Yadix Review 2026

What is Yadix?

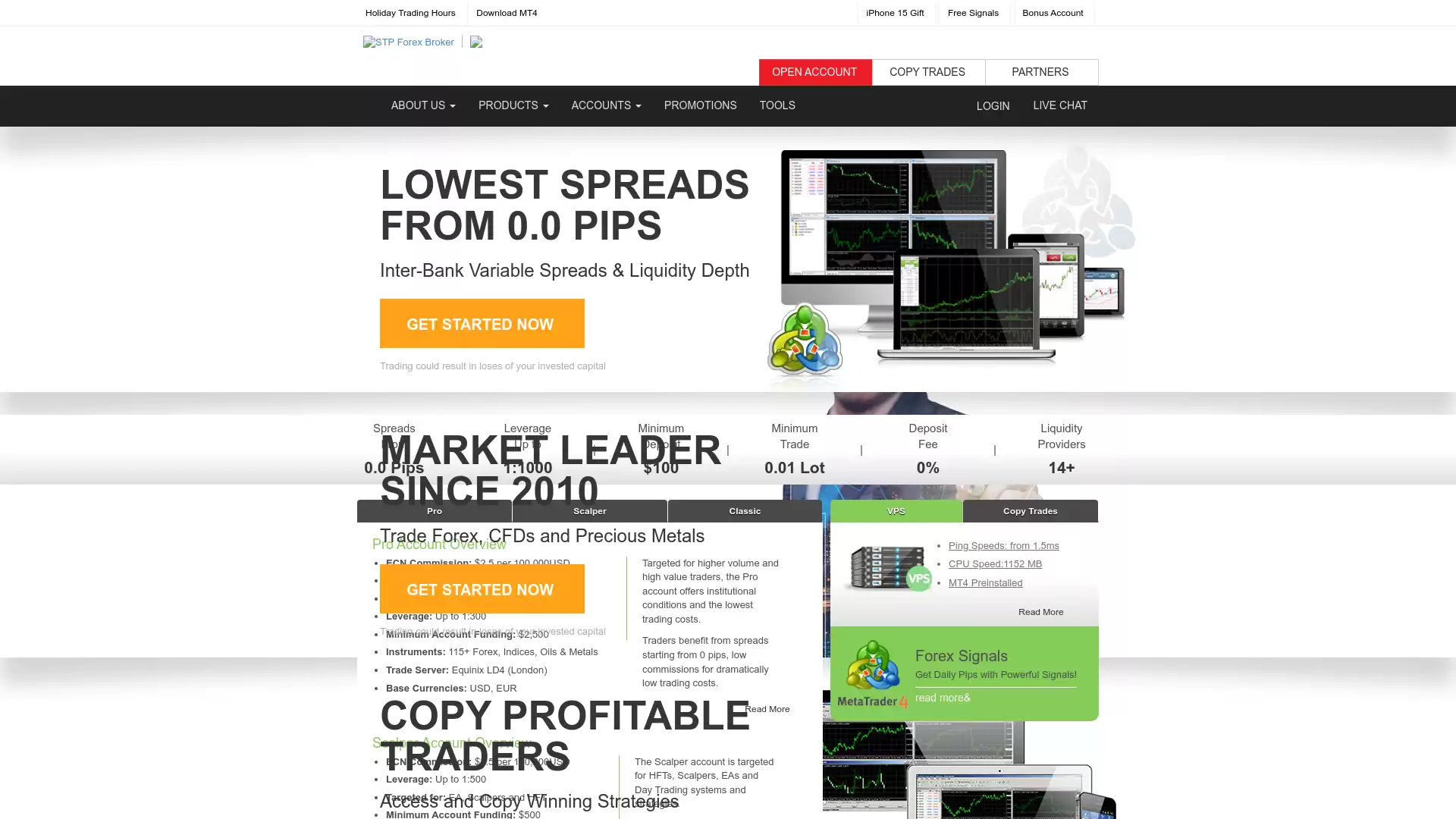

Yadix is a renowned broker in the world of forex trading. Established in 2010. , it has carved a niche for itself by focusing on providing services and trading facilities to retail, institutional, and professional clients globally. Yadix operates as an STP (Straight-Through Process) and ECN (Electronic Communication Network) broker. These models are particularly beneficial for high-speed scalping and algorithmic trading, as well as for classic manual Forex trading. The company’s financial activities are regulated by the Seychelles Financial Services Authority (FSA, SD021). One of the key features of Yadix is its focus on experienced traders who prefer ECN, high-speed trading, and minimum delay execution. However, it also offers a number of solutions for novice traders, mostly geared toward generating passive income. Yadix provides its clients with the opportunity to trade with 57 currency pairs with leverage of up to 1:500. It also allows its clients to copy other people’s strategies or broadcast their own to other clients of the broker. Despite its focus on forex, Yadix also offers trading in commodities and indices. The brokerage provides deep liquidity from over 15 providers, including 14 tier-1 banks. Overall, Yadix has positioned itself as a reliable platform for forex trading, offering a range of services to cater to the diverse needs of its global clientele.

What is the Review Rating of Yadix?

- 55brokers: 55brokers rated Yadix with a score of 20. This rating was last checked at 2024-01-06 14:24:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Brokersview: Brokersview rated Yadix with a score of 50. This rating was last checked at 2024-01-05 20:33:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Trustpilot: Trustpilot rated Yadix with a score of 70. This rating was last checked at 2024-01-06 00:26:03. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

- Wikifx: Wikifx rated Yadix with a score of 54. This rating was last checked at 2024-03-13 03:48:02. Forexbrokersinfo multiplies the 55brokers rating times 10 to normalize the rating to 100.

What are the Pros of Yadix?

