Trading 212 Review 2026

What is Trading 212?

Trading 212 is a fintech company that has made a significant impact in the financial markets by offering free, smart, and easy-to-use apps. This has enabled anyone to trade various financial assets, including Stocks, ETFs, Forex, Commodities, and more. The company has been successful in democratizing the financial markets by removing barriers to entry. It disrupted the stock brokerage industry by offering the first zero-commission stock trading service in the UK and Europe. This innovative approach has unlocked the stock market for millions of people. In the context of Forex, Trading 212 provides a platform for trading various currencies. This is part of their broader offering, which also includes the ability to trade Stocks, ETFs, and Commodities. The company’s platform is split into three distinct products: Invest, CFD, and ISA. Trading 212’s mobile app has gained significant popularity, with more than 15 million downloads. Since 2016, it has been the UK’s #1 trading app, and in 2017 it reached the #1 spot in Germany. The company has managed to build trust with its users, as evidenced by its TrustScore of 4.6 based on 23,834 reviews. It currently holds £3.5 billion in client assets and cash. In conclusion, Trading 212 is a pioneering fintech company that has successfully democratized access to the financial markets. Its user-friendly apps and zero-commission trading service have made it a popular choice for trading Forex, among other financial assets.

What is the Review Rating of Trading 212?

- 55brokers: 55brokers rated Trading 212 with a score of 89. This rating was last checked at 2024-01-06 08:53:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Trading 212 with a score of 66. This rating was last checked at 2024-01-05 20:36:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Forexbrokers: Forexbrokers rated Trading 212 with a score of 80. This rating was last checked at 2024-01-06 09:44:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Trading 212 with a score of 92. This rating was last checked at 2024-01-05 22:23:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Trading 212 with a score of 72. This rating was last checked at 2024-03-11 20:23:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Trading 212?

Trading 212 is a popular platform for forex trading, and it has several advantages that make it an attractive choice for both novice and experienced traders. Here are some of the key benefits:. Ease of Use: Trading 212 offers an intuitively designed, easy-to-use web trading platform and mobile app. This makes it a great choice for beginner investors. Variety of Forex Pairs: The platform supports a diverse range of nearly 10,000 symbols available for CFD and forex trading. It includes several exotic FX pairs, including 16 against the Bulgarian lev, and a total of over 180 forex pairs. Low Minimum Deposit: The overall minimum deposit for Trading 212 is €10. , making it accessible for traders with varying levels of capital. Insurance: Trading 212 offers indemnity insurance over EUR 1,000,000 per clients, underwritten by Lloyds of London. Customer Support: Trading 212 offers fantastic levels of customer support. , which can be crucial for resolving issues and answering queries. Education Materials: The educational materials of Trading 212 are also really great. They offer a variety of useful content, including affordable YouTube videos. However, it’s important to note that despite its well-designed platform and wide range of symbols, its lack of advanced trading tools and flat research offerings hamper Trading 212’s bid to be considered a top broker. Forex fees are quite high. and the research tools are also limited.

What are the Cons of Trading 212?

Trading 212 is a popular trading platform known for its commission-free trading. However, like any platform, it has its drawbacks. Here are some of the cons of Trading 212, particularly in the context of forex trading:. Limited Product Portfolio: Trading 212’s product portfolio is limited. Some popular asset classes such as options or bonds are missing. This could limit the diversity of your investment portfolio. High Forex Fees: Trading 212’s forex fees are quite high. This could significantly impact your returns if you’re a frequent forex trader. Limited Research Tools: The research tools provided by Trading 212 are limited. This could affect your ability to make informed trading decisions. Lack of Investment Programs: Trading 212 does not offer any investment programs. This could be a disadvantage for traders looking for structured investment opportunities. Limited Customer Support: The ways to contact Trading 212’s support are limited. This could be problematic if you encounter issues while trading. No Contests for Traders: Trading 212 does not hold contests for traders. While this may not directly impact your trading, it could be a missed opportunity for engagement and motivation. Please note that while Trading 212 has these drawbacks, it also has several advantages such as commission-free stock and ETF trading, quick and easy account opening, and well-designed web and mobile trading platforms. It’s important to weigh both the pros and cons when choosing a trading platform.

