leverage allows traders to control a larger position in the market with a smaller amount of capital. For instance, with a leverage of 1:1000, a trader can control a $1000 position in the market with just $1 of their own capital. In addition to forex, TMGM also offers leverage for trading other financial instruments. For share CFDs, the leverage can be up to 1:20 on the MT4 platform and 1:10 on the IRESS platform. Understanding the concept of margin is also essential when discussing leverage. A margin is the amount of money a trader needs to use leverage. It is the percentage of the trader’s own money used in a leveraged trade. For example, if a trader uses 10x leverage, the margin will be 10% of the overall size of the position. It’s also worth noting that high-level forex brokers like TMGM may use margin calls when a trader can no longer meet margin requirements due to a losing trade. A margin call is when the broker asks the trader to deposit more money to maintain the minimum margin amount. If the trader fails to do so, the broker closes the position automatically, requiring the trader to take the loss. In conclusion, leverage is a powerful tool that can help traders maximize their profits in forex trading. However, it’s crucial to use leverage wisely and understand the risks involved. TMGM offers high leverage levels, but traders should choose the right amount of leverage based on their risk tolerance and trading strategy.

What kind of Spreads are offered by TMGM?

TMGM, a leading Forex broker, offers a range of spreads for its clients. The proprietary TMGM Aggregation engine ensures that clients consistently get the best spreads. The spreads start from 0.0 pips. This is made possible by TMGM’s pool of 10+ Tier 1 Liquidity Providers, which ensures deep liquidity and the best rates for clients. For specific currency pairs, the spreads are as follows. EURUSD: 0.1. GBPUSD: 0.3. AUDUSD: 0.1. EURCHF: 0.4. EURGBP: 0.2. These spreads are considered low, providing a competitive advantage for traders. In addition to low spreads, TMGM also offers lightning-speed execution with their strategically located NY4 Servers. This ensures that clients never experience a single requote, further enhancing their trading experience. TMGM is a trusted and regulated broker with four reputable licenses – ASIC, FMA, VFSC & FSC. This provides assurance to clients that their funds are safe. It’s important to note that while TMGM offers low spreads, Forex trading involves risk and it’s crucial for traders to understand the market and manage trades effectively.

Does TMGM offer MAM Accounts or PAMM Accounts?

In the realm of forex trading, TMGM is a recognized platform that caters to the needs of diverse traders. One of the offerings of TMGM includes the Multi Account Manager (MAM). A MAM is an individual or company who manages the trades on behalf of their clients for a percentage of the profits. The money manager uses one master account to open and close orders for multiple client accounts (slave or sub accounts) at the same time. However, the search results do not explicitly mention whether TMGM offers Percentage Allocation Management Module (PAMM) accounts. PAMM accounts, like MAM accounts, allow fund managers to manage multiple accounts from a single account without having to create an investment fund. The performance (profits and losses) of a PAMM or MAM account manager is distributed among the managed accounts. The clients’ managed accounts are connected to the account manager’s main account and all trades made by the manager are reflected proportionally in the clients’ accounts. In conclusion, while TMGM does offer MAM accounts, it is not explicitly stated whether they offer PAMM accounts. For the most accurate and up-to-date information, it is recommended to directly contact TMGM or visit their official website.

Does TMGM allow Expert Advisors?

TradeMax Global Markets (TMGM), a leading online trading platform, allows the use of Expert Advisors (EAs). This feature is particularly beneficial for traders who prefer automated trading systems. EAs are software programs that automate trading decisions. They can monitor the market for specific conditions and execute trades when these conditions are met. This allows traders to take advantage of trading opportunities even when they are not actively monitoring the market. TMGM’s support for EAs extends to various trading strategies. There are no restrictions on trading strategies, and practices such as scalping, hedging, and news trading are allowed. This flexibility can be advantageous for traders who employ diverse strategies in their trading. Furthermore, TMGM provides an optimal environment for EAs to operate effectively. The platform offers tight spreads, low commissions, and quick execution speeds. These features can enhance the performance of EAs and potentially lead to more profitable trades. In conclusion, TMGM’s allowance of Expert Advisors, coupled with its favorable trading conditions, makes it a suitable choice for traders who prefer automated trading. However, it’s important to note that while EAs can automate trading decisions, they do not guarantee profits and traders should use them responsibly.