Yadix is a forex broker that has been recognized for its unique features and services in the financial market. Here are some of the key advantages:. STP/ECN Execution: Yadix provides Straight Through Processing (STP) and Electronic Communication Network (ECN) execution. This ensures fast execution speeds and a competitive environment for Expert Advisors (EAs) and scalping. Deep Liquidity: The broker has deep liquidity from over 15 providers. This ensures that orders can be filled quickly and efficiently, reducing the likelihood of slippage. Wide Range of Trading Tools: Yadix offers a large suite of trading tools, including forex signals, Virtual Private Server (VPS) hosting, and copy trading. These tools can help traders make informed decisions and execute trades more effectively. Educational Content: Yadix provides educational content for beginners, including integrated videos. This can help new traders understand the forex market and develop effective trading strategies. High Leverage: Traders can trade with high leverage up to 1:500. This allows traders to control larger positions with a smaller amount of capital. Choice of Accounts: Yadix offers a choice of STP and ECN accounts. This gives traders the flexibility to choose the account type that best suits their trading style and strategies. Competitive Spreads: Yadix offers tight spreads from 0 pips. This can help traders reduce their trading costs. . It’s important to note that while Yadix offers many advantages, it’s essential for traders to conduct their own research and consider their individual trading needs before choosing a forex broker.

What are the Cons of Yadix?

Yadix is a forex broker that offers ECN and STP accounts with low spreads and fast execution. However, it also has some drawbacks that you should be aware of before opening an account with them. Here are some of the cons of Yadix:. Offshore regulation: Yadix is regulated by the Financial Services Authority of Seychelles (FSA), which is not a reputable or well-known regulator in the forex industry. This means that your funds are not protected by any insurance or compensation scheme, and you may face difficulties in withdrawing your money or resolving any disputes with the broker. Limited product portfolio: Yadix only offers forex trading, with 57 currency pairs available. It does not offer CFDs on stocks, indices, commodities, or other assets. This limits your trading opportunities and diversification options. No US clients accepted: Yadix does not accept US clients due to the strict regulations imposed by the US government on forex brokers. If you are a US resident, you will not be able to open an account with Yadix or trade with them. No cent accounts: Yadix does not offer cent accounts, which are suitable for beginners who want to trade small amounts without risking too much capital. Cent accounts allow you to trade with as little as $0.01 per lot, which can help you practice your skills and test your strategies. No demo account for US clients: Yadix does not offer a demo account for US clients, which means that you cannot test their platform or services before risking real money. A demo account is a great way to familiarize yourself with the trading conditions and features of a broker. No educational resources: Yadix does not provide any educational resources for its clients, such as webinars, articles, videos, or ebooks. This means that you will have to rely on your own research and learning methods to improve your trading knowledge and skills. No customer support: Yadix does not have a dedicated customer support team that can assist you via phone, email, chat, or social media. The only way to contact them is through their website’s FAQ section or their online form. This may take a long time to get a response or a solution. No social trading features: Yadix does not offer any social trading features, such as signals, copy trading, or VPS hosting. These features can help you learn from other traders’ strategies and experiences, as well as automate your trading process and reduce human errors. . As you can see, Yadix has some serious cons that may affect your trading experience and results. Therefore, we recommend that you look for other brokers that offer better conditions and services for forex traders.

What are the Yadix Current Promos?

Yadix, a renowned name in the Forex trading industry, offers a variety of promotions to cater to the diverse needs of its traders. These promotions are designed to provide high-value rewards for trading and are available on multiple trading accounts, making them suitable for different trading strategies. iPhone 15 Pro Giveaway: This is a limited-time promotion where new traders have a chance to win a brand-new iPhone 15 Pro. To participate, traders need to open a Classic account, make a deposit, and meet the specified volume requirements. Bonus Account: This promotion offers a 50% bonus for each deposit made into a Bonus Account. The account comes with a leverage of 1:1000 and a 30% Stop Out level. The bonus is fully tradable and can support the account during drawdown. 25% Classic Bonus: With this promotion, traders receive an extra 25% trading equity that can support during drawdown. The bonus can be converted to balance once the volume target is completed. 50% Extra on Your Next Five Deposits: This promotion offers an extra 50% trading power up to $2,500. The bonus adds 50% extra value to your deposit value for each deposit, providing extra trading power. The bonus also protects your account against drawdown. These promotions not only provide financial incentives but also enhance the trading experience by offering increased leverage, protection during drawdown, and opportunities to win exciting prizes. However, traders are advised to read and understand the terms and conditions associated with each promotion before participating.

What are the Yadix Highlights?

Yadix is a leading ECN/STP Forex Broker providing services and trading facilities to retail, institutional and professional clients globally with particular focus on forex trading strategies such as scalping and the acceptance of forex scalping systems. Here are some of the key highlights:. Lowest Spreads: Yadix offers the lowest spreads from 0.0 pips, passing on the same raw pricing received from their pool of liquidity providers with no mark-ups or changes. Leverage: They provide leverage up to 1:1000. Minimum Deposit: The minimum deposit requirement is $100. Trading Instruments: Yadix offers over 115+ trading instruments including Forex, Indices, Oils & Metals. Pro Scalper Classic Pro Account: This account is targeted for higher volume and high value traders, offering institutional conditions and the lowest trading costs. Superior Order Execution: With more than 10 years’ experience of delivering innovative STP execution solutions for financial market traders, Yadix provides high-speed execution, directly to the interbank markets with the most competitive real market pricing. Support for Profitable Trading: Yadix supports HFT and EA trading with anonymous, fast, and low latency execution. Negative Balance Protection: Negative balance protection is a security feature that prevents your account from losing more money than you deposited. . These features make Yadix a preferred choice for many traders in the forex market.

Is Yadix Legit and Trustworthy?

Yadix is a Forex broker that has been in operation since 2010. It is owned by Quantix FS Limited, a financial services company registered in Seychelles. The broker is authorized and regulated by the Financial Services Authority of Seychelles (FSA). Yadix offers a variety of trading instruments including forex pairs, indices, metals, energies, ETFs, and CFDs. The broker provides a maximum leverage of 1:500. However, it’s important to note that high leverage can lead to significant losses as well as gains. Despite these features, there are conflicting reviews about the legitimacy and trustworthiness of Yadix. Some reviews suggest that Yadix is a trustworthy broker with a high trust score of 80 out of 100. On the other hand, there are reviews that label Yadix as a scam. , alleging market price manipulation and cancellation of withdrawal requests. It’s also worth noting that while Yadix is regulated by the FSA, this is an offshore regulator and may not provide the same level of oversight as regulators in jurisdictions with more stringent financial regulations. For instance, Yadix is not authorized to onboard residents of the EEA zone, US, Canada, Australia, or any country where a Tier 1 license is required. In conclusion, while Yadix is a regulated Forex broker, the conflicting reviews and its offshore regulation suggest potential risks. Therefore, traders should exercise caution and conduct thorough research before deciding to trade with Yadix. It’s always recommended to use brokers regulated by reputable financial authorities for added protection. Please note that this information is based on available resources and may not be fully up-to-date or complete. Always do your own research and consider consulting with a financial advisor before making investment decisions.