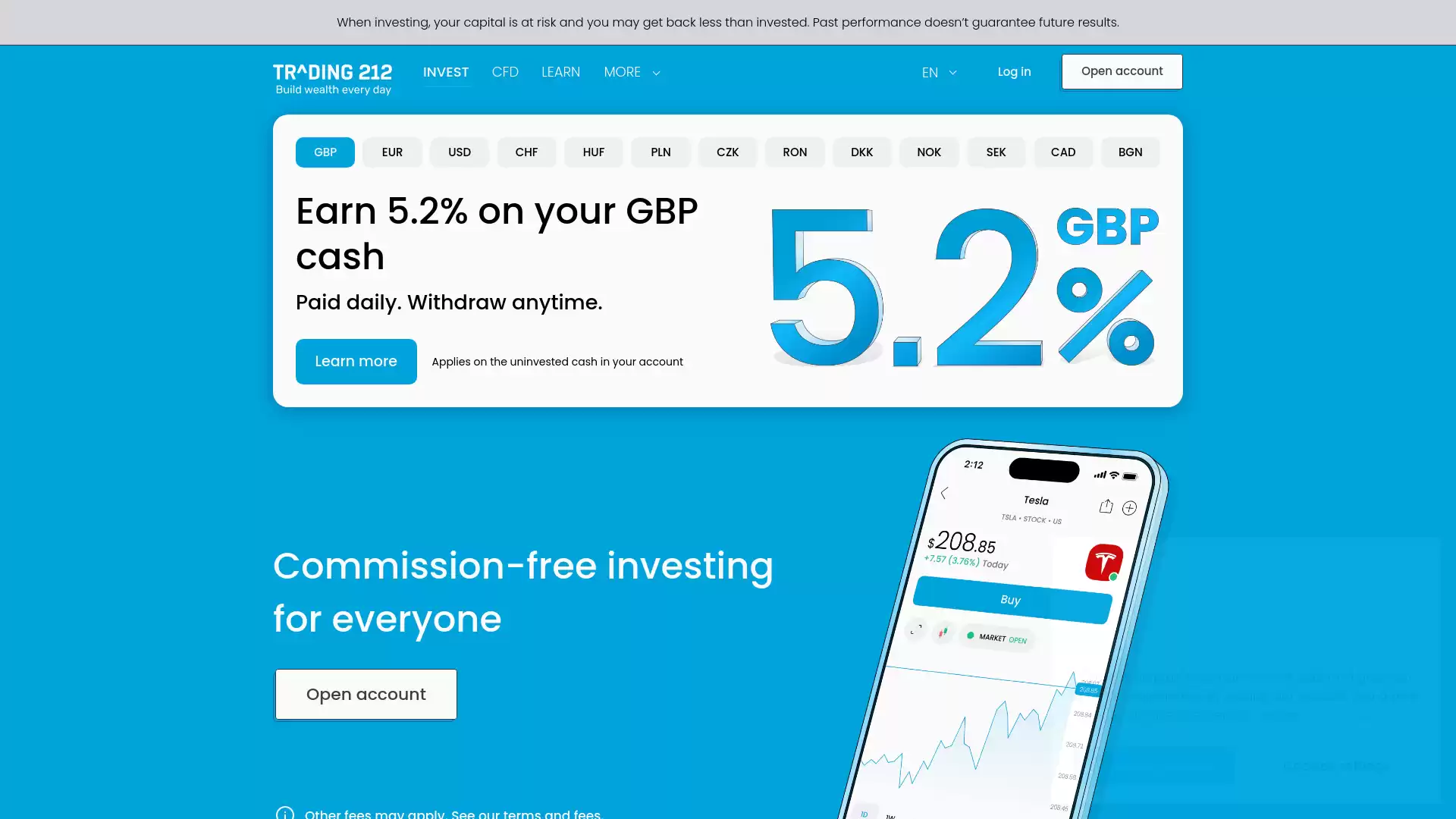

What are the Trading 212 Current Promos?

Trading 212, a London-based financial tech company, offers a variety of promotions to attract and retain users. These promotions are designed to provide value to users and encourage them to engage with the platform’s diverse trading options, which include equities, currencies, commodities, and more. Invite a Friend: One of the ongoing promotions is the “Invite a Friend” program. Users can invite their friends to join Trading 212, and in return, they receive free shares. This promotion not only rewards existing users but also helps expand the Trading 212 user base. Promo Codes: Trading 212 also offers promo codes that users can apply to get various benefits. For instance, as part of its marketing strategy, Trading 212 is giving a free share worth up to €100 just by signing up and depositing €10. Users need to open a Trading 212 account with a specific promo code to avail this offer. Earn Interest on Free Funds: Another unique promotion is the opportunity to earn interest on free funds. This allows users to earn higher interest rates on cash and interest on uninvested cash. It’s a great way for users to maximize their earnings, even on uninvested funds. Signup Free Share: New members are offered one free stock, worth up to $100. This is a welcoming gesture that aims to attract new users to the platform. ISA Cashback: Trading 212 also runs an ISA Deposit Cashback campaign. This promotion is designed to encourage users to make use of their Individual Savings Account (ISA) feature. It’s important to note that these promotions are subject to change and may vary based on the user’s location and other factors. Users are advised to check the official Trading 212 website or app for the most current and accurate information.

What are the Trading 212 Highlights?

Trading 212 is a forex broker that offers a wide range of forex pairs and CFDs for trading. Here are some of the highlights of Trading 212:. Pros: Intuitively designed, easy-to-use web trading platform and mobile app that earned Trading 212 a Best in Class spot for ease of use in our annual review. Diverse range of nearly 10,000 symbols available for CFD and forex trading. Supports several exotic FX pairs, including 16 against the Bulgarian lev, and a total of over 180 forex pairs. Offers indemnity insurance over EUR 1,000,000 per clients, underwritten by Lloyds of London. . Cons: Outside of the economic calendar events, no news headlines are offered in mobile app. Besides sentiment data, research in the web platform is limited to snippet-like updates. Despite a large number of videos, Trading 212 has few written articles for education. MetaTrader is not available. . Trading 212 is authorized by two Tier-1 regulators (Highly Trusted), zero Tier-2 regulators (Trusted), zero Tier-3 regulators (Average Risk), and zero Tier-4 regulators (High Risk). It is considered Average Risk, with an overall Trust Score of 77 out of 99. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. I hope this helps! Let me know if you have any other questions.

Is Trading 212 Legit and Trustworthy?

Trading 212 is a well-regulated and reputable online trading platform. It is regulated by several reputable watchdogs, including the UK’s Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Bulgaria Financial Supervision Commission (Bulgaria FSC). This regulatory oversight ensures that Trading 212 adheres to strict standards of operation, providing a level of trust and security for its users. In addition to its regulatory credentials, Trading 212 has a strong track record in the industry. It has not been involved in any major scandals, further attesting to its legitimacy and trustworthiness. User reviews also provide valuable insights into the platform’s reliability. Many users have reported positive experiences with Trading 212, praising its ease of use, range of features, and customer service. However, some users have reported issues with customer service, particularly during account verification processes. It’s important to note that these experiences can vary, and Trading 212 has responded to these concerns, indicating their commitment to improving their services. In the context of forex trading, Trading 212 offers a wide range of currency pairs for trading, making it a viable platform for forex traders. However, as with any trading platform, it’s crucial for potential users to conduct their own research and consider their individual trading needs and goals before choosing a platform. In conclusion, based on its regulatory oversight, industry track record, and user reviews, Trading 212 appears to be a legitimate and trustworthy platform for online trading, including forex trading. However, potential users should always conduct their own due diligence and consider their individual trading needs when choosing a platform.