Is Yadix Regulated and who are the Regulators?

Yadix is a forex broker that has been operating in the financial market for over a decade. The firm is currently owned by Quantix FS Ltd, a brand registered in Seychelles. Yadix is regulated by the Financial Services Authority (FSA) of Seychelles. This regulation, however, is considered to be offshore, as Seychelles is not a Tier 1 jurisdiction. Tier 1 jurisdictions are those that have stringent regulatory requirements, such as the European Securities and Markets Authority (ESMA), which demands brokers limit leverage to 1:30 for retail traders due to high risks. Despite being regulated, Yadix’s license with the FSA is not highly regarded in the industry. This is because offshore regulators like the FSA are known to be lenient and often let some activities slip under the radar. As a result, Yadix is not authorized to onboard residents of the EEA zone, US, Canada, Australia, or any country where a Tier 1 license is required. It’s important to note that while Yadix is duly licensed, it is not a broker that is highly recommended. This is because offshore brokers do not participate in the compensation fund, meaning that clients won’t be quickly reimbursed. Yadix offers a range of trading instruments including Forex, commodities, and indices. The firm provides a trading platform with a maximum leverage of 1:500. , which is significantly higher than the 1:30 limit set by the ESMA for retail traders. In conclusion, while Yadix is a regulated entity, potential investors should exercise caution due to its offshore regulation and the associated risks.

Did Yadix win any Awards?

Yadix, a leading ECN/STP Forex Broker. , has indeed been recognized in the world of forex broker companies. These awards from esteemed organizations or publications significantly contribute to the company’s reputation. Yadix, established in 2010. , is registered in Seychelles and regulated by the Financial Services Authority of Seychelles (FSA). The company provides services and trading facilities to retail, institutional, and professional clients globally. It focuses particularly on forex trading strategies such as scalping and the acceptance of forex scalping systems. The company boasts over 15 liquidity providers, including 14 tier-1 banks. With over 70 employees, Yadix brings in a yearly revenue of $16 million. It caters to anyone from Indonesia to the UK who is looking to get into forex trading. Yadix uses the award-winning MetaTrader 4 trading platform. , which is highly rated by many professional traders and is one of the most popular forex packages in the world. This platform can be downloaded from its website for Windows, Mac, and Linux computers. While specific awards are not mentioned in the search results, it is clear that Yadix has made a significant impact in the forex trading industry. Its recognition and high trust score of 80 out of 100. are testaments to its commitment to providing excellent service to its clients.

How do I get in Contact with Yadix?

Yadix is a well-established forex broker that offers various ways for traders and clients to get in touch with them. Their commitment to improving services is dependent on client satisfaction, and they welcome all comments and suggestions. Contact Methods: Email: You can reach out to Yadix via email. Their general support email is support@yadix.com. It’s recommended to include your MT4 ID in your email. Telephone: Yadix also offers support via telephone. The contact number is +44 (0) 20 3239 6117. Skype: You can contact Yadix through Skype. Their Skype ID is yadix.forex. Telegram: Yadix is available on Telegram. You can reach them at @YadixForex. WhatsApp: Yadix can be contacted via WhatsApp at +447585424285. Live Chat: Yadix offers live chat support on their website. . Yadix’s head office is located in Seychelles at Orion Mall, Palm Street, Victoria. They offer forex trading support by telephone, email, and live chat. Feel free to contact them with your questions, and one of their experienced forex support agents will be happy to assist. Yadix has been a market leader since 2010, offering trading in Forex, CFDs, and Precious Metals. They support HFT and EA trading with anonymous, fast, and low latency execution, directly through to the liquidity banks with no dealing desk intervention and no re-quotes. Remember, trading could result in losses of your invested capital. Always trade responsibly and seek advice if you’re unsure.

Where are the Headquarters from Yadix based?

Yadix is a well-known ECN/STP Forex Broker that provides services and trading facilities to retail, institutional, and professional clients globally. The company has a particular focus on forex trading strategies such as scalping and the acceptance of forex scalping systems. As a broker, Yadix passes on the same raw pricing that it receives from its pool of liquidity providers with no mark-ups or changes, directly to the trading platforms. This allows clients to benefit from spreads starting at 0 pips and low commissions. Yadix supports High-Frequency Trading (HFT) and Expert Advisor (EA) trading with anonymous, fast, and low latency execution. This is directly through to the liquidity banks with no dealing desk intervention and no re-quotes. Yadix is regulated by the Financial Services Authority (FSA), with the License#:SD021. For any queries or support, Yadix can be contacted via phone at +44 (0) 203 239 6117 or via email at support@yadix.com.

What kind of Customer Support is offered by Yadix?

Yadix, a renowned forex broker, offers a comprehensive customer support system to assist its clients. The support system is designed to address the queries and concerns of traders, ensuring a smooth trading experience. Multiple Channels of Communication: Yadix provides multiple channels for traders to reach out to their support team. These include: Telephone: Traders can reach out to the support team via telephone. Email: Email support is available for traders who prefer to communicate via written correspondence. Live Chat: For immediate assistance, traders can use the live chat feature. Skype: Yadix also offers support through Skype. Telegram and WhatsApp: These platforms are also used by Yadix to provide support. . Experienced Support Agents: Yadix’s support agents are experienced in forex trading and are ready to assist with any questions traders may have. Office Hours: The support team is available during trading hours, from Sunday 00:00 till Friday 00:00. Positive Reviews: The support service of Yadix has been reviewed as friendly and competent. In conclusion, Yadix’s customer support system is well-equipped to handle the needs of forex traders, providing them with multiple channels of communication and experienced support agents to ensure a seamless trading experience.

Which Educational and Learning Materials are offered by Yadix?

Yadix offers a range of educational and learning materials to help traders improve their trading skills and knowledge in forex. Here is a detailed list of the educational and learning materials offered by Yadix:. 1. E-books: Yadix provides a series of learning e-books that cover various topics such as forex basics, trading strategies, technical analysis, and more. These e-books are designed to help traders understand the forex market and develop their trading skills. 2. Videos: Yadix offers valuable videos that explain how to trade specific strategies and learn more about the forex markets and how they work. These videos cover topics such as forex basics, trading strategies, technical analysis, and more. 3. Webinars: Yadix hosts webinars that provide traders with the opportunity to learn from forex professionals. These webinars cover various topics such as trading strategies, market analysis, and more. 4. Trading Courses: Yadix offers trading courses that are designed to help traders improve their trading skills and knowledge. These courses cover various topics such as forex basics, trading strategies, technical analysis, and more. 5. Market Analysis: Yadix provides market analysis that helps traders stay up-to-date with the latest market trends and news. This analysis covers various topics such as technical analysis, fundamental analysis, and more. 6. Trading Tools: Yadix offers a range of trading tools that help traders improve their trading skills and knowledge. These tools include expert advisors, indicators, and more. 7. Trading Signals: Yadix provides trading signals that help traders make informed trading decisions. These signals are generated by forex professionals and are based on technical analysis and market trends. 8. Trading Contests: Yadix hosts trading contests that provide traders with the opportunity to win prizes and improve their trading skills. These contests are designed to help traders develop their trading skills and knowledge. 9. Practice Accounts: Yadix offers practice accounts that allow traders to practice trading without risking real money. These accounts are designed to help traders develop their trading skills and knowledge. 10. Customer Support: Yadix provides 24/5 customer support via phone, email, and live chat, in multiple languages. The customer support team is available to help traders with any questions or issues they may have. I hope this helps! Let me know if you have any other questions.

Can anyone join Yadix?

Yadix is a leading ECN/STP Forex Broker that provides services and trading facilities to retail, institutional, and professional clients globally. The platform is particularly focused on forex trading strategies such as scalping and the acceptance of forex scalping systems. Yadix offers a variety of account types to cater to different trading styles and strategies. These include the Classic, Scalper, and Pro accounts. Each account type has its own set of features and requirements. The Classic account offers spreads from 1 pip, with a maximum leverage of 1:500. The minimum deposit for this account is $100. The Scalper account, on the other hand, offers spreads from 0.0 pips, with a maximum leverage of 1:500 and a minimum deposit of $500. Lastly, the Pro account offers spreads from 0.0 pips, a maximum leverage of 1:300, and requires a minimum deposit of $2,500. It’s important to note that Yadix supports High-Frequency Trading (HFT) and Expert Advisor (EA) trading with anonymous, fast, and low latency execution. This is facilitated through direct access to liquidity banks with no dealing desk intervention and no re-quotes. However, it’s not explicitly stated whether anyone can join Yadix. The platform does mention that the no deposit bonus may be offered from time to time to clients that open a live trading account. This suggests that there may be certain eligibility criteria that need to be met. In conclusion, while Yadix offers a.

Who should sign up with Yadix?

Who should sign up with Yadix? Yadix is a forex broker that offers a variety of trading services and platforms for different types of traders. Whether you are a beginner or an experienced trader, Yadix has something to suit your needs and preferences. Here are some reasons why you should sign up with Yadix: High-speed trading and execution: Yadix offers both STP and ECN accounts, which means you can enjoy fast execution speeds of 15 ms and tight spreads from 0 pips. This is ideal for scalpers, algorithmic traders, and high-frequency traders who want to take advantage of the market movements and execute their trades quickly. Fair and transparent trading conditions: Yadix does not charge any commissions, swap fees, or hidden costs. You can trade with leverage up to 1:500 and access over 115 CFD products across forex, commodities, indices, and cryptocurrencies. You can also use a free VPS service to run your Expert Advisors (EAs) without interruption. Diversified trading tools and features: Yadix provides a range of tools and features to enhance your trading experience and performance. You can use forex signals from reputable providers, copy the trades of successful traders on the platform, or broadcast your own strategies to other clients. You can also access educational content, market analysis, economic calendar, and more. Friendly customer support: Yadix has a professional and responsive customer support team that is available 24/7 via phone, email, or live chat. You can also find answers to common questions on their website or FAQ section. If you are looking for a reliable broker that offers high-quality trading services and platforms for forex scalping and algorithmic trading, then you should sign up with Yadix today. You can open an account with a minimum deposit of $100 and start trading with confidence.

Who should NOT sign up with Yadix?

Who should NOT sign up with Yadix? Yadix is a forex broker that offers ECN and STP accounts, as well as CFDs on commodities and indices. The broker is regulated by the Financial Services Authority of Seychelles (FSA), which is a Tier 3 regulator that does not impose strict requirements on its licensees. Therefore, Yadix may not be suitable for traders who are looking for more security, transparency and protection in their trading environment. Some of the reasons why traders should NOT sign up with Yadix are: Yadix does not accept US clients. The broker does not have a license from the US Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA), which means that US traders cannot access its services or benefit from its regulation. Moreover, Yadix does not participate in the Investor Compensation Fund (ICF), which is a scheme that protects traders from losing their funds in case of broker insolvency. Yadix has a limited choice of assets. The broker offers only 57 currency pairs, 115 CFDs and no stocks or crypto. This means that traders who want to diversify their portfolio or trade other markets such as equities or digital assets may find Yadix too restrictive and boring. Yadix has high leverage and spreads. The broker allows traders to use leverage up to 1:500, which is very high compared to other brokers. However, this also increases the risk of losing more than the initial deposit. Moreover, Yadix charges tight spreads from 0 pips on its STP accounts and from 0.2 pips on its ECN accounts, which may reduce the profitability of trading. Yadix has poor customer service and support. The broker does not have a dedicated phone number or email address for customer inquiries or complaints. Instead, it relies on an online form that may take a long time to process or respond. Furthermore, some users have reported issues with withdrawals, deposits and verification processes on Trustpilot. In conclusion, Yadix is a forex broker that may appeal to some traders who are looking for fast execution speeds and low minimum deposits. However, it also has many drawbacks that make it unsuitable for most traders who value security, transparency and protection in their trading environment. Therefore, we do not recommend signing up with Yadix unless you are willing to take the risks involved.