Is Trading 212 Regulated and who are the Regulators?

Trading 212, a prominent player in the forex market, is indeed regulated by several top-tier financial authorities. This ensures that the company adheres to strict standards and regulations, providing a secure and trustworthy platform for its users. Trading 212 UK Ltd. is registered in England and Wales and is authorised and regulated by the Financial Conduct Authority (FCA), with the register number 609146. The FCA is a highly respected regulatory body that oversees financial firms in the UK, ensuring that they meet specific standards for integrity and security. In addition to the FCA, Trading 212 Markets Ltd. is registered in Cyprus and is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), under the license number 398/21. CySEC is known for its stringent regulations and supervision of companies operating in the financial markets, further enhancing the credibility of Trading 212. Moreover, Trading 212 Ltd. is registered in Bulgaria and is authorised and regulated by the Financial Supervision Commission (FSC), under the license number RG-03-0237. The FSC is responsible for the supervision of financial institutions in Bulgaria, ensuring their compliance with financial regulations and standards. These multiple layers of regulation significantly enhance the safety profile of Trading 212, providing important safeguards with respect to the fairness of pricing and trading conditions provided by the broker. As a client of a broker with top-tier regulation, you can be assured of the integrity and security of your investments. In conclusion, Trading 212 is a fully regulated broker, supervised by the FCA, CySEC, and FSC, offering a secure and reliable platform for forex trading.

Did Trading 212 win any Awards?

Trading 212, a global financial trading platform and broker, has been recognized in the industry for its services. While specific awards are not mentioned, the platform has been nominated for several categories in the Financial Times Awards. These categories include:. Low-cost stockbroking. Execution-only stockbroking. Self-select ISA. International share dealing. Contracts for difference. These nominations highlight Trading 212’s commitment to providing affordable and accessible trading services to its users. The platform is particularly noted for its zero fees, zero commission on currency exchange, and the offering of fractional shares. In addition to these services, Trading 212 has also introduced innovative features such as auto-invest and pies, which allow users to automate their investments and diversify their portfolios. The platform’s continual improvement and active participation in the client community have also been praised. Furthermore, Trading 212 has a high TrustScore of 4.6 based on over 23,880 reviews. , indicating a high level of customer satisfaction. Users have commended the platform for its transparency, customer service, and user-friendly interface. In conclusion, while Trading 212 may not have specific awards to its name, it has been recognized in several categories for its services and has received positive reviews from its users. This recognition, coupled with the platform’s innovative features and high customer satisfaction, underscores Trading 212’s standing in the financial trading industry. Please note that while Trading 212 offers a range of services, it’s important for individuals to understand the risks associated with trading and to make informed decisions. Please note that this information is based on the data available up to 2023 and may not include any awards or recognitions received after this date. For the most current information, please refer to the official Trading 212 website or other reliable sources.

How do I get in Contact with Trading 212?

Trading 212, a leading platform in the world of forex trading, provides multiple avenues for customers to get in touch with their support team. Email: One of the primary methods to contact Trading 212 is via email. Customers can write an email to info@trading212.com with their queries. Contact Form: Another method to reach out to the support team is by filling out the contact form available on their website. This method allows customers to provide detailed information about their query, ensuring a comprehensive response from the support team. Chat: For immediate assistance, customers can use the ‘Chat with us’ button available in the menu of their Trading 212 account. This feature provides real-time support to users, addressing their queries promptly. It’s important to note that the support team is available 24/7, providing round-the-clock assistance to customers across the globe. This ensures that traders, irrespective of their geographical location and time zone, can receive timely help. Whether you’re a seasoned trader or a beginner in the forex market, having reliable customer support is crucial. Trading 212’s multiple contact methods ensure that customers can choose the method that best suits their needs, providing a seamless trading experience.

Where are the Headquarters from Trading 212 based?

Trading 212, a prominent player in the forex trading industry, is headquartered at 107 Cheapside, London, England, EC2V 6DN, United Kingdom. Established in 2004, Trading 212 has made significant strides in the financial sector, offering trading services with forex, company shares, and CFDs. The company has disrupted the stock brokerage industry by offering the first zero-commission stock trading service in the UK and Europe. This innovative approach has unlocked the stock market for millions of people, democratizing access to financial markets. The company operates primarily through three entities: Trading 212 UK Limited (registered and regulated in the UK), Trading212 Limited (based in Bulgaria), and Cyprus-based Trading 212 Markets Limited. Despite a year-over-year decline of 17 percent in total revenue, the UK business alone brought in more than £98.7 million. The umbrella group turned a pre-tax profit of £40.5 million. Trading 212 is now shifting its focus from the CFDs business towards the stock brokerage with its zero-commission business model. This strategic move is expected to further strengthen its position in the forex trading industry and contribute to its growth strategy.

What kind of Customer Support is offered by Trading 212?

Trading 212, a popular platform in the forex trading industry, offers a comprehensive customer support system to assist its users. 24/7 Support: Trading 212’s customer support team is available 24/7. This round-the-clock service ensures that users can get help whenever they need it, regardless of their time zone or trading hours. Multiple Contact Methods: Users can reach out to the support team through various channels. They can fill out a contact form, send an email to info@trading212.com, or use the ‘Chat with us’ button in the user menu. This variety of contact methods caters to different user preferences and ensures that help is always just a few clicks away. Community Forum: In addition to the direct support channels, Trading 212 also has a community forum. Here, users can ask questions, share experiences, and learn from each other. If users need to reach out to the support team via the forum, they can tag the team using "@Team212". Complaints Handling: Trading 212 has a clear policy for handling complaints. Users can contact the Customer Service department by telephone or send an email to info@trading212.com. This structured approach to complaints handling ensures that any issues are addressed promptly and effectively. In conclusion, Trading 212’s customer support system is robust and user-friendly, making it a reliable platform for forex trading. Whether you’re a beginner needing guidance or an experienced trader with complex queries, Trading 212’s support team is ready to assist.