Does Yadix offer Discounts, Coupons, or Promo Codes?

Yadix, a renowned player in the Forex market, offers a variety of promotions and offers to enhance the trading experience of its users. Trading Bonus, Forex Rebates, Cash Backs: Yadix provides a range of high-value promotions on multiple trading accounts. These promotions are designed to suit different trading strategies and reward Forex volumes. iPhone 15 Pro Giveaway: In a limited-time promotion, Yadix is giving away a brand-new iPhone 15 Pro to all new traders. To claim this welcome gift, traders need to open a Classic account, make a deposit, and meet the easy volume requirements. Bonus Account: Traders can open a Bonus Account and benefit from 1:1000 leverage, 30% Stop Out Levels, and a 50% bonus for each deposit. The bonus is fully tradeable, supports the account in drawdown, and the bonus amount can be fully lost. 25% Classic Bonus: With the 25% profit sharing bonus, traders will benefit from extra trading equity that can support during drawdown. The bonus can be lost and converted to balance when the volume target is completed. These promotions not only provide financial benefits but also add an element of excitement to the trading experience. However, traders should carefully read the terms and conditions associated with these offers before participating.

Which Account Types are offered by Yadix?

Yadix, a renowned player in the Forex market, offers four distinct account types, each tailored to cater to different trading strategies and styles. Classic Account The Classic Account is designed for traders who prefer trading without any commission. The spreads start from 1 pip and the maximum leverage offered is 1:500. The minimum deposit required to open a Classic Account is $100. This account type supports STP execution. Scalper Account The Scalper Account, as the name suggests, is targeted towards traders who employ the scalping strategy. It offers core spreads from 0.0 pips and a commission of. /€3.5perlotperside(roundlot. /€7). The maximum leverage is 1:500 and the minimum deposit requirement is $500. This account type supports ECN execution. Pro Account The Pro Account is intended for high volume and high value traders. It offers institutional conditions and the lowest trading costs. Traders can benefit from spreads starting from 0 pips and low commissions, for example, trade one lot of EUR/USD for as low as $2.50 per 100k traded. The maximum leverage is 1:300 and the minimum deposit requirement is $2,500. This account type also supports ECN execution. Each account type offers a range of features including free tools like Copy Trades, Free Signals, and Free VPS. Clients can trade micro lots with unrestricted leverage. Yadix’s commitment to providing a superior trading experience is evident in their offering of competitive spreads, low trading costs, and no dealing desk execution.

How to Open a Yadix DEMO account?

Opening a Yadix Demo account is a straightforward process that allows you to test your trading strategy, EA performance, and familiarize yourself with the Yadix trading conditions. Here is a step-by-step guide:. Step 1: Registration Firstly, navigate to the Yadix website and locate the registration page for the Demo account. You will need to complete and submit the request form. The information required typically includes your email address, name, and country. Step 2: Download the MT4 Trading Platform While your application is being reviewed, you should download the MT4 trading platform. This platform is where you will conduct your trades. Step 3: Test Your Strategy Once your application is approved, you can use the Demo account to test your trading strategy and EA performance. The Yadix Demo Account mirrors the live trading conditions and operates using real-time data. Step 4: Ready to Trade With $100,000 available to trade on your demo account, you have enough balance to trade and test your account fully. Remember, the purpose of a Demo account is to provide a risk-free environment to practice and refine your trading strategies before you start live trading.

How Are You Protected as a Client at Yadix?

As a client at Yadix, you are protected through several measures:. 1. Segregation of Client Funds All clients’ funds are held in segregated accounts in AA rated banks and are fully protected. This ensures that clients feel comfortable in trading with Yadix. Furthermore, clients’ funds are kept completely separated from Yadix company funds. 2. Regulatory Supervision The Yadix brand is authorised and regulated by the Financial Services Authority of Seychelles (FSA) with license number SD021. All regulated Forex Brokers are required to handle all accounts and money flow according to strict financial standards, including capital adequacy requirements. Each day, financial reports are submitted to ensure that there is adequate capital to cover all liabilities and to ensure that company funds are held separately from the segregate client funds pool. 3. Fund Administration and Audit All accounts at Yadix are independently supervised by a third party auditors. Their history in fund administration and security is both proven and recognised within the financial industry. Yadix strictly deals with regulated financial institution to execute trades. 4. Negative Balance Protection Negative balance protection is in place as an extra layer of protection for clients’ accounts. It is applied to trading leveraged products and prevents accounts from losing more money than the total amount deposited to the account’s balance. These measures ensure that as a client at Yadix, you can focus on your trading strategies and feel secure about your funds.

Which Funding methods or Deposit Options are available at Yadix?

Yadix, a renowned player in the forex trading industry, offers a variety of deposit options to cater to the diverse needs of its clients. These options are designed to be easy, fast, and secure, ensuring a smooth and efficient trading experience. Skrill: This is a popular digital wallet that allows for transactions up to $25,000 USD per transaction with a minimum deposit of $100 USD. The supported currencies are EUR and USD and the credit time is automatic. Neteller: Similar to Skrill, Neteller also supports transactions up to $25,000 USD with a minimum deposit of $100 USD. The supported currencies are EUR and USD and the credit time is within minutes. Credit Card and Debit Card: These are common and convenient deposit methods. The maximum deposit per transaction is $10,000 USD and the minimum is $100 USD. The supported currencies are EUR and USD and the credit time is automatic. SEPA - Bank Wire and SWIFT - Bank Wire: These methods allow for bank transfers with no limit on the maximum deposit per transaction. The minimum deposit is $100 USD and the supported currency is USD. The credit time is within minutes. Perfect Money: This is another digital wallet option with no limit on the maximum deposit per transaction and a minimum deposit of $100 USD. The supported currencies are EUR and USD and the credit time is automatic. FasaPay: This method supports transactions up to $20,000 USD with a minimum deposit of $100 USD. The supported currencies are IDR and USD and the credit time is automatic. BitWallet: This is a digital wallet that allows for transactions up to $25,000 USD per transaction with a minimum deposit of $100 USD. The supported currencies are EUR and USD and the credit time is automatic. Bitcoin, Ethereum, and Tether: These are cryptocurrency deposit options that support transactions up to $25,000 USD with a minimum deposit of $500 USD. The supported currencies are EUR and USD and the credit time is within minutes. It’s important to note that all funds are held in segregated accounts in AA rated banks and are fully protected. This ensures the security of clients’ funds and allows traders to focus on their trading strategies.