Which Educational and Learning Materials are offered by Trading 212?

Trading 212, a leading online trading platform, offers a variety of educational and learning materials to help users navigate the world of investing. These resources are designed to provide both novice and experienced traders with the knowledge they need to make informed decisions. Investing 101: This is a series of articles that cover the basics of investing. It includes topics such as dollar cost averaging, which is a strategy used to reduce the risk of bad timing in the market. Understanding Financial Statements: This resource provides insights into how to read financial statements, a vital skill for long-term business and investing profitability. Beginner’s Guide to Diversification in Investing: This guide emphasizes the importance of diversification in preserving existing wealth and creating more of it. Dividends: This section provides a deep dive into dividend investing. It covers topics such as how dividends work, how to create a dividend portfolio, and what makes a good dividend stock. Moreover, Trading 212 also offers text and video tutorials on how to use the trading platforms and about the basics of trading. These tutorials are particularly useful for beginners who are new to the platform or trading in general. In the context of forex trading, it’s important to note that Trading 212 is primarily a CFD broker. However, some users have noted that the forex fees can be quite high. Therefore, it’s crucial for users to understand the fee structure before engaging in forex trading on this platform. Overall, Trading 212’s educational and learning materials are comprehensive and designed to equip users with the necessary knowledge and skills to navigate the financial markets effectively.

Can anyone join Trading 212?

Trading 212 is a popular platform known for its user-friendly interface and a wide range of investment options. It offers opportunities for trading in various markets including stocks, ETFs, and forex. However, it’s important to note that anyone interested in joining Trading 212 must meet certain requirements. Eligibility Criteria: Age: Applicants must be 18 years or older. Taxpayer Identification Number: A valid taxpayer identification number is required. Identity Verification: Applicants are required to verify their identity. This involves taking a picture of a valid government-issued photo ID and a selfie. . Once these requirements are met, one can apply for a Trading 212 account either by downloading the Trading 212 mobile app or signing up via the Trading 212 website. Trading 212 Features: Commission-free stock and ETF trading. Quick and easy account opening. Well-designed web and mobile trading platforms. Interest paid on uninvested cash. . However, potential users should be aware of certain limitations. The product portfolio is limited, and some popular asset classes such as options or bonds are missing. Forex fees are quite high and the research tools are also limited. Despite these limitations, Trading 212 is a good choice for beginner investors due to its easy-to-use trading platforms. It’s regulated by top-tier authorities including the UK’s FCA, the Bulgarian authority FSC, and CySEC in Cyprus. It’s worth noting that while Trading 212 is primarily a CFD broker, it also provides opportunities for forex trading. However, potential users interested in cryptocurrency should be aware that Trading 212 does not currently offer crypto trading. In conclusion, while anyone meeting the eligibility criteria can join Trading 212, it’s important for potential users to understand the platform’s features, limitations, and fee structure before making a decision.

Who should sign up with Trading 212?

Trading 212 is a platform that caters to a wide range of individuals interested in trading and investing, particularly in the forex market. Here are some categories of individuals who might find Trading 212 suitable:. 1. Novice Traders: Trading 212 is user-friendly and does not require prior knowledge to open an account. This makes it an excellent choice for individuals new to forex trading. 2. Experienced Traders: For seasoned forex traders, Trading 212 offers a variety of features that can help optimize their trading strategies. It’s regulated by top-tier authorities like the UK’s FCA, the Bulgarian authority FSC, and CySEC in Cyprus. , providing a secure platform for trading. 3. Long-term Investors: Individuals who prefer to invest conservatively and consistently in blue-chip companies may also benefit from Trading 212. The platform allows commission-free investing in stocks and ETFs. 4. Tech-savvy Individuals: Trading 212 offers a mobile app, making it a convenient option for those who prefer trading on the go. However, it’s important to note that forex trading involves significant risk, and it’s crucial that individuals understand these risks before opening an account. Trading 212 is not available for individuals living in the United States. To sign up for a Trading 212 account, individuals must meet the following requirements. Be 18 years or older. Have a valid taxpayer identification number. Verify their identity with a valid government-issued photo ID. In conclusion, Trading 212 can be a suitable platform for a variety of individuals, from novice traders to experienced investors, provided they understand the risks involved in forex trading.

Who should NOT sign up with Trading 212?

While Trading 212 offers a range of benefits to many investors, it may not be the ideal platform for everyone. Here are some categories of people who might want to consider other options:. 1. Those Seeking Diverse Market Access Trading 212 primarily allows investment in European and American markets. If you’re interested in investing in Asian or Australian markets, you might find the platform limiting. 2. Users Requiring External Trading Platforms Trading 212 does not support connection to external trading platforms such as MetaTrader or cTrader. If you rely on these platforms for your trading activities, Trading 212 might not be the best fit for you. 3. Investors Interested in Certain Financial Instruments While Trading 212 offers a variety of stocks to invest in, it does not support investment in other assets like mutual funds, currencies, etc. If your investment strategy involves these financial instruments, you might need to look elsewhere. 4. Individuals Seeking Comprehensive Support Materials Some users have found the help and support materials provided by Trading 212 to be lacking in detail. If you’re new to investing or if you prefer having detailed guides and tutorials at your disposal, this could be a drawback. 5. People Residing in Certain Countries The information on Trading 212’s site is not directed at residents of the United States, Canada, and Belgium or any particular country outside the EEA, except Switzerland. If you reside in these countries, you might face restrictions or complications. 6. Investors Needing Islamic Swap-Free Trading Trading 212 does not offer Islamic swap-free trading or Extended Swap-free status by default to all applicable trading accounts created by clients in non-Islamic countries. 7. Retail Investors in the EU As Trading 212 is regulated in the EU, retail investors will be impacted by ESMA’s leverage capping restrictions. In conclusion, while Trading 212 can be a great platform for many investors, it’s important to consider your individual needs and circumstances before signing up. Always do your research and consider consulting with a financial advisor to make the best decision for your financial future.