What is the Minimum Deposit Amount at Yadix?

Yadix, an established broker since 2010, offers a range of account types to cater to different trading strategies and styles. The minimum deposit amount varies depending on the type of account you choose to open. Classic Account: The minimum deposit for a Classic Account is $100. This account type is suitable for traders who prefer trading without commission. Rebate Account: Similar to the Classic Account, the Rebate Account also requires a minimum deposit of $100. Scalping Account: For a Scalping Account, the minimum deposit increases to $500. This account type is designed for traders who employ a scalping strategy. Pro Account: The Pro Account, aimed at professional traders, requires a significantly higher minimum deposit of $10,000. It’s important to note that these minimum deposit amounts apply regardless of the deposit method used. Yadix provides a range of easy, fast, and secure deposit methods, including Skrill, Neteller, Credit Card, Debit Card, SEPA - Bank Wire, SWIFT - Bank Wire, Perfect Money, FasaPay, BitWallet, Bitcoin, Ethereum, and Tether. Each of these methods supports different currencies and has different maximum deposit limits per transaction. Before choosing an account type, traders should consider their trading strategy, style, and financial capacity. It’s also recommended to understand the terms and conditions associated with each account type.

Which Withdrawal methods are available at Yadix?

Yadix, a renowned forex broker, offers a variety of withdrawal methods to cater to the diverse needs of its clients. Here are the details:. Skrill: Skrill allows for same-day withdrawals with no minimum limit. Neteller: Similar to Skrill, Neteller also provides same-day withdrawals with no minimum limit. Credit Card and Debit Card: Yadix accepts both credit and debit card withdrawals, processed on the same day with no minimum limit. FasaPay: FasaPay is another method available for same-day withdrawals with no minimum limit. Perfect Money: Perfect Money users can also withdraw on the same day with no minimum limit. SEPA - Bank Wire: SEPA Bank Wire transfers are available for same-day withdrawals with no minimum limit. SWIFT - Bank Wire: SWIFT Bank Wire transfers are also available for same-day withdrawals with no minimum limit. BitWallet: BitWallet users can withdraw on the same day with no minimum limit. Bitcoin: Bitcoin is accepted for same-day withdrawals with no minimum limit. Ethereum: Ethereum users can withdraw on the same day with no minimum limit. Tether: Tether is also accepted for same-day withdrawals with no minimum limit. To withdraw funds, clients need to log in to their personal account management area and complete the withdrawal request form, including the account details of the method of withdrawal. It’s important to note that all withdrawals will be sent to the method used to deposit. If the withdrawal sum is greater than the sum of the original deposit, the remaining profits can be withdrawn by Wire Transfer. Clients will be required to provide a Bank Statement dated within the past six months. Please note that while Yadix strives to process withdrawals within 24 hours, the actual time may vary depending on the withdrawal method and the bank’s processing times. It’s always recommended to check with the respective payment service provider for any additional fees or charges. This information is subject to change and it’s always a good idea to check Yadix’s official website or contact their customer service for the most up-to-date information.

Which Fees are charged by Yadix?

Yadix, a renowned forex broker, charges a variety of fees that traders should be aware of. Here’s a detailed breakdown:. ECN Commission: Yadix charges an ECN Commission of $2.5 per 100,000USD. This fee is applicable for every 100,000USD traded, making it a significant cost for high-volume traders. Spreads: The spreads at Yadix start from 0 pips. This means that the broker does not add any mark-up to the prices provided by their liquidity providers, resulting in lower trading costs for the clients. Deposit Fee: One of the advantages of trading with Yadix is that they do not charge any deposit fees. This applies to popular deposit methods including BTC, USDT (ERC20 & TRC20), Skrill, Neteller, FasaPay, Perfect Money, Credit/Debit card and bank transfers (Sepa/Swift). Account Types: Yadix offers different account types, each with its own fee structure. For instance, the ‘Classic’ account has a commission of. /€3.5perlotperside(roundlot. /€7), while the ‘Scalper’ and ‘Pro’ accounts charge a commission of. /€2.5perlotperside(roundlot. /€5). Leverage: The leverage offered by Yadix can go up to 1:500 for retail traders and scalpers, and up to 1:300 for professionals who use ECN technology. While not a direct fee, leverage can amplify both profits and losses, and should be used judiciously. Partnership Program: Yadix also has a partnership program where a fee of up to $12 is charged from each lot closed by referees. This can be a source of additional income for traders who refer others to the platform. Please note that while this information is accurate as of my last update in 2021, fees and charges may vary. Always check the latest information on the Yadix website or contact their customer service for the most up-to-date details.

What can I trade with Yadix?

You can trade a variety of instruments with Yadix, a forex broker that offers ECN and STP accounts and deep liquidity from 15+ providers. Here are some of the main features of trading with Yadix: Forex Trading: You can trade 57 major, minor and exotic currency pairs on the popular MetaTrader 4 platform. Trade currencies with leverage up to 1:500 and raw spreads from 0.0 pips. You can also use the broker’s proprietary copy trading platform to follow or broadcast your own strategies. CFD Trading: You can trade 115+ CFD products across forex, commodities and indices with leverage up to 1:500. The minimum order size is 0.01 lots and there are no restrictions on trading strategies. You can also access the broker’s free VPS hosting service to run your Expert Advisors (EAs) and scalping programs. Other Instruments: You can also trade gold, silver, oils, and indices with Yadix. The broker offers competitive spreads and fast execution speeds of 15 ms. You can also benefit from regular rewards and financial incentives offered by the broker. Yadix is a suitable broker for traders who are looking for STP/ECN execution, a competitive environment for EAs and scalping, and a wide range of trading tools. However, you should also be aware of some of the drawbacks of trading with Yadix, such as its offshore regulation from the Seychelles Financial Services Authority (FSA), which reduces its safety score. , its slim product portfolio with no stocks and crypto. , and its exclusion of US clients. Therefore, you should always do your own research before choosing a broker to trade with.

Which Trading Platforms are offered by Yadix?

Yadix is a leading ECN/STP forex broker that offers a variety of trading platforms to suit different trading styles and preferences. Whether you are a scalper, an EA trader, or a news trader, Yadix has a platform that can meet your needs and expectations. MT4 Terminal Platform: This is the award-winning MT4 platform that provides raw pricing connectivity, fast execution speeds, and flexible trading conditions. You can use one-click trading, trade from charts, add custom EAs and indicators, and customize your charts. The MT4 terminal platform is available for Windows or Mac computers. MT4 Mobile Terminal for iPhone / iPad: This is the mobile version of the MT4 platform that allows you to access the forex markets using your smartphone or tablet device. You can trade directly from your iPhone or iPad in a secure trading environment while using the range of facilities offered by the MT4 app. The app has 30 technical indicators and tools, 3 chart types with 9 time-frames, an optimized display layout for tablets, and a market news feed. MT4 Mobile Terminal for Android: This is the mobile version of the MT4 platform that allows you to access the forex markets using your Android device. You can control your forex trading account directly from your mobile phone or tablet device with the free MT4 app. The app has 30 technical indicators and tools, 3 chart types with 9 time-frames, an optimized display layout for tablets, and a market news feed. . You can download any of these platforms from the Yadix website. or from the respective app stores. You can also find more information about each platform on their respective pages. Yadix also offers other services and facilities to enhance your trading experience, such as free VPS, forex rebates, no trading restrictions for EA traders and scalpers, free London VPS with low latency and super-fast execution, bonus accounts with high leverage and low stop out levels, free iPhone 13 Pro gift for new traders who trade 50 lots in 90 days, access to thousands of forex signals with high success rates, investment opportunities in proven trading strategies by master traders with solid track-record using their own manual and automated strategies. If you are interested in opening an account with Yadix or learning more about their services and products, please visit their website. or contact their customer support team.

Which Trading Instruments are offered by Yadix?

Yadix, a renowned forex trading platform, offers a wide range of trading instruments to cater to the diverse needs of traders. Here’s a detailed overview:. Forex Trading Platforms: Yadix provides a variety of forex trading platforms to suit individual requirements. They offer the award-winning MT4 platform available for PC or laptop, as well as a range of mobile trading MT4 applications for iPad, iPhone, and Android devices. MT4 Terminal Platform: The MT4 Terminal Platform, with its one-click order execution, is an excellent tool to manage forex activity. It offers a variety of charting tools and indicators that are pre-installed and available on the platform. Traders can also install their own custom EAs for automated trading via the MetaTrader4 platform. Mobile Platforms: Yadix offers mobile platforms for iPhone, iPad, and Android devices. These platforms allow clients instant access to the markets regardless of location. The user-friendly interfaces allow clients to trade directly from their devices in a secure trading environment. Trading Instruments: Yadix offers over 115+ trading instruments. These include Forex, Indices, Oils & Metals. This wide range of instruments provides traders with the flexibility to choose the instruments that best suit their trading strategies. Trading Tools: Yadix also offers premium trading tools that support profitable trading. These tools include a free forex VPS, Economic calendar, market data, and FIX API. Order Execution & Pricing: Yadix provides high-speed execution, directly to the interbank markets with the most competitive real market pricing. Liquidity is provided by 14 tier-1 banks, ECNs, and non-bank execution venues that are cross-connected at Equinix London for low latency connectivity. In conclusion, Yadix offers a comprehensive suite of trading instruments and platforms, making it a preferred choice for many forex traders.

Which Trading Servers are offered by Yadix?

Yadix, a leading ECN/STP Forex Broker, offers a range of trading servers to cater to its diverse clientele, which includes retail, institutional, and professional traders. The servers are designed to support various forex trading strategies such as scalping and the acceptance of forex scalping systems. The primary trading server offered by Yadix is the Equinix LD4 (London). This server is located at the heart of London’s financial centre and is known for its low latency connections, which deliver faster and more accurate order execution to co-located liquidity banks. The Equinix LD4 server facility ensures ultra-fast order execution, low trading costs, and no dealing desk execution, providing a truly extraordinary trading experience. Yadix also offers a Virtual Private Server (VPS). The VPS is designed to host your Yadix MT4 platform and forex robot, ensuring stable auto-trading performance regardless of location. The VPS allows your Expert Advisor or robot to trade the forex markets 24 hours a day, ensuring accurate order filling and super-fast execution of all order types. The VPS is available for free for high-frequency traders. In terms of trading conditions, Yadix offers spreads starting from 0 pips and low commissions. For example, one can trade one lot of EUR/USD for as low as $2.50 per 100k traded. The broker passes on the same raw pricing that it receives from its pool of liquidity providers with no mark-ups or changes, directly to the trading platforms. Yadix supports High-Frequency Trading (HFT) and EA trading with anonymous, fast, and low latency execution, directly through to the liquidity banks with no dealing desk intervention and no re-quotes. This allows traders to benefit from unrestricted trading and no limitations to suit any trading style or system. In conclusion, Yadix offers a comprehensive suite of trading servers and conditions that cater to various trading strategies and styles, making it a preferred choice for many forex traders.

Can I trade Crypto with Yadix? Which crypto currencies are supported by Yadix?

Yadix is a well-established broker that offers a wide range of trading options. It is particularly known for its Straight-Through Processing (STP) and Electronic Communication Network (ECN) accounts, which are designed to provide fast execution speeds and a competitive environment for Expert Advisors (EAs) and scalping. One of the key features of Yadix is its support for cryptocurrency trading. The broker accepts deposits in more than 20 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and USD Tether (USDT). This makes it a viable platform for traders who wish to diversify their portfolio with digital assets. However, it’s important to note that while Yadix accepts cryptocurrency deposits, it does not currently offer cryptocurrency trading. Its product portfolio is primarily focused on forex, commodities, and indices. Traders can execute trades with 57 currency pairs with leverage of up to 1:500. Despite this, Yadix provides a robust trading environment with a suite of tools that can be beneficial for cryptocurrency traders. These include forex signals, Virtual Private Server (VPS) hosting, and copy trading. These tools can help traders develop and implement effective trading strategies. Furthermore, Yadix offers educational content for beginners, including integrated videos. This can be particularly useful for those new to trading or those looking to expand their knowledge of the financial markets. In conclusion, while Yadix does not currently offer cryptocurrency trading, it does accept deposits in various cryptocurrencies and provides a range of tools and features that can support a diverse trading strategy.