Does Trading 212 offer Discounts, Coupons, or Promo Codes?

Yes, Trading 212 does offer discounts, coupons, and promo codes. Here are some details:. Promo Codes: Trading 212 provides promo codes that offer up to 50% off. These codes are available on various coupon websites and can be used at checkout for discounts. Free Gifts: There are coupon codes that provide free gifts on welcome bonus. and free shares when you sign up. These offers are subject to certain exclusions. Exclusive Benefits: By signing up for the newsletter at Trading 212, users can get exclusive benefits. Referral Bonus: Trading 212 offers a referral bonus when you sign up to claim shares. This is a great way to earn extra benefits while trading. Discounts on Amazon: Trading 212 has partnered with Amazon to offer up to 5% off on Investing & Trading Apps. Competitor Codes: Trading 212 also accepts competitor codes, which can get you up to 50% off on Investing & Trading Apps. Please note that these offers are subject to change and it’s always a good idea to check the latest offers on their official website or trusted coupon websites. Remember, investing in forex involves risks and it’s important to understand the terms and conditions before using any promo codes or discounts. Happy trading!.

Which Account Types are offered by Trading 212?

Trading 212 offers a variety of account types suitable for different trading needs. Here’s a detailed overview:. 1. Trading 212 CFD Account This account type is best suited for margin trading. It offers access to a wide range of markets including Forex, commodities, stocks, indices, ETFs, and cryptocurrencies, with over 10,000 assets in total. The account operates under the regulations of CySEC, FCA, and FSC. The minimum deposit required to open a live account is $10. The leverage offered is up to 1:30. 2. Trading 212 Invest Account The Invest account is ideal for real asset investment. It provides access to stocks and ETFs, with over 10,000 assets in total. This account also operates under the regulations of CySEC, FCA, and FSC. The minimum deposit required to switch to a live account is $1. The leverage offered is 1:1. One of the special features of this account is the availability of fractional shares. 3. Trading 212 ISA Account The ISA account is best for tax-free investments. It provides access to stocks and ETFs, with over 10,000 assets in total. This account operates under the regulations of FCA. The minimum deposit required to switch to a live account is $1. The leverage offered is 1:1. 4. Trading 212 Professional Account The Professional account is designed for pro traders. It offers access to a wide range of markets including Forex, commodities, stocks, indices, ETFs, and cryptocurrencies, with over 10,000 assets in total. This account operates under the regulations of FCA. The minimum deposit required to open a live account is $10. The leverage offered is up to 1:500. Please note that all account types charge a spread starting from 1 pip and may apply rollover fees on open positions overnight. Also, all account types provide access to the Trading 212 WebTrader platform. The trade size starts from 1 micro lot for all account types. It’s important to note that the features and financial assets available in Trading 212 accounts may vary slightly depending on your country of residence.

How to Open a Trading 212 LIVE Account?

Opening a Trading 212 LIVE Account involves a few steps. Here’s a detailed guide:. Step 1: Eligibility To apply for a Trading 212 account, you must be 18 years or older. Step 2: Identification You need to have a valid taxpayer identification number. This is crucial for tax reporting purposes. Step 3: Identity Verification You will need to verify your identity. This involves taking a picture of a valid government-issued photo ID and a selfie. This is a standard procedure for most financial institutions to comply with Know Your Customer (KYC) regulations. Step 4: Account Setup To set up your account, you can either download the Trading 212 mobile app or sign up via the Trading 212 website. Step 5: Selecting Account Type Trading 212 offers different types of accounts, including a practice account and a real money trading account. For forex trading, you would want to select the real money trading account. Step 6: Funding Your Account Once your account is set up, the next step is to fund it. The process for this may vary depending on your location and the available funding options. Remember, forex trading involves significant risk and it’s important to understand the market before you start trading. It’s also a good idea to familiarize yourself with the platform’s features and fees. Please note that this information is based on the details available as of the time of this response and may change over time. Always refer to the official Trading 212 website for the most accurate and up-to-date information.

How to Open a Trading 212 DEMO account?

Opening a Trading 212 Demo Account is a straightforward process that allows you to practice trading in a risk-free environment. Here’s a step-by-step guide on how to do it:. Visit the Trading 212 Website: The first step is to visit the Trading 212 website. Open an Account: Click on the “Open Account” button. Select Your Country of Residence: You will then select your country of residence from the drop-down menu. Choose the Practice Option: Look for the “Practice” option and click on it. Fill in the Registration Form: A registration form will open where you will need to enter your details. This includes your email address and a password. Verify Your Email Address: After registration, verify your email address by clicking on the Trading 212 link that you will receive in your mail. Select the Invest or CFD Versions: Once you arrive at the Trading 212 trading page, specify either the Invest or CFD versions for your demo account. You can alternate between the two versions anytime you want. Your demo account should be open within two days. The Trading 212 Demo Account provides a similar trading environment to the live one, but trades with virtual funds. It’s a great way to begin your trading journey or get used to the platform. The demo account runs on the MT4 and MT5 software platforms. and provides access to all of the trading instruments on the platform. Trading 212 provides $50,000 to every demo account on their platform. , so you have enough resources to test your strategies and build up confidence and experience. Remember, the financial market will always be a tricky arena, especially if you are new to a trading platform. The Trading 212 Demo Account is a great way to learn the ropes of trading or get familiar with the new environment. Happy trading!.

How Are You Protected as a Client at Trading 212?

As a client at Trading 212, you are protected in several ways:. 1. Client Money Protection: At Trading 212, all client funds are handled in accordance with the regulations set out by the CySEC Directive DI87-01. This means that client funds are pooled into a separate bank account, which is completely separate from Trading 212’s own funds. Importantly, Trading 212 does not use any of its clients’ funds for its own hedging or margin trading. 2. Client Assets Protection: Client assets, such as shares and funds held on behalf of clients, are held in accordance with the CySEC Directive DI87-01. These assets are pooled together and held in segregated accounts with a custodian, separate from Trading 212’s own assets. 3. Protection Schemes: Trading 212 is a member of the Investors Compensation Fund (ICF), which is the Cyprus’ compensation fund of last resort for customers of authorised financial services firms. This means that in the unlikely event Trading 212, Interactive Brokers or the bank holding your client funds were to go into liquidation, and if there was a failure to safeguard your assets, the value of your client funds and client assets held with Trading 212 is protected by the ICF up to a maximum of €20,000. In addition to the ICF, Trading 212 Markets Ltd. provides its clients with free private insurance from Lloyd’s of London, giving coverage of up to 1 million Euro. 4. Information Protection: Trading 212 takes the protection of your information seriously. They use the best technologies available from industry-leading providers, which are monitored by their dedicated 24/7 Security Operations Center. 5. Negative Balance Protection: As a retail client, you can never lose more funds than you initially deposited into your Trading 212 account. Trading 212 will send a margin call when you have lost all your available funds. Once your positions can no longer be maintained, they will automatically close them, which will release the remaining blocked funds. In conclusion, Trading 212 provides a robust system of protections for its clients, ensuring the safety of both their funds and personal information.

Which Funding methods or Deposit Options are available at Trading 212?

Trading 212 offers a variety of funding methods to cater to the diverse needs of its users. Here are the deposit options available:. Bank Transfers: This is a traditional method of transferring money from your bank account to your Trading 212 account. It’s reliable and widely used, although it might take some time for the funds to reflect in your account. Instant Bank Transfers: For those who prefer speed, instant bank transfers are an excellent option. As the name suggests, the transfer of funds is almost immediate. Card Payments: Trading 212 accepts both credit and debit card payments. This is a quick and convenient way to fund your account. OnlineBankingPL, Giropay, Carte Bleue, Blik, Direct eBanking: These are online payment methods that are popular in certain regions. They offer a secure and efficient way to deposit funds into your Trading 212 account. Apple Pay / Google Pay: For users who prefer digital wallets, Trading 212 accepts payments through Apple Pay and Google Pay. These methods are fast and secure. PayPal: This is a widely used online payment system that allows users to make payments using only their email address and password. iDEAL: This is a Netherlands-based payment method that allows users to make direct online transfers from their bank account. It’s important to note that while some deposit methods like bank transfers and instant bank transfers remain free, others like card payments, Google Pay, Apple Pay, iDeal, OnlineBankingPL, GiroPay, and Sofort will remain fee-free until you have deposited 2,000 GBP/EUR in total. Once this limit is reached, a fee of 0.7% will apply. In the context of forex trading, having a variety of deposit options is crucial as it allows traders from all over the world to fund their accounts conveniently and start trading currencies. Each of these deposit methods has its own advantages and can be chosen based on the user’s preference and convenience. Please note that it’s always recommended to check with your bank or payment provider about any potential fees they might charge for these transactions.

What is the Minimum Deposit Amount at Trading 212?

The minimum deposit amount at Trading 212 depends on the type of account and the user’s region. Here are the details:. Invest/ISA Account: The minimum deposit amount for the Invest/ISA account depends on the user’s country of residence. However, according to some sources, the minimum deposit is £1 GBP, €1 EUR, or $1 USD. CFD Account: For the CFD account, no matter the payment method, the minimum deposit is £10 GBP or €10 EUR. When setting up an account, users are asked to choose a trading currency, which cannot be changed once the account is active. The majority of stocks traded on Trading 212 are in USD, but some are in GBP and EUR. If a stock is bought in a different currency, the invested money could be affected by forex fluctuations. For funding the account, Trading 212 does not charge any fees up to a certain amount. For the Invest or ISA account, users can make as many free deposits as they like up to a limit of £2,000. Once this limit is reached, a fee of 0.7% is charged. Payments made via bank transfer are free of charge. Please note that while I strive to provide accurate information, it’s always a good idea to check the official Trading 212 website or contact their customer service for the most up-to-date information.

Which Withdrawal methods are available at Trading 212?

Trading 212, a popular platform in the world of forex trading, offers a variety of withdrawal methods to cater to the diverse needs of its users. The platform prioritizes the security of its users’ accounts and, by default, sends funds through the same payment method used for funding. Withdrawal Methods: Credit Card: One of the most common methods, users can withdraw their funds directly to their credit card. Bank Wire Transfer: Users can also choose to have their funds transferred directly to their bank account. Skrill and Neteller: For those who prefer online payment systems, Skrill and Neteller are also available. . It’s important to note that if a user has used multiple different methods for deposit, they will see a list of all of them when they withdraw. However, they may be unable to choose a certain one due to limitations imposed by payment service providers or anti-financial crime precautions. For instance, the chosen card may not be used for withdrawals, or there may be a limitation on the amount. In such cases, it is necessary to request a withdrawal from another payment method. Furthermore, the amount that can be withdrawn to a certain method may be limited to the total amount of deposits made with it. If a previous withdrawal was unsuccessful due to specifics related to the card itself, an alternative payment method needs to be used. If a user’s debit/credit card has been cancelled prior to its expiry date, they can request the card to be removed by contacting Trading 212 before placing a withdrawal request. The withdrawal process on Trading 212 is straightforward. Users need to tap on the Account Menu, choose ‘Manage funds’, then ‘Withdraw funds’, confirm their password, select an account, type the amount, select a payment method, and confirm the withdrawal. The withdrawal time varies from a few hours to 5 working days. , and the minimum withdrawal amount is $1.