What is the Leverage on my Yadix Trading Account?

Leverage is a critical aspect of your trading strategy, particularly in the context of forex trading. At Yadix, leverage is offered at a flexible range from 1:1 to 1:500. This means that for every dollar in your account, you can trade up to $500. However, it’s important to note that while higher leverage can increase your trading capabilities, it also amplifies the potential risks. Yadix operates with a philosophy that encourages careful consideration of leverage use. While it can be beneficial by allowing you to maximise the profitability of successful trading positions, misuse or higher leverage can result in stop-outs on unsuccessful positions or if a trade goes against you. As an STP forex broker, Yadix highly recommends that the leverage choice should be set to a maximum of 1:200. This level still allows a significant increase of account margin but also provides protection against losing positions. In the forex markets, leverage is used to reduce the collateral needed to enter the market, referred to as margin in the MT4 trading platform. For instance, if you choose a leverage of 1:500 with a $1,000 balance, you can purchase $500,000 of a chosen currency. As the market moves for or against your order, the account equity either grows or reduces at the same rate according to the leverage level. It’s crucial to remember that in forex, leverage is a double-edged sword. It can multiply your profits, but it can equally increase your potential losses. The leverage ratio and minimum margin requirements are also important considerations. At Yadix, margin is calculated as follows: Position Size/Leverage * Currency Pair Current Exchange Rate. By using a leverage of 1:100, you can enter the market with $100 for every dollar in your account. With a balance of $1,000 in the account, you can trade up to $100,000. Your trade has the earning potential of a $100,000 order, but you also face the risk of losing the equivalent of a $100,000 trade if the position goes against you. In conclusion, Yadix offers a flexible choice of leverage from 1:1 up to 1:500. All traders should carefully consider their leverage choice, and Yadix recommends a maximum leverage of 1:100 for better risk management. Trading with higher leverage is a common error and can increase the risks of trading. Therefore, understanding the full risk of misusing leverage is highly recommended.

What kind of Spreads are offered by Yadix?

Yadix, a renowned player in the Forex market, offers a variety of spreads to cater to the diverse needs of traders. The company works with more than 15 liquidity banks, enabling it to offer core bank spreads starting from 0.0 pips on Forex majors. Forex Spreads: EUR/USD: Minimum spread is 0.0 pips and the average spread is 0.2 pips. USD/JPY: Minimum spread is 0.1 pips and the average spread is 0.3 pips. USD/CAD: Minimum spread is 0.1 pips and the average spread is 0.4 pips. AUD/USD: Minimum spread is 0.1 pips and the average spread is 0.4 pips. GBP/USD: Minimum spread is 0.1 pips and the average spread is 0.4 pips. . These are just a few examples. Yadix offers competitive spreads for a wide range of currency pairs. Indices Spreads: Dow Jones (U30USD): Minimum spread is 1 pip and the average spread is 2 pips. S&P 500 (SPXUSD): Minimum spread is 0.2 pips and the average spread is 0.5 pips. Nasdaq 100 (NASUSD): Minimum spread is 0.5 pips and the average spread is 1 pip. FTSE 100 (100GBP): Minimum spread is 0.5 pips and the average spread is 1 pip. Euro Stoxx 50 (E50EUR): Minimum spread is 1 pip and the average spread is 2 pips. . Again, these are just a few examples. Yadix offers competitive spreads for a wide range of indices. It’s important to note that the spreads can vary depending on the account type and trading conditions. Yadix is committed to providing its clients with tight raw bank spreads, best bid and best ask pricing, and higher tick frequency for optimized pricing and trading efficiency.

Does Yadix offer MAM Accounts or PAMM Accounts?

Yadix, a well-known broker in the forex trading industry, offers a variety of account types and services to cater to the diverse needs of traders. One of the key offerings of Yadix is its PAMM community, which provides investors access to multiple forex PAMM managers and winning trading strategies. This allows for low forex risk and the potential for profitable returns. PAMM, or Percentage Allocated Money Manager, is a system that allows investors to allocate funds to account (money) managers, which can then be traded from one master account. This system is predominantly used in forex, providing investors with the opportunity to profit from trading, without needing to carry out technical analysis or take positions themselves. However, it’s important to note that while Yadix does offer PAMM accounts, it currently does not offer MAM (Multi-Account Manager) accounts. MAM accounts are similar to PAMM accounts but offer more flexibility in terms of allocation methods and are typically used by professional money managers. In addition to PAMM accounts, Yadix also offers a variety of other services. For instance, they provide a proprietary copy trading platform and third-party signals. These services can be particularly beneficial for novice traders or those who prefer to generate passive income. To summarize, while Yadix does offer PAMM accounts, it does not offer MAM accounts. However, it does provide a range of other services and account types, making it a versatile choice for forex traders of all experience levels. As always, potential investors should conduct thorough research and consider their financial goals and risk tolerance before choosing a forex broker or account type.

Does Yadix allow Expert Advisors?

Yes, Yadix does allow the use of Expert Advisors (EAs). This is a key feature of their platform, particularly in relation to forex trading. Yadix is a leading ECN/STP Forex Broker providing services and trading facilities to retail, institutional, and professional clients globally. They have a particular focus on forex trading strategies such as scalping and the acceptance of forex scalping systems. Yadix recognizes the potential and needs of EA users and developers. They are fully committed to providing the necessary tools, trading conditions, testing environments, and settings to allow the Expert Advisor to perform in the most efficient way and maximize the full trading potential. Yadix’s trading environment is unique as no forex trading strategies are restricted. They offer no limits on Stop Loss, Take Profit, and pending orders, including zero pip limits and zero time limits. This unrestricted trading environment is ideal for forex scalping strategies, including the use of scalping systems and EAs. Yadix also provides a range of valuable tools to clients such as multiple trading platforms, EA hosting, and zero stop levels to complement the STP trading conditions, superior execution, and to comfortably accept all forex trading strategies without discrimination. In conclusion, Yadix not only allows but also actively supports the use of Expert Advisors in forex trading. They provide a conducive environment and the necessary tools for EAs to perform efficiently, thereby maximizing their trading potential.