Which Fees are charged by Trading 212?

Trading 212 is a popular trading platform known for its commission-free structure. However, it’s important to note that while there are no commissions, other fees may apply. Here’s a detailed breakdown:. FX Fee: Trading 212 applies an FX fee of 0.5% to the results of closed positions if the currency of the traded instruments differs from the currency of your account. This is particularly relevant in the context of forex trading, where currency exchange is the core of the activity. Deposit and Withdrawal Fees: In most cases, deposits and withdrawals with Trading 212 are free of charge. This is a significant advantage for traders as it allows for flexibility in managing funds. However, the Invest Account might present a fee depending on the amount you invest. Inactivity Fee: Trading 212 does not mention an inactivity fee in its fee structure. This means that traders are not penalized for keeping their accounts inactive for a certain period. Stock Exchange Fees: Trading 212 may apply stock exchange fees. These are fees charged by the stock exchange itself and are usually passed on to the trader. CFD Account: If you’re trading with a CFD Account, you will not be charged a deposit or withdrawal fee. However, it’s important to understand that CFD trading involves different risks and may not be suitable for all investors. It’s always recommended to review the fee structure of any trading platform thoroughly before starting to trade. This helps in understanding the cost implications and aids in making informed trading decisions.

What can I trade with Trading 212?

Trading 212 is a versatile online trading platform that offers a wide range of financial instruments for trading. In the context of forex, it provides a significant opportunity for traders. Multi-Currency Support: Trading 212 Invest is a multi-currency account that allows you to hold money and trade in multiple currencies. This means you will no longer have to convert money and incur FX fees each time you trade in a different currency. The supported currencies for now are GBP, USD, EUR, CHF, DKK, NOK, PLN, SEK, CZK, RON, BGN, HUF. Forex Trading: Trading 212 offers access to over 170+ currency pairs. This extensive range of currency pairs provides a vast field for forex trading. It allows traders to speculate on the price movements of various currency pairs and take advantage of market volatility. Trading Platform: Trading 212’s platforms have access to global currency markets. The user-friendly interface of the platform makes it suitable for both beginners and experienced traders. Regulation: Trading 212 is regulated by trustworthy bodies including the UK’s prestigious Financial Conduct Authority (FCA), making it a highly trusted and safe broker. Additional Features: Trading 212 also offers features like low minimum deposit, opportunity to invest in fractional stocks, no withdrawal or inactivity fees, quick and easy account openings, and 24/7 live customer support. In conclusion, Trading 212 provides a comprehensive platform for forex trading with its wide range of currency pairs, user-friendly platform, and robust regulatory oversight.

Which Trading Platforms are offered by Trading 212?

Trading 212, a popular online trading platform, offers a variety of trading platforms to cater to the diverse needs of traders. Here are the key platforms:. Trading 212 CFD: This platform allows traders to engage in Contracts-for-difference on forex, commodities, stocks, and indices. It provides access to various financial instruments, from major EU stock exchanges and global currency markets, to a myriad of commodities. Trading 212 Invest: This platform offers real stocks and exchange-traded-funds (ETFs) from as little as £1. It allows traders to buy stocks instantly, choose their favourite company, select how much to invest, and get their shares in seconds. Trading 212 ISA: This platform offers tax-free, zero commission stocks from £1. It allows traders to put their money to work with Pies & AutoInvest, build a diversified pie and customize it to their unique financial goals. In the context of forex, Trading 212 provides a robust platform for forex trading through its CFD platform. Traders can leverage their investment using the MetaTrader 4 platform. The platform provides access to global currency markets, allowing traders to engage in forex trading with ease and efficiency. Please note that while Trading 212 offers a wide range of trading platforms, it’s important for traders to understand the risks associated with trading. Investments can rise and fall, and traders may get back less than they invested.

Which Trading Instruments are offered by Trading 212?

Trading 212, a popular trading platform, offers a wide range of trading instruments. These instruments are categorized based on the type of account you hold. Invest and ISA Accounts. For Invest and ISA accounts, the available instruments are broadly classified as Stocks and ETFs. They include:. Ordinary shares: These are the most common form of shares that companies issue. Owners of these shares have voting rights in the company. Preferred shares: These shares have a higher claim on the company’s earnings and assets than ordinary shares. However, they usually don’t come with voting rights. Exchange-traded funds (ETFs): These are investment funds traded on stock exchanges. ETFs hold assets such as stocks, commodities, or bonds. Exchange-traded products (ETPs). Exchange-traded commodities (ETCs). Real Estate Investment trusts (REITs). Investment Trusts. CFD Accounts. For CFD accounts, the available instruments are. FOREX: This refers to the foreign exchange market where currencies are traded. Stocks. Index futures. Commodity futures. FOREX futures. Treasury futures. Cryptocurrencies: CFDs on cryptocurrencies are only available for accounts with Trading 212 Markets Ltd. In the context of forex, Trading 212 offers both FOREX and FOREX futures for trading. This allows traders to speculate on the price movements of various currency pairs, providing opportunities for profit in both rising and falling markets. Please note that the availability of these instruments may vary based on your account type. You can see all available instruments categorized in the ‘Search Bar’ within the Trading 212 app or review the ’Trading instruments’ on their website.

Which Trading Servers are offered by Trading 212?

Trading 212 is a fintech company that democratizes the financial markets with free, smart, and easy-to-use apps, enabling everyone to trade in Stocks, ETFs, Forex, Commodities, and more. However, the specific details about the trading servers offered by Trading 212 are not available from the current search results. It’s recommended to visit the official Trading 212 website or contact their customer service for the most accurate and up-to-date information.

Can I trade Crypto with Trading 212? Which crypto currencies are supported by Trading 212?

Trading 212 is a popular broker in Europe, offering a wide range of products, a low-cost fee structure, and features like fractional shares and auto investing. However, as of the latest information available, Trading 212 does not offer the option to directly buy or trade cryptocurrencies such as Bitcoin or Ethereum. Before the 6th of January 2021, buying cryptocurrencies on Trading 212 via crypto-derivative financial instruments was possible. But, this service has been suspended, which means you cannot buy, sell, or trade digital assets on their platform. Despite the lack of direct cryptocurrency trading, Trading 212 does offer the ability to trade a wide array of other assets. These include stocks, forex, indices, and commodities. For forex trading, more than 180 pairs are available around the clock. It’s important to note that while Trading 212 does not currently support cryptocurrency trading, there are many other platforms that do. Therefore, individuals interested in trading cryptocurrencies may need to explore other options. Please note that trading involves risks and it’s possible to lose more than your initial investment. Always do thorough research and consider seeking advice from financial professionals before making any trading decisions.

What is the Leverage on my Trading 212 Trading Account?

Verkennen. Leverage on a Trading 212 account is a powerful tool that allows you to trade with more capital than you have in your account. It’s essentially a form of loan provided by the broker, which lets you control larger positions with a smaller amount of money. How Does Leverage Work?. Leverage works by allowing you to purchase more units of a financial instrument than your available funds or initial deposit would allow. For example, if you have deposited $100 in your account and you wish to trade with an instrument with leverage of 1:10, you can open a position of up to $100 * 10 = $1000 in value. Leverage Ratios. Different instrument types have different leverage ratios. In the context of forex trading, the maximum leverage available is typically 1:30. However, professional clients of Trading 212 UK Ltd. have the option to apply for a professional CFD account, which allows them to utilize higher leverage, with ratios of up to 1:500. Benefits and Risks. The main benefit of leverage is that it can magnify your profits. If a trade goes in your favor, you stand to gain much more than you would have with just your initial deposit. However, it’s important to note that leverage can also magnify your losses if the trade goes against you. Therefore, it’s crucial to use leverage responsibly and understand the risks involved. Conclusion. In conclusion, leverage is a double-edged sword that can significantly increase both your potential profits and losses. It’s an essential tool for forex traders on platforms like Trading 212, but it must be used with caution and a clear understanding of the risks involved.

What kind of Spreads are offered by Trading 212?

Trading 212, a popular online trading platform, offers a variety of spreads for its users. The spread, which is the difference between the buy (ask) and sell (bid) prices, is a crucial aspect of forex trading. At Trading 212, the spread may be set as ‘Floating’, meaning it can fluctuate throughout the day depending on market conditions such as volatility and liquidity. For example, the spread for the EUR/USD currency pair is 1.0, which is considered average. Other major currency pairs also have similar spreads. Here are some examples:. EUR/USD: 1.0 (Average). GBP/USD: 1.2 (Average). AUD/USD: 1.0 (Average). EUR/CHF: 1.2 (Low). EUR/GBP: 1.2 (Average). . It’s important to note that there is no FX commission at Trading 212. All FX fees are built into the spread. This means that traders do not have to pay any additional costs on top of the spread when trading forex. However, it’s worth mentioning that the spread of an instrument may widen during times of thinner liquidity and high volatility, such as during market opening or during large-scale corporate news or geopolitical events. This is something that traders should be aware of, as it can impact the profitability of their trades. Overall, while the spreads at Trading 212 are considered average rather than low, the platform’s lack of commission fees and the flexibility of floating spreads can make it an attractive option for many forex traders.

Does Trading 212 offer MAM Accounts or PAMM Accounts?

The query pertains to whether Trading 212, a popular online trading platform, offers Multi-Account Manager (MAM) or Percentage Allocation Management Module (PAMM) accounts. These types of accounts are prevalent in the world of forex investing. MAM Accounts A MAM account allows professional traders to manage multiple client accounts from a single master account. The master account is controlled by the trader and is linked to several sub-accounts, each owned and controlled by a different individual investor. The funds of the investors are pooled together and managed by the trader. As the trader executes trades in the master account, the same trades are automatically replicated on the individual sub-accounts according to the allocation percentage. PAMM Accounts A PAMM account is a type of investment account offered by some forex brokers, which allows retail investors to allocate their funds to be managed by experienced traders. An investor deposits funds into a PAMM account, which are then pooled together with funds from other investor accounts. The appointed trader or investment manager then makes investment decisions on behalf of the group. Unfortunately, the search results do not provide specific information on whether Trading 212 offers MAM or PAMM accounts. It is recommended to directly contact Trading 212 or visit their official website for the most accurate and up-to-date information.

Does Trading 212 allow Expert Advisors?

Trading 212 is a popular online trading platform that offers a wide range of tradable assets, including forex pairs. However, it’s important to note that Trading 212 does not allow the use of Expert Advisors (EA). Expert Advisors are automated trading systems that operate within trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They are designed to implement advanced trading strategies without the need for manual intervention. While EAs can be highly beneficial for forex trading, providing the ability to analyze market conditions and execute trades automatically, they are not supported by Trading 212. This could be a significant limitation for traders who rely on automated trading strategies. Despite this, Trading 212 does offer a range of other features that may be attractive to traders. For instance, it provides a free, smart, and easy-to-use app, and in 2017, it launched the UK’s first zero commission trading platform. It also offers a good range of trading platforms, including a mobile app for Google Play, iOS, and Webtrade. However, it’s worth noting that Trading 212’s research section could do with some improvements. While it offers basic features such as news, an economic calendar, and market analysis, it does not provide the same level of in-depth analysis and advanced tools that some other platforms offer. In conclusion, while Trading 212 offers a range of features and a user-friendly platform for trading forex and other assets, it does not support the use of Expert Advisors. Traders who rely on automated trading strategies may need to consider other platforms that support EAs.